Why Claims Management Needs an Urgent Overhaul

AI-powered claims automation is changing how P&C insurance carriers, TPAs, and IA firms process claims. By using technologies like machine learning and agentic AI, these systems automatically extract data, assess claims, detect fraud, and accelerate settlements from weeks to minutes.

Key benefits of AI-powered claims automation include:

- Faster Processing: Reduce claim settlement times with productivity boosts up to 75%.

- Greater Accuracy: Achieve over 98% accuracy in document classification and data extraction.

- Fraud Detection: Automatically flag anomalies and suspicious patterns.

- Straight-Through Processing: Automate 57% to 99%+ of routine claims without manual intervention.

- Cost Savings: Cut operational costs by reducing manual effort.

- Happier Customers: Decrease wait times and resolve a majority of claims almost instantly.

The pressure on P&C insurance claims managers is immense. Adjusters spend roughly 30% of their time on tedious document review and data entry. Meanwhile, 31% of recent claimants were dissatisfied, with 60% citing slow settlement as the primary reason. Of those unhappy customers, 30% switch insurers.

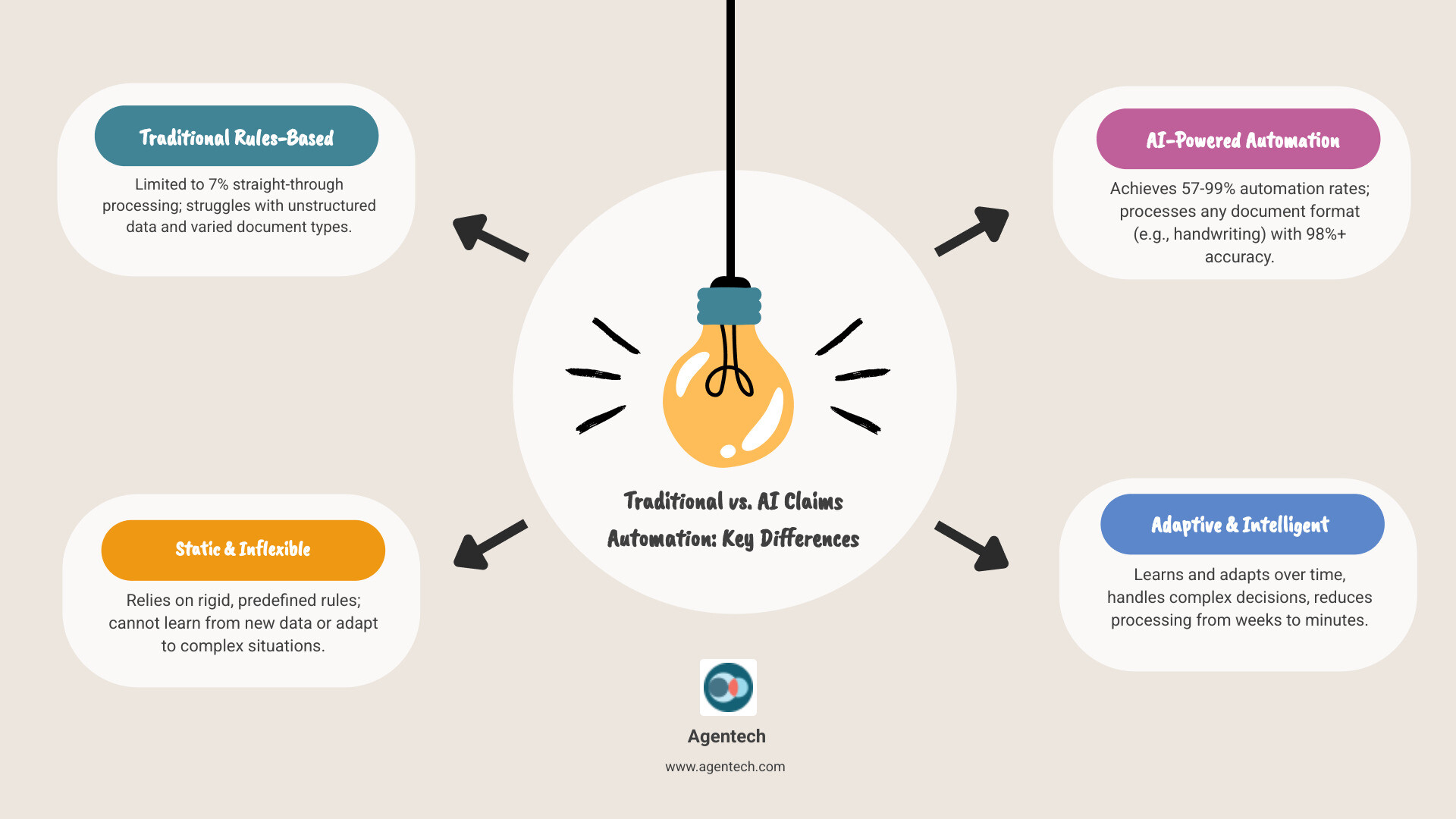

Traditional rules-based automation has failed to solve this. Only 7% of claims currently qualify for straight-through processing because most data arrives in unstructured formats like handwritten notes and photos. This is where AI changes everything.

Unlike rigid systems, AI-powered claims automation understands the messy reality of real-world claims. It reads unstructured data, learns from patterns, and makes intelligent decisions. For residential property, auto, pet, and workers' compensation claims, this allows your team to focus on complex cases and customer relationships instead of paperwork.

I'm Alex Pezold, founder of Agentech AI. We're building the AI workforce for the P&C insurance industry with a focus on AI-powered claims automation for P&C carriers and TPAs. After exiting my previous company, TokenEx, in 2021, I've dedicated my work to solving these challenges with cutting-edge AI.

This guide explains how to implement AI-powered claims automation in your organization, from choosing the right technology to deploying it without disrupting your existing claims management software.

Why P&C Insurers Are Adopting AI-Powered Claims Automation

The P&C insurance industry is at a turning point. Carriers, TPAs, and IA firms face mounting pressure from demanding customers, rising costs, and fierce competition. AI-powered claims automation is no longer just a trend; it's a strategic necessity for survival and growth.

Forward-thinking P&C insurers are already using AI to empower their claims professionals, leading to faster resolutions, fewer errors, and happier policyholders. Let's explore why this is critical for your organization.

