Beyond Automation: The Rise of Autonomous AI in Insurance

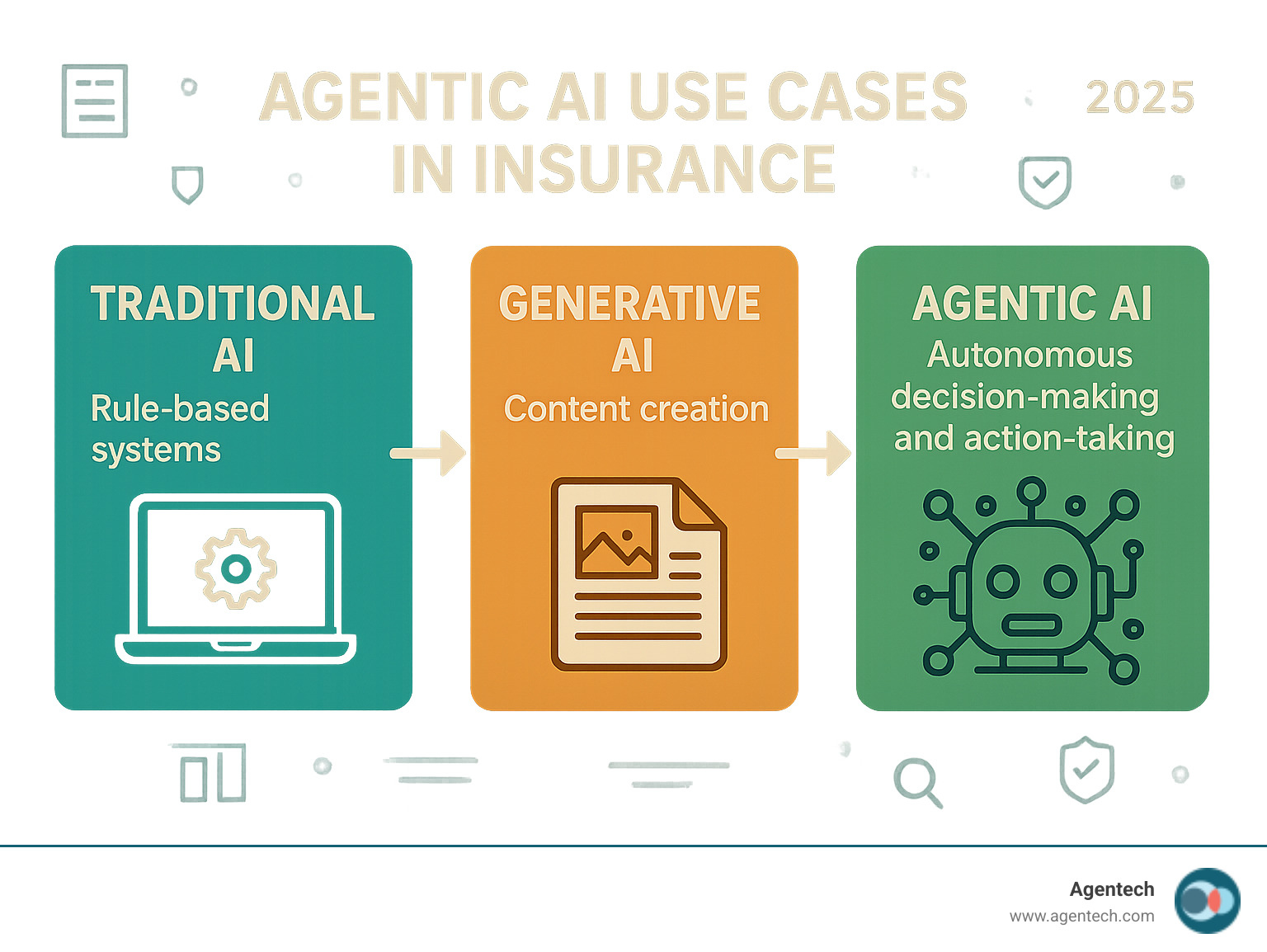

Agentic ai use cases in insurance industry are changing how insurers handle everything from claims processing to customer service. Unlike traditional AI that simply analyzes data or generative AI that creates content, agentic AI takes autonomous action to complete entire workflows without human intervention.

