The High Cost of Manual Claims Processing

Automating insurance claims processing transforms how Property & Casualty (P&C) insurance carriers, Third-Party Administrators (TPAs), and Independent Adjusting (IA) Firms handle claims. By using AI, machine learning, and robotic process automation, these organizations can reduce manual work, improve accuracy, and accelerate settlements.

Key benefits include:

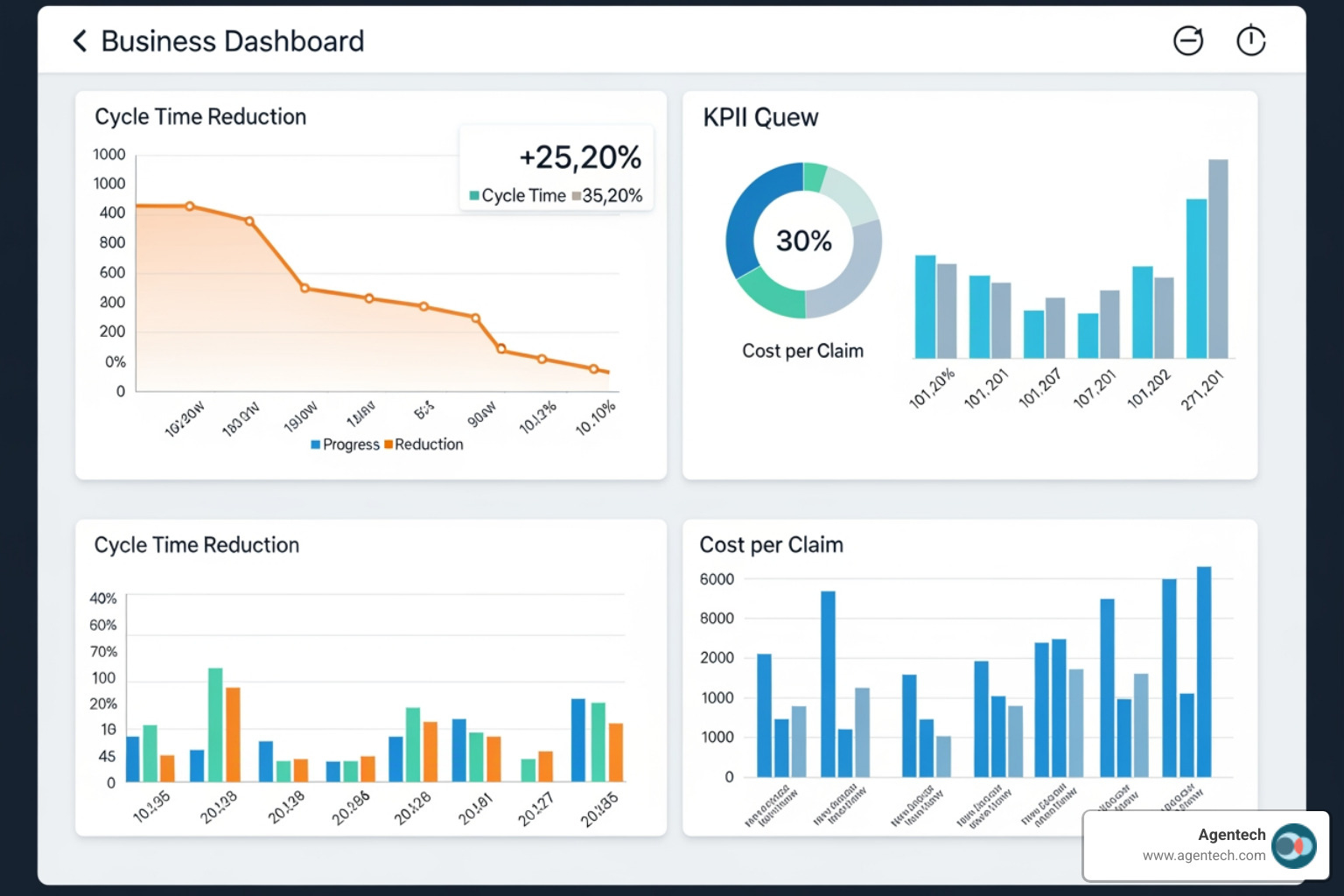

- Cost reduction of up to 30% in claims operations

- 50% to 70% faster resolution times for standard claims

- 98% to 99% accuracy rates for document processing and data extraction

- Significant reduction in manual data entry and administrative tasks

- Improved fraud detection with AI identifying 53% more fraud indicators

Manual claims processing creates significant challenges. Auto repair claims now take 23.1 days to process, nearly double the pre-pandemic time, and a typical claim involves around 26 separate touchpoints. Claims associates spend up to 80% more time on manual data entry compared to automated processes, increasing the risk of errors and delays.

The financial impact is substantial. Traditional claims handling involves paperwork, phone calls, and repetitive data entry. Each manual step increases the risk of human error, and approximately 10% to 15% of all P&C claims costs are attributed to fraud that manual processes struggle to detect. Furthermore, 30% of policyholders will switch providers after a poor claims experience.

For claims managers at P&C carriers, TPAs, and IA firms, these inefficiencies create daily pressure. Adjusters are bogged down with tedious tasks instead of using their expertise. During peak periods like CAT season, manual processes cannot scale to meet demand.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance. After founding and scaling TokenEx to a successful exit, I've focused on automating insurance claims processing to help P&C carriers transform operations across residential property, auto, pet, and workers' compensation claims.

The Core Technologies Driving Claims Automation

Think of automating insurance claims processing like assembling a high-performing team. No single technology does all the work. Instead, AI, machine learning, intelligent document processing, and robotic process automation operate as one integrated system to transform how P&C insurance carriers, TPAs, and IA firms handle claims.

This integrated approach is crucial for P&C insurance because claims vary widely. An auto accident claim is different from property damage, a workers' compensation case, or a pet insurance claim. These technologies adapt to handle that diversity, freeing your adjusters from tedious work.

How AI and Machine Learning (ML) Create Efficiency

Artificial Intelligence and Machine Learning are the brain of modern claims automation. They are practical tools that learn from data, spot patterns, and make smart decisions.

Our AI agents function as digital coworkers, continuously analyzing incoming claims data. Through predictive analytics, these systems can forecast claim outcomes, helping adjusters set accurate reserves. This prevents tying up capital unnecessarily or creating financial surprises.

Machine learning excels at pattern recognition, which is crucial for detecting fraud. While traditional rule-based systems are easy to game, AI-augmented systems identify 53% more potential fraud indicators by recognizing subtle patterns across thousands of claims. For a midsized P&C carrier, this can translate to millions in savings annually.

Agentic AI represents the next evolution. These systems understand context, make judgment calls, and know when to escalate issues to human adjusters. This shift from basic automation to intelligent agents is transforming insurance claims from generative AI to agentic AI and shaping the future of P&C insurance.

Intelligent Document Processing (IDP) for Unstructured Data

P&C claims involve a flood of paperwork, from handwritten police reports to repair estimates and medical records. Most of this information is unstructured. Manual extraction is slow and error-prone.

Intelligent Document Processing combines several technologies to solve this. Optical Character Recognition (OCR) converts scanned documents and images into machine-readable text. Natural Language Processing (NLP) then helps claims software understand human language, parsing adjuster narratives and categorizing documents by content.

The biggest benefit is data extraction. IDP systems trained on insurance documents can identify and pull specific data points like claimant names, policy numbers, and loss causes with accuracy rates often exceeding 98%. For auto claims, this means processing damage estimates quickly. For property claims, it extracts details from inspection reports.

At Agentech, we've focused our AI on the most tedious, time-consuming task in claims processing: creating the claim profile. This eliminates hours of manual data entry and reduces errors.

The Role of Robotic Process Automation (RPA)

If AI is the brain, Robotic Process Automation is the hands. RPA bots are software robots that mimic human actions to interact with digital systems, but much faster and without fatigue.

In P&C claims processing, RPA excels at automating rules-based tasks like verifying policy details, cross-referencing data, and flagging discrepancies. These bots can automatically populate digital forms with extracted data and handle data transfer between legacy platforms and modern claims software.

This system integration is especially valuable for established P&C carriers and TPAs running multiple platforms that don't communicate. RPA acts as a bridge, moving data seamlessly between systems. A bot can register a new claim, download attachments, extract data, and update multiple systems in minutes.

When you combine these technologies, you create a powerhouse system for automating insurance claims processing. P&C carriers, TPAs, and IA firms using these integrated tools achieve efficiency and accuracy that manual processes cannot match.

Key Benefits of Automating Insurance Claims Processing

Adopting automated claims processing is a fundamental shift that creates value for everyone. When P&C carriers, TPAs, and IA firms accept automating insurance claims processing, they are not just upgrading systems; they are improving how they serve policyholders and empowering their teams.

For P&C Insurers, TPAs, and IA Firms

The business case for automation is compelling. Eliminating repetitive manual work makes operations smoother and faster. For example, one P&C insurance company achieved near real-time processing of claim documents, which dropped claims processing costs by 30%.

