Why Claims Automation Software is Essential for Modern P&C Insurance

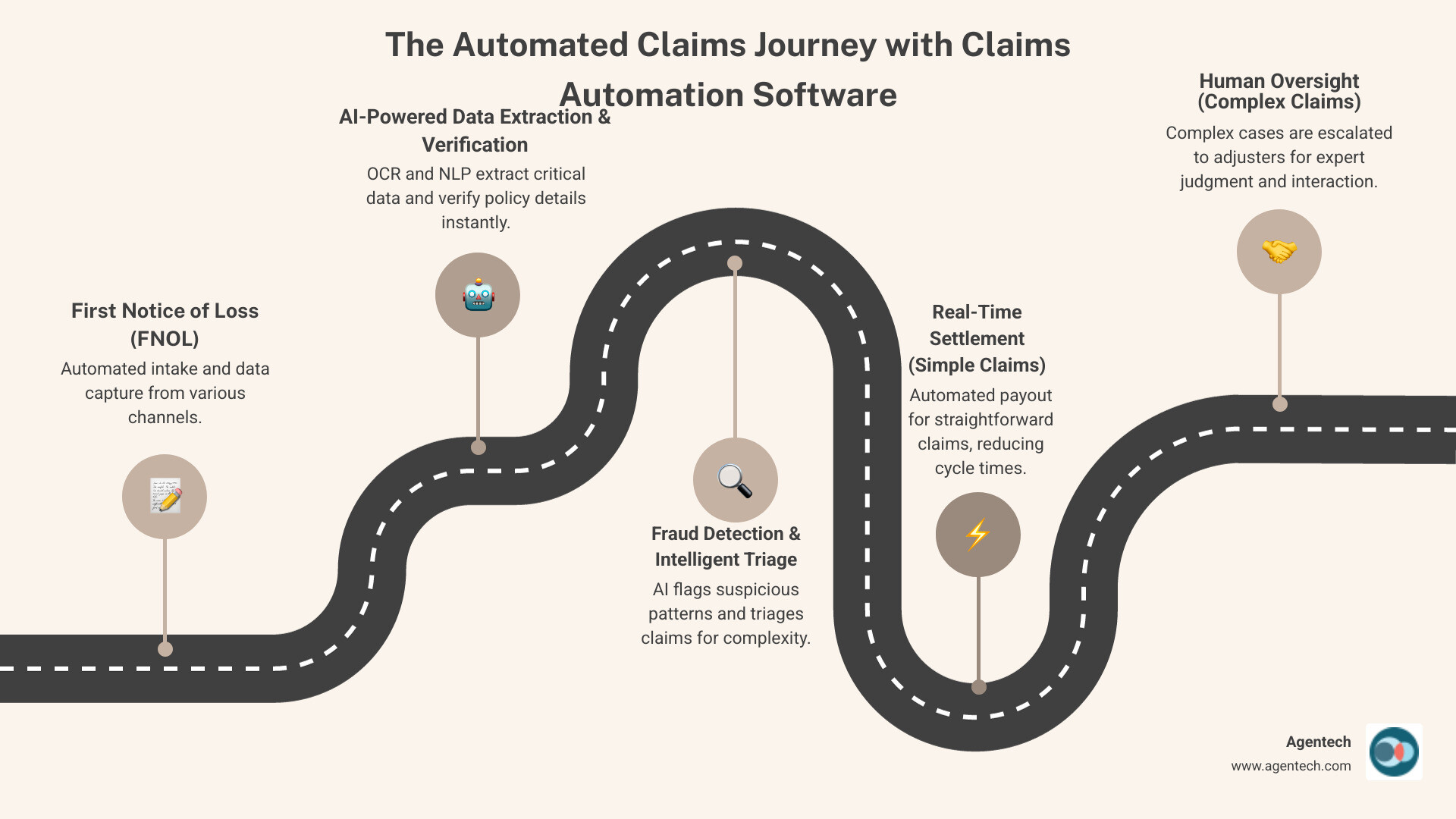

Claims automation software is changing how Property & Casualty insurance companies manage the entire claims lifecycle, from First Notice of Loss (FNOL) to settlement. These platforms use AI and automation to streamline the claims workflow, reducing manual data entry, cycle times, and errors.

