Why Speed and Precision Matter in Modern Freight Protection

Automated cargo insurance services are changing how freight forwarders, logistics providers, and P&C insurance carriers protect shipments. Using AI and machine learning, these platforms deliver instant quotes, one-click binding, and automated claims processing. This efficiency results in quotes in under 60 seconds, claims settled within 48 hours, and seamless integration with existing TMS or ERP systems.

Quick Overview of Automated Cargo Insurance Services:

- Instant Quotes: AI-powered pricing delivers bindable quotes in minutes, not days.

- Automated Claims: Digital processing resolves claims in 48 hours (22x faster than industry standard).

- Flexible Coverage: Per shipment or annual policies for marine cargo, motor truck cargo, and delay protection.

- Seamless Integration: API connections to TMS and ERP systems in under 24 hours.

- Real Time Risk Management: Continuous underwriting and exposure tracking across all shipments.

The traditional cargo P&C insurance process is broken. Freight moves at the speed of modern commerce, but legacy P&C insurance systems still rely on manual underwriting and paper documents. With thousands of shipping incidents occurring annually and supply chain disruptions costing businesses billions, the industry needs a better solution.

Automation has arrived. Platforms now leverage AI to extract data from bills of lading and commercial invoices, assess risk in milliseconds, and issue certificates instantly. For claims managers, this technology eliminates repetitive tasks while improving accuracy to 98% or higher. For logistics operations, it means protecting every load without slowing down the workflow.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for Property & Casualty insurance. After scaling and exiting TokenEx in 2021, I've focused on changing claims processing through AI-driven solutions. My experience has shown me how the right automation can turn operational challenges into competitive advantages.

The Bottlenecks of Traditional Cargo P&C Insurance

The global supply chain operates at an incredible pace, but the P&C insurance processes designed to protect it have lagged. Traditional cargo P&C insurance is plagued by inefficiencies that create friction, delays, and financial exposure. These challenges stem from outdated manual processes, opaque pricing, and a lack of real time data utilization.

