Why Insurance IT Systems Are Essential for Modern Operations

Insurance it systems are the digital backbone that transforms how carriers, agencies, and brokers manage policies, process claims, and serve customers. These comprehensive software solutions streamline everything from initial quotes to final claim settlements, making operations faster, more accurate, and more profitable.

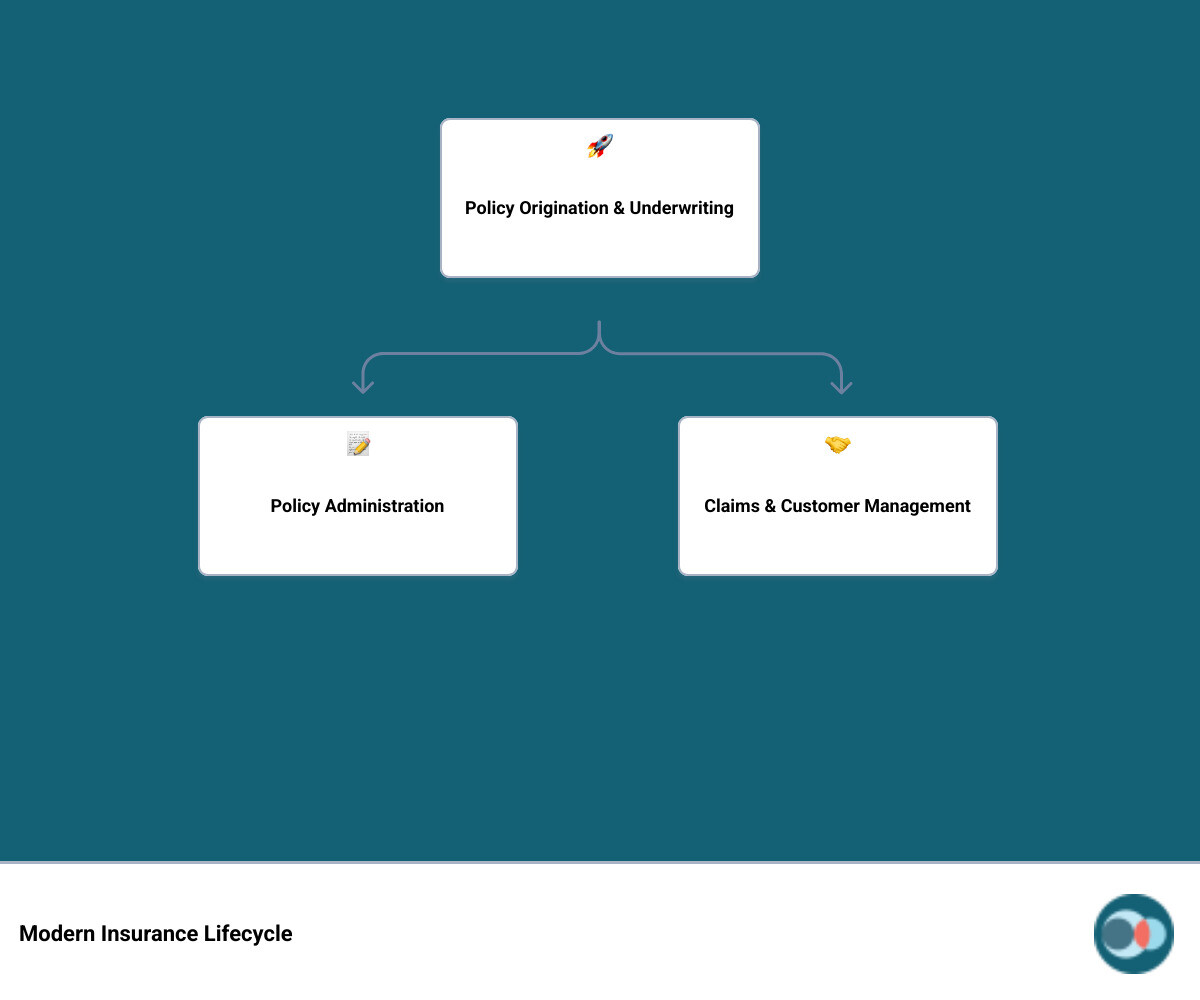

Core Insurance IT System Components:

- Policy Administration Systems (PAS) - Handle policy lifecycle from quotes to renewals

- Claims Management Systems - Process claims from first notice to settlement

- Underwriting Software - Assess risk and make pricing decisions

- CRM Systems - Manage customer relationships and agent interactions

- Supporting Systems - Document management, billing, and reporting tools

The insurance software market is experiencing explosive growth, projected to reach $5511 million by 2031 (Source: Verified Market Research). This surge reflects the industry's urgent need to modernize legacy systems and meet rising customer expectations for faster, more transparent service.

