Why AI-Driven Claims Processing is Changing P&C Insurance

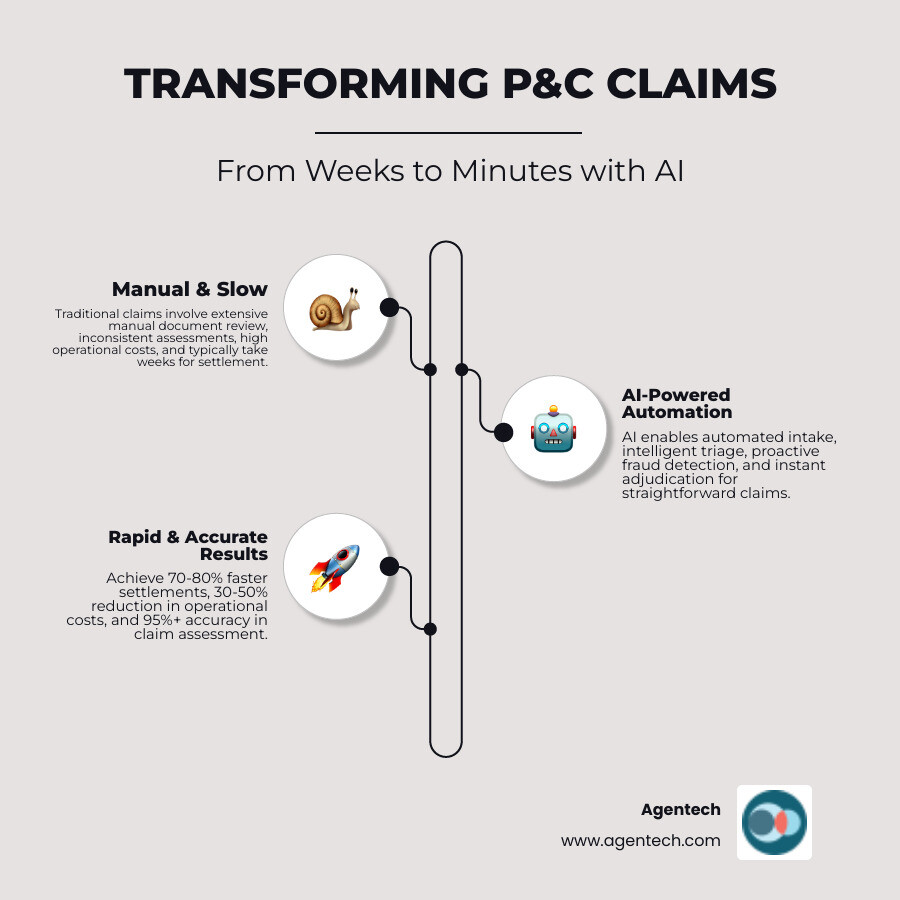

AI-driven claims processing uses advanced technologies like machine learning and natural language processing to automate and improve the claims lifecycle in Property & Casualty insurance. The results are compelling:

- Dramatically faster settlement times

- Significant reduction in operational costs

- High accuracy in claim assessment and data extraction

- Automated fraud detection that identifies patterns humans can miss

- Improved customer satisfaction through faster, more transparent resolutions

Traditional claims handling in P&C insurance is struggling. Whether managing auto, property, pet, or workers' compensation claims, the challenges are the same: mountains of paperwork, endless data entry, and frustrated policyholders. Claims handlers spend about 30% of their time on low-value administrative work. Meanwhile, many policyholders who file claims are dissatisfied with the experience, with a majority citing slow settlement speed as the primary complaint.

The root cause is a reliance on manual processes. Most P&C insurers can only handle a small fraction of claims through straight-through processing. The vast majority require human intervention to manage unstructured data like police reports, medical records, and photos. This bottleneck creates backlogs, drives up costs, and leaves adjusters drowning in paperwork.

AI-driven claims processing changes this equation. By automating routine tasks, AI handles claims in minutes instead of days. This frees your adjusters to focus on high-value activities like customer service and complex investigations. Insurers implementing AI are seeing major improvements in automation rates and processing times.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance. After successfully scaling and exiting TokenEx in 2021, I've focused on helping P&C insurance carriers, TPAs, and IA firms modernize their operations with AI-driven claims processing solutions designed specifically for adjusters.

