Why Insurance Claims Automation Benefits Matter Now

Insurance claims automation benefits are changing P&C insurance operations in measurable ways. As a claims manager, you're likely dealing with manual data entry, slow processing times, and mounting customer expectations. Automation addresses these pain points directly.

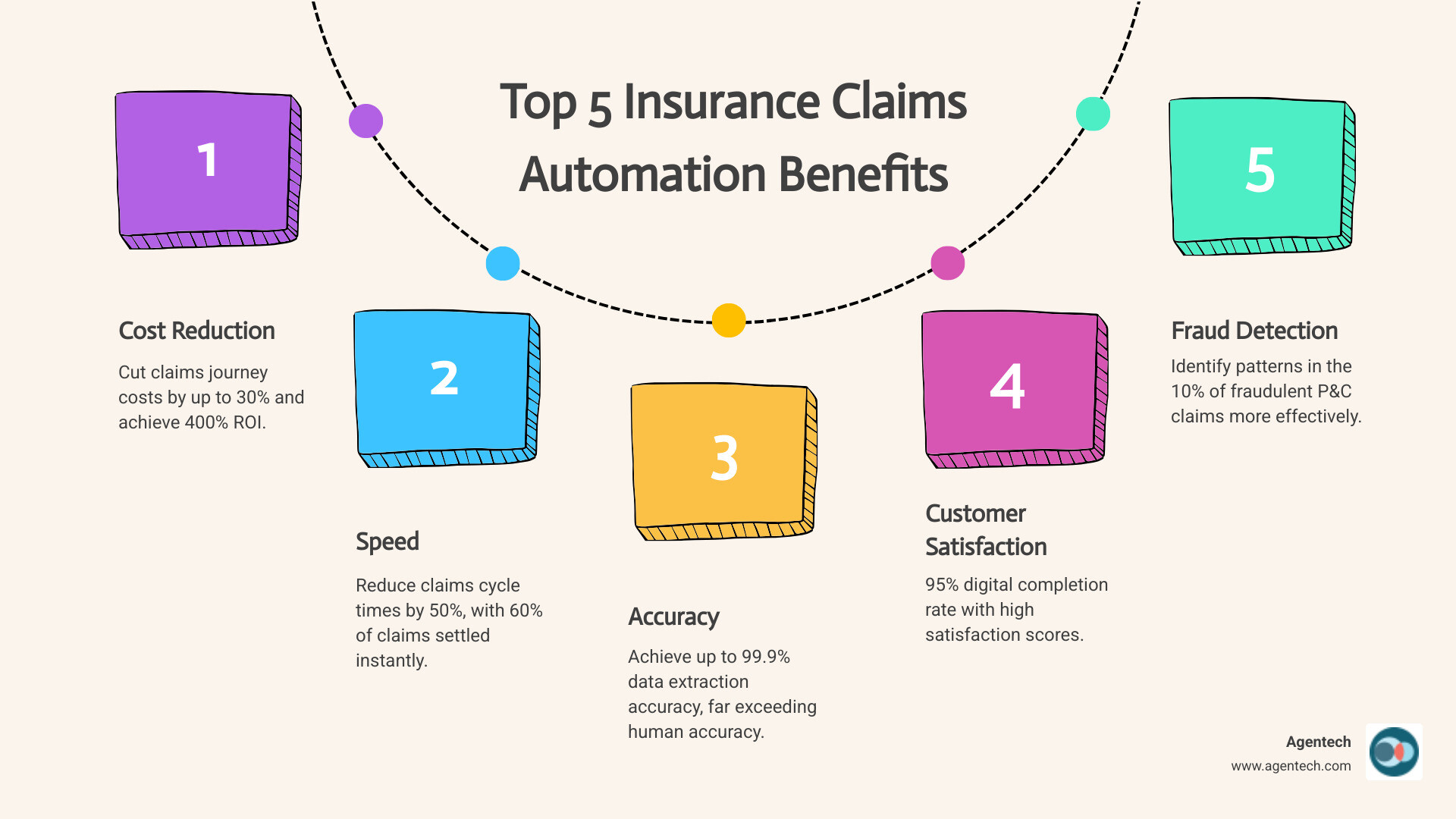

Top 5 Insurance Claims Automation Benefits:

- Cost Reduction: Cut claims journey costs by up to 30% and achieve 400% ROI

- Speed: Reduce claims cycle times by 50%, with 60% of claims settled instantly

- Accuracy: Achieve up to 99.9% data extraction accuracy, down from 80% human accuracy

- Customer Satisfaction: 95% digital completion rate with high satisfaction scores

- Fraud Detection: Identify patterns in the 10% of fraudulent P&C claims more effectively

The P&C insurance industry is at a turning point. McKinsey predicts that around 50% of claims processing will be automated by 2030. Meanwhile, 22% of business policyholders now prioritize fully digital claims processing when selecting a P&C insurance provider.