Modern insurance companies face mounting pressure to reduce manual processes, accelerate claim settlements, and deliver seamless customer experiences. Traditional paper-based workflows and disconnected systems simply can't keep pace with today's digital demands. Companies using advanced IT systems report dramatic improvements - some settling over 50% of claims in real-time compared to the industry average of 25 days for manual processing.

The shift toward digital change isn't just about efficiency - it's about survival. Customers increasingly expect instant quotes, real-time policy updates, and rapid claim resolutions. Companies that fail to modernize risk losing market share to more agile competitors.

I'm Alex Pezold, and through my experience building and scaling technology businesses, I've seen how the right insurance it systems can revolutionize operations and drive unprecedented growth. At Agentech AI, we're specifically focused on changing claims processing through AI-powered solutions that work alongside human adjusters to automate administrative tasks and accelerate settlements.

The Core Components of Modern Insurance IT Systems

Modern insurance it systems consist of several core software modules that work together to manage the entire insurance lifecycle. Here are the essential components.

Policy Administration Systems (PAS)

Your Policy Administration System is the heart of your insurance operation, managing every policy from the initial quote through renewals. A solid PAS handles quoting with speed and accuracy, giving customers the information they need without the wait. Once they're ready to buy, the system smoothly transitions to policy issuance, capturing all important details.

Life changes, and so do insurance needs. Your PAS manages endorsements (mid-term changes) and handles renewals automatically. The system keeps track of everything, eliminating manual errors.

The real value comes from centralized data. Instead of hunting through multiple systems, everything lives in one place: customer details, coverage information, premium history, and claims data. This unified approach provides real-time insights that help you make better decisions and work more efficiently.

Some modern systems are so agile they can launch new products in just 30 days. That's the kind of speed today's market demands. You can learn more about Agentech's Product to see how modern policy administration works.

Claims Management Systems

The claims process is a critical customer touchpoint. A great claims management system turns a potentially stressful experience into a smooth one.

The journey starts with First Notice of Loss (FNOL). From there, the system guides the entire process through investigation, adjudication, and final settlement. Every step is tracked and every deadline monitored.

Traditional manual claims processing takes an average of 25 days. With modern systems, many insurers are settling over 50% of claims in real-time. That's the difference between frustrated customers and loyal advocates.

At Agentech, we believe adjusters are irreplaceable—they bring empathy and judgment that no machine can match. Our approach focuses on automating the repetitive administrative tasks that bog adjusters down, freeing them to do what they do best: help people through difficult times.

This human-AI partnership dramatically reduces settlement times while improving customer satisfaction. When adjusters can focus on complex cases instead of paperwork, everyone wins. Learn more about how our AI Designed with Adjusters in Mind transforms the claims experience.

Underwriting and Risk Assessment Software

Underwriting requires making smart decisions with incomplete information. Modern underwriting software provides the analytical power to make this process more scientific.

These systems excel at risk evaluation, pulling in vast amounts of data from multiple sources. They perform sophisticated data analysis that would take human underwriters hours to complete manually. The result is more accurate risk assessment and better pricing decisions.

Automated decision-making handles straightforward cases, freeing up your expert underwriters for complex situations that need human judgment. This amplifies their expertise and improves pricing accuracy.

Some insurers have cut their risk assessment time by 50% or more. That means faster quotes for customers and more capacity for your team to handle complex risks.

The key is moving from reactive to proactive risk management. This strategic approach helps you break through the data plateau and gain deeper insights into risks and customer behavior.

Agent, Broker, and Customer Relationship Management (CRM)

Agents, brokers, and customers are the lifeblood of your business. A good CRM system helps manage these vital relationships effectively.

For agents and brokers, agent portals provide everything they need in one place. Commission tracking shows what they've earned, and sales pipeline management helps them stay on top of prospects.

