Why Your P&C Claims Process Is Costing You More Than You Think

Automated claims handling uses technology like AI and machine learning to process P&C insurance claims with minimal human intervention. The results are powerful: carriers can reduce costs by up to 30% while cutting settlement times in half. Automation speeds up processing from weeks to minutes, reduces manual data entry, improves accuracy, and detects fraud faster. This frees adjusters to focus on complex cases requiring human judgment.

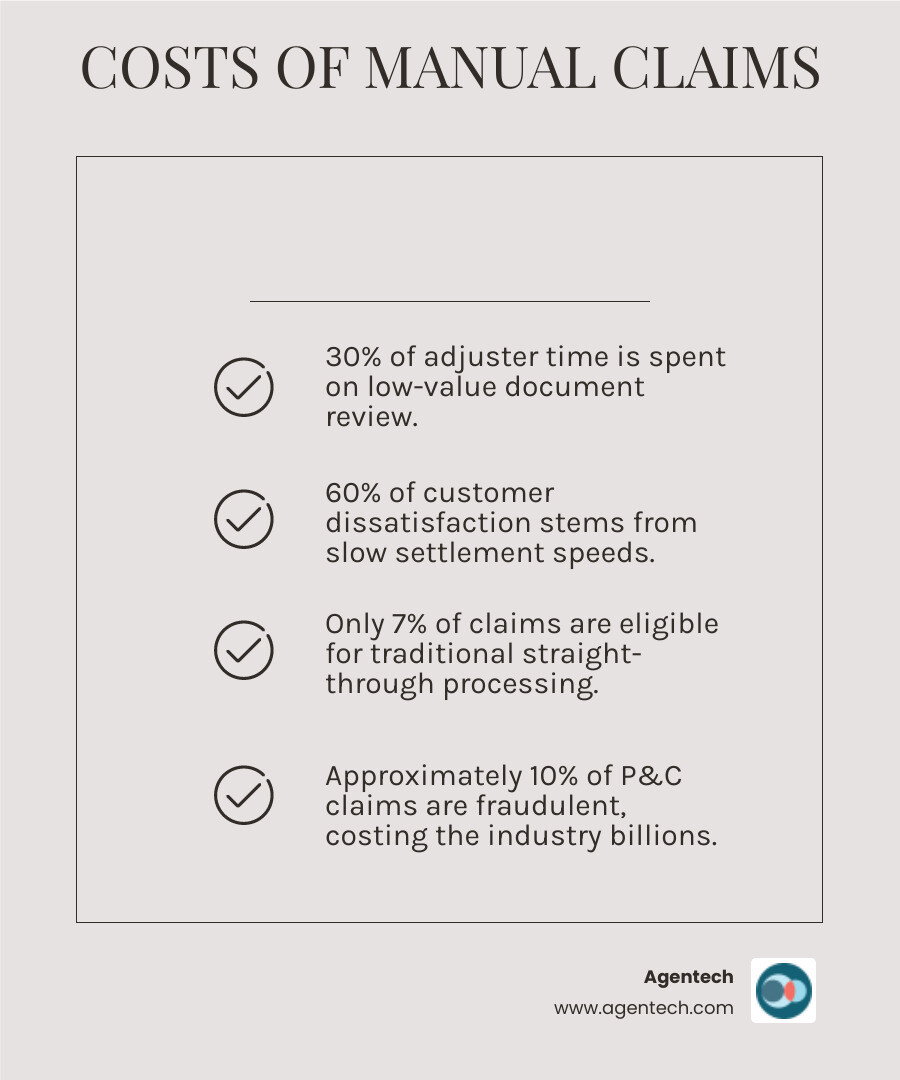

Currently, your claims team is likely drowning in paperwork, spending about 30% of their time on low value work like data entry. This inefficiency leads to customer frustration; an industry report highlights that 31% of recent claimants were dissatisfied, with 60% citing slow settlement as the main issue.

The numbers tell an even harder truth. With traditional methods, only 7% of claims can be processed through straight through processing. This bottleneck drives up Loss Adjustment Expense (LAE) and pushes frustrated customers to competitors.

