The Hidden Cost of Chaos in P&C Insurance Claims Processing

Automated claims processing uses technologies like artificial intelligence and machine learning to handle P&C insurance claims with minimal human intervention. Here's what you need to know:

- Speed: Claims can be resolved in hours or days, not weeks.

- Cost Savings: Reduces processing costs by up to 30%.

- Accuracy: Achieves faster resolution with fewer errors.

- Key Technologies: OCR, AI, machine learning, and intelligent document processing.

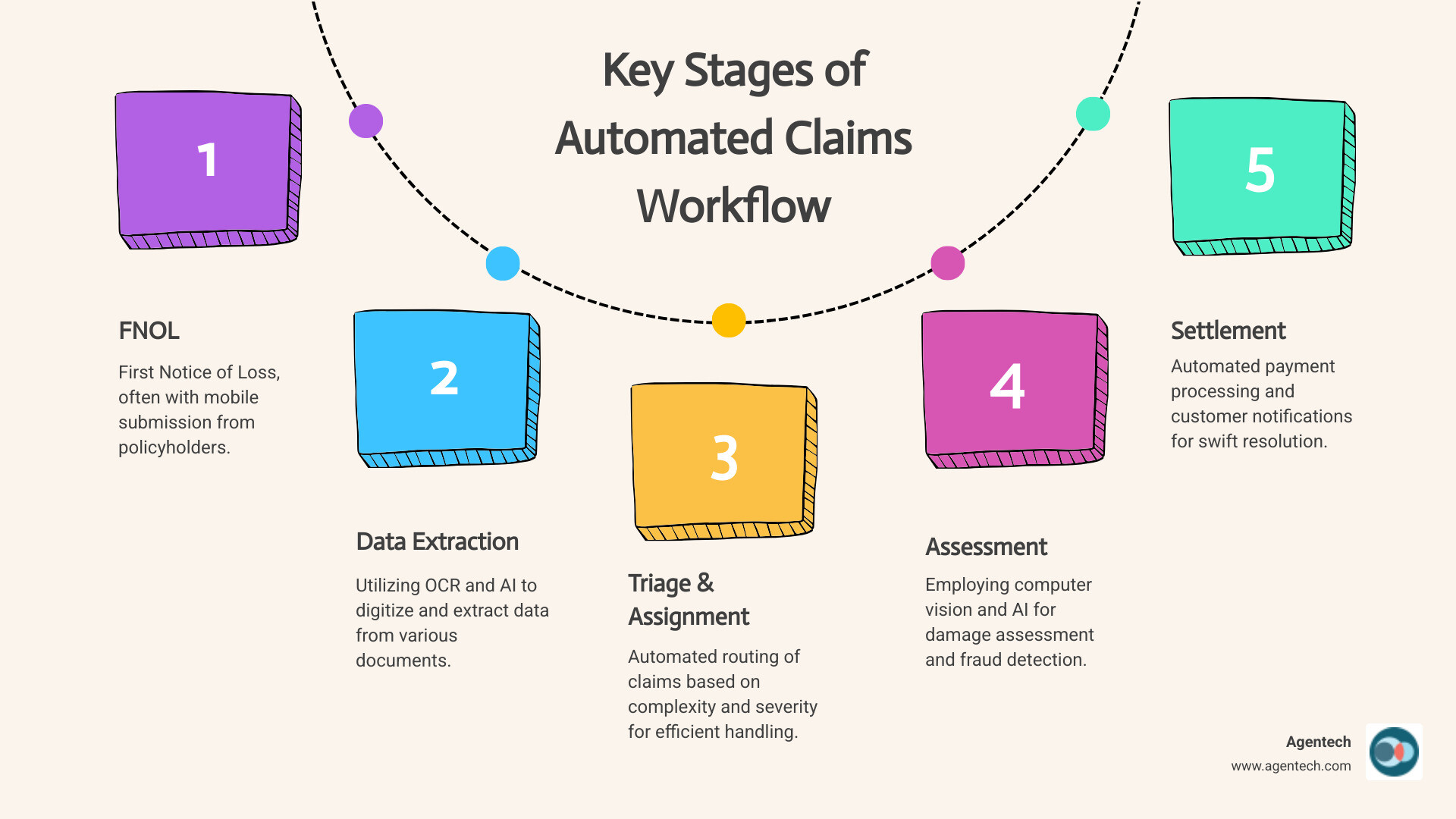

- Core Stages: FNOL intake, data extraction, triage, assessment, and settlement.

