Why Automated Click to Claim Software is Revolutionizing Insurance Operations

Automated click to claim software is changing how insurance companies handle claims by eliminating repetitive manual tasks and accelerating settlements through intelligent automation. Here's what you need to know:

Key Benefits:

- Reduced processing time: Up to 95% reduction in manual data entry tasks

- Cost savings: Up to 48% reduction in Total Cost of Risk

- Fraud prevention: Advanced AI detection saves insurers billions annually

- 24/7 availability: Customers can submit and track claims anytime

- Integration ready: Works with existing insurance systems and workflows

Main Types:

- Basic automation tools: Simple click and macro software for repetitive tasks

- Advanced claims platforms: End to end processing from FNOL to payment

- AI powered solutions: Intelligent document analysis and decision support

Insurance claims managers are drowning in paperwork. Manual claims processing consumes up to 84% of staff time on administrative tasks, while customers demand faster settlements and 24/7 service. Meanwhile, fraudulent claims cost U.S. insurers nearly $40 billion each year.

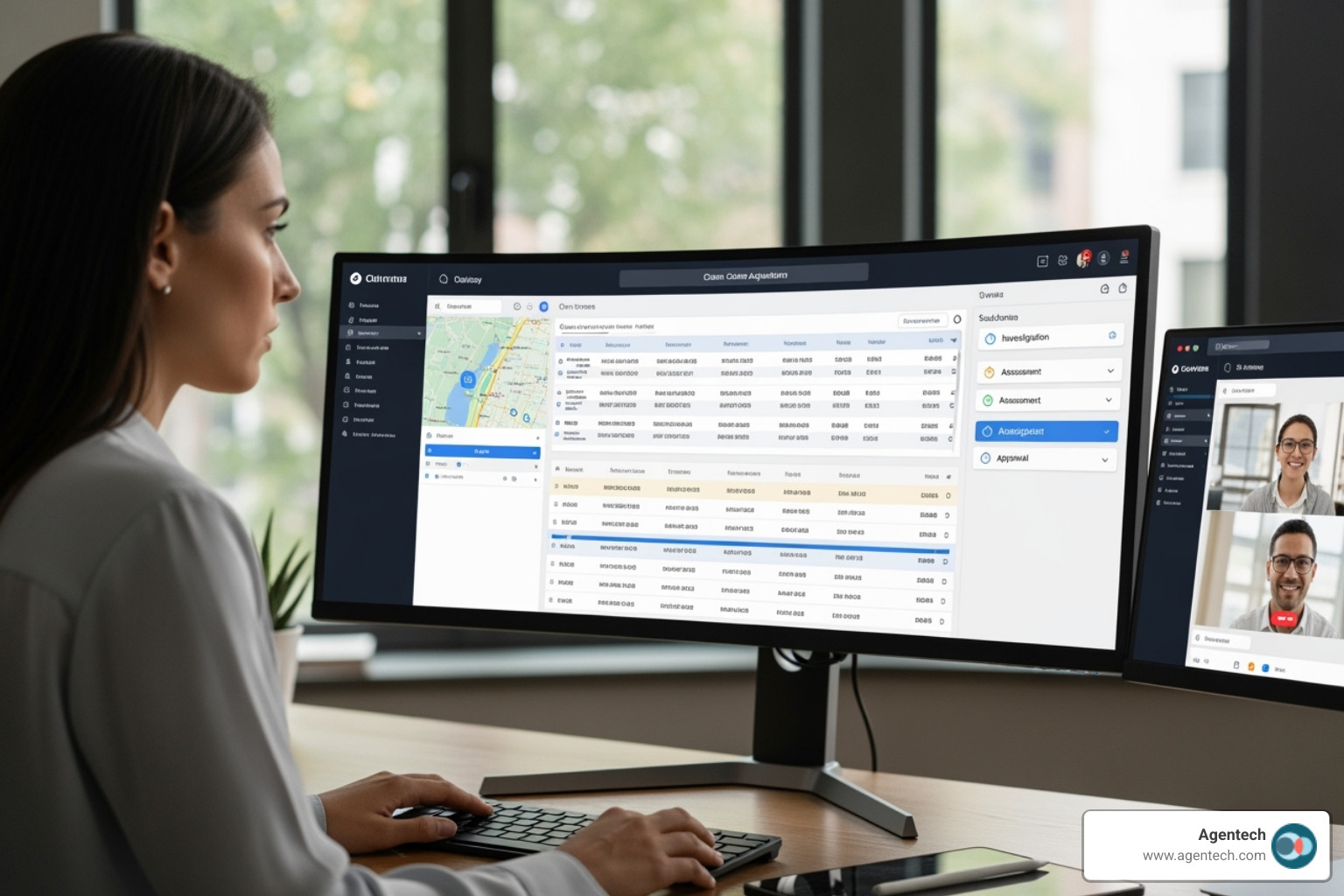

The solution is automation that handles routine tasks, freeing adjusters for complex cases. Modern automated click to claim software offers comprehensive workflow orchestration, AI powered fraud detection, and seamless system integration, going far beyond simple clicking tools.

As Alex Pezold, founder of Agentech AI, I've spent years building technology that scales businesses, culminating in my successful exit of TokenEx in 2021. At Agentech, we're revolutionizing the insurance industry with automated click to claim software that processes pet insurance claims with unprecedented speed and accuracy.

What is Automated Click to Claim Software and How Does It Work?

Think of automated click to claim software as your digital assistant that never sleeps, gets tired, or makes typos. This technology transforms how insurance companies handle claims by taking over repetitive tasks.

The software automates the entire claims process, from arrival to payment. It extracts data, routes tasks, and makes preliminary decisions using AI and machine learning. This frees your claims team to focus on complex problem solving and customer care during difficult times.

This is a major shift for the insurance industry. Instead of drowning in paperwork, companies can offer faster, more accurate service while staff focus on work requiring human judgment and empathy. The Future of Insurance: How AI is Changing the Game explores this change.

