Why Insurance Claims Solutions Matter More Than Ever

Insurance claims solutions are claims software platforms and AI tools that help Property & Casualty (P&C) insurance carriers, Third-Party Administrators (TPAs), and Independent Adjusting (IA) Firms automate claims processing, reduce manual work, and deliver faster settlements. Modern solutions typically include:

- Automated FNOL intake: Capture first notice of loss from multiple channels

- AI-powered document processing: Extract data from claims documents with 98%+ accuracy

- Smart claims triage: Route claims to the right adjuster based on complexity and expertise

- Fraud detection: Flag suspicious claims using predictive analytics

- Real-time dashboards: Monitor claim status and adjuster workloads

- Integration capabilities: Connect seamlessly with existing core systems

The stakes for getting claims right have never been higher. Research shows that 3.5x more policyholders renew after a positive claims experience, while 30% of dissatisfied claimants switch carriers, citing claims experience as a bigger factor than price. Yet many P&C insurers struggle to meet rising customer expectations. Policyholders want resolutions within hours, but too many wait weeks or months.

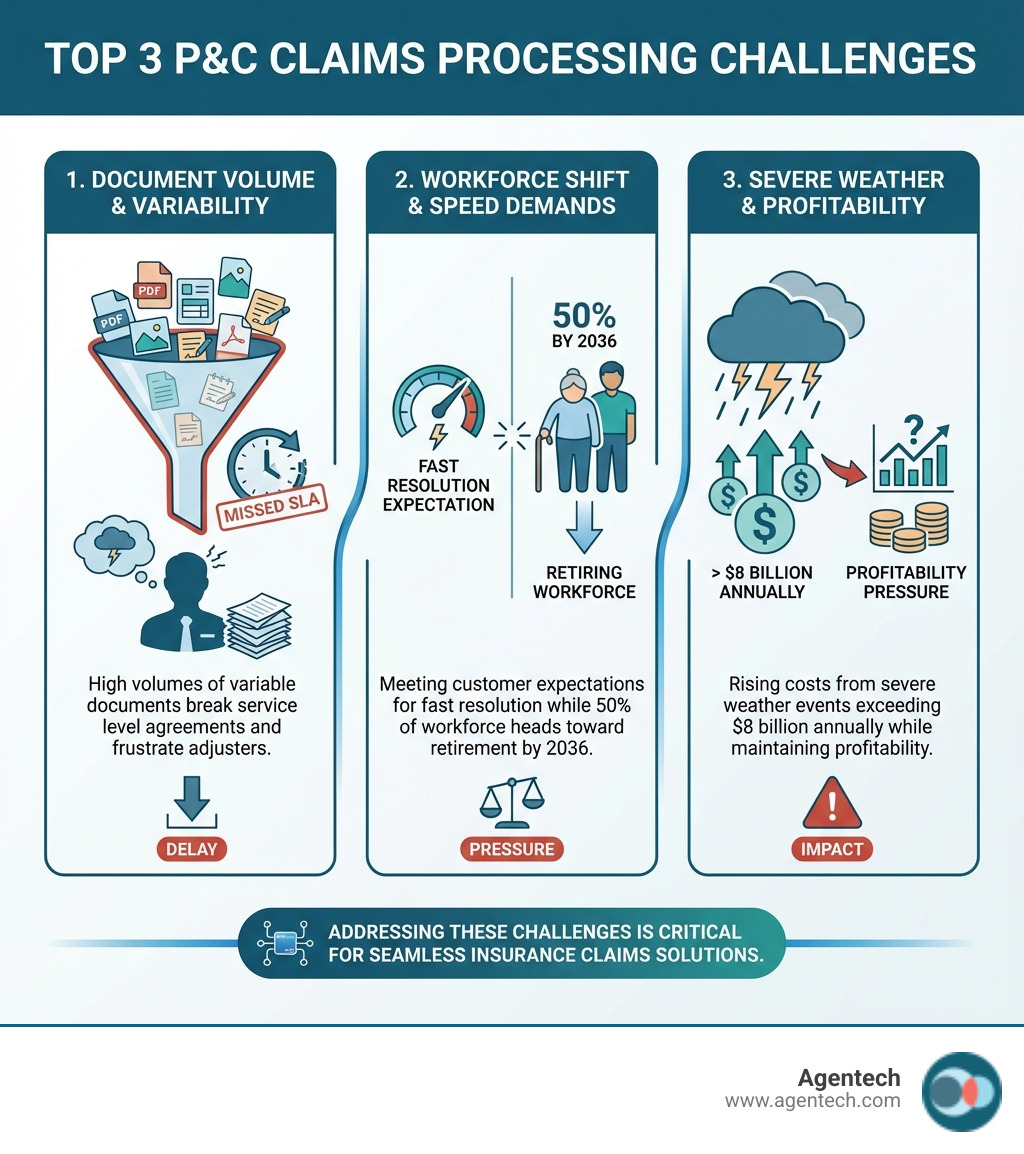

At the same time, the industry faces mounting operational pressure. Insured damage from severe weather events in Canada alone surpassed $8 billion in 2024. Half of the current P&C insurance workforce will retire by 2036. Manual processes that worked a decade ago now create bottlenecks, delays, and frustrated customers.

The good news? Technology is changing what's possible. AI agents now process 99%+ of FNOL requests straight through. Document classification times have dropped by over 90%. Some carriers achieve instant settlement on more than 67% of claims, with up to 48% reduction in operating costs.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for the P&C insurance industry, starting with claims automation in the pet insurance sector. Before Agentech, I founded and successfully exited TokenEx, and I've spent years helping insurers leverage Insurance claims solutions to create scalable, high-impact operations that reduce costs while improving customer outcomes.

The Modern Claims Challenge: Navigating Complexity and Customer Expectations

P&C claims are often called the "moment of truth" for insurers. It is during this critical interaction that a policyholder truly experiences the value of their coverage. Yet, this pivotal moment is fraught with challenges for P&C insurance carriers, TPAs, and IA Firms.

