Why Reducing Administrative Burden Matters for P&C Claims

To reduce administrative burden in Property & Casualty insurance claims, operations must automate, streamline workflows, and eliminate the repetitive manual tasks that consume valuable adjuster time.

Quick Ways to Reduce Administrative Burden in P&C Claims:

- Automate data entry with AI-powered tools that extract information from claim forms.

- Standardize processes by creating clear SOPs and checklists for common claim types.

- Implement digital intake to replace manual FNOL processing with automated capture.

- Leverage claims software that integrates verification, communication, and reporting.

- Optimize workflows by mapping current processes to identify and remove redundant steps.

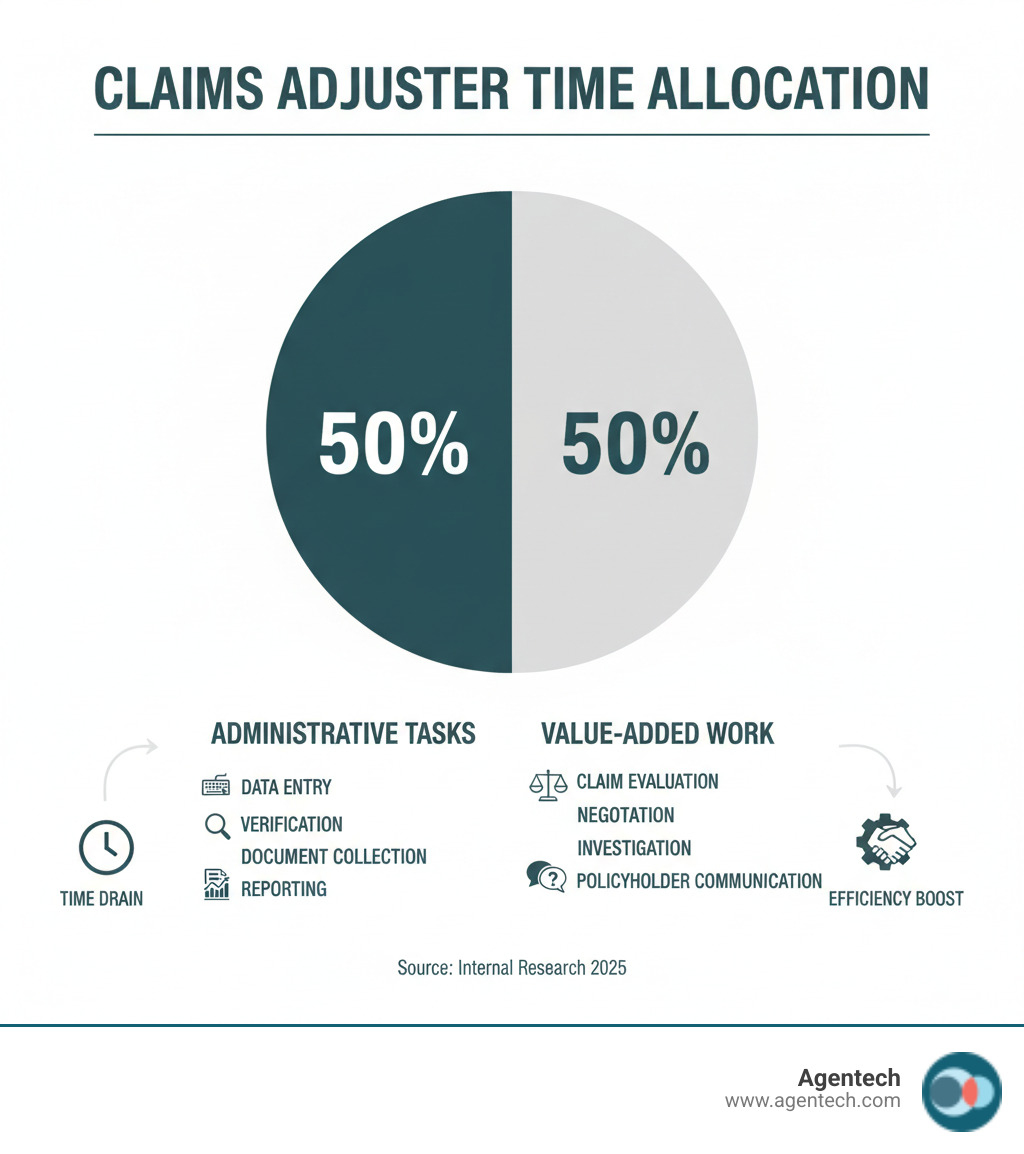

Administrative burden in P&C insurance refers to the time-consuming tasks that pull claims professionals from their core duties. This includes manual data entry, verifying coverage across multiple systems, chasing documentation, and generating reports. Research shows these tasks can consume up to 50% of a claims adjuster's workday.

