The Document Dilemma in P&C Insurance

AI for insurance document management transforms how Property and Casualty (P&C) carriers, Third-Party Administrators (TPAs), and Independent Adjusting (IA) firms handle the overwhelming volume of claims forms, policy applications, and customer communications. Instead of manual data entry and paper shuffling, AI-powered solutions can:

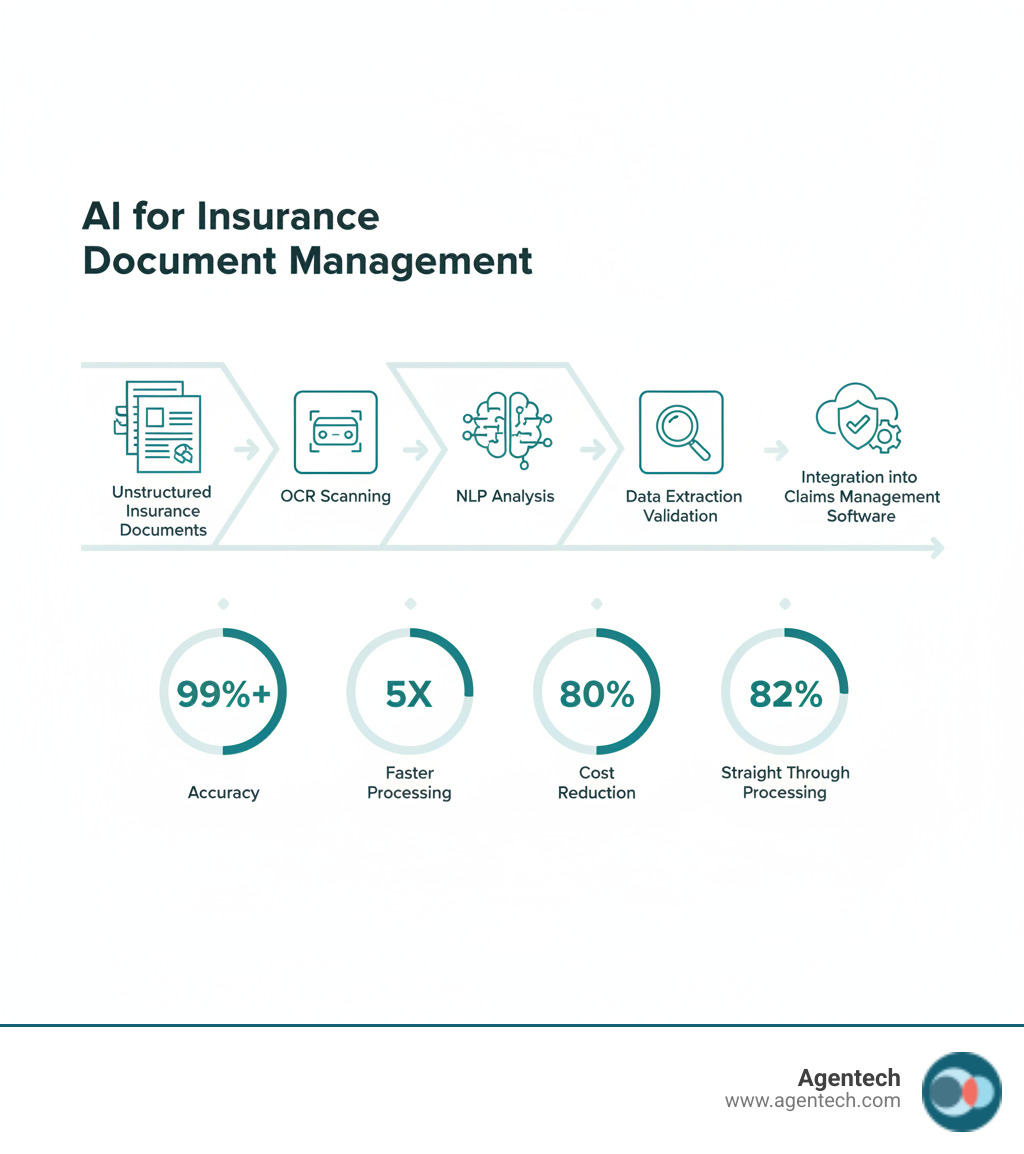

- Extract data automatically from any document with over 99% accuracy.

