Why Automation is No Longer Optional for Insurers

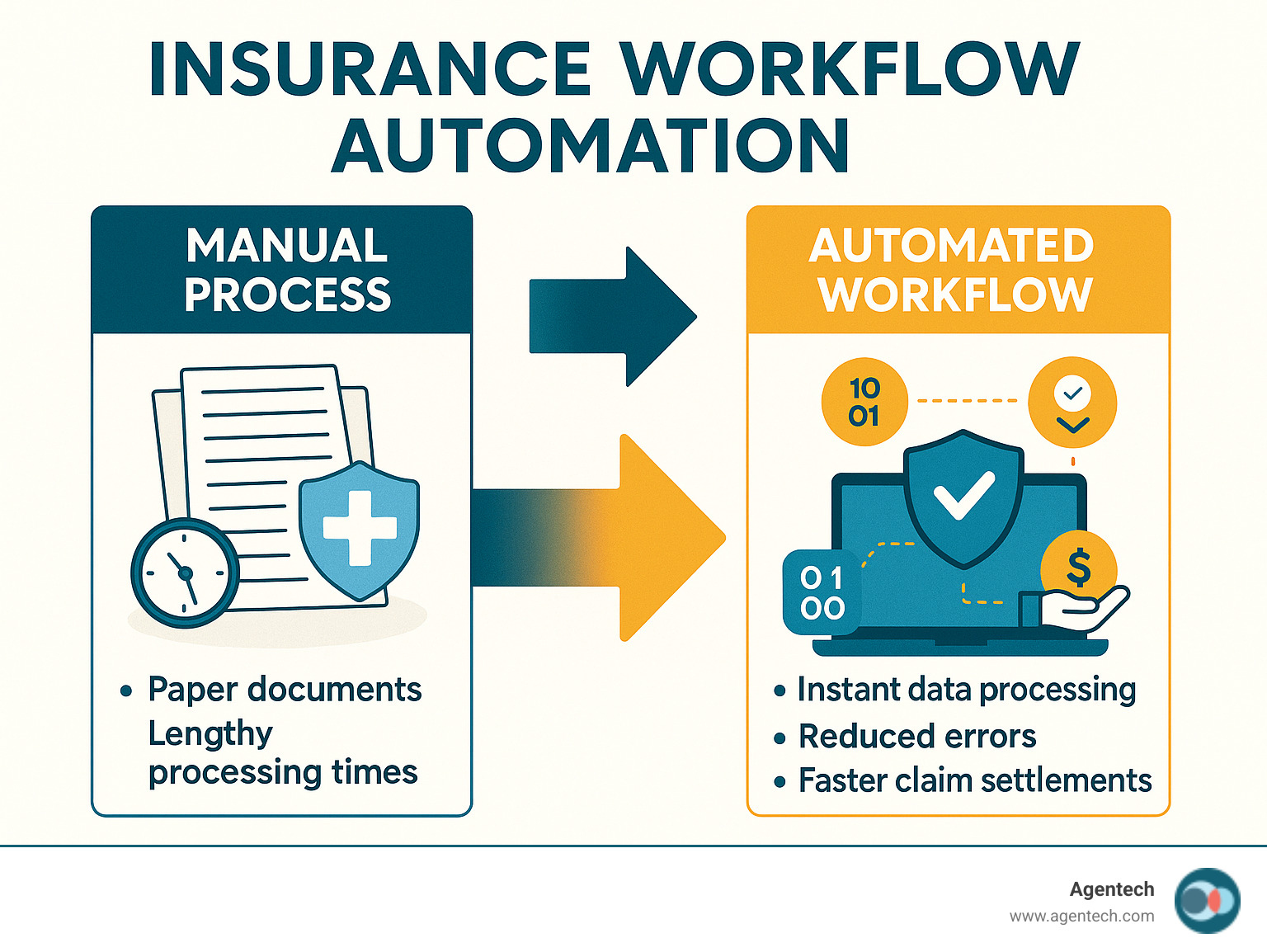

Insurance workflow automation is the use of technology to streamline and digitize core insurance operations, from policy creation and underwriting to claims processing and customer service. For busy claims managers facing mounting pressure to reduce costs while improving service quality, automation has become essential for survival in today's competitive market.

