Why Simplifying Your Claims Process Matters More Than Ever

For Property & Casualty (P&C) insurance carriers, Third-Party Administrators (TPAs), and Independent Adjusting (IA) firms, the need to simplify claims process operations is a strategic imperative. The traditional approach is slow, manual, and expensive, struggling to keep pace with rising claim volumes and customer expectations for nearly instant resolution.

This outdated model creates a perfect storm for claims managers. Manual data entry consumes adjuster time, claims leakage hurts profitability, and poor service leads to customer churn. Studies show 30% of dissatisfied claimants switch carriers, and acquiring new customers costs significantly more than retaining existing ones.

The good news is that modern claims automation and AI can transform this challenge into a competitive advantage. Companies implementing these solutions see up to a 50% reduction in claims expenses1 and a 25% increase in customer satisfaction.2

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for the P&C insurance industry. After founding and successfully exiting TokenEx in 2021, I've focused on helping P&C insurers simplify their claims process with cutting-edge AI agents that handle routine work, so your team can focus on what truly matters.

The High Cost of an Outdated Claims Process

For many P&C carriers, TPAs, and IA firms, the claims process is burdened by outdated and manual workflows. This inefficiency creates significant costs that ripple through the organization.

The problems begin with manual data entry. Hours are spent typing information from a First Notice of Loss (FNOL), policy documents, and damage reports. This tedious work is not only slow but also prone to human error, leading to incorrect settlements and costly rework. These manual efforts drive up operational costs and contribute to claims leakage, where money is lost through overpayments, missed subrogation, or undetected fraud.

Policyholders bear the brunt of this dysfunction. After a stressful event like a car accident or property damage, they face inconsistent service and long, uncertain wait times for a decision. This poor experience has consequences, as a significant percentage of dissatisfied claimants switch carriers, and acquiring new customers is far more expensive than retention.

Regulatory pressures add another layer of complexity. Guidelines from bodies like the National Association of Insurance Commissioners (NAIC) demand transparency and fairness, and failing to meet these standards can result in penalties and reputational damage. Compounding this is the rising number of property claims, driven by severe weather, which overwhelms traditional systems based on paper. To remain competitive, organizations must simplify claims process operations before they fall behind.

