Why Insurance Claims Experience Matters More Than Ever

Insurance claims experience is the single most critical factor determining whether a policyholder stays with your company or switches to a competitor. A superior claims experience in P&C insurance is defined by several key factors: Speed, with auto claims settled in days, not weeks, and home claims resolved in weeks, not months; Transparency through real-time claim tracking via mobile apps and online portals; Communication with proactive updates at every stage, from FNOL to settlement; Empathy from dedicated adjusters who guide policyholders through stressful moments; and Simplicity using digital tools that eliminate paperwork and reduce friction.

The stakes are high. 70% of customers say a positive claims experience is a key factor in their loyalty to an insurer. When you consider that 16.7 million auto insurance claims and 1.7 million homeowners insurance claims were filed in the U.S. in 2023, the volume alone demands efficiency without sacrificing quality.

For Property & Casualty insurance carriers, Third-Party Administrators, and Independent Adjusting firms, the claims process is no longer just operational infrastructure. It's your brand promise delivered at the moment that matters most. A smooth, efficient claims journey drives renewals and referrals. A frustrating one sends policyholders shopping for alternatives.

The average cost of an auto insurance claim reached $4,800 in 2023, while homeowners claims averaged $13,500. These aren't small transactions. They're financial events that test trust. Policyholders expect the same digital convenience they get from Amazon or Uber. They want to report a claim at 2 AM from their phone, upload photos instantly, and track progress in real time.

Yet many carriers and TPAs still rely on manual data entry, phone tag with adjusters, and paper-heavy workflows. The gap between policyholder expectations and operational reality creates frustration on both sides. Claims managers face mounting pressure to reduce cycle times, improve accuracy, and deliver better experiences with the same or fewer resources.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance to transform the insurance claims experience through speed and accuracy. After a successful career building and scaling technology companies, I'm now focused on helping carriers, TPAs, and IA firms modernize claims processing with AI-driven claims management software.