This overload creates a "time tax"—the cumulative cost of administrative processes. For P&C insurance carriers, TPAs, and IA firms, this tax results in delayed settlements, adjuster frustration, and higher operational costs. The impact extends to customers, with nearly 24% experiencing delayed service due to these bottlenecks. In a competitive market, such delays push policyholders to carriers offering faster claims experiences.

I'm Alex Pezold, founder of Agentech AI, where we build AI-powered digital coworkers to reduce administrative burden in P&C insurance claims processing. After founding and scaling TokenEx before a successful exit in 2021, I've focused on applying AI to eliminate the repetitive tasks that slow down claims teams and frustrate adjusters.

The High Cost of Administrative Overload in P&C Insurance

Administrative burden in P&C insurance is more than an annoyance; it's a serious financial drain that impacts your bottom line, team morale, and customer satisfaction. Every hour your adjusters spend on paperwork is an hour they are not focused on their primary responsibilities, and the costs add up quickly.

The Financial Drain of Manual Processes

Manual processes in P&C claims are inefficient and costly. Research indicates that at least half of administrative costs are wasteful, and streamlining these workflows can open up significant savings.

Consider where the money goes. Manual verification costs for policy coverage, claimant details, and provider credentials add up. In similar industries, automating these checks could save billions annually. Claim rework expenses also accumulate when documentation is incomplete or contains errors. Each mistake requires reprocessing, doubling the effort. When claims are denied, the cost to recover them can reach $118 per claim, a steep price for fixing preventable errors.

Perhaps the biggest hidden cost is lost productivity. Paying expert-level salaries for clerical work means fewer claims are processed, cycle times are slower, and your capacity to handle new claims is reduced. For P&C insurance carriers, TPAs, and IA firms, this lost time represents a major drain on resources.

The Impact on Your Team and Customers

The financial hit is only part of the story. The human cost of administrative overload affects both your team and your policyholders.

Excessive administrative tasks lead directly to employee burnout. When adjusters spend more time on paperwork than on meaningful investigation, frustration and mental exhaustion build. Studies show over 60% of professionals in similar roles experience burnout, with work overload as a major factor. This pressure causes high staff turnover rates, as nearly half of professionals who leave their field cite burnout. For P&C insurance operations, high turnover is expensive and disruptive, a challenge we explore in our article on Solving the Insurance Labor Crisis with AI-Driven Innovation.

Repetitive manual tasks also increase the potential for human error, which can damage customer trust. All this administrative work creates delayed claims processing, leading to longer cycle times. For policyholders, these delays can cause real financial hardship and result in a negative customer experience, pushing them toward competitors. Our article on The Future of Work in Insurance: Embracing AI Agents as Digital Co-Workers explores how AI can improve the human element of claims processing.

The good news is that automation can significantly reduce administrative burden. A Forbes survey found that 92% of companies saw improved employee satisfaction after implementing AI and RPA, as employees were able to focus on more engaging work.

Citations:

- Forbes. (2022). How Healthcare Providers Can Improve Patient Experiences With RPA, AI And Digital Workflows.

- Health Affairs. (2022). The Role Of Administrative Waste In Excess US Health Spending.

Key Sources of Administrative Burden in P&C Claims

To effectively reduce administrative burden, you must first identify where it originates in your claims operation. Administrative tasks accumulate throughout the P&C claims lifecycle, from first notice of loss to final settlement.

Manual FNOL intake is a common first bottleneck. When claims arrive via phone, email, or web forms, someone must manually transcribe the details into your claims management software. This initial data entry is both time consuming and prone to error.

Repetitive data entry continues throughout the process, as the same information is re-entered for verification, communication logs, and payment processing. This redundancy wastes time and creates opportunities for inconsistencies.

Policy and coverage verification is another major source of administrative work. Determining what is covered under a residential property or workers' compensation policy often requires navigating multiple systems and documents, a process that can take an adjuster 30 minutes or more.

Document collection and organization is a significant pain point. Every claim generates reports, photos, estimates, and invoices. Manually collecting, sorting, and attaching these files is exhausting, and a single misplaced document can derail a settlement.

Statusing claims with body shops, contractors, or medical providers involves endless follow-up calls and emails. Research shows that manually statusing a claim takes an average of 19 minutes and costs over $9 per instance, a substantial drain when multiplied across thousands of claims.

Finally, generating reports for internal metrics, carrier updates, and compliance pulls adjusters away from their core responsibility of resolving claims.