Understanding Basic Automation Tools

Let's start with the basics. Simple automation tools, like macros or auto clickers, handle repetitive clicking tasks by executing a predefined sequence of actions. They are great for simple data entry but lack the intelligence for complex insurance claims. They cannot adapt to unexpected events or make decisions. This is where modern automated click to claim software excels. It goes beyond simple clicking to understand context, analyze information, and make smart decisions.

Exploring Advanced Claims Automation Platforms

Advanced claims automation platforms are like a team of digital workers handling the complete claims journey. From the First Notice of Loss (FNOL) through final payment processing, these systems manage every step with remarkable efficiency.

When a claim comes in, the platform immediately gets to work. It pulls relevant information from emails, photos, and databases through sophisticated document analysis. This end to end processing means no more manual data entry, less hunting through different systems, and fewer human errors.

Modern platforms often feature a no code approach, allowing your team to configure workflows and rules without extensive IT support. You can adjust how claims are routed or add new verification steps yourself.

These systems excel with various claim types. For auto accidents, they process repair estimates and coordinate with shops. For property damage, they analyze photos and connect with contractors. For healthcare, they verify eligibility and process payments, catching errors.

At Agentech, our approach focuses on seamless integration with your existing systems. Our AI agents work alongside your team, handling tedious parts while your adjusters focus on cases that need human insight. You can see exactly How it Works on our platform.

The role of AI in claims and machine learning cannot be overstated. These technologies analyze patterns across thousands of claims, spot potential fraud, and guide your team through complex decisions. This workflow orchestration ensures nothing falls through the cracks while dramatically speeding up the entire process.

The Transformative Benefits for Insurers and Customers

The magic happens when automated click to claim software starts working behind the scenes. Insurance companies find they can slash costs while customers get the fast, transparent service they've been hoping for. It's a win win situation that addresses major pain points for both insurers and policyholders.

