Why AI Customer Service is Changing Insurance Operations

AI customer service insurance solutions are revolutionizing how insurers manage customer interactions, claims, and overall efficiency. Here’s a look at the key applications and benefits:

Key AI Applications in Insurance:

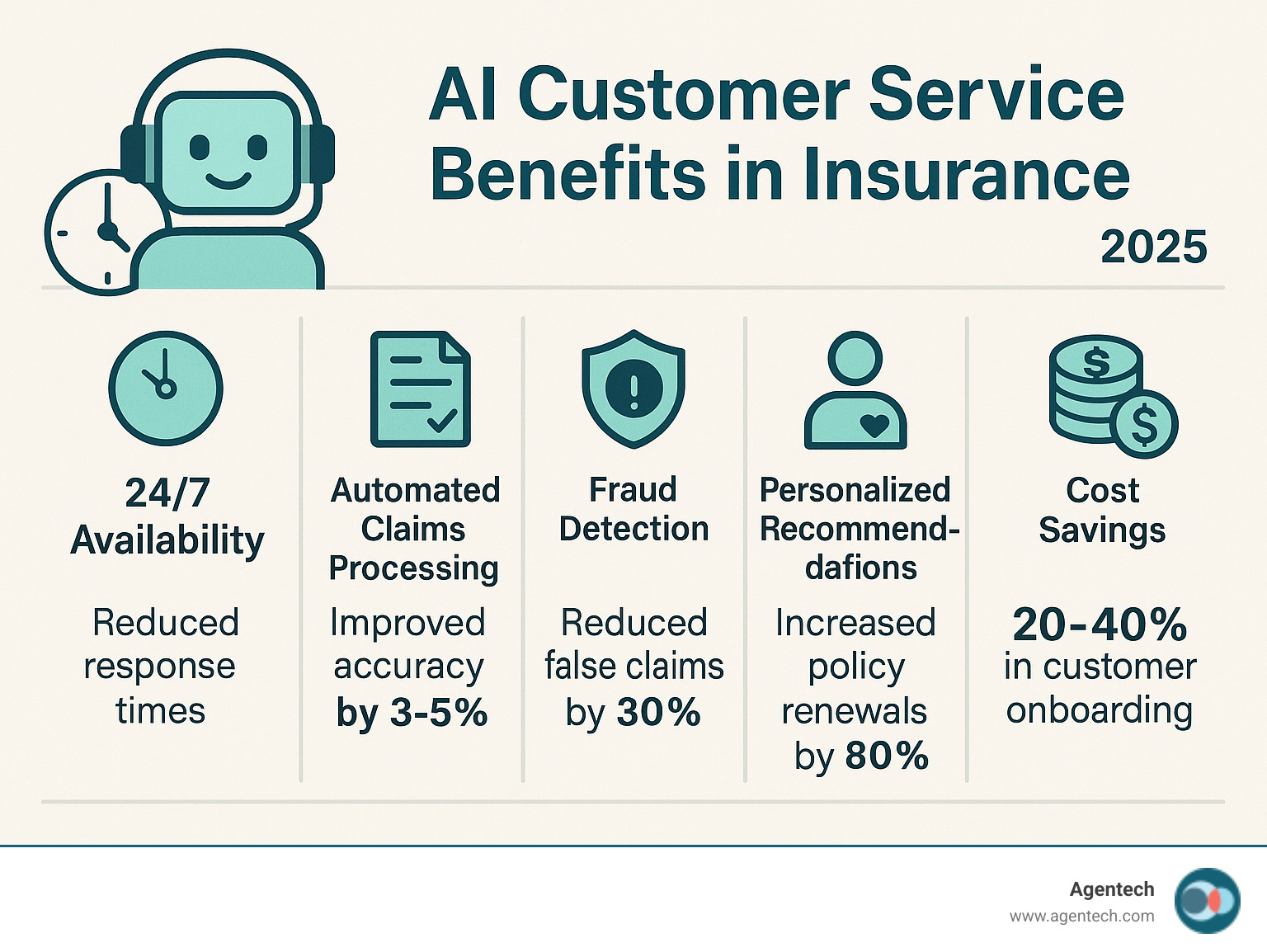

- 24/7 automated support via chatbots and virtual assistants

- Instant claims processing: AI can assess simple auto claims in 6 seconds, versus nearly 7 minutes for humans.

- Fraud detection using pattern and anomaly recognition.

- Personalized policy recommendations based on customer data.

- Automated routine tasks like billing inquiries and policy updates.

Core Benefits:

- Cost reduction of 20-40% for customer onboarding.

