Why AI Assistants Are Revolutionizing the Insurance Industry

AI assistant for insurance solutions are changing how insurance companies handle everything from claims processing to customer service, offering 24/7 support and dramatically faster settlement times.

Key Benefits of AI Assistants in Insurance:

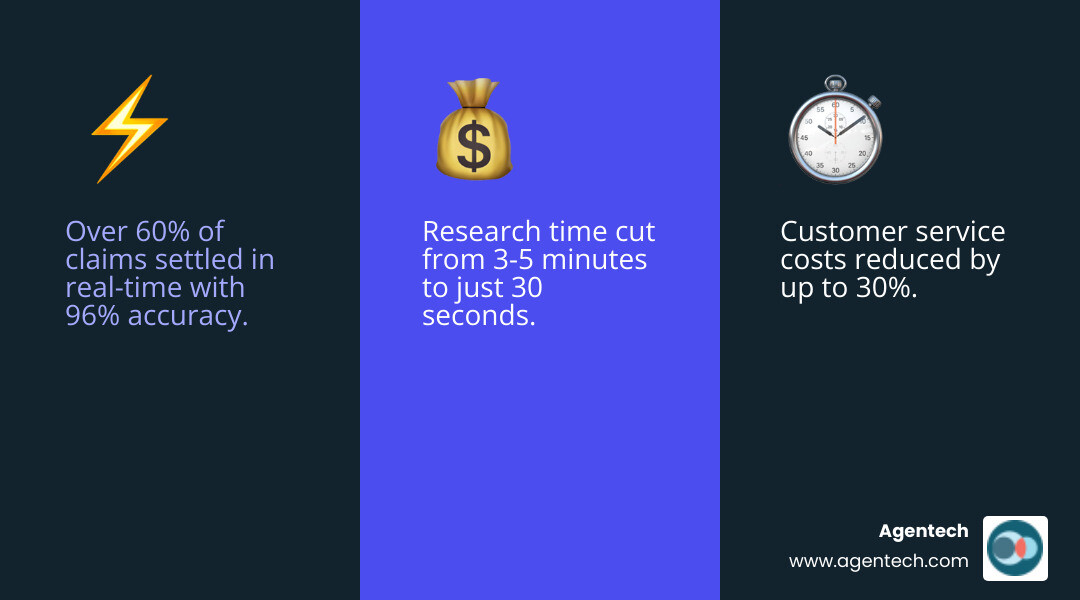

- Claims Processing: Settle over 60% of claims in real-time with 96% accuracy

- Cost Reduction: Save $1-3 per customer interaction compared to traditional support

- Time Savings: Reduce research time from 3-5 minutes to 30 seconds

- 24/7 Availability: Provide instant customer support without wait times

- Fraud Detection: Identify suspicious claims through pattern analysis

- Automated Underwriting: Speed up policy approvals with risk assessment tools

The insurance industry faces mounting pressure to deliver faster service while managing complex regulations and rising customer expectations. Traditional manual processes that take weeks can now be completed in hours or even real-time.

As Ben Bomhoff, VP of Enterprise Systems at Security First Insurance, noted: AI technology creates "improvements in customer satisfaction, cost reduction, and competitive advantage through a defined technology strategy."

The change is already happening. Insurance companies using AI report settling over 50% of claims instantly, while chatbots reduce customer service costs by up to 30%. For mid-sized insurers handling 100,000 monthly inquiries, this translates to annual savings of $1.2-3.6 million.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for insurance with a focus on revolutionizing claims processing through cutting-edge ai assistant for insurance solutions. Having successfully scaled and exited TokenEx in 2021, I now lead our mission to transform the insurance industry with AI-driven automation that delivers unprecedented speed and accuracy.

The Transformative Power of an AI Assistant for Insurance Operations

For insurance companies, AI is more than hype—it's a genuine change. An ai assistant for insurance delivers real cost savings, faster processes, and better accuracy across the board.

Companies are cutting customer service costs by up to 30% by letting AI handle routine inquiries. When an AI assistant answers basic policy questions and processes simple requests, human agents can focus on complex cases requiring their expertise.

The numbers are impressive. A mid-sized insurer handling 100,000 monthly customer calls can save $1.2-3.6 million annually. Each AI-handled interaction saves 4-6 minutes of human time, with some companies reducing call center volume by 50-70%. These figures align with industry-wide analyses, such as those from McKinsey & Company, which project a massive shift in insurance operations due to AI.

Claims processing sees some of the most exciting gains. The days of waiting weeks for a settlement are disappearing. With AI automation, claims can be settled in real-time—instantly. Some systems now settle over 60% of claims immediately with 96% accuracy.