Why Old Methods Can't Keep Pace

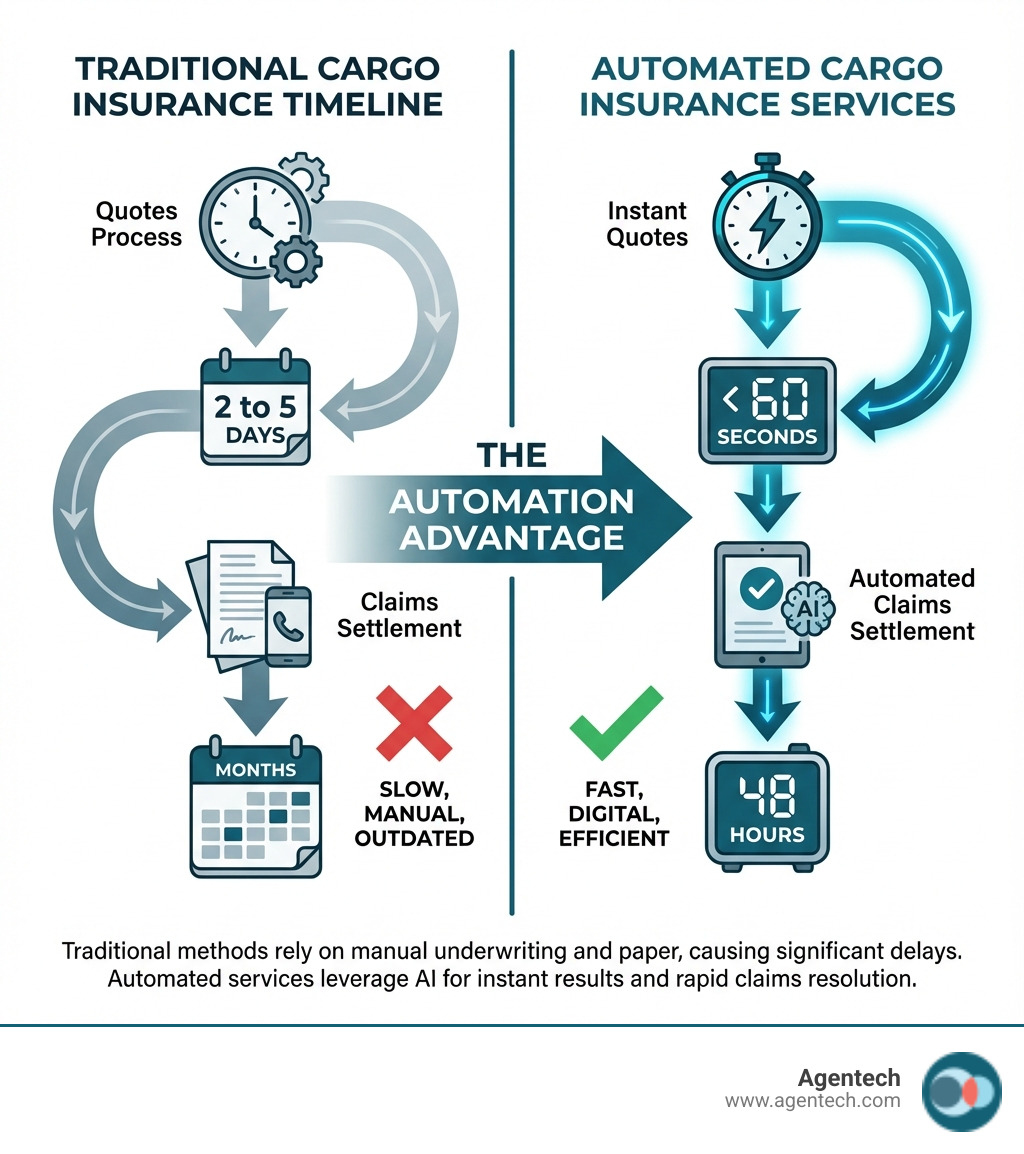

Traditional cargo P&C insurance feels like navigating modern logistics with an outdated map. The process is inherently slow, with average bind times often taking 2 to 5 days. This is due to a reliance on manual intervention, which introduces several pain points:

- Slow Quoting and Underwriting: Obtaining a quote often requires extensive paperwork and manual review by underwriters, a time consuming task that delays coverage.

- Manual Data Entry Errors: Copying information between documents creates opportunities for human error, leading to inaccuracies that can affect coverage or delay claims.

- High Administrative Costs: The labor intensive nature of traditional processes translates into higher operational costs for insurers, which can be passed on to policyholders.

- Inadequate Risk Assessment: Without real time data, traditional methods rely on historical averages rather than current conditions, leading to less precise risk assessment.

- Poor Customer Experience: The slow pace and lack of transparency are frustrating for businesses that need quick decisions in a fast moving environment.

The Financial Risk of Uninsured or Underinsured Cargo

Beyond operational headaches, the financial risks of inadequate cargo P&C insurance are substantial. With thousands of shipping incidents annually and supply chain disruptions causing an estimated $50 billion in financial losses, businesses cannot afford to be underinsured.

A common misconception is that carriers are fully liable for any loss. However, carrier liability is often legally limited to an amount significantly less than the goods' replacement value. This leaves businesses exposed to several critical risks:

- Limited Carrier Liability: Carriers have strict liability limits and may not cover the full value of goods. In maritime shipping, businesses may even be forced to contribute to a general average, sharing losses from an incident even if their own cargo was saved.

- Environmental Factors: Bad weather accounts for a significant percentage of shipping losses, and other natural disasters can cause damage or delays.

- Operational Failures: Machinery damage is a frequent cause of shipping incidents, leading to direct losses or significant delays.

- Theft and Piracy: Global hot spots for theft and piracy pose a constant threat to high value cargo.

- Cargo Delays: Traditional P&C insurance policies have historically excluded delays. This is a critical gap that new automated cargo insurance services are now addressing, as delays cause significant financial and business interruption losses.

How Automation and AI Are Revolutionizing Freight Protection

The logistics industry has long used technology to optimize operations. Now, P&C insurance is catching up. Today, AI and automation are fundamentally changing cargo P&C insurance, creating a more responsive, efficient, and transparent ecosystem. This shift is explored in our article, "The Future of Insurance: How AI is Changing the Game".