- Improved accuracy by 3-5% in claims processing.

- Customer satisfaction increases of 36 percentage points.

- Complaint reduction by up to 65%.

The insurance industry is undergoing a digital change driven by new customer expectations for instant, personalized, and seamless experiences. Traditional customer service models are struggling to keep pace.

The competitive advantage is clear: AI leaders in insurance have generated 6.1 times the Total Shareholder Return of AI laggards over the past five years. Companies that fail to adopt AI risk being left behind.

Technology is moving beyond simple chatbots to sophisticated generative AI that can understand context, detect emotion, and hold human-like conversations. These advances are reshaping the entire customer journey.

I'm Alex Pezold, and through my experience in technology, I've seen how ai customer service insurance solutions can revolutionize operations. At Agentech AI, we're building the AI workforce that's changing insurance with unprecedented speed and accuracy.

The Foundation: What is AI in Insurance Customer Service?

Think of AI customer service insurance as a digital teammate that automates tedious tasks and delivers personalized service. At its core, it uses conversational AI—technology that enables computers to chat like humans. This is achieved by combining Natural Language Processing (NLP) with Machine Learning (ML).

NLP helps AI understand the real meaning behind a customer's words, even if they're informal or emotional. ML allows these systems to learn from every interaction, continuously improving their responses. The most visible applications are AI chatbots and virtual assistants, which work 24/7 to handle everything from simple questions to complex policy changes. They are sophisticated systems capable of data analysis and automation that are reshaping the industry.

The future of AI in changing insurance is not just about speed; it's about making AI an integral, evolving part of every customer interaction.

How AI Understands and Responds to Customers

Human language is complex, filled with slang and emotion. This is where AI's capabilities shine:

- NLP for intent recognition: When a customer types, "My basement is underwater," the AI recognizes it as an urgent property damage claim, routing them to the right help immediately.

- Sentiment analysis: The AI detects if a customer is calm, frustrated, or panicked. A distressed customer can be prioritized for human assistance, while routine queries receive efficient automated help.

- Context-aware conversations: The AI remembers previous interactions, so customers don't have to start from scratch each time they make contact.

- Voice recognition: This technology allows customers to speak naturally to AI systems, making interactions more accessible.

- Continuous learning: Every conversation makes the system smarter and more helpful for the next customer.

The Core Benefits for Insurers and Policyholders

Effective AI customer service insurance solutions create wins for both insurers and their customers.

- 24/7 availability: Accidents and emergencies don't keep business hours. AI assistants are always available to start claims or answer urgent questions, providing peace of mind.

- Cost reduction: By handling routine tasks, AI allows human agents to focus on complex issues. This can lead to a 20-40% reduction in customer onboarding costs alone.

- Increased efficiency and accuracy: AI processes information at high speed, leading to faster claims processing. This speed comes with improved accuracy of 3-5%, meaning fewer errors.

- Personalized experiences: AI learns from each interaction to provide service that feels custom, remembering preferences and policy details.

- Improved customer satisfaction: Prompt, accurate, and personalized service leads to happier customers. Satisfied customers are 80% more likely to renew their policies, and AI can reduce complaints by up to 65%.

This isn't about replacing humans, but about making every interaction more meaningful.

How AI is Revolutionizing the Insurance Customer Journey

AI customer service insurance solutions are changing the traditionally cumbersome insurance journey into a smoother, faster experience. From the first notice of a claim to routine policy management, AI is reshaping every touchpoint.

This change begins with the First Notice of Loss (FNOL). AI can guide a stressed customer through the process with clarity, gathering necessary information 24/7. For policy management, customers can check coverage or update information by simply asking a question, without waiting on hold.

Behind the scenes, AI provides powerful underwriting support by analyzing data to assess risk more accurately, leading to better pricing. In sales and lead generation, AI can engage website visitors to provide personalized recommendations. Customer onboarding becomes a guided conversation, helping new policyholders understand their coverage and start their relationship with confidence.

Streamlining Claims: From 6 Minutes to 6 Seconds

One of the most dramatic changes is in claims processing. AI can assess simple auto insurance claims in just six seconds based on photos, compared to nearly seven minutes for a human. This is a improvement for customers dealing with property damage.

- Automated damage assessment: Computer vision analyzes photos of damage, providing a preliminary estimate within seconds.

- Real-time status updates: Customers receive automatic updates on their claim's progress, reducing anxiety and follow-up calls.

- Fraud detection: AI spots irregularities that may indicate fraud, protecting honest policyholders from higher premiums. Suspicious claims are flagged for human review.