Key Agentic AI Use Cases in Insurance:

- Claims Processing: Automated damage assessment, fraud detection, and payout decisions

- Underwriting: Real-time risk analysis and dynamic policy pricing

- Customer Service: 24/7 virtual assistants handling complex inquiries

- Fraud Prevention: Proactive pattern detection and real-time alerts

- Policy Administration: Automated renewals and coverage adjustments

The insurance industry faces pressure from all sides: customers demand instant service, regulators require more transparency, and operational costs are rising amid staff shortages.

While traditional AI analyzes data and generative AI creates content, agentic AI represents the next evolution: systems that don't just think or create, but act.

These autonomous agents perceive their environment, make goal-oriented decisions, and execute complex tasks from start to finish. They work around the clock, learn from each interaction, and adapt their approach based on outcomes.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for insurance with a focus on agentic ai use cases in insurance industry that deliver measurable results. After successfully scaling and exiting TokenEx in 2021, I've dedicated my expertise to revolutionizing claims processing through autonomous AI agents that work alongside human adjusters.

What is Agentic AI and How Does It Work?

Imagine a digital coworker that handles complex insurance tasks from start to finish, 24/7. That's agentic AI. At Agentech, we define agentic AI as intelligent systems that don't just analyze data or generate reports. These autonomous agents can think through problems, make decisions, and take action to achieve goals with minimal human input.

Unlike traditional AI that might flag a suspicious claim for review, or generative AI that drafts a response, agentic AI can spot the fraud, investigate it, gather evidence, make a determination, and file the necessary reports. It's like having a seasoned adjuster who works around the clock.

The agentic ai use cases in insurance industry are compelling because insurance involves complex, multi-step processes. These agents don't just follow rigid scripts—they adapt their approach based on what they encounter.

Here's how different types of AI stack up in insurance contexts:

| Feature | Traditional AI (e.g., Predictive Models) | Generative AI (e.g., Large Language Models) | Agentic AI (Autonomous Agents) |

|---|---|---|---|

| Primary Function | Analyzes data, identifies patterns, flags anomalies | Creates new content (text, images, code) | Takes proactive action, executes workflows |

| Decision-Making | Rule-based or statistical predictions | Content generation based on prompts | Autonomous, goal-oriented, adaptive |

| Human Intervention | Often requires human interpretation/action | Requires human prompts and oversight | Minimal human input for routine tasks, human oversight for complex/sensitive decisions |

| Workflow Involvement | Assists in parts of a process | Generates components for a process | Manages entire workflows from intake to resolution |

| Key Capability | Prediction, Classification | Creation, Summarization | Autonomous Execution, Planning, Adaptation |

The beauty of agentic AI lies in its proactive nature. Instead of waiting for instructions, these systems actively work toward their assigned goals while keeping humans in the loop for complex or sensitive decisions.

Want to dive deeper into the mechanics? Check out the key steps in how AI agents work for a more technical perspective.

The Core Agentic Workflow

Agentic AI follows a five-step problem-solving cycle that mirrors an experienced professional and continuously improves over time.

Perception: The agent gathers all relevant data for a claim, such as policy details, photos from the scene, weather reports, and contractor estimates.

Reasoning & Planning: The agent analyzes the collected data, identifies patterns, and maps out the best sequence of actions to reach its goal, like validating damage or checking for coverage exclusions.

Decision-Making: The agent weighs multiple factors to select the best action, such as automatically approving a simple claim or flagging a complex one for human review.

Execution: The agent takes action by updating claim status, sending notifications, ordering inspections, or initiating payments.

Feedback & Learning: The agent evaluates the outcome of its actions and learns from successes and mistakes, improving its performance over time.

This recursive workflow creates AI agents that become increasingly effective, developing their own "experience" to handle more complex scenarios. This learning capability transforms how agentic ai use cases in insurance industry scenarios play out, as agents get better at understanding your specific business needs over time.

Top Agentic AI Use Cases in the Insurance Industry

The real magic of agentic ai use cases in insurance industry is seeing these systems in action. Autonomous AI agents are already changing daily operations for insurers. These applications don't replace human expertise—they amplify it. Our AI agents handle repetitive, data-heavy tasks, freeing up your team to focus on complex judgments and building relationships.