One of the primary challenges we face is the ever increasing complexity of claims. Whether it is residential property, auto, pet, or workers' compensation claims, the volume and intricacy of each case seem to grow. For instance, in Canada alone, insured damage from severe weather events surpassed $8 billion in 2024, leading to a surge in complex property claims. This means more claims to process, often under urgent circumstances, and with greater scrutiny.

Customer expectations in P&C insurance are also soaring. Policyholders, accustomed to instant gratification in other areas of their lives, now expect rapid, transparent, and empathetic claims resolution. They want to be made whole again faster. Our research indicates that 48% of policyholders do not believe insurers have their best interests at heart. When claims are denied, whether valid or not, it can frustrate clients and even expose brokers to errors and omissions (E&O) risks. As Linda Buckton, Vice President of Client Executive at BFL Canada, wisely notes, "When people have been involved in a claim, it is never a happy situation. I do think having someone who shows compassion and caring goes a long way."

Adding to this pressure is a looming workforce crisis. A significant portion of the current P&C insurance workforce, 50%, is projected to retire by 2036. This impending talent gap means we must find ways to maintain, or even improve, operational efficiency with fewer human resources. Manual processes, once the norm, now contribute to bottlenecks and delays, making it harder to meet service level agreements (SLAs).

The cumulative effect of these factors is immense pressure to reduce costs while simultaneously improving operational efficiency. We are constantly seeking ways to streamline processes, minimize claims leakage, and optimize resource allocation. This is where modern Insurance claims solutions step in, offering a lifeline to steer these complexities.

How Technology and AI are Changing Claims Management

The P&C insurance industry is undergoing a profound change, moving from predominantly manual processes to highly automated, intelligent workflows. At the heart of this shift are advancements in technology and artificial intelligence (AI).

AI and machine learning are no longer futuristic concepts; they are actively reshaping every stage of the claims process. From the moment a claim is filed, AI can step in to assist. For example, AI agents are now capable of processing over 99% of First Notice of Loss (FNOL) requests straight through, significantly reducing initial handling times. This level of automation is crucial for us, especially when considering the volume of digital claims. Indeed, approximately 80% of all claims are filed digitally by customers, with almost 50% handled straight through. This is a testament to the power of AI in accelerating the claims journey. You can learn more about how AI is revolutionizing claims processing by reading our article on AI Claims Processing Insurance.

