Why P&C Insurance Document Processing Automation Matters Now

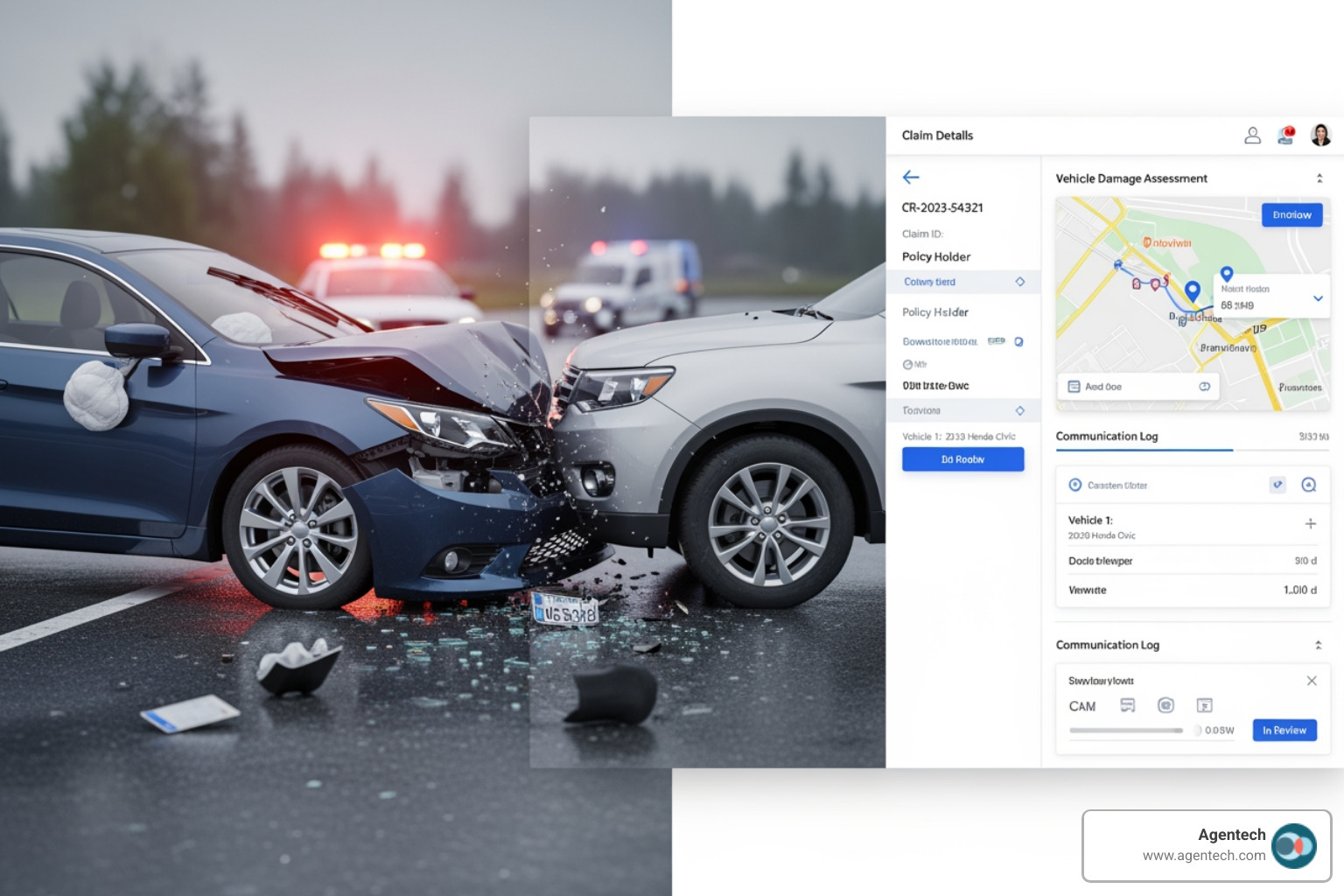

Insurance document processing automation uses AI technology to automatically read, extract, and organize data from claims forms, policy documents, and other paperwork. Instead of manual data entry, AI handles the heavy lifting while your team focuses on decisions that matter.

