Why Machine Learning in Claims Processing is Changing the Insurance Industry

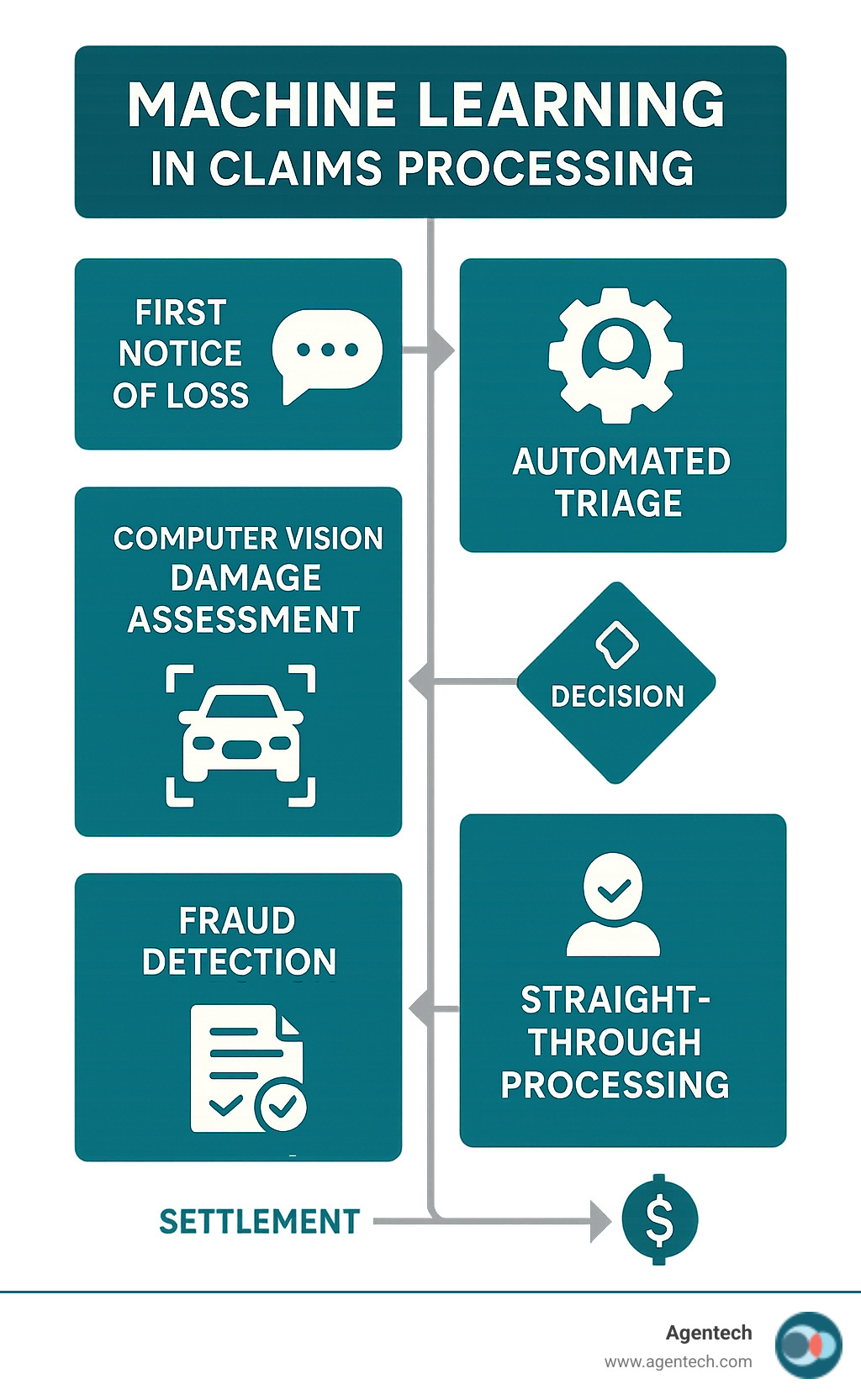

Machine learning in claims processing is revolutionizing how insurers handle everything from first notice of loss to final settlement. Here's what you need to know:

Key Applications:

- Automated FNOL and Triage - AI chatbots guide customers through claim submission 24/7

- Instant Damage Assessment - Computer vision analyzes photos for repair estimates in seconds