The good news is that automation is solving these problems. A large US based travel insurer achieved 57% automation, reducing processing time from weeks to minutes. Another carrier cut claims processing time from 60 days to just 3 days. As Alex Pezold, founder of Agentech AI, I founded Agentech to revolutionize P&C insurance through Automated claims handling. Our mission is to build AI that works alongside your adjusters, not against them.

The Evolution of Claims: From Manual to Automated

For decades, P&C claims processing involved mountains of paperwork, endless data entry, and frustrating delays. This manual system created high error rates, slow processing times, and climbing operational costs, disappointing policyholders accustomed to digital speed. Every handwritten report or scanned estimate created another opportunity for mistakes.

Early attempts at a fix with rules based automation showed promise but ultimately fell short. These systems could handle simple, predictable tasks but failed when faced with the unstructured data common in P&C claims, like handwritten notes or diverse property damage reports. This is why only about 7% of claims could achieve true Straight Through Processing (STP). The other 93% still required human intervention.

The shift to intelligent automation changes everything. Instead of rigid rules, AI and machine learning can learn, adapt, and make sense of complex data. These systems get smarter over time, handling exceptions that would stump traditional automation. This is a fundamental rethinking of how P&C claims work, as explored in The Future of P&C Insurance: How AI is Changing the Game.

| Metric | Traditional Claims Handling | Automated Claims Handling |

|---|---|---|

| Speed | Weeks to months | Minutes to days |

| Accuracy | Prone to human error | High, consistent accuracy |

| Cost | High operational overhead | Significantly reduced |

| Customer Satisfaction | Often dissatisfied, slow | High, transparent, fast |

| Fraud Detection | Manual, reactive | AI driven, proactive |

| Adjuster Focus | Low value, repetitive tasks | Complex cases, customer care |

What is Automated Claims Processing?

Automated claims processing uses technologies like AI and Machine Learning to handle P&C insurance claims with minimal manual effort. Instead of adjusters spending hours on data entry or document review, claims software does the heavy lifting. The goal is to digitize and accelerate workflows, from the first report of damage to the final payment.

For P&C carriers, TPAs, and IA firms, our AI claims processing system is not designed to replace adjusters but to augment them. We free them from tedious tasks so they can focus on what humans do best: handling complex cases, negotiating settlements, and providing empathetic service.

The Traditional vs. Automated Claims Handling Workflow

Let's see how automated claims handling transforms a typical P&C claim.

Traditionally, the First Notice of Loss (FNOL) involved a phone call and manual data entry, inviting errors and delays. With automation, policyholders submit information via a mobile app, and AI agents instantly capture and validate it.

The data entry and document review phase was a major bottleneck. Adjusters spent hours extracting information from police reports, repair estimates, and medical records. Our AI agents excel here. We made AI do the most tedious, time consuming task in claims processing: creating the claim profile, processing millions of documents and pulling out key data from unstructured sources.

During adjudication, manual reviews led to inconsistencies. Automated systems apply policy rules uniformly, cross-reference data instantly, and can even approve straightforward claims without human intervention.

Finally, settlement involved manual calculations and slow payment processing. Automated systems now initiate digital payments immediately, cutting settlement times from weeks to hours.

The difference is dramatic. A tangled web of manual handoffs becomes a clean, efficient pipeline.

The Core Benefits of Automated Claims Handling

Automated claims handling is a strategic advantage that transforms operations for P&C insurance carriers, TPAs, and IA firms. The benefits range from your bottom line to your customer satisfaction scores.

The most tangible benefit is cost reduction. Industry analysis shows that automation can reduce claims processing expenses by up to 30%. For a mid sized P&C carrier, these savings add up quickly.

Beyond costs, automation delivers the speed and transparency policyholders expect. Faster settlements and real-time updates build trust, directly addressing the frustration of the 60% of policyholders who cite settlement speed as their main complaint.

Accuracy is another key factor. When AI handles routine tasks, data entry mistakes and inconsistent policy interpretation virtually disappear. This precision is invaluable for both efficiency and regulatory compliance. Our insurance back office automation solutions are designed to deliver these benefits directly to your team.

Boosting Speed and Slashing Costs

Speed is everything in P&C claims, and automated claims handling delivers. One P&C carrier processed claims 95% faster, while another reduced processing time from 60 days to just 3 days. A large US-based travel insurer cut processing time from weeks to minutes.