The Current State of P&C Claims: Why Modernization is a Necessity

Let's be honest: the traditional P&C insurance claims process is struggling. Carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) firms face rising operational costs, overwhelming claim volumes, and inconsistent assessments.

The consequences show up in policyholder satisfaction. According to Accenture research, 31% of policyholders who made recent claims were dissatisfied with their experience. The biggest complaint? Slow settlement speed, cited by 60% of unhappy customers. Poor claims experiences put billions of dollars in premiums at risk as policyholders switch carriers.

The labor crisis makes everything worse. The industry faces a demographic cliff, with 50% of the P&C insurance workforce projected to retire in the next 15 years. This talent gap is not just about numbers; the skills required for modern claims handling are evolving. Adjusters now need stronger data analysis and technological capabilities. For P&C insurance organizations trying to scale, this labor shortage creates a difficult choice between service quality and speed. As we explored in our article on solving the P&C insurance labor crisis with AI-driven innovation, there are ways forward.

Then there's the data quality problem. Manual data entry introduces errors that cascade through the claims process, leading to poor decision making and increased costs. Research shows that human input is a leading cause of data inaccuracies.

AI-driven claims processing addresses these challenges by automating the repetitive work that creates bottlenecks and errors, empowering your team to focus on serving policyholders.

From Rules-Based Systems to Intelligent Automation

Many P&C insurance organizations have tried to modernize using rules-based automation. These systems handle straightforward, structured tasks but hit a wall with the messy reality of claims data.

The fundamental problem is unstructured data. Police reports, medical records, and photographs do not fit neatly into predefined fields. Rules-based systems cannot understand context or learn from new information, which is why only about 7% of claims can be processed via straight-through processing. The remaining 93% require manual intervention, defeating the purpose of automation.

These systems are static and require constant human oversight. When a claim deviates from expected patterns, the system fails and kicks it to a human reviewer.

AI-driven claims processing takes a different approach. Instead of following rigid rules, AI uses machine learning to understand unstructured data. It goes beyond simple character recognition to employ sophisticated models trained on P&C insurance documents. By integrating all data types, AI can assess situations, make recommendations, and automate decisions with high accuracy. This accelerates resolution and increases straight-through processing rates. To understand how modern P&C insurance claims IT systems work together, our detailed guide breaks down the technology landscape.

| Feature | Rules-Based Automation | AI-Driven Automation |

|---|---|---|

| Data Handling | Structured data only; struggles with unstructured data. | Handles both structured and unstructured data seamlessly. |

| Learning | Static; requires manual updates for new rules. | Dynamic; learns and improves over time with new data. |

| Contextual Awareness | Limited; follows explicit instructions. | High; interprets nuances and context from diverse sources. |

| Scalability | Limited by the complexity of rules and exceptions. | Highly scalable; adapts to varying claim volumes. |

| Error Handling | Fails on deviations from rules; high manual intervention. | Adapts to variations; flags anomalies for human review. |

| Straight-Through Processing | Very low (approx. 7% of claims). | Significantly higher for routine claims. |

The Impact on Adjusters and TPAs

Talented claims professionals spend about 30% of their time on work that does not use their skills, such as document sorting and data entry. This administrative burden contributes to burnout and high turnover rates.

Instead of investigating complex cases and applying their expertise, adjusters get buried in paperwork. The intellectual challenge and human connection that make claims work meaningful get crowded out by repetitive tasks.

AI-driven claims processing changes this by handling the tedious work automatically. Our AI agents at Agentech manage initial intake, document analysis, and data extraction. This frees adjusters to focus on engaging with policyholders, investigating complex cases, and building stronger relationships. The goal is not to replace adjusters but to empower them. As we discuss in our article on AI designed with adjusters in mind, technology should augment human capabilities. The result is greater job satisfaction and improved retention for your teams.

Core Technologies and Benefits of AI-Driven Claims Processing

Imagine a claims adjuster who starts their day not by wading through hundreds of documents, but by reviewing a prioritized dashboard where AI has already sorted and analyzed the incoming claims. Routine auto, property, pet insurance, and workers' compensation cases have been processed, allowing the adjuster to focus on complex cases where their expertise truly matters.