The real power comes from customer data management. Your CRM creates a 360-degree customer view of every interaction, policy, and claim. When a customer calls, your team immediately knows their history and can provide personalized service.

This comprehensive view transforms relationships. Instead of treating each interaction as isolated, you're building on every previous touchpoint. Improved relationships are essential for business growth. Happy customers renew more often, buy additional coverage, and cost less to serve. Your CRM system makes this possible by keeping everyone on the same page.

Supporting Systems for Seamless Operations

While core systems get the attention, supporting systems are the behind-the-scenes heroes that ensure smooth operations.

Document management systems eliminate the chaos of paper files. Everything is digitized, organized, and searchable, so a policy from three years ago can be found in seconds.

Reinsurance management handles the complex world of risk-sharing agreements, managing treaties, tracking facultative reinsurance, and handling the associated accounting.

Integrated billing and payment processing automates the financial side of insurance. Invoices go out on time, payments are processed smoothly, and accounts receivable stays current.

Data retrieval and organization tools ensure information flows freely between all your systems. This connectivity is vital for reporting, auditing, and gaining insights across your entire operation.

These supporting insurance it systems work together to create one integrated, automated operation that spans your entire business.

The Technology Driving the Future of Insurance

Explore the transformative technologies being integrated into insurance software, from AI-driven automation to the scalability of the cloud.

The Role of AI and Automation

Artificial intelligence and automation are truly changing how insurance works. Think of AI as a smart assistant that handles repetitive tasks, allowing you to focus on helping customers and solving complex problems.

Machine learning powers these AI systems, learning from data to make better decisions over time. In insurance it systems, this technology is making waves everywhere—from processing claims faster to helping underwriters assess risks more accurately.

AI can read through mountains of paperwork, extract key information, and even make sense of handwritten notes. What used to take days can now happen in minutes. Some companies are settling over 50% of their claims in real-time, compared to the industry average of 25 days for manual processing. That's a game-changer for both insurers and customers.

At Agentech, we believe in the power of human-AI collaboration. Our AI-powered tools handle the administrative heavy lifting in claims processing, but we never lose sight of the human element. Our approach means adjusters can spend more time providing empathy and tackling complex cases, while AI handles data extraction, policy verification, and routine tasks.

The beauty of this approach is improved decision-making without losing the personal touch. AI provides insights and recommendations, but experienced professionals make the final calls. It's about working smarter, not harder. You can dive deeper into The Future of Insurance: How AI is Changing the Game and explore our specific AI Agents to see how this technology can transform your operations.

Cloud-Based Solutions for Flexibility and Scale

The days of on-premise server rooms are fading thanks to cloud computing. Moving insurance it systems to the cloud is a fundamental operational shift, not just a hardware change.

Software as a Service (SaaS) solutions offer incredible scalability. Need to handle more policies during busy season? The cloud adjusts automatically. Want to add new team members in different locations? They can access everything they need from anywhere with an internet connection.

The cost-effectiveness is hard to ignore. Instead of massive upfront investments in servers, you pay for what you use. Your cloud provider handles system updates and maintenance, so your team can focus on insurance, not IT management.

Remote access has become essential, and cloud solutions make it seamless. Whether your team is working from home or meeting clients on-site, everyone has access to the same real-time information. This flexibility is a competitive advantage.

Data security and business continuity are built into modern cloud platforms. Professional cloud providers invest heavily in security measures, and your data is automatically backed up and protected against disasters. Learn More about How it Works with cloud-based insurance solutions.

Analytics, Reporting, and Customer Engagement

Modern business intelligence tools transform raw data into actionable insights. Instead of guessing, you can make decisions based on real data insights about customer needs and risks.

Performance tracking becomes effortless with the right analytics tools. You can see which processes are working well, where bottlenecks occur, and how to optimize your operations. Predictive analytics help you anticipate trends and prepare for future challenges.

Analytics isn't just for internal use. Customer portals powered by data insights create the personalized experiences that today's customers expect. A policyholder can log in to see coverage details, track claim status, and get personalized recommendations.

Chatbots and self-service options are changing customer service from a cost center into a competitive advantage. These AI-powered assistants can handle routine questions 24/7, freeing up your human agents for complex issues. Customers get instant answers, and your team can focus on high-value interactions.

The key is creating a seamless experience where technology improves rather than replaces human connection. When customers can easily find information online but still reach a knowledgeable person when needed, everyone wins.

