Why P&C Insurance Needs AI-Powered Automation Now

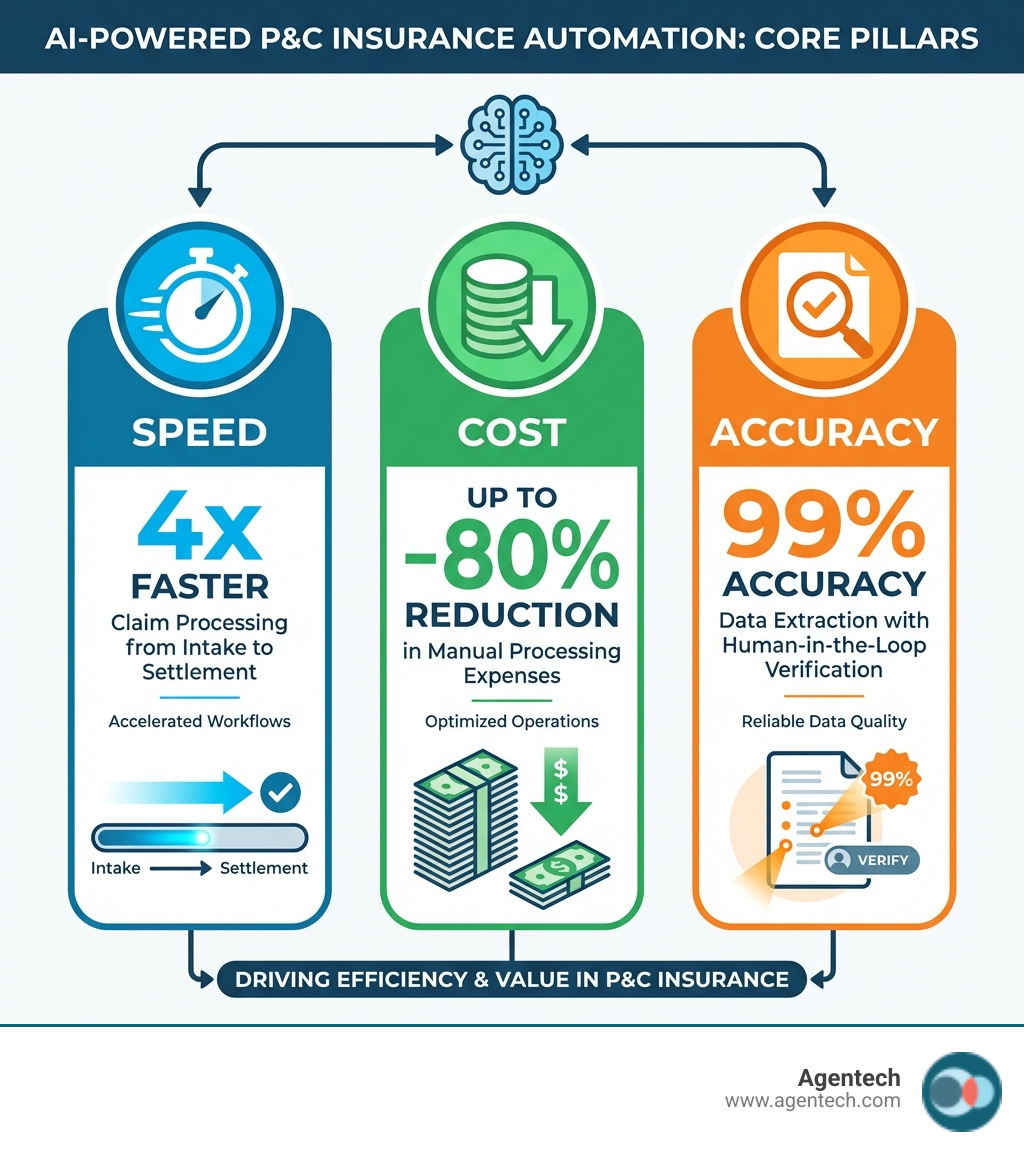

AI-powered insurance automation uses artificial intelligence to streamline manual tasks across the P&C insurance lifecycle, from claims intake to settlement. Here's what it delivers:

Core Benefits: • 4x faster processing of claims, policies, and applications • Up to 80% reduction in operational costs • 99% accuracy in data extraction and validation • 24/7 automation for FNOL, document processing, and customer inquiries

If you're a claims manager at a P&C carrier, TPA, or IA firm, you already know the reality. Manual data entry from claim forms, photos, and medical records eats up hours every day. Your team is drowning in paperwork while policyholders wait days for updates. Labor shortages make it worse. Every new hire takes months to train, and turnover is brutal.