Here at Agentech, our AI handles everything from the first notice of loss through to predicting settlement outcomes. The technology uses smart document reading to pull information from PDFs, photos, and even handwritten notes. It then checks everything against policy terms, spots potential fraud, and predicts outcomes with up to 98% accuracy. It's a super-efficient assistant that never gets tired and rarely makes mistakes. You can see how we're making this happen with our AI Agents for Insurance Claims.

Underwriting also gets a major boost. AI assistants gather customer data, spot missing information, and flag potential risks. By analyzing risk factors, budget constraints, and individual needs, they can suggest ideal insurance packages. This frees underwriters to focus on complex cases that require human judgment while AI handles the data-heavy lifting.

Fraud detection capabilities are also powerful. AI systems constantly monitor patterns, spot anomalies, and flag suspicious claims as they arrive. By processing historical data, they catch fraudulent activities humans might miss, protecting both insurers and honest policyholders.

Sophisticated data analysis and risk assessment make this possible. AI assistants update risk profiles, evaluate multiple data points, and calculate premiums with precision, leading to smarter decisions. This technology also helps address the industry's labor shortage, allowing companies to maintain high service levels even with open positions. You can learn more in our article on Solving the Insurance Labor Crisis with AI-Driven Innovation.

The bottom line is simple: ai assistant for insurance solutions aren't just nice-to-have tools anymore. They're becoming essential for staying competitive, keeping costs under control, and delivering the fast, accurate service that customers expect.

Elevating the Human Experience: How AI Improves Customer and Agent Roles

Here's the truth about AI in insurance: it's not here to steal jobs. It's here to make everyone's work life better. When we talk about an ai assistant for insurance, we're really talking about giving both customers and agents superpowers.

Think about the last time you needed help with insurance. Maybe it was 10 PM on a Sunday, or you were stuck in traffic and just had a fender bender. Traditional customer service would leave you waiting until business hours or sitting on hold forever. AI assistants change that completely.

With 24/7 support, customers can get instant answers whenever they need them. No more "please hold for the next available agent" music. Whether someone needs proof of insurance at midnight or wants to understand their deductible after an accident, AI is there immediately. This isn't just convenient—it's life-changing for people dealing with stressful situations.

The magic really happens with personalized interactions. AI doesn't just give generic responses. It learns what each customer needs and tailors every conversation. When someone calls about adding teenage driver coverage, the AI already knows their policy details, family situation, and budget range. It can suggest the exact coverage options that make sense for them, not just read from a script.

Here's what makes this even better: customer satisfaction shoots through the roof. Our data shows that 62% of customers stick with their insurer after a good experience, compared to only 19% after a bad one. When AI handles the routine stuff perfectly every time, those good experiences become the norm instead of the exception.

Now let's talk about what this means for insurance agents. Instead of drowning in paperwork and repetitive questions, agents get to focus on what they do best—building relationships and solving complex problems. Agent productivity increases dramatically when AI takes care of the routine inquiries, generates quotes instantly, and handles basic policy questions.

The sales process improvement is remarkable. While AI chats with prospects, gathers initial information, and provides quotes, agents can spend their time on high-value activities like consulting with clients on coverage gaps or helping families steer major life changes. It's like having a tireless assistant who never takes a coffee break.

But here's where it gets really smart: complex query handling with a human-in-the-loop approach. AI is brilliant, but it knows its limits. When a customer needs empathy during a difficult claim or has a unique situation that requires human judgment, the AI smoothly hands off to a live agent—along with all the relevant information already collected. No starting over, no repeating the story three times.

This partnership between AI and humans creates something neither could achieve alone. Customers get instant help for simple needs and compassionate human support for complex ones. Agents get freed up from routine tasks to focus on meaningful work that requires their expertise and emotional intelligence.

The result? Everyone wins. Customers feel heard and helped. Agents feel valued and productive. And insurance companies see happier customers and more efficient operations. As we explore in The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers, this isn't about replacing the human touch—it's about amplifying it.

A Practical Guide to Implementing and Leveraging AI Assistants

Implementing an ai assistant for insurance requires a strategic approach that works for your team and customers. You need to understand what type of AI fits your needs and how to set it up for success.

Types of AI Assistants and Their Core Functionalities

The world of ai assistant for insurance solutions isn't one-size-fits-all. Different tools serve different purposes, and understanding these distinctions helps you choose the right fit.

Chatbots and virtual assistants are front-line tools for 24/7 customer interaction. They answer common questions and guide users through basic processes like claims submissions or policy inquiries.

Agentic AI is more advanced. These digital workers can think, make decisions, and manage entire workflows, such as a complete claims process or underwriting assessment, without constant supervision. This represents a significant evolution in AI capabilities.

Claims automation tools specialize in post-claim activities. They can read documents, verify information, detect potential fraud, and suggest settlement amounts.