This acceleration directly lowers your Loss Adjustment Expense (LAE). As claims are processed faster with less manual work, the cost per claim drops. Your adjusters become more productive, focusing on complex cases that need their expertise. This reallocation of talent is key to solving the insurance labor crisis. Some companies have reported an 8X return on investment after adopting an enterprise wide automation platform.

Enhancing Accuracy and Fraud Detection

Automated claims handling ensures your policy terms and regulatory requirements are applied uniformly every time, eliminating inconsistencies between adjusters. This improves fairness and reduces errors.

Fraud detection is another area where automation shines. With approximately 10% of property and casualty claims being fraudulent, AI's ability to spot suspicious patterns that humans would miss is invaluable. Our AI solutions use advanced pattern recognition and anomaly detection to flag suspicious claims automatically. For example, AI's photo similarity scoring can identify reused images in a claim, helping you quickly prove fraud.

Beyond fraud, AI can also identify subrogation opportunities that might otherwise be missed. Our insurance claims machine learning capabilities continuously refine these detection systems, getting smarter with every claim processed.

Under the Hood: The Technology Powering Automation

The power behind automated claims handling lies in a sophisticated blend of technologies. The core strength of modern claims automation is its ability to process unstructured data. Unlike older systems that require predefined formats, AI can read, interpret, and extract meaning from police reports, adjuster notes, and photos, turning a flood of information into structured, usable data. This ability is central to our agentic AI definition.

Key Technological Components

Let us break down the essential technologies driving this revolution in P&C claims:

- Artificial Intelligence (AI): The core intelligence that enables systems to mimic human problem solving and decision-making, analyzing complex claim scenarios.

- Machine Learning (ML): A subset of AI that allows systems to learn from historical claims data to predict outcomes, identify patterns like fraud, and continuously improve accuracy.

- Natural Language Processing (NLP): Enables computers to understand and interpret human language, extracting key information from unstructured documents and summarizing reports.

- Optical Character Recognition (OCR): Converts scanned documents, PDFs, or images into editable and searchable data, digitizing paper based claim forms.

Our agentic AI for P&C insurance leverages these technologies to create intelligent assistants that streamline your operations.

The Step by Step Automation Process

With these technologies, the automated claims handling process becomes highly efficient:

- Digital FNOL Intake: Policyholders initiate claims through mobile apps or online portals. AI agents instantly capture and validate initial details.

- Data Extraction and Validation: OCR and NLP extract relevant information from all submitted documents. ML models then validate this data against policy terms.

- Policy Verification: AI rapidly cross-references claim details with the policyholder's specific coverage, limits, and exclusions.

- Automated Triage and Routing: AI intelligently triages the claim, routing it to the correct adjuster or fast tracking it for straight-through processing.

- Damage Assessment with Computer Vision: For auto or property claims, computer vision analyzes photos or videos of damage to provide instant estimates.

- AI Powered Decisioning: For straightforward claims, AI can automatically approve the claim based on predefined rules. Complex cases are escalated to human adjusters with a comprehensive summary.

- Automated Payment: Once approved, the system automatically triggers digital payment, ensuring policyholders receive funds quickly.

This seamless process is how we are designing for the future and changing the claims experience.

Navigating the Transition: Implementation and Adoption Strategies

Implementing automated claims handling presents common challenges, including integrating with legacy systems, ensuring data quality, and managing employee adoption. For P&C insurance carriers, TPAs, and IA firms, wrestling with outdated IT and skeptical teams is normal. However, these obstacles are surmountable with the right strategy, whether you choose to buy a SaaS AI solution or build one in house.

Overcoming Implementation Problems

The secret to success is a measured, step by step approach, not an overnight overhaul.

- Start with a phased rollout. Begin with a pilot program on a high volume, straightforward claim type, like auto glass damage. This allows your team to learn the system and build confidence before a wider launch.

- Use middleware solutions. Middleware acts as a translator between your old P&C insurance IT systems and new AI tools, enabling data flow without a complete system replacement.