- Process documents 5X faster than manual methods, reducing turnaround times by 50%.

- Cut operational costs by up to 80% while freeing up your workforce for higher-value tasks.

- Achieve 82% straight-through processing for routine documents.

- Reduce compliance errors by 30% through automated validation.

The challenge is significant. P&C insurance companies generate massive volumes of data. Claims adjusters and underwriters spend up to 40% of their time on repetitive document tasks. Every FNOL report, damage photo, medical bill, and police report requires human review and data entry. This manual approach is slow, error-prone, and expensive, leading to potential premium leakage, compliance violations, and delayed claim settlements.

When document volume spikes due to catastrophic events, service levels suffer and customer satisfaction drops. Traditional, rule-based automation struggles with the unstructured nature of P&C insurance documents, where formats vary widely. As a result, most P&C insurers still rely heavily on manual labor to bridge the technology gap.

The P&C insurance world is drowning in unstructured data, including the PDFs, scanned images, emails, and handwritten notes that make up a single claim. Teams spend countless hours manually reviewing, classifying, and extracting data from these documents. This work is not just tedious; it is a breeding ground for errors. A single mistyped policy number can lead to significant delays and incorrect payouts.

These manual processes dramatically slow down claims processing. When customers expect instant service, waiting days for someone to sift through documents is no longer acceptable. This directly impacts customer satisfaction and increases operational costs. Furthermore, the P&C insurance industry is heavily regulated, and manual processes make it difficult to ensure consistent compliance, leading to potential fines and reputational damage.

Delays in First Notice of Loss (FNOL) processing are particularly critical for auto and property damage claims. The longer it takes to process the initial report, the longer it takes to start the claims process, impacting customer experience. Solving the Insurance Labor Crisis with AI-Driven Innovation highlights how tackling these inefficiencies is crucial for the P&C insurance industry's future.

Citations:

- Agentech. (n.d.). Solving the Insurance Labor Crisis with AI-Driven Innovation. Retrieved from https://www.agentech.com/resources/articles/solving-the-insurance-labor-crisis-with-ai-driven-innovation

How AI Technologies Automate Document Processing

Artificial intelligence is fundamentally changing how P&C insurance companies handle documents. This is not about replacing skilled professionals but about giving them superpowers, freeing them from mind-numbing data entry to focus on complex problem-solving and customer connection. As we like to say, The Best AI Doesn't Feel Like AI. It's Invisible.

Think of ai for insurance document management as a suite of technologies working together. Each component plays a specific role in turning chaotic, unstructured documents into clean, actionable data.

- Optical Character Recognition (OCR) gives your claims management software the ability to "read" documents. It converts scanned reports and bills into machine-readable text, eliminating the need for manual retyping.

- Natural Language Processing (NLP) makes sense of that text. It understands meaning and context, allowing AI agents to extract specific information like policy numbers, claim dates, and damage descriptions, even when formats differ. It can also classify documents and validate data against existing records.

- Generative AI is a game-changer that can create new content. It enables powerful document summarization, condenses lengthy claim histories into concise overviews, and drafts automated correspondence for common inquiries. For policy comparison, it can quickly highlight differences between versions.

- Machine Learning (ML) is the brain that helps the system get smarter. ML algorithms allow AI agents to learn from the data they process, continuously improving their accuracy and adapting to new document types without constant human reprogramming.

This technology stack works together seamlessly. OCR digitizes, NLP understands, Generative AI creates and enriches, and Machine Learning makes it all smarter. For P&C carriers, TPAs, and IA firms, this means documents that once took hours to process can now be handled in minutes with greater accuracy.

