The AI Revolution in Insurance Claims Processing

The insurance world is changing fast, driven by transformative ai applications in insurance claims processing. These aren't just buzzwords; they're tools delivering real impact.

Here's what AI can do in insurance claims:

- Automate tasks: AI handles repetitive jobs like data entry and document sorting. This frees up human workers.

- Process documents: It reads and understands unstructured data from many sources. This includes handwritten notes and medical reports.

- Detect fraud: AI spots suspicious patterns quickly, much faster than humans. This helps reduce financial losses.

- Speed up investigations: Tools like computer vision analyze images for damage. Drones can also help with this.

- Improve customer service: Faster processing and constant updates keep customers happier. This can reduce claim resolution times.

- Augment adjusters: AI frees up adjusters from routine work. This lets them focus on complex cases and build customer relationships.

I’m Alex Pezold, founder of Agentech AI. My experience building technology businesses and creating an AI workforce for insurance has shown me the power of ai applications in insurance claims processing to deliver unprecedented speed and accuracy.

Why Traditional Claims Processing Is Ripe for Disruption

The traditional insurance claims process is often stuck in the past. Filing a claim usually means mountains of paperwork, endless phone calls, and agonizing wait times—a bureaucratic maze for customers. This isn't just frustrating for them; it's a major challenge for insurers, making the industry ripe for disruption.

Claims data comes from various sources like bills, medical records, and handwritten notes. Managing this high volume of unstructured data is a struggle, leading to data silos where information is fragmented. Agents are often stuck with time-consuming manual data entry for each claim.

Manual data entry inevitably leads to errors. In fact, up to 35% of data inaccuracies stem from human input. These mistakes cause delays, rework, and incorrect payouts, costing an average of $25 for each manually corrected claim.

Many insurers still use legacy systems built on old technologies. These rigid systems are difficult to integrate with modern tools and limit real-time data access, hindering performance.

These manual processes and outdated systems result in high operational costs. The industry faces growing loss costs, but experts suggest ai applications in insurance claims processing could open up $100 billion in savings.

The industry also faces an aging workforce and a talent shortage, creating a significant skill gap as experienced adjusters retire. AI can help soften this blow by supporting new talent as they develop their expertise. Learn more in our article on Solving the Insurance Labor Crisis with AI-Driven Innovation.

Without standardized tools, inconsistent decision-making becomes a problem, leading to variations in claims handling that affect customer satisfaction and increase legal risks.

For too long, the insurance industry has lagged in customer experience innovation. The good news is that AI is now more accessible and affordable than ever, providing the tools to tackle these challenges and turn chaos into clarity.

How AI Transforms the Claims Lifecycle from FNOL to Settlement

AI is a powerful tool that reshapes the entire claims process, from first report to final payment. It streamlines workflows, improves accuracy, and speeds up processing, creating a smoother experience for policyholders and insurance teams alike.

Let's explore how ai applications in insurance claims processing make every stage of the claims journey faster, fairer, and friendlier.

Streamlining First Notice of Loss (FNOL)

The First Notice of Loss (FNOL) is where every claim begins. Traditionally, this involved long phone calls and manual data entry, but AI dramatically changes this process. Policyholders can now interact with 24/7 AI-powered chatbots and virtual assistants. Using Natural Language Processing (NLP), these tools understand inquiries, ask clarifying questions, and ensure cleaner submissions from the start, freeing up staff from routine tasks.

With IoT (Internet of Things) and telematics integration, claims can almost start themselves. Smart devices can automatically alert insurers, enabling real-time reporting. AI then takes over with automated data intake, extracting key details from various feeds. This cuts down on manual entry and ensures immediate, accurate data capture. A smoother FNOL process reduces administrative workload and puts the claim on a fast track, as we discuss in our article on creating the claim profile.

Accelerating Investigation and Damage Assessment

After a claim is reported, the investigation begins. This phase can be complex, but AI offers powerful tools to increase speed and precision. For property and vehicle claims, computer vision combined with drones optimizes investigations. AI models analyze images from smartphones or drones to quickly detect damage and create estimates, leading to faster, more consistent assessments, often without a physical inspection.