Customer expectations have changed. People want instant answers and fast settlements, just like they get from e-commerce. But most P&C insurance operations still rely on processes built decades ago. Legacy claims management software wasn't designed for the speed and accuracy modern consumers demand.

The stakes are high. AI leaders in the P&C insurance sector have created 6.1 times the Total Shareholder Return of companies that lag behind. The gap is widening fast. Insurers that don't adopt intelligent automation risk losing market share to competitors who can process claims faster, price policies more accurately, and deliver better customer experiences.

AI-powered insurance automation isn't about replacing your adjusters. It's about giving them better tools. Instead of spending hours typing data from PDFs and photos, they focus on complex decisions, customer conversations, and high-value work that requires human judgment. AI handles the repetitive, data intensive tasks that slow everything down.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance, starting with claims automation that delivers unprecedented speed and accuracy. Before Agentech, I founded and scaled TokenEx to one of Oklahoma's largest tech exits, and I've seen how AI-powered insurance automation transforms operations when implemented strategically.

What is AI Insurance Automation and How Does It Work?

At its heart, AI-powered insurance automation is the application of artificial intelligence technologies to automate and optimize various tasks and workflows within the P&C insurance industry. It moves beyond simple Robotic Process Automation (RPA), which handles predictable, rule-based tasks, by introducing cognitive capabilities. This means AI can understand unstructured data, learn from experience, and make data-driven decisions, fundamentally changing how P&C insurance operations function.

Instead of merely automating a single step, intelligent automation aims for a core process change, changing entire workflows. For instance, in P&C claims, this could mean an AI system ingesting a claim, extracting key data, validating it, routing it, and even making preliminary settlement recommendations, all with minimal human intervention. This shift allows for more efficient, accurate, and consistent outcomes, paving the way for truly optimized P&C Insurance Workflow Automation.

The Key Technologies Driving Automation

The magic behind AI-powered insurance automation lies in a suite of sophisticated technologies working in concert:

- Machine Learning (ML): This is the engine that allows AI systems to learn from data without explicit programming. In P&C insurance, ML models analyze historical claims data to predict fraud risk, assess claim validity, or forecast future liabilities. They continuously improve their performance as they process more data, making predictions and decisions more accurate over time.

- Natural Language Processing (NLP): P&C insurance is awash in text, including policy documents, claim narratives, emails, and customer inquiries. NLP enables AI to understand, interpret, and generate human language. This is crucial for extracting information from claim forms, summarizing customer interactions, and powering chatbots.

- Intelligent Document Processing (IDP): Combining ML, NLP, and Optical Character Recognition (OCR), IDP is transformative for handling the diverse documents in P&C insurance. It allows AI to extract, classify, and validate data from various formats, including scanned images, PDFs, and even handwritten notes, turning unstructured information into usable data.

- Computer Vision: Especially vital for P&C insurance, computer vision allows AI to "see" and interpret images and videos. For example, in auto or property claims, it can analyze photos of damage to assess severity, estimate repair costs, and even identify specific damaged parts, accelerating the claims process significantly.

- Agentic AI: This represents the cutting edge of AI, moving beyond predictive models to autonomous agents capable of reasoning, planning, and executing complex tasks. These "AI Agents" can act as digital coworkers, collaborating with human teams to manage entire workflows. Our Agentic AI Definition explores how these systems can handle judgment, conversational interaction, and multistep reasoning, making them particularly adept at tackling intricate P&C insurance processes.

Together, these technologies create a powerful synergy, enabling AI to automate, augment, and accelerate P&C insurance workflows in ways previously unimaginable.

The Role of Document Automation

The P&C insurance industry is notoriously heavy with documents. From First Notice of Loss (FNOL) reports and police statements to medical records and repair estimates, claims adjusters spend countless hours manually processing information. This is where AI-powered document automation shines.