Top Claims Automation Software Benefits:

- Speed: Settle over 50% of claims in real time vs. a 25-day manual average

- Accuracy: Achieve 96-98% processing accuracy with AI-powered systems

- Cost Savings: Reduce claims journey costs by up to 30%

- Efficiency: Eliminate up to 85% of manual administrative tasks

- Customer Satisfaction: 62% of customers stay after a good claims experience

The urgency is clear. While 21% of customers expect claims settled in hours, 43% currently wait over two weeks. This gap presents a major opportunity for P&C carriers, TPAs, and Independent Adjusting firms that accept automation.

Manual processes struggle with high volumes of claims documents, causing delays and frustrating adjusters, especially during CAT season. Modern claims automation software handles these repetitive tasks, freeing human experts for complex cases that require judgment and customer interaction.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for insurance with a focus on claims automation software solutions. After successfully scaling and exiting TokenEx in 2021, I've dedicated my expertise to helping P&C insurers transform their claims operations through cutting-edge AI technology.

The Core Benefits of Automating Your Claims Workflow

Skilled adjusters often spend too much time on data entry. Claims automation software changes this, changing operations for P&C insurance companies, TPAs, and Independent Adjusting firms. This shift lets your team focus on what they do best: solving complex problems and connecting with customers. When automation handles repetitive tasks, your people can focus on high-value work.

The numbers tell a compelling story. P&C insurance companies can reduce the cost of the claims journey by as much as 30 percent through automation. This is about operational efficiency that streamlines every step. Most importantly, a staggering 62 percent of customers stay with a P&C insurer after a good claims experience. Your claims process is your most powerful customer retention tool.

Cost reduction, improved risk management, and soaring customer retention are the natural results of eliminating manual bottlenecks and delivering the fast, accurate service people expect.

Drastically Reduce Claims Cycle Times

A significant gap exists between customer expectations and reality: 21 percent of customers want claims settled in hours, while 43 percent are currently waiting over two weeks. This presents a huge opportunity.

With modern claims automation software, the First Notice of Loss (FNOL) can trigger an immediate, automated response that verifies policies and begins assessments, eliminating common delays. The results are impressive: modern platforms can settle over 50 percent of claims in real time. For straightforward claims, customers can go from filing to settlement in minutes.

This speed creates customer satisfaction that translates directly to loyalty. When you deliver what customers want, you create a powerful competitive advantage. This approach is what we explore in Designing for the Future: How AI Transforms the Claims Experience.

Improve Accuracy and Reduce Costs

Manual error is expensive. A mistyped policy number or miscategorized claim can cost thousands and cause frustration. Claims automation software eliminates these mistakes through consistent, standardized processes. AI-powered systems achieve 98 percent or higher accuracy in data processing.

Furthermore, data extraction technologies can eliminate up to 85 percent of manual administrative tasks. Imagine what your adjusters could accomplish with that time back. This isn't about replacing human judgment; it's about freeing your most valuable resources to handle complex negotiations, difficult assessments, and sensitive customer interactions—work that requires experience and empathy.

Fewer errors mean less rework and fewer disputes, leading to significant improvements in operational efficiency. Learn more in our analysis in AI Claims Processing Insurance.

Mitigate Fraud and Improve Risk Management

Approximately 10 percent of property and casualty claims are fraudulent, costing insurers and honest customers. Claims automation software turns the tables with sophisticated fraud detection that analyzes patterns, cross-references data, and identifies suspicious patterns that might take human investigators weeks to uncover.

Automated claims triage not only catches bad actors but also fast-tracks legitimate claims. When you can quickly process the 90 percent of legitimate claims, your Special Investigative Unit can focus its expertise where it's most needed. Risk management improves dramatically with systems that can process thousands of claims while spotting inconsistencies human reviewers might miss.

This targeted approach means legitimate customers get the white glove treatment they deserve, while suspicious claims get the scrutiny they require. It's a win-win for protecting your business and delivering exceptional service.

Citations:

- Insurance Fraud Coalition

- Agentech Resources

Key Technologies Powering Claims Automation Software

The magic behind modern claims automation software is a combination of powerful technologies. For P&C carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) Firms, understanding these technologies reveals why automation delivers such dramatic results.

Think of these technologies as superpowers for your team. Artificial Intelligence acts as the brain, understanding documents instantly. Machine Learning is the experienced adjuster who learns from each claim, and Robotic Process Automation is the tireless assistant handling data entry without errors.

Crucially, these technologies complement human expertise. Your experienced adjusters remain essential for complex decisions and customer relationships; the technology simply handles repetitive work so your team can focus on what they do best. See the bigger picture in The Future of Insurance: How AI is Changing the Game.

Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence (AI) and Machine Learning (ML) are the core of modern claims automation software, learning from your data to make your operation smarter. ML systems improve at predictive analytics over time, recognizing patterns to forecast claim severity, spot fraud, and optimize resource assignment.

Their data analysis capabilities can sift through massive amounts of information in minutes, leading to more informed decision making. Two key components make this possible: Natural Language Processing (NLP) and Optical Character Recognition (OCR). NLP allows the software to understand human language from emails and unstructured documents. OCR converts any image of text into machine-readable data. Together, they automatically extract critical information from any claims document.

For a deeper dive, explore Insurance Claims Machine Learning.

Robotic Process Automation (RPA)

While AI provides the brains, Robotic Process Automation (RPA) provides the reliable hands. RPA uses software robots to handle repetitive, rule-based tasks like data entry and form filling with perfect speed and consistency. This can save significant time for each claim handler daily.

Your human adjusters are freed to focus on complex investigations and customer conversations that require judgment and empathy. RPA bots work around the clock without fatigue or error, handling mundane tasks so your experienced team can tackle more interesting challenges. Learn more in Insurance Back Office Automation.

Agentic AI: The Next Evolution in Automation

The latest evolution is Agentic AI, a leap beyond traditional automation. These are digital coworkers, not just tools, capable of handling complex workflows and adapting in real time. Unlike basic RPA bots, Agentic AI agents can break down complicated problems, prioritize task execution, and learn from experience.

Designed with a human in the loop approach, they handle routine decisions independently but escalate complex cases to human adjusters. This creates a collaborative environment where AI agents work alongside your team, processing straightforward claims while flagging unusual situations for review. This scales expertise by embedding your best practices into the digital workforce.

Explore how this technology is reshaping claims in Agentic AI in Insurance: When Bots Become Your Best Agents and Changing Insurance Claims: The Evolution from Generative AI to Agentic AI.

A Feature Checklist for Selecting Your Platform

Selecting the right claims automation software can be overwhelming. Some platforms are too complex, while others lack the scalability for your P&C insurance workflows. No single solution fits every P&C carrier, TPA, or Independent Adjusting firm. The ideal platform depends on your current systems, claim volumes, and specific pain points.

What matters most is finding software that makes your adjusters' lives easier while delivering measurable results. Knowing what to look for is key.

For a comprehensive overview, check out Insuretech Made Easy: Understanding Insurance Software Systems.

Essential Features in Modern Claims Automation Software

When evaluating claims automation software, focus on features that solve real workflow challenges. The best platforms streamline the entire claims lifecycle for your team.

- Automated FNOL intake: Allows policyholders to submit claims via multiple channels, with automatic data capture and validation.

- Intelligent triage and assignment: AI analyzes claim complexity and routes it to the right adjuster or team, optimizing workloads.

- Data extraction capabilities: Uses OCR and NLP to automatically extract key details from documents like police reports and repair estimates.

- Automated policy verification: Instantly confirms coverage details, limits, and deductibles to catch issues early.

- Fraud detection flags: Employs machine learning to spot suspicious patterns and highlight potentially fraudulent claims for investigation.

- Integrated communications: Keeps everyone informed through automated notifications and messaging, reducing inbound calls.

- Analytics dashboards: Provides real-time reporting on cycle times, costs, and productivity to help you identify bottlenecks.

Types of Claims Automation Solutions

The claims automation software market offers several approaches:

- All-in-one platforms handle the entire process in a single system, ideal for larger carriers wanting unified data but can be complex to implement.

- Point solutions focus on specific tasks like document processing, delivering quick wins without disrupting your core system.

- Low-code and no-code platforms allow business users to build and modify workflows without extensive IT support.

- SaaS solutions offer fast, cloud-based implementation with subscription pricing, reducing IT overhead and scaling easily.

Learn how a hybrid approach delivers results in A Hybrid AI Solution for Claims Automation: How Agentech Combines Out-of-the-Box Efficiency with Custom QA Precision.

The Role of Data Analytics and Reporting

Robust analytics are crucial. Claims automation software without them is like a car without a speedometer; you're moving fast but with no direction. The best platforms turn claims data into a goldmine of insights.

Cycle time tracking shows you where claims get stuck. Settlement accuracy metrics help spot payment patterns before they become costly problems. Adjuster productivity reporting reveals how automation impacts team efficiency. Advanced analytics can even predict future claim volumes to help with staffing and planning.