Strategic Considerations for Your Tech Stack

Choosing and implementing the right software is a critical business decision. This section covers key factors, from custom builds to future-proofing your investment.

How to Choose the Right Insurance IT Systems for Your Business

Selecting the right insurance IT systems is a strategic decision that will shape your operations for years. The right approach makes this complex choice simpler.

Start by getting clear on your business goals. Are you trying to slash claims processing times, boost customer retention, or launch new products faster? Your software choice must align with these objectives.

Scalability needs deserve serious attention. A system working for your current volume might crumble as you grow. Think ahead to ensure you have room to expand.

Integration capabilities can make or break your tech stack. Your new system must work with your existing tools and any future additions to avoid data silos.

Don't overlook vendor support. You're not just buying software; you're entering a partnership. Look for vendors who understand your challenges and provide reliable assistance.

The user experience is critical. Even the most powerful system is worthless if your team finds it frustrating to use. Finally, consider the total cost of ownership, which includes implementation, training, and ongoing maintenance.

Custom vs. Ready-Made Insurance Software

A key decision is whether to use a ready-made solution or build custom software. Both paths have their merits.

Ready-made solutions are quicker to implement and have a lower upfront cost. These systems include standard functionalities and can get you up and running in weeks. The trade-off is you might not get specific features that provide a competitive edge.

Custom software is built around your unique workflows. This approach offers a competitive advantage through custom functionality your competitors can't match. The downside is a higher upfront investment, longer implementation times, and responsibility for ongoing maintenance.

| Feature | Ready-Made Software | Custom Software |

|---|---|---|

| Cost | Lower upfront, subscription-based | Higher upfront, potentially lower long-term TCO |

| Implementation | Faster, less complex | Slower, more complex, but custom |

| Features | Standard, general-purpose | Custom to specific business needs |

| Scalability | Relies on vendor's roadmap | Built for your future needs |

| Competitive Advantage | Limited differentiation | Significant, unique capabilities |

| Maintenance | Handled by vendor | Your responsibility, more control |

The decision often comes down to your budget, timeline, and need for unique capabilities. For companies looking to differentiate, custom solutions can be game-changing. For those needing proven functionality quickly, ready-made options make sense.

If you're wrestling with this decision, our guide on Buy vs. Build: Navigating the SaaS AI Technology Decision dives deeper into the considerations.

Key Trends Shaping the Future of Insurance IT Systems

The insurance IT systems landscape moves fast. Staying ahead of the trends reshaping our industry is essential for survival.

Agentic AI is perhaps the most exciting development. This goes beyond simple chatbots or basic automation to AI agents that can perform complex tasks autonomously, make decisions, and interact with multiple systems. At Agentech, we're pioneering this in claims processing, where our AI agents work alongside human adjusters to accelerate settlements.

Hyper-automation is another game-changer, integrating AI, machine learning, and robotic process automation to automate nearly every process. We're moving toward end-to-end digital workflows that handle everything from policy issuance to complex claims.

Embedded insurance is gaining serious momentum. Think about buying travel insurance seamlessly when you book a flight. This trend requires highly flexible, API-driven insurance IT systems that can connect with diverse platforms and deliver insurance when and where customers need it.

The rise of low-code/no-code platforms is democratizing software development. Business users can now build applications with minimal coding, speeding up product development. Combined with robust API ecosystems that let different systems communicate effortlessly, these trends are creating a more interconnected and agile insurance industry.

The shift from generative AI to agentic AI alone is changing how we think about claims processing. You can explore this evolution in our article on Changing Insurance Claims: The Evolution from Generative AI to Agentic AI.

These trends are becoming competitive necessities. Companies that adopt them early will gain significant advantages in efficiency, customer satisfaction, and market positioning.

Frequently Asked Questions about Insurance Software

We know that choosing and implementing new insurance it systems can feel overwhelming. That's why we've compiled answers to the questions we hear most often.

How do insurance IT systems support regulatory compliance?

Staying compliant in the insurance industry is a major challenge due to constantly changing regulations and serious penalties. Modern insurance it systems are built to make this much easier.

These systems include automated checks that verify compliance with industry regulations at every step, from policy issuance to claims processing. When regulations change, systems provide real-time updates that automatically adjust workflows to keep you compliant.