If you're a claims manager in Property & Casualty insurance, you know the daily grind: stacks of paper, endless data entry, and adjusters buried in routine tasks. This chaos isn't just frustrating; it's expensive.

Manual claims processing costs the P&C insurance industry billions. About 10% of claims are fraudulent, adding complexity to an overwhelming workload. Claims handlers spend hours daily on repetitive tasks that automation could handle in seconds. Meanwhile, 30% of policyholders will switch providers after a poor claims experience, especially when communication breaks down.

The good news is that automation can transform this chaos into clarity. AI-powered claims management software can slash processing times, cut costs by 30%, and improve accuracy and customer satisfaction. For carriers, TPAs, and independent adjusting firms, this isn't just about efficiency. It's about survival.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for insurance. After a successful exit from my previous venture, I've focused on revolutionizing automated claims processing in P&C insurance, starting with the pet insurance sector and expanding across multiple lines of business.

The Stark Contrast: Manual vs. Automated Claims Processing

Picture your claims department after a major storm. Phones are ringing, adjusters are drowning in paperwork, and someone is manually typing policy numbers into multiple systems. This is the reality of manual claims processing in Property & Casualty insurance. Every step requires human intervention, causing claims to stretch from days into weeks or months. When catastrophic events bring a surge of property or auto claims, the system buckles.

The operational costs are staggering. Claims handlers spend 2 to 3 hours daily on repetitive administrative tasks. Adjusters, who should be helping customers, find themselves buried in data entry. This grind leads to burnout and high turnover. Meanwhile, frustrated policyholders wait, and about 30% will switch providers after a poor claims experience.

Automated claims processing flips this script. Intelligent digital workflows handle the mundane tasks, freeing adjusters to focus on complex cases and customer interactions. The change is dramatic.

The financial impact is compelling. Automation can reduce claims processing costs by up to 30%, according to McKinsey & Company. It minimizes manual effort, catches errors early, and streamlines the entire workflow. Claims leakage, which includes costly overpayments and underpayments, drops significantly when intelligent systems validate every detail.

Speed improves just as dramatically, with resolution times often 50 to 70% faster. One Nordic insurer processed claims 95% faster after implementing AI automation, while another provider slashed processing time from 60 days to just 3. For policyholders, this speed means getting back to normal life much sooner.

Accuracy also gets a major boost. One insurer saw an 80% reduction in human error in invoice matching. When systems extract data, validate policy terms, and flag inconsistencies, fewer mistakes slip through.