The numbers are impressive. Companies using advanced automation can see their Total Cost of Risk drop by up to 48%. This serious financial impact improves the bottom line through better fraud detection and smoother operations.

Consider this reality: fraudulent claims cost U.S. insurers nearly $40 billion annually. That's money that could be returned to honest policyholders. Smart automation helps catch these fraudulent patterns before they become expensive problems.

Gaining Efficiency and Reducing Costs

Automated click to claim software eliminates tedious tasks, reducing manual work by up to 84% and cutting time on data reports by 95%.

This means your claims adjusters can stop typing data and focus on complex cases that need human insight. They can investigate unusual claims, talk with customers, and make judgment calls that require experience.

This efficiency boost comes at a perfect time. The insurance industry faces a labor shortage, and automation helps existing teams handle more work without burning out. Solving the Insurance Labor Crisis with AI Driven Innovation explores how smart technology bridges this gap.

Fraud detection becomes much more powerful when AI systems analyze thousands of claims simultaneously. These systems spot patterns that human eyes might miss, like similar damage photos submitted for different claims. By catching fraud early, insurers protect their resources.

The cost savings extend beyond labor. Faster processing means lower administrative overhead and fewer errors that require expensive corrections. When systems handle routine tasks automatically, operational expenses drop significantly.

Enhancing the Customer Claims Experience

Filing an insurance claim is often frustrating. Traditional processes feel like a maze where customers submit paperwork and wait, unsure of the status.

Automated click to claim software transforms this experience. It offers 24/7 self service options for submitting claims, uploading photos, and checking status anytime, eliminating the need to wait for business hours.

The real game changer is faster settlements. When systems handle data entry, document analysis, and payment processing automatically, claims move through the pipeline much quicker. Customers get their money when they need it most.

Transparency becomes the new standard. Instead of wondering where their claim stands, customers receive automatic updates. This proactive communication builds trust and reduces anxiety.

Communication automation means customers don't have to call repeatedly for updates. The system keeps them informed, which also reduces call center volume and lets human staff focus on customers who need personal assistance.

This change in customer experience is essential for staying competitive. Designing for the Future: How AI Transforms the Claims Experience shows how forward thinking insurers are using technology to create better customer relationships.

When customers have positive claims experiences, they're more likely to renew their policies and recommend the company. That's how operational efficiency translates directly into business growth.

Key Features of Top Tier Automated Click to Claim Software

Choosing the right automated click to claim software can transform your claims operation. The best solutions don't just automate tasks; they improve how your entire team works together.

The features that matter solve real problems. Your software must integrate with existing systems, spot fraud effectively, and ensure top tier data security and compliance.

AI Driven Intelligence and Fraud Detection

The real magic happens when artificial intelligence works alongside your claims team. Modern automated click to claim software doesn't just follow rules; it learns, adapts, and gets smarter with every claim.

Predictive analytics uses historical data to forecast which claims may become complex or litigated, allowing you to focus resources proactively.

Anomaly detection acts as a fraud investigator, examining every claim. It flags anything unusual, like a suspicious injury pattern or billing code. This capability is invaluable, as reports suggest one in ten claims may be fraudulent.

The software excels at data cross referencing, comparing information across multiple databases faster than any human could. It might notice that the same accident was reported by different people or that a provider has an unusually high rate of certain procedures.

Natural language processing is where things get impressive. The system can read medical records, claim notes, and emails to extract key information automatically. It understands context and can even gauge the emotional tone of communications.

The shift toward agentic AI is particularly exciting because these systems are becoming truly proactive partners. Changing Insurance Claims: The Evolution from Generative AI to Agentic AI explores how this technology is reshaping the entire claims landscape.

Seamless Integration and Workflow Automation

Your new automated click to claim software should feel like it's always been part of your team. The best solutions integrate smoothly with your existing systems.

API capabilities are key to making everything work together. They allow your claims software to connect with policy, billing, and customer systems in real time, eliminating the need to switch between screens.