The challenge is real. Legacy systems struggle with unstructured data. Claims adjusters spend days sifting through forms, handwritten documents, PDFs, and images. Manual processing creates bottlenecks that frustrate policyholders and drive up operational costs.

The opportunity is bigger. P&C insurance carriers, TPAs, and IA firms that accept automation are seeing dramatic results. One major insurer increased claim handling efficiency by 30%. Another now settles 45% of customer claims in real time. These aren't future promises. They're happening today.

Poor claims experiences put up to $170 billion in renewal premiums at risk globally over the next five years. For P&C insurers handling residential property, auto, pet, and workers' compensation claims, the stakes have never been higher.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance, starting with pet insurance claims. After founding and scaling TokenEx to one of Oklahoma's largest tech exits, I've seen how the right technology transforms operations and the insurance claims automation benefits that come with strategic AI implementation.

The Top Insurance Claims Automation Benefits for Carriers and TPAs

For P&C insurance carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) Firms, the drive to automate claims processing isn't just about keeping up; it's about getting ahead. We're talking about tangible, operational advantages that redefine efficiency and profitability. The insurance claims automation benefits extend across every facet of your operations, from the initial claim filing to the final settlement.

Drastically Reduce Operational Costs and Boost ROI

Let's face it, claims handling has historically been a significant cost center. Manual processing means more staff time, more errors, and more expenses. But with claims automation, we can flip that script. Automation streamlines workflows, eliminating redundant tasks and drastically reducing the need for manual labor. This translates directly into lower claim expenses. McKinsey's study on digital disruption in P&C insurance highlights that automation can reduce the cost of a claims journey by as much as 30% (1). Imagine the impact that could have on your bottom line.

Beyond cost reduction, we see a significant boost in Return on Investment (ROI). For TPAs and P&C insurers, innovative claims software can deliver an outstanding 400% ROI. This isn't just about saving money; it's about optimizing your resources, freeing up your skilled adjusters and claims handlers from mundane, repetitive administrative tasks. They can then focus on valuable activities like complex case management, customer engagement, and strategic decision making. This shift in focus not only improves efficiency but also lifts job satisfaction for your team.

Improve Efficiency and Accelerate Claim Cycles

One of the most immediate and impactful insurance claims automation benefits is the dramatic improvement in efficiency and speed. Slow, rigid, and complex claims processes are a relic of the past. With automated claims software, we can transform these bottlenecks into smooth, rapid workflows.

Consider this: one PwC client, dealing with complex employer liability claims, saw their claim handling efficiency increase by 30% after implementing automation. This isn't an isolated case. Across the industry, claims cycle times are typically reduced by 50%. What does this mean for your P&C insurance business? Faster compensation for policyholders, which is a huge win for customer satisfaction, and a much quicker resolution for your internal processes.

Automated systems are tireless. They can process claims 24/7, maintaining consistent performance even during seasonal spikes or unexpected surges in volume, such as after natural disasters. This capability is particularly crucial for P&C insurers, who often face thousands of claims following a major event. Without automation, managing such an influx would require temporary staffing and could lead to significant delays. With claims automation, your operations remain agile and responsive, ensuring that every policyholder gets the attention they need, when they need it.

Strengthen Fraud Detection and Risk Assessment

Fraud is a persistent challenge in the P&C insurance industry. Approximately 10% of property and casualty claims are fraudulent, representing a substantial financial drain. Traditionally, fraud detection has often relied on human judgment and a slow, manual review of documents. Claims automation changes the game entirely.

By leveraging predictive analytics, claims software can analyze vast datasets to identify patterns and anomalies that signal potential fraud. This includes cross referencing data from various sources, flagging suspicious claims for further investigation. Automated data gathering and pattern identification help us to reduce loss exposure significantly. Instead of sifting through mountains of paperwork, your Special Investigation Unit (SIU) teams receive pre triaged suspicious claims, allowing them to focus their expertise where it's most needed. This proactive approach not only helps prevent losses but also ensures that legitimate claims are processed without unnecessary delays.

Improve Accuracy and Ensure Compliance

It is only human to make mistakes. In the complex world of P&C insurance claims, a single mistake can have cascading effects, leading to rework, delays, and dissatisfied policyholders. Claims automation minimizes this risk by standardizing processes and reducing manual data entry.