Key components of insurance workflow automation include:

- Claims Processing: Automated data entry, document validation, and fraud detection

- Policy Management: Digital forms, automated renewals, and policy updates

- Customer Service: Chatbots, automated responses, and self-service portals

- Compliance: Real-time monitoring, audit trails, and regulatory reporting

- Underwriting: Risk assessment, document processing, and decision routing

The numbers tell a clear story about why insurers can no longer afford to rely on manual processes. Research shows that 41% of consumers are likely to switch insurance providers due to a lack of digital capabilities. Meanwhile, the average claim takes 25 days to settle manually, while insurers using AI powered automation settle over 50% of claims in real time.

Manual processes create bottlenecks that hurt both operational efficiency and customer satisfaction. Claims managers spend countless hours on repetitive data entry, document processing, and administrative tasks that could be automated. This not only increases costs but also prevents teams from focusing on complex cases that require human expertise.

The competitive landscape has shifted dramatically. Insurance companies that accept automation report up to 30% reduction in operational costs and significantly improved customer satisfaction scores. Those that resist digital change risk losing market share to more agile competitors.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for insurance with a focus on revolutionizing claims processing through advanced automation solutions. Having previously founded and scaled TokenEx to one of Oklahoma's largest technology exits, I've seen how insurance workflow automation can transform business operations and create sustainable competitive advantages.

The Core Benefits of Automating Insurance Workflows

When we talk about insurance workflow automation, we're not just discussing a technological upgrade. We're exploring a fundamental shift that transforms how insurance companies operate from the ground up. The benefits ripple through every corner of your business, creating positive change that goes far beyond simple time savings.

Think about your typical workday. How much time do you and your team spend on repetitive tasks that could easily be handled by smart technology? The answer might surprise you, and it's exactly why operational efficiency becomes the cornerstone benefit of automation.

Operational efficiency transforms your entire workflow in remarkable ways. Processes that once consumed days or weeks now complete in minutes or hours. AI supported automation can accelerate quote submissions and claim decisions by up to 12 times, while document processing becomes 50 times quicker. Imagine settling over half your claims in real time instead of waiting the industry average of 25 days.

The cost reduction benefits speak directly to your bottom line. McKinsey research shows that automation can reduce operational costs by up to 30% within five years. Those savings come from fewer manual hours, reduced rework cycles, and better resource allocation toward high value activities that actually grow your business.

Improved accuracy might be automation's most underappreciated benefit. Humans make mistakes, especially when handling repetitive data entry and calculations. Well programmed automation systems don't. This means cleaner data, fewer compliance issues, and dramatically reduced rework that currently drains your team's energy and your company's resources.

Your customers notice the difference immediately through improved customer satisfaction. Today's insurance buyers expect speed and convenience. They want policies issued quickly and claims settled without endless back and forth communication. Automated workflows deliver exactly that experience, creating the kind of service quality that builds lasting customer relationships.

Here's something many executives overlook: automation dramatically improves employee morale. When your team spends their days on intellectually stimulating tasks instead of tedious data entry, job satisfaction increases significantly. Employees focus on complex problem solving, strategic thinking, and meaningful customer interactions. This shift reduces burnout and helps you retain talented team members who might otherwise leave for more engaging opportunities. You can learn more on how AI solves the labor crisis.

Scalability becomes effortless when automation handles your routine processes. Whether you're facing a sudden surge in claims or experiencing rapid customer growth, automated systems scale seamlessly without requiring proportional increases in headcount. Your operations adapt to demand fluctuations while maintaining consistent service quality.

