Why Manual Claims Processing Is Costing You More Than You Think

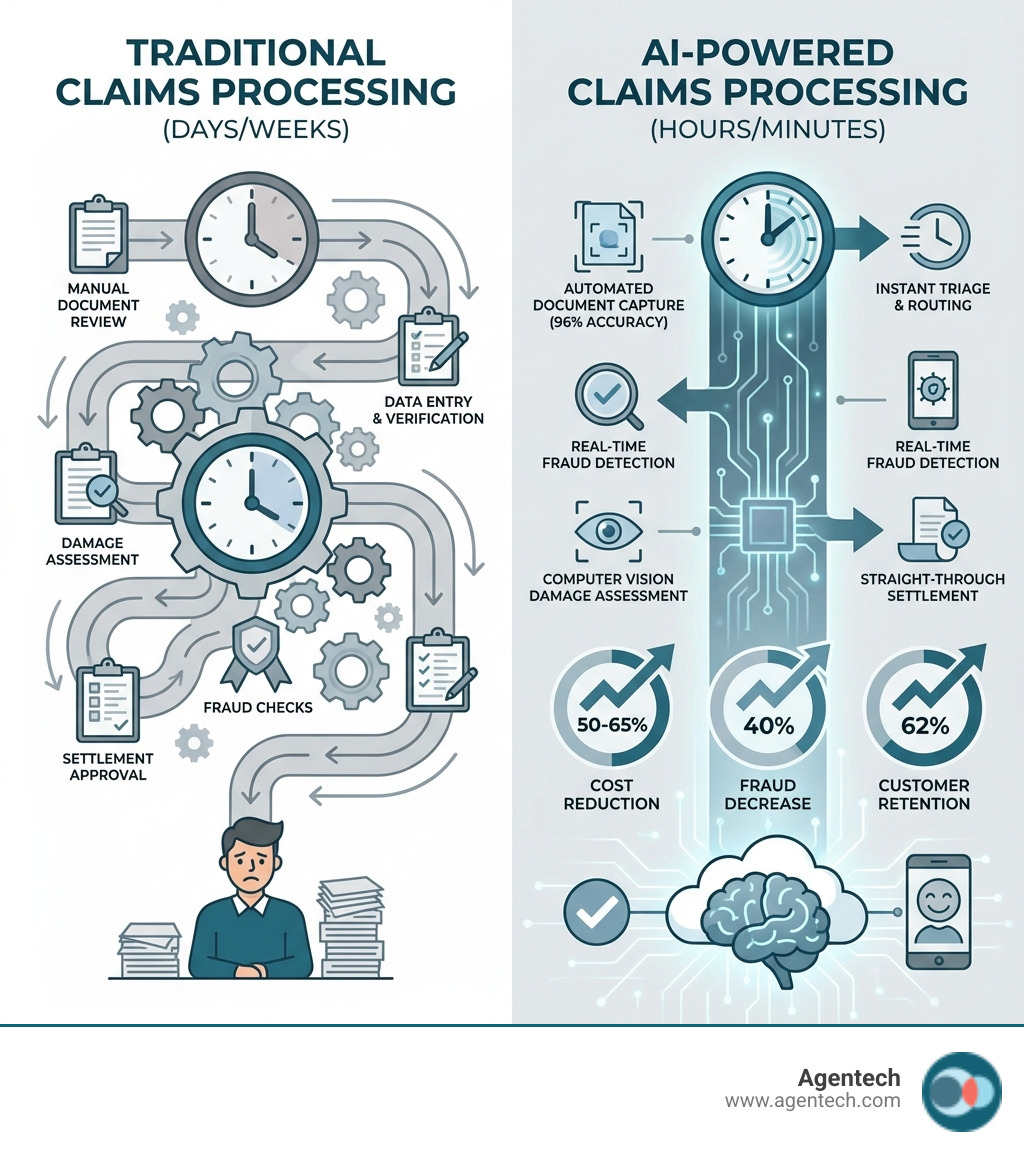

AI-powered claims processing uses artificial intelligence to automate and streamline P&C insurance claims from submission to settlement. It dramatically reduces manual work, improves accuracy, and accelerates claim resolution times while keeping human adjusters in control. Here is how it works:

- Automated Data Capture: AI extracts information from claim documents, emails, and forms with up to 96% accuracy, feeding your claims management software without manual rekeying.