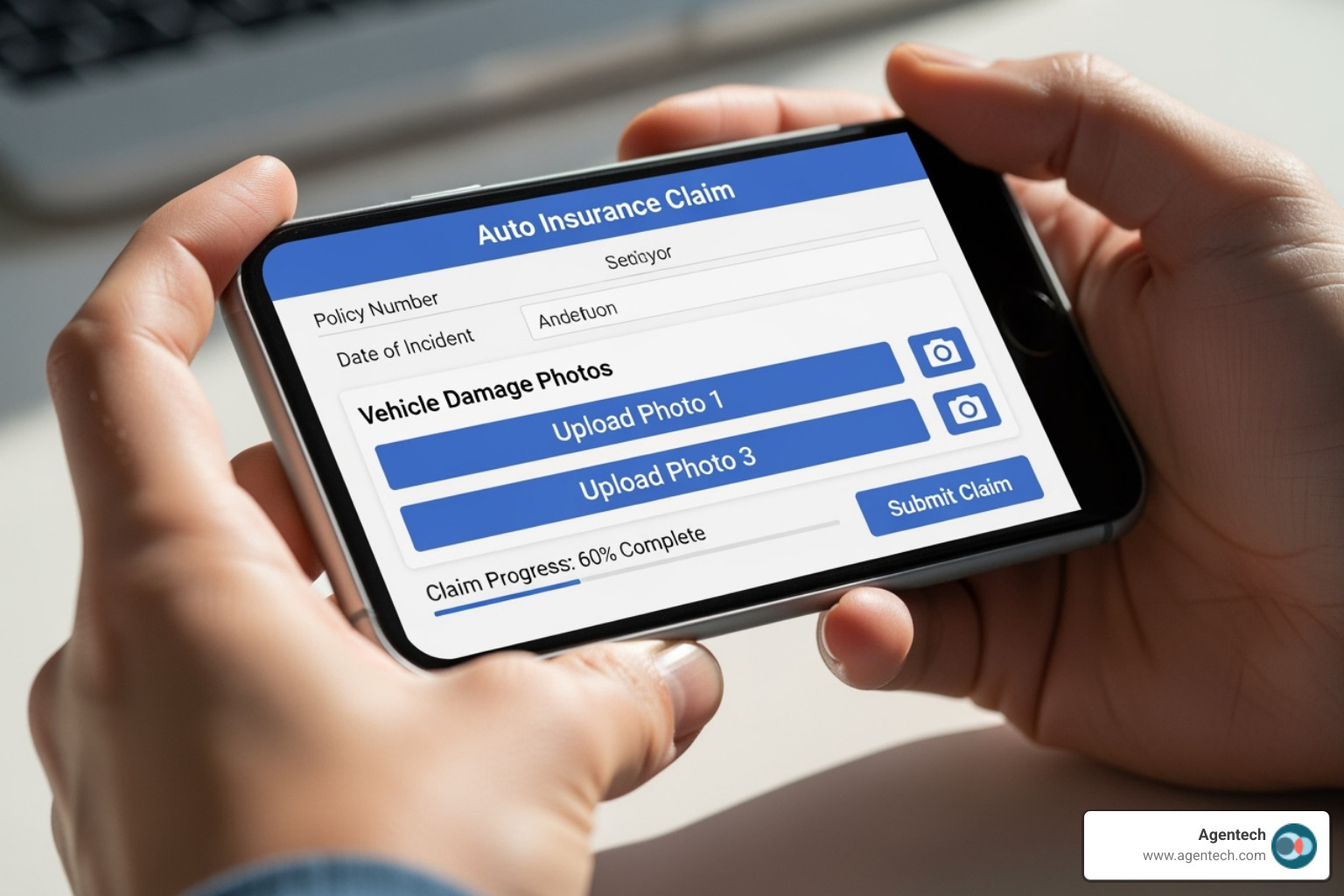

The customer experience transforms completely. A P&C insurer saw a 20% reduction in call center volume after deploying digital claims intake. Policyholders get real-time updates and can submit documents from their phones, leading many insurers to see double-digit increases in their Net Promoter Score.

Perhaps most importantly, automation makes work more fulfilling. Instead of data entry, adjusters focus on complex cases that need human judgment. This shift addresses the P&C insurance labor crisis by making jobs more engaging.

| Feature | Manual Claims Processing | Automated Claims Processing |

|---|---|---|

| Speed | Days to weeks, often months | Hours to days, sometimes minutes |

| Cost | High operational costs, prone to leakage | Up to 30% reduction, minimized leakage |

| Accuracy | Prone to human error, inconsistencies | Low error rate, high data integrity |

| Customer Satisfaction | Often low due to delays and lack of transparency | High due to speed, transparency, and consistent service |

| Adjuster Workload | Repetitive, high administrative burden, burnout risk | Focus on complex cases, higher value tasks, improved satisfaction |

| Scalability | Difficult to scale during volume spikes | Easily scales to handle increased volumes |

| Fraud Detection | Reactive, relies on human review, often misses patterns | Proactive, AI driven pattern recognition, real time flagging |

The difference is strategic. In a market where customer expectations are rising, automation has become essential for P&C insurance carriers, TPAs, and IA firms that want to remain competitive.