From Scanned Images to Structured Data

Let me walk you through what happens when an AI agent processes your documents. Imagine a claims adjuster receives a mix of items for a property damage claim: digital photos, a scanned repair invoice, and a handwritten statement. In the past, someone would manually review each item and type the details into the claims management software.

AI changes that process. First, OCR converts the scanned invoice and handwritten statement into digital text. Next, NLP analyzes this text. From the invoice, it identifies the vendor, repair costs, and service date. From the statement, it extracts the policyholder's account of the incident.

Then, the AI takes that extracted information and automatically populates the correct fields in your claims management software. The repair cost goes into the "Repair Cost" field, the policyholder's name into "Insured Name," and so on. This process virtually eliminates manual data entry and its associated errors. Modern AI systems achieve 99%+ accuracy in information extraction, far exceeding human capabilities over thousands of documents. This evolution represents a fundamental shift in how claims operations work, as detailed in Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI.

Understanding and Generating Content with Advanced AI

Beyond data extraction, advanced AI solutions powered by Generative AI lift document intelligence. These systems understand, summarize, and create content to help your team work more efficiently.

- Generative AI summaries can turn a 50-page medical report into a concise summary highlighting key injuries, treatments, and prognosis. An adjuster can review this in minutes instead of hours.

- Automated correspondence allows Generative AI to draft personalized emails or letters for routine communications, such as claim decision notifications. Your team simply reviews and sends, turning a 20-minute task into a two-minute one.

- Policy comparison becomes faster and more accurate. Generative AI can swiftly highlight discrepancies between policy versions or confirm coverage details, improving underwriting and policy servicing.

- Data enrichment takes things a step further. The AI can analyze extracted data and flag potential inconsistencies, such as a repair estimate that seems too high or a claimant's statement that contradicts a police report.

These capabilities are part of what we call Agentic AI, where AI agents function as intelligent assistants that complete tasks autonomously while keeping humans in control. To learn more about how AI can transform content workflows, explore our primer on Agentic AI for content operations.

Citations:

- Agentech. (n.d.). The Best AI Doesn't Feel Like AI. It's Invisible. Retrieved from https://www.agentech.com/resources/articles/the-best-ai-doesnt-feel-like-AI-its-invisible

- Agentech. (n.d.). Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI. Retrieved from https://www.agentech.com/resources/articles/transforming-insurance-claims-the-evolution-from-generative-ai-to-agentic-ai

- Agentech. (n.d.). Agentic AI: Definition and use cases. Retrieved from https://www.agentech.com/resources/articles/agentic-ai-definition

Core Benefits and Use Cases of AI for P&C Insurance Document Management

The implementation of ai for insurance document management is a strategic move that delivers tangible benefits across P&C operations. When P&C carriers, TPAs, and IA firms adopt AI-powered document automation, they see immediate and significant improvements.

- Increased Efficiency and Productivity: By automating repetitive tasks like data entry and classification, AI allows adjusters and underwriters to focus on complex decision-making and customer interaction. This can lead to a 95%+ reduction in manual work.

- Improved Accuracy: AI agents perform tasks with remarkable consistency, achieving 99%+ accuracy in information extraction. This means fewer costly errors and re-works.

- Cost Savings: Less manual work, fewer errors, and faster processing can reduce document processing costs by up to 80%, freeing up budget for innovation and improved service.

- Faster Claims Cycles: AI helps P&C insurers process documents 5X faster than manual methods, decreasing turnaround times by 50%. This speed is critical for auto, property, and workers' compensation claims.

- Improved Customer Satisfaction: When claims are processed quickly and accurately, policyholders are happier. This leads to increased loyalty and positive word-of-mouth, as explored in Designing for the Future: How AI Transforms the Claims Experience.

- Scalability: AI solutions scale effortlessly to handle surges in document volume from major storms or seasonal trends, without the need to hire temporary staff.

- Better Compliance and Audit Readiness: AI agents process every document according to predefined rules, creating detailed audit trails automatically. This can reduce compliance data errors by 30%.