How Automation and AI Simplify the Claims Process

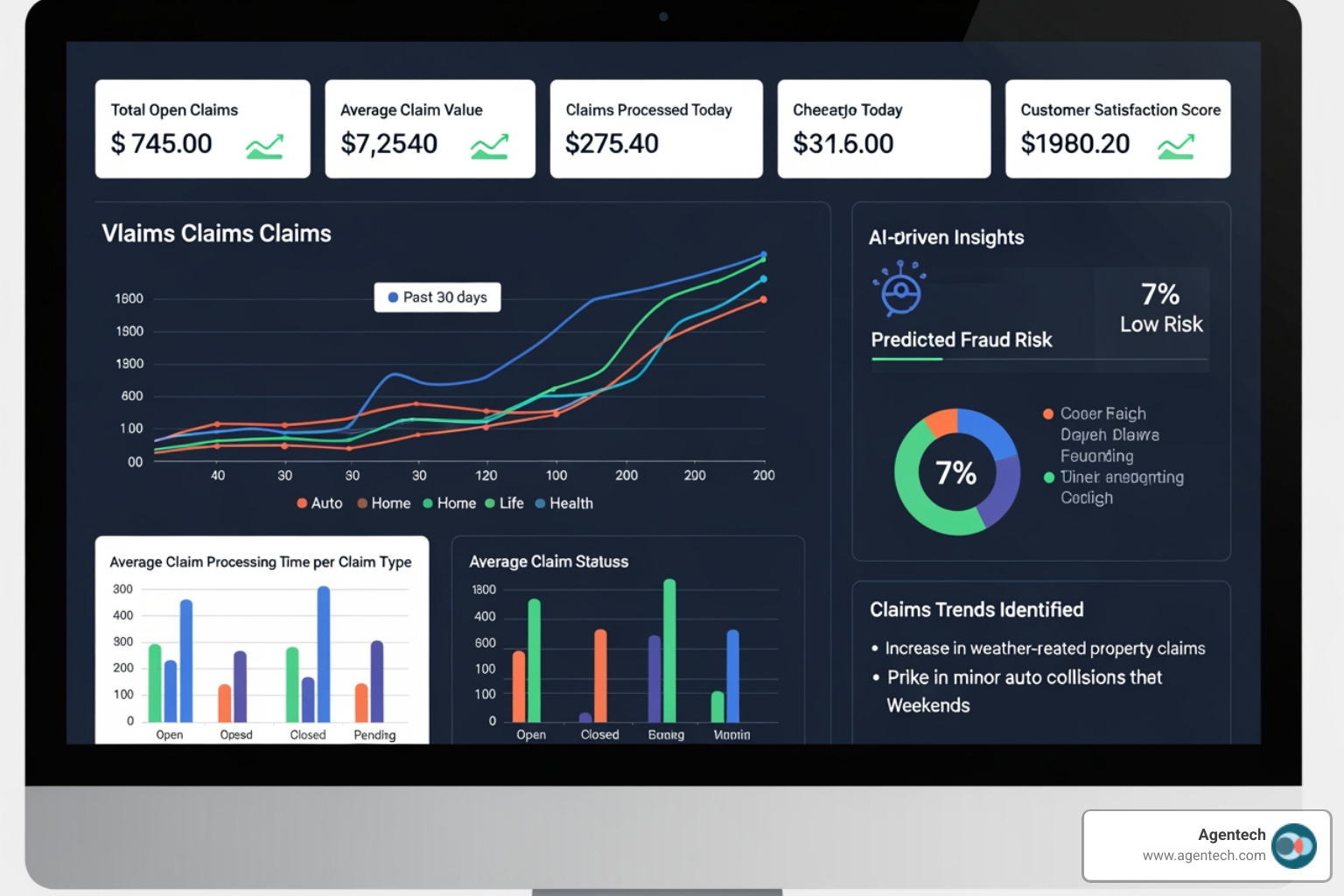

A revolution in P&C claims management is underway, driven by AI, machine learning, and data analytics. By integrating advanced claims software, P&C carriers, TPAs, and IA firms can move toward touchless workflows and straight-through processing, making the entire lifecycle smarter, faster, and more reliable.

Key Benefits for P&C Insurers and TPAs

When you simplify claims process operations with automation, the benefits are transformative.

- Increased Efficiency and Accuracy: Automation eliminates bottlenecks by handling repetitive work based on rules, ensuring claims flow seamlessly from FNOL to settlement with fewer errors.

- Cost Reduction: Streamlined workflows can lead to up to a 50% reduction in claims expenses, freeing up capital for strategic initiatives.1

- Reduced Claims Leakage: Improved accuracy and standardized processes help identify and prevent overpayments and missed subrogation opportunities.

- Improved Fraud Detection: Machine learning algorithms analyze data to spot patterns and flag suspicious claims early.

- Empowered Adjusters: With up to 80% of routine claims handled automatically, adjusters can focus on complex cases, customer interactions, and strategic problem-solving, boosting productivity and job satisfaction.1

Enhancing the Policyholder Experience

Automation directly improves the policyholder experience during a stressful time, leading to a 25% increase in customer satisfaction.2

- Faster Settlements: Automated workflows accelerate the entire journey, leading to quicker decisions and payments.

- 24/7 Access and Transparency: Digital portals for self service and AI assistants allow policyholders to file claims, upload documents, and track progress in real-time, whenever they choose.

- Personalized Communication: AI helps tailor messages, providing relevant updates with an empathetic tone, so policyholders feel valued and informed.

The Crucial Balance of Automation and Empathy

At Agentech, we believe technology should improve human connection, not replace it. Our approach, which keeps a human in the loop, uses AI to handle repetitive administrative tasks, freeing human adjusters to focus on what they do best: managing complex cases, negotiating settlements, and providing empathy to policyholders. This balance achieves empathy at scale, building trust and reinforcing the value of your P&C insurance policy. It's not about choosing between technology and people; it's about using technology to empower your team.

A Practical Blueprint for Automating Your Claims Workflow

Automating your entire claims workflow is a manageable journey, not an overnight change. The most successful P&C carriers, TPAs, and IA firms take a measured, strategic approach.

To simplify claims process operations effectively, start by assessing your current workflow to identify bottlenecks and pain points. Define clear automation goals, such as reducing processing costs or improving customer satisfaction. Select a modular claims software solution that integrates with your existing systems, like Agentech's AI Agents, which allow for a phased approach. Run a pilot program with a small team before a full rollout, and invest in training to ensure your team understands how automation makes their jobs easier, not obsolete.

Step 1: From FNOL to Data Intake Automation

The claims journey begins with the First Notice of Loss (FNOL). Automation transforms this initial touchpoint. Policyholders can submit claims through their preferred channel, whether it's a mobile app, website, or a chatbot powered by AI. This submission through multiple channels makes the first step painless.

Once a claim is submitted, automated data extraction takes over. Technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP) instantly read and understand documents like claim forms and police reports. The system performs document classification, automatically recognizing, extracting, and organizing all relevant data. This eliminates manual entry errors and provides adjusters with clean, accurate data from the first day.

Step 2: Intelligent Triage, Assessment, and Adjudication

With clean data, the next step is intelligent routing. Automated triage uses AI to analyze each claim's complexity and severity, routing simple claims to a fast track for straight-through processing and complex cases to experienced adjusters.