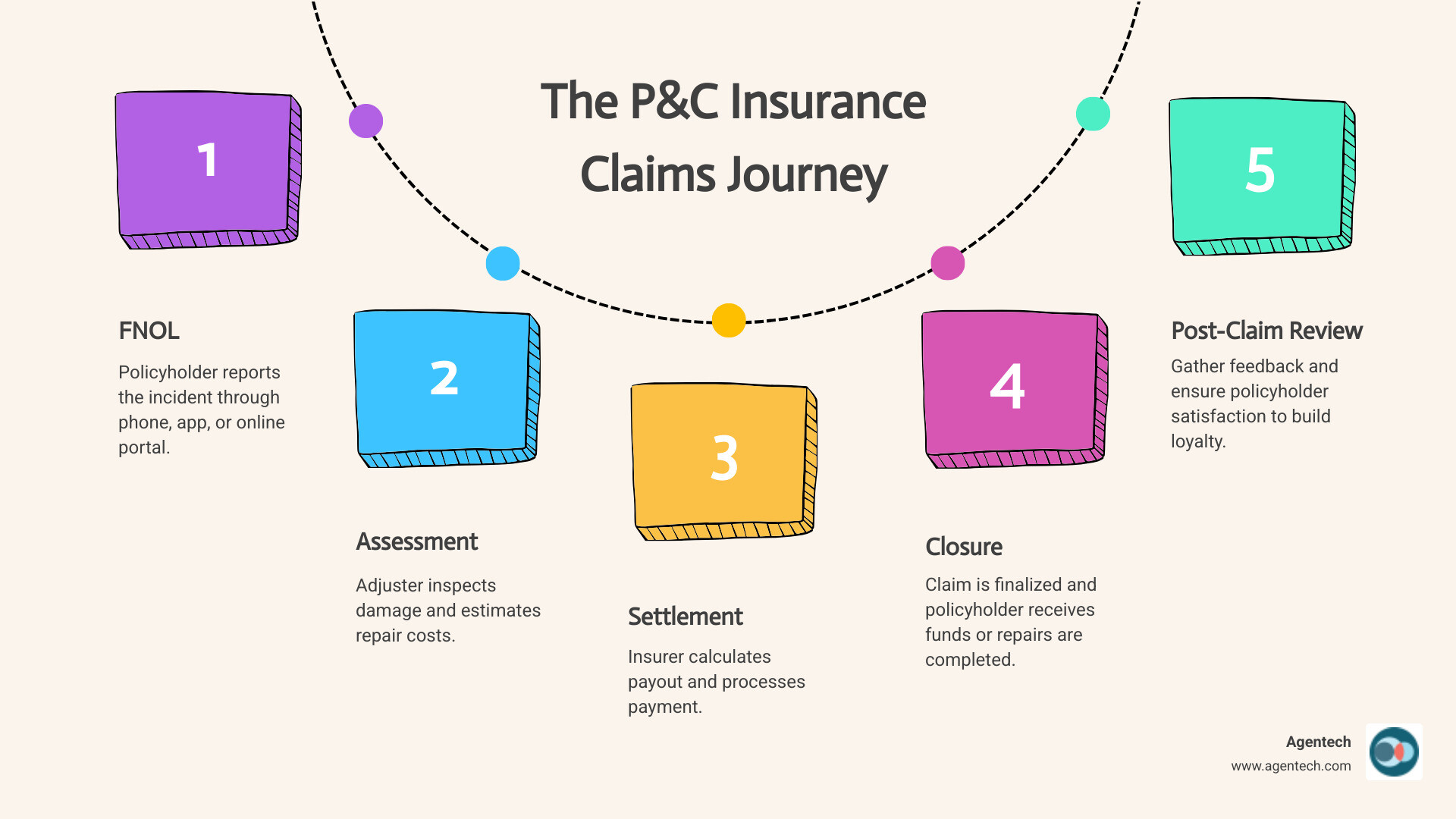

The Modern Policyholder's Journey: What Defines a Positive Claims Experience?

The modern policyholder expects a seamless, digital-first experience, akin to their interactions with leading tech companies. Their satisfaction hinges on clear communication, rapid processing, and a genuine sense of empathy from their insurer. This is especially true for Property & Casualty insurance, where events like car accidents or home damage are often stressful. The claims process can significantly impact customer satisfaction, with 70% of customers indicating that a positive claims experience is a key factor in their loyalty to an insurer. Customers who experience a smooth and efficient claims process are more likely to renew their policies and recommend their insurer to others.

Consider the timelines: the average time to settle a homeowners insurance claim can range from a few weeks to several months, depending on complexity. For auto insurance, this can span from a few days to several weeks. These periods, while necessary for thorough investigation and repair, can feel like an eternity to a policyholder waiting to get back on their feet. Our goal at Agentech is to compress these timelines, ensuring that the customer's journey is as swift and stress-free as possible.

First Notice of Loss (FNOL): The First Impression

The First Notice of Loss (FNOL) is the initial contact a policyholder makes after an incident, and it sets the tone for the entire insurance claims experience. It's the moment when fear and uncertainty are often at their highest. Therefore, 24/7 availability and multiple reporting channels are not just conveniences; they are necessities. Whether it's through a dedicated mobile app, an online portal, or a phone call, policyholders need to easily submit a claim online at any time.

Empathy and reassurance are paramount here. A dedicated claims representative who can swiftly guide the policyholder through the initial steps, explaining what to expect, can significantly reduce anxiety. For instance, some leading insurers highlight a "30 Minute Claims Guarantee," promising that a dedicated representative will begin the process within 30 minutes of a call. This kind of commitment to rapid response and clear communication from the outset helps build trust and confidence.

Assessment and Adjustment: Speed and Accuracy

Once the initial report is made, the assessment and adjustment phase begins. This involves damage estimation, often by a claims adjuster, who determines the extent of the loss and the estimated cost of repairs. For Property & Casualty insurance, this can mean inspecting a damaged car or a hurricane-battered home. Modern claims management software allows for more efficient handling of these tasks, often incorporating virtual inspections to speed up the process.

The California Department of Insurance provides excellent Residential Property Claims Information Guides that detail the adjuster's role and the process of "scoping the loss." Policyholders are advised to document everything, verify adjuster identity, and even seek multiple repair estimates. Our claims software solutions streamline these steps for P&C carriers and adjusters, allowing for faster data capture, more accurate estimations, and better coordination with trusted repair networks. For example, some insurers emphasize that repairs are guaranteed for as long as the car is owned and insured if using their approved network shops, offering peace of mind to policyholders.

Settlement and Resolution: The Final Touchpoint

The final stage, settlement and resolution, is where the promise of insurance is fulfilled. Clear communication about the settlement amount, the breakdown of costs, and the reasons for any deductions is vital. Digital payments can accelerate this process, putting funds into the policyholder's hands much faster than traditional checks.

Handling disputes efficiently is also crucial. The California Department of Insurance, for instance, outlines policyholders' rights under the Unfair Practices Act and Fair Claims Settlement Practices Regulations, providing avenues to dispute settlement offers. Our claims management software can accelerate resolution for P&C insurance by providing adjusters with comprehensive data and insights, enabling them to make fair and consistent decisions, and reducing the likelihood of disputes arising in the first place.