It tackles the challenge of handling unstructured data, which often comes in varied formats like handwritten forms, scanned images, and PDFs. Using IDP, AI Agents can accurately extract critical information such as policyholder names, claim amounts, incident details, and coverage specifics from these diverse documents. In fact, AI extracts, cleanses, and validates information from P&C insurance documents with up to 99% accuracy.

This capability significantly reduces manual data entry, a tedious and error-prone task. Instead of human staff spending hours transcribing data, AI Agents can perform this with speed and precision, freeing up valuable time. The extracted and validated information is then automatically inputted into your claims software, ensuring consistency and that records are ready for audits. To learn more about how this transforms operations, dive into our guide on AI for P&C Insurance Document Management.

Core Applications of AI in P&C Insurance

AI is not just a buzzword; it's a practical solution changing core P&C insurance functions. Let's look at some of its most impactful applications.

How AI-Powered Insurance Automation Transforms Claims Processing

Claims processing is often the most critical touchpoint for policyholders, and historically, it's been a bottleneck. AI-powered insurance automation is revolutionizing this area, making it faster, more accurate, and more focused on the customer.

- First Notice of Loss (FNOL) Intake: This initial step sets the tone for the entire claims journey. AI Agents can automate the FNOL intake process by capturing claim details from various digital channels, such as web forms, mobile apps, emails, or even voice interactions. They standardize the data, categorize the claim, and initiate the workflow, significantly reducing manual sorting and improving resource allocation.

- Automated Data Extraction: Once an FNOL is received, AI steps in to process supporting documents. From police reports and medical bills to property damage estimates and witness statements, AI Agents leverage IDP to extract key data points. This means claims that previously took days of manual effort can be reviewed and processed within hours.

- Damage Assessment with Computer Vision: For auto and property claims, computer vision is a game-changer. AI can analyze photos and videos of damage, assess severity, and even estimate repair costs with unprecedented precision. This accelerates evaluation dramatically, allowing human adjusters to focus on complex cases.

- Fraud Detection Patterns: AI's ability to analyze vast amounts of data helps in identifying suspicious activities. By analyzing transaction patterns and flagging anomalies in claims data, AI systems can detect and prevent fraudulent claims, leading to a 3 to 5 percent accuracy improvement in claims assessments.

- Straight Through Processing (STP): For simple, low risk P&C claims, AI can facilitate straight through processing, automating the entire workflow from intake to payment without human intervention. This significantly reduces claim cycle times and operational costs. For a deeper dive, check out our insights on AI-Powered Claims Automation. This automation ensures faster claims resolution, leading to happier policyholders and more efficient operations.

AI in Underwriting and Risk Management

Underwriting is the backbone of P&C insurance, determining risk and setting premiums. AI improves this critical function by providing deeper insights and greater efficiency.

- Data Aggregation for Risk Analysis: AI can aggregate and analyze vast amounts of internal and external data, including historical claims, policyholder demographics, real time weather patterns, and property data. This comprehensive view allows for more nuanced risk assessment.

- Predictive Analytics for Pricing: Leveraging ML, AI uses predictive analytics to assess individual risk profiles, enabling insurers to offer more accurate and competitive premiums. This leads to a 10 to 15 percent increase in premium growth for AI leaders.

- Personalized Policy Creation: AI systems analyze customer data to deliver personalized policy recommendations and tailor P&C insurance products to individual needs, such as specific coverage for pet owners or bespoke property protection plans.

- Identifying New Risk Factors: By combining claims data with external information, AI can identify emerging risk factors, such as the impact of climate change on property claims, allowing P&C carriers to proactively adjust their strategies. Explore more about this in our article on AI Underwriting. This leads to improved accuracy in risk assessment and more profitable portfolios.

Enhancing Customer Service and Communication

Policyholders expect seamless, 24/7 service. AI-powered customer service systems help P&C insurers meet and exceed these expectations.

- 24/7 Support with Chatbots and Virtual Assistants: Virtual assistants driven by AI provide real-time support for policyholders, answering routine questions about coverage, assisting with claims, and helping customers find the right products. This results in an 11 percent increase in prospective customers buying policies after interacting with 24/7 chatbots.