- Advanced Fraud Detection - Pattern analysis identifies suspicious claims that cost the industry over $40 billion annually

- Straight-Through Processing - Simple claims get approved and paid without human intervention

- Subrogation Optimization - AI identifies recovery opportunities human adjusters often miss

Primary Benefits:

- 99.99% accuracy in AI-driven claim validation

- 60% boost in operational efficiency

- 25-30% expense reduction through improved claim handling

- 75% fraud reduction for insurers using AI tools

Traditional claims processing is defined by manual data entry, prolonged wait times, and paper-heavy workflows. Each manually reworked claim costs an average of $25, and with roughly 20% of claims delayed or denied, insurers lose thousands monthly on rework alone.

Machine learning transforms this outdated process into a streamlined, intelligent system that processes claims in minutes instead of days, dramatically improving accuracy and customer satisfaction.

As Alex Pezold, founder of Agentech AI, I've seen how machine learning in claims processing can revolutionize insurance operations after successfully scaling and exiting TokenEx, one of Oklahoma's largest technology companies. Now I'm focused on building AI solutions that automate the tedious tasks that bog down claims teams daily.

Understanding the Shift: From Rules-Based Automation to Intelligent Processing

Imagine a claim with photos from an unusual angle or descriptions using unfamiliar terms. Traditional, rules-based automation would stumble, unable to handle variations outside its rigid "if-then" programming. These systems are fast but inflexible, requiring manual reconfiguration for every new scenario.

This is where machine learning in claims processing changes everything. Instead of following static rules, ML models learn from data, much like a person recognizes patterns after seeing thousands of examples.

Think of it this way: traditional automation is a cookbook with exact recipes, while machine learning is a chef who understands cooking principles and can adapt to available ingredients.

By analyzing massive amounts of historical claims data, ML models spot patterns, relationships, and anomalies impossible for humans or rule-based systems to detect. They make predictions and classify information with increasing accuracy over time. This dynamic, adaptive approach is what we call "intelligent processing."

Here's how the two approaches stack up:

| Feature | Traditional Automation | Machine Learning Automation |

|---|---|---|

| Logic Basis | Pre-defined, static rules | Learns from data, adapts over time |

| Flexibility | Rigid, struggles with variations | Highly adaptable, handles complexity |

| Data Handling | Primarily structured data | Structured, semi-structured, unstructured |

| Decision Making | Rule-bound, binary | Predictive, probabilistic, nuanced |

| Improvement | Requires manual reprogramming | Continuous learning, self-improving |

| Complexity Handled | Simple, repetitive tasks | Complex patterns, uncertain scenarios |

| Scalability | Limited by rule maintenance | Scales efficiently with data volume |

How Machine Learning Improves Efficiency and Accuracy

The efficiency and accuracy gains from machine learning in claims processing are remarkable. AI systems make consistent, data-driven decisions, avoiding the human errors that account for up to 35% of data inaccuracies in traditional processes. These systems work 24/7 without fatigue, reviewing and resolving claims at incredible speeds, which dramatically cuts wait times for policyholders.

The real game-changer is handling unstructured data—emails, notes, and PDFs. Traditional systems fail here, but ML uses Natural Language Processing (NLP) to read and extract key information from documents just like a skilled adjuster, only faster. For visual assessment, computer vision analyzes photos to estimate repair costs instantly, eliminating the need for an inspector's visit.

The results speak for themselves: AI-driven validation accuracy reaches up to 99.99%. Combined with a 60% boost in operational efficiency, we're not just doing things faster—we're doing them right.

At Agentech, our solutions are AI-designed with adjusters in mind, ensuring these powerful tools augment human capabilities, not replace the expertise of experienced adjusters.

The Critical Role of Data in ML Models

If machine learning is the engine, then data is its fuel. Without high-quality, relevant data, even the most sophisticated ML models will fail. Our models thrive on historical claims data, policy information, text, images, and video to learn context and make accurate predictions.

The insurance industry sits on a goldmine of data, yet most insurers only use about 10-15% of it. The remaining 85-90% of potential insights are untapped, holding keys to understanding customer behavior, improving risk assessment, and detecting fraud with unprecedented precision.