Revolutionizing Claims Processing

Claims processing is where agentic AI truly shines. Our AI agents handle the entire claims workflow, from First Notice of Loss (FNOL) to settlement. An agent can instantly pull policy details, initiate a claim file, and gather information within seconds of a report.

- Automated damage assessment: By analyzing photos with computer vision, agents can estimate repair costs with up to 96% accuracy, eliminating long waits for an initial assessment.

- Real-time validation: The agent cross-references policy data, checks coverage limits, and verifies documents, flagging inconsistencies immediately to prevent delays.

- Fraud flagging: Agents continuously scan for suspicious patterns, such as mismatched photos or claim histories, escalating only truly questionable cases to human investigators.

- Payout recommendations: For straightforward claims, the agent can make payout recommendations, resolving cases that once took days in mere hours. Over 60% of simple claims can be settled in real-time.

Supercharging Underwriting and Risk Assessment

Agentic AI makes underwriting more dynamic and precise. Dynamic underwriting allows an AI agent to adjust premiums based on real-time information, such as a policyholder's improving health metrics from a fitness tracker.

Agents perform real-time data analysis, pulling from Data from IoT devices, weather patterns, and economic indicators to create a complete risk picture. This enables personalized policy creation that matches individual risk profiles, not just demographics. Advanced risk modeling helps predict potential losses, and by removing human bias, these systems enable fairer pricing decisions.

Enhancing Customer Service and Engagement

Agentic AI is changing insurance customer service. 24/7 virtual assistants understand context and access customer histories to provide helpful responses anytime. Communication becomes proactive, with agents sending personalized renewal offers or suggesting coverage adjustments based on life changes.

Proactive support means solving problems before customers are aware of them, like reaching out to policyholders in a storm's path. These Complex customer interaction systems handle nuanced conversations, and complaint resolution becomes faster as agents can quickly analyze issues and route them to the right human specialist. This human-AI collaboration is the future we're building. Learn more about The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers.

Bolstering Fraud Detection and Prevention

Agentic AI is a powerful defense against insurance fraud. Through continuous pattern analysis and anomaly detection, agents spot subtle inconsistencies that humans might miss. This enables A proactive approach to fraud, preventing it before it happens.

Real-time alerts notify human specialists of suspicious activity immediately, allowing them to act quickly. The result is reduced fraudulent payouts and lower costs for everyone, with improved detection accuracy and fewer false positives. This is part of how we're Solving the Insurance Labor Crisis with AI-Driven Innovation.

The Tangible Benefits of Adopting Agentic AI

When we talk about agentic ai use cases in insurance industry, we're not discussing future possibilities but real, measurable improvements. The change creates value across the entire business, from the C-suite to individual policyholders.