Automated claims software ensures consistent decision making across all claims. It applies predefined rules and logic uniformly, eliminating the variability that can arise from different human adjusters handling similar cases. This leads to greater accuracy and fewer errors in processing. Furthermore, these systems come with automated audit trails and robust data governance features. This means every step of the claims journey is recorded and verifiable, ensuring strict compliance with regulatory requirements such as GDPR and other P&C specific regulations. With multi modal processing capabilities, advanced Optical Character Recognition (OCR) and computer vision AI can analyze text, images, and even handwritten notes with up to 99.9% accuracy. This level of precision is virtually impossible to achieve with manual methods alone.

How Automation Lifts the Policyholder Experience

In the P&C insurance world, a claim isn't just a transaction; it's often the first meaningful interaction a policyholder has with their P&C insurer since purchasing coverage. It's the moment of truth. Automation transforms this critical touchpoint from a potential point of friction into a positive, reassuring brand interaction, driving customer satisfaction and retention.

Deliver Faster Settlements and 24/7 Self Service

Modern policyholders expect speed and convenience, much like they experience with online banking or shopping. Lengthy waiting periods for claims resolution are a major source of frustration. Insurance claims automation benefits directly address this.

With advanced claims software, we can achieve instant claim settlement for a significant portion of claims. Some providers successfully settle 60% of claims instantly with exceptional accuracy. Policyholders can file claims 24/7 through mobile apps or online portals, initiating the process at their convenience, not just during business hours. This immediate access and rapid resolution are powerful drivers of satisfaction. In fact, 67% of customers prefer self service options that give them control over the process, and 22% of business insurance policyholders prioritize fully digital claims processing when choosing a provider. By empowering policyholders with these tools, we reduce their waiting periods and improve their overall experience.

One of the Key Insurance Claims Automation Benefits: Increased Transparency

Imagine being able to track your claim's progress just like you track a package delivery. That's the level of transparency claims automation brings to the policyholder experience. Real time status updates, delivered via digital communication channels like email or text, keep customers informed every step of the way. Proactive notifications alleviate anxiety and reduce the need for policyholders to call for updates, which in turn reduces outbound calls by as much as 25%.

We know that 95% of customers complete the claims process digitally with satisfaction. This high level of satisfaction isn't just about speed; it's about clarity and control. Conversely, poor claims experiences could put up to $170 billion in renewal premiums at risk globally over the next five years (2). By providing transparent, digitally enabled claims journeys, we build trust, improve loyalty, and ensure policyholders feel valued and informed, strengthening their relationship with their P&C insurance provider.

The Technology Behind Automated Claims Processing

Understanding the engine that drives claims automation is key to leveraging its full potential. Modern claims management software integrates several powerful technologies to create a seamless, efficient, and intelligent claims journey.

The Automated Claims Workflow: From FNOL to Payout

Let's walk through how an automated claims process typically works for P&C claims, from the moment a policyholder first reports a loss to the final payment.

- First Notice of Loss (FNOL): This is where it all begins. Policyholders can submit their FNOL through various digital channels: a mobile app, an online portal, or even via a chatbot. Automated systems capture this initial data, often pre filling information based on the policyholder's profile, significantly reducing manual data entry for our teams.

- Automated Data Collection and Document Validation: Once the FNOL is submitted, the system automatically collects all necessary supporting documentation. This could include images of damages, repair estimates, medical records for workers' compensation claims, or police reports for auto incidents. Advanced claims software uses technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP) to extract relevant data from these documents, regardless of their format. The system then validates this data against policy terms and predefined rules, flagging any inconsistencies or missing information.

- AI Powered Triage: With validated data in hand, AI algorithms swiftly triage the claim. Simple, low complexity claims can be fast tracked for automated processing, often leading to instant settlement. More complex cases, such as a major property loss or a complicated workers' compensation claim, are routed to the most appropriate human adjuster, complete with all relevant, pre processed information.

- Automated Adjudication: For eligible claims, the system can automatically determine the validity of the claim and calculate the appropriate payout based on policy coverage and rules. This significantly reduces the need for human intervention on routine cases, freeing adjusters to focus on claims that truly require their expertise and empathy.

- Digital Payment Processing: Once adjudicated, the claims software initiates digital payment processing. This can include direct deposits to policyholders or payments to approved vendors, ensuring a swift and secure payout.

This entire workflow is designed to be fast, accurate, and transparent, benefiting both the insurer and the policyholder.