Accelerating Claims Resolution and Boosting Efficiency

Your claims handlers spend nearly a third of their week on low-value work like reviewing documents and entering data. AI-powered claims automation handles this repetitive work, freeing your team to focus on complex cases and customer interactions. The speed improvements are remarkable. Where traditional processing takes weeks, AI can resolve claims in minutes. For example, one travel insurer deployed an AI solution and saw 57% of its claims fully automated [3]. Other organizations report productivity boosts of up to 75% [4].

AI makes this possible by automatically capturing, extracting, and validating data from any claim document, including handwritten notes and photos. This creates clean, structured data your team can act on immediately, dramatically expanding the potential for straight-through processing.

You can learn more about how AI accelerates this process in our article, AI Claims Processing Insurance.

Enhancing Accuracy and Reducing Claims Leakage

In P&C claims, errors lead to overpayments, underpayments, and missed subrogation opportunities. Manual data entry is a primary source of these mistakes. AI-powered claims automation provides consistent precision, capturing and validating data with high accuracy to establish "clean claims." A European P&C insurer automated its unstructured data processing and achieved 70% automatic extraction and interpretation of documents, leading to significant gains in efficiency and customer experience [2].

Beyond data extraction, AI ensures payments are accurate by consistently applying business rules and identifying liable parties for subrogation. This helps you recover losses faster. Our AI solutions excel at creating the initial claim profile, ensuring every claim starts with accurate information to prevent errors from cascading through the process. Learn more in We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile.

Improving the Policyholder Experience

An industry report found that 31% of recent claimants were dissatisfied, with 60% blaming slow settlement speeds [5]. Since unhappy customers often switch insurers, a poor claims experience directly impacts your bottom line. AI-powered claims automation addresses this by reducing wait times by up to 60% [6]. Imagine a policyholder receiving a resolution in minutes instead of weeks.

Speed isn't the only benefit. When AI handles administrative tasks, your adjusters have more time for meaningful customer interactions. They can provide empathy, answer questions, and guide policyholders through difficult situations. This combination of speed and human touch builds loyalty. To explore how AI is reshaping customer interactions, see Designing for the Future: How AI Will Transform the Claims Experience.

