Why AI Claims Processing Insurance is Changing the Industry

AI claims processing insurance represents a fundamental shift from manual, time-consuming claims handling to intelligent, automated workflows that can process claims in minutes rather than weeks.

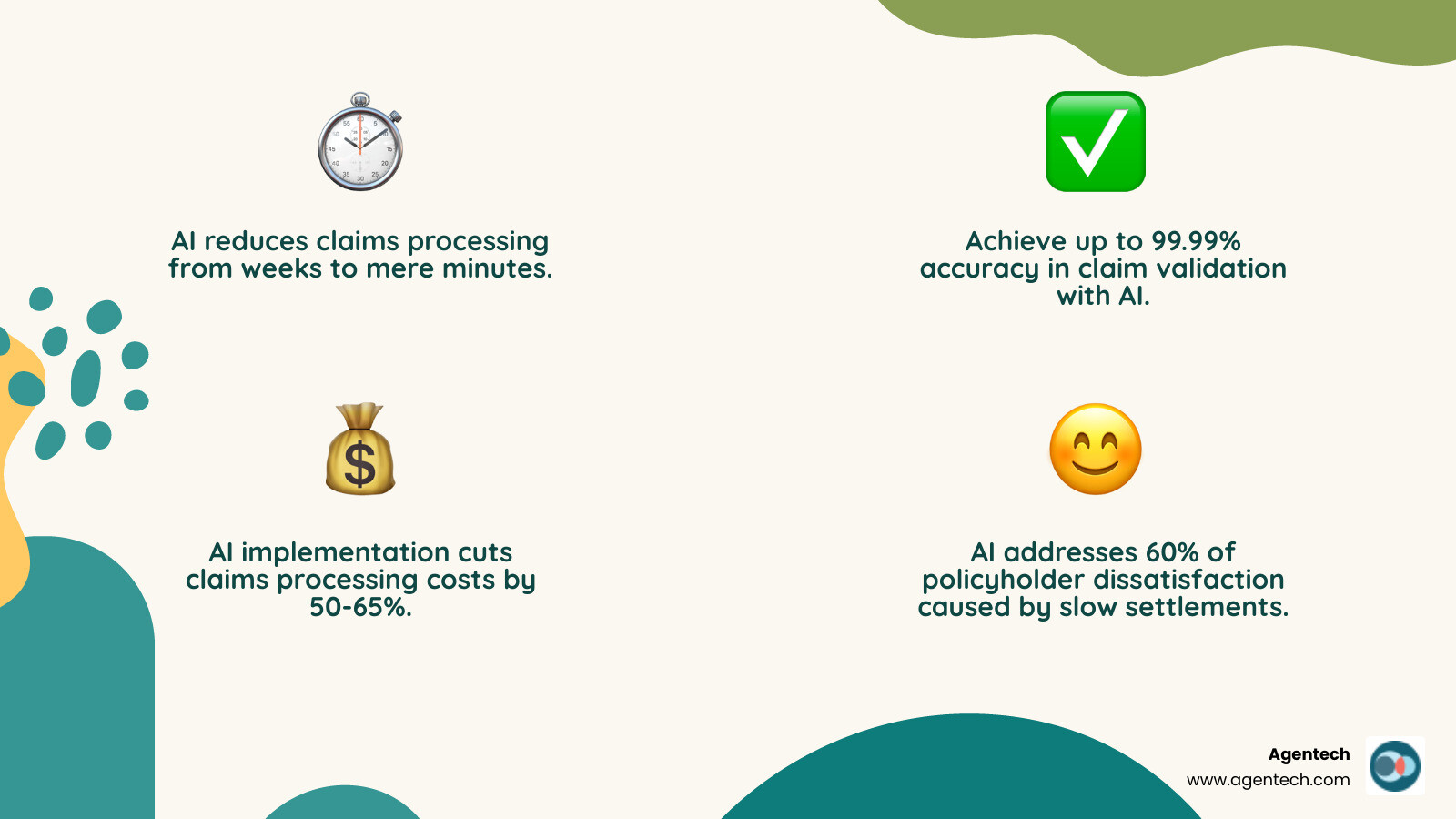

Key Benefits of AI in Insurance Claims:

