Why AI Claims Processing Systems Are Changing Insurance

An AI claims processing system uses artificial intelligence to automate and improve insurance claim handling from submission to settlement. By combining machine learning, natural language processing, and computer vision, these systems process claims faster and more accurately, with less human intervention than traditional methods.

Key capabilities of AI claims processing systems:

- Automated data extraction from unstructured documents like police reports and medical records

- Straight-through processing for simple claims without human intervention

- Fraud detection through pattern recognition and anomaly analysis

- Predictive analytics to estimate claim values and settlement timelines

- Real-time processing that can reduce settlement times from weeks to minutes

The insurance industry is shifting away from traditional claims processing, which relies on manual data entry and paper-based workflows. This old approach creates bottlenecks that frustrate customers and drain resources.

Consider this: 31% of policyholders who made recent claims were dissatisfied with their experiences, with 60% citing settlement speed as the primary cause. Meanwhile, claims handlers spend about 30% of their time on repetitive, low-value administrative tasks.

The numbers tell a compelling story about AI's impact:

- AI can achieve 57% automation in claims processing

- Processing time can drop from weeks to minutes

- Over 65% of claims can be processed straight through

- Customer satisfaction can increase by 25%

- Claims expenses can be reduced by up to 50%

But this revolution isn't about replacing human expertise—it's about amplifying it. The best implementations combine AI's speed and accuracy with human judgment for complex decisions and empathetic customer service.

I'm Alex Pezold, founder of Agentech AI. Having previously scaled a tech company to a successful exit, I've seen how the right technology can revolutionize industries. Now, we're building the AI workforce for insurance with a focus on cutting-edge AI claims processing system solutions.

How AI Fundamentally Transforms Claims Management

Picture this: A customer files a claim after a car accident. Traditionally, this meant weeks of calls and paperwork. With an AI claims processing system, that same claim can be processed, validated, and settled in the time it takes to drink your morning coffee.

The magic happens at the First Notice of Loss (FNOL). Traditional systems struggle to make sense of varied police reports, handwritten notes, different medical bill layouts, and countless photos.

AI shines here. It acts like a tireless, super-smart assistant, reading everything from a doctor's handwriting to blurry license plates. An AI claims processing system doesn't just store this data—it understands it.

This understanding enables remarkable straight-through processing (STP). Instead of claims sitting in queues, AI extracts data, cross-references it with policy info, checks for fraud, and calculates settlement amounts automatically. It's workflow automation on a new level.

The results speak for themselves. While traditional systems handled about 7% of claims via STP, modern AI systems push that past 65%. This is a complete change in how claims work. Our research on AI's impact on claims outcomes shows just how dramatic this shift can be.

The Limits of Rules-Based Automation vs. AI

For years, insurers tried to automate claims with rules-based systems. These were like literal-minded robots: "If claim is under $1,000 AND damage is windshield, THEN approve." Simple, but rigid.

The problem is, real life is complex. What if a windshield claim photo also shows front-end damage? Legacy systems would freeze, requiring manual intervention for anything unexpected.

| Feature | Traditional Rules-Based Automation | AI-Driven Systems (AI Claims Processing System) |

|---|---|---|

| Data Handling | Primarily handles structured data (e.g., policy numbers, claim dates) | Handles both structured and unstructured data (e.g., police reports, photos) |

| Logic | Rigid "if-then" rules; predefined pathways | Contextual understanding, pattern recognition, learning from data |

| Flexibility | Inflexible; requires manual updates for new scenarios | Adaptive; learns and improves over time with new data |

| STP Rates | Low, often below 10% (struggles with exceptions) | High, can exceed 65% (excels at identifying and routing exceptions) |

| Complexity Handling | Struggles with nuanced, ambiguous, or incomplete information | Interprets complex scenarios, infers meaning, and recommends actions |

| Effort to Maintain | High, as rules need constant modification | Lower, as models self-optimize and learn |

This inflexibility is why only 7% of claims can be ingested via straight-through processing without advanced AI. Manually updating thousands of decision trees for every new rule was exhausting and expensive.

AI takes a different approach. Instead of following rigid rules, it learns patterns from millions of claims. It can analyze a damaged car photo and understand the type and severity of damage, and whether it matches the incident. It adapts and learns from new information.