The Technology Powering Modern Claims Automation

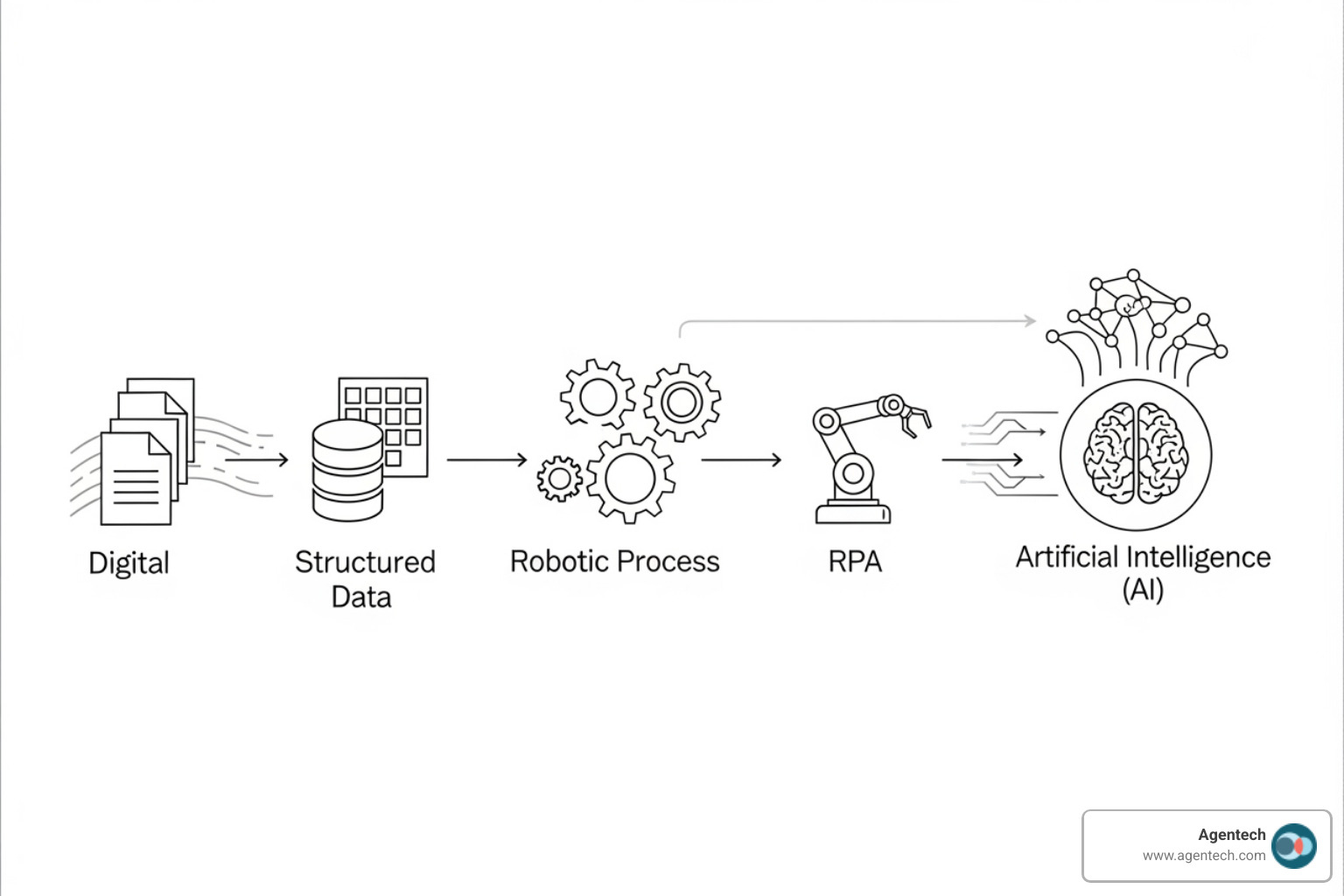

The magic behind automated claims processing isn't a single tool but a sophisticated blend of technologies. Each plays a part in creating a symphony of efficiency that transforms how P&C insurance carriers, TPAs, and IA firms handle claims.