Core Technologies Enabling Automation

The backbone of modern claims automation is a suite of sophisticated technologies that work in concert.

- Robotic Process Automation (RPA): RPA bots are like tireless digital assistants. They handle repetitive, rule based tasks such as data entry, form filling, and moving files between systems. This is particularly useful for integrating with legacy systems, allowing automation without needing to completely replace the old systems.

- Artificial intelligence (AI): AI is the broader field encompassing machine learning and natural language processing. In claims, AI systems analyze large datasets, identify patterns, and detect anomalies, significantly reducing the time and effort required for manual processing (3).

- Machine Learning (ML): A subset of AI, ML algorithms learn from data to make predictions or decisions without explicit programming. In claims, ML can continuously review patterns to flag potential issues, improve fraud detection, and optimize claim segmentation over time. The more data the system processes, the smarter it becomes.

- Natural Language Processing (NLP): NLP enables computers to understand, interpret, and generate human language. This is crucial for analyzing unstructured data from claim forms, adjuster notes, emails, and even customer complaints. NLP can extract key information, summarize documents, and even adjust complex P&C insurance language for different audience types, making documents easier to understand.

- Optical Character Recognition (OCR): OCR technology converts different types of documents, such as scanned paper documents, PDFs, or images, into editable and searchable data. This allows claims software to "read" and extract information from virtually any document, including handwritten notes from medical professionals or accident reports, with up to 99.9% accuracy when combined with other AI techniques.

Together, these technologies form a powerful engine for claims automation, enabling unprecedented levels of efficiency and insight.

The Role of Generative AI in Modern Claims

The advent of Generative AI (GenAI), particularly large language models (LLMs), is ushering in a new era for claims automation, moving beyond simple automation to intelligent augmentation (4).

GenAI can assess damages with unprecedented precision when combined with image recognition and computer vision technologies, which is especially valuable for auto and property claims. It can analyze complex commercial policy terms and conditions to quickly assess claim coverage validity, a task that traditionally requires extensive manual review.

One of the most exciting insurance claims automation benefits of GenAI is its ability to augment adjuster expertise. By automating mundane administrative tasks like preparing standard mailings to claimants or drafting engagement letters for external service providers, GenAI allows adjusters to focus on activities of higher value. This can lead to a productivity improvement of 20% to 30% for administrative tasks related to claims. In fact, nearly half of P&C insurance companies are already testing the use of large language models for claims automation and other operational tasks.

GenAI powered virtual assistants and chatbots can provide round the clock customer support, giving policyholders instant access to information and guidance through the claims process. For our adjusters, GenAI can act as an AI assistant that is always on, providing better data visualization, access to historical references, timely alerts, and recommendations driven by data, all without replacing human decision making. This collaboration between human expertise and advanced AI is how we open up the full potential of claims processing.

Your Roadmap to Implementing Claims Automation

Embracing claims automation doesn't mean tearing down your existing infrastructure. Instead, it's about a strategic, phased approach that ensures a smooth transition and delivers quick, measurable wins.

Overcoming Common Implementation Challenges

While the insurance claims automation benefits are clear, implementing new technology can present problems. Many P&C insurers, TPAs, and IA Firms grapple with legacy systems and fragmented data. Integrating new claims software with these older systems can be complex, and the initial investment in resources and training can seem daunting.

However, these challenges are not impossible. The key is to approach implementation strategically. Start with a clear understanding of your current processes and identify specific pain points that automation can address. For instance, focusing on high volume, low complexity claims first can provide early successes and build internal confidence.

Overcoming cost concerns requires a detailed cost benefit analysis, demonstrating the significant ROI that automation delivers through reduced operational expenses, fraud prevention, and improved customer retention. As McKinsey advises in "Claims in the digital age: How insurers can get started" (5), a phased approach, starting with pilot projects, allows for testing and adjustments, mitigating risk and ensuring a successful rollout. Change management is also crucial; involving your team from the outset, providing comprehensive training, and communicating the long term benefits helps ensure smooth adoption.

A Key Insurance Claims Automation Benefits Discussion: Essential System Features

When evaluating claims software, certain features are non negotiable for maximizing insurance claims automation benefits:

- Seamless Integration: The chosen claims software must integrate effortlessly with your existing core systems, as well as with third party data sources and service providers. This ensures a unified ecosystem and avoids creating new data silos.

- Scalability: Your claims software needs to be able to handle fluctuating claim volumes, from everyday occurrences to catastrophic events, without compromising performance. This flexibility is vital for P&C insurers.