Image analysis and automated estimates allow AI to analyze policyholder photos, comparing them against large databases to generate preliminary repair costs. This provides consistent, objective damage assessment. AI can also validate claims against policy contracts by automatically checking coverage details, which reduces manual review and helps ensure accurate payouts. These technologies significantly speed up investigations, leading to faster decisions. At Agentech, our goal is to provide AI Designed with Adjusters in Mind, ensuring our tools augment human expertise.

Enhancing Fraud Detection and Settlement

Insurance fraud is a costly problem, with fraudulent claims costing over $40 billion a year according to the FBI. AI offers a strong defense by making detection more efficient. Predictive analytics and anomaly detection are key, as AI algorithms spot unusual patterns by comparing new claims against historical data, flagging suspicious activity much faster than manual review.

For routine, low-risk claims, automated payment triggers can manage the entire payment workflow. AI can predict a value, create an estimate, and use Robotic Process Automation (RPA) to coordinate with financial systems for fast, simple payment. AI also assists with subrogation identification by analyzing claims data to find recovery opportunities from at-fault third parties. Using AI for fraud detection and settlement protects an insurer's finances and ensures legitimate claims are paid quickly, improving customer satisfaction.

Core AI Applications in Insurance Claims Processing

Imagine a smart assistant that can read through handwritten police reports, medical records, and claim forms in seconds, extracting and organizing key information. That's what ai applications in insurance claims processing do today.

The real magic happens when AI tackles unstructured data – all those messy documents that don't fit neatly into spreadsheets. Traditional claims processing means someone has to manually read through accident reports and hunt for missing information. It's tedious work that takes hours.

AI changes this by acting like an intelligent reading machine. It can review lengthy accident declarations in seconds, extract key details, create clear summaries, and populate your claims management system automatically. This is huge when you consider that insurance companies deal with massive volumes of unstructured claims data daily. At Agentech, we've seen this evolution firsthand, as our insights on Changing Insurance Claims: The Evolution from Generative AI to Agentic AI show.

The Technologies Powering the Change

Behind these capabilities are several key AI technologies:

- Optical Character Recognition (OCR) converts scanned documents, PDFs, and handwritten notes into machine-readable text.

- Natural Language Processing (NLP) understands the meaning within the text, reading through claims narratives and policy documents.

- Machine Learning (ML) provides the brains, with algorithms that learn from past claims to spot patterns and make smart predictions.

- Predictive Analytics looks into the future, predicting potential fraud, estimating costs, or suggesting settlement amounts.

- Generative AI is a powerful new player that can summarize unstructured data, draft communications, and create training data.

- Robotic Process Automation (RPA) handles repetitive, rule-based tasks like data entry and payment coordination.

Real-World AI Applications in Insurance Claims Processing

In the real world, these technologies enable:

- Automated data entry: AI extracts information from forms and populates your database with high accuracy.

- Claims triage and routing: The system determines if a claim can be automated or needs human expertise, routing it accordingly.

- Risk scoring: AI models assess each claim's risk profile, flagging high-risk factors for review.

- Sentiment analysis: NLP reads customer communications to identify frustration or urgency.

- Automated customer communication: AI-powered systems send real-time status updates, keeping customers informed.

- Document summarization: Generative AI can summarize long reports into key points in minutes.

The results speak for themselves: ai applications in insurance claims processing can boost operational efficiency by 60% and achieve 99.99% claim validation accuracy. See how Odie Pet Insurance Implements Agentic AI to Automate Claims Tasking for a real-world example.

Empowering Adjusters: AI as a Digital Co-Worker

The best ai applications in insurance claims processing don't replace people; they make them better at their jobs. Think of AI as an efficient colleague who handles tedious tasks, freeing you to focus on what really matters.

Instead of spending hours on data entry or sorting documents, adjusters can evaluate complex damages, assess liability, and provide personalized advice to customers. This shift is crucial for job satisfaction. When you're not drowning in repetitive tasks, you can build real relationships and use your expertise on challenging cases.

The timing is critical, as the industry faces an aging workforce. AI helps bridge the resulting skill gap by giving new claims professionals the support they need to develop their skills on complex cases while AI handles routine work.