- Automated Status Updates: AI systems can proactively send automated updates on claim status, policy renewals, or upcoming payments, keeping policyholders informed without requiring human intervention.

- Personalized Communications: By analyzing customer data, AI helps deliver personalized messages and offers, making interactions more relevant and engaging.

- Reduced Customer Complaints: UK insurer Aviva rolled out over 80 AI models in its claims domain, reducing customer complaints by an impressive 65 percent. This highlights AI's ability to improve the overall customer experience. Learn how AI can redefine policyholder interactions in AI Customer Service for P&C Insurance. This leads to increased policyholder satisfaction and loyalty.

The Business Impact of AI Automation in P&C Insurance

The adoption of AI-powered insurance automation isn't just about incremental improvements; it's about fundamental change that drives significant business value. As we've seen, AI leaders in the P&C insurance sector have created 6.1 times the Total Shareholder Return of AI laggards over the past five years. This measurable ROI translates into a powerful competitive advantage for P&C carriers, TPAs, and IA firms that accept this technology. For a comprehensive overview of this change, McKinsey's "The future of AI in the P&C insurance industry" provides valuable insights, and their broader analysis of AI's impact across industries in "The economic potential of generative AI" highlights just how transformational these tools can be.

Boosting Efficiency and Slashing Costs

One of the most immediate and tangible benefits of AI automation is the dramatic improvement in efficiency and reduction in operational expenses.

- Processing claims 4x faster: Our AI-powered solutions streamline P&C insurance tasks, enabling you to process claims, policies, and applications four times faster. This speed is critical for modern operations.

- Reducing operational costs up to 80%: By automating repetitive and data-intensive tasks with AI Agents, operational costs can be reduced by up to 80%. This figure represents substantial savings that can be reinvested into growth or passed on to policyholders.

- Cutting turnaround time from days to hours: Claims that previously took days of manual effort can be reviewed and processed within hours. Complex processes like disability assessments or P&C claims underwriting can now be completed in a fraction of the time. This focus on efficiency helps Reduce Administrative Burden across the board.

- Automating repetitive back office tasks: AI systems automate tasks like data entry, document classification, and reconciliation, freeing up human staff for more complex, work facing customers.

Improving Accuracy and Ensuring Compliance

Accuracy is paramount in P&C insurance, and AI significantly bolsters it while ensuring regulatory compliance.

- Minimizing human error: AI-powered systems can extract, clean, and validate information from P&C insurance documents like dates, premiums, policy, or plan numbers with 99% accuracy. This dramatically reduces the potential for human error in data processing.

- 3 to 5 percent accuracy improvement in claims: Domain-level rewiring with AI has led to a 3 to 5 percent accuracy improvement in claims, ensuring more precise assessments and fair payouts.

- Consistent rules application: AI enforces standardized rules and business logic consistently across all processes, eliminating the variability that can arise from manual interpretation.

- Records that are ready for audit: Automated systems maintain clear, traceable records of every action and decision, making compliance audits smoother and more transparent.

- Human in the loop oversight for quality control: While AI automates many tasks, we believe in "human-verified" AI. This means finance teams, for instance, remain in control with the ability to review, validate, and approve AI outputs at every stage, ensuring accuracy and confidence.

Empowering Employees and Elevating CX

AI automation isn't just good for the bottom line; it's good for your people and your customers.

- Reducing adjuster burnout: By taking over the tedious, repetitive, and data-intensive tasks, AI significantly reduces the administrative burden on P&C claims adjusters, mitigating burnout and improving job satisfaction. We made AI do the most tedious, time-consuming task in claims processing: creating the claim profile.

- Freeing up staff for high-value tasks: With AI handling the grunt work, human adjusters and agents can focus on complex problem-solving, empathetic customer interactions, and strategic decision-making. These are tasks that truly leverage their expertise and cannot be replicated by machines.

- Faster, more transparent service for policyholders: Policyholders across residential property, auto, pet, and workers' compensation lines benefit from faster claims processing, 24/7 support, and personalized communications, leading to a much-improved customer experience. After implementing intelligent automation for offering quotes and selling policies, customer satisfaction scores rose 36 percentage points.