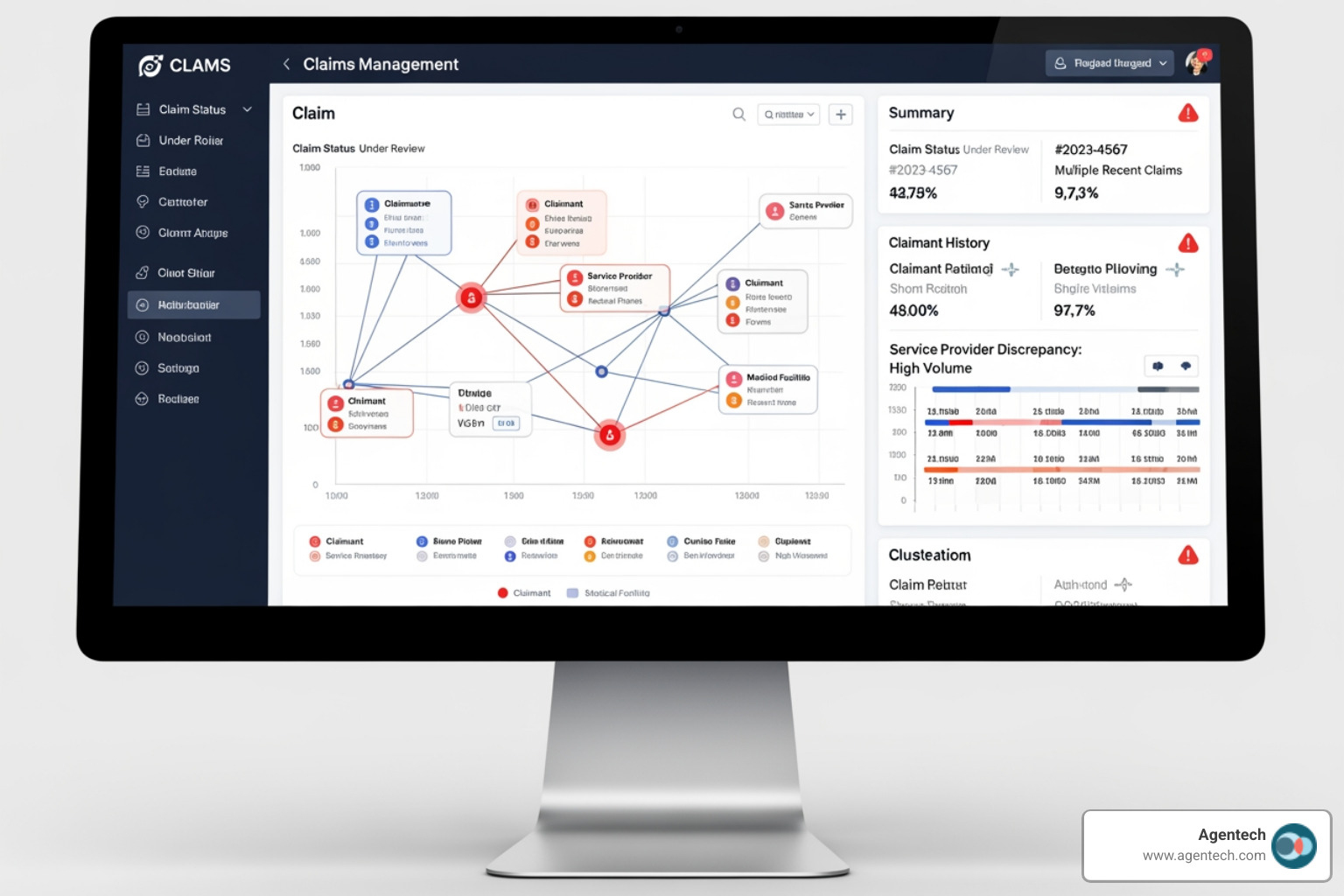

Advanced Fraud Detection and Cost Control

Fraud directly impacts your combined ratio and forces honest policyholders to pay higher premiums. AI-powered claims automation uses powerful pattern recognition to detect potential fraud that the human eye might miss. It analyzes vast amounts of data to identify anomalies and suspicious connections with a speed and consistency that manual review cannot match.

For example, AI can flag photos that have been reused across multiple claims. In one case, AI spotted that photos of spoiled food in a weather claim matched images from three previous claimsa connection nearly impossible for an adjuster to catch manually. By providing clear explanations of suspicious activity, AI allows your team to focus investigations on genuinely questionable claims, improving your combined ratio.

Citations:

[1] Internal Agentech content

[2] EY. How a Nordic insurance company automated claims processing.

[3] Industry case study on claims automation.

[4] Industry report on AI-powered insurance automation.

[5] Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research.