Data analytics plays a pivotal role in this change. Leading industry data providers leverage vast databases, with one prominent example encompassing 1.8 billion claims, used by 95% of the top P&C insurance carriers in the U.S. This wealth of data, combined with cutting edge AI powered technology, allows us to embed timely, reliable insights directly into our claims management systems. This leads to more informed decision making throughout the entire claims lifecycle, from FNOL to final settlement.

AI tools are proving invaluable in streamlining various aspects of claims management, including intake, triage, and document management. This allows our claims professionals to focus on strategic thinking and customer connections rather than repetitive administrative tasks. As we explore in our piece on Agentic AI in Insurance: When Bots Become Your Best Agents, these intelligent assistants are becoming integral to our operations. They transform the claims process by offering AI driven insights and guidance, enabling quicker, more accurate processing of auto, residential property, pet, and workers' compensation claims.

The integration of advanced machine learning techniques, as discussed in our Insurance Claims Machine Learning article, empowers us to automate with confidence, identifying low risk claims earlier and investigating high risk claims faster. This not only reduces cycle times and associated expenses but also improves the overall outcome for our policyholders.

Key Features of Top-Tier Insurance Claims Solutions

When we evaluate Insurance claims solutions, we look for specific features that empower P&C insurance carriers, TPAs, and IA Firms to excel. The ideal claims management software is not just a tool; it is a strategic asset that integrates seamlessly into our operations, enhancing every aspect of the claims lifecycle.

Modern claims management software is typically offered as Software as a Service (SaaS) platforms, providing flexibility, scalability, and ease of deployment. These solutions must offer robust core systems integration, connecting effortlessly with our existing P&C insurance IT systems. As we discuss in Insurance IT Systems, seamless integration is non negotiable for maintaining a cohesive and efficient environment. Furthermore, strong security protocols, such as ISO 27001 certification and GDPR compliance, are paramount to protect sensitive policyholder data.

Intelligent Automation and Workflow

At the core of effective Insurance claims solutions is intelligent automation. Our goal is to leverage AI Agents to streamline workflows and boost adjuster productivity without replacing human decision making.

These AI Agents, acting as virtual assistants for insurance, are particularly adept at handling routine and repetitive tasks. They excel at FNOL intake, capturing initial claim details from various channels. Through AI Optical Character Recognition (OCR) and advanced data extraction, they can process vast volumes of documents, converting unstructured data into structured, actionable information with impressive accuracy, often exceeding 98%. This capability is vital for residential property, auto, pet, and workers' compensation claims, which can generate extensive documentation. We explore the benefits of these assistants further in our article Virtual AI Assistants for Insurance: Meet Your New Best Friend.

Smart assignment is another critical feature. It ensures that each claim is instantly routed to the right expert at the right time. This routing can be based on a multi factor system, considering factors such as an adjuster's skill set, licensing, geographical location, claim type, complexity, and even vendor involvement. This intelligent triage process significantly speeds up initial claim handling and ensures that specialized cases, like complex workers' compensation claims, land in the hands of the most qualified professionals. Automated policy checks further improve efficiency by instantly verifying coverage details against policy documents. Our article AI Claims Processing System digs deeper into how these systems revolutionize claims processing.

Data Analytics and Fraud Detection

The sheer volume of data generated by P&C claims is immense, and modern Insurance claims solutions harness this data for powerful insights. Leading data providers manage vast claims databases, providing unparalleled resources for analysis.

The role of data analytics in modern claims management cannot be overstated. It enables predictive analytics, allowing us to anticipate potential issues and identify trends. This is particularly valuable for fraud detection. AI powered fraud flagging and anomaly detection capabilities analyze claims data to identify suspicious patterns, helping us prevent fraudulent payments. These systems can compare claims for similarities, integrate external data, and apply machine learning models to flag inflated costs or suspicious activity.