- Speed: Reduce processing time from weeks to minutes

- Accuracy: Achieve up to 99.99% accuracy in claim validation

- Cost Savings: Cut processing costs by 50-65%

- Customer Satisfaction: Meet the 21% of customers who expect claims settled in hours

- Fraud Detection: Identify suspicious patterns that humans might miss

- Efficiency: Automate the 30% of low-value work that claims handlers currently do manually

The traditional claims process is broken. 31% of policyholders who made recent claims were dissatisfied, with 60% citing settlement speed as the primary issue. Meanwhile, claims handlers spend about 30% of their time on repetitive document review and data entry tasks.

AI changes this entire equation. Instead of waiting weeks for manual processing, AI can analyze unstructured data from police reports, medical records, and photos to make intelligent decisions in real-time. A travel insurance company achieved 57% automation and reduced processing time from weeks to minutes for 400,000 claims annually.

But this isn't about replacing human expertise - it's about augmenting it. AI handles the routine work so adjusters can focus on complex cases that require human judgment and empathy.

I'm Alex Pezold, and I've spent years building technology solutions that scale, including my previous company TokenEx which had one of Oklahoma's largest tech exits in 2021. At Agentech, we're specifically focused on ai claims processing insurance solutions that work as digital assistants to claims professionals, processing routine tasks while keeping humans in control of critical decisions.

The Revolution: How AI is Changing the Claims Landscape

Picture this: a claims adjuster sits at a cluttered desk, surrounded by stacks of paper documents, sticky notes, and multiple computer screens showing different systems that don't talk to each other. Now imagine that same adjuster working with a clean, digital interface where AI claims processing insurance technology handles the paperwork while they focus on what really matters - helping customers.

That's the revolution happening right now in insurance claims.

For decades, the insurance industry has been stuck in the past when it comes to customer experience. While other industries transformed their operations, claims processing still looked remarkably similar to how it worked twenty years ago. The numbers tell the story: claims handlers spend 30% of their time on low-value work like reviewing documents and entering data manually.

This isn't just inefficient - it's frustrating for everyone involved. Adjusters feel bogged down by paperwork instead of doing meaningful work, and customers wait weeks for simple claims that should take hours.

The real challenge lies in unstructured data. Most claims information doesn't come in neat, organized formats. Instead, it arrives as handwritten notes, police reports, medical records, photos, and emails. Traditional rules-based automation simply can't handle this complexity, which is why it struggles with the vast majority of real-world claims.

AI changes everything because it excels at exactly what traditional systems can't do - understanding and analyzing unstructured data. It can read a police report, extract the key details, analyze photos for damage assessment, and put everything into context. As we explore in The Future of Insurance: How AI is Changing the Game, this isn't just about automation - it's about intelligent change.

From Manual Reviews to Intelligent Automation

Let's be honest about the traditional claims process - it's broken in several fundamental ways.

High error rates plague manual data entry. When humans type the same information over and over, mistakes happen. A mistyped policy number or incorrectly entered claim amount can delay processing for days.

Inconsistent outcomes result from human variability. One adjuster might approve a claim that another would deny, simply because they interpreted the same information differently.

Slow settlement times frustrate policyholders who are already dealing with stressful situations like car accidents or property damage.

AI-driven straight-through processing (STP) addresses these pain points head-on. Instead of claims sitting in queues waiting for manual review, AI can analyze documents, extract relevant information, and make recommendations in minutes rather than days.

But here's what makes our approach different: we're not trying to replace human adjusters. We're augmenting their capabilities. AI handles the tedious administrative tasks - the document review, data extraction, and initial analysis - so adjusters can focus on high-value work that requires human judgment, empathy, and expertise.