The Core Benefits of Automated Cargo P&C Insurance

For businesses, the advantages of adopting automated cargo insurance services are profound and directly address the pain points of traditional methods:

- Speed: What once took days can now be done in minutes. We are talking about bindable quotes in minutes and insurance certificates issued in less than 60 seconds.

- Cost Efficiency: Automating manual tasks reduces administrative overhead, which can lead to more competitive policy pricing.

- Improved Coverage: AI driven analysis allows for more precise risk assessment, leading to coverage custom to each shipment's specific needs.

- Transparency: Digital platforms provide clear visibility into policy terms, pricing, and claims status, simplifying management.

- Improved Cash Flow: Faster claims processing means businesses receive compensation quicker, minimizing financial disruption. Claims can be paid within 48 hours, up to 22 times faster than the industry standard.

To understand how AI is streamlining operations, explore our guide, "Artificial Intelligence SaaS Explained: Your Ultimate Guide".

AI Powered Pricing and Real Time Underwriting

At the heart of modern cargo P&C insurance is the sophisticated use of AI for pricing and underwriting. Our AI-powered models incorporate real-time information to dynamically assess risk, ensuring premiums accurately reflect current conditions.

- Dynamic Pricing Models: AI algorithms analyze vast datasets, including historical claims, market conditions, and geopolitical events, to generate precise premium calculations.

- Predictive Analytics: Machine learning models predict potential risks by identifying patterns in data, such as forecasting delays due to weather or identifying high risk theft areas.

- Real Time Data Inputs: Platforms integrate with GPS tracking, weather forecasts, and traffic data, allowing for continuous underwriting where a shipment's risk profile is monitored throughout its journey.

- Continuous Underwriting: Unlike traditional methods, AI enables "always on" risk monitoring. If a storm develops or a carrier's safety record changes, the system can flag it for proactive risk management.

This intelligent approach ensures fair pricing for businesses and more effective portfolio management for insurers. To learn more, read our article, "Insurance Claims Machine Learning".

The Power of an Automated Claims Processing System

For P&C insurance carriers, TPAs, and IA firms, the claims process has historically been a bottleneck. Automated cargo insurance services are revolutionizing this function. Our AI agents are designed to assist claims professionals by handling repetitive tasks with incredible speed and accuracy.

- Digital First Notice of Loss (FNOL): The claims journey begins with a streamlined digital FNOL process, allowing policyholders to report incidents quickly online.

- Automated Document Ingestion: AI driven solutions use OCR and NLP to automatically ingest and extract key information from documents like bills of lading and damage reports. Roots AI Agents, for example, work 24/7 to reduce manual effort and can categorize over 50 document types with 98+% accuracy.

- AI Data Extraction: AI agents extract critical data points, reducing manual entry errors and improving data quality.

- Parametric Triggers: For certain claims like cargo delays, parametric insurance uses predefined triggers. For instance, if a flight is delayed by a specific number of hours, the system can automatically initiate a payout, often within 48 hours.

- Faster Settlements & Reduced Leakage: By automating data validation and accuracy checks, we significantly accelerate the settlement process. This speed, combined with consistent rule application, helps reduce claims leakage and ensures fair outcomes. Advanced platforms synthesize data to provide predictive and generative AI insights, enabling claims professionals to work more effectively.

Our claims software, powered by AI, transforms the experience for policyholders and frees adjusters to focus on complex cases. Learn more in our "AI Claims Processing System" article.

A Closer Look at Automated Cargo Insurance Services

The shift to automated cargo insurance services is about comprehensive, intelligent solutions that fit seamlessly into modern logistics. For P&C insurance carriers, TPAs, and IA firms, understanding the features and integration capabilities of these platforms is crucial. These are not just digital versions of old processes; they are redesigned workflows supported by sophisticated Insurance IT Systems.

Core Features of Leading Platforms

Modern automated platforms are designed for efficiency and offer a suite of features that empower businesses to manage their cargo P&C insurance needs with ease:

- Instant Quotes: AI powered engines can generate bindable quotes in minutes by analyzing real time data.