This is happening now at P&C insurance carriers, TPAs, and IA firms that have adopted intelligent automation.

The Primary Benefits of AI-driven claims processing

The change that AI-driven claims processing brings to P&C insurance is measurable and significant, impacting both your bottom line and policyholder satisfaction.

Speed is the first game changer. Claims that once took weeks to settle can now be closed in minutes or hours. For a policyholder dealing with a damaged car or flooded home, this speed means getting back to normal life faster. For your business, it means handling peak periods without adding headcount.

The cost savings are equally impressive. By automating repetitive work, carriers can cut operational costs significantly. These savings come from multiple sources: manual rework drops when AI extracts data with high accuracy, and claims leakage decreases when payments are validated against policy terms.

Accuracy improvements touch every part of the process. AI-powered validation leads to fewer disputes, fewer reprocessed claims, and more consistent outcomes. For example, some insurers have automated their claims processing and seen not just faster settlements but dramatically improved customer experience scores because policyholders received consistent, fair treatment.

Fraud detection gets a major upgrade. AI can analyze patterns across millions of claims, spotting anomalies that would be difficult for human reviewers to find. This technology can review evidence against your entire claims database, a task impossible for manual review.

Even subrogation opportunities increase when advanced AI models evaluate claims against criteria that human reviewers might overlook. For a comprehensive look at how these benefits apply across different claim types, check out our article on AI claims processing for P&C insurance.

Key AI Technologies at Work

The power behind AI-driven claims processing comes from several technologies working together.

Machine Learning forms the foundation. These algorithms learn from your historical claims data to identify patterns and predict outcomes. They get smarter with every claim processed. Our deep dive into P&C insurance claims machine learning explores this further.

Natural Language Processing (NLP) tackles the text challenge. NLP allows AI to read unstructured documents like police reports and medical notes, extracting key facts and understanding context. This technology turns messy text into structured data your systems can use.

Computer Vision handles visual evidence. When a policyholder submits photos of property or vehicle damage, Computer Vision analyzes those images to assess severity and identify components that need repair. It can recognize damage consistency and flag photos that may have been digitally altered.

Generative AI brings a new level of intelligence. This technology can summarize lengthy documents into concise reports and draft personalized communications to policyholders. Instead of an adjuster spending an hour reading records, GenAI can provide a structured summary in seconds.

Agentic AI represents the next evolution. Unlike basic AI, Agentic AI can plan and execute complete workflows autonomously. Think of it as a digital coworker that manages a routine claim from start to finish, routing it to a human adjuster only when necessary. Our Agentic AI definition explains how this technology is changing claims operations.

These technologies collaborate to create an intelligent system that understands your business, adapts to your processes, and gets smarter every day.

AI in Action: Real-World Success Stories

The promise of AI-driven claims processing becomes clear when you see what is already happening. P&C insurance carriers, TPAs, and IA firms are changing their operations today and seeing remarkable results.

Some insurers have faced challenges with mountains of diverse, unstructured documents. By integrating an AI-powered document intelligence solution, they achieved high accuracy in automatically extracting and interpreting information. Their agents suddenly had time to focus on building relationships and providing empathetic service to policyholders.

We have seen similar breakthroughs with our own clients at Agentech. Odie Pet Insurance recognized that pet parents needed faster, more personalized service. By implementing our Agentic AI solutions to automate claims tasking, they freed their team to focus on what really matters: the unique needs of each pet and the concerns of worried pet owners Odie Pet Insurance implements Agentech to automate claims tasking. The efficiency gains were significant, but what really stood out was how much more personal their service became.

These are not isolated stories. They represent a fundamental shift in how P&C insurance claims can work when you combine human expertise with intelligent automation.

Challenges and Limitations of AI-driven claims processing

Implementing AI-driven claims processing has its challenges. The good news is that they are all manageable with proper planning.

Implementation complexity is often the first hurdle. Many organizations work with legacy systems not designed for modern AI tools. Integration requires thoughtful planning and robust APIs. Our guide on Insuretech made easy: Understanding P&C insurance claims software systems walks through these considerations.

Data security and privacy are paramount. Any AI system must protect sensitive policyholder information with robust encryption, strict access controls, and full compliance with regulations.