Perhaps most importantly, automation provides a crucial competitive advantage in today's insurance market. Research shows that 88% of small and medium sized businesses believe automation helps them compete with larger companies. When you operate more efficiently, reduce costs, and deliver superior customer experiences, you gain significant market advantages that translate directly into business growth.

The reality is clear: insurance workflow automation isn't just about keeping up with technology trends. It's about positioning your company to thrive in an increasingly competitive landscape while creating better experiences for both your customers and your employees.

5 Key Insurance Processes to Automate Today

Now that we understand the profound benefits of insurance workflow automation, let's explore the specific areas where automation can deliver the most immediate and transformative results. Think of these as the low hanging fruit that can revolutionize your operations almost overnight.

Customer Onboarding and Policy Issuance

First impressions matter, especially in insurance. A clunky onboarding process can send potential customers running before they even get started. The good news? This is one of the easiest areas to automate effectively.

Digital forms replace those tedious paper applications that nobody enjoys filling out. When customers can complete their applications online, the data flows directly into your systems without any manual typing. Even better, Optical Character Recognition can extract information from uploaded documents like driver's licenses or property photos, making the process feel almost magical for customers.

KYC checks that used to take days now happen in minutes. Automated systems verify identities and run background checks while customers wait, creating a seamless experience. Meanwhile, automated communication keeps everyone in the loop with welcome emails, status updates, and gentle reminders about missing documents.

The real payoff comes with faster policy generation. Once all the data is validated, automated systems can generate and issue policies within minutes rather than days. Industry reports show that digitizing underwriting and onboarding processes can reduce cycle times by 50 to 70 percent while cutting administrative expenses by 20 to 30 percent.

Underwriting and Risk Assessment

Underwriting is where art meets science, and automation improves both sides of this equation. Data extraction becomes effortless when automated tools pull relevant information from multiple sources and formats. Optical Character Recognition (OCR) transforms scanned documents into searchable, actionable data that your systems can actually use.

For straightforward cases, rule based decision making allows automation to apply your predefined criteria and make instant underwriting decisions. No more waiting around for simple approvals that follow clear guidelines.

Standardized risk assessment models ensure consistency across your entire operation. Every application gets evaluated using the same criteria, reducing subjective decisions and improving accuracy. When complex cases do arise, AI systems can flag potential issues and provide underwriters with comprehensive data summaries, creating solutions that are truly AI designed with adjusters in mind.

Optimizing Claims with Insurance Workflow Automation

Claims processing represents both your biggest opportunity and your biggest challenge. It's where customers are most vulnerable and where your costs can spiral out of control. This is exactly where insurance workflow automation delivers its greatest impact.

First Notice of Loss systems let customers submit claims instantly through web portals, mobile apps, or chatbots. All the necessary information gets collected upfront, eliminating the phone tag that frustrates everyone involved.

Automated data entry and validation takes over the tedious work of inputting claim information. The system extracts details from forms and supporting documents, validates everything for accuracy, and flags any inconsistencies. This alone can reduce claims processing costs by up to 30%.

Document management becomes a breeze when automation organizes and classifies all claim related paperwork. Everything becomes searchable and retrievable, so adjusters can find what they need instantly. Fraud detection algorithms analyze claim patterns in the background, flagging suspicious cases for human review without slowing down legitimate claims.

Task routing ensures claims flow to the right people at the right time. No more claims sitting in the wrong inbox or falling through organizational cracks. At Agentech, we've focused intensively on this area, creating AI assistants that handle the repetitive administrative work while boosting adjuster productivity. Our systems tackle even the most tedious tasks, like creating the claim profile with AI, freeing up adjusters for the human elements that really matter.

Policy Renewals and Management

Policy renewals might seem straightforward, but they're actually make or break moments for customer retention. Automation transforms these routine interactions into opportunities to strengthen relationships.

Automated reminders reach customers at exactly the right time through their preferred channels, whether email or SMS. Personalized communication goes beyond generic renewal notices, tailoring offers and messages based on each customer's history and preferences. This personal touch significantly increases renewal rates.

