Why Efficient Claims Handling Defines Success in P&C Insurance

Efficient claims handling is the critical measure of a P&C insurance carrier's operational excellence and customer commitment. It is defined by:

- Speed: Processing claims in minutes or hours, not days or weeks.

- Accuracy: Reducing errors through standardized workflows and automated data capture.

- Transparency: Providing real time updates and clear communication.

- Cost Control: Cutting operational expenses by up to 30% with modern systems.

- Customer Satisfaction: Delivering experiences that make policyholders 3.5x more likely to renew.

The stakes are high. Manual claims handling creates average delays of 7 to 10 days. Workers' compensation claims reported over two weeks post-injury cost 18% more than those reported in the first week. Insurance fraud costs the industry over $308 billion annually. These figures represent significant financial and competitive pressure.

For Property & Casualty insurance carriers, Third-Party Administrators, and Independent Adjusting firms, claims are the moment of truth. It is where customer loyalty is won or lost and where operational efficiency directly impacts the bottom line.

The shift to modern claims management is already happening. Leading P&C insurers using modern systems process claims up to 30% faster, while approaches driven by AI improve success rates by 10-20%. AI enables straight-through processing that reduces cycle times from days to minutes for straightforward claims.

Yet many organizations still wrestle with time consuming documentation, inconsistent processes, fraud risks, and communication gaps. These challenges are solvable with the right combination of standardized workflows, intelligent technology, and an approach centered on the customer.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance. After founding and scaling TokenEx to one of Oklahoma's largest technology exits, I've focused on revolutionizing efficient claims handling through AI solutions that augment human expertise rather than replace it, starting with residential property, auto, pet, and workers' compensation claims.

This guide walks you through the complete playbook: understanding the cost of inefficiency, overcoming roadblocks, implementing proven strategies, leveraging AI, and building a high performance ecosystem. Whether you're at a regional carrier, a TPA, or an IA firm, you'll find actionable steps to transform your operation.

The High Stakes of Claims Inefficiency

The true cost of a slow or inconsistent claims process extends far beyond operational budgets, directly impacting customer loyalty, loss ratios, and profitability. Understanding these stakes is the first step toward meaningful improvement.

Why Prioritize Efficiency?

The question is not whether to prioritize efficient claims handling, but how quickly you can begin. The benefits touch every part of your P&C insurance operation.

When a policyholder files a claim, they are often experiencing a difficult event like a car accident, a house fire, or a workplace injury. How you handle their claim defines your relationship. A positive claims experience makes policyholders 3.5 times more likely to renew their policy, a crucial factor for growth in a competitive market.

The financial case is equally compelling. Modern claims processing can reduce costs by up to 30%, changing a cost center into a strategic advantage. When you streamline processes, your adjusters can focus on complex cases that need their expertise, rather than drowning in paperwork.

This efficiency translates directly into a competitive advantage. Policyholders expect seamless digital experiences, and a swift claims process is now table stakes for competing in today's market.

Finally, consider employee morale. Your claims professionals want to help people and solve problems, not spend hours on repetitive tasks. By automating this work, you empower them to focus on the rewarding parts of their job. This reduces burnout, improves retention, and creates a more engaged workforce that delivers better customer experiences.

The Financial Drain of Delays

The consequences of inefficient claims handling hit your bottom line hard. Every delay creates a ripple effect that compounds costs across your operation.

A National Council on Compensation Insurance (NCCI) study reveals that workers' compensation claims reported more than two weeks after the date of injury cost 18% more on average than claims reported within the first week. This is a significant hit to your loss ratios.

Delayed claims cost more because medical treatment can become more complicated, legal involvement may increase, and administrative overhead spirals. These escalating costs fall under Loss Adjustment Expenses (LAE) and can quickly get out of control.

Manual claims handling often leads to an average delay of 7 to 10 days. During that time, your policyholders are waiting, your adjusters are buried in busywork, and your costs are climbing.

Then there are regulatory penalties. States have specific requirements for Property & Casualty insurance claims processing, and missing a deadline can lead to fines and compliance issues.

Perhaps most damaging is customer churn. Slow communication and lengthy processing times send a clear message that a claim is not a priority. That negative experience drives policyholders to your competitors, impacting renewal rates and long term profitability.