The Claims Experience Letter: A Key Document in P&C Insurance

Beyond the immediate claims process, policyholders often encounter a crucial document that summarizes their entire insurance claims experience: the claims experience letter. This letter plays a vital role in risk assessment, underwriting, and verifying insurance history for new P&C policies, making it indispensable for carriers, TPAs, and IA firms.

What is a Claims Experience Letter and Why is it Important?

A claims experience letter, also known as a letter of experience or claims history letter, is a formal document issued by an insurance provider detailing a policyholder's insurance history with that company. Think of it as a professional reference for your history as a policyholder. It serves as proof of your past coverage, including policy dates, types of coverage, and, most importantly, your claims history.

This letter is important for several reasons. It is used for Verifying Insurance History, as new P&C insurers often request this letter to verify the information you provide during the application process, especially if their internal databases cannot access your full history (e.g., if you've moved provinces or countries). It can help in Lowering Premiums, because a clean claims history, free of at-fault accidents or frequent claims, can demonstrate you are a lower risk to a new insurer. This can translate into more favorable rates and potentially lower premiums. The letter is also useful for Proving Insurability; for those with a lapse in coverage or who were previously secondary drivers, this letter can help establish a credible insurance track record. Finally, it helps in Qualifying for No Claims Discounts, as many insurers offer discounts for policyholders with a history of safe driving and no claims. The claims experience letter provides the necessary evidence to qualify for these valuable savings.

Anatomy of a Claims Experience Letter

So, what exactly can you expect to find in a claims experience letter? This document is designed to provide a comprehensive snapshot of your history as an insured. While the exact format may vary slightly between insurers, it typically includes:

- Policyholder Name and Address: Essential identifying information.

- Policy Number(s): Reference for the specific policies held.

- Coverage Dates: The start and end dates of all policies under your name.

- Objects of Insurance: Details about what was insured (e.g., vehicle make/model/VIN, property address).

- Claims History: This is the core of the letter. It details every claim made during the policy period, including:

- Date of claim

- Type of claim (e.g., collision, fire, theft)

- Claim status (open/closed)

- Reason for claim

- Amount paid out

- At-Fault Status: Crucially, for auto insurance, it will specify if you were deemed at-fault in any accidents. Understanding how at-fault accidents are determined is key, as this significantly impacts future premiums.

- Names of People Included in the Policy: All drivers or residents covered.

- Payment History: Some letters may include details about payment punctuality, instances of non-sufficient funds (NSF), or policy suspensions due to non-payment.

- Reasons for Any Insurance Cancellations: If a policy was cancelled by the insurer, the reason will be stated.

Here’s a list of key information typically included in a claims experience letter:

- Policyholder's full name and address

- Policy number(s)

- Effective and expiry dates of all policies held

- Details of insured items (vehicle VIN, property address)

- Date and type of every claim filed

- Status and payout amount of each claim

- Determination of fault for auto accidents

- Names of all drivers/residents covered

- History of policy cancellations, if any

- Payment history (sometimes)

Obtaining and Using the Letter: Process and Challenges

Obtaining a claims experience letter is generally straightforward. You can request one by contacting your current or past P&C insurance provider directly, either by phone, email, or sometimes through their online portal. It's good practice to request one every time you switch providers, even if you don't immediately need it, so you have an updated record on hand.

You might specifically need this letter when:

- Switching P&C Insurers: Your new insurer will use it to assess your risk and offer a quote.

- Moving Provinces or Countries: Local insurers may not have access to your out-of-province or foreign insurance history. For example, if you've moved to a new country, your past insurance history might not be automatically available through local industry databases.

- Lapse in Coverage: To explain any gaps in your insurance history.

- Secondary Driver Status: If you were a secondary driver on a previous policy, this letter can help establish your individual history.

- Discrepancies: If a new insurer's records appear incorrect, your letter can provide accurate verification.

While generally beneficial, there can be challenges. Insurers are typically obligated to provide these letters, but in rare cases, they might refuse due to company policy, outstanding balances, or unpaid premiums. Furthermore, some insurers may not fully honor foreign driving or insurance experience when calculating discounts, even with a letter of experience.

If you find discrepancies in a claims experience letter, it's crucial to address them promptly. We'll cover the steps for this in our FAQ section.