- Prioritize data cleansing. Effective automation requires accurate, consistent data. If you're not sure where to start with AI, improving data quality is always a smart first step.

- Communicate clearly. Be transparent about the goals, timeline, and benefits for everyone involved. Open dialogue builds trust and smooths the transition.

Key Features in an Automated Claims Handling Solution

When evaluating automated claims handling solutions, prioritize these features:

- Integration Capabilities: The solution must work seamlessly with your existing policy administration systems and claims software to avoid data silos.

- Scalability: Choose a platform that can grow with your business volume and adapt to new product lines without performance issues.

- User friendly interface: An intuitive interface for both adjusters and policyholders accelerates adoption and improves the user experience.

- Security and Compliance: The solution must have robust security protocols and comply with all relevant regulations like GDPR.

- Analytics and Reporting: Real-time dashboards provide insights to identify bottlenecks and optimize processes for data-driven decision-making.

Our hybrid AI solution combines out of the box efficiency with custom QA precision to ensure these features work for your needs.

Ensuring Employee Adoption

The best AI is useless if your team won't use it. Success depends on your people embracing the technology. This is why we believe in augmenting adjusters, not replacing them.

- Involve adjusters early. Include your claims team in planning to tap into their expertise and give them ownership of the outcome.

- Provide role specific training. Show your team how AI will improve their work. Our training emphasizes that the technology is designed with adjusters in mind to handle tedious tasks.

- Highlight employee benefits. Show adjusters how automation frees them from repetitive work to focus on complex problem solving and meaningful customer interactions.

- Create AI champions. Empower early adopters to become internal advocates who can share success stories and mentor colleagues.

By embracing AI agents as digital coworkers, you are shaping the future of work in P&C insurance.

Automation in Action: Real World Results and Use Cases

The proof of automated claims handling is in the remarkable results achieved by P&C insurers, TPAs, and IA firms. These are tangible improvements in efficiency, cost savings, and customer satisfaction across auto, property, workers' compensation, and pet insurance. For instance, Odie Pet Insurance recently implemented Agentic to automate claims tasking, showcasing AI's versatility.

Success Stories from Leading P&C Insurers

Consider these compelling examples:

- Dramatic Speed Increases: Major P&C carrier Trygg Hansa processed claims 95% faster with an AI solution. Another insurer, Select Health, reduced its claim processing time from 60 days to just 3 days.

- Improved Customer Experience: A Japanese P&C insurer saw a 20% reduction in call center volume after deploying a digital claims intake system. Faster processing and transparency have led some insurers to report double digit increases in Net Promoter Score (NPS), often by 10–15 points.

- Operational Efficiency: The complex worker's compensation claims process is now being done by bots in half the time, with an 80% reduction in audits and 100% accuracy.

Quantifiable Impact on KPIs

The impact of automated claims handling is measurable across key performance indicators:

- Reduction in Cycle Time: Reductions from weeks to days or even minutes are common.

- Increase in Straight Through Processing (STP) Rate: Some insurers have achieved as high as 99% STP for certain claim types, a massive jump from the traditional 7%.

- Lowered Operational Costs: Insurers can expect operational cost reductions of up to 30% with claims automation.

- Reduction in Claims Leakage: One European insurer reduced claims leakage by 10–15% through automated claims validation, ensuring accurate payouts.

Frequently Asked Questions about Claims Automation

How does automation impact the role of a human claims adjuster?

Automated claims handling is not about replacing adjusters; it is about augmenting them. AI agents handle the repetitive, low value tasks like data entry and initial document review. This frees adjusters to focus on work that requires human expertise: complex cases, delicate negotiations, and situations where empathy and experience are critical.

We see AI as a digital coworker, a virtual AI assistant that handles the administrative work so your adjusters can be more strategic and customer focused. The result is higher job satisfaction and better outcomes.

What types of P&C claims are best suited for automation?

The ideal candidates for automated claims handling are high frequency, low to medium complexity claims that follow predictable patterns. These are your best starting points for achieving high Straight Through Processing (STP) rates and demonstrating a clear return on investment.

Examples include:

- Minor auto damage: Windshield repairs, small fender benders, or hail damage claims can often be assessed through photos and processed quickly.

- Simple property claims: A minor water leak or a routine storm damage claim where the assessment is straightforward.