The regulatory landscape adds another layer of complexity. AI solutions need to meet evolving standards around fairness and explainability. When an AI system makes a recommendation, you need to be able to explain how it reached that conclusion. We explore this in AI in P&C insurance: Balancing innovation and regulation.

Addressing bias and ensuring fairness is a nuanced challenge. AI models learn from historical data, and if that data reflects past biases, the AI can perpetuate them. This requires rigorous testing and continuous monitoring.

Finally, organizational resistance to change is real. Effective change management, transparent communication, and involving your team in the process are essential to building enthusiasm rather than resistance.

At Agentech, we have designed our solutions with these challenges in mind. Our AI agents integrate with existing systems, prioritize explainable AI, and focus on augmenting your human teams.

Developing a Strategic AI Plan for Claims

Jumping into AI-driven claims processing without a roadmap is a mistake. For P&C insurance carriers, TPAs, and IA firms, a successful AI change requires thoughtful planning across your people, processes, technology, and risk management.

Start with people, because this is where many AI initiatives stumble. Your strategic AI plan should address how you will help your team develop new skills for working alongside AI, such as interpreting AI-generated insights and handling exceptions. Communicate openly about what AI will and will not do. Show your team how it will free them from tedious tasks so they can focus on more engaging work. A human-in-the-loop approach, where adjusters maintain oversight, builds trust and adoption.

Process mapping comes next. Before you automate, you need to understand how claims flow through your organization today. Map every step from First Notice of Loss to settlement for your P&C lines. Identify bottlenecks and pain points, as these are your best candidates for AI intervention. Once you understand your current state, you can redesign workflows to take advantage of what AI does best.

Technology evaluation requires careful consideration. Look for modularity and scalability so you can implement AI in stages. Your solution must integrate seamlessly with your existing claims management systems through flexible APIs. You should not have to rip and replace your entire technology stack. Understanding your current P&C insurance claims IT systems is crucial.

Insurance-grade AI matters. Generic AI models will not understand the nuances of P&C insurance. You need AI specifically trained on claims data and industry documents. You will also need to decide whether to build, buy, or partner. Our article on Buy versus Build: Navigating the SaaS AI technology decision can help you evaluate these options.

Risk and governance are critical. Data security and privacy must be built in from day one. Your AI solution needs to comply with all relevant regulations. Establish processes for continuously monitoring your AI models to ensure they produce fair and equitable outcomes. You also need AI that can explain its decisions, not a black box. This transparency supports compliance and builds trust.

Creating a business-led roadmap means getting your leadership aligned and making data central to your operations. If you are feeling overwhelmed, our guide on Not sure where to start with AI? can help you take the first steps with confidence.

Frequently Asked Questions about AI in Claims Processing

We often hear similar questions from P&C insurance carriers, TPAs, and IA firms considering AI-driven claims processing. Let's address some of the most common ones.

How does AI in claims processing improve the experience for policyholders?

AI transforms the policyholder experience in several key ways:

- Faster Settlement Times: AI can dramatically reduce settlement times. For a policyholder dealing with a stressful event, getting a quick resolution is paramount. According to Accenture, slow settlement speed is a major driver of customer dissatisfaction.

- Increased Transparency: AI-powered systems can provide real-time updates on claim status, giving policyholders a clear view of where their claim stands.

- Proactive Communication: AI can trigger automated, personalized communications at key stages of the claim, keeping policyholders informed.

- 24/7 Access via Chatbots: AI-powered chatbots can handle initial inquiries and guide policyholders through the FNOL process at any time of day or night.

AI helps P&C insurance organizations deliver on the promise of P&C insurance: peace of mind and prompt support. We believe in Designing for the future: How AI transforms the claims experience for policyholders.

What is insurance-grade AI and why is it important?

"Insurance-grade AI" refers to AI models and solutions specifically designed and trained for the unique complexities of the P&C insurance industry. It is not generic AI applied to P&C insurance; it is AI built for P&C insurance.

Here is why it is critically important:

- Industry-Specific Training Data: These models are trained on massive datasets of claims, policies, and industry terminology, allowing them to understand context in a way general-purpose AI cannot.