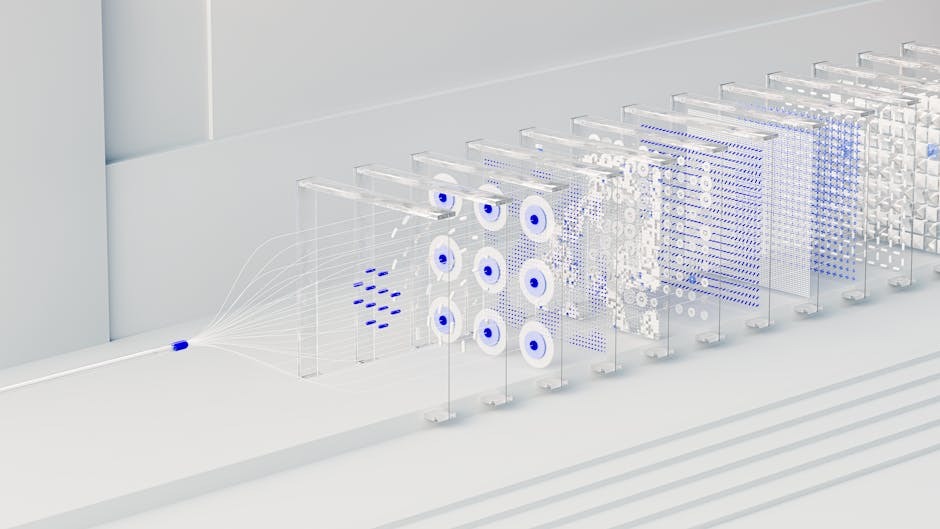

Key Technologies in an AI Claims Processing System

What's under the hood of these smart systems? An AI claims processing system combines several powerful technologies.

Machine Learning (ML) is the brain, analyzing historical data to predict outcomes for new claims. It acts like an adjuster with infinite experience, spotting patterns to predict fraud likelihood or settlement amounts with high accuracy.

Natural Language Processing (NLP) gives AI the ability to read and understand human language. When a police report mentions "significant front-end damage," NLP understands this implies a serious accident. It processes documents in over 100 languages, extracting key data from formal reports or brief text messages.

Computer Vision is AI's expert eyes. It analyzes photos of damaged property to assess severity and authenticity, even spotting when the same photo is used in multiple claims. Some systems can also verify if damage patterns match the reported cause of loss.

Predictive Analytics uses all this information to look into the future. It forecasts claim resolution times or the likelihood of litigation, helping adjusters prioritize their work and allocate resources effectively.

Generative AI is the newest addition. It reads lengthy reports, extracts key details, and creates concise summaries for adjusters. It's an intelligent assistant that never tires of paperwork.

At Agentech, we've seen these technologies work best when designed with real adjusters in mind. We build AI tools that handle tedious tasks, leaving important decisions to human experts. Learn about Agentic AI and how it's evolving to be a digital coworker, not a replacement for human judgment.

The Core Benefits of an AI Claims Processing System

When you implement an AI claims processing system, you're not just upgrading technology—you're changing your entire operation. The benefits range from back-office efficiency to happier customers.

The change happens across five key areas. Operational efficiency skyrockets as AI handles tedious work. Cost reduction becomes tangible, with potential savings up to 50% in claims expenses. Accuracy reaches levels like 99.99% in claim validation.

But the most exciting benefits are improved customer satisfaction from settling claims in minutes, not weeks, and scalability. An AI system handles claim spikes 24/7 without issue.

AI's role in modern claims management shows these benefits aren't just theoretical—they're happening now in insurance companies worldwide.

Boosting Efficiency and Accuracy

With an AI claims processing system, a claims handler's Monday morning starts not with a mountain of paperwork, but with a dashboard showing AI has already processed routine claims over the weekend. That's the new reality.

One travel insurer achieved 57% automation and slashed processing time from weeks to minutes for 400,000 annual claims. Think about what that means for your team's daily workload.

Claims handlers currently spend about 30% of their time on repetitive administrative tasks. AI can reduce these manual tasks dramatically, freeing up up to 80% of staff time for work that requires human expertise.

The accuracy improvements are equally impressive. When AI systems can achieve improved accuracy to 99.99% in claim validation, you get fewer mistakes, less rework, and more consistent outcomes. Adjusters can trust the system to handle routine tasks while they focus on complex cases.

We've seen how Agentech AI tackles tedious tasks like creating claim profiles—work that used to consume hours of an adjuster's day.

Enhancing the Customer Experience

Today, 43% of customers wait over two weeks for claims settlement, while 21% expect it within hours. This gap between reality and expectations is costing the industry dearly.

An AI claims processing system bridges this gap. When you can settle over 60% of claims in real time and cut response times from hours to seconds, you're not just meeting expectations—you're exceeding them.

Speed is only part of the story. AI enables transparent communication, giving customers real-time updates. This transparency builds the trust that creates loyalty.