- Pet insurance: Processing routine veterinary bills for common ailments involves clear documentation and predictable workflows.

- Non-complex workers' compensation claims: Cases that follow standardized processes also benefit tremendously from automation.

How can we ensure AI decisions are fair and compliant?

Fairness and compliance are fundamental to responsible AI use in P&C insurance. We address this through a multi layered approach:

- Explainable AI (XAI): We use transparent models that can articulate how a decision was reached. This is essential for audits, regulatory compliance, and building trust.

- Human Oversight: A human adjuster always has the final say on complex claims, borderline cases, or potential denials. The AI provides recommendations, but experienced adjusters make the critical decisions.

- Bias and Fairness Audits: We conduct regular audits to detect and eliminate bias, ensuring decisions are fair across all policyholder demographics.

- Built-in Compliance: Our solutions are designed to adhere to industry standards and data privacy laws, helping you balance innovation with regulation. This gives you the benefits of AI without the compliance headaches.

Conclusion: The Future is Efficient, The Future is Automated

Automated claims handling is no longer an innovation but a strategic imperative for P&C insurance carriers, TPAs, and IA firms. As we have explored, automation delivers faster processing, significant cost reductions, improved accuracy, and a superior customer experience that builds loyalty.

This is not about replacing the human element. The evolution from generative AI to agentic AI creates a new reality where technology and human expertise work in partnership. AI handles the repetitive tasks, while your adjusters manage complex negotiations and customer relationships. Together, they achieve more than either could alone.

Future trends point toward AI becoming even more autonomous and integrated into claims operations. The carriers, TPAs, and IA firms that adopt it now will gain a significant competitive advantage.

At Agentech, our mission is to create AI agents that integrate seamlessly into your existing workflows, augmenting your claims teams without replacing them. Our tools are designed with adjusters in mind to make their jobs easier and more rewarding.

Whether you process auto, property, workers' compensation, or pet insurance claims, our AI solutions can help you achieve the efficiency needed to thrive. We invite you to explore our AI agents and find how we can transform your claims operations.

The future of P&C insurance is efficient. The future is automated. And the future is now.

Citations: Source 1: Accenture, "Poor Claims Experiences Could Put Up to $170B of Global Insurance Premiums at Risk by 2027" Source 2: Agentech, "The Future of P&C Insurance: How AI is Changing the Game" Source 3: Agentech, "AI Claims Processing System" Source 4: Agentech, "We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile" Source 5: Agentech, "Insurance Back Office Automation" Source 6: Agentech, "Solving the Insurance Labor Crisis with AI-Driven Innovation" Source 7: Insurance Information Institute, "Insurance Fraud Stats" Source 8: Agentech, "Insurance Claims Machine Learning" Source 9: Agentech, "Breaking Through the Data Plateau: A Strategic Opportunity" Source 10: Agentech, "Agentic AI Definition" Source 11: Agentech, "Agentic AI in P&C Insurance: When Bots Become Your Best Agents" Source 12: Agentech, "Designing for the Future: How AI Transforms the Claims Experience" Source 13: Agentech, "P&C Insurance IT Systems" Source 14: Agentech, "Buy vs. Build: Navigating the SaaS AI Technology Decision" Source 15: Agentech, "Not Sure Where to Start with AI?" Source 16: Agentech, "A Hybrid AI Solution for Claims Automation: How Agentic combines out-of-the-box efficiency with custom QA precision" Source 17: Agentech, "AI Designed With Adjusters In Mind" Source 18: Agentech, "The Future of Work in P&C Insurance: Embracing AI Agents as Digital Coworkers" Source 19: Agentech, "Odie Pet Insurance Implements Agentic to Automate Claims Tasking" Source 20: Decerto, "Streamlining Insurance Claims Processes with AI and Machine Learning" Source 21: Agentech, "Virtual AI Assistants for P&C Insurance: Meet Your New Best Friend" Source 22: Agentech, "AI in P&C Insurance: Balancing Innovation and Regulation" Source 23: Agentech, "Changing P&C Insurance Claims: The Evolution from Generative AI to Agentic AI" Source 24: Agentech, "Explore our AI Agents"