- Reduced human error: Automating data entry and initial assessments minimizes mistakes that can delay claims.

The result is faster settlements. Our AI is designed to support adjusters, not replace them. It handles repetitive tasks, allowing human experts to focus on complex cases requiring empathy and nuanced judgment.

Personalizing Policies and Boosting Sales

AI makes true personalization profitable. Instead of one-size-fits-all policies, AI enables coverage that fits a customer's actual life.

- Data-driven recommendations: AI analyzes a customer's situation to suggest relevant coverage.

- Predictive analytics: The system can identify life changes—like a marriage or home purchase—that may require new coverage, creating natural sales opportunities.

- Helpful cross-selling: When AI identifies a genuine gap in protection, such as suggesting renters insurance to a new auto policyholder who rents, the offer feels like a service, not a sales pitch.

- Custom communication: Messages are timed and custom to each customer. This personal touch is why satisfied customers are 80% more likely to renew their policy.

Enhancing Day-to-Day Support and Engagement

AI shines in the everyday interactions that build lasting customer relationships.

- Answering FAQs: Get instant, accurate answers about policy numbers, deductibles, or coverage details without navigating phone trees.

- Handling billing inquiries: Check balances, make payments, or set up payment plans through a simple, conversational interface.

- Processing policy changes: Simple updates like an address change or adding a vehicle are handled automatically.

- Proactive outreach: AI can send helpful, personalized reminders about payments or suggest policy reviews based on life events.

This efficient, always-on support makes insurance feel less like a chore and more like a conversation, building a foundation for long-term loyalty.

Your Playbook for Implementing AI Customer Service in Insurance

Adopting ai customer service insurance is a strategic move that requires a thoughtful plan. Without a clear roadmap, even the best technology can lead to confusion.

First, engage in strategic planning. Define your goals clearly. Are you aiming for faster response times, reduced paperwork, lower complaint volumes, or all of the above? This vision will guide every decision.

Next, focus on change management. You're not just installing software; you're reshaping how your team works. Communicate how AI will eliminate tedious tasks, allowing employees to focus on higher-value work like building relationships and solving complex problems. Effective change management represents half the effort of a successful AI transition.

Data security and regulatory compliance are non-negotiable. Insurance companies handle highly sensitive data, so your AI solution must comply with regulations like GDPR, CCPA, and HIPAA. This requires robust encryption, strict access controls, and regular security audits.

Finally, be prepared to address legacy systems and data silos. These common challenges can be overcome with a modular and flexible AI architecture, turning potential roadblocks into stepping stones.

Choosing Your AI Teammate: Rule-Based vs. Generative AI

Different AI types are suited for different tasks. Understanding the distinction is key to choosing the right solution.

- Rule-based chatbots are highly efficient for predictable, high-volume questions like, "What are your hours?" or "How do I pay my bill?" They follow a script perfectly but lack the ability to handle complex or unexpected queries. They are reliable and cost-effective for simple tasks.

- Generative AI chatbots, powered by large language models, can understand context, nuance, and emotion. They can guide customers through complex claims, offer personalized advice, and hold human-like conversations. They require a larger initial investment but open up a much wider range of capabilities.

Where should you start? Often, a rule-based system can handle a majority of your inquiry volume, providing immediate ROI. As you mature, you can layer in generative AI for more complex interactions.

The Build vs. Buy Decision for your AI Customer Service Insurance Platform

This is a critical decision. Building in-house offers complete control but requires a specialized team of AI engineers and data scientists, and the time to market can be years. Maintaining and updating the technology is also a continuous, costly effort.

Buying a platform via SaaS AI technology is typically the smarter choice for most insurers. It offers faster deployment, predictable costs, and automatic scalability. The vendor handles the technological heavy lifting, allowing you to focus on serving customers. Modern platforms offer robust configuration, providing the benefits of cutting-edge AI without the need to become an AI company.

Key Risks and How to Mitigate Them

Implementing AI comes with risks that must be managed proactively.

- Data privacy: A breach can destroy trust. Mitigate this with military-grade encryption, strict access controls, and full compliance with data protection regulations.

- Algorithmic bias: AI can amplify biases present in its training data. Combat this with careful data curation, regular bias audits, and strong ethical AI guidelines.

- Cybersecurity threats: Hackers are also using AI. Stay ahead with multi-layered security protocols and regular penetration testing.

- Seamless human handoff: When AI reaches its limits, the transition to a human agent must be smooth. The AI should provide the agent with a full interaction summary so the customer doesn't have to repeat themselves.