Key Use Cases Across P&C Operations

The applications of ai for P&C insurance document management touch nearly every facet of P&C insurance operations.

- Claims Processing Automation: This is where AI delivers the most immediate value. AI agents automate data extraction from FNOL reports, police reports, medical bills, and repair estimates. This leads to faster claim setup and a smoother experience for policyholders. According to McKinsey research, AI can reduce claims processing time by up to 50% while improving accuracy. Our AI Claims Processing System is designed for this challenge.

- Underwriting Support: AI swiftly extracts relevant information from applications and inspection reports, accelerating the underwriting process and allowing underwriters to focus on complex risk analysis.

- Policy Servicing: AI automates the processing of change requests, generates renewal notices, and helps manage policy documents, keeping administration running smoothly.

- First Notice of Loss (FNOL) Intake: AI rapidly processes FNOL documents from various channels, extracts key details, and initiates the claims process almost instantly, achieving straight-through processing for over 80% of documents.

- Regulatory Reporting: AI automatically compiles and formats data from various documents to generate accurate and timely regulatory reports, reducing the burden on compliance teams.

- Fraud Detection: By analyzing patterns and anomalies within claims documents, AI helps identify suspicious claims that warrant further investigation, mitigating losses from fraud.

Citations:

- Agentech. (n.d.). AI Claims Processing System. Retrieved from https://www.agentech.com/resources/articles/ai-claims-processing-system

- Agentech. (n.d.). Designing for the Future: How AI Transforms the Claims Experience. Retrieved from https://www.agentech.com/resources/articles/designing-for-the-future-how-ai-transform-the-claims-experience

- McKinsey & Company. (2021). Insurance 2030: The impact of AI on the future of insurance. Retrieved from https://www.mckinsey.com/industries/financial-services/our-insights/insurance-2030-the-impact-of-ai-on-the-future-of-insurance

A Practical Guide to Implementing AI Document Automation

Implementing ai for insurance document management can feel overwhelming, but you don't need to start from scratch. Smart AI implementation is about augmenting what you already have. If you're thinking, Not Sure Where to Start with AI?, this practical guide can help.

First, map your current document workflows to identify bottlenecks and pain points. Then, define specific, measurable goals, such as cutting claims processing time by 50% or achieving 99% data extraction accuracy. These goals are essential for evaluating success and building a business case. Calculate your ROI early by quantifying current costs and potential savings. This is not just an IT project; involve cross-functional teams like adjusters and underwriters from day one. Their insights are invaluable for designing a tool they will actually use. Finally, start with a pilot program on a specific document type, like auto claims FNOLs, to demonstrate early wins and build momentum.

Choosing the Right Tools for AI for P&C Insurance Document Management

Not all AI is created equal, especially for P&C insurance. The biggest decision is between generic AI models and P&C insurance-specific solutions. Generic models lack the domain knowledge for policy language and claims terminology, and they weren't designed for the P&C insurance industry's strict security and compliance needs.

P&C insurance-specific AI models are purpose-built. They are trained on thousands of P&C insurance documents, leading to higher accuracy and a better understanding of context.

| Feature | Generic LLMs | P&C Insurance-Specific AI Models |

|---|---|---|

| Accuracy | Acceptable for simple text, struggles with P&C insurance nuances | 95%+ accuracy on insurance documents, trained on industry data |

| Security | Public models, data privacy concerns, not built for compliance | Enterprise grade security, SOC 2/GDPR compliant, data protection |

| Compliance | No inherent compliance features for regulated industries | Built in audit trails, explainable AI, regulatory adherence |

| Cost | Lower initial cost, but high error rates increase TCO | Higher initial investment, but significant ROI from accuracy/efficiency |

| Domain Expertise | General knowledge, lacks insurance specific context | Deep understanding of P&C insurance terminology, forms, and workflows |

| Traceability | Limited | Complete audit trail, linking extracted data to source |

Beyond the model, consider integration capabilities. Your AI solution must work seamlessly with your existing core systems, whether Guidewire, Duck Creek, or a proprietary claims management platform. Also, look for scalability to handle volume surges and adaptability for changing regulations. Finally, choose a vendor with proven P&C insurance experience, enterprise-grade security, and an intuitive user interface. For more on this decision, Buy vs. Build: Navigating the SaaS AI Technology Decision offers a helpful framework.