This philosophy is at the heart of everything we do. As we discuss in AI Designed with Adjusters in Mind, the goal isn't to eliminate jobs but to make them more fulfilling and impactful.

Overcoming the Limits of Rules-Based Systems

Traditional rules-based systems work great for simple, predictable scenarios. They follow rigid "if-then" logic: if the claim amount is under $1,000 and there's no injury reported, then approve it automatically.

The problem? Real-world insurance claims are rarely that straightforward.

These systems can't interpret nuance or understand context. They struggle when a claim doesn't fit neatly into predefined categories. What happens when a police report mentions weather conditions that might have contributed to an accident, but uses informal language? Rules-based systems miss these subtleties entirely.

That's why only 7% of claims can be ingested via straight-through processing with traditional automation. The other 93% require manual intervention because the systems can't handle the complexity of real-world data.

AI's adaptability changes this equation completely. Unlike rules-based systems that follow fixed logic, AI learns from new data. It recognizes patterns, understands context, and can even interpret the emotional tone of customer communications.

This means AI can handle complex, non-standard claims that would immediately stall a traditional system. It can process handwritten notes from accident scenes, understand medical terminology in injury reports, and correlate information across multiple documents to build a complete picture of what happened.

The result? More claims processed automatically, faster resolution times, and adjusters freed up to handle the cases that truly need human expertise.

Core Technologies Behind AI Claims Processing Insurance

When people ask me about ai claims processing insurance, they often wonder what's actually happening "under the hood." It's not magic - it's a sophisticated blend of technologies working together like a well-orchestrated team. Each technology has its own superpower, and when combined, they create something truly transformative.

The landscape is evolving rapidly too. We're seeing a fascinating shift from basic generative AI to what we call agentic AI - systems that don't just respond to commands but can actually take initiative and work autonomously. As we explore in Changing Insurance Claims: The Evolution from Generative AI to Agentic AI, this represents a fundamental change in how AI assistants support claims professionals.

[LIST] of Key AI Technologies in Claims

Let me walk you through the core technologies that make modern ai claims processing insurance possible:

- Machine Learning & Predictive Analytics: This is like giving computers the ability to learn from experience, just like humans do. In claims processing, machine learning algorithms analyze thousands of past claims to spot patterns that would be impossible for humans to detect. They're incredibly good at identifying fraud patterns - those subtle red flags that might slip past even experienced adjusters. The technology also excels at predicting claim severity, helping insurers know whether they're dealing with a simple fender-bender or a total loss. Perhaps most valuable is how it can identify subrogation opportunities, finding cases where another party should be paying instead of the insurer. It's like having a detective that never sleeps and remembers every case it's ever seen.

- Natural Language Processing (NLP): Think of NLP as the technology that teaches computers to read and understand human language - all the messy, complicated ways we actually communicate. This is what makes extracting data from documents possible, whether it's a handwritten police report or a detailed medical record. NLP can analyze police reports and medical records, pulling out the key facts that matter for claim decisions. It's also what powers those helpful chatbots that can understand customer communications and provide real-time assistance. The beauty of NLP is that it doesn't just look for keywords - it actually understands context and meaning.

- Computer Vision: This technology gives AI the gift of sight, allowing it to analyze photos and videos with remarkable accuracy. When it comes to assessing vehicle damage from photos, computer vision can often provide estimates as accurate as in-person inspections. It's revolutionizing property claims too, analyzing property damage from drone footage to assess roof damage or flood impacts safely and quickly. The technology is also excellent at validating visual evidence, catching when someone tries to submit photos from a previous claim or altered images.

- Generative AI: This is the newest star in the AI family, and it's particularly exciting for claims processing. Generative AI can create new content based on what it's learned, which translates to incredible time savings. It excels at summarizing complex claim files, turning hundreds of pages into clear, actionable summaries. It can draft customer communications that sound natural and empathetic, maintaining consistency while saving hours of writing time. Most impressively, it can create claim profiles automatically, handling one of the most time-consuming tasks in claims processing. At Agentech, we've seen How Agentech leverages advanced generative AI to transform these tedious administrative tasks into seamless, automated processes.