Proactive retention strategies use customer data analysis to identify at risk policies before they lapse. The system can trigger outreach from agents or offer incentives to customers who might be considering other options. Simplified policy updates through self service portals let customers make minor adjustments without involving agents, creating convenience while reducing your workload.

Compliance and Reporting

In an industry as regulated as insurance, compliance can't be an afterthought. Automation builds compliance directly into your processes, making adherence automatic rather than accidental.

Automated audit trails record every action within your workflows, creating clear, immutable records for regulatory purposes. Real time monitoring watches for compliance issues continuously, alerting the right people immediately when potential problems arise.

Standardized reporting eliminates the monthly scramble to compile regulatory reports. Data collection and aggregation happen automatically, generating accurate reports faster than manual processes ever could. Regulatory adherence gets built directly into your workflows, ensuring processes automatically follow the latest regulations while balancing innovation and regulation with AI.

The beauty of focusing on these five key areas is that each one builds momentum for the next. Success in claims processing makes underwriting automation more valuable, while streamlined onboarding creates better data for compliance reporting. It's a virtuous cycle that compounds your investment in automation.

Your Strategic Guide to Implementing Insurance Workflow Automation

Implementing insurance workflow automation isn't just about buying new software and hoping for the best. It's a strategic change that touches every part of your organization. Think of it as renovating your house while you're still living in it. You need a solid plan, the right tools, and a clear understanding of what you're trying to achieve.

The good news? You don't have to figure this out alone. We've helped countless insurance companies steer this journey, and there's a proven roadmap that works.

Step 1: Assess Needs and Choose the Right Technology

Before you fall in love with any shiny new automation tool, take a step back and really understand what's broken in your current processes. This might sound obvious, but you'd be surprised how many companies jump straight to solutions without clearly defining their problems.

Start by identifying your biggest bottlenecks. Walk through your current workflows with fresh eyes. Where do claims sit for days without anyone touching them? Which tasks make your adjusters groan when they see them on their desk? These pain points are your golden opportunities for automation.

Prioritize for maximum impact. Not every process deserves the same attention. Focus first on workflows that handle high volumes, consume lots of manual effort, or directly affect customer satisfaction. A small improvement in claims processing might save you hundreds of hours per month, while automating a rarely used report might barely move the needle.

Legacy system integration often becomes the make or break factor. Most insurance companies run on systems that were built when flip phones were cutting edge technology. The key is finding automation solutions that play nicely with what you already have.

Robotic Process Automation (RPA) acts like a digital employee that can click buttons and fill forms in your existing systems. It's perfect for older systems that don't have modern connectivity options, though it can be a bit fragile if your software interfaces change frequently.

API based integration creates direct communication channels between systems. This approach is rock solid and handles high volumes beautifully, but it requires systems that can actually talk to each other through modern interfaces.

Low code platforms let your business users build and modify workflows without needing a computer science degree. This approach speeds up development and gives you more control over your automation destiny.

The buy vs. build decision depends on your specific situation, technical resources, and long term strategy. There's no universal right answer, but there are definitely wrong choices for your particular circumstances.

Step 2: The Evolving Role of AI in Insurance Workflow Automation

AI has moved far beyond the field of science fiction and into the practical world of insurance workflow automation. Today's AI tools can handle complex tasks that would have required human judgment just a few years ago.

Machine learning algorithms excel at finding patterns in massive datasets that humans would never spot. In underwriting, they can evaluate risk factors across thousands of variables simultaneously. In claims processing, they can detect fraud patterns that might take human investigators months to uncover.

Predictive analytics takes this pattern recognition a step further by forecasting future outcomes. Imagine knowing which claims are likely to become complex before they actually do, or predicting which customers might not renew their policies. This foresight allows you to take proactive action instead of constantly reacting to problems.

Natural Language Processing (NLP) bridges the gap between human communication and computer understanding. It can read through claim notes, extract key information from emails, and even understand the sentiment behind customer communications. This capability transforms unstructured text into actionable data.