- Intelligent Triage: Claims are automatically categorized, prioritized, and routed to the right adjuster or TPA workflow based on rules and risk signals.

- Fraud Detection: Machine learning highlights suspicious patterns, inconsistencies, or repeat behaviors that human reviewers might miss.

- Damage Assessment: Computer vision analyzes photos and videos to estimate repair costs for residential property, auto, and pet claims in near real time.

- Straight Through Processing: Simple, low risk claims are auto adjudicated and settled without manual intervention, while complex cases are escalated to experienced adjusters.

Traditional P&C claims processing is slow, error prone, and expensive. An industry report found 31% of policyholders were dissatisfied with their claims experience, with 60% citing settlement speed as the main problem. Meanwhile, claims handlers at P&C carriers, TPAs, and IA firms spend roughly 30% of their time on low value administrative work.

The numbers tell a sobering story. Manual handling adds 7 to 10 days to each claim, a manually reworked claim costs $25 on average, and claims leakage often sits between 8% and 12%. Furthermore, up to 35% of data inaccuracies come from human input.

For claims managers at Property & Casualty carriers, TPAs, and IA firms, these inefficiencies mean higher costs, frustrated customers, and burned out adjusters. The challenge is to fundamentally change how claims are processed while maintaining accuracy, compliance, and human oversight.

AI-powered claims processing offers a practical path forward. By automating routine tasks and augmenting human decisions, AI enables faster settlements, lower operational costs, and better customer experiences without forcing a rip and replace of existing claims management software.

I am Alex Pezold, founder of Agentech AI. We build the AI workforce for P&C insurance, helping carriers, TPAs, and IA firms transform claims handling with AI-powered claims processing that integrates seamlessly with your current tools and workflows.

Citations:

- Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research.

- Statista. (2021). Reasons for inaccurate customer data according to professionals in the United Kingdom (UK) in 2021.

- Agentech. (n.d.). Why AI Claims Processing is Revolutionizing the Insurance Industry.

What is AI-Powered Claims Processing and How Does It Work?

Imagine your P&C claims process flowing like a well oiled machine, responding to policyholders in minutes, not weeks, and freeing your adjusters for complex residential property, auto, pet, and workers compensation cases. That is the promise of AI-powered claims processing. It is the application of artificial intelligence to automate and improve every stage of the claims lifecycle in P&C insurance.

Unlike manual methods, AI brings speed, accuracy, and scalability. It transforms unstructured data from emails, photos, and reports into actionable insights that drive quicker, more consistent decisions in your claims management software.

From Manual Rules to Intelligent Automation

Traditional P&C claims processing is a maze of manual steps. Handlers review documents, enter data, and verify coverage in a slow, error prone process where every touchpoint adds delay.

Early rules based automation in claims management software offered limited help. These systems use predefined "if then" logic, which works for simple, structured data but fails with the unstructured data common in P&C claims, like emails or scanned reports. Rules based systems struggle to interpret context or learn from new information. As a result, only 7% of claims can be ingested via straight through processing with this older technology, requiring human intervention for the other 93%.

This is where AI-powered claims processing shines. Our AI Claims Processing System is designed to overcome the unstructured data challenge for P&C carriers, TPAs, and IA firms. Instead of rigid rules, AI uses advanced algorithms to understand, interpret, and process information in many formats, learning from patterns and continuously improving.