[6] Industry report on AI in claims management.

The Core Technologies Driving Claims Automation

At Agentech, we've seen how AI-powered claims automation transforms P&C insurance operations. This change is driven by a sophisticated blend of technologies working together in modern claims software to handle the complexity of real-world claims.

Traditional automation is like a vending machine: it works only with precise inputs. But claims data is messy. It arrives as handwritten notes, varied forms, and smartphone photos. Intelligent automation is designed for this reality, and it's changing everything for P&C carriers, TPAs, and IA firms.

| AI Technology | Function in Claims Processing |

|---|---|

| Machine Learning (ML) | Identifies patterns, predicts claim severity, automates routing, detects fraud by learning from historical data. |

| Natural Language Processing (NLP) | Extracts key information from unstructured text (notes, reports), summarizes documents, aids in communication. |

| Computer Vision | Analyzes images and videos for damage assessment, verifies claim details, detects photo manipulation or reuse. |

| Generative AI (GenAI) | Drafts communications, summarizes complex documents, generates reports, assists adjusters with information retrieval. |

| Agentic AI | Orchestrates complex multi-step tasks, makes decisions, collaborates with human adjusters, learns and adapts autonomously. |

From Rules-Based Systems to Intelligent Automation

Rules-based systems have a place, but they are rigid. They require perfectly structured data, which is why only about 7% of claims can be processed straight through [1]. The other 93% of claims data arrives as unstructured information, such as adjuster notes, police reports, and customer emails, that these systems cannot handle [2]. AI-powered claims automation overcomes this limitation. Instead of following rigid rules, it understands context, reads handwriting, and interprets varied formats. This allows claims that once required manual review to be processed automatically, accelerating resolution and improving accuracy [1]. Learn more about this evolution in our article on Insurance Back Office Automation.

Key AI Technologies in Modern Claims Management Software

Modern claims software uses a suite of AI technologies.

Machine Learning (ML) is the foundation. Algorithms learn from past claims to recognize patterns and make predictions, such as routing claims to the right adjuster or flagging potential fraud [3]. We train our models on P&C insurance data to create "insurance-grade AI" that delivers expert-level accuracy [1]. For a deeper dive, visit Insurance Claims Machine Learning.

Natural Language Processing (NLP) allows AI to understand written text. It extracts key details from adjuster notes, police reports, and medical assessments, and can even detect sentiment in customer emails to flag frustrated policyholders [4].

Computer Vision gives AI the ability to interpret images and videos. For auto and property claims, it can assess damage from photos, verify vehicle information, and detect when a photo is submitted for multiple claims.

Generative AI (GenAI) acts as an efficient assistant. It can draft claim summaries, write personalized communications to policyholders, and help adjusters find information buried in lengthy documents [4].

The Rise of Agentic AI for Complex Tasks

While the above technologies are powerful tools, Agentic AI is a digital coworker. It acts autonomously to manage entire workflows with minimal human supervision [6]. Unlike other AIs that follow rules or respond to prompts, Agentic AI can plan, break down complex goals into sub-tasks, and choose the best strategy to achieve them [6].

In P&C claims, an Agentic AI can receive a First Notice of Loss and then independently extract data, check policy coverage, flag fraud indicators, and draft policyholder communications. This happens automatically, while the system learns and improves through a 'P&C insurance common sense' layer [9]. These are not simple bots; they are sophisticated systems designed to collaborate with human adjusters, handling the administrative work so your team can focus on complex decisions and customer relationships.

Agentic AI augments human capabilities, giving your adjusters a tireless digital partner. Explore this concept in Rise of the Machines: A Friendly Guide to Agentic AI and Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI.

Citations:

[1] Agentech. Introduction: The New Era of Claims Management.

[2] EY. How a Nordic insurance company automated claims processing.

[3] Industry report on claims management automation.

[4] Industry report on the benefits of AI-driven insurance claims management.

[6] Agentech. Rise of the Machines: A Friendly Guide to Agentic AI.

[9] Agentech. Changing Insurance Claims: The Evolution from Generative AI to Agentic AI.

How to Implement AI Claims Automation: A Step by Step Guide

You've seen the potential of AI-powered claims automation. Now, let's discuss how to make it a reality. For P&C carriers, TPAs, and IA firms, implementing AI can be a straightforward process that transforms your operations without overwhelming your team.