At Agentech, our AI technology is focused on eliminating these exact pain points. Our article, We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile, explains how targeted automation can transform these bottlenecks into efficient workflows.

Citations:

- Becker's Hospital Review. Manual claim status checks cost analysis.

A Practical Framework to Reduce Administrative Burden

Reducing administrative burden doesn't require an overnight overhaul. A thoughtful approach can deliver both immediate relief and long-term change. The American Academy of Family Physicians developed a useful framework organized into the "Three T's": Techniques, Technologies, and Changes [AAFP, 2023].

- Techniques are quick wins and practical adjustments to current workflows.

- Technologies involve using automation to handle repetitive tasks.

- Changes are bigger-picture shifts that reimagine how your claims operation functions.

This balanced approach creates a realistic roadmap. You can achieve early wins with simple techniques while laying the groundwork for deeper technological and organizational changes that deliver lasting impact. A Guide to Relieving Administrative Burden explores this framework in more depth.

Techniques: Streamline Your Current Workflows

The simplest way to reduce administrative burden is to optimize what you already do. These techniques improve efficiency without requiring new technology.

- Process mapping: Chart every step of your claims process to identify bottlenecks and redundant steps that have become invisible in day-to-day work.

- Standardizing operating procedures (SOPs): Create clear, practical SOPs for common tasks like FNOL intake and coverage verification. This reduces guesswork, minimizes errors, and speeds up training.

- Checklists: For complex claims, simple checklists ensure no steps are missed, reducing follow-up work and freeing up mental energy for adjusters.

- Optimizing team communication: Establish clear protocols and shared digital workspaces to eliminate time spent tracking down information that another team member already has.

- Eliminating redundant steps: Once you've mapped your processes, remove outdated or unnecessary tasks, such as generating unread reports or performing duplicate verifications.

Technologies: Using Automation to Reduce Administrative Burden

While techniques optimize processes, technology can eliminate entire categories of administrative work. Modern automation, especially AI-powered tools, doesn't just speed up manual tasks—it removes them from your team's plate.

A robust claims management software platform is the foundation, but advanced automation capabilities are what truly transform workloads.

- Robotic Process Automation (RPA) for P&C claims handles repetitive, rules-based tasks like moving data between systems or generating routine correspondence.

- AI-powered data extraction addresses a major time drain. An AI Claims Processing System can read, understand, and extract key information from unstructured documents like incident reports and repair estimates, populating claim files automatically and reducing errors.

- Automated communication tools handle routine interactions, such as acknowledging claim receipt or providing status updates, ensuring timely communication while freeing up adjusters.

The most advanced AI offers intelligent task automation. These AI agents analyze claim data, flag issues, and assist with decision-making by surfacing relevant information. They understand context, not just rules. Our article Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI explores how this technology is reshaping claims processing. These AI agents act as digital coworkers, handling the administrative work so your adjusters can focus on what they do best.

Changes: Reimagining Your Claims Operating Model

To truly reduce administrative burden, you may need to rethink the fundamental structure of your claims operation. These strategic changes redefine roles and processes.

A digital-first P&C claims processing approach designs the entire operation around digital tools from the start. Digital FNOL, electronic document management, and automated workflows inherently minimize administrative friction and dramatically cut processing time.

The hybrid workforce model is a fundamental shift where AI-powered digital coworkers handle data-intensive administrative tasks, while human adjusters focus on work requiring judgment, empathy, and creativity. The AI collects information and handles routine processing; the human investigates, negotiates, and provides empathetic support. This model, which is central to the Agentech platform, optimizes what both humans and AI do best. Our article Virtual AI Assistants for Insurance: Meet Your New Best Friend explores this partnership.

By centralizing back-office functions and supporting them with automation, you create efficiency through specialization. This ultimately shifts the focus to high-value tasks, allowing adjusters to apply their skills to complex investigations, negotiations, and strategic problem-solving. This not only improves claim outcomes but also makes the adjuster role more engaging and less prone to burnout. Our piece on Insurance Back Office Automation digs into the specifics.

Citations:

- American Academy of Family Physicians. (2023). A Guide to Relieving Administrative Burden. Family Practice Management.

Frequently Asked Questions about Administrative Task Reduction

If you're thinking about ways to reduce administrative burden in your claims operation, you probably have questions. We hear them all the time from P&C insurance carriers, TPAs, and IA firms. Here are the answers to the most common ones.

What is the first step to reduce administrative burden in P&C claims?

The first step is to audit your current claims processes to understand where time and effort are going.