Consider this table comparing the two approaches:

| Feature | Rules Based Automation | AI Driven Automation |

|---|---|---|

| Data Handling | Structured data only (forms, databases) | Structured, semi structured, and unstructured data (emails, photos, PDFs) |

| Learning Capability | None, requires manual updates for new scenarios | Learns from data, adapts, and improves over time |

| Accuracy | High for predefined rules, low for exceptions | High, even for complex cases, with continuous improvement |

| Straight Through Processing | Limited (around 7%) | Significantly higher (up to 99% for FNOL, much higher overall) |

| Scalability | Hard to scale with increasing complexity | Highly scalable, handles large volumes and complexity |

| Fraud Detection | Basic rule violations | Advanced pattern recognition and anomaly detection |

| Cost | Lower initial, higher maintenance for updates | Higher initial, lower ongoing operational costs |

The Core Technologies Driving the Revolution

The engine behind AI-powered claims processing is a combination of advanced AI disciplines, purpose built for P&C insurance operations.

- Machine Learning (ML): ML algorithms learn from historical P&C claims data to identify patterns, predict outcomes like fraud or claim escalation, and inform decisions. Our Insurance Claims Machine Learning solutions are built on this foundation.

- Natural Language Processing (NLP): NLP enables AI to understand and process human language in claim reports, emails, and adjuster notes. It can extract key data and summarize documents, saving adjusters significant time.

- Computer Vision: For residential property, auto, and pet P&C insurance, computer vision lets AI analyze photos and videos to assess damage and estimate repair costs, from car photos to drone footage of roofs.

- Predictive Analytics: Predictive models use historical data to forecast outcomes like claim severity, litigation risk, or fraud likelihood, allowing for proactive management and better reserve allocation.

- Generative AI (GenAI): GenAI creates new content, such as summarizing complex medical or legal documents for workers compensation claims, drafting claim communications, and tailoring explanations for policyholders. Learn more in Generative AI (GenAI) in the evolution of claims processing.

- Agentic AI: Taking GenAI a step further, Agentic AI refers to digital agents that act autonomously to manage multi step tasks. They can plan, adapt, and execute complex claims processes with human oversight, representing a leap toward truly intelligent automation. Understand more in our Agentic AI Definition.

Together, these technologies form the backbone of modern AI-powered claims processing, allowing P&C carriers, TPAs, and IA firms to move into a new era of efficient, data driven claims operations without losing human judgment.

Citations:

- McKinsey & Company. (2021). Insurance 2030: The impact of AI on the future of insurance.

- Boston Consulting Group. (2023). GenAI Will Write the Future of Insurance Claims.

- Agentech. (n.d.). Insurance Claims Machine Learning.

The 5 Key Benefits of AI in P&C Claims

Implementing AI-powered claims processing opens up a cascade of benefits that redefine the claims experience for everyone involved, from boosting your bottom line to empowering your team.

1. Boost Operational Efficiency

A primary benefit of AI in P&C claims is a major boost in operational efficiency. AI automates the low value administrative tasks that consume about 30% of a claims handler's time, freeing them for complex cases and customer service. Our Automating Insurance Claims Processing solutions can reduce processing costs by 50% to 65% for P&C carriers, TPAs, and IA firms.

Consider the First Notice of Loss (FNOL) process. AI can process over 99% of FNOL requests straight through, using intelligent assistants to guide customers and provide immediate acknowledgment in your claims management software. Beyond FNOL, AI enables automated triage and routing, instantly categorizing claims and directing them to the appropriate handler or workflow. This reduces bottlenecks and ensures claims are handled by the right resources from the start. For example, one travel P&C insurer reduced processing time from weeks to minutes and automated 57% of its 400,000 annual claims with an AI solution. This leads to truly Efficient Claims Handling. Industry experts predict that more than half of claims activities can be automated by 2030.

2. Achieve Unprecedented Accuracy

Accuracy is essential in P&C claims, as errors lead to incorrect payments and compliance issues. Manual data entry is a major culprit, with human input causing up to 35% of data inaccuracies.

AI-powered claims processing improves accuracy by minimizing human involvement in routine data handling. Our Insurance Document Processing Automation solutions leverage advanced AI to reach up to 96% accuracy in data extraction. This level of precision helps ensure that policy numbers are correct, claim amounts are accurate, and all relevant details are captured without transcription errors.