Leveraging AI to Improve the P&C Insurance Claims Experience

The sheer volume of claims—16.7 million auto and 1.7 million homeowners claims in the U.S. in 2023—underscores the urgent need for efficiency in the P&C insurance industry. This is where AI truly shines, driving automation, enhancing operational efficiency, boosting adjuster productivity, and providing invaluable data-driven insights. At Agentech, we believe AI-Powered Claims Automation is not just a future possibility but a present necessity.

Automating Administrative Tasks to Free Up Adjusters

One of the most significant pain points for claims adjusters is the heavy administrative load. Manual document review, data entry, and the laborious process of creating a claim profile consume valuable time that could be spent on complex cases or direct policyholder interaction. Our AI-powered automation tools are designed to tackle these repetitive, time-consuming tasks head-on.

We know that a substantial portion of an adjuster's day is spent on non-cognitive, rules-based activities. By automating these, we can Reduce Administrative Burden dramatically. For example, we've focused on automating the most tedious task in claims processing: creating the claim profile. This means our AI agents can rapidly ingest and process unstructured data from various sources—like police reports, repair estimates, and medical records—to build a comprehensive claim profile in minutes, not hours. This frees up adjusters to focus on what they do best: applying their expertise, making nuanced decisions, and providing empathetic support to policyholders.

The Role of Agentic AI in a Superior P&C Insurance Claims Experience

Agentic AI takes automation a step further, not just by automating tasks but by acting as an intelligent, proactive assistant that works alongside human adjusters. Our Agentic AI solutions are designed to improve the entire insurance claims experience by providing:

- Proactive Communication: AI can monitor claim progress and trigger automated, personalized updates to policyholders, ensuring they are always informed.

- Issue Resolution: For common queries or simple issues, our AI agents can provide 24/7 assistance, resolving problems quickly and efficiently without human intervention.

- Human-in-the-Loop Decision Making: Crucially, our AI doesn't replace human adjusters. Instead, it empowers them with pre-analyzed information and recommendations, allowing adjusters to make faster, more informed decisions. This ensures that complex or sensitive cases always benefit from human judgment and empathy.

As we explore in Agentic AI in Insurance: When Bots Become Your Best Agents, these digital coworkers boost adjuster productivity, enabling them to handle more claims with greater accuracy and less stress, ultimately leading to a superior insurance claims experience for everyone involved.

Improving Risk Assessment for a Better P&C Insurance Claims Experience

AI's impact extends beyond just processing efficiency; it fundamentally transforms risk assessment within Property & Casualty insurance. By leveraging advanced Machine Learning in Claims Processing, we can extract deeper insights from claims data, leading to more accurate underwriting, better fraud detection, and improved trend analysis.

Our claims management software can analyze vast datasets to:

- Improve Claims Analytics: Identify patterns and anomalies that might indicate emerging risks or opportunities for process improvement.

- Bolster Fraud Detection: AI can flag suspicious claims based on various data points and historical patterns, helping insurers combat the significant costs associated with fraud. For example, AI platforms have shown a strong ability to detect workers' compensation fraud with confidence.

- Refine Trend Analysis: Understand long-term trends in claim types, severity, and geographical impact, which is vital for strategic planning and product development.

- Enable More Accurate Pricing: With a clearer picture of individual and collective risk, P&C insurers can offer more competitive and equitable premiums.

By making risk assessment more precise, we contribute to a healthier insurance ecosystem, benefiting both insurers through reduced losses and policyholders through fairer pricing and a more stable market.

Frequently Asked Questions about the Claims Experience

Navigating insurance claims experience can bring up many questions. Here, we address some of the most common ones to help clarify key aspects for policyholders and industry professionals alike.

How does a claims experience letter differ from a driver history report?

While both documents relate to an individual's history, a claims experience letter and a driver history report serve very different purposes in P&C insurance:

- Claims Experience Letter: This document focuses on your insurance policy history. It details the policies you've held, their coverage dates, and most importantly, your claims history with a specific insurer. This includes information about any claims you've made, their nature, payout amounts, and whether you were deemed at-fault for auto accidents. It's essentially a record of your financial interactions and incidents covered by P&C insurance.

- Driver History Report (or Motor Vehicle Record): This report, typically obtained from a government agency (like the DMV), focuses on your driving record. It details your license status, traffic violations, demerit points, accidents (regardless of whether an insurance claim was filed), and any criminal convictions related to driving. It reflects your adherence to traffic laws and your behavior behind the wheel.

A claims experience letter is about your relationship with your insurer and your use of your policy, while a driver history report is about your legal driving conduct. Insurers use both to assess risk, but for different aspects of your profile.