AI can now automate the creation of claim profiles, a once time-consuming task. Find out how in We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile.

Citations:

- Agentech AI

- Insurance Forums

- Workgroup Maine

Overcoming Implementation and Integration Challenges

Implementing new claims automation software can seem daunting. P&C carriers, TPAs, and IA firms often face challenges with change management, staff training, and data migration. The key is to start with pilot projects. Testing automation on a specific process, like FNOL intake, allows your team to get comfortable with the technology while you work out any issues.

When adjusters see how automation makes their lives easier by reducing paperwork, resistance quickly fades. For practical guidance on where to begin, check out Not Sure Where to Start with AI?.

Integrating with Legacy P&C Insurance IT Systems

Your legacy systems likely weren't designed for modern automation, but you don't need a complete overhaul. Modern claims automation software uses Application Programming Interfaces (APIs) to connect with your existing systems. A well-designed platform will integrate smoothly with your policy administration systems and claims databases.

The goal is seamless integration that improves your current setup. Data should flow naturally between systems, eliminating manual entry. We ensure our solutions work with the leading claims management software and core systems you already use, so you get the benefits of automation without rebuilding your tech stack. For more insights, see Insurance IT Systems.

Ensuring Data Security and Regulatory Compliance

Security is paramount when handling sensitive policyholder data in P&C insurance. A single breach can destroy trust. The right claims automation software prioritizes security with strong data encryption and solid cloud security practices.

GDPR compliance and PII protection should be built into every feature. Many trustworthy providers earn certifications like SOC 2 Certification to prove their commitment to security. Your automation platform must help you stay compliant with industry regulations. We explore this balance in AI in Insurance: Balancing Innovation and Regulation.

Navigating the Adoption of Claims Automation Software

The buy versus build dilemma is a common concern. Building a custom solution in-house can be tempting but often leads to high costs, long timelines, and maintenance challenges. Buying a specialized SaaS solution is usually more practical, offering faster implementation and a lower total cost of ownership.

When it comes to vendor selection, partner with experts who understand P&C insurance. Check their track record and ask about their implementation timeline. Modern cloud-based platforms can be running in 5 to 10 weeks, delivering a much faster return on your investment. We dive deeper into this decision in Buy vs. Build: Navigating the SaaS AI Technology Decision.

Citations:

- Insurance-Forums.com

- Workgroup Maine

Frequently Asked Questions about Claims Automation

As P&C insurance carriers, TPAs, and Independent Adjusting firms explore automation, common questions arise. Here are the answers to the ones we hear most often about claims automation software.

What is the first step to automating claims processing?

Starting your automation journey begins with clear goals. Are you aiming to reduce cycle times, cut costs, or free adjusters from paperwork? Once you have identified your goals, pick a high-impact process like First Notice of Loss (FNOL) for a pilot project. This approach demonstrates value quickly and builds momentum with your team.

Does claims automation replace claims adjusters?

This is a common concern. Modern automation is designed to make adjusters more valuable, not replace them. Claims automation software handles repetitive tasks like data entry and document routing. This allows your experienced adjusters to focus on what they do best: investigating complex claims, negotiating settlements, and providing the human touch customers need. AI designed with adjusters in mind boosts their productivity and job satisfaction.

How long does it take to implement claims software?

Implementation timelines vary. Traditional on-premise systems can take months or even years. In contrast, modern, cloud-based SaaS platforms can often be up and running in as little as 5 to 10 weeks. This speed comes from pre-built integrations and systems designed for rapid deployment, delivering a much faster return on investment.

The Future is Automated: Taking the Next Step

The P&C insurance landscape is shifting. Claims automation software is now essential for companies that want to thrive. The future belongs to organizations that use automation not to replace people, but to open up their team's full potential.

Your best adjusters are skilled investigators and negotiators, not data entry clerks. Automation lets them focus on high-value work like complex claims and customer support. Digital coworkers are no longer science fiction; they are already handling repetitive tasks alongside claims teams.

Platforms like Agentech are pioneering the use of AI Agents to create a collaborative environment between human adjusters and their digital teams. These intelligent agents tackle mundane work, freeing your experts to focus on strategic tasks that matter.

The competitive advantage is clear: while others are buried in paperwork, your team can build stronger customer relationships and close claims faster. This improves efficiency and creates a superior customer experience.

Whether you're a P&C carrier, a TPA, or an Independent Adjusting firm, the path forward is clear. Ready to see what's possible when humans and AI work together? Learn how Agentic AI is revolutionizing the industry.