- Solving the P&C Insurance Labor Crisis with AI Innovation: AI helps address labor shortages by augmenting human capabilities, effectively expanding your team's capacity without needing to hire more staff for repetitive tasks.

- Improving new agent success rates: AI-powered tools can also contribute to a 10 to 20 percent improvement in new agent success rates and sales conversion rates by providing agents with better support and insights.

A Strategic Guide to Implementing AI-Powered Insurance Automation

Implementing AI-powered insurance automation is a strategic undertaking that requires careful planning and execution. It's not just about adopting new technology; it's about changing how your P&C insurance business operates.

Navigating Challenges and Mitigating Risks

While the benefits are clear, there are important challenges and risks to address when adopting AI in P&C insurance:

- Data security and privacy: Handling sensitive customer data requires robust safeguards. Risks include data breaches, regulatory failure to comply, and reputational damage.

- Mitigation: Implement closed environments for sensitive data, adhere to strict data governance policies, and partner with vendors certified to global standards like ISO/IEC 27001:2022 and SOC 2.

- Integration with legacy claims software: Many P&C carriers, TPAs, and IA firms operate with established, sometimes outdated, claims software systems. Integrating new AI solutions can be complex.

- Mitigation: Prioritize AI solutions with designs that prioritize APIs for seamless integration. Consider a phased approach, starting with specific, high-impact workflows.

- AI model bias and fairness: AI models trained on biased data can perpetuate or even amplify existing biases, leading to unfair outcomes in areas like underwriting or claims.

- Mitigation: Implement ethical AI frameworks, ensure diverse and representative training data, and prioritize explainable AI to understand how decisions are made. Guidance like the NAIC AI Model Guidance is crucial.

- Regulatory compliance: The regulatory landscape for AI in P&C insurance is still evolving, posing challenges for compliance.

- Mitigation: Stay informed about emerging regulations (e.g., EU AI Act), partner with compliance-focused AI providers, and maintain transparent audit trails for all AI-driven processes.

- Change management and user adoption: Employees may resist new technologies due to fear of job displacement or unfamiliarity.

- Mitigation: Involve cross functional teams early, provide comprehensive training, and clearly communicate how AI will augment, not replace, human roles. Change management represents half the effort for successful AI changes.

Key Considerations for Your AI-Powered Insurance Automation Strategy

Choosing and implementing the right AI automation tools for your P&C insurance business requires a thoughtful approach. Here are key considerations:

- Conduct a process audit to find bottlenecks: Before investing in any technology, thoroughly analyze your current P&C claims and underwriting workflows to identify inefficiencies, manual bottlenecks, and areas with high error rates.

- Define clear goals and KPIs: What do you want to achieve? Reduce claim cycle time by X%? Improve data accuracy by Y%? Increase customer satisfaction scores? Clear, measurable goals will guide your implementation and help assess ROI.

- Start with a pilot project: Don't try to automate everything at once. Select a critical but manageable workflow for a pilot. This allows you to test the solution, gather feedback, and demonstrate value before a broader rollout.

- Prioritize vendor security (ISO, SOC 2): Given the sensitive nature of insurance data, ensure your chosen AI vendor adheres to the highest security and compliance standards, such as ISO/IEC 27001:2022 and SOC 2 Type 2.

- Plan for team training and adoption: Successful AI integration depends on your team's willingness to accept it. Invest in comprehensive training and foster a culture that views AI as an assistant, not a threat.

We often encounter the question of whether to Buy vs. Build: Navigating the SaaS AI Technology Decision. For most P&C carriers, TPAs, and IA firms, buying a specialized SaaS solution is more efficient than building in-house. Look for solutions that offer robust scalability to handle fluctuating volumes and future growth, and prioritize vendors with an integration that prioritizes APIs for seamless connectivity with your existing claims software and other core systems.

The Future: From Generative AI to Agentic AI

The AI landscape is evolving at a breathtaking pace. We've moved from traditional analytical AI, which understands patterns in data, to Generative AI (GenAI), which can create new content and understand unstructured data with greater depth. GenAI is already transformative for P&C insurance claims, as highlighted by EY.