- One Click Binding: Once a quote is accepted, policies can be bound with a single click, eliminating delays.

- Automated Certificate Issuance: After binding, a P&C insurance certificate is automatically generated, providing immediate proof of coverage in under 60 seconds.

- Digital Claims Portals: Policyholders can initiate and track claims online, uploading documents digitally and receiving real-time status updates.

- Real Time Exposure Tracking: For annual policies, dashboards help users monitor exposure across all active shipments, providing insights into risk aggregation.

- API Access: Application Programming Interfaces (APIs) are crucial for allowing the insurance platform to connect directly with existing logistics and enterprise systems.

These features streamline the entire insurance lifecycle. To see how these processes are automated, refer to our article on "Insurance Back Office Automation".

Types of Coverage You Can Automate

The scope of automated cargo insurance services is expanding, covering a wide array of needs:

- Per Shipment Policies: Ideal for businesses with fluctuating shipping volumes, these policies allow you to insure only what you need.

- Annual Policies: For consistent shippers, annual policies can provide broad coverage for all shipments over a year.

- Motor Truck Cargo: This P&C insurance protects against loss or damage to goods while in transit on land.

- Shipper's Interest: This covers the shipper's financial interest in the goods, providing comprehensive "all risk" coverage for the full replacement value.

- Last Mile Package Protection: For e-commerce merchants, this specialized P&C insurance safeguards against loss or theft during the final leg of delivery.

- Parametric Delay Insurance: This cutting edge offering provides instant payouts based on predefined triggers, such as a flight delay exceeding a certain duration, without requiring proof of actual loss. This is valuable for time critical cargo like vaccines or perishable goods.

These diverse options ensure that businesses can find automated solutions for almost any cargo P&C insurance requirement.

Integrating Automation into Your Logistics Workflow

The true power of automated cargo insurance services lies in their ability to integrate with existing logistics systems. We understand that businesses need solutions that improve, not disrupt, their workflows.

- API Integration: APIs are the cornerstone of seamless integration, allowing software to communicate and exchange data automatically. For example, a new shipment in a TMS can automatically trigger a quote request.

- TMS Integration: Integrating automated cargo P&C insurance directly into your Transportation Management System (TMS) makes securing coverage an embedded step in your shipping process. Integration can often be completed in less than 24 hours.

- ERP Integration: Connecting P&C insurance solutions to an Enterprise Resource Planning (ERP) system can provide a holistic view of costs, risks, and financial performance.

- Embedded P&C Insurance: This concept involves offering P&C insurance directly at the point of booking a shipment. This allows for "one click coverage" and "automatic documentation," simplifying the customer experience and opening new revenue streams for logistics companies.

- Seamless Data Flow: With integrated systems, data flows effortlessly between platforms, reducing manual entry, minimizing errors, and ensuring all parties have up to date information.

For a deeper understanding of how our solutions work, we encourage you to visit our "How it Works" page.

Risks, Resilience, and the Road Ahead

The advent of automated cargo insurance services marks a significant leap forward in freight protection. As we accept these innovations, it is vital for P&C insurance carriers, TPAs, and IA firms to understand both the opportunities and responsibilities. This change is pivotal for enhancing supply chain resilience, as discussed in "Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI".

Potential Limitations and Considerations

While the benefits of automation are clear, we must also acknowledge potential challenges:

- Technology Reliance: Over reliance on automated systems could create vulnerabilities. Robust backup systems and contingency plans are essential.

- Data Privacy and Cybersecurity: Automated systems handle sensitive data, so ensuring the highest levels of cybersecurity is paramount to maintain trust.

- Complex Claims Handling: While AI excels at high frequency claims, complex or unusual cases may still require human expertise. Our philosophy at Agentech is to augment human adjusters with AI agents, ensuring complex cases benefit from human insight.

- Human Oversight: Human oversight remains critical. Adjusters and underwriters need to monitor AI driven decisions, ensure fairness, and intervene when necessary.

- Regulatory Compliance: The rapid evolution of AI in P&C insurance can outpace regulatory frameworks. Companies must remain vigilant to ensure compliance with all relevant laws, a topic we cover in "AI in Insurance: Balancing Innovation and Regulation".

