Why Insurance Software Systems Are Essential for Modern Claims Management

Insurance software systems are digital platforms that automate the insurance lifecycle, from policy administration to claims processing. As the backbone of modern insurance, they help companies reduce manual work, improve accuracy, and deliver faster service.

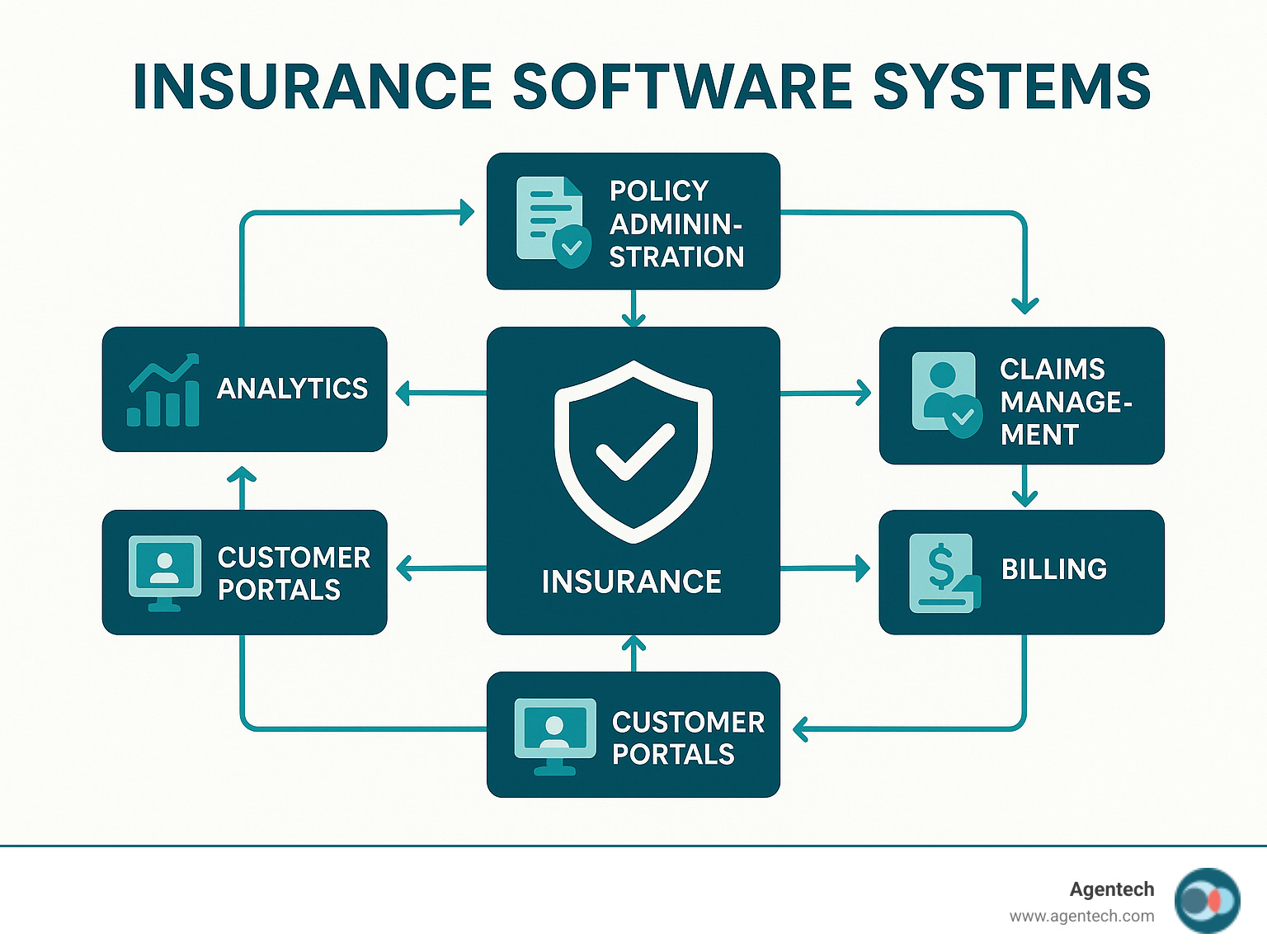

Key components include:

- Policy Administration Systems (PAS): Manage policy creation and renewals.