AI decision support tools provide adjusters with intelligent recommendations and rationales, boosting their confidence and consistency in decision making. Real time dashboards offer a comprehensive overview of claims operations, highlighting bottlenecks and performance metrics. Furthermore, secure, anonymous peer benchmarking allows us to optimize decisions and lower claims loss ratios by comparing our performance against industry standards. This continuous analysis helps us to break through the data plateau and open up new strategic opportunities, as discussed in Breaking Through the Data Plateau: A Strategic Opportunity.

Customer and Adjuster Experience Tools

A positive claims experience hinges on both customer satisfaction and adjuster efficiency. Modern Insurance claims solutions are designed with both in mind.

For policyholders, multi channel communication options, including online portals, phone, email, and mobile apps, ensure accessibility and convenience. Real time status updates provide transparency, keeping customers informed throughout the claims journey. Simplifying complex insurance language also contributes to a more positive and less stressful experience.

Crucially, these solutions are designed to support, not replace, our adjusters. As we emphasize in AI Designed With Adjusters in Mind, AI assistants for adjusters take on repetitive administrative tasks, freeing up their time to focus on complex cases and empathetic customer interactions. This reduction in administrative burden, which we explore in Insurance Back Office Automation, empowers adjusters to apply their expertise where it matters most, leading to faster and more accurate claims resolution across all P&C lines, including residential property, auto, pet, and workers' compensation.

The Core Benefits of Modern Insurance Claims Solutions

Why should P&C insurance carriers, TPAs, and IA Firms prioritize modernizing their Insurance claims solutions? The answer lies in a compelling combination of competitive advantage, significant return on investment (ROI), and the ability to steer the complex landscape of today's P&C insurance market. The decision to invest in advanced claims software, whether buying a robust SaaS solution or developing in house, is a strategic one, as highlighted in our article Buy vs. Build: Navigating the SaaS AI Technology Decision.

Improve Operational Efficiency and Reduce Costs

One of the most immediate and tangible benefits of implementing modern Insurance claims solutions is a dramatic improvement in operational efficiency and a significant reduction in costs.

By automating manual and time consuming processes, we can achieve substantial reductions in claims cycle times. Some solutions enable instant settlement on more than 67% of claims, changing what once took days or weeks into seconds or minutes. This not only delights customers but also frees up valuable adjuster time. We have seen instances where operating costs have been reduced by up to 48%, a testament to the power of automation.

These solutions also help us reduce claims leakage by ensuring more accurate, error free data collection and consistent application of claim processing rules, thus minimizing overpayments. Optimized resource allocation becomes possible through intelligent claim assignment and workload management, allowing adjusters to focus on complex cases that require their unique expertise. In fact, by leveraging AI driven innovation, we are effectively solving the P&C insurance labor crisis, as discussed in Solving the Insurance Labor Crisis with AI-Driven Innovation, by increasing adjuster capacity without proportionally increasing headcount.

Improve Accuracy and Compliance

Accuracy is paramount in claims handling. Modern Insurance claims solutions significantly reduce manual errors by automating data capture and processing, leading to more data driven decisions. Leading AI agents, for example, achieve 98% accuracy across a broad of data capture and classification tasks.

Comprehensive audit trails ensure that every decision and action within the claims process is traceable and explainable, providing a robust defense against disputes. Automated reporting capabilities simplify compliance with state and federal regulations, minimizing compliance risk and avoiding costly penalties, particularly for areas like Medicare compliance in workers' compensation claims. This focus on accuracy and compliance is essential for building trust and maintaining a strong reputation. Our article AI in Insurance: Balancing Innovation and Regulation further explores this delicate balance.

Create a Positive Customer Experience

The goal of any claims solution is to "make customers whole again faster." A positive claims experience is a powerful driver of customer loyalty. Research consistently shows that policyholders are 3.5 times more likely to renew after a positive claims experience. Conversely, 30% of dissatisfied claimants switch carriers, often citing the claims experience as a bigger reason than price.