Accuracy improves dramatically when you remove human error from data entry. Automated systems powered by AI and intelligent document processing achieve 98% to 99% accuracy rates, meaning fewer mistakes and more consistent application of policy terms.

Fraud detection also gets a major boost. AI-augmented systems can identify 53% more potential fraud indicators than manual review, saving a midsized insurer an average of $4.2 million annually. This is significant, as fraud costs the P&C insurance industry over $45 billion each year in the United States. You can find more on how AI can manage fraud and its impact.

Automated systems scale effortlessly during peak times like CAT season, handling thousands of claims without sacrificing speed or accuracy. Regulatory compliance also becomes simpler with built-in checks, reducing risk and making audits less painful. This efficiency supports growth and aligns with the broader digital disruption in P&C insurance. The centralized data also delivers rich analytics for better risk assessment and underwriting, which is valuable for P&C insurance back office automation initiatives.

For Policyholders and Claims Adjusters

Automation improves the experience for your policyholders and your claims team.

For policyholders, speed makes all the difference. Automated claims processing cuts resolution times by 50% to 70%. Fast payouts for auto repairs or property damage improve customer satisfaction and retention. Real-time updates also keep policyholders informed, reducing anxiety and building trust.

Your claims adjusters benefit just as much. Automation frees them from tedious tasks that consume up to 80% of their time. Claims handlers can save 2 to 3 hours daily when AI handles mundane work. This is why our solutions are designed with adjusters in mind.

When adjusters are not buried in paperwork, they can focus on what humans do best: applying judgment to complex cases and building relationships with policyholders. They become strategic advisors, not data entry clerks. This shift embodies the future of work in P&C insurance: embracing AI agents as digital coworkers. This leads to higher job satisfaction and improved employee retention, which is invaluable in today's labor market.

Automating insurance claims processing creates a true win for everyone. P&C carriers operate more efficiently, policyholders receive faster service, and adjusters are empowered to do more meaningful work.

A Practical Framework for Automating Insurance Claims Processing

Getting started with automating insurance claims processing can feel overwhelming, but you don't need to transform everything overnight. A step-by-step approach allows P&C carriers, TPAs, and IA firms to integrate automation without disrupting operations. The goal is to understand your pain points, choose the right technology, and weave it into your workflows.

Step 1: Assess Workflows and Choose a Solution

Before investing in technology, understand your current claims operation. Where are the slowdowns and errors? Where do adjusters spend too much time on manual tasks?

Start by mapping your current workflows for different claim types like residential property or auto claims. Talk to your adjusters to identify bottlenecks, such as manual data entry at First Notice of Loss (FNOL) or tedious document sorting. These pain points are your automation opportunities.

Define what success looks like. Are you aiming to cut costs, speed up settlements, or reduce adjuster burnout? Your goals will shape your choice of claims software and how you measure results.

When evaluating solutions, focus on key features. Integration capabilities are critical for connecting with your existing policy administration and payment systems. Scalability is essential for handling volume spikes during CAT claims. Security and compliance are non-negotiable. A good user experience is vital for adoption, and true AI capabilities that use machine learning and IDP are more powerful than basic RPA. Finally, look for a system that allows customization without coding.

If you're feeling stuck, our guide on not sure where to start with AI can help you steer these early decisions.

Step 2: Integration, Compliance, and Human Oversight

Once you've chosen a solution, the next step is integration.

Most P&C insurance organizations run on legacy systems. Your automation solution must integrate seamlessly with this existing infrastructure. Agentech's solutions are designed for this, allowing data to flow between platforms without replacing your core systems. We support ACORD standards for compliant, real-time data exchange with carriers, TPAs, and other partners.

Data security is paramount. Your automated system must include encryption, strict access controls, and comprehensive audit trails to protect sensitive policyholder information. You must also ensure compliance with all relevant data privacy regulations, especially for workers' compensation claims involving medical records.

Crucially, human oversight should always be part of the equation. AI is powerful for routine tasks and flagging anomalies, but complex claims and situations requiring empathy still need human decision-making. We call this a "human-in-the-loop" approach. AI processes the straightforward work, but your adjusters remain in control of critical decisions. This protects against bias and allows human expertise to shine. Our hybrid AI solution for claims automation combines efficiency with quality assurance, ensuring important judgments receive human validation.

Step 3: Phased Rollout and Measuring Success

Avoid automating everything at once. Start small to build momentum.