The real magic happens when all these technologies work together. It's not just about having powerful individual tools - it's about creating an integrated system that can handle the full complexity of modern insurance claims while keeping humans firmly in control of the important decisions.

The Tangible Benefits: Efficiency, Accuracy, and Customer Happiness

When we talk about ai claims processing insurance, the proof is in the pudding. These aren't just theoretical improvements - they're real, measurable changes that transform how insurers operate and how customers feel about their claims experience.

The numbers tell a compelling story. Poor claims experiences could put up to $170 billion of global insurance premiums at risk by 2027, according to an industry report on claims experiences. That's not just a customer service problem - it's an existential business threat.

But here's the good news: AI is already solving these problems in remarkable ways. Let me show you how the landscape is changing:

| Metric | Before AI | After AI |

|---|---|---|

| Processing Time | Weeks (43% wait over two weeks) | Minutes to Hours (some travel insurers: weeks to minutes) |

| Accuracy Rate | Prone to human error and inconsistencies | Up to 99.99% accuracy in validation |

| Customer Satisfaction | 31% dissatisfied (60% citing speed issues) | 62% retention after good experiences |

| Automation Level | Only 7% straight-through processing | Up to 57% automation achieved |

| Fraud Detection | Manual and labor-intensive | 40% improvement with AI detection |

Boosting Efficiency and Accuracy in ai claims processing insurance

Think about your most experienced claims adjuster. They're probably spending hours each day on tasks that, frankly, don't require their expertise. Document review, data entry, cross-referencing information - these are the time-sinks that keep talented professionals from doing what they do best.

AI claims processing insurance flips this equation entirely. By automating these repetitive tasks, we're not just saving time - we're changing entire workflows. Claims that used to take weeks now process in hours or even minutes. One travel insurance company we know achieved 57% automation and reduced their processing time from weeks to minutes for 400,000 claims annually.

The accuracy improvements are equally impressive. Human error is inevitable when you're dealing with high volumes of complex data. But AI systems can achieve up to 99.99% accuracy in claim validation. That's not just fewer mistakes - it's fewer disputes, less rework, and more consistent outcomes for everyone involved.

This change frees up adjusters to focus on what really matters: the complex cases that need human judgment, the sensitive situations that require empathy, and the strategic decisions that drive business value. As we explored in our article about how we made AI do the most tedious, time-consuming task in claims processing: creating the claim profile, this isn't about replacing human expertise - it's about amplifying it.

Elevating the Policyholder Experience

Here's a sobering reality check: 31% of policyholders who made recent claims were dissatisfied with their experience. Even worse, 60% cited settlement speed as their primary complaint. When 21% of customers expect claims settled in hours but 43% wait over two weeks, you've got a serious expectation gap.

This isn't just about customer service scores - it's about business survival. Only 19% of customers stay after a bad claims experience, while 62% stay after a good one. In an industry where customer acquisition costs are skyrocketing, retention isn't just important - it's everything.

AI transforms this entire dynamic. Instead of waiting days for someone to manually review their claim, policyholders get real-time updates and faster resolutions. 24/7 claims filing and support through AI-powered chatbots means customers can get help when they need it, not just during business hours.

The transparency factor is huge too. When AI can instantly analyze documents, photos, and other evidence, customers get proactive communication about their claim status. No more calling to ask "what's happening with my claim?" - they already know.

Most importantly, this speed and transparency directly impact the bottom line. When customers have good claims experiences, 87% consider it when renewal time comes. That's the difference between a one-time transaction and a lifetime relationship.

The change happening in ai claims processing insurance isn't just about making existing processes faster - it's about fundamentally reimagining what's possible when you combine human expertise with intelligent automation.