But the future is shifting towards Agentic AI. While GenAI excels at generating text, images, or code, Agentic AI adds unprecedented levels of automation to complex workflows by giving AI systems the ability to reason, plan, and execute tasks autonomously. These AI Agents are designed to act as digital coworkers, capable of multistep reasoning and integrating unique expertise.

Imagine ensembles of AI agents handling intricate P&C insurance processes: an intake agent ingesting information, a risk profiling agent building a comprehensive risk assessment, a pricing agent suggesting policy structures, and a compliance agent reviewing processes for regulatory adherence. This is the vision of autonomous agents working collaboratively, freeing human experts to focus on the most complex aspects of their roles that are centric to humans. We dig deeper into this exciting shift in The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers.

Frequently Asked Questions about AI in Insurance Automation

How does AI handle the variety of documents in P&C claims?

AI handles the vast array of documents in P&C claims through Intelligent Document Processing (IDP). This powerful technology combines Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML). It allows AI to "read" and understand diverse formats, from structured forms like ACORD forms to unstructured data such as photos of damage, emails from policyholders, police reports, medical records, and even handwritten notes. The AI extracts relevant information with high accuracy, validates it against existing data, and categorizes documents automatically, preparing them for further processing within your claims software.

Will AI automation replace claims adjusters?

No, the goal of AI-powered insurance automation is augmentation, not replacement. Our AI Agents are designed to be digital coworkers, taking on the tedious, administrative, and repetitive tasks that consume so much of an adjuster's day. This frees up human claims adjusters to focus on what they do best: applying complex judgment, engaging in empathetic customer interaction, negotiating settlements, and handling unique or sensitive cases that require a human touch. AI acts as an Always On AI Assistant, providing support and data-driven insights, allowing adjusters to be more efficient, accurate, and ultimately, more valuable.

What is the typical ROI for implementing AI in claims processing?

The Return on Investment (ROI) for implementing AI in P&C claims processing can be significant and multifaceted, though it varies based on implementation scope and existing inefficiencies. Many firms experience:

- Reduced operational costs: Up to an 80% reduction in manual processing expenses, as AI handles repetitive tasks.

- Faster claim cycles: Turnaround times are cut from days to hours, leading to quicker resolutions and happier policyholders.

- Improved accuracy: We see a 3 to 5 percent accuracy improvement in claims assessments and 99% accuracy in data extraction, reducing errors and potential overpayments.

- Increased revenue and growth: Clients using AI Agents have seen an average 15% increase in revenue, driven by optimized processes and improved efficiency.

- Higher profitability and customer retention: By delivering faster, more accurate service and freeing up staff for high-value interactions, AI contributes to overall business health and strengthens customer loyalty.

Conclusion

The P&C insurance industry is at an inflection point. AI-powered insurance automation is no longer a luxury; it's an essential strategy for survival and growth. We've seen how it can fundamentally transform operations, from streamlining claims processing and enhancing underwriting to revolutionizing customer service. The benefits are clear: unparalleled efficiency, significant cost savings, superior accuracy, and a dramatically improved experience for both employees and policyholders.

For P&C carriers, TPAs, and IA firms, adapting to this new landscape is paramount. The shift towards Agentic AI, with its promise of autonomous digital coworkers, signifies an even more profound evolution. We believe in using this power to augment human capabilities, ensuring that your teams can focus on the critical aspects of their roles that are centric to humans.

At Agentech, we provide a seamless, platform verified by humans that is designed specifically for the unique demands of P&C insurance. Our AI Agents are ready to integrate with your existing claims software, boosting adjuster productivity and delivering unprecedented speed and accuracy.

Take the next step in your automation journey. Explore how our AI Agents can transform your operations.

Citations: *McKinsey & Company. "The future of AI in the P&C insurance industry." *McKinsey & Company. "The economic potential of generative AI: The next productivity frontier." *BCG. "GenAI Will Write the Future of Insurance Claims." *EY. "Releasing the potential of generative AI: a game-changer for P&C insurance claims." *Rough Notes. "Smarter account rounding, stronger relationships." *BCG. "In P&C Insurance, Generative AI Can Transform the Finance Function."