The audit trail capabilities are particularly valuable. Every transaction and decision gets recorded with timestamps and user information. During regulatory audits, you'll have an irrefutable digital paper trail.

Standardized reporting features generate compliance reports with a click, saving countless hours. Plus, built-in data security protocols ensure customer information stays protected according to privacy regulations.

The bottom line is that good software reduces the time and effort needed to stay on top of changing regulations. For more insights, check out AI in Insurance: Balancing Innovation and Regulation.

What are the essential features of a modern insurance IT system?

Not all insurance it systems are equal. Several must-have features separate modern systems from legacy solutions.

Cloud-native architecture tops our list. This means systems are designed from the ground up for scalability and flexibility. You can access data from anywhere, scale up during busy periods, and let your provider handle maintenance.

API-first design is crucial for your business. It means your system can easily connect with other tools—accounting software, third-party data providers, and future technologies.

AI and analytics capabilities transform raw data into actionable insights. Modern systems don't just store information; they help you understand patterns, detect fraud, and make smarter business decisions.

Robust security protects your most valuable asset: customer trust. Look for systems with multi-layer security, encryption, and regular security audits.

User-friendly interface ensures your team actually uses the system effectively. If it's confusing, productivity suffers.

Finally, scalability means the system grows with your business, maintaining consistent performance whether you're processing 100 policies or 100,000.

What are the biggest benefits of upgrading legacy systems?

Upgrading from legacy systems to modern insurance it systems can transform an insurance company's operations, with improvements often exceeding expectations in key areas.

Increased efficiency is usually the most immediate benefit. Modern systems automate repetitive tasks, with some companies achieving up to 98% straight-through processing rates. Your team spends less time on paperwork and more on value-added activities.

Improved customer experience follows closely. Today's customers expect instant quotes and fast claim settlements. Modern systems enable 24/7 self-service portals, automated communications, and faster processing.

Better data insights open up strategic advantages. Legacy systems often trap information in disconnected silos. Modern systems unify this data and apply analytics to reveal patterns in customer behavior, risk factors, and operational bottlenecks.

Improved security addresses growing cyber threats. Legacy systems were built when security was an afterthought. Modern systems include advanced security features and compliance with current privacy regulations.

Greater business agility might be the most valuable long-term benefit. Modern systems are built for flexibility, allowing you to launch new products, enter new markets, or adapt to regulatory changes quickly.

The insurance industry faces a growing labor shortage, but AI-driven innovation can help optimize your existing workforce. Learn more about Solving the Insurance Labor Crisis with AI-Driven Innovation.

Conclusion

The journey through modern insurance IT systems reveals a clear truth: technology isn't just changing how we do business—it's becoming the foundation for everything we accomplish. From policy administration to claims settlement, from customer engagement to regulatory compliance, these systems touch every corner of our operations.

What excites me most is how these technologies empower people rather than replace them. Yes, AI can process documents in seconds and cloud systems can scale instantly. But at the heart of every successful implementation, you'll find human expertise guiding the way. The best insurance IT systems amplify our natural abilities, letting us focus on what we do best: solving problems, building relationships, and protecting what matters most to our customers.

The competitive edge that comes from modernization isn't just about speed or efficiency—though those benefits are significant. It's about creating an organization that can adapt, innovate, and thrive in an ever-changing marketplace. Companies that accept this digital change position themselves not just to survive, but to lead their markets into the future.

For carriers specifically looking to revolutionize their claims processing, the path forward is clearer than ever. Advanced AI integration doesn't have to mean disrupting your entire workflow or replacing your experienced adjusters. Instead, it can mean giving them powerful tools that handle the administrative burden while they focus on complex decisions and customer care.

The insurance industry stands at a pivotal moment. The technology exists today to transform operations, delight customers, and build more resilient businesses. The question isn't whether to modernize—it's how quickly you can get started.

At Agentech, we've seen how AI Agents working alongside human adjusters can automate administrative tasks and dramatically boost productivity. This seamless integration approach ensures you get the benefits of cutting-edge technology without losing the human touch that makes insurance personal.

The future belongs to organizations that accept change while staying true to their core mission of protection and service. By investing in the right technology stack, you're not just improving your operations—you're building a foundation for decades of growth and success.

Ready to transform your claims processing and open up your team's full potential? Get started on your digital change journey today.