Modern claims management software combines several key technologies to turn messy data into smooth workflows. Understanding these components is key for managers handling residential property, auto, pet, and workers' compensation claims.

Intelligent Document Processing (IDP) and OCR

Claims data often arrives in unstructured formats like scanned documents, faxes, and emails. This is where Intelligent Document Processing (IDP) and Optical Character Recognition (OCR) become lifesavers.

OCR converts images of text into machine-readable data. IDP takes this further, using AI to understand what it's reading, classify document types, and extract specific information from complex layouts like FNOL forms, repair estimates, and medical invoices. A significant portion of documents fed into an advanced system can be correctly interpreted automatically, without human intervention. This capability is vital when juggling diverse paperwork across multiple lines of business.

Leveraging industry standards like ACORD for real-time data exchange with ADEPT can further accelerate this. We specifically designed our AI to handle the most tedious and time-consuming task in claims processing: creating the claim profile. No one got into P&C insurance to spend hours building a claim file.

Robotic Process Automation (RPA)

Once data is digitized, Robotic Process Automation (RPA) takes over repetitive, rule-based tasks. RPA bots mimic human actions on a computer, but they work tirelessly and without error.

These bots excel at high-volume tasks like data entry, updating policyholder information, validating policy details, and triggering notifications. RPA is the backbone of P&C insurance back office automation, ensuring consistency and speed in processes that would otherwise drain your team.

How AI and Machine Learning Lift Automation

Artificial Intelligence (AI) and Machine Learning (ML) are the brains of the operation, enabling systems to learn from data, make predictions, and support complex decision-making.

Predictive analytics allows AI models to analyze historical data to spot patterns, predict claim severity, and flag claims needing specialized expertise. This helps adjusters prioritize their workload. For more, explore how P&C insurance claims machine learning is changing the industry.

Fraud detection is a critical application. With approximately 10% of property and casualty claims being fraudulent, AI has become essential. It detects anomalies and suspicious patterns to identify potential fraud, helping triage legitimate claims for fast-track settlement while routing suspicious ones for human review.

Triage and routing gets smarter with AI, intelligently assigning claims based on type, severity, and adjuster workload. This ensures the right claim reaches the right person at the right time.

Decision support is the sweet spot between automation and human expertise. For straightforward claims, AI can automate decisions entirely. For complex cases, it provides adjusters with data-driven recommendations to support their judgment. This is where Agentic AI comes in, creating AI agents that perform sophisticated tasks and collaborate seamlessly with human teams.

Real World Applications of Automated Claims Processing in P&C Insurance

The real proof of automated claims processing is in the daily operations of P&C insurance carriers, TPAs, and IA firms. These aren't distant possibilities; they're happening now, changing how claims are handled across residential property, auto, pet, and workers' compensation.

Property Claims (Residential & Commercial)

Property claims present unique challenges, especially during catastrophes. When a major storm hits, thousands of homeowners file claims at once. Without automation, adjusters drown in paperwork.

Today's automated systems change this. Policyholders can submit their First Notice of Loss through a mobile app, uploading photos and videos of damage. Computer vision and AI analyze these images immediately, assessing damage severity and generating preliminary repair estimates. The system intelligently assigns claims based on location and adjuster workload. During catastrophic events like Hurricane Irma, which caused an estimated $50 billion in damage, this capability is critical for processing high volumes quickly.

Firms like AmeriAdjust leverage our digital claims co-workers to handle property claims more efficiently. The result is faster response times and happier policyholders.

Auto Claims

Auto claims are perfect for automation due to their high volume and predictable patterns. When an accident occurs, a policyholder can report it instantly through a mobile app, snapping photos of the damage.