Strategic Implementation and Overcoming Challenges

Rolling out ai claims processing insurance isn't like flipping a switch. It's more like orchestrating a complex dance between technology, people, and processes. While the rewards are substantial, smart insurers know they need to steer several key challenges to get there successfully.

The biggest stumbling block? Data quality. Here's a sobering statistic: between 83% and 92% of AI projects fail because of poor data quality. Think about it - if you feed an AI system incomplete or messy data, you'll get incomplete or messy results. It's like trying to bake a cake with spoiled ingredients.

Then there's the privacy puzzle. AI systems need access to personal information to work effectively, but this creates real risks around data confidentiality. One breach can damage years of trust-building with customers.

Legacy system integration presents another headache. Many insurers are running on systems that were built decades ago. Getting these older systems to play nicely with cutting-edge AI is like trying to connect a smartphone to a rotary phone - technically possible, but it takes some creative engineering.

Finally, there's the human element. New technology means new workflows, new responsibilities, and sometimes new fears. Change management isn't just about training people on new tools - it's about helping them see how AI makes their work better, not obsolete.

At Agentech, we help insurers think through these decisions carefully. Our guide on Buy vs. Build: Navigating the SaaS AI Technology Decision walks through the key factors to consider when planning your AI implementation.

Addressing the Workforce Skills Gap

The insurance industry is facing a perfect storm: experienced claims professionals are retiring faster than new talent is coming in. Many seasoned adjusters have decades of knowledge locked in their heads, and when they walk out the door, that expertise goes with them.

But here's where AI becomes a game-changer - not by replacing people, but by acting as a digital mentor. Think of AI as the ultimate training wheels for new claims handlers. While a rookie adjuster might feel overwhelmed by a complex case, AI can handle the routine paperwork, data extraction, and initial analysis. This gives new team members more time to learn from experienced supervisors and focus on the decision-making skills that really matter.

AI levels the playing field in remarkable ways. A less experienced handler can suddenly process claims with the same accuracy and efficiency as someone who's been doing it for years. The AI takes care of the tedious stuff, while humans focus on building relationships with policyholders and making nuanced judgments that require empathy and experience.

This approach doesn't just solve today's staffing challenges - it creates a stronger workforce for tomorrow. New hires can accelerate their learning curve because they're spending time on meaningful work instead of drowning in paperwork. It's a win-win that addresses what we call Solving the Insurance Labor Crisis with AI-Driven Innovation.

The Role of Explainable AI (XAI) in Building Trust

Nobody likes a "black box" - especially when it's making decisions about their insurance claim. Traditional AI systems often work like magic tricks: you see the result, but you have no idea how they got there. For claims adjusters, policyholders, and regulators, this mystery creates serious trust issues.

Explainable AI (XAI) solves this problem by showing its work. Instead of just saying "claim denied," XAI explains exactly which factors led to that decision and why they matter. It's like having a math teacher who doesn't just mark your answer wrong, but shows you exactly where you made the mistake.

For claims adjusters, this transparency is invaluable. They can confidently explain AI decisions to policyholders because they understand the reasoning themselves. When someone asks "Why was my claim handled this way?" the adjuster has clear, logical answers.

XAI also helps ensure fairness and reduces bias in decision-making. When you can see how an AI system weighs different factors, you can spot potential problems and fix them before they impact real people. This transparency is crucial for regulatory compliance and builds the foundation for long-term trust.

The insurance industry is heavily regulated for good reason - people's financial security depends on fair treatment. As we explore in AI in Insurance: Balancing Innovation and Regulation, XAI isn't just nice to have - it's essential for the ethical deployment of ai claims processing insurance solutions that everyone can trust.

The Future of Claims: What's Next for AI in Insurance?

We're standing at the edge of something remarkable. The current state of ai claims processing insurance is just the opening act of what's coming next. By 2030, we're looking at a world where automation could handle over half of all claims activities - not just the simple stuff, but complex decision-making that requires real intelligence.