AI also supports consistent decision making. Unlike humans, who can be influenced by fatigue, AI applies logic uniformly across P&C claims, leading to fairer outcomes. Automated damage assessment using computer vision provides objective evaluations of residential property or vehicle damage. Furthermore, by intelligently coding information and streamlining authorizations, AI can reduce denials by up to 70%, accelerating the entire claims adjudication process. Our Automated Claims Adjudication Software is a game changer for your operations.

3. Drastically Reduce Claims Leakage and Fraud

Claims leakage and fraud silently drain 8% to 12% of claim payouts in P&C insurance. These schemes are increasingly hard for human adjusters to detect at scale.

AI-powered claims processing offers a powerful defense. AI algorithms analyze large datasets, spotting subtle patterns and anomalies that humans often miss. Some insurers have reported a 40% drop in fraudulent activities after implementing AI solutions. Our AI driven claims processing systems analyze claim data in near real time, flagging potential fraud risks for human review. This allows legitimate claims to proceed quickly while suspicious ones are investigated. For example, AI can identify potential photo reuse in damage claims, a task that would be slow and error prone with manual review.

Beyond fraud, AI also helps identify subrogation opportunities that might otherwise be overlooked. By cross referencing claim details with policy information, AI can highlight cases where another party is liable for a loss. This ability extends to proactive loss prevention, as P&C carriers use AI to gain a deeper understanding of risk and identify insured properties most at risk of fire and water damage claims. P&C carriers are using AI to gain a deeper understanding of risk.

4. Revolutionize the Policyholder Experience

Customer experience is a key differentiator in the competitive P&C market. Slow settlements are a top complaint, with 31% of policyholders dissatisfied with the claims process. A good experience drives retention (62% vs. 19% for a bad one), which is crucial since acquiring new customers is far more expensive than keeping existing ones.

AI-powered claims processing is a major lever for policyholder satisfaction. By automating tasks, AI reduces processing time from weeks to minutes for many P&C claims, addressing the number one cause of dissatisfaction. Our Simplify Claims Process solutions help ensure policyholders get a quick and efficient resolution.

AI also enables 24 hour service through intelligent assistants, allowing policyholders to get instant updates or initiate a claim at any time through your existing channels. Proactive communication, where AI automatically sends status updates, builds trust and transparency. As we emphasize in Designing for the Future: How AI Transforms the Claims Experience, a seamless and swift claims experience builds lasting customer loyalty.

5. Empower Your Adjusters and TPAs

Instead of replacing jobs, AI-powered claims processing empowers P&C adjusters and TPAs. It shifts their role from administrative work to strategic problem solving and customer advocacy.

AI acts as a digital coworker, handling repetitive tasks like data entry, document review, and basic coverage checks. This frees your adjusters to focus on high value tasks that require human empathy, complex judgment, and negotiation. This is the core philosophy behind AI Designed with Adjusters in Mind.

With AI handling routine work, adjusters can dedicate their expertise to complex claims and provide personalized support to policyholders. AI provides them with data driven recommendations, summarizing lengthy reports in seconds to give them critical information at a glance. This shift not only makes adjusters more productive but also helps reduce burnout, as nearly half of adjusters handle over 125 claims. By offloading routine work, AI helps manage caseloads, leading to higher job satisfaction and better retention. As highlighted in The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers and Solving the Insurance Labor Crisis with AI-Driven Innovation, AI augments your team's capabilities and supports a more sustainable workforce.

Citations:

- Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research.

- McKinsey & Company. (2021). Insurance 2030: The impact of AI on the future of insurance.

- Zurich. (2024). Caroline Dunn: Accelerated AI development, sustainability key themes for 2024.

- EY. (n.d.). How AI-powered document intelligence transformed an insurer’s operations.

- Agentech. (n.d.). Why AI Claims Processing is Revolutionizing the Insurance Industry.