The system gets to work immediately. Computer vision analyzes the photos to generate preliminary repair estimates. For minor incidents, the system can validate coverage and disburse payments automatically, with settlements occurring in hours, not weeks. More complex cases are routed to human adjusters, but the AI has already done the heavy lifting of data extraction and policy verification. Our partnership with Snapsheet demonstrates this, revolutionizing claims processing with AI-driven digital agents that handle routine auto claims.

Workers' Compensation and Pet Insurance

These lines of business share a common challenge: mountains of documentation. Workers' compensation involves injury reports and medical records, while pet insurance requires vet bills and diagnostic reports.

Automation transforms this into a manageable workflow. Intelligent document processing handles intake and classification automatically. AI extracts key information like diagnoses, treatment dates, and costs from medical reports. What used to take hours of manual review now happens in minutes.

The system validates claim details against policy terms and regulatory guidelines, reducing errors and ensuring compliance. Reimbursement processing becomes straightforward, with the system calculating payments and initiating disbursements. This speed is crucial for injured workers and pet owners facing unexpected bills.

Odie Pet Insurance implements our AI to automate claims tasking, showing how automation can handle the unique demands of this growing sector.

A Strategic Guide to Implementing Claims Automation

Implementing automated claims processing is a strategic change that requires careful planning and execution. For P&C insurance carriers, TPAs, and IA firms, getting this right is critical for a smooth transition.

Key Steps for a Successful Rollout

Think of implementation like a planned renovation. You need a clear blueprint to succeed.

- Assess Your Current Workflows: Before automating, map your existing manual processes. Identify bottlenecks, time-consuming tasks, and common errors to find where automation will deliver the greatest impact.

- Define Clear Objectives: Set specific, measurable goals. Whether it's cutting costs by 20% or reducing resolution time to three days, clear targets provide focus.

- Choose the Right Technology Partner: Select a partner who understands P&C insurance claims. Look for solutions that augment your adjusters, not replace them. At Agentech, our AI agents are designed to work alongside your team. You can see how it works on our site.

- Start with a Pilot Project: Don't try to automate everything at once. Pick a high-volume, straightforward claim type, run a pilot for a few months, and gather data and feedback before expanding.

- Train Your Team: Show your adjusters how automation removes tedious work, giving them more time for complex problem-solving and customer interaction. Adoption is smoother when your team sees automation as an assistant.

- Measure and Iterate: Continuously track key performance indicators against your goals. Use feedback to refine processes and expand automation gradually.

Navigating Challenges and Considerations

Even with a solid plan, you'll face challenges. Knowing what to expect is half the battle.

- Legacy System Integration: Many P&C insurers run on older claims systems. Getting modern AI to work with these platforms requires a partner with robust integration capabilities.

- Data Security and Privacy: Claims data is highly sensitive. Your automated workflows must have strong cybersecurity, encryption, and access controls to protect customer trust.

- Regulatory Compliance: P&C insurance is heavily regulated. Your automated systems must adhere to all applicable rules, and transparency in AI decision-making is increasingly important, as noted in the European insurance regulator's governance principles. This reflects the challenge of AI in P&C insurance: balancing innovation and regulation.

- Keeping the Human in the Loop: Automation should improve, not eliminate, human judgment. Complex claims and situations requiring empathy still need a person. Your system should flag exceptions for human review.

The Future of Automated Claims Processing

The evolution of claims automation is accelerating. Today's cutting-edge will be tomorrow's standard.

Hyperautomation combines multiple technologies to create seamless, end-to-end digital workflows. Agentic AI and digital coworkers are sophisticated AI agents that learn and make decisions, working alongside human adjusters. This vision aligns with the future of work in P&C insurance: embracing AI agents as digital coworkers. Parametric insurance, where payouts are triggered automatically by verified data points, shows how automation can eliminate entire categories of manual work.

Frequently Asked Questions about Automated Claims Processing

How does automation impact the role of a claims adjuster?