Integration with existing systems extends beyond internal tools. The software connects with appraisal services, payment processors, and fraud databases automatically. At Agentech, we've perfected this balance between ready to use efficiency and custom precision. A Hybrid AI Solution for Claims Automation: How Agentech Combines Out of the Box Efficiency with Custom QA Precision shows how we make this work.

The customizable rules engine lets you teach the software your company's unique way of doing things. For example, complex injury claims can always go to a specialist, or claims over a certain amount can require extra approval. The system learns these rules and follows them perfectly.

Automated task routing ensures the right person handles each claim from the start. No more claims sitting in the wrong queue. The software knows who's available and has the right expertise.

The choice between buying a ready made solution or building your own often comes down to how quickly you need these integrations working. Buy vs. Build: Navigating the SaaS AI Technology Decision can help you think through this important decision.

Robust Security and Compliance

When handling sensitive insurance data, security is the foundation. The best automated click to claim software treats your data like the precious asset it is.

Data encryption protects your information in transit and at rest, acting like an unbreakable safe for your data.

Access controls ensure that people only see what they need to see. The system enforces these boundaries automatically, reducing security risks and compliance headaches.

For health claims, HIPAA compliance is legally required. Top solutions also meet SOC 2 standards, proving their commitment to data security, and may adhere to PCI DSS, NIST, GLBA, and FISMA requirements.

Regulatory adherence helps you sleep better at night, knowing your software keeps up with changing regulations automatically. Instead of scrambling to update processes, your system adapts and keeps you compliant.

The insurance industry faces unique challenges balancing innovation with regulation. AI in Insurance: Balancing Innovation and Regulation dives deeper into how leading companies steer these waters.

Real World Impact and Future of Claims Automation

The theoretical benefits of automated click to claim software are compelling, but its true power is best understood through real world impact. Companies that have successfully implemented these solutions have seen dramatic improvements in efficiency, cost savings, and customer satisfaction.

The real world impact is significant. For example, some insurers have built and launched new claims systems in only a few months, dramatically reducing cycle times and issuing payments in minutes. Others have achieved five times faster claim payments through digitization. These examples underscore the tangible gains in operational excellence.

How to ensure successful adoption of automated click to claim software

Successfully implementing new technology requires a thoughtful strategy. Insurers must actively manage the transition, not just buy the software.

- Change management: Clearly communicate the benefits of the new system to all stakeholders. Address concerns and highlight how the technology will make their jobs easier and more impactful.

- Stakeholder buy in: Involve key users in the selection and implementation process. Their input is invaluable for tailoring the software to real world needs.

- Phased rollout: Consider a phased rollout, starting with a pilot program or a specific claim type to work out issues before wider deployment.

- Continuous training: Provide comprehensive and ongoing training to ensure users are proficient with the new system. Support resources like in app guidance are crucial.

- Feedback loops: Establish mechanisms for users to provide feedback on the software. This allows for continuous improvement and shows their input is valued.

Successful adoption means embracing AI agents as digital co workers, augmenting human capabilities rather than replacing them. The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers emphasizes this collaborative future.

The next wave: Agentic AI and hyper automation

Claims automation continues to evolve toward Agentic AI and hyper automation. This means orchestrating entire processes with intelligent, autonomous AI agents, not just automating single tasks.

- Conversational AI: Increasingly sophisticated conversational AI can handle initial claim intake, answer common queries, and guide policyholders through the submission process.

- Digital agents: These AI entities can perform complex, multi step tasks, make decisions, and learn from interactions. They can proactively manage claims and trigger actions without human intervention.

- Proactive claims management: With Agentic AI, systems can move beyond reactive processing to proactively identify claims that require special attention and suggest optimal resolution paths.

- End to end automation: The goal is a fully automated claims journey where AI handles most routine tasks, escalating to human adjusters only for complex or high empathy situations.

This represents a profound shift in insurance operations. How Agentic AI is Changing Insurance Operations offers a glimpse into this exciting future.

Frequently Asked Questions about Claims Automation Software

When insurance companies explore automated click to claim software, certain questions come up again and again. Implementing new technology is a big decision, so these concerns are understandable. Let me address the most common questions.