However, data quality is paramount. As the saying goes, "garbage in, garbage out." An estimated 83% to 92% of all AI projects fail due to poor data quality, often caused by data silos and inconsistent formats. This is why robust data governance policies are essential. Data cleansing, preparation, and monitoring ensure AI models receive clean, structured information to deliver reliable insights.

A Step-by-Step Guide to Implementing Machine Learning in Claims Processing

Implementing machine learning in claims processing is a strategic journey, not an overnight switch. A phased approach focusing on key areas yields significant benefits and revolutionizes claims operations.

Step 1: Automate First Notice of Loss (FNOL) and Triage

The First Notice of Loss (FNOL) sets the tone for the claims experience. Traditional methods involving phone calls and manual entry are often frustrating. With machine learning, FNOL intake becomes seamless and efficient.

AI-powered chatbots and voice assistants guide customers through claim submission 24/7, collecting details, media files, and structured data. This provides immediate support and reduces manual data entry.

Once captured, machine learning excels at intelligent triage. Models analyze incoming data, assign a complexity score, and categorize claims by urgency, severity, and fraud potential. Simple cases are routed for automated processing, while complex claims are flagged for human adjusters. This ensures skilled adjusters focus their time where it matters most.

Step 2: Leverage Computer Vision for Instant Damage Assessment

Instead of waiting days for an adjuster, a policyholder can snap photos of damage with their smartphone. Within seconds, machine learning takes over using computer vision.

Our computer vision models analyze photos and videos, compare them against historical data, and provide instant, accurate repair estimates. This accelerates the claims process and can lead to straight-through processing for simple claims, with payment initiated almost immediately. This capability boosts efficiency and provides a superior customer experience, turning a stressful event into a swift resolution.

Step 3: Implement Advanced Fraud Detection

Fraud is a persistent challenge for the insurance industry, costing over $40 billion a year. Traditional, rule-based fraud detection is slow and often misses sophisticated schemes. Machine learning offers a powerful antidote.

Our ML models analyze vast amounts of claims data to identify patterns and anomalies indicative of fraud. They can spot unusual claim timing, suspicious networks of claimants and repair shops, and other red flags. As new fraud tactics emerge, our AI systems adapt and improve their detection capabilities.

The impact is substantial: insurers using Agentech's AI have reduced fraud by up to 75%. This saves millions and helps maintain affordable premiums. By flagging suspicious activities for human review, AI acts as an invaluable first line of defense.

Step 4: Enable Straight-Through Processing (STP) and Subrogation

The ultimate goal is straight-through processing (STP), where claims are handled from start to finish without human intervention. For low-complexity claims, machine learning makes this a reality. Our automated decision engines can assess claims, verify data, and approve payments in minutes, leading to "touchless claims" and instant settlement.

Beyond settlements, machine learning improves subrogation—the process of recovering money from a responsible third party. Identifying these opportunities is traditionally time-consuming. Our AI models automate the review of claim data, police reports, and photos to spot subrogation chances that humans might miss, significantly increasing revenue recapture for insurers.

Overcoming Key Implementation Challenges

Implementing machine learning in claims processing has its challenges, but they are manageable with proactive planning and strategic implementation. We recommend a human-in-the-loop approach that keeps your experienced team at the center while AI handles repetitive tasks.

Effective change management is crucial. Adjusters need to see how AI makes their jobs easier, not harder. The most successful implementations occur when everyone understands AI is a tool to augment human expertise, not replace it.

Tackling Data Quality and Governance

Poor data quality is the primary reason an estimated 83% to 92% of all AI projects fail. Data silos and inconsistent data—where the same event is described with different terms—prevent AI from getting a complete picture.

Data cleansing and preparation are critical first steps. We help partners standardize formats, remove duplicates, and fill in missing information. Establishing solid data governance policies is the real game-changer. Clear rules for data entry, storage, and access ensure AI models learn from clean, consistent data.

Addressing Ethical Concerns and Algorithmic Bias

AI bias is a real-world problem, as seen in the Apple Card case, where an algorithm produced discriminatory results by learning from biased historical data. Fairness and transparency are essential for maintaining policyholder trust.

We are committed to Explainable AI (XAI). When our AI flags a claim, it explains its reasoning in plain English, allowing adjusters to use their judgment. We also conduct regular bias testing to check for discriminatory outcomes and retrain models as needed.