Automated claims processing is not here to replace your adjusters; it's here to make their jobs better. Too often, adjusters are drowning in paperwork and routine tasks. Automation changes this dynamic completely.

When AI handles data entry, document classification, and initial triage, your adjusters can focus on what they do best: solving complex problems, negotiating settlements, and providing empathetic support to policyholders. Our AI is explicitly designed with adjusters in mind, built to augment human expertise.

This shift allows adjusters to become better communicators and make more consistent decisions with the help of data-driven insights. It's not about reducing headcount; it's about changing your claims department into a strategic advantage.

Can automation handle complex, non-standard claims?

Yes, but the best approach is a hybrid one. Automated claims processing excels at handling high-volume, straightforward claims, often processing them from start to finish without human intervention.

For outliers involving unusual circumstances or subjective judgment, intelligent automation supports human expertise. The system handles the initial intake and data extraction, so when a claim reaches your adjuster, the preliminary work is already done. The AI is designed to detect when a claim deviates from standard patterns and automatically routes it to an experienced adjuster. The AI doesn't make the final decision; it ensures the right human makes it.

This hybrid AI solution combines out of the box efficiency with custom QA precision, giving you speed for routine work and human expertise where it's needed most.

What is the typical ROI for claims automation?

The ROI for automated claims processing is substantial and appears in multiple ways across your P&C insurance operations.

The most direct impact is on operational costs. Automation can reduce claims processing costs by up to 30%. These savings come from real reductions in manual labor and fewer errors.

Beyond that, ROI comes from reducing claims leakage. With approximately 10% of property and casualty claims being fraudulent, improved fraud detection through AI can generate significant savings. Better accuracy means you pay the right amount on claims.

Faster settlements also improve cash flow and reduce the carrying costs of open claims.

Perhaps the most valuable ROI comes from improved customer retention. A superior claims experience leads to higher loyalty. Since 30% of policyholders will switch providers after a poor claims experience, the value of keeping customers is clear. For many organizations, these combined savings lead to a positive ROI within the first two years.

Conclusion

The days of drowning in paper claims are ending. For P&C insurance carriers, TPAs, and IA firms, automated claims processing is no longer a luxury but an essential tool for survival in a competitive market.

The numbers are compelling: up to 30% cost reduction, claims resolved in days instead of weeks, and fewer errors. But beyond the metrics lies a more important change to your team's daily experience.

Automation returns adjusters to meaningful work by handling the repetitive tasks that drain their energy. The result is more engaged employees, better customer relationships, and a workplace where people want to stay. This shift from chaos to clarity positions your organization as a leader, delivering the fast, transparent service today's policyholders expect.

At Agentech, we are building the AI workforce for P&C insurance, creating solutions that integrate seamlessly with your existing systems. Our AI agents work alongside your team as digital coworkers, boosting productivity without replacing the human judgment that makes great claims handling possible.

The path forward is clear. The technology is proven, and the results speak for themselves. Your team and your customers deserve the clarity of a modern claims experience.

Ready to transform your claims operations from chaos to clarity? Find how Agentic's AI Agents can open up new levels of efficiency for your team.

Citations:

- ACORD. (n.d.). ACORD Solutions. Retrieved from https://www.acordsolutions.com/solutions/adept

- EY. (n.d.). How a Nordic insurance company automated claims processing. Retrieved from https://www.ey.com/en_gl/insights/financial-services/emeia/how-a-nordic-insurance-company-automated-claims-processing

- insurancefraud.org. (n.d.). Fraud Stats. Retrieved from https://insurancefraud.org/fraud-stats/

- Pinsent Masons. (n.d.). European insurance regulator artificial intelligence governance. Retrieved from https://www.pinsentmasons.com/out-law/news/european-insurance-regulator-artificial-intelligence-governance

- World Vision. (n.d.). 2017 Hurricane Irma facts. Retrieved from https://www.worldvision.org/disaster-relief-news-stories/2017-hurricane-irma-facts