Step 1: Assess Your Current Claims Workflow

Before you can improve your claims operation, you must understand its current state. Map your entire workflow from First Notice of Loss to settlement, identifying bottlenecks where claims pile up. Look at how your adjusters spend their time; the 30% they spend on administrative work is your opportunity [1]. Ask your team where errors occur most often and what parts of the process frustrate them and policyholders. Pay special attention to how you handle unstructured data like handwritten notes and photos, as this is where AI delivers the biggest impact. Our article Not Sure Where to Start With AI? offers practical guidance.

Step 2: Define Your Automation Goals and Scope

With a clear picture of your workflow, decide what you want to achieve. Be specific. Instead of a vague goal like "automate claims," focus on measurable outcomes. Identify the stages where automation will add the most value, such as First Notice of Loss processing, document indexing, or triage. Start with a focused, modular deployment. For example, begin by automating data extraction from medical bills in workers' compensation claims. These targeted wins build momentum and prove AI's value. Set clear targets, like "reduce claim intake time by 50%" or "achieve 70% straight-through processing for routine claims."

Step 3: Choosing the Right AI-Powered Claims Automation Solution

This decision is critical. The first choice is whether to build a solution in-house or buy one. Building requires a significant investment in time, money, and specialized talent, distracting from your core business. For most P&C organizations, buying a specialized SaaS claims software solution is more practical. You get a proven solution that can be implemented in months, not years.

When evaluating vendors, prioritize API integration. The AI must work seamlessly with your existing claims software. At Agentech, we design for "no friction, just change," plugging into your current setup without requiring a complete overhaul [9]. Scalability is also crucial; the solution must handle fluctuating claim volumes without issue. Ensure any vendor meets strict data security and compliance standards. Finally, choose a partner with deep P&C insurance expertise. Generic AI won't understand P&C insurance nuances. You need 'insurance grade AI' trained on claims specific data [1]. For more on this, read Buy vs. Build: Navigating the SaaS AI Technology Decision and Artificial Intelligence (SaaS) Explained: Your Ultimate Guide.

Step 4: Manage Implementation and Empower Your Team

Successful implementation is about people as much as technology. Communicate clearly with your team, emphasizing that AI will handle repetitive tasks, freeing them for more meaningful work. Invest in adjuster training so they understand how to work alongside AI, trusting its recommendations while knowing when to intervene. The human in the loop approach is critical; AI prepares the groundwork, but the adjuster makes the final call on complex claims.

Position AI as a digital coworker, not a replacement. Our AI agents are designed to be collaborative partners that handle tedious tasks, making adjusters more productive and satisfied. Measure success not just by efficiency metrics but also by employee and policyholder satisfaction. Start with a pilot group of early adopters to gather feedback and build advocacy before a company-wide rollout. This journey requires patience, but the payoff in productivity, accuracy, and satisfaction is well worth the effort. Learn more in The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers.

Citations: [1] Context from previously written sections [9] Company information: Agentech

The Future of Claims: Trends and the Evolving Role of Adjusters

The landscape of P&C insurance claims is constantly evolving, with AI-powered claims automation at the forefront. As we look ahead, we see exciting trends and a new, more strategic role for human adjusters.

Overcoming Potential Challenges in AI Automation

Implementing AI-powered claims automation has challenges, but they are manageable. Data quality is paramount; AI is only as smart as the data it learns from, so robust data governance is essential. AI bias can arise if training data reflects historical inequities, requiring careful data selection and human oversight. Hallucinations, where AI generates plausible but incorrect information, can be managed with strong validation logic and human review [6]. Solutions must also be transparent and auditable to meet regulatory compliance standards [3, 6]. Finally, implementation costs and change resistance can be addressed with clear communication and a phased rollout that demonstrates early wins. Our article AI in Insurance: Balancing Innovation and Regulation explores this further.

The New Role of the Human Adjuster

AI-powered claims automation does not replace human adjusters; it lifts them. By automating the tedious administrative tasks that consume 30% of an adjuster's day, AI frees them to focus on what humans do best. Strategic thinking becomes central as adjusters analyze complex cases and make sophisticated judgments. They can dedicate their expertise to complex claims that require nuanced investigation, while AI handles more straightforward ones.

Most importantly, adjusters can devote more energy to customer empathy and relationship building. A person experiencing a loss needs compassion, which AI cannot provide. Adjusters also become the key point for exception handling, stepping in when AI flags an anomaly. In this AI-driven environment, adjusters become super-adjusters, empowered by intelligent tools that handle the grunt work. They collaborate with AI as a coworker, a philosophy central to our design process. Learn more in AI Designed With Adjusters In Mind.