The retention numbers speak volumes: 62% of customers stay after a good claims experience, while only 19% stick around after a bad one. Younger customers are actively seeking this technology: 40% of 18-24 year-olds and 37% of 25-34 year-olds prefer insurers with AI-assisted processing.

Our industry report on claims experiences dives deeper into these trends, and our insights on designing the future claims experience show how forward-thinking insurers are capitalizing on these preferences.

Proactively Identifying and Preventing Fraud

Insurance fraud costs billions annually. An AI claims processing system makes fraud detection proactive rather than reactive.

AI's pattern recognition analyzes massive datasets to spot subtle correlations that human reviewers might miss, such as patterns that reveal organized fraud rings.

Anomaly detection establishes a baseline for normal claims and flags anything unusual for human review. Data cross-referencing happens in seconds, checking for inconsistencies or duplicate claims across multiple databases.

For example, using photo similarity scoring, an insurer's AI identified reused photos in weather-related claims. The system flagged the duplicates, preventing fraudulent payouts and saving thousands—a task nearly impossible for human reviewers to do at scale.

Predictive flagging assigns risk scores to each claim, helping adjusters prioritize investigations and focus on high-risk cases while AI handles routine validations. This proactive approach protects honest policyholders from bearing the cost of fraud through higher premiums.

Navigating the Challenges of AI Implementation

Implementing an AI claims processing system is more complex than installing a new printer. While the benefits are compelling, the journey requires thoughtful planning and a realistic view of the challenges ahead.

The biggest challenge is data quality. It's the foundation for everything, and it's where many AI projects stumble. An estimated 80% of AI projects fail, often due to poor data quality. If your AI learns from incomplete or inconsistent information, it will make flawed decisions.

Integration with legacy systems is another major hurdle. Many insurers run on decades-old systems not designed for AI. Getting them to work with modern platforms can be difficult. At Agentech, we've made seamless integration a cornerstone of our approach because we know this pain point well.

Then there's the regulatory landscape. Insurance is a highly regulated industry. Regulatory compliance means ensuring your AI decisions are transparent, auditable, and fair, and that you follow privacy laws like GDPR.

Implementation costs can also be a concern. The long-term ROI is impressive, but the upfront investment is substantial. A solid business case is key to showing the path to profitability.

Perhaps the most overlooked challenge is change management—the human side of the equation. Introducing AI changes daily workflows, which can cause employee anxiety about job security or resistance to new systems. This is why we believe in AI designed with adjusters in mind, making the transition as smooth and empowering as possible.

The Future is Hybrid: Human Oversight in an AI Claims Processing System

Here's something that might surprise you: the future of claims isn't about replacing humans with robots. It's about creating the perfect partnership between human expertise and artificial intelligence. We call this augmented intelligence.

Think about what an AI claims processing system does brilliantly: it processes thousands of documents in seconds, spots patterns in massive datasets, and works 24/7. But it can't comfort a grieving customer or handle the subtle negotiations of a complex liability case.

This is where the human-in-the-loop (HITL) approach shines. AI handles the heavy lifting—data extraction, initial analysis, routine decisions. Meanwhile, human adjusters focus on what they do best: complex claims requiring experience, providing empathy in service, and making final decision-making calls.

By 2030, automation could replace over half of current claims activities, but this doesn't mean mass layoffs. It means evolution. Claims handlers are becoming strategic thinkers and problem-solvers, not data entry clerks.

We're already seeing this change. AI Agents as Digital Coworkers are handling tedious tasks, while human adjusters focus on building relationships and solving complex problems that require a human touch.

Preparing Your Organization for AI Adoption

Ready to take the plunge? Smart AI adoption is about taking measured, strategic steps for long-term success.

Start by defining clear objectives. What are your biggest pain points? Slow settlements? High processing costs? Customer complaints? Your AI implementation should directly address these with measurable goals.

Data readiness is next. Clean, well-organized data is premium fuel for your AI engine. You may need to standardize formats, fill gaps, and establish ongoing data quality processes. It's critical work.

Choosing the right partner can make or break your project. Look for providers who understand insurance, not just technology, and have a proven track record. This is where the buy vs. build decision becomes crucial.

Starting with a pilot project is a smart move. Pick a specific area, like FNOL processing, to test the waters. This lets you learn, adjust, and build confidence before a full rollout.

Finally, train your team. Your people need to understand how AI will improve their roles, not threaten them. The most successful implementations happen when employees become AI advocates.

Not sure where to start with AI? Every insurer faces this challenge. The key is taking that first step with a clear plan and the right support.