Quick Overview:

- What it does: Converts paper and digital documents into structured data using OCR, NLP, and AI

- Who needs it: P&C carriers, TPAs, and IA firms processing claims for auto, property, workers' comp, and pet insurance

- Key benefits: 40 to 50% more cases handled per adjuster, 95% or higher accuracy rates, processing times cut by 84%

- Core technologies: Optical Character Recognition (OCR), Natural Language Processing (NLP), Vision Language Models (VLMs)

- Main use cases: FNOL intake, claims processing, policy renewals, ACORD forms, compliance reporting

The Property & Casualty insurance industry runs on documents. Claims forms, medical bills, police reports, and damage estimates create a constant stream of paperwork. Your adjusters spend hours hunting through these files instead of adjusting claims, leading to significant problems. Up to 40% of an underwriter's time is lost to administrative work, while a shrinking workforce faces rising caseloads.

This inefficiency directly impacts customer satisfaction. Unhappy claimants often cite slow settlement speeds and a difficult closing process. Document automation solves this by teaching AI to read and understand your documents like a human would, but faster and more consistently. The technology extracts data from any format, validates it, and routes it to the right workflows automatically.

This isn't about replacing your team; it's about giving them superpowers. Adjusters can handle more cases without working longer hours, spending their time on meaningful analysis instead of administrative tasks.

I'm Alex Pezold, founder of Agentech AI. After scaling and exiting my previous company, I've focused on applying agentic AI to solve real operational challenges in P&C insurance. This guide walks you through the technology, use cases, and practical steps for implementation. By the end, you'll understand how to build a streamlined, efficient operation.

The "Why": Key Benefits of Automating P&C Insurance Documents

When you implement insurance document processing automation, your adjusters can focus on adjusting claims, and your underwriters can analyze risk instead of hunting for documents. The benefits go far beyond saving time; they fundamentally change how your P&C insurance operation runs, leading to better accuracy, happier customers, and more engaged teams.

According to McKinsey, P&C insurance companies that accept AI see significant improvements in premium growth, customer onboarding costs, and claims accuracy [1]. These numbers represent real operational change for P&C carriers, TPAs, and IA firms. AI-driven innovation is not just possible but necessary for solving the insurance labor crisis [2].

Boost Operational Efficiency and Productivity

Your talented claims professionals spend too much time on administrative tasks. Accenture found that up to 40 percent of an underwriter's time goes to noncore work, an inefficiency that costs the P&C industry billions [3]. Insurance document processing automation flips this equation. When AI handles tedious data extraction, your adjusters have time to actually adjust. We see teams handle 40 to 50 percent more cases without burnout because they are no longer buried in paperwork. This shift toward high value work is central to effective insurance back office automation [4].

Improve Data Accuracy and Decision Making

Manual data entry is prone to errors, no matter how skilled your team is. A transposed number or a missed field can create significant problems in workers' compensation or auto claims. Insurance document processing automation brings consistency, with modern AI systems achieving 95 percent or higher accuracy rates. They read a medical bill the same way every time, without fatigue or distraction. This transforms unstructured data from claim forms and damage estimates into clean, structured information your claims management software can use. Your risk assessments become more reliable, and underwriting decisions rest on better data, a key opportunity we explore in Breaking Through the Data Plateau [5].

Accelerate Turnaround Times and Improve Customer Experience

Speed matters in P&C insurance. When a policyholder files a claim, they need answers, not silence. Research shows that many claimants are unhappy with their providers, citing slow settlement speeds and poor closing processes. Insurance document processing automation addresses this directly. Claims that once took days can be processed in hours, with some carriers cutting processing times by 84 percent. Faster processing allows your team to communicate with policyholders more quickly and accurately, building trust and improving retention. This is how AI transforms the claims experience from a pain point into a competitive advantage [6].