Underwriting platforms help underwriters make faster, data-driven decisions by analyzing data, identifying risks, and recommending coverage and pricing.

Sales intelligence tools help agents identify and connect with prospects. They can predict renewals, enrich customer data, and draft outreach messages, turning prospecting into a strategic activity.

Key Considerations for a Successful AI Assistant for Insurance Implementation

A successful ai assistant for insurance implementation requires thoughtful planning.

System integration is critical. Your AI assistant must connect seamlessly with existing systems (CRM, claims management, etc.) to access real-time data and update records automatically. At Agentech, we build our solutions to act as a layer that works with any insurance process, making integration as painless as possible.

Workflow automation should start with high-volume, repetitive tasks like data entry. Quick wins build confidence and help your team adapt before you expand to more complex processes.

Data privacy and security are foundational. Your AI solution must meet strict compliance standards (ISO 27001, SOC 2 Type 2, HIPAA, CCPA) through secure hosting, encryption, and access controls. We take this seriously at Agentech, building responsible AI with robust data protection from day one. You can review our commitment in Agentech's applicable privacy policy.

Best practices include: using short, direct prompts; being specific in requests; providing regular feedback to improve AI performance; and offering ongoing training and support for your team.

Overcoming Challenges and Limitations of an AI assistant for insurance

Knowing potential implementation challenges helps you prepare.

Data quality is crucial. Poor quality data (messy, inconsistent, or incomplete) will hinder AI performance. Invest time in data cleanup before implementation.

Complex or nuanced situations still require human judgment. AI excels at routine tasks, but complex cases should be handled by experienced team members. The best systems know when to escalate to a human.

Empathy and the human touch are vital in insurance. AI cannot replicate genuine human compassion for customers in stressful situations. A smart implementation preserves the human touch for these moments while automating administrative work.

Integration with legacy systems can be a technical hurdle. Thorough planning and a phased rollout can mitigate these challenges without disrupting operations.

Bias in AI decisions is a real concern. AI can perpetuate biases from training data, so regular auditing and transparency are essential. At Agentech, we believe the best AI should feel invisible and natural—not like you're dealing with a robot. You can read more about this philosophy in The Best AI Doesn't Feel Like AI. It's Invisible.

The key is remembering that AI is a powerful tool, not a magic wand. With realistic expectations and thoughtful implementation, it becomes an invaluable team member that makes everyone's job easier and more effective.

The Future is Now: Trends and Advancements in Insurance AI

The world of ai assistant for insurance technology is moving at lightning speed, and honestly, it's pretty exciting to watch. What seemed like science fiction just a few years ago is now becoming everyday reality for insurance companies around the globe.

We're witnessing a fascinating shift from simple automation tools to truly intelligent digital partners. The generative AI revolution has opened doors we didn't even know existed, while agentic AI is taking things to an entirely new level of sophistication.

Think about it this way: today's AI can handle your basic customer questions and process straightforward claims. But tomorrow's AI? It's going to be like having a brilliant colleague who never sleeps, never takes a sick day, and can juggle dozens of complex tasks simultaneously.

Hyper-personalization is where things get really interesting. Instead of offering the same generic policy options to everyone, AI will soon craft completely customized insurance experiences. Imagine an AI that knows your exact risk profile, understands your lifestyle, and can predict what coverage you'll need before you even realize it yourself.

The move toward proactive risk management is perhaps the most game-changing trend we're seeing. Rather than waiting for accidents to happen and then processing claims, AI will help prevent those incidents in the first place. Your AI assistant might notice patterns in weather data and traffic reports, then send you a gentle reminder to avoid a particular route on a stormy Tuesday morning.

We're also seeing AI evolve into true digital coworkers. These aren't just tools you use—they're team members who can think, plan, and even make suggestions about strategy. They'll work alongside human agents, handling the routine stuff while humans focus on building relationships and solving complex problems.

| Current AI Capabilities | Future Advancements |

|---|---|

| Automated data entry from structured forms | Automated data extraction from any document type (handwritten, images, voice) |

| Simple chatbots for FAQs and basic inquiries | Agentic AI managing end-to-end customer journeys and complex multi-turn conversations |

| Basic claims triage and routing | Fully autonomous claims settlement for routine cases, proactive fraud prevention |

| Predictive analytics for risk assessment | Hyper-personalized risk profiles and real-time, dynamic premium adjustments |

| Agent assistance for data lookup | AI copilots providing real-time strategic advice and decision support for agents |

| Limited system integrations | Seamless, real-time integration across all enterprise systems and external data sources |

The timeline for these advancements isn't some distant future—many of these capabilities are already being tested and rolled out by forward-thinking insurers. At Agentech, we're constantly pushing the boundaries of what's possible, always with the goal of making insurance work better for everyone involved.