These problems are solvable. Understanding the stakes is the first step. The next is taking action to transform your claims operation into an efficient, customer focused process.

Overcoming Common Roadblocks in Claims Processing

Many organizations struggle with persistent challenges that create bottlenecks and drive up costs. Identifying these roadblocks is critical to dismantling them and paving the way for a more streamlined operation.

Inconsistent Workflows and Documentation

One of the biggest headaches in claims processing is the chaos from inconsistent workflows and documentation. When each adjuster has a unique approach, the result is a patchwork of varying statement quality, inconsistent documentation, and different outcomes for similar cases.

This lack of standardization makes it difficult to ensure fairness and efficiency. Manual data entry compounds the problem, eating up valuable time while introducing errors. Adjusters waste hours searching through multiple systems or manually processing information when documentation is not properly integrated.

The challenge gets worse when teams wrestle with disparate systems that do not communicate. An adjuster might record a statement on their phone, then have to upload it to multiple platforms. This tedious work, which is prone to error, leads to professional burnout.

This time consuming documentation is a primary cause of delays. Manual claims handling creates an average delay of 7 to 10 days, a week your policyholder spends waiting and worrying.

The Challenge of Fraud Detection

Fraudulent claims are a massive issue. Insurance fraud costs the P&C insurance industry $308.6 billion annually, impacting premiums and carrier profitability.

The difficulty in spotting patterns makes fraud detection challenging. Fraud can be sophisticated and buried within mountains of legitimate data. A single adjuster reviewing claims manually cannot identify patterns that might span hundreds of cases over time.

When a claim does raise red flags, the investigation becomes resource intensive. Your best adjusters are pulled away from legitimate claims to dig through documentation and piece together evidence, creating a bottleneck for the entire operation.

Modern technology is essential here. Clear, accessible recorded statements are vital for fraud detection. Modern statement management platforms provide tools for analyzing voice patterns, flagging inconsistencies, and maintaining a secure chain of custody. For more insights, check out our article on using AI for fraud detection.

Communication and Customer Experience Gaps

Nothing frustrates claimants more than silence. When policyholders file a claim, they are often going through a personal crisis. Lack of transparency during these moments can quickly erode trust.

When policyholders do not hear from their insurer, they worry if their claim is being processed or if their paperwork was lost. These worries magnify slow response times, leading to frustrated customers who feel abandoned.

The result is repetitive customer inquiries that flood phone lines and email inboxes. Adjusters and customer service teams spend their days answering the same questions, creating an enormous administrative burden.

This communication breakdown leads to a negative impact on Net Promoter Score (NPS) and damages customer loyalty. These communication challenges are solvable with proactive updates and clear timelines, which we will explore in the sections ahead.