- Maintaining the "human touch": True empathy is human. For major losses like a house fire, AI should handle the paperwork, freeing up human agents to provide the care and compassion customers need.

The Future: Agentic AI as Your Digital Coworker

The evolution of AI in insurance is moving beyond chatbots toward Agentic AI. Think of Agentic AI not as a tool, but as a digital coworker—an intelligent agent that can understand goals, plan actions, execute tasks, and learn from feedback with minimal human oversight.

These AI copilots and digital coworkers are set to revolutionize the industry by handling a full spectrum of self-service automation. The future of work will involve human professionals collaborating with AI agents on complex claims and underwriting decisions.

Generative AI is the backbone of these systems. This technology holds immense potential, with some reports projecting it could boost Canada’s economy by C$187 billion annually by 2030. For insurance, this means unprecedented hyper-personalization, where AI agents can proactively manage risks and suggest preventive measures based on real-time data.

Imagine an AI agent that automatically assesses a property's risk by factoring in hyper-local weather patterns, historical claims data, and drone imagery. This proactive risk management allows insurers to offer more accurate pricing and help policyholders avoid claims. The ability to integrate unique expertise into these agentic systems will become a core part of an insurer's intellectual property.

Frequently Asked Questions about AI Customer Service Insurance

Here are answers to the big questions we hear about implementing ai customer service insurance.

Will AI completely replace human customer service agents in insurance?

No. AI is not here to replace agents but to make their jobs better. It acts as the ultimate teammate by handling repetitive, administrative tasks that consume valuable time. This frees up your human agents to focus on what they do best: applying empathy, managing complex cases, and building relationships with customers during critical moments.

When a customer is dealing with a serious loss, they need a caring human. AI empowers agents by giving them more time for these crucial interactions. This approach addresses the insurance labor challenge with innovation, making work more meaningful and operations more efficient.

How do you measure the ROI of an AI customer service solution?

Measuring the return on your AI investment is straightforward when you track the right key metrics:

- Cost savings: Expect 20-40% reductions in customer onboarding costs and significant savings from automating routine inquiries.

- Average handling time (AHT): Resolution times drop dramatically when AI handles initial data gathering, allowing agents to help more customers faster.

- Customer satisfaction (CSAT) scores: We've seen increases of up to 36 percentage points. Happy customers are loyal customers.

- First contact resolution (FCR): AI's ability to provide immediate, accurate answers reduces callbacks and follow-ups.

- Complaint reduction: AI can cut customer complaints by up to 65%, freeing your team from damage control.

- Employee satisfaction: When your team isn't bogged down by paperwork, they are more engaged and less likely to leave, reducing turnover costs.

Is it safe to use AI for handling sensitive policyholder data?

Yes, provided you partner with a vendor who prioritizes security. A well-implemented AI solution can make your data more secure, not less. Key security measures include:

- Data encryption: All information is protected with advanced encryption, both in transit and at rest.

- Compliance: The platform must ensure full adherence to regulations like GDPR, CCPA, and HIPAA, often backed by certifications like ISO 27001 and SOC 2 Type 2.

- Secure infrastructure: The solution should run on robust, monitored systems with multiple layers of protection against threats.

- Access controls: Strict authentication and permission systems ensure only authorized personnel can view sensitive data.

- Regular security audits: Independent experts should regularly test for vulnerabilities to keep the system secure.

Choosing a trusted vendor with a proven track record is essential for protecting customer information while delivering powerful AI capabilities.

Conclusion: Make AI Your Most Valuable Player

The message is clear: AI customer service insurance is no longer a future concept. It's a present-day reality that is fundamentally changing the industry for the better.

We've seen that AI can process a simple auto claim in six seconds, slash customer complaints by 65%, and boost satisfaction scores by 36 percentage points. These numbers represent real people getting faster, better help when they need it most.

AI is a strategic partner, not a replacement for your team. It handles the repetitive tasks, freeing your human agents to apply empathy, solve complex problems, and build genuine customer relationships. This empowerment of human agents is where the real magic happens. A customer facing a major loss needs human compassion, and AI creates the time for it.

In today's market, gaining a competitive edge is essential. Insurers leading with AI are generating significantly better returns than those lagging behind. At Agentech, we've seen this firsthand. Our AI agents make your adjusters superheroes by handling the administrative burden, allowing them to focus on the work that matters.

The future is a hybrid human-AI workforce where each plays to their strengths: human empathy and creativity combined with AI's speed and accuracy. Together, they create an experience that neither could achieve alone. The technology is ready. Your customers are waiting.