Can a positive claims history really lead to lower P&C insurance premiums?

Absolutely, yes! A positive insurance claims experience history is one of the most powerful tools a policyholder has to secure lower P&C insurance premiums. Here's why:

- No Claims Discounts: Almost all P&C insurance providers offer discounts to customers who have a history of holding insurance policies without making many claims. This "claims-free discount" is a direct reward for demonstrating lower risk.

- Loyalty Rewards: Many insurers also offer loyalty discounts to long-term policyholders, especially those with a consistent record of few or no claims.

- Risk Profiling: Insurers are in the business of assessing risk. A policyholder with a clean claims record, particularly one with no at-fault accidents, is statistically less likely to file future claims. This makes them a more attractive, lower-risk client.

- Insurer Perspective: From the insurer's viewpoint, a policyholder who always paid their premiums on time and rarely (or never) filed a claim shows they are an upstanding policyholder who poses less risk of making future claims or delaying payment. This often translates to discounted rates compared to other policyholders.

While a positive claims history is a significant factor, it's worth noting that other elements like your driving record, credit-based insurance score, location, and vehicle type also influence premiums.

What is the first step to take if there is a mistake in a claims experience letter?

Finding an error in your claims experience letter can be frustrating, but correcting it is crucial for maintaining accurate records and potentially impacting your future premiums. Here are the steps to take:

- Contact the Issuing Insurer Directly: The very first step is to reach out to the insurance company that issued the letter. Explain clearly what the discrepancy is and provide any documentation you have to support your claim (e.g., policy documents, police reports, or previous communication about a claim).

- Request a Review and Correction: Ask them to review their records and issue a corrected letter. Keep a detailed log of all communications, including dates, names of people you spoke with, and what was discussed. If possible, correspond in writing (email or registered mail) to create a paper trail.

- Escalate if Necessary: If your initial contact doesn't resolve the issue, ask to speak with a supervisor or a claims manager within the company. Sometimes, a higher-level review can quickly resolve misunderstandings.

- Contact Regulatory Bodies: If the insurer is unwilling to correct a verifiable error, you can escalate the matter to your state's Department of Insurance (or equivalent regulatory body). They act as consumer protection agencies and can mediate disputes. For instance, the California Department of Insurance provides resources and assistance for policyholders who disagree with their insurers, including a "Request for Assistance" process.

Being proactive and organized with your documentation is key to successfully resolving any discrepancies in your claims experience letter.

Conclusion: Building the Future of Claims with Agentic AI

The insurance claims experience is undeniably the defining moment for policyholders. In a digital age, it's no longer enough for P&C insurers to simply process claims; they must delight their customers with speed, transparency, and empathy. The statistics are clear: a positive experience fosters loyalty, while a cumbersome one drives customers away.

We believe that the future of claims lies in empowering human adjusters with intelligent AI. Agentic AI is not about replacing the human element, but rather augmenting it. Our AI agents handle the tedious, time-consuming administrative tasks, freeing up adjusters to focus on complex decision-making and empathetic policyholder interaction. This leads to faster claims resolution, more accurate risk assessment, and ultimately, a superior insurance claims experience.

For P&C insurance carriers, TPAs, and IA firms, embracing this digital change is no longer optional. It's about customer retention, adjuster empowerment, and staying competitive in a rapidly evolving market. At Agentech, we are dedicated to providing the tools that enable this change. We envision a future where AI acts as a digital coworker, streamlining workflows and providing valuable insights, allowing your team to deliver exceptional service. Learn more about The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers and how our solutions can revolutionize your claims process. Learn how Agentech's AI Agents can transform your claims process.

Citations:

- TD Insurance. (n.d.). Your TD Insurance Auto Claims Experience.

- ThinkInsure. (n.d.). What Is A Letter Of Experience For Insurance?.

- BrokerLink. (n.d.). Claims Experience Letter.

- McDougall Insurance. (n.d.). Letter of Experience Insurance: What You Need to Know.

- Square One Insurance. (n.d.). Insurance letters of experience.

- Intact Insurance. (n.d.). Claims.

- California Department of Insurance. (n.d.). Residential Property Claims Information.

- GEICO. (n.d.). Policy Management Page.

- California Department of Insurance. (n.d.). What to do After a Loss.

- Consumer Reports. (n.d.). How to File an Insurance Claim After a Car Accident.

- Experian. (n.d.). How Insurance Claims Work.

- Report Summary. (n.d.). Customer Experience: the Claim Handler’s Perspective.