- Human in the Loop Workflows: While automation handles routine tasks, human adjusters remain critical for complex, sensitive, or ambiguous cases. The system should facilitate seamless handover and collaboration, allowing human oversight and intervention when necessary.

- Advanced Analytics and Reporting: Robust reporting capabilities provide insights into operational efficiency, claims trends, fraud patterns, and compliance. This approach driven by data supports continuous improvement and strategic decision making.

- Multi Format Document Support: The ability to ingest and process data from various document types—PDFs, images, handwritten notes, structured forms—is essential for comprehensive automation in P&C claims.

- Robust Security: Protecting sensitive policyholder data is paramount. The claims software must adhere to the highest security standards and compliance regulations to safeguard information throughout the claims lifecycle.

Getting Started: A Practical Guide

Ready to open up the insurance claims automation benefits for your organization? Here's a practical roadmap:

- Identify Strategic Goals: What do you want to achieve with automation? Is it faster processing, cost reduction, improved customer satisfaction, or better fraud detection? Clearly define your objectives.

- Select Pilot Processes: Start small to learn fast. Identify high volume, low complexity claims or specific tasks performed at a desk that are ripe for automation. This could be initial FNOL intake for pet claims or routine verification for auto claims.

- Define Requirements: Work with your teams to map out existing workflows and identify the functional and technical requirements for your claims software.

- Choose the Right Claims Software Partner: Look for a partner with deep industry expertise in P&C insurance and a proven track record of successful integrations. They should offer solutions that augment your team, not replace them.

- Measure Progress and ROI: Establish key performance indicators (KPIs) from the outset. Continuously track and measure the impact of automation on efficiency, costs, accuracy, and customer satisfaction.

- Continuous Improvement: Automation is not a one time project. Use the data and insights gathered to continually refine your automated processes and expand automation to new areas.

The Future is Automated: Trends and Next Steps

The evolution of claims processing is ongoing, with technology continuing to open up new levels of efficiency and service. The insurance claims automation benefits we see today are just the beginning.

Future Trends in Claims Automation

The landscape of P&C insurance claims is dynamic, driven by technological advancements and evolving customer expectations. We anticipate several key trends:

- Hyper Personalization: Future claims processes will be highly custom to individual policyholders' preferences and circumstances, offering bespoke communication and service experiences.

- Proactive Claims Prevention: Leveraging IoT devices and advanced analytics, P&C insurers will move towards proactive risk mitigation and even claims prevention, particularly in residential property and auto insurance. Imagine smart home sensors alerting policyholders to potential water leaks before significant damage occurs.

- IoT Integration: The Internet of Things (IoT) will play an even larger role, providing real time data from connected cars, smart homes, and wearables. This data will enable more accurate, faster, and fairer claims assessments, from auto accident reconstruction to health metrics for workers' compensation.

- Deeper Ecosystem Integration: Claims software will seamlessly integrate with a broader ecosystem of third party providers, including repair shops, rental car companies, medical providers, and legal services. This creates a complete digital experience from start to finish for the policyholder.

- The Shift from Claims as a Cost Center to a Strategic Asset: As automation matures, the claims department will transform from a necessary expense into a strategic differentiator. With 50% of claims processing predicted to be automated by 2030 (6), claims will become a source of valuable data and insights, informing product development, underwriting, and risk management.

Accept the Benefits with Agentech

We've explored the profound insurance claims automation benefits that are reshaping the P&C insurance industry. From drastically reducing operational costs and accelerating claim cycles to strengthening fraud detection and elevating the policyholder experience, automation is no longer a luxury; it's a necessity.

At Agentech, we are committed to helping P&C insurance carriers, TPAs, and IA Firms streamline their operations, boost productivity, and improve customer loyalty. Our AI powered automation tools are designed to handle the repetitive administrative tasks that bog down your adjusters, allowing them to focus on what they do best: applying their expertise and empathy to complex cases. We believe in augmenting human capabilities, not replacing them, fostering a more engaging and efficient work environment for your team.

The future of P&C claims is automated, intelligent, and customer centric. We're here to help you steer this change. To see how AI assistants can transform your claims department, explore our AI Agents for P&C insurance.

Citations

- McKinsey & Company. (2017). Time for insurance companies to face digital reality.

- Accenture. (2022). AI transforming claims and underwriting.

- McKinsey & Company. (2021). Insurance 2030: The impact of AI on the future of insurance.

- BCG. (2023). GenAI Will Write the Future of Insurance Claims.

- McKinsey & Company. (2022). Claims in the digital age: How insurers can get started.

- McKinsey & Company. (2023). Claims 2030: Dream or reality?.