- Higher Accuracy: Because these models are fine-tuned for P&C insurance, they achieve significantly higher accuracy in tasks like document extraction and fraud detection.

- Understanding of P&C Insurance Nuances: Insurance-grade AI understands the specific language and rules of P&C insurance, reducing the risk of errors.

- Reduced Hallucinations: Generic AI models can sometimes produce plausible but incorrect information. Insurance-grade AI is built with validation logic and domain-specific guardrails to minimize these errors.

Insurance-grade AI ensures the technology speaks the language of P&C insurance, leading to more reliable and effective AI-driven claims processing. This is the foundation of A hybrid AI solution for claims automation: How Agentic combines out-of-the-box efficiency with custom QA precision.

What are the future trends for AI in claims management?

We see several key trends emerging for P&C insurance carriers, TPAs, and IA firms:

- Agentic AI as Digital Coworkers: Agentic AI systems will become increasingly sophisticated, capable of handling multi-step tasks autonomously. They will act as true "digital coworkers," managing entire segments of the claims process and freeing adjusters to focus on the most complex and empathetic aspects of their roles. We are already seeing this evolution from generative AI to Transforming P&C insurance claims: The evolution from generative AI to agentic AI.

- Hyper-Personalization: AI will enable carriers to offer hyper-personalized claims experiences, tailoring communication and settlement options based on individual policyholder needs.

- Proactive Risk Prevention: Beyond fraud detection, AI will help predict potential claims before they happen and recommend preventative measures to policyholders.

- End-to-End Automation: The trend is towards complete end-to-end automation for an even wider range of claims, with human oversight primarily for exceptions and complex scenarios.

Conclusion: Partnering with AI for a Competitive Edge

The story of AI-driven claims processing is ultimately about people. It is about empowering your adjusters, delighting your policyholders, and positioning your organization for long-term success.

Throughout this article, we have explored the tangible impact AI brings to P&C insurance carriers, TPAs, and IA firms. Processing times shrink, operational costs drop, and accuracy climbs. These represent real policyholders getting help when they need it most and real adjusters freed from administrative work to focus on what truly matters.

The traditional claims landscape is giving way to something better. Through Machine Learning, Natural Language Processing, and Agentic AI, we are creating intelligent systems that understand context, learn from experience, and collaborate seamlessly with human teams.

What excites me most is how this technology honors the human element of claims. Your adjusters are not being replaced; they are being liftd. Instead of drowning in document review, they are building relationships with policyholders and solving complex problems. Our AI agents work as digital coworkers, always on, handling the routine so your people can handle the remarkable.

For P&C insurance carriers, TPAs, and IA firms, the question is not whether to adopt AI-driven claims processing, but how quickly you can implement it to stay competitive. The insurers winning tomorrow are the ones investing in AI today, not as a replacement for their people, but as a force multiplier that makes everyone more effective.

At Agentech, we have built our AI solutions with one core belief: technology should serve people. Our AI agents integrate seamlessly with your existing systems and are designed from the ground up with adjusters in mind. They boost productivity without adding complexity.

The future of P&C insurance claims is intelligent, efficient, and deeply human. It is a future where AI handles what machines do best, freeing your talented teams to do what only humans can do: empathize, innovate, and build lasting relationships.

Ready to see how our AI Agents can transform your claims processing? Explore our AI Agents and transform your claims processing today.

Citations:

- Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research. https://newsroom.accenture.com/news/2022/poor-claims-experiences-could-put-up-to-170b-of-global-insurance-premiums-at-risk-by-2027-according-to-new-accenture-research

- Aon. (n.d.). 5 Ways Artificial Intelligence can Boost Claims Management. https://assets.aon.com/-/media/files/aon/insights/five-ways-artificial-intelligence-can-boost-claims-management-use-cases.pdf

- EY. (n.d.). How a Nordic insurance company automated claims processing. https://www.ey.com/en_us/insights/financial-services/emeia/how-a-nordic-insurance-company-automated-claims-processing

- McKinsey & Company. (2024). The future of AI in the insurance industry. https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-ai-in-insurance

- Statista. (2021). Leading reasons for inaccurate customer or prospect data in the United Kingdom (UK) in 2021. https://www.statista.com/statistics/1185730/reasons-inaccurate-customer-data-uk/