Why Insurance Back Office Automation Is Your Strategic Advantage

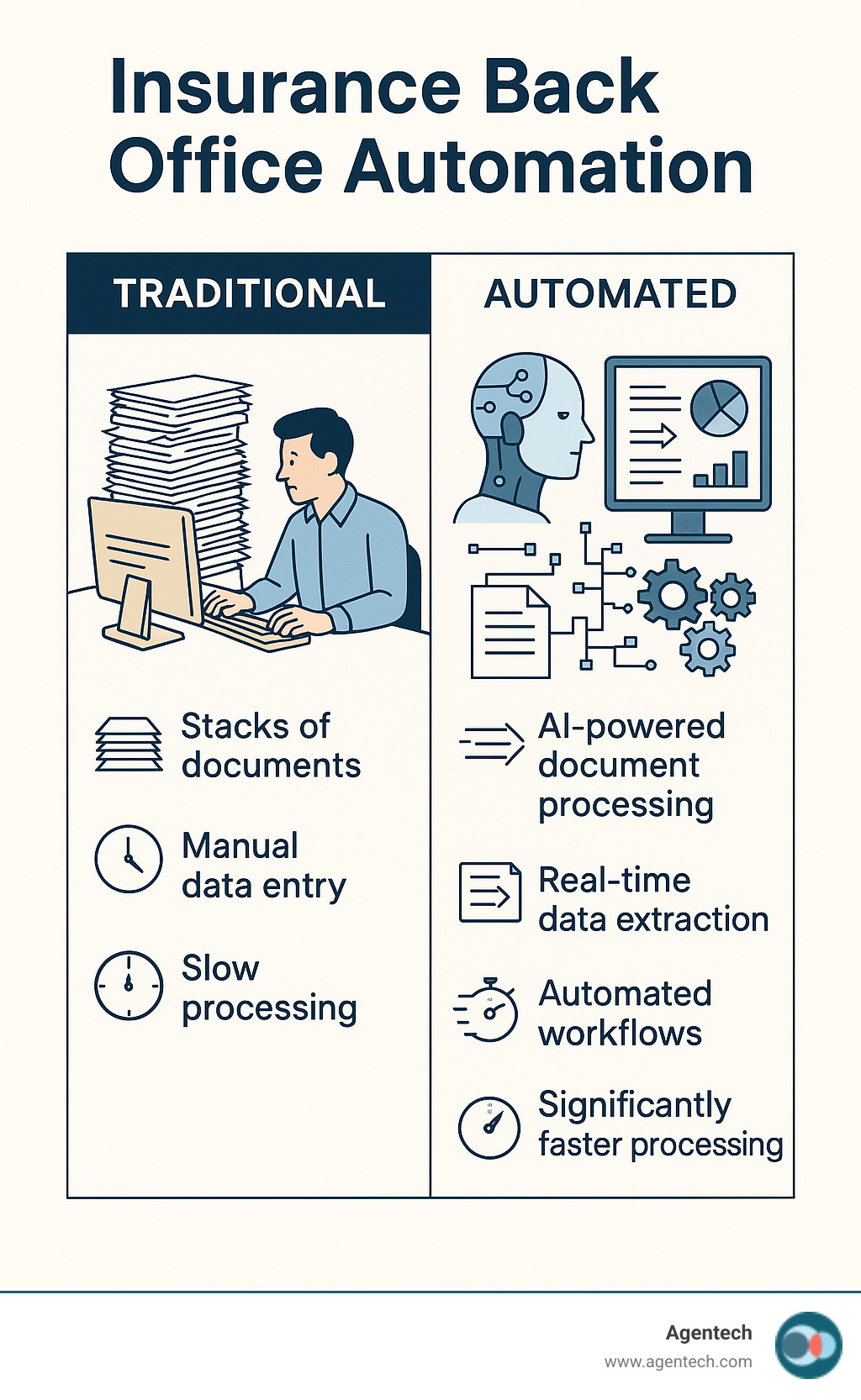

Insurance back office automation uses AI, RPA, and intelligent document processing to streamline manual tasks across claims, underwriting, and policy administration. This strategic shift is no longer optional for insurers facing soaring customer expectations and intense regulatory pressure.