Frequently Asked Questions about AI in Claims

I get these questions all the time when talking with insurance professionals about AI claims processing systems. Let me share the answers to the most common concerns that come up in our conversations.

How does AI handle different languages and document formats?

This is one of the most practical questions we hear, especially from insurers dealing with diverse customer bases. The good news is that modern AI claims processing systems are remarkably versatile when it comes to language and document handling.

These systems rely on Natural language processing (NLP) and optical character recognition (OCR) that have been trained on massive datasets from around the world. This training allows them to understand over 100 languages in natural language understanding and more than 50 languages in intelligent document processing.

But it's not just about languages it's about the messy reality of how documents arrive. AI can process everything from crisp PDFs and formal emails to barely legible handwritten notes from accident scenes. The technology can achieve 98.3% document layout accuracy, which means it can make sense of documents even when they're formatted differently or contain mixed content types.

Think about it: a single claim might include a police report in Spanish, medical records in English, and handwritten witness statements. An AI claims processing system can handle all of these seamlessly, extracting the key information regardless of format or language.

Will AI replace claims adjusters?

This is probably the question I hear most often, and I understand why it causes concern. The short answer is no AI won't replace claims adjusters. The goal has always been augmentation, not replacement.

Here's what actually happens when you implement an AI claims processing system: the technology takes over those tedious, repetitive tasks that nobody really enjoys doing anyway. Things like data entry, document review, and basic validation checks. This frees up your experienced adjusters to focus on what humans do best handling complex cases that require empathy, negotiation, and critical judgment. This human-plus-machine model is often called augmented intelligence.

Imagine an adjuster who no longer spends hours typing information from forms into systems, but instead focuses on helping a family steer a difficult property damage claim or negotiating a fair settlement in a complex liability case. That's the future we're building toward.

The numbers tell an interesting story too. By 2030, automation could replace over half of current claims activities. But notice that word activities, not jobs. What's happening is a shift in what adjusters do, not whether they're needed. They're evolving from data processors into strategic problem-solvers and empathetic communicators.

Is AI-driven claims processing secure?

Security concerns are completely valid, especially when you're dealing with sensitive policyholder information. The reality is that leading AI platforms are built with security as their foundation, not as an afterthought.

These systems adhere to strict data privacy protocols like the General Data Protection Regulation (GDPR) and ISO/IEC 27001. They use enterprise-grade security measures that include data encryption, secure integrations, and robust access controls. Many solutions can integrate securely with over 200+ systems, ensuring that data integrity and compliance are maintained across your entire technology stack.

The key is choosing a provider that emphasizes transparent data handling and follows best-in-class security protocols. At Agentech, we understand that trust is everything in this industry. Our systems are designed to give you complete peace of mind while delivering the productivity benefits you need.

When evaluating any AI claims processing system, ask detailed questions about their security certifications, data handling practices, and compliance measures. A reputable provider will be happy to share this information and demonstrate their commitment to protecting your data.

Conclusion: The Future of Claims is Intelligent and Human-Centric

We've reached a turning point in insurance history. The AI claims processing system revolution isn't just about swapping old technology for new – it's about creating a future where claims processing actually works the way it should.

Think about what we've finded together. AI can cut processing times from weeks to just minutes. It can boost accuracy to an incredible 99.99%. It can settle over 60% of claims in real time. These aren't just impressive numbers – they represent real people getting help when they need it most.

The change goes deeper than speed and accuracy. When AI handles the tedious paperwork and data entry, something beautiful happens. Claims adjusters get their humanity back. Instead of drowning in administrative tasks, they can focus on what they do best – helping customers steer difficult moments with empathy and expertise.

This shift to augmented intelligence is where the magic really happens. AI becomes the ultimate assistant, working tirelessly in the background while human adjusters handle the complex, nuanced situations that require a personal touch. It's not about replacing people – it's about releaseing their potential.

The benefits ripple through every corner of the insurance world. Operational efficiency means resources go where they're needed most. Cost reduction keeps insurance affordable for everyone. Superior customer experience builds the trust that keeps families protected for generations. And proactive fraud detection ensures honest policyholders aren't paying for someone else's dishonesty.

At Agentech, we're not just building technology – we're crafting the future of insurance. Our always-on AI assistants work seamlessly with your existing systems, boosting productivity without disrupting the human connections that make insurance meaningful. We believe the best AI claims processing system is one that makes adjusters more effective, not obsolete.

The future of claims is already here, and it's more human than ever. Ready to see what's possible? See how Agentech's AI works and find how we're building this exciting future together.