Modern solutions deliver faster settlements and increased transparency through customer portals and real time updates. This proactive communication, combined with simplified language, fosters trust and reduces anxiety for policyholders. As Linda Buckton of BFL Canada aptly states, empathy is just as important as efficiency during a claim. By streamlining processes with AI, our adjusters have more capacity to deliver that crucial human touch, ensuring policyholders feel heard and supported. We know that winning new customers costs 7 to 9 times more than keeping current policyholders happy, making customer retention through superior claims service an economic imperative. Our approach to Designing for the Future: How AI Transforms the Claims Experience reflects this commitment.

Emerging Trends and the Future of Claims Management

The landscape of P&C insurance claims management is continuously evolving, driven by technological innovation and shifting policyholder expectations. As we look to the future, several key trends are emerging that will shape the next generation of Insurance claims solutions.

One significant shift is towards proactive loss prevention and mitigation. Instead of simply reacting to claims, insurers are leveraging data and predictive analytics to identify potential risks before they materialize, or to minimize their impact when they do. This foresight can lead to better outcomes for both policyholders and carriers, particularly in areas prone to severe weather events.

Agentic AI represents a leap forward in automation. Unlike traditional AI that follows predefined rules, agentic AI systems can autonomously plan, adapt, and execute multi step tasks. These "digital coworkers" are not just tools; they are intelligent agents that can break down complex goals into sub tasks and select optimal strategies, continuously learning and improving. This evolution from generative AI to agentic AI is changing claims, as detailed in Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI. We envision a future where these AI agents work seamlessly alongside human adjusters, as explored in The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers.

However, the future of claims management is not solely about technology; it is about balancing technology with the human touch. As Elizabeth Bull, Senior Vice President of Claims, Canada, reminds us, the future of claims service involves "a careful balance between utilizing new technological advancements in the claims arena and preserving the high touch, hands on service." AI tools can streamline intake, triage, and document management, but this must be in harmony with human judgment and emotional awareness. Chelsea Thibodeau, Vice President of Business Development and Senior Claims Specialist, echoes this sentiment, emphasizing that "you need a human in the mix, especially in a charged claim situation."

This balance will enable hyper personalization of the claims experience. By leveraging data and AI, insurers can tailor communication, support, and even settlement options to individual policyholder needs, creating a truly bespoke and empathetic experience. Brokers are already placing less emphasis on speed alone, and greater value on technical expertise and client service. This indicates a growing desire for nuanced, expert driven interactions, facilitated by efficient technology.

Conclusion: Building a Future Ready Claims Operation

The P&C insurance industry stands at a critical juncture. The challenges of increasing claim complexity, escalating customer expectations, and a shrinking workforce are undeniable. However, these very challenges are also catalyzing unprecedented innovation in Insurance claims solutions.

We have seen how modern claims management software, powered by AI and advanced analytics, can transform these obstacles into opportunities. By implementing intelligent automation, enhancing data driven fraud detection, and prioritizing both customer and adjuster experience, P&C insurance carriers, TPAs, and IA Firms can achieve remarkable improvements in operational efficiency, cost reduction, accuracy, and compliance. Crucially, these solutions foster a positive customer experience, leading to greater loyalty and a stronger bottom line.

The future of claims management is exciting, with emerging trends like proactive loss prevention, agentic AI, and hyper personalization promising even more sophisticated and seamless workflows. The key to success lies in embracing these innovations while maintaining the essential human element of empathy and expertise.

At Agentech, we are dedicated to helping you steer this evolving landscape. Our AI Agents are designed to provide seamless integration and act as always on digital coworkers, boosting adjuster productivity without ever replacing the invaluable human decision making that defines the P&C insurance industry. The path to a truly seamless workflow is clear: it involves strategic investment in advanced Insurance claims solutions.

Explore AI Agents for Claims Automation

Citations:

- The Top Insurance Claims Carriers in Canada | 5-Star Claims. (2025). Insurance Business Canada.

- Insurance Claims Management System Reviews and Ratings. (n.d.). Gartner Peer Insights.

- Claims Adjusting Services. (n.d.). ClaimsPro.

- Insurance claims services. (n.d.). PwC.

- Northbridge Insurance – AI-powered progress. (n.d.). Insurance Business Canada.

- Royal Claims Services – Digitizing with purpose. (n.d.). Insurance Business Canada.