Key benefits are transformative:

- Cost Reduction: Decrease operational costs by up to 40%.

- Speed Improvement: Accelerate claims processing by 30% or more.

- Accuracy Gains: Drop error rates from 7% to below 0.2%.

- Customer Satisfaction: Address the 60% of dissatisfaction originating from back-office delays.

- Scalability: Handle volume surges without proportional staff increases.

While administrative expenses can consume 20% of gross written premium, automation delivers proven results, including an 85% reduction in invoice processing time and a 42% boost in operational productivity. This isn't just about efficiency—it's about survival and growth in a rapidly evolving market.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for insurance through cutting-edge automation solutions. Having successfully scaled and exited TokenEx in 2021, I've seen how insurance back office automation can transform operations in highly regulated industries.

The Back Office Bottleneck: Why Traditional Operations Are Holding You Back

Many insurance offices are trapped in a cycle of inefficiency. Adjusters are buried in paperwork, customers are frustrated by delays, and teams are working overtime just to manage basic tasks. This isn't a people problem; it's a process problem.

The core issues are clear:

- Legacy Systems & Manual Data Entry: Outdated systems turn quick tasks into lengthy ordeals, with every keystroke introducing the risk of human error.

- Regulatory Complexity: Manually navigating an ever-changing maze of compliance requirements is a constant struggle.

- Talent Shortage: Finding and retaining skilled employees for repetitive administrative work is increasingly difficult, leading to high turnover.

This perfect storm creates high administrative costs and slow cycle times. But the damage runs deeper. Repetitive work leads to low employee morale and disengagement, which in turn causes more errors and inaccurate data. These mistakes cascade through billing and claims, multiplying compliance risks and repair costs.

Most critically, this inefficiency directly impacts your customers. A staggering 60% of customer dissatisfaction originates from the back office. Policyholders don't see the internal struggles; they only experience the delays and errors. When a claim that could be resolved in hours with insurance back office automation takes weeks, it feels like a broken promise. These are not permanent problems but symptoms of outdated systems that can be fixed.

At Agentech, we've seen how AI-driven solutions turn these pain points into competitive advantages. Learn more about our approach in Solving the Insurance Labor Crisis with AI-Driven Innovation.

The Automation Advantage: Quantifiable Benefits for Insurers

Implementing insurance back office automation isn't just about replacing manual work; it's about open uping your team's potential and achieving dramatic, measurable results. By automating repetitive tasks, you empower adjusters to focus on complex cases and customer care.

The impact is immediate and quantifiable across your entire operation:

- Skyrocketing Efficiency and Productivity: With AI handling routine tasks, operational productivity can jump by 42%. This frees your team to focus on high-value work, improving employee engagement and job satisfaction.

- Game-Changing Cost Savings: Insurers routinely slash operational expenses by up to 40%. Some have cut the cost per processed invoice by over 60% and reduced IT costs by $41 per policy, freeing up capital for growth and innovation.

- Drastic Improvements in Speed: Automation delivers speed. While overall claims processing can improve by 30%, specific tasks like invoice processing have seen an 85% reduction in time. What once took weeks can now be done in a day.

- Near-Perfect Accuracy: Automation virtually eliminates human error, with rates dropping from a typical 7% to below 0.2%. This leads to cleaner data, more reliable reports, and a stronger reputation for dependability.

- Effortless Scalability: When claims flood in during a storm or business grows unexpectedly, automated systems scale to meet demand without frantic hiring or employee burnout. One insurer processed 1.5 million pages in three months—nearly double their previous capacity.

- Actionable, Data-Driven Insights: Every automated process generates valuable data, allowing you to spot trends, identify bottlenecks, and make strategic decisions based on real information instead of gut feelings.

At Agentech, our solutions are specifically AI-Designed with Adjusters in Mind, enhancing the human expertise that makes great adjusters invaluable.

Key Technologies and Use Cases for Insurance Back Office Automation

A smart blend of technologies powers modern insurance automation, working together to handle nearly any repetitive back-office task.

- Robotic Process Automation (RPA): Digital bots that mimic human actions like clicking, filling forms, and updating records—only faster and without errors.