How to Implement AI-Powered Claims Processing in Your Operations

Starting the journey to implement AI-powered claims processing can seem daunting, but a strategic, phased approach allows P&C carriers, TPAs, and IA firms to integrate this technology into existing claims management software. It is about smart adoption, not a rip and replace scenario.

Starting Your AI Journey: A Phased Approach

The key to successful AI implementation is to start small, show quick wins, and build momentum.

- Assess Current Workflows: Map your existing P&C claims processes to identify bottlenecks, manual touchpoints, and areas prone to human error.

- Identify Bottlenecks: Focus on the stages that cause the most delays or consume the most resources, such as FNOL intake or document indexing.

- Start with High Impact Projects: Choose contained projects with clear data that can deliver measurable benefits quickly. Our Not Sure Where to Start with AI guide offers more insights.

- Pilot Programs: Before a full scale rollout, implement AI solutions in a controlled pilot to test the technology, refine workflows, and gather feedback from adjusters and supervisors.

Here is a list of ideal first projects for AI automation in P&C claims:

- FNOL Intake: Automating the initial capture of First Notice of Loss data from channels like email and web forms.

- Document Indexing and Classification: Automatically sorting incoming documents (for example, police reports, medical bills, estimates) and extracting key data.

- Simple Auto Glass Claims: These high volume, straightforward claims are well suited for straight through processing.

- Basic Coverage Verification: Using AI to quickly check policy terms against claim details for simple cases.

- Initial Fraud Flagging: Implementing AI to identify basic suspicious patterns for human review.

Integrating AI with Your Existing Systems

A common concern for P&C carriers, TPAs, and IA firms is integrating AI with legacy claims management software. Modern AI-powered claims processing solutions are designed for seamless integration.

- APIs and Middleware: Robust Application Programming Interfaces (APIs) act as bridges, allowing AI tools to communicate with your existing claims software and other core platforms. Learn more in Insurance IT Systems.

- Seamless Data Exchange: The goal is a smooth flow of accurate, actionable data between your AI tools and current infrastructure, avoiding data silos and duplicate entry.

- Scalability: Choose AI solutions that can scale to handle increased claim volumes, especially during catastrophic events, without compromising performance.

- Buy vs. Build: For many organizations, a Software as a Service (SaaS) model offers faster deployment, lower upfront costs, and continuous updates. Explore our insights on Buy vs. Build: Navigating the SaaS AI Technology Decision and get an Artificial Intelligence SaaS Explained: Your Ultimate Guide.

Navigating Challenges and Ethical Considerations

Implementing AI-powered claims processing requires navigating potential challenges and ethical issues. Thoughtful planning is key to mitigating these risks.

- Data Privacy and Security: Protecting sensitive policyholder data is essential. A robust AI solution requires advanced encryption, strict access controls, and compliance with regulations like HIPAA, GDPR, and PCI DSS, especially when handling medical data for workers compensation claims.

- Algorithmic Bias: AI models learn from data. If historical P&C data contains biases, the AI might perpetuate them. It is important to use diverse datasets, test models thoroughly, and continuously monitor AI outputs for bias.

- Regulatory Compliance: The regulatory landscape for AI in P&C insurance is evolving. P&C insurers, TPAs, and IA firms must ensure their AI solutions comply with all relevant laws, such as the NAIC AI Model Guidance.

- Change Management: Introducing AI means changing how your team works. Effective change management involves clear communication, practical training, and involving adjusters in the adoption process so AI is seen as support, not a threat.

- Upskilling Your Workforce: Empower your adjusters by providing training in new skills, such as how to work alongside AI, interpret its recommendations, and override or escalate when needed. This transforms your team into a future ready P&C workforce.

Citations:

- U.S. Department of Health & Human Services. (n.d.). Health Information Privacy.

- NAIC. (n.d.). Model Bulletin on the Use of Artificial Intelligence Systems by Insurers.

- Agentech. (n.d.). Insurance IT Systems.

Frequently Asked Questions about AI in Claims

Will AI completely replace P&C claims adjusters?