Launch a pilot project with a narrow scope, like FNOL for auto claims. A controlled test of 60 to 90 days allows you to gather feedback and refine the system before a broader rollout.

Your people are key to success. Invest in comprehensive training for your adjusters. Emphasize how automation will augment their work, freeing them from tedious tasks to focus on complex cases. This is about empowering people, not replacing them. Effective change management, with clear communication and employee involvement, is essential.

Track the right metrics from day one to prove value. Monitor cost per claim, cycle time, error rates, and customer satisfaction. Also, track adjuster productivity by measuring hours saved on administrative tasks. Use these metrics to drive continuous improvement, refining your automation strategy as your business evolves. This commitment is central to designing for the future: how AI transforms the claims experience.

By following this framework, P&C carriers, TPAs, and IA firms can successfully implement automation that delivers real results.

Frequently Asked Questions about Claims Automation

We often hear the same questions from P&C carriers, TPAs, and IA firms considering automating insurance claims processing. Let's address the most common ones.

How does automation handle different types of P&C claims such as auto, property, pet, or workers' compensation?

Modern AI-powered automation is highly adaptable. While the documents differ, the core processing mechanics are similar: extracting data, validating information, and routing the claim.

- For auto claims, automation processes accident reports, repair estimates, and damage photos.

- For property claims, it extracts details from inspection reports and contractor bids.

- For pet insurance claims, it processes vet records and invoices, like our work with Odie Pet Insurance.

- For workers' compensation claims, it handles medical reports and wage statements while ensuring regulatory compliance.

In each case, the AI acts as an assistant, processing information and giving adjusters a consolidated view, regardless of the claim type.

Will AI replace claims adjusters?

No, and that is not the goal. The industry is moving toward augmentation, not replacement. Our AI is designed with adjusters in mind.

AI excels at repetitive, high-volume tasks that consume up to 80% of an adjuster's day, such as data entry, document sorting, and initial validation. When AI takes over these tasks, adjusters are free to focus on what requires human judgment: showing empathy, conducting complex investigations, and negotiating nuanced settlements.

Our AI agents act as digital coworkers, boosting productivity by handling tedious work. The "human-in-the-loop" approach ensures that an adjuster is always there for critical decisions.

What is the biggest challenge when starting with claims automation?

The biggest challenges are typically integration with existing systems and internal change management, not the technology itself.

Many P&C organizations run on legacy systems not built for AI. Getting a modern automation solution to communicate with these platforms without disruption requires careful planning, which is why seamless integration is a core focus of our solutions.

The human element is another hurdle. Introducing new technology requires changing how people work. Clear communication, comprehensive training, and showing how automation makes jobs better are essential for successful adoption. We often recommend starting with a pilot project to identify bottlenecks and demonstrate value early.

If you're not sure where to start with AI, we can guide you through these challenges, from assessment to full implementation.

Conclusion: The Future of Claims is Efficient and Human Centric

The P&C insurance industry is at a turning point. The old way of handling claims is no longer sustainable. Automating insurance claims processing has become a necessity for carriers, TPAs, and IA firms that want to thrive.

As we've explored, AI, Machine Learning, and Intelligent Document Processing deliver transformative results: claims resolved 50% to 70% faster, operational costs cut by up to 30%, and accuracy rates reaching 98% to 99%. This is a complete reimagining of how P&C insurance claims can work across auto, property, pet, and workers' compensation.

At Agentech, we believe this change is about freeing talented adjusters from tedious work. When AI agents handle data entry and routine validation, adjusters can focus on what they were hired to do: investigate complex cases, provide empathy to policyholders, and apply their expertise where it matters.

This is the future we are building: one where technology handles the heavy lifting while human judgment and compassion remain at the center of every claim. Our AI agents act as digital coworkers, amplifying your team's capabilities, not replacing them.

The claims experience of tomorrow is faster, more accurate, and more cost-effective. More importantly, it is deeply human—empowering adjusters and providing policyholders with the fair, fast service they deserve. This future is happening now.

Learn how AI Agents can transform your claims operations

Citations:

- EY. (n.d.). How a Nordic insurance company automated claims processing. EY.

- Pingili, R. (2024). The Basics of Robotic Process Automation in Insurance Claims. International Journal For Multidisciplinary Research.

- McKinsey & Company. (n.d.). Digital disruption in insurance. McKinsey.

- J.D. Power. (2023). US Auto Claims Satisfaction Study. J.D. Power.

- insurancefraud.org. (n.d.). Fraud Stats. insurancefraud.org.

- ACORD. (n.d.). ACORD. ACORD.