How AI Powers P&C Insurance Document Processing Automation

Modern insurance document processing automation works much like a skilled claims adjuster, but at machine speed. It understands context, spots inconsistencies, and knows what information matters.

The process begins when documents arrive, whether as an email, a scanned report, or a PDF. The AI system ingests these different formats, identifies each document, extracts the important data, validates it, and feeds it directly into your claims management software. No manual typing, no hunting through attachments. P&C carriers and TPAs are using this technology now to process auto, workers' compensation, property, and pet insurance claims. As we move toward a future where bots become your best agents, AI is giving teams the tools they need to focus on what humans do best [7].

Core Technologies Behind the Automation

Several AI technologies work together to understand your P&C insurance documents.

- Optical Character Recognition (OCR) converts images of text—like a scanned estimate or a photo of a VIN plate—into machine readable text.

- Natural Language Processing (NLP) understands the meaning behind the text. It identifies names, dates, and locations, and distinguishes between an auto accident and a property claim.

- Vision Language Models (VLMs) are a breakthrough for P&C insurance, as they understand both images and text together. A VLM can analyze a medical chart with handwritten notes, deciphering hard to read script by understanding the medical context. For property claims, it can analyze damage photos alongside repair estimates to spot inconsistencies.

- Machine Learning (ML) ties everything together. ML models learn from thousands of claims to improve over time, recognizing patterns and adapting to variations in terminology.

The Six Step Automation Workflow

Here’s how these technologies work together in a typical workflow:

- Ingestion: Documents are collected automatically from emails, web portals, or APIs.

- Classification: The system identifies each document (e.g., medical bill, repair estimate) and routes it correctly.

- Extraction: AI reads each document and pulls out key data points like policy numbers, incident dates, and claimant information.

- Validation: The extracted data is cross referenced with your existing records to check for inconsistencies.

- Integration: Validated data flows directly into your core systems, like your claims management software, to create a complete claim profile.

- Analytics: The system provides detailed audit trails and performance analytics to help you track accuracy and optimize workflows.

The Rise of Agentic AI in Document Processing

Traditional automation follows rigid rules, but P&C insurance work is rarely so simple. This is where Agentic AI changes the game. Agentic AI agents don't just follow instructions; they reason through problems and make contextual decisions. Think of them as digital coworkers who understand the nuances of insurance work. An agent can receive a new claim, classify all attachments, extract the data, notice a high repair estimate, and route the package to an experienced adjuster with a summary of what needs attention. This isn't about replacing adjusters but augmenting them, a concept we explore in The Future of Work in Insurance [8]. For TPAs and IA firms, agentic AI adapts to different carrier requirements automatically, learning your specific workflows and getting smarter with experience.

Key Use Cases for P&C Carriers, TPAs, and IA Firms

Insurance document processing automation is solving real world problems today for P&C carriers, TPAs, and IA firms across residential property, auto, pet, and workers' compensation insurance. Here is how it applies to daily operations.

Automating the Claims Lifecycle

The claims process is where automation delivers the biggest impact.

- First Notice of Loss (FNOL): Instead of manual data entry, AI agents instantly ingest an FNOL from any source, extract key details, and create a preliminary claim file in your claims management software in seconds. This streamlines the critical first touchpoint.

- Medical Bill Processing: For workers' compensation and pet insurance, AI reads bills, extracts line items and codes, and validates them against fee schedules and policy limits automatically. Your team only reviews the exceptions.

- Damage Estimates and Police Reports: AI extracts crucial information from lengthy auto body quotes and complex police reports, accurately assessing liability and damages so adjusters can focus on judgment calls.

- Claim Profile Creation: AI can gather information from all submitted documents—the FNOL, police report, photos, and estimates—and synthesize it into a single, structured profile in your claims software. We've built AI specifically to tackle this task, allowing adjusters to jump straight to analysis [9].

Streamlining Underwriting and Policy Management

Automation also transforms front and middle office operations.

- Submissions Intake: Automation classifies incoming applications and supporting documents, extracts key data, and routes them for a faster time to quote.

- ACORD Forms: AI reads and extracts data from all common ACORD forms, ensuring accuracy and seamless integration with your policy administration systems.

- Loss Run Analysis: AI rapidly extracts and summarizes historical claims data, highlighting patterns and red flags so underwriters can produce accurate quotes without the manual work.

- Policy Renewals and Endorsements: AI can pre-fill renewal applications, validate customer data, and process endorsement requests by extracting changes and updating policy details automatically.

- Certificate of Insurance (COI) Creation: Automation enables 24/7 COI generation, allowing agents and policyholders to get what they need on demand. Understanding these applications is vital to understanding modern insurance software systems [10].

Strengthening Compliance and Reporting

With compliance costs for P&C insurance on the rise, meticulous documentation and audit trails are more critical than ever.

- Automated Audit Trails: Every action taken by an AI agent is logged, creating a permanent, transparent record for regulatory reviews.

- Regulatory Data Aggregation: AI can automatically compile data from disparate systems into specific regulatory formats, reducing manual effort and error risk.

- Anomaly Detection for Fraud: The system analyzes document data to identify discrepancies or patterns that may indicate fraud, alerting your Special Investigation Unit in real time.

- Justifiable Decisions: With explainable AI, every automated decision can be traced back to its source documents and the rules applied. This transparency is essential for balancing innovation and regulation [11].

A Practical Guide to Implementing P&C Insurance Document Automation

Implementing insurance document processing automation is a strategic project. While challenges like initial investment and integration with legacy claims software exist, a thoughtful approach ensures success.

| Feature | Foundational Automation (e.g., RPA + OCR) | Agentic AI Automation (e.g., Agentech AI Agents) |

|---|---|---|

| Document Understanding | Reads structured data, struggles with unstructured text/context | Comprehends context, handles unstructured data, visual elements, reasoning |

| Decision Making | Rule based, limited to predefined logic | Contextual, adaptive, can orchestrate dynamic workflows |

| Integration | Mimics human actions (UI based), can be brittle | API first, seamless integration with claims management software, robust |

| Scalability | Can scale for volume, but limited by process complexity | Highly scalable, can handle fluctuating volumes and diverse document types |

| Learning | Requires explicit programming for new scenarios | Continuously learns and improves from data and feedback, self optimizing |

| Human Oversight | Typically flags exceptions for human review | Designed for human in the loop, explainable AI, augments human decision making |

| Use Cases | Data entry, simple form processing, rule based data transfer | Complex claims processing, underwriting, fraud detection, dynamic workflow execution |

How to Choose the Right P&C Insurance Document Automation Tools

Selecting the right partner is paramount. Look for these key attributes:

- Business Needs Alignment: Clearly define your pain points. Which P&C documents cause the most delays? What are your goals?

- Scalability and Adaptability: The solution must handle fluctuating volumes and adapt to new P&C insurance products or regulations.

- Integration Capabilities: Prioritize an API first approach for seamless integration with existing claims software and legacy systems.

- Accuracy and Compliance: The tool must deliver high precision with advanced AI and provide robust audit trails to support regulatory compliance.

- Vendor Support and Security: A reliable vendor offers comprehensive support and prioritizes data security with certifications like SOC 2 and ISO 27001.

- Ease of Use: The interface should be intuitive, allowing your P&C adjusters and underwriters to work with the system without extensive training. This is a key factor when deciding whether to buy versus build your AI solution [12].

Best Practices for a Smooth Rollout

Follow these best practices for a successful implementation:

- Start with a Process Audit: Understand your current P&C document workflows to identify bottlenecks and inefficiencies.

- Define Clear Goals and KPIs: Establish measurable Key Performance Indicators (KPIs) to track progress and demonstrate ROI.

- Involve Cross Functional Teams: Engage stakeholders from claims, underwriting, IT, and compliance early to ensure buy-in.

- Pilot a Specific Workflow: Start with a manageable workflow, like FNOL intake, to test the solution and gather feedback before a wider rollout.

- Train Your Team: Show your P&C professionals how the new tools will make their jobs easier, not replace them. Provide role-specific training to foster adoption.

- Monitor and Optimize: Continuously monitor performance against your KPIs and use feedback to improve the system over time. A structured approach is key if you're not sure where to start with AI [13].

Security and Compliance Considerations for P&C Insurance Document Processing Automation

In the P&C insurance industry, security and compliance are nonnegotiable.

- Data Privacy: Ensure any solution complies with regulations like GDPR and CCPA. For health related data in workers' compensation or personal injury claims, HIPAA compliance is also critical.

- Industry Certifications: Look for solutions with SOC 2 Type 2 and ISO 27001 certifications, which demonstrate a commitment to data security.

- Explainable AI for Auditability: Avoid "black box" AI. You need solutions that offer explainable AI (XAI), where every decision can be traced back to its source. This provides the airtight audit trails that authorities like KPMG highlight as essential for visibility in the claims process [14].

Conclusion: Empower Your Team and Future Proof Your Operations

Here's the truth about P&C insurance today: the paper stacks aren't getting smaller and the regulations aren't getting simpler. But insurance document processing automation changes the equation.

We've seen how AI-powered automation transforms document heavy workflows for P&C carriers, TPAs, and IA firms. The results are clear: adjusters handling more cases, accuracy rates climbing to 95% or higher, and processing times dropping significantly. These are measurable outcomes being achieved right now across auto, property, pet, and workers' compensation insurance.

This technology is not about replacing your experienced adjusters and underwriters. It's about giving them their time back. When AI handles the tedious work of reading medical bills, extracting data from police reports, and building claim profiles, your team can focus on what they do best: complex case analysis, thoughtful risk assessment, and empathetic customer communication.

Organizations that adopt intelligent automation are already pulling ahead in efficiency, customer satisfaction, and employee engagement. The question isn't whether to automate, but how quickly you can start.

We've covered the practical steps: audit your processes, pilot a workflow, involve your team, and choose tools that integrate with your existing claims software. Security and compliance are built in, not afterthoughts, with features like SOC 2 certification and explainable AI.

At Agentech, we've built our agentic AI specifically for P&C insurance operations. Our AI agents don't just extract data; they understand context, make decisions, and orchestrate complex workflows while keeping humans in control. The future of P&C insurance is about combining human expertise with AI capability. When your team has intelligent automation handling the repetitive work, they can bring their full judgment and empathy to every case. That's how you build an operation that's both more efficient and more human.

Ready to see what this looks like for your organization? Explore our AI Agents for Insurance and find how we can help you transform your document processing workflows [15].

Citations:

[1] McKinsey: The Future of AI in the Insurance Industry

[2] Solving the Insurance Labor Crisis with AI-Driven Innovation

[3] Accenture: Why AI in Insurance Claims and Underwriting

[4] Insurance Back Office Automation

[5] Breaking Through the Data Plateau: A Strategic Opportunity

[6] Designing for the Future: How AI Will Transform the Claims Experience

[7] Agentic AI in Insurance: When Bots Become Your Best Agents

[8] The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers

[9] AI Claims Processing Insurance

[10] InsureTech Made Easy: Understanding Insurance Software Systems

[11] AI in Insurance: Balancing Innovation and Regulation

[12] Buy vs. Build: Navigating the SaaS AI Technology Decision

[13] Not Sure Where to Start With AI?

[14] KPMG: Insurance Transformation - Modernising the Claims Function