Key Benefits for Insurers

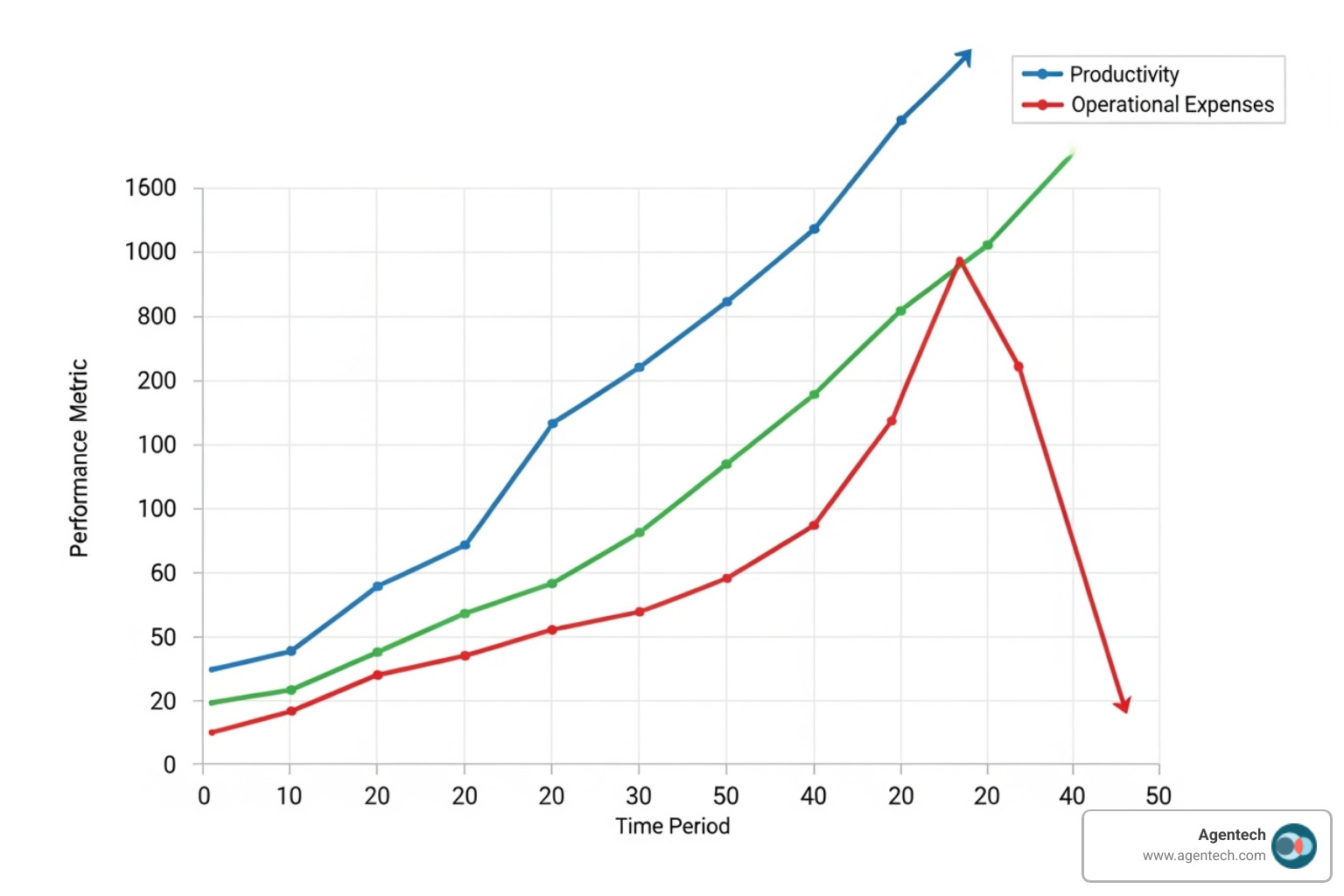

The numbers tell a compelling story. Companies embracing agentic AI are pulling ahead of the competition.

- Operational efficiency: A 25% improvement in efficiency allows departments to handle double the volume without adding headcount.

- Cost savings: Insurers see a 20% reduction in operational expenses, plus a 20-40% reduction in customer onboarding costs.

- Improved accuracy: AI agents achieve a 96% accuracy rate in decision-making, with a 3-5% accuracy improvement in claims processing, eliminating costly errors.

- Market leadership: AI leaders have generated 6.1 times the Total Shareholder Return (TSR) compared to peers over the past five years.

- Improved decision-making: Agents consolidate data in real-time, providing comprehensive insights to augment human judgment.

At Agentech, we've built our AI designed with adjusters in mind, focusing on augmenting human capabilities, not replacing them.

Key Benefits for Policyholders

Agentic AI creates a win-win situation, leading to dramatically better customer experiences.

- Faster claims settlements: Instead of waiting weeks, agentic AI can settle over 60% of claims in real-time. This speed is life-changing for customers dealing with an emergency.

- Personalized service: Policies and offers are custom to fit each person's unique situation, increasing loyalty and trust.

- 24/7 support: Customers get instant answers and real-time updates on claims status at any time of day.

- Fairer pricing: More precise risk assessment enables pricing that accurately reflects individual risk profiles.

- Improved customer experience: These benefits lead to a 5-10% boost in retention rates. Statistics show 62% of customers stay with an insurer after a good experience, compared to only 19% after a bad one.

The companies embracing these agentic ai use cases in insurance industry are setting new standards for the customer experience.