This human-in-the-loop approach is crucial. Adjusters review AI output, verify recommendations, and apply their judgment when needed. It's a collaboration that combines AI's speed with human wisdom and empathy. At Agentech, we believe in augmenting human capabilities, not replacing them. Our AI agents work alongside adjusters, handling tedious work so humans can focus on what they do best. Learn more in The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers.

Building Trust and Ensuring Transparency

For AI to work as a digital co-worker, people need to trust it. This trust is earned through transparency and reliability.

- Explainable AI is a game-changer. Instead of a "black box," AI should show how it reached a conclusion, whether assessing damage or flagging fraud. This transparency builds confidence.

- AI governance provides the rules of the road, ensuring AI meets business objectives and handles sensitive data privacy securely.

- Mitigating bias is another crucial piece. AI learns from data, so regular audits and human oversight are needed to identify and correct biases.

- Controlled confidence levels mean that when AI is unsure, the case is routed to a human adjuster. This ensures human intervention for complex or uncertain situations.

The goal is to create AI systems that adjusters can trust as true digital partners. When that trust exists, humans and AI can work together to deliver better outcomes.

Frequently Asked Questions about AI in Claims

When people hear "AI in insurance," they often picture robots taking over. Change can be intimidating, but the reality is far more encouraging than the headlines suggest.

Will AI replace insurance claims adjusters?

This is a common concern, but the answer is no, AI will not replace insurance claims adjusters. Like calculators for mathematicians, AI is a tool. It frees adjusters from tedious tasks like data entry so they can focus on solving complex problems. That's exactly what ai applications in insurance claims processing do.

AI excels at repetitive work, allowing adjusters to spend their time handling complex cases, enhancing their expertise, and building relationships with customers. The role is shifting, not disappearing. Adjusters are becoming more strategic and customer-focused. AI investments help soften the blow of impending retirements and support new talent development.

What are the biggest benefits of using AI in claims?