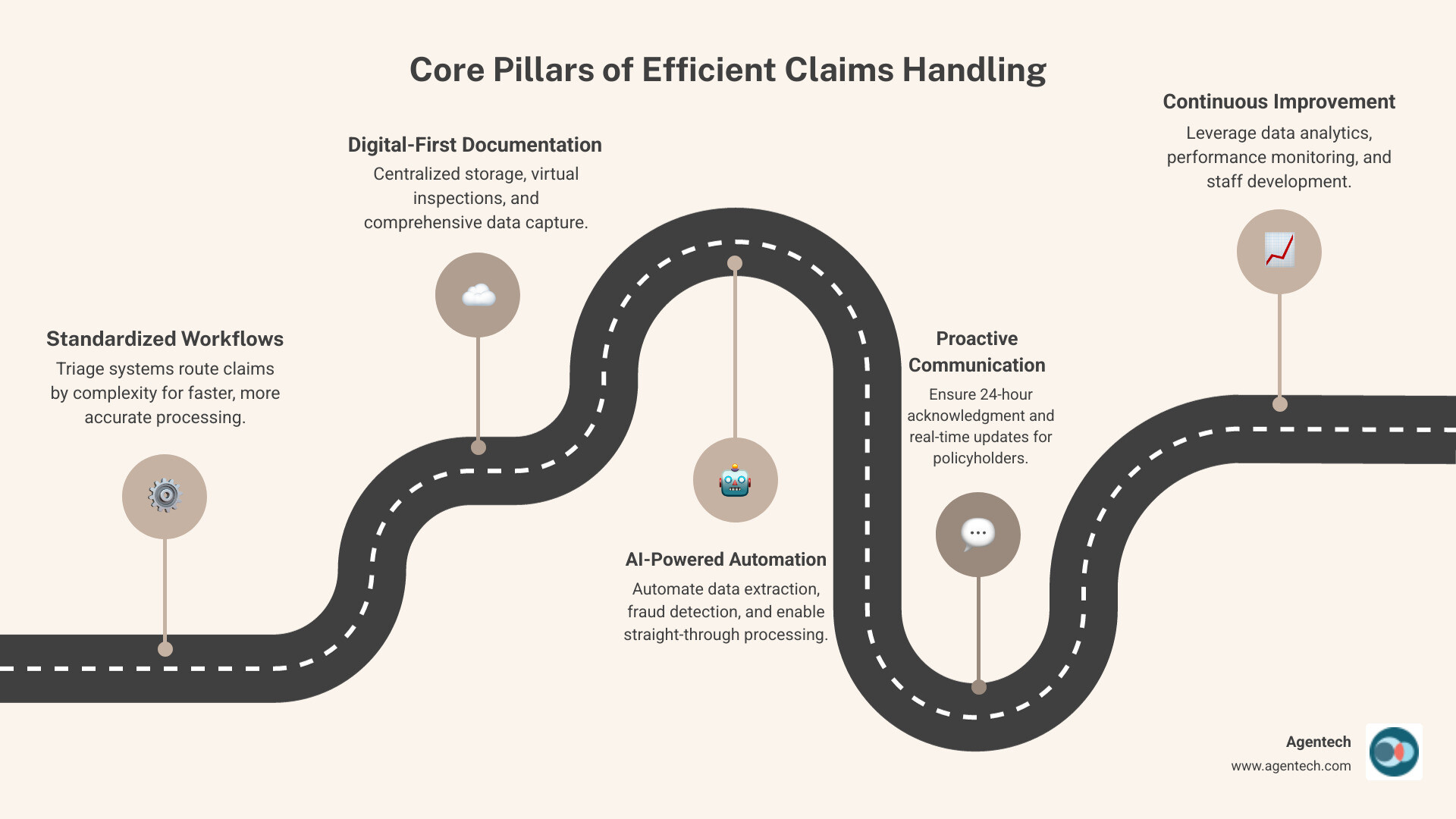

The Modern Playbook for Efficient Claims Handling

Achieving efficient claims handling requires a strategic approach that weaves together standardized processes, smart technology, and genuine care for policyholders. This is the playbook that separates top performing P&C insurance organizations from the rest.

Core Strategies for Efficient Claims Handling

At the foundation of every successful claims operation is prompt communication. The first 24 hours after a claim is filed are critical for building trust. This initial contact should confirm receipt, provide a claim number, introduce the handler, and set realistic timeframes. Regular updates throughout the process are essential, even if there is no major progress to report.

Next comes claims triage and segmentation. This involves categorizing claims by complexity and value. Simple, low value claims can be fast-tracked, often with automation. Standard claims follow established procedures, while complex cases are routed to experienced adjusters. This segmentation ensures simple claims are resolved quickly and complex claims receive the careful attention they deserve.

Standardized workflows make this possible. Clear, consistent protocols for every stage of the claims process, executed within a claims management system, eliminate the guesswork that leads to errors and delays. Consistency is key to quality and efficiency.

Finally, make proactive updates a core part of your service. Modern claims software can automatically notify policyholders at key milestones, reducing inbound calls. Key touchpoints include initial acknowledgment, handler introduction, process explanation, documentation requests, investigation updates, and settlement notifications.

The Role of Documentation in Efficient Claims Handling

Effective documentation is the nervous system of claims handling. That means digital, centralized, and intelligent practices.

Centralized document management is now table stakes. All claim documentation should live in a single, easily accessible system, eliminating wasted time hunting for files. Everything is in one place, accessible to authorized personnel with proper security controls.

The journey often starts with Digital First Notice of Loss (FNOL). Leading P&C insurers have mobile friendly FNOL for auto, home, pet, and workers' compensation claims, allowing policyholders to submit information and photos directly from their smartphones.

Virtual inspections have become a game changer for residential property and auto claims. Using smartphone cameras, damage can be documented in detail without the delays of in-person visits, speeding up the investigation process.