Boosting Supply Chain Resilience

Despite these considerations, the impact of automated cargo insurance services on supply chain resilience is overwhelmingly positive. These services strengthen a business's ability to withstand disruptions.

- Mitigating Financial Risk: Automated P&C insurance provides timely, comprehensive coverage, protecting businesses from the financial impact of lost or damaged goods.

- Reducing Business Interruption: Faster claims payouts minimize downtime by allowing businesses to replace goods or recover losses quickly.

- Faster Incident Recovery: The efficiency of automated claims processing accelerates the entire recovery process, from reporting to compensation.

- Improved Cash Flow: Predictable and swift payouts help businesses manage their finances and avoid liquidity issues from prolonged claims disputes.

- Data Driven Decisions: The data gathered by automated systems provides insights into supply chain risks, enabling more informed decisions.

Automated P&C insurance significantly contributes to overall supply chain resilience, helping address broader industry challenges as explored in "Solving the Insurance Labor Crisis with AI-Driven Innovation".

The Future of Automated Cargo P&C Insurance

The trajectory for automated cargo insurance services is one of continuous innovation. We anticipate even more sophisticated solutions as technology evolves:

- Agentic AI: The next generation of AI, where systems act more autonomously to handle complex, multi step tasks. For P&C insurance claims, this means AI agents could manage more nuanced aspects of the process. Learn more in our "Agentic AI Definition".

- Hyperautomation: This involves combining multiple advanced technologies like AI, machine learning, and RPA to automate as many business processes as possible, creating end to end workflows.

- Blockchain for Transparency: Blockchain technology could create immutable records of shipments, policies, and claims, improving transparency and preventing fraud.

- IoT Sensor Integration: Integrating Internet of Things (IoT) sensors into cargo can provide real time data on conditions like temperature and shock, feeding directly into AI models for hyper precise risk assessment.

- Predictive Loss Prevention: The future will shift further towards predictive loss prevention, where AI models actively predict potential incidents, allowing for proactive measures to avoid losses altogether.

These advancements promise a more secure and efficient future for freight protection, benefiting P&C insurance carriers, TPAs, IA firms, and businesses alike.

Frequently Asked Questions about Automated Cargo Insurance Services

Why is automated P&C insurance better than relying on carrier liability?

Carrier liability is legally limited and often fails to cover the full value of goods after a loss. For example, many carriers have liability limits that are a fraction of the cargo's actual worth, and they may exclude losses due to acts of God. Automated cargo insurance services provide comprehensive, "all risk" coverage for the full replacement value, offering true financial protection for your goods, regardless of carrier limitations.

How fast can I get a quote and a policy?

With automated platforms, you can receive a quote in seconds and bind a policy with a single click. The entire process, from quote to receiving your P&C insurance certificate, can take less than a minute, a stark contrast to the 2 to 5 day average of traditional methods.

Can I insure a single shipment without an annual policy?

Yes. A key benefit of many automated cargo insurance services is flexibility. You can purchase "pay as you go" or per shipment coverage, allowing you to insure only what you need without the commitment of an annual policy. This is particularly advantageous for businesses with variable shipping volumes.

Conclusion: Securing the Future of Your Freight

The shift from slow, paper based processes to instant, data driven solutions is complete. Automated cargo insurance services are no longer the future; they are the new standard for modern logistics, offering unparalleled speed, efficiency, and resilience. By leveraging technology to streamline everything from quotes to claims, P&C insurance carriers, TPAs, and IA firms can protect their clients' assets and maintain momentum in a fast moving world. Platforms powered by advanced AI Agents are at the forefront of this change, empowering organizations to turn risk into a competitive advantage.

Citations:

- Agentech Product and Resource Pages:

- The Future of Insurance: How AI is Changing the Game

- Artificial Intelligence SaaS Explained: Your Ultimate Guide

- How it Works

- AI Claims Processing System

- Insurance IT Systems

- Insurance Back Office Automation

- Insurance Claims Machine Learning

- Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI

- Agentic AI Definition

- Solving the Insurance Labor Crisis with AI-Driven Innovation

- AI in Insurance: Balancing Innovation and Regulation

- AI Agents

- External references: