The Tipping Point for Claims: Why Change is No Longer Optional

AI driven claims management uses artificial intelligence technologies like machine learning, natural language processing, and optical character recognition to automate and improve the insurance claims process. Here's what it delivers for P&C insurers:

- Speed: Process routine claims in minutes instead of days or weeks

- Accuracy: Reduce manual data entry errors and improve decision consistency

- Cost Savings: Achieve 20 to 40% reduction in operational costs

- Customer Satisfaction: Resolve claims faster with 24/7 automated support

- Fraud Detection: Identify suspicious patterns and photo reuse across claims

Core Technologies:

- Machine learning for damage assessment and risk prediction

- Natural language processing for document analysis

- Optical character recognition for data extraction

- Predictive analytics for fraud detection and claim triage

The pressure on claims managers has never been greater. Property claims volume surged 36% in 2024, driven by a 113% spike in catastrophe related claims. At the same time, 31% of policyholders report dissatisfaction with their claims experience, and 60% cite slow settlement speed as the main reason. (Accenture, 2022)

Behind these numbers is a harsh reality. Claims handlers spend roughly 30% of their time on low value administrative work like reviewing documents and entering data. Manual processing creates bottlenecks, drives up costs, and leads to adjuster burnout. Furthermore, traditional rules based systems are limited, with only a small fraction of claims qualifying for straight through automation.

The stakes are high. Poor claims experiences could put up to $170 billion in global insurance premiums at risk by 2027. (Accenture, 2022) For carriers, TPAs, and independent adjusting firms, the choice is clear: modernize claims operations or lose market share to competitors who already have.

This is where AI driven claims management changes everything. Early adopters are seeing 80 to 90% reductions in document review time, faster claim resolution cycles, and significant cost savings. A European insurer projects 20 to 30% productivity improvements through AI adoption. (Boston Consulting Group, 2023)

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance with a focus on changing claims processing through AI driven claims management. After founding and scaling TokenEx to one of Oklahoma's largest tech exits, I'm now dedicated to helping P&C insurers modernize their operations with practical, implementable AI solutions.

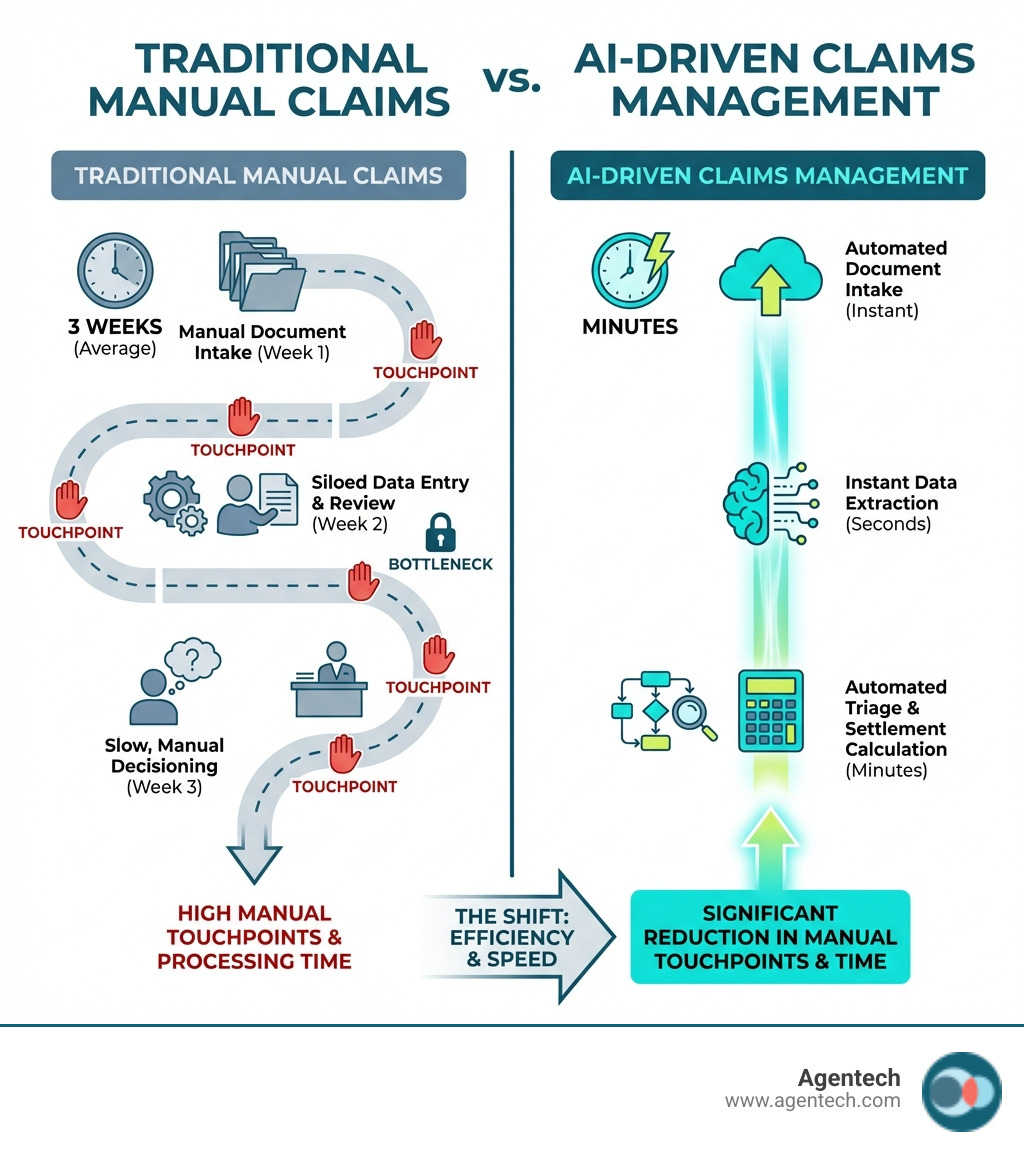

The Shift from Traditional to AI Driven Claims Management

For decades, traditional claims processing has been a paper heavy, manual endeavor. It often involves adjusters sifting through stacks of physical documents or digital scans, manually extracting data, and making subjective decisions based on limited, siloed information. This labor intensive approach is slow, prone to human error, and costly. It leaves little room for adjusters to focus on complex cases or provide empathetic support to policyholders.

AI driven claims management, on the other hand, revolutionizes this process. It employs sophisticated artificial intelligence technologies to automate repetitive tasks, analyze vast amounts of data with unparalleled speed and accuracy, and provide adjusters with actionable insights. This is not about replacing human judgment, but augmenting it. We call this augmented intelligence: AI acts as a powerful co pilot, empowering adjusters to work more efficiently and effectively.

Here is a comparison of traditional versus AI driven claims management:

| Metric | Traditional Claims Processing | AI Driven Claims Management |

|---|---|---|

| Speed | Weeks to months, manual data entry, slow communication | Minutes to days, automated data extraction, instant updates |

| Accuracy | Prone to human error, inconsistent decisions | High accuracy, consistent application of rules, data validation |

| Cost | High operational costs, significant labor investment | Reduced operational costs, lower claims leakage, optimized resources |

| Customer Satisfaction | Often dissatisfied due to delays and lack of transparency | High satisfaction due to faster resolution, proactive communication |

| Fraud Detection | Reactive, relies on manual review, often misses patterns | Proactive, identifies complex patterns, flags suspicious activity |

| Adjuster Focus | Burdened by administrative tasks | Focused on complex cases, customer empathy, strategic decisions |

Core Technologies Powering the Revolution

The magic behind AI driven claims management lies in its sophisticated technological foundation. These core components work in concert to transform raw data into actionable intelligence:

- Machine Learning (ML): At the heart of AI claims, ML algorithms learn from vast datasets to identify patterns and make predictions. For example, ML can predict the severity of a claim, estimate repair costs, or even forecast the likelihood of litigation. This continuous learning improves accuracy over time. To dive deeper into this, read our article on Machine Learning in Claims Processing.

- Natural Language Processing (NLP): Claims involve a lot of unstructured text: police reports, medical records, policy documents, emails. NLP allows AI to understand, interpret, and generate human language. It can extract key information from dense text, summarize documents, and even draft communications.

- Optical Character Recognition (OCR): Many claims documents still arrive as scanned images or PDFs. OCR converts these image based documents into machine readable text. Combined with NLP, it allows the system to "read" and understand documents that would otherwise require manual data entry.

- Predictive Analytics: Building on ML, predictive analytics uses statistical models to forecast future events. In claims, this means predicting fraud risk, determining the likelihood of subrogation, or identifying claims that are likely to escalate in cost or complexity.

- Computer Vision: This technology enables AI to "see" and interpret images and videos. For example, in auto claims, computer vision can analyze photos of vehicle damage to identify damaged parts, estimate repair costs, and even assess the severity of an accident.

- Generative AI: A cutting edge development, generative AI can create new content, such as drafting initial claim summaries, generating personalized customer responses, or even simulating accident scenarios for training purposes. It is reshaping how we interact with claims data and automate complex tasks.

How AI Transforms the Claims Workflow

From the moment a claim is reported until its final settlement, AI seamlessly integrates into and improves every step of the P&C insurance claims workflow:

- First Notice of Loss (FNOL): AI powered chatbots or virtual assistants can guide policyholders through the initial claim submission, capturing necessary details and documents efficiently and accurately, often 24/7.

- Automated Data Extraction: Using OCR and NLP, AI automatically extracts relevant information from various documents like incident reports, medical bills, and policy details. This eliminates manual data entry, drastically reducing errors and processing time.

- Triage and Assignment: AI analyzes incoming claims for severity, complexity, and potential fraud indicators, then intelligently triages them and assigns them to the most appropriate adjuster, or even handles simple claims straight through processing.

- Coverage Verification: AI rapidly cross references claim details with policy terms and conditions, identifying coverage and exclusions with high accuracy. This ensures consistent decision making and reduces disputes.

- Damage Assessment: For auto or property claims, computer vision can analyze images or drone footage to assess damage, estimate repair costs, and even identify specific parts needed, speeding up the estimation process.

- Settlement Calculation: AI can assist in calculating appropriate settlement amounts by analyzing historical data, market rates, and policy specifics, providing adjusters with data driven recommendations.

- Workflow Automation: Beyond individual steps, AI orchestrates the entire claims journey, automating handoffs between tasks, sending reminders, and ensuring compliance. To understand the broader impact, explore our guide on Insurance Workflow Automation.

Opening up Key Benefits for P&C Insurers and Policyholders

The implementation of AI driven claims management is not merely an operational upgrade; it is a strategic imperative that delivers profound benefits for both P&C insurers and their policyholders.

Boosting Operational Efficiency and Reducing Costs

One of the most immediate and tangible benefits of AI in claims is its ability to dramatically boost operational efficiency and cut costs. As we know, claims handlers spend about 30% of their time on low value administrative tasks. AI minimizes this by automating document review, data extraction, and other repetitive processes.

- Reducing Review Time: AI powered tools can review medical records and legal demands, reducing document review time by up to 90%.

- Faster Claims Resolution: With automated processing, claims can be resolved significantly faster. For P&C insurers, this translates into faster payouts and happier policyholders.

- Lowering Indemnity Costs: AI can identify claims with a high likelihood of attorney involvement early on. For example, in workers' compensation, claims involving attorneys can have significantly higher indemnity costs. By predicting and proactively managing these cases, AI helps mitigate escalating costs.

- Minimizing Claims Leakage: AI's precision in coverage verification and fraud detection helps prevent overpayments and fraudulent claims, directly impacting the insurer's bottom line.

- Significant Cost Savings: Insurers adopting aggressive AI strategies can achieve cost savings between 20 to 40% in claims management. Even early adopters can see 5 to 25% savings. (Oliver Wyman, n.d.) This is a game changer for profitability. For more on this, see our article on Automated Claims Processing.

Enhancing Accuracy, Compliance, and Fraud Detection

Accuracy is paramount in claims processing, impacting everything from customer trust to regulatory adherence. AI significantly lifts this standard.

- Consistent Decision Making: AI applies rules and logic consistently across all claims, eliminating human bias and ensuring fair and equitable outcomes.

- Improved Data Accuracy: Automated data extraction and validation reduce errors inherent in manual entry, leading to a cleaner, more reliable dataset. For a deeper look, check out our insights on Insurance Claims Analytics Software.

- AI for Regulatory Adherence: The insurance industry is heavily regulated. AI driven solutions can steer complex compliance landscapes, driving auditability and transparency to protect data and mitigate risks associated with regulations like CCPA, CPRA, GLBA, and HIPAA.

- Identifying Fraudulent Patterns: AI excels at analyzing vast amounts of data from multiple sources to identify anomalies and suspicious patterns that human adjusters might miss. This can involve cross referencing claim details, policyholder history, and external data.

- Photo Similarity Scoring: AI can detect if the same photos of damage are being reused across multiple claims, a common tactic in fraudulent schemes, helping to prevent fraudulent payouts.

- Mitigating Risk: By accurately detecting fraud and ensuring compliance, AI helps insurers mitigate financial, reputational, and regulatory risks.

Creating a Superior Customer Experience

In today's competitive landscape, customer experience is a key differentiator. AI driven claims management is instrumental in delivering the responsive, transparent, and swift service policyholders demand.

- 24/7 Support with Chatbots: AI powered chatbots and virtual assistants provide instant support to policyholders, answering common questions, guiding them through the claims process, and offering personalized assistance around the clock. This significantly reduces wait times and improves satisfaction.

- Proactive Communication: AI can keep policyholders informed at every stage of their claim, sending automated updates and personalized notifications, enhancing transparency and reducing anxiety.

- Faster Settlements: With AI streamlining internal processes, claims are resolved much faster. This directly addresses the 60% of policyholder dissatisfaction caused by slow settlement speed. (Accenture, 2022) A faster, smoother process leads to happier customers. For more on improving customer satisfaction, refer to this industry report on improved claims experience for policyholders.

- Increased Policyholder Retention: Satisfied customers are loyal customers. A positive claims experience, facilitated by AI, leads to higher customer retention rates and stronger brand loyalty.

- Personalized Service: AI can analyze customer data to offer custom interactions, making each policyholder feel valued and understood. Explore how AI assists in customer service with our article on AI Customer Service Insurance.

AI in Action: Practical Use Cases in P&C Insurance

AI driven claims management is not a theoretical concept; it is actively being deployed across various lines of P&C insurance, delivering tangible results.

Auto Insurance Claims

Auto claims often involve visual evidence and standardized processes, making them ideal for AI intervention.

- Automated Damage Estimation from Photos: Policyholders can upload photos or videos of vehicle damage, which AI then analyzes using computer vision to identify damaged parts and estimate repair costs.

- Vehicle Parts Identification: AI can accurately identify specific vehicle parts and their condition, streamlining the repair estimation process.

- Total Loss Prediction: By comparing damage estimates with vehicle value, AI can quickly determine if a vehicle is a total loss, accelerating the settlement.

- Subrogation Opportunity Identification: AI analyzes claim data to identify instances where another party may be liable, flagging potential subrogation opportunities that might otherwise be missed.

- Streamlined First Notice of Loss: Tools like Automated Click to Claim Software allow for quick, digital claim submission directly from a smartphone.

Property & Casualty Insurance Claims

Property claims, particularly those involving catastrophes, are complex and high volume, benefiting immensely from AI.

- Drone and Satellite Imagery Analysis: For property damage, AI can analyze aerial imagery from drones or satellites to assess the extent of roof damage, structural issues, or flood impact, especially useful after large scale events.

- Catastrophe (CAT) Claim Triage: With property claims volume surging 36% in 2024, largely due to a 113% increase in catastrophe related claims, AI is crucial for rapidly triaging these claims, prioritizing the most severe, and deploying resources effectively. (Oliver Wyman, n.d.)

- Water Leak Detection: AI can analyze sensor data or images to pinpoint the source and extent of water damage, accelerating mitigation efforts.

- Contents Inventory Analysis: AI can help policyholders create and verify contents inventories, streamlining the personal property claims process.

- Comprehensive Applications: For a broader view, our article on AI Applications in Insurance Claims Processing details many more uses.

Workers' Compensation and Liability Claims

These claims are often characterized by extensive documentation and potential litigation, areas where AI provides critical support.

- Medical Record Summarization: AI uses NLP to review and summarize lengthy medical records, extracting key diagnoses, treatments, and prognoses, reducing review time by up to 90%.

- Litigation Risk Prediction: AI analyzes historical data, legal demands, and claim characteristics to predict the likelihood of a claim escalating to litigation, allowing for proactive intervention.

- Attorney Involvement Analysis: Given that workers' compensation claims with attorney involvement can be significantly more expensive, AI helps identify and manage these cases strategically.

- MSA Submission Streamlining: AI can accelerate the complex process of submitting Medicare Set Aside (MSA) proposals, which traditionally can take weeks.

- Automated Claim Profile Creation: One of the most tedious administrative tasks, creating the initial claim profile, can be automated by AI, as detailed in our article We Made AI Do the Most Tedious, Time Consuming Task in Claims Processing: Creating the Claim Profile.

Implementing AI: A Practical Guide for Carriers, TPAs, and IA Firms

While the benefits of AI driven claims management are compelling, successful implementation requires a thoughtful and strategic approach. It is not just about technology; it is about people, processes, and data. Carriers, TPAs, and IA firms often face challenges with integration into legacy systems, ensuring data quality and security, managing organizational change, and understanding the true cost and return on investment. If you are unsure where to begin, our guide Not Sure Where to Start with AI? offers a great starting point.

A Strategic Approach to AI Driven Claims Management Integration

Successfully integrating AI into existing claims workflows involves more than just plugging in new claims software. It demands a clear strategy and careful execution.

- Identify High Impact Use Cases: Start by targeting specific pain points where AI can deliver the most significant and measurable improvements, such as automated data extraction, fraud detection, or initial claim triage.

- Ensure Data Readiness: AI thrives on data. Clean, well structured, and comprehensive data is crucial. Invest in data governance and ensure your historical claims data is ready for AI training and analysis.

- Choose the Right Partner (Buy vs. Build): Decide whether to develop AI solutions in house or partner with specialized vendors. For most P&C insurers, leveraging proven, off the shelf AI platforms offers faster implementation and lower risk.

- Start with a Pilot Program: Begin with a small scale pilot in a controlled environment. This allows for testing, fine tuning, and demonstrating early successes without disrupting the entire operation.

- Focus on Adjuster Adoption and Training: AI is a tool to empower adjusters, not replace them. Provide comprehensive training, communicate the benefits, and involve adjusters in the design process to ensure smooth adoption and maximize efficiency gains.

- Measure ROI and Scale: Continuously monitor key performance indicators (KPIs) to measure the return on investment. Once successful, gradually scale the AI solutions across more claims types and departments.

The Human in the Loop: Why Adjuster Expertise Still Matters

Despite the power of AI, human judgment remains indispensable in claims management. AI is designed to augment, not automate entirely.

- Complex Claim Evaluation: AI can process facts, but complex claims often involve nuances, unforeseen circumstances, and subjective interpretation that require human adjusters.

- Empathy and Negotiation: When policyholders are facing difficult situations, empathy, compassion, and skilled negotiation are critical. These are uniquely human traits that AI cannot replicate.

- Customer Relationship Management: Building and maintaining trust with policyholders is a cornerstone of the insurance business. Human adjusters foster these relationships.

- AI as a Co Pilot: Think of AI as an intelligent assistant providing adjusters with data driven insights, automating tedious tasks, and flagging critical information. It is a co pilot, enhancing their capabilities. Our solutions are explicitly AI Designed with Adjusters in Mind.

- Final Decision Making: The responsibility for final claim decisions, especially those with significant financial or emotional impact, rests with a human adjuster.

The Future is Now: The Role of Generative AI in Claims

Generative AI (GenAI), the technology behind advanced language models, is not just a buzzword; it is actively reshaping the landscape of AI driven claims management. Its ability to understand context, generate human like text, and even create images is opening up new frontiers for efficiency and personalization.

How Generative AI is Reshaping AI Driven Claims Management

GenAI is taking automation and insight generation to unprecedented levels in P&C insurance claims.

- Automated Claim Summaries: GenAI can ingest all relevant documents and communications related to a claim and instantly generate a concise, accurate summary for adjusters, saving hours of manual review.

- Drafting Customer Communications: From initial acknowledgments to status updates and settlement offers, GenAI can draft personalized, clear, and compliant communications to policyholders, ensuring consistency and speed.

- Answering Adjuster Queries: Adjusters can query GenAI about specific policy clauses, historical precedents, or best practices, receiving instant, intelligent answers that inform their decisions.

- Advanced Risk Correlation: GenAI can analyze thousands of past loss appraisals from weather events to identify complex risk correlations and cost drivers, helping insurers better prepare for future catastrophes. (Boston Consulting Group, 2023)

- Significant Productivity Improvements: Large scale adoption of GenAI for administrative tasks related to claims is anticipated to improve productivity by 20 to 30%. (Boston Consulting Group, 2023) This allows adjusters to focus on high value, complex interactions. For more on this, read GenAI Will Write the Future of Insurance Claims.

Emerging Trends: From Agentic AI to Hyper Personalization

The evolution of AI in claims is continuous, with exciting new trends emerging.

- Agentic AI: This refers to AI systems that can act autonomously, performing sequences of tasks to achieve a goal. In claims, an agentic AI could manage an entire simple claim from FNOL to payout, coordinating with other systems and only escalating to a human when necessary. We are at the forefront of this with Agentic AI in Insurance: When Bots Become Your Best Agents.

- Proactive Risk Prevention: Beyond claims processing, AI will increasingly analyze data to predict and prevent incidents before they occur, such as identifying properties at high risk of water damage or vehicles prone to specific mechanical failures.

- Continuous Underwriting: AI will enable dynamic underwriting, where policies are continuously assessed and adjusted based on real time data, leading to more accurate pricing and personalized coverage.

- Hyper Personalization: Leveraging AI, insurers will be able to offer extremely personalized products, services, and claims experiences custom to individual policyholder needs and behaviors, further enhancing satisfaction and loyalty.

Conclusion: Empowering Adjusters and Changing Operations

The journey from manual to magical in claims management is well underway, powered by AI driven claims management. We have seen how AI is not just a technological advancement but a transformative force that redefines efficiency, accuracy, customer experience, and compliance in P&C insurance.

The benefits are clear: faster resolution times, significant cost reductions, superior fraud detection, and a much improved experience for policyholders. Most importantly, AI acts as an enabler, freeing adjusters from the drudgery of administrative tasks and allowing them to focus on what they do best: applying their expertise, empathy, and judgment to serve policyholders when they need it most.

For carriers, TPAs, and IA firms, embracing AI is no longer optional; it is a competitive advantage. Early adopters are already reaping substantial rewards, setting new benchmarks for operational excellence and customer satisfaction. We at Agentech AI are committed to making this transition seamless, providing AI powered automation tools and always on AI assistants that boost adjuster productivity without replacing the invaluable human element.

The future of claims is efficient, accurate, and customer centric. It is a future where AI and human intelligence work hand in hand, creating a more responsive, fair, and ultimately magical experience for everyone involved.

Explore our AI Agents to see how they can transform your claims process

Citations:

- Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research. https://newsroom.accenture.com/news/2022/poor-claims-experiences-could-put-up-to-170b-of-global-insurance-premiums-at-risk-by-2027-according-to-new-accenture-research

- Agentech. (n.d.). Machine Learning in Claims Processing. https://www.agentech.com/resources/articles/machine-learning-in-claims-processing

- Agentech. (n.d.). Insurance Workflow Automation. https://www.agentech.com/resources/articles/insurance-workflow-automation

- Agentech. (n.d.). Automated Claims Processing. https://www.agentech.com/resources/articles/automated-claims-processing

- Agentech. (n.d.). Insurance Claims Analytics Software. https://www.agentech.com/resources/articles/insurance-claims-analytics-software

- Agentech. (n.d.). AI Customer Service Insurance. https://www.agentech.com/resources/articles/ai-customer-service-insurance

- Agentech. (n.d.). Automated Click to Claim Software. https://www.agentech.com/resources/articles/automated-click-to-claim-software

- Agentech. (n.d.). AI Applications in Insurance Claims Processing. https://www.agentech.com/resources/articles/ai-applications-in-insurance-claims-processing

- Agentech. (n.d.). We Made AI Do the Most Tedious, Time Consuming Task in Claims Processing: Creating the Claim Profile. https://www.agentech.com/resources/articles/we-made-ai-do-the-most-tedious-time-consuming-task-in-claims-processing-creating-the-claim-profile

- Agentech. (n.d.). Not Sure Where to Start with AI?. https://www.agentech.com/resources/articles/not-sure-where-to-start-with-ai

- Agentech. (n.d.). AI Designed with Adjusters in Mind. https://www.agentech.com/resources/articles/ai-designed-with-adjusters-in-mind

- Agentech. (n.d.). Agentic AI in Insurance: When Bots Become Your Best Agents. https://www.agentech.com/resources/articles/agentic-ai-in-insurance-when-bots-become-your-best-agents

- Boston Consulting Group. (2023). GenAI Will Write the Future of Insurance Claims. https://www.bcg.com/publications/2023/the-future-of-insurance-claims

- Oliver Wyman. (n.d.). Generative AI and the Future of Claims Management. https://oliverwyman.com/content/dam/oliver-wyman/v2/publications/2025/may/Oliver-Wyman-Generative-AI-for-Claims-Management.pdf