Use process mapping to chart your entire workflow and visually identify bottlenecks and redundancies. Look for tasks with the highest time cost and lowest value, as these are prime candidates for automation or streamlining. A crucial tip is to focus on one area first for a quick win. Pick a high-impact area, like automating FNOL data extraction for auto claims. A successful initial project builds momentum and proves the concept to your team. This systematic approach of identifying burdens before implementing solutions is a proven strategy [CMS, OIRA].

How does automation impact employee roles in the P&C insurance industry?

Automation changes roles for the better; it doesn't eliminate the need for skilled claims professionals. When you reduce administrative burden, you shift the focus from data entry to decision-making. Adjusters spend less time on clerical work and more time analyzing claims, investigating complex situations, and applying their expertise.

This creates higher-value roles and improves job satisfaction. The Forbes survey we mentioned found that 92% of companies saw an improvement in employee satisfaction after implementing AI and RPA because people prefer meaningful work [Forbes, 2022]. At Agentech, we believe AI agents augment human capabilities, not replace them. Our digital coworkers handle routine tasks so human adjusters can excel at applying empathy, judgment, and relationship-building skills. We explore this partnership in our article, Virtual AI Assistants for Insurance: Meet Your New Best Friend.

What is the ROI on investing in claims automation technology?

Let's talk numbers, because the return on investment from claims automation is both significant and multifaceted. When you reduce administrative burden, you open up benefits across your entire operation.

- Reduced operational costs: Automating manual tasks means less time spent on repetitive processes like data entry, manual verification, and claim statusing. Manually statusing a single claim can take 19 minutes and cost over $9 [Becker's Hospital Review]. Multiply that across hundreds or thousands of claims, and the savings add up quickly.

- Faster claim cycle times: Automation accelerates every stage of the claims process, from initial FNOL intake through data extraction, verification, and payment processing. Policyholders get their claims resolved faster, which leads to better reviews and stronger retention.

- Increased adjuster capacity: With AI handling administrative tasks, each adjuster can effectively manage more claims without feeling overwhelmed. Or, they can dedicate more attention to complex claims that require deeper investigation. Either way, you're getting more value from your existing team.

- Lower employee turnover: Recruiting, hiring, and training new adjusters is expensive and disruptive. When you reduce the administrative burden that leads to burnout, you retain experienced professionals who know your processes, understand your policyholders, and bring institutional knowledge that's invaluable.

- Improved policyholder retention: In competitive P&C insurance markets, the claims experience is often what determines whether a policyholder renews or switches carriers. Faster processing, clearer communication, and more attentive service all contribute to satisfaction. Happy policyholders stay, and retention is far more cost-effective than acquisition.

Our partnership with Snapsheet, detailed in Snapsheet and Agentive Partner to Revolutionize Claims Processing with AI-Driven Digital Agents, demonstrates how these benefits play out in real world implementations. The ROI isn't theoretical. It's measurable, substantial, and achievable for P&C insurance carriers, TPAs, and IA firms ready to accept automation.

Conclusion: From Overloaded to Optimized

The journey to reduce administrative burden in P&C insurance claims is about more than cutting costs; it's about changing how your team works and delivering a claims experience that builds loyalty.

Administrative overload is a costly "time tax" that drains resources, burns out professionals, and frustrates policyholders. The solution is a multi-faceted approach using the "Three T's" framework: refining Techniques, implementing Technologies, and making strategic Changes to your operating model.

The most powerful change is creating a hybrid workforce where AI-powered digital coworkers and human adjusters work together. When AI handles tedious data entry, document organization, and routine verifications, your adjusters are free to focus on what they do best: applying empathy, investigating complex situations, and negotiating fair settlements. This isn't about replacing human judgment; it's about releaseing it.

At Agentech, we built our AI agents for this purpose. They work alongside your team as always-on assistants, handling administrative tasks so your human talent can focus on high-value work.

The future of P&C claims processing is one where your team is engaged, your operations are efficient, and your policyholders receive the swift, fair service they deserve. The path from overloaded to optimized is clear, and the technology to support the journey is available today.

Discover how AI Agents can transform your claims processing.

Citations:

- American Academy of Family Physicians. (2023). A Guide to Relieving Administrative Burden: Essential Innovations for Documentation Burden. FPM. https://www.aafp.org/pubs/fpm/issues/2023/0700/relieving-admin-burden.html

- Forbes. (2022). How Healthcare Providers Can Improve Patient Experiences With RPA, AI And Digital Workflows. https://www.forbes.com/sites/forbestechcouncil/2022/09/28/how-healthcare-providers-can-improve-patient-experiences-with-rpa-ai-and-digital-workflows/?sh=ce963cf30557

- Health Affairs. (n.d.). The Role Of Administrative Waste In Excess US Health Spending. https://www.healthaffairs.org/content/briefs/role-administrative-waste-excess-us-health-spending