What's particularly exciting is how these trends all work together. Agentic AI combined with generative AI creates systems that can not only process information but also communicate naturally and make intelligent decisions. Add in the power of proactive risk management, and you've got a recipe for changing the entire insurance experience.

The companies that accept these changes now will have a significant competitive advantage. Those that wait? Well, they might find themselves playing catch-up in a market that's moved far beyond traditional approaches.

For deeper insights into where the industry is headed and how these trends are shaping the future of insurance, check out our Thought Leadership | Agentech section. We're not just watching these changes happen—we're helping to create them.

Frequently Asked Questions about AI Assistants in Insurance

When it comes to AI in insurance, many people have valid questions and concerns. Here are some straight answers to the most common ones.

Will AI replace insurance agents?

AI is not coming for your job; it's coming to make your job better. An ai assistant for insurance should be viewed as a digital teammate, not a replacement.

AI excels at repetitive tasks: answering common policy questions, generating quotes, handling initial claims intake, and extracting key information from documents. It can also spot fraud patterns much faster than humans.

However, AI cannot replicate the human touch. It cannot build long-term client trust, read between the lines of a customer's concerns, or provide the genuine empathy needed during a stressful event like a house fire or serious accident.

AI frees you up to be more human. It allows you to focus on relationship building, complex problem-solving, and supporting clients during critical moments. It's about working smarter, not just harder.

How do AI assistants ensure data privacy and security?

Protecting sensitive customer data—social security numbers, financial records, health information—is paramount. When considering an ai assistant for insurance, security must be the top priority.

Reputable AI providers offer robust security. Look for solutions that meet strict compliance standards like ISO 27001, SOC 2 Type 2, HIPAA (for health information), and CCPA (for consumer privacy rights).

Data should be encrypted both in transit and at rest. Role-based access controls ensure that only authorized personnel can access sensitive information.

Many providers also use external Data Protection Officers and conduct regular security audits and penetration testing to identify and fix vulnerabilities proactively.

Whenever possible, data is anonymized during AI training, allowing the system to learn from patterns without accessing personally identifiable information.

How much can an insurance company save with an AI assistant for insurance?

The financial benefits of implementing an AI assistant are significant.

Insurance companies are cutting customer service costs by up to 30%. For a mid-sized insurer with 100,000 monthly inquiries, this can mean $1.2 to $3.6 million in annual savings.

The savings go beyond direct cost-cutting. AI assistants operate 24/7, handling multiple conversations simultaneously without breaks. This provides customers with instant answers and frees up human staff for more complex work.

Claims processing sees transformative gains. While manual claims can take weeks, AI can help settle over 50% of claims in real-time. This shift from weeks to minutes for straightforward cases dramatically improves customer satisfaction.

Each routine interaction handled by AI saves your team 4-6 minutes. Across thousands of interactions, this frees up significant time for staff to focus on high-value customer support.

The return on investment is clear, with some processes seeing 20x time savings and a 50% reduction in manual work. Faster, better service also leads to higher customer retention.

Conclusion: Accept Your Digital Coworker and Transform Your Agency

The insurance industry stands at a pivotal moment. While others debate whether AI will disrupt their business, forward-thinking agencies are already experiencing the incredible benefits of working alongside ai assistant for insurance solutions. This isn't just about buying new software—it's about embracing a fundamental shift in how insurance gets done.

Think of AI as your newest team member, one who never gets tired, never makes calculation errors, and is always ready to tackle those time-consuming administrative tasks that bog down your human agents. This digital coworker doesn't replace the relationships and empathy that make great agents irreplaceable. Instead, it handles the paperwork, data entry, and routine inquiries so your team can focus on what they do best: building trust, solving complex problems, and being there when customers need them most.

The competitive advantage this creates is remarkable. While your competitors are still processing claims manually over weeks, you're settling them in hours or even real-time. While they're struggling with after-hours customer service, you're providing instant, accurate responses 24/7. This isn't just efficiency—it's a complete change in how customers experience insurance.

At Agentech, we've seen this change firsthand. Our AI-powered solutions integrate seamlessly into existing workflows, becoming an invisible yet indispensable part of daily operations. We designed our tools specifically for insurance professionals who want to work smarter, deliver faster service, and create better outcomes for everyone involved.

The future of insurance isn't about choosing between human expertise and artificial intelligence. It's about combining both to create something better than either could achieve alone. Your customers get faster, more accurate service. Your agents get to focus on meaningful work. And your agency gets a sustainable competitive edge.

The digital change is happening now. The question isn't whether AI will change insurance—it already has. The question is whether you'll lead that change or scramble to catch up later.

Ready to meet your new digital coworker? Find AI Agents for Insurance and find how Agentech can transform your agency today.