The future isn't just about faster processing or better accuracy. It's about fundamentally reimagining how insurance works, from the moment a loss occurs to the final settlement. Think of it as moving from having helpful tools to having truly intelligent partners that can think, learn, and act on their own.

Hyper-automation is where we're headed first. This goes way beyond today's automation. Instead of automating individual tasks, we're talking about orchestrating entire workflows where AI, machine learning, and robotic process automation work together seamlessly. Imagine a claim that flows from first notice of loss to settlement without a single human touch - except when human judgment is truly needed.

But the real game-changer is agentic AI. These aren't just smart programs that follow instructions. They're digital coworkers that can make decisions, learn from experience, and even take initiative to solve problems before they become bigger issues. It's like having a claims assistant that never sleeps, never forgets, and gets smarter every day. As we explore in Amazon CEO Forecasts Billions of AI Agents as Coworkers—and Agentech is Already Powering Insurance Claims with Hundreds, we're already seeing this future take shape.

The integration with IoT and telematics will make claims processing almost magical. Your car will automatically report an accident, complete with damage photos and impact data. Smart homes will detect water leaks and file claims before you even know there's a problem. Wearable devices will provide instant health data for life and disability claims.

This real-time data flow enables something even more powerful: proactive risk prevention. Instead of just processing claims after something bad happens, AI will help prevent losses in the first place. Your insurance company might alert you about potential hail damage based on weather patterns, or suggest maintenance based on your home's sensor data.

Personalized insurance products become possible when AI understands your unique risk profile in real-time. Instead of broad categories, you get coverage that adapts to your actual behavior and circumstances. Safe drivers pay less automatically. Healthy lifestyle choices get rewarded instantly.

The evolution toward prescriptive AI means systems won't just predict what might happen - they'll recommend exactly what to do about it. For adjusters, this means AI partners that don't just process information but actively suggest the best course of action for each unique situation.

At Agentech, we're not just watching this future unfold - we're building it. Our AI agents are already handling hundreds of claims tasks, learning and improving with each interaction. We're proving that the future of ai claims processing insurance isn't about replacing human expertise, but about amplifying it with truly intelligent digital partners.

Conclusion

The change we've witnessed through ai claims processing insurance represents more than just technological advancement—it's a complete reimagining of how the insurance industry serves its customers. What started as a necessary evolution to address inefficiencies has become a revolution that's turning claims departments from traditional cost centers into powerful value drivers.

Throughout this journey, we've seen how AI tackles the industry's biggest challenges head-on. Faster settlements that meet customer expectations, improved accuracy that reduces errors and disputes, and improved customer experiences that build loyalty rather than frustration. The numbers speak for themselves: processing times shrinking from weeks to minutes, accuracy rates reaching 99.99%, and customer satisfaction improving dramatically.

But perhaps the most important lesson is that this isn't about replacing human expertise—it's about empowering it. AI handles the tedious document review, data entry, and routine analysis that currently consumes 30% of claims handlers' time. This frees up adjusters to do what they do best: apply their judgment to complex cases, provide empathetic support to policyholders during difficult times, and make nuanced decisions that require human insight.

The future we're moving toward is a hybrid workforce where human wisdom and AI efficiency work hand in hand. Experienced adjusters focus on strategic thinking and customer relationships, while digital agents handle the heavy lifting of data processing and routine tasks. New team members get AI-powered support that accelerates their learning and helps them contribute meaningfully from day one.

At Agentech, we're proud to be building this future with our seamless AI assistants that work alongside claims professionals, not instead of them. Our approach ensures that human decision-making remains at the center of the process, while AI provides the speed, accuracy, and insights that modern policyholders demand.

The insurance industry has always been about providing peace of mind when people need it most. AI claims processing insurance simply ensures we can deliver on that promise faster, more accurately, and with the human touch that makes all the difference.

Ready to see how this change can work for your team? Find how AI Agents can revolutionize your claims processing and find what's possible when human expertise meets intelligent automation.