Chatbots and virtual assistants powered by AI can handle routine customer inquiries around the clock. They're particularly effective for simple tasks like checking claim status, explaining policy details, or guiding customers through standard processes. The best part? They never get tired or have bad days.

The insurance industry is experiencing the evolution from Generative AI to Agentic AI. While Generative AI can create content and provide information, Agentic AI can actually plan, execute, and monitor complex tasks independently. This represents a fundamental shift toward AI systems that can truly augment human capabilities rather than simply following pre programmed rules.

Step 3: Implement Best Practices for a Successful Rollout

Technology implementation is as much about people and processes as it is about software. The most sophisticated automation system in the world won't help if your team doesn't trust it or know how to use it effectively.

Start with a pilot project that's big enough to matter but small enough to manage. Choose a process that's important but not mission critical for your initial automation effort. This gives you room to learn and make mistakes without risking your core operations. Success with a pilot project builds momentum and credibility for larger initiatives.

Data security cannot be an afterthought in insurance automation. You're dealing with highly sensitive personal and financial information that requires the highest levels of protection. Every automated process must include robust security measures, encryption, and access controls. Compliance with regulations isn't optional, it's fundamental to your business license.

Change management makes or breaks automation initiatives. Many employees worry that automation means their jobs are at risk. Address these concerns head on by clearly communicating how automation will eliminate tedious tasks and free people to focus on more interesting, valuable work. Emphasize that you're building AI assistants, not AI replacements.

Comprehensive training ensures adoption and success. Your team needs to understand not just how to use the new automated workflows, but why they work the way they do. Hands on training sessions, clear documentation, and ongoing support help people feel confident with the new tools. If you're not sure where to start with AI, training programs can provide an excellent foundation.

Continuous monitoring and optimization transform good automation into great automation. Set up metrics to track performance, collect feedback from users, and identify opportunities for improvement. The best automated systems evolve and improve over time based on real world usage and changing business needs.

Insurance workflow automation is a journey, not a destination. Each successful implementation builds the foundation for the next level of capability and efficiency.

Frequently Asked Questions about Insurance Automation

Let's tackle some of the most common questions we hear from insurance professionals exploring insurance workflow automation. These concerns are completely natural, and we're here to provide clear, practical answers.

How does automation help with regulatory compliance?

If you're feeling overwhelmed by the ever growing maze of insurance regulations, you're not alone. The good news is that automation can actually make compliance much easier to manage, not harder.

Think of automated systems as having a perfect memory and never getting tired. Every single action, decision, and data entry gets recorded automatically, creating automated audit trails that regulators love to see. No more scrambling to reconstruct what happened six months ago when an auditor comes knocking.

Consistent process application is another huge advantage. When humans handle the same task repeatedly, small variations creep in. Maybe someone's having a rough day, or they're rushing to meet a deadline. Automation eliminates this variability entirely, ensuring every process follows the exact same steps every time.

Real time monitoring means your system can catch potential compliance issues the moment they happen, rather than finding them weeks later during a manual review. It's like having a vigilant compliance officer working 24 hours a day, seven days a week who never needs coffee breaks.

The reduced human error factor alone can save you from costly compliance penalties. Manual data entry mistakes that could trigger regulatory issues become virtually nonexistent. Plus, modern automation platforms come with built in data security protocols including encryption and access controls, helping you meet strict privacy requirements without extra effort.

Can automation tools integrate with legacy insurance systems?

This might be the number one concern we hear, and we totally understand why. You've invested millions in systems that work, even if they're not exactly cutting edge. The relief on clients' faces when we tell them "Yes, absolutely!" is always wonderful to see.

API based integration is the gold standard when your legacy system has accessible interfaces. Think of APIs as translators that let your old and new systems have smooth conversations with each other. Data flows back and forth seamlessly, and everything just works.