Navigating the Path to Agentic AI Adoption

Adopting agentic AI requires a strategic plan. Success depends on three pillars: data quality, technology platforms, and talent development. Getting these right open ups the full potential of agentic ai use cases in insurance industry. Many insurers are not sure where to start with AI, but a methodical approach that balances ambition with practicality is key.

Overcoming Challenges and Risks

Implementing agentic AI has challenges, but they can be managed with a clear plan.

- Data privacy: Processing sensitive data requires strict compliance. Our solutions are built with HIPAA and GDPR compliance in mind, featuring robust access controls and audit trails.

- Regulatory compliance: We help establish transparent decision-making processes with human oversight to meet regulatory demands for accountability.

- Algorithmic bias and fairness: Our focus on explainable AI ensures systems can articulate their decisions, building trust with regulators and customers.

- Implementation costs: While there are upfront costs, companies that invest in AI are seeing 6.1 times better returns than those that wait.

- Legacy system integration: Our solutions are designed for seamless integration with existing platforms, so you don't need to rip and replace your entire tech stack.

Overcoming these challenges requires balancing innovation and regulation with a focus on practical implementation.

A Strategic Framework for Implementation

Our proven framework takes the guesswork out of AI adoption.

- Assess your current state: Identify time-consuming processes ripe for automation and evaluate your data and system readiness for AI integration.

- Build a solid data foundation: We help create unified, clean datasets that are essential for effective AI performance.

- Establish clear governance: Define the rules of engagement for your digital workforce, determining what decisions AI can make independently and when to involve human experts.

- Launch targeted pilot projects: Start with quick wins, like automating claim profile creation, to prove value and build momentum.

- Invest in your people: Upskill your workforce to work alongside AI agents, allowing them to focus on complex cases and strategic decisions.

A critical decision is whether to buy vs. build your AI solutions. Partnering with specialists often delivers value faster. This framework allows you to start small, learn quickly, and expand gradually.

The Future is Autonomous: What's Next for Agentic AI?

The insurance industry is on the verge of extraordinary change. The agentic ai use cases in insurance industry will soon expand far beyond what we see today. At Agentech, our AI agents already handle hundreds of claims daily, but this is just the beginning of what's possible when autonomous intelligence meets insurance innovation.

- Hyper-personalization: Imagine policies that adjust in real-time based on behavior. Car insurance premiums could decrease after a month of safe driving detected by telematics, creating truly individualized coverage.

- Predictive loss prevention: Instead of just processing claims, agentic AI will work to prevent losses before they happen, such as alerting homeowners to flood risks and coordinating with emergency services.

- Collaborative AI: Advanced agents will amplify human expertise. Adjusters will work with AI partners that handle data gathering, freeing humans for complex negotiations and empathetic customer interactions.

- Multi-agent systems: Networks of specialized AI agents will work together on large claims, with each agent handling a specific task like damage assessment or vendor coordination to resolve cases faster.

According to Gartner's prediction on agentic AI adoption, by 2028, 33% of enterprise software applications will include agentic AI capabilities, and it will enable 15% of day-to-day work decisions to be made autonomously.

The vision is becoming reality. As Amazon's CEO forecasts billions of AI agents as coworkers, Agentech is already powering insurance claims with hundreds of autonomous agents. We're not waiting for the future of insurance—we're building it today.

Conclusion: Your Most Valuable Agent is an AI

The insurance world is changing fast, with agentic ai use cases in insurance industry leading the charge. These autonomous agents are reshaping claims processing and customer service with proven results: dramatic efficiency gains, cost savings, and superior accuracy. Most importantly, they lift human potential.

Your team isn't being replaced—they're being empowered. Our AI agents handle the tedious, repetitive tasks like creating claim profiles and validating documents. This frees your experts from administrative work so they can focus on complex cases that require human judgment, empathy, and intuition.

At Agentech, we've built our philosophy around this human-AI partnership. Our agents handle the routine so your people can handle the remarkable. It's about creating a world where insurance professionals can be more strategic, more engaged, and more human than ever.

The future of insurance isn't just here—it's working alongside your team right now. Every day, hundreds of our AI agents are processing claims, learning from each interaction, and getting better at supporting the human experts who guide them.

Ready to find what your most valuable agent can do? Explore how Agentech's AI Agents can transform your claims processing and see how autonomous intelligence can amplify your team's expertise.