Practical Steps for Implementing AI for P&C Insurance Document Management

Once you've selected a solution, focus on execution.

- System Integration: The AI must feed extracted data directly into the claims software your team already uses, such as Guidewire ClaimCenter or Duck Creek Claims. An API-first approach allows for flexible, seamless data exchange, eliminating manual data transfer.

- Data Security and Compliance: This is foundational. Ensure your solution encrypts all policyholder information, offers granular access controls, and provides detailed audit trails. Compliance with standards like SOC 2 and GDPR is not optional.

- Training and Adoption: Invest time in showing your team how the AI makes their jobs easier. Frame it as a helpful assistant that handles tedious work, which smooths adoption and empowers your staff.

- Monitoring and Optimization: AI is not a "set it and forget it" tool. Continuously track performance metrics like accuracy and processing times to fine-tune the models and workflows.

The Critical Role of Human-in-the-Loop Verification

At Agentech, we believe AI should empower people, not replace them. This is especially true in P&C insurance, where claims decisions affect people's lives. That's why human-in-the-loop verification is critical for successful ai for insurance document management.

Think of AI as augmentation, not replacement. Your adjusters bring judgment and expertise that no algorithm can replicate. AI handles the repetitive work, freeing them to apply their unique skills to complex cases and customer interactions. Our philosophy of AI Designed With Adjusters in Mind puts people at the center.

Human oversight provides essential quality assurance, acting as a safety net to catch nuances the AI might miss. This is also a training opportunity: when a human reviewer makes a correction, the AI learns from it, improving its accuracy for future documents. This feedback loop creates a dynamic partnership between human and artificial intelligence, building trust and leading to continuous improvement.

Citations:

- Agentech. (n.d.). Not Sure Where to Start with AI?. Retrieved from https://www.agentech.com/resources/articles/not-sure-where-to-start-with-AI

- Agentech. (n.d.). Buy vs. Build: Navigating the SaaS AI Technology Decision. Retrieved from https://www.agentech.com/resources/articles/buy-vs-build-navigating-the-saas-ai-technology-decision

- Agentech. (n.d.). AI Designed With Adjusters in Mind. Retrieved from https://www.agentech.com/resources/articles/ai-designed-with-adjusters-in-mind

Conclusion

The future of ai for insurance document management in P&C insurance is not just about technology; it is about changing how we work. By embracing AI, P&C carriers, TPAs, and IA firms can move beyond the "document dilemma" and achieve unprecedented levels of efficiency, accuracy, and customer satisfaction. The statistics speak for themselves: up to 80% reduction in processing costs, 99%+ accuracy, and 5X faster processing times.

Our AI agents are designed to be your best digital coworkers, seamlessly integrating into your existing claims software and empowering your human teams. By automating repetitive document tasks, P&C carriers, TPAs, and IA firms can empower their teams to focus on what truly matters: complex decision making and delivering exceptional service to policyholders. Explore how AI Agents can become your most efficient digital coworkers.

Citations:

- EY. (n.d.). How a Nordic insurance company automated claims processing. Retrieved from https://www.ey.com/en_uk/insights/financial-services/emeia/how-a-nordic-insurance-company-automated-claims-processing

- Agentech. (n.d.). Designing for the Future: How AI Transforms the Claims Experience. Retrieved from https://www.agentech.com/resources/articles/designing-for-the-future-how-ai-transform-the-claims-experience

- PwC. (n.d.). Cross Insurance uses GenAI-powered document extraction to better serve customers. Retrieved from https://www.pwc.com/us/en/tech-effect/ai-analytics/cross-insurance-genai-document-extraction.html