But what if your legacy system is more like that reliable old truck that doesn't speak modern computer languages? That's where Robotic Process Automation (RPA) becomes your best friend. RPA bots literally watch and learn how humans interact with your legacy system, then replicate those exact mouse clicks and keyboard entries. They can log in, steer menus, and input data just like a person would, but faster and without ever making typos.

Most successful implementations use hybrid solutions that combine different approaches. You might use APIs for the heavy data lifting while RPA handles those quirky legacy screens that haven't been updated since the early 2000s.

Sometimes we can even create modern, user friendly interfaces that sit on top of your legacy system, wrapping legacy systems with modern UIs. Your team gets to work with sleek, intuitive tools while the automation handles all the complex backend conversations with your old systems.

What is the future of insurance workflow automation?

The future of insurance workflow automation is genuinely exciting, and it's arriving faster than many people realize. We're moving toward what experts call hyperautomation, where multiple technologies work together like a well orchestrated symphony.

AI agents as digital coworkers represent the next major evolution. These aren't just simple bots following basic scripts. They're sophisticated systems that can handle complex tasks, make nuanced decisions, and even learn from experience. Amazon's CEO Andy Jassy predicts billions of AI agents will become our coworkers, and we're already seeing this change begin in insurance claims.

Proactive risk management will completely flip the traditional insurance model. Instead of waiting for claims to happen and then reacting, automated systems will continuously analyze patterns and predict potential risks before they occur. Imagine being able to alert a policyholder about a potential issue before it becomes a claim.

The personalized customer experiences enabled by automation will make today's "one size fits all" approach seem quaint. Every interaction, recommendation, and communication will be custom to individual customer needs and preferences, all happening automatically in the background.

Perhaps most importantly, this evolution creates space for humans to focus on what we do best: strategic thinking, creative problem solving, and providing the empathy and understanding that customers need during difficult times. The future of insurance with AI isn't about replacing people, it's about amplifying human capabilities and creating more meaningful, impactful work for everyone involved.

Conclusion: Accept the Future of Insurance Operations

The journey through insurance workflow automation brings us to an inescapable truth: automation has moved from being a nice to have advantage to an absolute business necessity. The numbers don't lie, and neither do the customer expectations we face every day.

Throughout this guide, we've seen how automation transforms every corner of insurance operations. Operational efficiency soars when repetitive tasks disappear from human workloads. Cost reductions of up to 30% become reality, not just wishful thinking. Improved accuracy means fewer costly mistakes and rework cycles. Most importantly, both customers and employees walk away happier from their interactions with your company.

The beauty of modern automation lies in its ability to handle everything from the first customer interaction during onboarding to the final compliance report. Whether you're processing claims faster, making underwriting decisions with greater precision, or ensuring every regulatory requirement gets met automatically, automation provides the foundation for sustainable growth.

But here's what really excites us about the future: insurance workflow automation isn't about replacing the human touch that makes insurance meaningful. Instead, it's about amplifying human capabilities. When your adjusters spend less time on data entry and more time helping customers through difficult situations, everyone wins. When your underwriters can focus on complex risk assessment instead of paperwork, better decisions emerge.

The competitive landscape has already shifted. Companies that accept automation are pulling ahead, while those clinging to manual processes find themselves struggling to keep up. The question isn't whether to automate, but how quickly you can implement the right solutions.

At Agentech, we've built our entire mission around this change, particularly in claims processing. Our AI powered solutions take on those tedious administrative tasks that consume valuable time, while seamlessly integrating with your existing systems. We believe in creating always on AI assistants that boost adjuster productivity without sacrificing the human judgment that complex claims require.

The future of insurance operations is bright, efficient, and deeply human. Automation handles the routine, freeing your team to focus on relationships, complex problem solving, and the empathetic support that customers need most during challenging times.

Ready to transform your insurance operations and open up new levels of efficiency and customer satisfaction? Learn more about Agentech's AI solutions and find how we can help you accept this exciting future.