- Artificial Intelligence (AI) and Machine Learning (ML): The "brains" of the operation, these systems learn from data to make smart decisions, from detecting fraud to predicting policy lapses.

- Natural Language Processing (NLP): Gives computers the ability to read and understand human language in emails, claim notes, and customer messages to extract key details instantly.

- Intelligent Document Processing (IDP): Combines Optical Character Recognition (OCR) with AI to not just read but understand complex documents like handwritten forms and repair estimates.

Top Applications for Insurance Back Office Automation

This technology toolkit makes the biggest impact in core insurance functions:

- Claims Processing: Automation handles the entire lifecycle, from First Notice of Loss (FNOL) to settlement. It processes documents, extracts data, detects fraud, and routes claims, reducing resolution times from weeks to days.

- Underwriting Support: AI instantly gathers and analyzes applicant data from multiple sources, allowing underwriters to focus on complex risk assessment rather than data collection.

- Policy Administration: Manages routine lifecycle events like renewals, address changes, and payment processing, freeing your team for customer-facing work.

- Data Entry and Management: Eliminates manual typing from forms by using RPA and IDP to process documents automatically with superior accuracy.

- Compliance and Reporting: Automates routine monitoring and report generation, ensuring you can track regulatory changes and maintain compliance with less stress.

To see the bigger picture of how AI is reshaping our industry, check out The Future of Insurance: How AI is Changing the Game.

Deep Dive: Automating Claims from FNOL to Settlement

Claims processing is where automation delivers its greatest value. The journey begins with automated FNOL intake from any channel (web, mobile, email), where AI extracts details and verifies coverage. From there, IDP indexes all related documents—repair estimates, medical records, police reports—and extracts critical data. AI-powered fraud detection runs in the background, while data analysis helps establish more accurate reserve setting. Throughout the process, AI agents handle administrative tasks like updating files and routing claims, keeping adjusters in control of key decisions but free from the busywork.

At Agentech, we've perfected this by creating AI that handles the most tedious task: building the initial claim profile. Learn more in our article: We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile.

Your Roadmap to Success: A Strategic Implementation Guide

Starting your insurance back office automation journey requires thoughtful planning, not flipping a switch overnight. A successful implementation is about steady, strategic progress.

Follow this proven roadmap:

- Conduct a Process Assessment: Identify repetitive, rule-based tasks that are time-consuming and prone to error. These are your prime candidates for automation.

- Start with Pilot Projects: Resist the urge to automate everything at once. Pick a high-impact process like invoice processing to prove the concept, build momentum, and generate enthusiasm.

- Prioritize Stakeholder Engagement: Involve your team from day one. They understand the real-world challenges and can help design better solutions. When people are part of the change, they are more likely to accept it.

- Measure ROI Relentlessly: Define key metrics before you start—processing times, error rates, costs—and track them. Demonstrating a clear return on investment is crucial for expanding the program.

Critical Success Factors for Your Automation Initiative

Successful projects consistently share these characteristics:

- Clear Objectives: Go beyond "be more efficient." Aim for specific goals, like "reduce claim processing time by 30%" or "cut data entry errors to below 1%."

- A Phased Rollout: Start with one process or department. Learn, adapt, and then expand. This minimizes disruption and builds a foundation for success.

- The Right Technology Partner: You need a partner who understands the insurance industry's unique challenges, not just a software vendor. At Agentech, we work with you to customize solutions that fit your workflows.

- Uncompromising Data Security: Ensure any solution meets the highest industry standards (e.g., ISO 27001, SOC 2). Protecting sensitive policyholder data is non-negotiable.

- Employee Training and Upskilling: Invest in your people. Teach them how to work alongside AI assistants and manage automated workflows. Empowered employees are the key to realizing automation's full potential.

Our hybrid approach at Agentech is built on this philosophy, keeping humans in control of important decisions. Learn more in A Hybrid AI Solution for Claims Automation: How Agentech Combines Out-of-the-Box Efficiency with Custom QA Precision.

The Future of Work: AI, Automation, and the Evolving Insurance Workforce

A common concern with insurance back office automation is its impact on jobs. The reality is not one of replacement, but of evolution. Just as calculators empowered accountants to solve more complex problems, AI is elevating the role of the insurance professional.