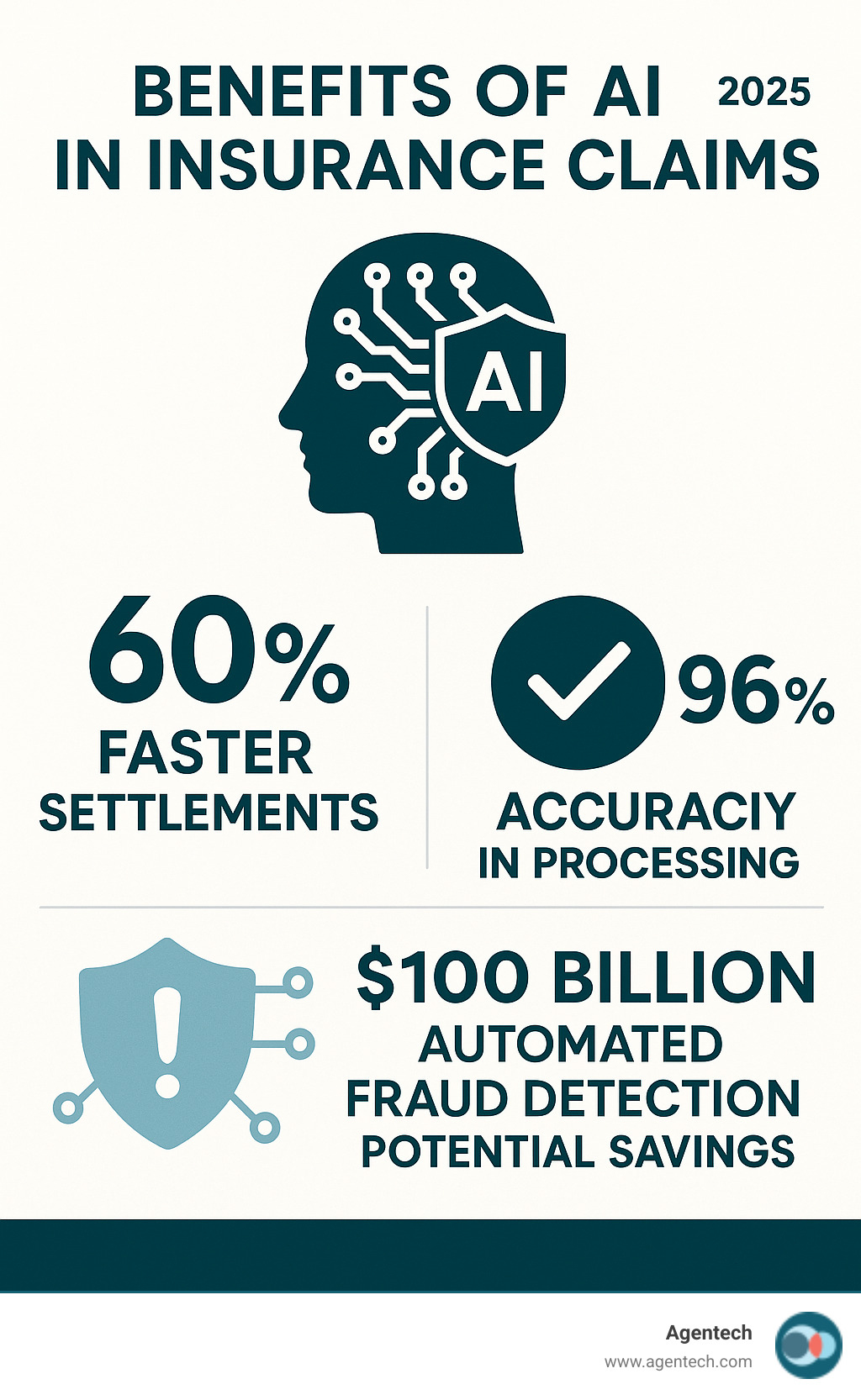

The benefits of AI implementation are remarkable:

- Increased efficiency: Automating parts of the claims lifecycle can boost operational efficiency by 60%.

- Faster settlement times: While manual claims can take 25 days, AI enables insurers to settle over 60% of claims in real-time.

- Improved accuracy: Reducing manual errors helps AI-driven claim validation achieve 99.99% accuracy.

- Improved customer experience: Faster, proactive, and personalized service builds loyalty. 62% of customers stay with an insurer after a positive claims experience.

- Cost reduction: Automation and fraud reduction could lead to $100 billion in industry savings, supporting business growth.

How do you get started with AI in claims processing?

Starting your AI journey doesn't have to be overwhelming.

- Start small and identify your biggest bottlenecks. Pick one specific pain point, like manual data extraction, where AI can deliver immediate value.

- Run pilot programs to test the technology, quantify benefits, and build internal confidence before committing to larger changes.

- Choose the right technology partner. Look for a partner who understands insurance, offers seamless integration, and prioritizes a human-centric approach. The right partner provides comprehensive support.

For insights into this approach, read about A Hybrid AI Solution for Claims Automation: How Agentic AI Combines Out-of-the-Box Efficiency with Custom QA Precision.

Successful adoption is about people and technology. Invest in training, communicate clearly, and foster a collaborative environment where humans and AI work as partners.

The Future of Claims is Collaborative and Intelligent

The future of insurance claims is a team effort, where human expertise meets intelligent technology. Soon, AI applications in insurance claims processing won't be an option; they'll be the standard.

As AI continues to evolve, we'll see even more advanced uses. Generative AI will not only summarize documents but also suggest next steps and help plan claim strategies. Closer integration with IoT and telematics will enable proactive risk management, helping to prevent losses before they happen.

Insurance companies that succeed will be those that build a smart AI strategy now. This means understanding their teams, workflows, and the best technologies to use. A thoughtful approach leads to efficient operations, happier customers, and better claim outcomes.

That's where Agentech comes in. We're here to help make this intelligent future a reality. We offer powerful AI automation that fits into your existing systems, with "always-on" assistants that boost adjuster productivity without replacing their critical decision-making role.

We believe AI should be a helpful partner, freeing adjusters from repetitive chores. This allows them to focus on what they do best: investigating damages, determining liability, and providing the expert advice that helps customers.

The path from confusing claims to clear, efficient ones is being paved. We invite you to join us on this journey. Find how Agentech is revolutionizing claims processing and let's explore how we can help you lead the way in this new age of smart claims management.