Future Trends in AI for P&C Insurance Claims

The future of AI-powered claims automation is bright. Hyperautomation is expanding to create seamless, end-to-end workflows that integrate AI across the entire claims lifecycle. Predictive analytics is shifting the industry from reactive to proactive, identifying risks before they become claims. Personalized customer journeys will become the norm, with AI enabling customized communication and settlement options. We are also seeing advanced data synthesis, where AI pulls information from diverse sources like IoT devices and weather patterns to create richer claims assessments.

A European P&C insurance company offers a glimpse of this future, having implemented AI to automate unstructured data processing, which dramatically increased efficiency and improved customer experience [2]. Early adopters of AI are gaining a competitive advantage that will only grow over time. To dive deeper, read The Future of Insurance: How AI is Changing the Game.

Citations:

[2] EY. How a Nordic insurance company automated claims processing. https://www.ey.com/en_no/insights/financial-services/emeia/how-a-nordic-insurance-company-automated-claims-processing

[3] Industry report on claims management automation.

[6] Industry report on AI in claims management.

Frequently Asked Questions about AI in Claims

How does AI handle unstructured data in claims documents?

This is a key differentiator for AI-powered claims automation. Traditional systems fail because claims data—handwritten notes, photos, and varied report formats—is messy. AI thrives in this environment. It uses Optical Character Recognition (OCR) to convert images to text, then Natural Language Processing (NLP) to understand the context and extract key information like names, dates, and policy numbers. Machine Learning (ML) learns from vast datasets to classify documents and extract data accurately, even from unfamiliar formats. The result is that AI converts messy, unstructured data into clean, structured information ready for automated processing. This is why AI can automate a high percentage of claims while older systems handle less than 10%.

Will AI replace claims adjusters?

No. Our philosophy at Agentech is that AI should be a digital coworker, not a replacement. AI-powered claims automation handles the high-volume, repetitive administrative tasks that consume about 30% of an adjuster's day. This frees skilled professionals to focus on what they do best: complex cases requiring human judgment, customer empathy during stressful times, and relationship building with stakeholders. Adjusters provide the critical oversight and exception handling that ensures every claim is handled fairly. AI makes adjusters more efficient and their jobs more satisfying by allowing them to apply their expertise where it matters most.

What is the typical ROI for AI claims automation?

The return on investment for AI-powered claims automation is significant and multifaceted for P&C carriers, TPAs, and IA firms. Organizations typically see a positive ROI within months, driven by several key benefits:

- Cost Reduction: Operational costs can be cut by up to 48% through reduced manual effort and prevention of claims leakage [6, 7].

- Productivity Gains: With productivity boosts of up to 75%, your existing team can handle more claims and focus on high-value work [8].

- Speed and Customer Satisfaction: Processing times drop from weeks to minutes, with some solutions resolving over 67% of routine claims instantly [6]. This directly addresses the top customer complaint, which is slow settlements, and can reduce wait times by 60% [3, 4, 8].

- Improved Accuracy: Improved fraud detection and more consistent decision-making contribute to a healthier combined ratio [6, 7].

For modern P&C organizations, AI claims automation is a compelling investment that improves efficiency, reduces costs, and improves both the employee and customer experience.

Citations:

[3] Industry report on claims management automation.

[4] Industry report on the benefits of AI-driven insurance claims management.

[6] Industry report on AI in claims management.

[7] Industry case study on claims automation.

[8] Industry report on AI-powered insurance automation.

Conclusion: Start Your Claims Change Journey

AI-powered claims automation is no longer a future concept; it's a present-day reality changing how P&C insurance carriers, TPAs, and IA firms handle claims. This is a fundamental rethinking of the claims process, offering a significant competitive advantage to early adopters. While others remain bogged down by manual data entry, your organization could be settling claims in minutes instead of weeks.

Your policyholders will notice the speed, and your adjusters will feel the relief of focusing on meaningful work. At Agentech, we believe the best technology is invisible. Our AI Agents integrate seamlessly into your existing claims software, augmenting your team's capabilities without disruption. They act as digital coworkers, empowering your adjusters to apply their expertise to complex cases and provide the human empathy that builds lasting loyalty.

Future-proofing your business means embracing tools that make your team stronger. You've seen the data and understand the benefits. Now is the time to act.