This is a common question, and the answer is no. The industry trend is one of augmentation, not replacement. AI is not designed to replace P&C claims adjusters but to act as a digital coworker. As many industry experts note, AI excels at the tedious administrative tasks that consume an adjuster's day. This frees human adjusters to focus on what they do best: handling complex residential property, auto, pet, and workers compensation claims, applying nuanced judgment, negotiating settlements, and providing empathetic customer service. The "human in the loop" remains critical, especially for high value or sensitive claims where human intuition is essential.

What is the expected ROI from implementing AI in claims?

The ROI from AI-powered claims processing in P&C insurance is significant, multifaceted, and often seen within the first year.

- Cost Savings: Automation can reduce processing costs by 50% to 65%. AI reduces the need for rework, where a single manually reworked claim costs $25 on average.

- Reduced Processing Time: Processing times can drop from weeks to minutes for many P&C claims, directly addressing a major source of policyholder dissatisfaction.

- Fraud Reduction: AI's ability to spot subtle patterns can lead to a meaningful reduction in fraudulent activities, with some insurers reporting a 40% drop. This also reduces claims leakage, which can cost 8% to 12% of payouts.

- Improved Customer Retention: A faster, more transparent claims experience leads to higher policyholder satisfaction. With 62% of customers staying after a good experience compared to 19% after a bad one, the ROI on customer loyalty is substantial.

Our case studies, such as Odie Pet Insurance Implements Agentech to Automate Claims Tasking and Ameradjust Leverages Agentech's Digital Claims Co-Workers, demonstrate these real world benefits.

How does AI handle different P&C insurance lines like auto, property, and workers' comp?

AI-powered claims processing is versatile and adaptable to the unique needs of various P&C insurance lines.

- Auto Claims: For auto claims, computer vision analyzes photos of vehicle damage to estimate repair costs and flag inconsistencies, speeding up assessments and reducing the need for in person inspections.

- Property Claims: For residential property claims, AI analyzes drone footage or ground level images to assess roof damage or evaluate catastrophe related destruction.

- Workers' Compensation: For workers compensation, NLP analyzes complex medical and legal documents to extract key data, verify information, and identify subrogation opportunities, streamlining adjudication.

- Pet Insurance: For pet P&C insurance, AI automates the processing of vet invoices and medical records for fast, accurate reimbursement.

- Cargo Insurance: For specialized lines like cargo P&C insurance, AI can streamline processes by automating tasks related to tracking and damage reports. Our Automated Cargo Insurance Services demonstrate this capability.

The strength of AI is its adaptability. Agentech can configure custom workflows within your claims management software to meet the specific requirements of each P&C line, ensuring the technology delivers maximum value across your portfolio.

Citations:

- Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research.

- Agentech. (n.d.). Odie Pet Insurance Implements Agentech to Automate Claims Tasking.

- Agentech. (n.d.). Ameradjust Leverages Agentech's Digital Claims Co-Workers.

The Future is Now: Build a Smarter Claims Operation

AI is no longer a future concept but a present day necessity for P&C insurance carriers, TPAs, and IA firms. By embracing AI-powered claims processing, you can create a faster, more accurate, and customer centric claims operation across residential property, auto, pet, and workers compensation lines. The key is to view AI as a powerful partner that augments your human experts, freeing them to deliver exceptional value where it matters most.

Agentech's digital agents are designed to integrate seamlessly into your existing claims management software, providing the efficiency of automation with the precision of expert oversight. They handle repetitive, rules driven work so your adjusters can focus on high impact decisions and policyholder relationships.

Ready to transform your P&C claims process without disrupting your current systems? Explore our AI Agents.

Citations:

- McKinsey & Company. (2021). Insurance 2030: The impact of AI on the future of insurance.

- Oliver Wyman. (2023). How Insurers Can Successfully Use Generative Artificial Intelligence.

- Zurich. (n.d.). Artificial intelligence (AI) is helping transform insurance, including claims.

- Agentech. (n.d.). Why AI Claims Processing is Revolutionizing the Insurance Industry.