All of this data flows into secure cloud storage that maintains compliance with stringent security standards like SOC2 Type II certification, which is fundamental to protecting policyholder data.

AI solutions can then automatically create the claim profile, extracting essential data from documents and presenting it in an organized format. This frees adjusters from time consuming tasks, allowing them to focus on critical analysis and policyholder interaction. For more details, visit our article on how AI can help create the claim profile automatically.

The Technology Catalyst: AI and Automation

Technology is the engine of modern claims efficiency. Artificial intelligence and automation are essential tools for augmenting human expertise, eliminating repetitive tasks, and opening up powerful data insights.

How AI and Automation Streamline Workflows

The adoption of AI and automation is fundamentally reshaping claims in P&C insurance. For carriers, TPAs, and IA firms handling thousands of residential property, auto, pet, and workers' compensation claims, this change is a complete reimagining of what is possible.

One of the most impactful advancements is Straight-Through Processing (STP). AI enables STP that can drop the aggregate cycle time from days to minutes for many claims. This means simple, clear cut claims can be processed from FNOL to payment without human intervention.

Automation tools powered by AI excel at automated tasking and routing. Incoming claims are intelligently classified and routed to the correct adjusters or automated workflows. Modern change initiatives can achieve up to 30% efficiency gains through improved task management and process automation. Imagine a workers' compensation claim automatically flagged for expedited processing based on injury severity.

The overall impact is a significantly reduced administrative burden. Research indicates that a large portion of working hours in the P&C insurance industry can be automated or augmented by AI technologies. This frees adjusters from the mundane, repetitive tasks that slow down the entire claims process. You can learn more about how we tackle these challenges with Insurance Back Office Automation.

Augmenting Adjusters with Digital Coworkers

AI is an assistant, not a replacement. This is the foundation of our work at Agentech. We are in the business of making adjusters more effective, satisfied, and focused on the work that truly matters.

Think of AI as a digital coworker that handles the heavy lifting of administrative tasks, empowering your human experts to apply empathy and critical thinking. When an adjuster opens a new auto claim, the AI has already extracted relevant data, pulled policy details, and flagged potential concerns. The adjuster can jump straight into meaningful work: talking to the policyholder and making fair decisions.

This shift allows adjusters to dedicate more time to high value work, such as direct policyholder interaction and negotiating settlements. The result is faster decision making because adjusters have instant access to organized, pre analyzed information. Our solutions are specifically AI Designed with Adjusters in Mind, ensuring seamless integration into their daily workflows.

Perhaps most importantly, this approach leads to reduced burnout. By offloading tedious tasks like document processing and data entry, AI allows adjusters to engage in more satisfying work. This helps address the shortage of experienced claims professionals in the P&C insurance industry. We see AI agents as The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers.

Leveraging Data Analytics for Smarter Decisions

Beyond automation, AI transforms vast amounts of claims data into actionable insights for residential property, auto, pet, and workers' compensation claims.

We use predictive analytics for triage, instantly categorizing incoming claims and flagging those with high severity or potential for fraud. This allows for effective allocation of human adjusters, ensuring urgent cases receive immediate attention.

For fraud pattern recognition, AI is invaluable. With insurance fraud costing billions, AI algorithms can analyze voice patterns, flag inconsistencies, and identify subtle anomalies that might otherwise go unnoticed. This includes detecting repeated claims or unusual claim frequency in a specific region. For more on this, explore our resources on Insurance Claims Machine Learning.

Through continuous performance monitoring, we leverage analytics to track Key Performance Indicators across the organization. This provides real-time insights into bottlenecks and adjuster workloads, allowing for continuous optimization.

By analyzing claims data, we can identify loss trends that inform broader business strategy. If AI reveals a spike in water damage claims from a particular appliance, carriers can work with underwriting to adjust policies or offer preventive advice. This transforms claims from a reactive function into a proactive source of enterprise intelligence. Best in class P&C insurers implementing domain-level AI can achieve a 3% to 5% accuracy improvement in claims.

Building a High Performance Claims Ecosystem

Technology alone is not enough. Lasting success requires a supportive ecosystem that includes well trained staff, strategic vendor partnerships, and a culture of continuous improvement and compliance.