How does automation software improve fraud detection?

Fraud detection is where automation shines. With fraudulent claims costing U.S. insurers nearly $40 billion each year, and with reports suggesting one in ten claims may be fraudulent, this is a massive problem that requires advanced technology to solve effectively.

AI algorithms can process thousands of claims in the time it takes a human to review one. These systems learn from every fraudulent claim they've seen, building a sophisticated understanding of what fraud looks like. They use pattern recognition to spot connections impossible for humans to catch, like multiple claimants using the same unusual phrasing.

The real power comes from data cross referencing. While a human adjuster might check one or two databases, automated systems can instantly compare claim details against dozens of sources, including public records, previous claims history, and external fraud databases.

When something doesn't add up, the system generates anomaly alerts that flag the claim for human review. This means your adjusters spend their time investigating genuinely suspicious cases instead of manually reviewing hundreds of legitimate claims.

Can this technology integrate with our company's existing systems?

This is a common and practical question. The answer is yes. Modern automated click to claim software is built to work with your current technology, not replace it.

Most insurance companies have invested years in their technology stack. Today's automation solutions come with robust API capabilities that let them talk directly to your existing policy administration systems, billing platforms, and customer databases.

Cloud based solutions make integration even smoother. Instead of requiring massive IT projects, these systems can often connect to your current platforms within weeks, not months.

Data migration is handled carefully by experienced teams who understand your historical claims data is irreplaceable. The process involves thorough testing and validation to ensure nothing gets lost.

At Agentech, we've designed our system to be integration friendly. Our AI agents work alongside your existing workflows without requiring you to rebuild everything. You can explore more details on our Product page.

Does claims automation replace human adjusters?

This is a common concern, but the software doesn't replace adjusters; it makes them better at their jobs.

Augmented intelligence gives adjusters a smart assistant that handles tedious work flawlessly. The adjuster still makes the important decisions but with powerful support.

Digital coworkers handle the boring stuff. They extract data, populate claim files, run eligibility checks, and send status updates. This frees up your adjusters to focus on high value work like complex investigations, difficult negotiations, and providing genuine human support to customers.

The empathy and personal connection that skilled adjusters provide simply cannot be automated. When a family has lost their home, they need a real person who understands their situation. When a claim involves complex liability or requires creative problem solving, you need human judgment.

We've designed our AI to be AI designed with Adjusters in Mind, ensuring that technology serves as a powerful tool that improves your team's capabilities rather than threatening their roles. The result is adjusters who can handle more claims, provide better service, and find more satisfaction in their work.

Conclusion

The insurance industry stands at a pivotal moment. Companies that accept automated click to claim software are positioning themselves for future challenges and opportunities. This is about gaining a strategic advantage in a competitive marketplace.

The benefits are clear. Insurers see dramatic efficiency improvements, with some reducing manual tasks by up to 84%. Customers enjoy faster settlements and 24/7 service. Meanwhile, AI powered fraud detection helps protect against billions in annual losses from fraudulent claims.

Crucially, this software doesn't replace the human touch. It amplifies your team's strengths. With AI handling repetitive tasks, your adjusters can focus on complex cases, customer relationships, and applying empathy and judgment that machines cannot replicate.

Digital change in insurance is accelerating. Early adopters of these solutions gain a significant competitive edge, seeing faster claim cycles, happier customers, and more productive teams.

At Agentech, we've built our AI powered automation with one clear goal: boosting adjuster productivity while preserving the human elements that matter most. Our solutions integrate seamlessly with your existing systems, so you can start seeing benefits without disrupting your operations.

The future of claims processing is here. Your adjusters get their time back to focus on meaningful work. Your customers receive faster, more transparent service. Your business becomes more efficient and profitable.

Ready to see how automated click to claim software can transform your operations? Visit us at https://www.agentech.com to learn more about our innovative solutions and find how we can help you reclaim your time and redefine your insurance operations.