The risk of bias in training data is manageable with diverse datasets, human oversight, and feedback loops that help the system learn better patterns. Staying compliant is also crucial, which is why we focus on AI in insurance: balancing innovation and regulation.

The Future of Claims: Trends and Outlook

The change from machine learning in claims processing is just beginning. Today's innovations will soon be standard as the industry moves to full-scale AI implementation. Key trends include continuous evolution, increased adoption, hyper-personalization, and proactive risk mitigation.

We're witnessing a fundamental shift away from one-size-fits-all processing toward intelligent systems that adapt to each unique situation.

The Rise of Generative and Agentic AI

The next wave of AI is here. Changing Insurance Claims: The Evolution from Generative AI to Agentic AI shows where we're headed.

Generative AI acts as a brilliant assistant, summarizing complex documents in seconds or drafting empathetic, compliant customer communications.

Agentic AI takes this further, acting as digital coworkers that automate multi-step workflows. These AI agents can review claims, make decisions, route tasks, and trigger payments autonomously. They are not just tools; they are tireless team members that get things done.

Empowering Adjusters and Bridging the Skills Gap

AI won't replace adjusters; it will augment them. As a "bionic co-pilot," AI handles tedious administrative work so adjusters can focus on what matters: complex negotiations, tricky liability questions, and empathetic conversations with policyholders.

AI augments human expertise by spotting patterns, flagging potential issues, and providing instant access to case histories. This is crucial for bridging the industry's skills gap. AI acts as a mentor for new adjusters, enabling them to get up to speed quickly with guidance based on thousands of successful claims.

With the administrative burden gone, experienced adjusters can focus on complex, high-empathy cases. Faster onboarding means teams can scale without sacrificing quality. We're not just solving the insurance labor crisis with AI-driven innovation; we're creating a future where technology and human expertise work together for better outcomes.

Frequently Asked Questions about Machine Learning in Claims Processing

Will AI and machine learning replace claims adjusters?

No. This is a common misconception. The goal of machine learning in claims processing is to augment the invaluable human touch, not replace it. Think of AI as a powerful "bionic co-pilot" for your adjusters.

Our AI tools handle repetitive, data-heavy tasks like data extraction and initial claim profiling. By taking on these administrative burdens, AI frees up human adjusters to manage complex negotiations, build empathetic relationships with policyholders, and apply critical judgment where human experience is essential. The future is about combining AI's efficiency with human expertise.

How does machine learning improve the customer experience?

Machine learning in claims processing transforms a traditionally slow and frustrating process into one that is fast, clear, and user-friendly. It reduces wait times from weeks to days or even minutes for simple claims.

ML enables 24/7 service through intelligent chatbots that handle FNOL and answer questions instantly. This accessibility, combined with more consistent and accurate outcomes, dramatically boosts customer satisfaction and loyalty. The streamlined process makes a stressful time easier for your policyholders.

What is the first step to getting started with ML in claims?

The best first step is to assess your data readiness and identify a specific, high-impact pain point in your workflow, such as FNOL intake or a high-volume, low-complexity claim type. Starting with a focused pilot project allows you to demonstrate tangible value quickly and build momentum.

Clean, structured data is the fuel for any successful AI project, so prioritizing data quality and governance from the outset is crucial. Starting with smaller "quick wins" builds confidence and paves the way for bigger changes.

Conclusion

It's clear machine learning in claims processing is a game-changer for insurance. It delivers speed, accuracy, and cost savings while improving customer satisfaction by accelerating claims. From automated FNOL and damage assessment to advanced fraud detection and straight-through processing, ML is redefining what's possible by taking the heavy lifting out of daily tasks.

This shift to AI isn't about replacing your talented adjusters; it's about giving them superpowers. As "bionic co-pilots," they are freed from paperwork to focus on complex cases and build empathetic relationships with policyholders. It also helps new team members get up to speed faster, future-proofing your team.

At Agentech, we make this change smooth and effective. We provide AI-powered automation tools that fit into your existing workflows. Our smart AI assistants boost adjuster productivity without removing their crucial human decision-making. The future of claims is smarter, more automated, and ready to help your business thrive.

Ready to see how intelligent automation can lift your business?

Learn more about how AI can transform your claims operations.