We are moving toward a hybrid workforce where AI agents become digital coworkers. An AI assistant handles routine reporting and data chasing, while the human adjuster focuses on high-value work: empathizing with customers, making complex judgment calls, and solving problems that require a human touch.

This human-in-the-loop model makes work more engaging and valuable. It requires a commitment to upskilling and reskilling, training employees to manage automated workflows and interpret AI-driven insights. This investment transforms them from data processors into strategic problem-solvers.

Looking ahead, trends like hyperautomation—the seamless integration of multiple automation technologies—will create even more efficient digital teams. We are also seeing the rise of predictive ecosystems, where insurance can proactively prevent losses rather than just paying for them.

This shift is already underway. In fact, a McKinsey study predicts that by 2030, most underwriting tasks will be automated. This doesn't mean underwriters will disappear; it means they will be freed to focus on crafting innovative products and managing complex client relationships. Automation is not about replacing human judgment—it's about amplifying human potential.

At Agentech, our AI agents are designed to free up adjusters to be more human, not less. Dive deeper into this partnership in The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers.

Frequently Asked Questions about Insurance Back Office Automation

Here are straight answers to the most common questions about implementing insurance back office automation.

How does automation impact data security in insurance?

Contrary to common concerns, automation significantly improves data security.

- Reduces Human Touchpoints: Fewer manual interactions with sensitive data mean fewer opportunities for human error, data loss, or accidental exposure.

- Enforces Consistent Protocols: Automated systems apply security rules consistently every time, without distraction or fatigue.

- Provides Robust Audit Trails: Every action taken by an AI agent is logged, creating a detailed and transparent record for compliance and security reviews.

- Enables Faster Threat Detection: AI can identify suspicious patterns and potential fraud indicators far more quickly than manual review, allowing for immediate action.

Security is paramount. A trustworthy automation partner will build solutions with encryption, secure access controls, and regular audits as a foundation.

What is the typical ROI for back-office automation projects?

The return on investment is both rapid and dramatic. Most projects show a positive ROI within months, not years, by delivering measurable results:

- Cost Reduction: Operational costs can decrease by up to 40%.

- Speed and Efficiency: Claims processing times improve by 30%, while specific tasks like invoice processing can be accelerated by 85%.

- Error Reduction: Accuracy improves drastically, with error rates falling from an average of 7% to below 0.2%.

Beyond the numbers, strategic benefits like improved employee morale, higher customer satisfaction, and improved data-driven decision-making create long-term competitive advantages.

Will automation replace insurance back-office jobs?

Automation will transform jobs, not eliminate them. It takes over the tedious, repetitive tasks, allowing your team to focus on work that requires uniquely human skills.

- Focus on High-Value Work: Adjusters can dedicate more time to complex claims and customer empathy. Underwriters can focus on nuanced risk assessment instead of data compilation.

- Creation of "Digital Coworkers": AI agents handle the busywork, acting as assistants that augment your team's capabilities.

- Emphasis on Upskilling: The shift requires reskilling employees to work alongside AI, manage automated systems, and interpret data—making their roles more strategic and engaging.

The goal is not to replace people but to make them more productive, engaged, and effective at their jobs.

Conclusion

The change of the insurance back office is here. Insurance back office automation is no longer a future concept but a present-day strategic necessity. The choice is between clinging to manual processes that lead to high costs and customer frustration, or embracing automation to achieve unprecedented efficiency and growth.

The benefits are clear: reduced costs, faster processing, near-perfect accuracy, and improved employee and customer satisfaction. By adopting intelligent automation, you are future-proofing your operations and creating a hybrid workforce where human ingenuity meets AI efficiency. Your team is freed to focus on what they do best: solving complex problems and delivering exceptional customer care.

At Agentech, this is the future we build every day. Our AI-powered solutions integrate seamlessly into your workflows, acting as digital coworkers that handle the tedious tasks so your people can handle the human ones.

The window of opportunity is now. Companies that act decisively will gain a lasting competitive edge, attract top talent, and earn customer loyalty. Your journey can start with a single pilot project, but it must start.

Ready to see what insurance back office automation can do for your organization? Learn how AI-powered Digital Agents can transform your operations. Let's build the future of insurance together.