Training Staff for a Digital Future

As we integrate more sophisticated claims software and AI tools, investing in our teams is critical. This is about fostering a fundamental shift in how they approach their work.

Training staff for a digital future starts with comprehensive onboarding on new claims software tools. Adjusters need to feel confident with these systems. When teams understand how AI can handle tedious administrative work, they can focus their energy on serving policyholders.

We also need to develop communication capabilities centered on the customer. While AI can handle routine updates, our human adjusters must excel at empathetic, clear communication for complex cases. This human touch remains irreplaceable.

Another crucial skill is data literacy. As AI provides more insights, our adjusters need to interpret and act on this information effectively. This requires both technological understanding and human wisdom.

We are committed to continuous professional development because the P&C insurance landscape is always evolving. Effective change management is essential, ensuring teams see AI as a tool that improves their roles and makes their work more meaningful, not as a threat.

Managing Vendors and Ensuring Compliance

Our claims ecosystem extends beyond our internal teams. Managing external partner relationships effectively is crucial for maintaining efficient claims handling and service quality.

Supplier network development is foundational. We establish strong relationships with repair shops, medical professionals, and other providers who can deliver reliable services. These are strategic partnerships that directly impact the policyholder experience.

To maintain high standards, we implement performance scorecards that track service levels, turnaround times, and quality metrics. This helps ensure consistency and identify opportunities for improvement.

Data security is non-negotiable. We ensure every partner meets rigorous security standards. Our claims management systems maintain SOC2 Type II certification for secure document storage, and every vendor who touches our data must meet these same standards.

Finally, we maintain strict adherence to state regulations. P&C insurance is heavily regulated, and our processes must be designed to meet these obligations without fail. This means transparent processes, clear documentation, and a culture of compliance throughout the organization.

Conclusion

The journey to a modern, proactive claims operation is about fundamentally changing how we serve policyholders. When we streamline workflows, tackle bottlenecks, and implement technology, costs drop, adjusters find renewed purpose, and customers receive service that turns them into lifelong advocates.

Throughout this guide, we have explored the complete picture of efficient claims handling for P&C insurance organizations. We have seen how delays inflate costs, fraud drains the industry, and manual processes erode trust. But we have also found the solutions: intelligent triage, automation powered by AI, and digital coworkers that free adjusters to focus on complex decision making and human connection.

Leading P&C insurance carriers, TPAs, and IA firms are already making this change. They are seeing significant cost reductions, faster cycle times, and climbing customer satisfaction scores. These results represent the new baseline for competitive performance.

Your adjusters want to help people and solve problems, not get bogged down by administrative tasks. By embracing automation powered by AI, you empower them to apply their expertise, empathy, and judgment where it truly matters.

At Agentech, we build our AI solutions specifically for the P&C insurance industry, focusing on residential property, auto, pet, and workers' compensation claims. Our AI agents work alongside your adjusters as digital coworkers, handling repetitive tasks. The result is a claims operation that is faster, more accurate, more cost effective, and ultimately more human.

Ready to open up peak performance in your claims operation? Explore our AI Agents and see how they can revolutionize your claims process.

Citations:

- Agentech. "AI Designed with Adjusters in Mind." https://www.agentech.com/resources/articles/ai-designed-with-adjusters-in-mind

- Agentech. "Insurance Back Office Automation." https://www.agentech.com/resources/articles/insurance-back-office-automation

- Agentech. "Insurance Claims Machine Learning." https://www.agentech.com/resources/articles/insurance-claims-machine-learning

- Agentech. "The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers." https://www.agentech.com/resources/articles/the-future-of-work-in-insurance-embracing-ai-agents-as-digital-coworkers

- Agentech. "We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile." https://www.agentech.com/resources/articles/we-made-ai-do-the-most-tedious-time-consuming-task-in-claims-processing-creating-the-claim-profile

- Insurance Business Review. "Streamlining Claims Processing and Management: Enhancing Efficiency and Customer Experience in the Insurance Industry." https://www.insurancebusinessreview.com/news/streamlining-claims-processing-and-management-enhancing-efficiency-and-customer-experience-in-the-insurance-industry-nwid-230.html

- Nasdaq. "Insurance Fraud Statistics 2024." https://www.nasdaq.com/articles/insurance-fraud-statistics-2024

- National Council on Compensation Insurance (NCCI). https://www.ncci.com/