- Claims Management Systems: Automate claims intake and settlement.

- Underwriting Platforms: Assess risk and determine policy terms.

- Billing and Collections: Handle premium payments.

- Customer Portals: Provide self-service options.

- Analytics and Reporting: Generate insights from data.

The insurance software market is projected to reach $5,511 million by 2031, according to Verified Market Research, driven by the demand for digital efficiency. Modern platforms deliver remarkable results; for example, Velocity Risk Underwriters doubled profitability in two years while cutting costs by 60%.

For claims managers, these systems are a lifeline. They automate manual processes, allowing adjusters to focus on complex cases instead of administrative tasks.

I'm Alex Pezold, founder of Agentech, where we build AI-powered solutions for insurance claims processing. My focus is on helping insurance companies use cutting-edge insurance software systems to transform operations and boost adjuster productivity.

The Core Components of Modern Insurance Software Systems

Think of insurance software systems as the digital backbone of an insurance company. These sophisticated platforms handle everything from the initial quote to the final claim payment.

At the core is the Policy Administration System (PAS), which manages the entire policy lifecycle, from quotes to renewals. The Claims Management component tracks everything from first notice of loss to settlement, with top systems enabling straight-through processing rates as high as 98%. The Underwriting component is a risk assessment powerhouse, processing applications in minutes instead of days. Billing and Collections handles premium payments and invoicing, while Reinsurance Management helps larger insurers spread risk.

Types of Insurance Software

The world of insurance software systems isn't one-size-fits-all. Different types of insurance require different tools.

- P&C Insurance Platforms: Focus on Property & Casualty lines like auto and home, often built in the cloud for scalability.

- Life and Health Systems: Handle the long-term nature of life insurance, annuities, and health coverage, including complex calculations and regulations.

- All-in-One Suites: Integrate policy administration, claims, billing, and underwriting into a single platform to eliminate data silos.

- Agency Management Systems (AMS): Built for agencies and brokerages to manage client relationships and daily workflows.

- CRM for Insurance: Focuses on customer relationships and sales processes to build loyalty.

Want to dive deeper into how technology is changing our industry? Check out this article about AI in insurance.

Key Features of Top-Tier Insurance Software Systems

When evaluating insurance software systems, certain features are foundational for modern operations.

- Automation Tools: Handle document processing with OCR, automate data entry, and orchestrate workflows. At Agentech, we see how AI-powered automation transforms claims processing by taking over repetitive tasks.

- Data Analytics & Reporting: Turn business data into actionable insights to inform pricing decisions and identify trends.

- Customer Portals: Offer policyholders 24/7 self-service options to file claims, upload documents, and track progress.

- Document Management: Keeps all paperwork organized, secure, and searchable.

- Integration Capabilities: APIs allow your software to connect with other tools, data providers, and third-party services.

- Scalability: Cloud-based solutions grow with your business, handling increased volume without expensive hardware upgrades.

- Security: Protects customer data with advanced encryption, access controls, and certifications like SOC 2 and ISO 27001.

How Insurance Software Drives Digital Change and Efficiency

The insurance industry is undergoing a massive digital shift, led by insurance software systems. These platforms are reshaping how insurance companies operate, connect with customers, and manage risk.

A key development is straight-through processing (STP), which handles an entire process without human intervention. One company boosted its STP rate from 80% to 98%, cutting costs by 60% and doubling profits in two years. Digitizing the product lifecycle breaks down data silos, leading to improved data accuracy and smarter decisions.

Boosting Efficiency and Customer Engagement

Modern insurance software systems create a win-win for your team and your customers. Automated workflows handle repetitive tasks like data entry and document filing, freeing up adjusters to focus on complex problem-solving and customer support. At Agentech, our AI tools target these administrative tasks, allowing adjusters to focus on the human side of their job.

The customer experience also improves with 24/7 self-service options through portals, apps, and chatbots. Personalized communication becomes possible, tailoring messages to individual customer needs. Most importantly, faster claims processing is a major benefit. While manual claims can take 25 days, AI-powered systems can handle over 60% in real time. This speed is critical, as 62% of customers stay after a good claims experience, versus only 19% after a bad one.

For more insights into how AI works alongside adjusters, check out AI Designed with Adjusters in Mind.

Assisting with Regulatory and Compliance Management

Compliance is critical in the highly regulated insurance industry. Insurance software systems make this challenge manageable. Automated compliance checks ensure every policy and claim meets current regulatory requirements, saving time and reducing manual monitoring.

For complex standards like IFRS 17, modern software comes with preconfigured financial systems and automated reporting. Real-time policy updates allow companies to adapt quickly to new regulations. Standardized reporting and audit trails simplify regulatory submissions and provide a clear record of every transaction. When compliance is handled efficiently, it becomes a competitive advantage that supports growth.

To learn more about balancing innovation with regulatory requirements, explore AI in Insurance: Balancing Innovation and Regulation.

Key Trends Shaping Insurance Software in 2025

The world of insurance software systems is constantly evolving. Looking ahead to 2025, several key trends are shaping the future of these platforms.

- Hyper-automation: This combines RPA, AI, and machine learning to automate complex business processes, creating highly efficient digital operations.

- Low-code/No-code Platforms: These enable users to create applications with minimal coding, accelerating development and giving insurers more autonomy.

- Data-driven Underwriting: Insurers are using external data, telematics, and predictive models to improve risk selection and personalize offerings.

- Telematics Integration: Expanding beyond auto insurance to property and health, telematics data allows for personalized policies and proactive risk management.

The Rise of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are becoming integral to insurance software systems.

- Predictive Analytics: AI algorithms analyze historical data to predict outcomes like claim frequency and severity. Our AI platform achieves 98% accuracy in predictions, helping handlers focus on complex cases.

- Fraud Detection: AI identifies patterns of fraudulent activity that humans might miss, preventing significant losses.

- AI-powered Chatbots: These virtual assistants provide 24/7 customer support, answer queries, and assist with initial claim filing.

- Agentic AI for complex tasks: This advanced AI performs multi-step, reasoning-based tasks. Our always-on AI assistants boost adjuster productivity by handling administrative work, allowing humans to focus on evaluation and communication.

While consumer comfort with AI is growing, just over 1 in 3 UK consumers are comfortable with AI making price decisions without human review. However, younger demographics are more open to it, suggesting growing acceptance.

The Benefits of Cloud-Based Platforms

The move to cloud-based insurance software systems offers substantial advantages.

- Scalability and Flexibility: Cloud platforms allow insurers to rapidly adjust computing resources based on demand, preparing them for growth without large upfront hardware costs.

- Reduced IT Overhead: The service provider handles infrastructure and maintenance, freeing up internal IT teams for strategic initiatives.

- Remote Accessibility: Cloud systems are accessible from anywhere, supporting remote work and ensuring business continuity.

- Faster Deployments: Cloud environments enable much faster deployment of new features and updates. One firm saw 10x faster deployment after migrating to the cloud.

- Improved Data Security: Leading cloud providers invest heavily in security, often offering more robust measures than individual companies can afford. One company achieved a 75% reduction in downtime after migrating its suite to the cloud.

Ready-Made vs. Custom: Which Solution is Right for You?

Choosing the right insurance software systems is a critical decision. It comes down to a key question: Do you adapt your processes to fit proven software, or build software that fits your exact processes?

| Feature | Ready-Made Software | Custom Software |

|---|---|---|

| Cost | Lower initial upfront cost (subscription/license fees) | Higher initial development cost |

| Implementation | Faster (weeks to a few months) | Slower (several months to 1–2 years or more) |

| Scalability | Generally scalable within vendor's architecture | Highly scalable, built to specific future needs |

| Customization | Limited (configuration options, integrations) | Unlimited (custom to exact requirements) |

When evaluating the Total Cost of Ownership (TCO), look beyond the initial price. A thorough Business Needs Analysis will help you identify your unique challenges and budget, guiding you to the right path. For ready-made solutions, Vendor Support is key, while custom solutions require a strong development partner.

When to Choose a Ready-Made Solution

Ready-made insurance software systems are often the smart choice for companies with:

- Standard Business Processes: These solutions are designed for industry best practices.

- Limited Budget: Subscription fees are more manageable than custom development costs.

- Need for Rapid Deployment: They can be up and running in weeks or months, not years.

- Proven Functionality: You benefit from systems tested by thousands of users.

- Strong Vendor Support: Reputable providers offer training, assistance, and regular updates.

Why Consider a Custom Insurance Software System

Custom insurance software systems make sense when you need to address:

- Unique Business Requirements: Handle specialty products or proprietary processes without compromise.

- Gaining a Competitive Edge: Build software that does things your competitors' systems can't.

- Long-term Scalability: You control the development path to align with your future growth.

- Full Control Over Features: Every feature is built to serve your specific business goals.

- Seamless Integration with Legacy Systems: Design software to work perfectly with existing platforms.

The buy-versus-build decision deserves careful thought. For insights on this choice in the AI space, check out Buy vs. Build: Navigating the SaaS AI Technology Decision.

Frequently Asked Questions about Insurance Software

When I talk to insurance professionals about insurance software systems, a few questions always come up. Here are the answers based on my experience building AI solutions for the industry.

How does insurance software improve adjuster productivity?

This is the question I hear most. Insurance software systems boost adjuster productivity by automating repetitive administrative tasks like data entry and document indexing. This frees adjusters from paperwork to focus on high-value activities that require human expertise: complex case evaluation, customer communication, and thoughtful decision-making.

At Agentech, our always-on AI assistants act as "co-pilots," not replacements. They summarize information and handle routine work, but the adjuster remains in control of all decisions. The result is faster claims cycles, lower operational costs, and happier customers.

What is the typical implementation time for a new insurance system?

Implementation time varies. For small agencies using ready-made, cloud-based solutions, it can take a few weeks to a few months. Some companies launch new components in as little as 11 weeks.

Large-scale implementations for major carriers are more complex, typically taking 12 to 18 months or longer. The timeline depends on factors like data migration complexity, integration needs, and customization requirements. At Agentech, we achieve 99.9% accuracy in data migrations, but it remains a detailed process.

How secure is cloud-based insurance software?

Security is a top concern, but leading cloud providers often offer more advanced security than individual companies can manage. Reputable cloud-based insurance software systems use multiple layers of protection, including data encryption both in transit and at rest.

Major cloud providers invest heavily in secure infrastructure and have dedicated teams monitoring threats 24/7. Look for compliance with standards like SOC 2 Type 2, ISO 27001, HIPAA, and CCPA, which represent rigorous auditing and high security standards. While no system is completely invulnerable, leading cloud platforms are designed with security as a core principle.

Conclusion

The insurance industry is at a pivotal moment. Insurance software systems are no longer a luxury—they are the foundation of modern operations. Companies that accept these technologies are not just surviving; they are thriving.

We've moved from manual paperwork to AI-powered systems that can process claims in real time. The results are clear: 60% cost reductions, doubled profitability, and 98% straight-through processing rates. More importantly, these systems free insurance professionals from tedious tasks, allowing them to focus on what matters most: complex problem-solving and customer support.

The future is being shaped by AI, cloud platforms, and automation. At Agentech, we believe the best technology empowers people. Our AI assistants work alongside your team, handling the administrative burden so your professionals can focus on serving customers and growing your business.

The question isn't whether to modernize, but how quickly you can start. The right partner will help you lead the change, not just keep up with it.

Ready to see what modern claims processing looks like? Learn how Agentech can transform your claims processing.