For property, auto, pet, or workers' comp claims, AI for damage assessment can analyze photos to identify damage and generate preliminary repair estimates. Predictive analytics uses historical data to forecast outcomes, such as litigation risk or settlement range, helping adjusters prioritize their work. For straightforward P&C claims, automated decision engines can adjudicate and approve payments without human intervention, while fraud detection powered by AI runs in the background to flag suspicious activity.

Step 3: Streamlining Communication and Settlement

The final stage is where you solidify a positive customer experience. Automated status updates keep policyholders informed at every milestone via email, text, or a portal for self service. When a claim is approved, digital payment systems deliver funds electronically within hours, not days.

Document automation technology generates all necessary closing paperwork, such as settlement letters and release forms, ensuring accuracy and compliance. Finally, the system closes the loop by archiving all documents and sending final notifications. This streamlined finish leaves policyholders satisfied and your files in perfect order.

The Future of Claims: Trends and Regulatory Considerations

The P&C insurance landscape is constantly evolving. To simplify claims process operations for the long term, carriers, TPAs, and IA firms must stay ahead of technological and regulatory trends.

Navigating Regulatory Guidelines

Regulatory guidelines are a roadmap for building a better, more compliant claims process. Automation helps meet key requirements for transparency, documented procedures, and fair settlement practices by applying rules consistently and creating effortless audit trails. Every action is logged automatically, ensuring a complete history is available for review. Building these requirements into automated workflows makes compliance a natural part of operations, not an extra burden.

What's Next? From Generative to Agentic AI

While generative AI is already helping summarize documents and draft communications, the next wave is agentic AI. Unlike traditional AI that waits for instructions, agentic AI acts as a capable team member, planning and executing tasks with multiple steps to achieve a goal.

Imagine an AI agent handling an entire auto claim from FNOL to payment, only involving a human adjuster for exceptions or empathy. This is the future we are building at Agentech.3 This shift, combined with predictive risk management using data from IoT devices like smart home sensors and vehicle telematics, allows the industry to move from reactive claim processing to proactive risk prevention. This makes the claims process faster, fairer, and more focused on policyholder needs.

Frequently Asked Questions about Simplifying the Claims Process

How long does it take to implement an automated claims system?

Implementation time varies, but with modern SaaS claims software and a phased rollout, P&C carriers, TPAs, and IA firms can see initial benefits in weeks. A modular approach, starting with high-impact areas like data intake, allows you to scale automation at your own pace.

Will AI replace claims adjusters?

No. The goal of AI in P&C claims processing is to augment human adjusters, not replace them. AI handles repetitive tasks with high volume, freeing your expert team to focus on complex cases, strategic decisions, and providing empathetic support to policyholders. This approach makes adjusters more efficient and their work more valuable.4

How do you measure the ROI of claims automation?

Key metrics for measuring the ROI of claims automation include:

- Reduced Processing Time (Cycle Time): The time from FNOL to settlement.

- Lower Operational Costs: A decrease in the cost per claim due to less manual work.

- Decreased Claims Leakage: Preventing overpayments and fraud through better accuracy.

- Improved Customer Satisfaction (CSAT/NPS): Higher scores resulting from a faster, more transparent experience.

- Increased Adjuster Productivity: More claims handled per adjuster.

Tracking these metrics demonstrates the clear financial and operational benefits of your automation initiatives.

Conclusion: Start Your Journey to a Simplified Claims Process

To simplify claims process operations is to fundamentally improve the moment when your policyholders need you most. It's about delivering the fast, transparent, and empathetic experience they expect while building a more efficient and profitable organization. By embracing automation, you free your adjusters from administrative work to focus on human connection, reduce claims leakage, and create a lasting competitive advantage.

This journey is a strategic necessity for any P&C carrier, TPA, or IA firm looking to thrive. You don't have to do it alone.

At Agentech, our AI Agents are designed to empower your team, not replace them. They handle the repetitive tasks so your experts can focus on what they do best: making thoughtful decisions and providing genuine care. The change can start small, with one area of high impact, and scale as you see the value.

Ready to take the first step? Find out how our AI Agents can revolutionize your workflow and deliver the results your organization needs.5 The future of claims processing is here.

Citations

- Agentech. (n.d.). AI Agents. Retrieved from https://www.agentech.com/product/ai-agents/

- Insurance Business Canada. (n.d.). Simplifying the claims process for the end customer. Retrieved from https://www.insurancebusinessmag.com/ca/news/breaking-news/simplifying-the-claims-process-for-the-end-customer-185105.aspx

- Agentech. (n.d.). AI Agents. Retrieved from https://www.agentech.com/product/ai-agents/

- Unified Public Advocacy. (n.d.). Streamline Claims: A Fast-Track Guide. Retrieved from https://upaclaim.org/blog/streamline-claims-a-fast-track-guide

- Agentech. (n.d.). AI Agents. Retrieved from https://www.agentech.com/product/ai-agents/