Why Automate? The Transformative Benefits of P&C Insurance Automation Tools

In the modern P&C insurance world, insurance automation tools are a necessity for carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) Firms. These solutions streamline operations, cut costs, and improve results.

Here is how they can transform your P&C insurance business:

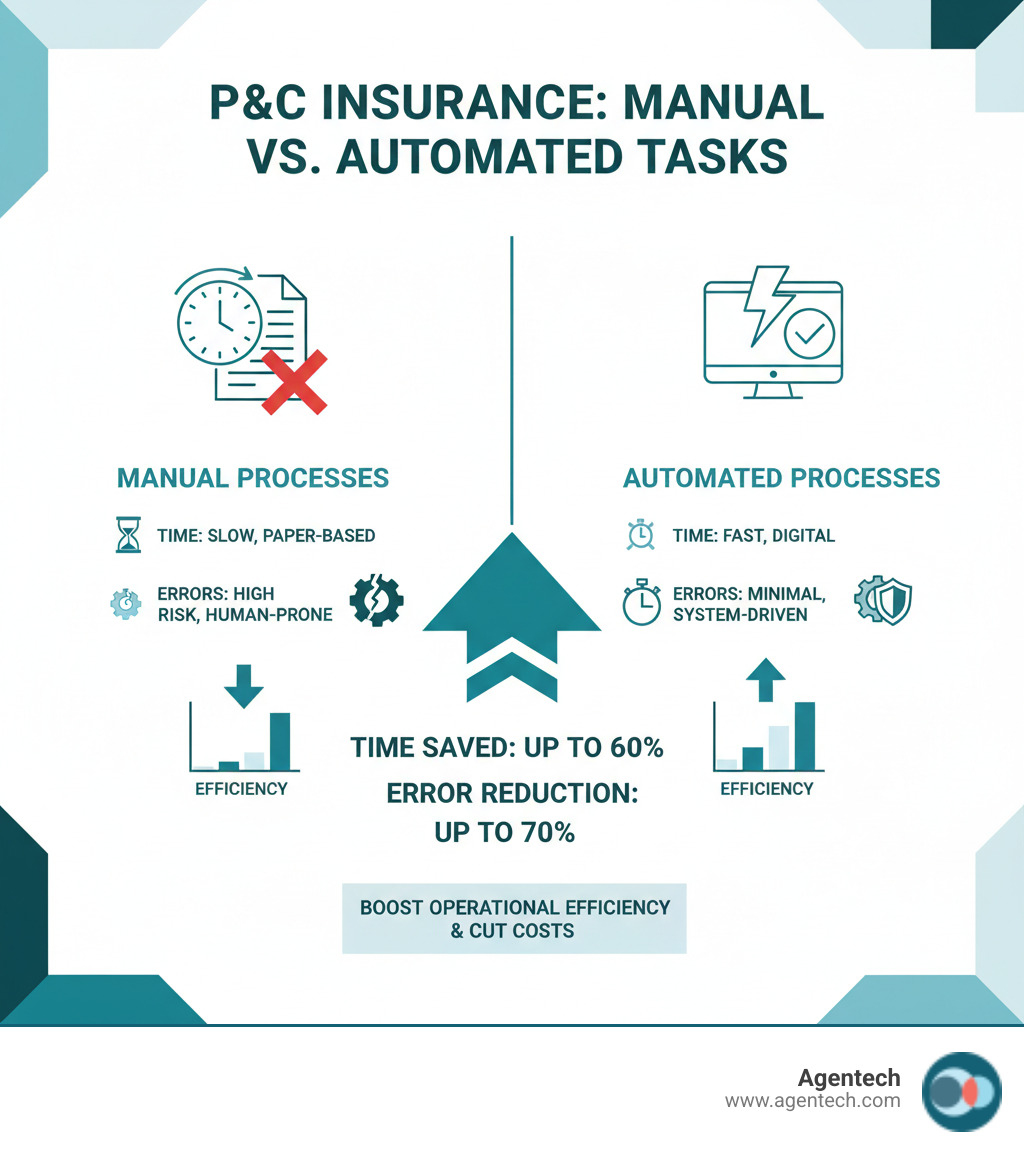

- Boost Operational Efficiency: Automation accelerates tasks like data entry and document processing. This provides faster access to vital information for underwriting, claims, and policy administration.

- Reduce Costs: Companies can cut operational expenses by up to 60% in core areas. With AI, claims processing costs can be reduced by a remarkable 70% as manual tasks are minimized.

- Improve Customer Experience: Policyholders receive quicker responses for quotes and faster claims settlements, leading to higher satisfaction and retention.

- Gain a Competitive Edge: Automation allows smaller agencies to compete effectively with larger players. A study found that 88% of small and medium sized businesses believe automation helps them compete better.

- Lower Errors & Omissions (E&O) Risk: Automated systems reduce manual mistakes, which helps ensure compliance and protects against costly errors.

P&C insurance companies face constant pressure to deliver excellent customer service while staying profitable. Automation offers a strategic way to meet these demands, empowering adjusters and improving the customer journey from start to finish.

Boost Operational Efficiency and Cut Costs

Saving time and money is crucial for P&C insurance carriers, TPAs, and IA Firms. Insurance automation tools deliver measurable benefits that directly impact your bottom line. Imagine achieving operational cost savings of up to 60% in underwriting and claims, or a 70% reduction in claims processing costs through artificial intelligence (AI). These savings free up resources for innovation and growth.

Automation can slash manual document processing time by up to 95%, saving teams 15 to 20 hours each week. Early adopters report reclaiming 8 to 12 hours per Customer Service Representative (CSR) weekly, allowing them to focus on higher value activities like client service. This shift is vital for Solving the Insurance Labor Crisis with AI-Driven Innovation by ensuring your skilled workforce focuses on what matters most.

Improve the Customer and Adjuster Experience

Happy customers and empowered adjusters are at the heart of a successful P&C insurance operation. For policyholders, automation means a smoother journey with quicker quotes and faster claims resolution. This improved engagement can lead to a 16% increase in revenue opportunities and higher policyholder retention.

For adjusters and agents, automation reduces burnout by handling repetitive administrative tasks. This frees them to focus on advising clients and solving complex cases that require human judgment. Our AI Designed With Adjusters In Mind ensures technology works for them. Teams have reported saving 3.2 hours per teammate per week, allowing them to engage in more meaningful work while self service options empower customers.

7 Key P&C Insurance Workflows to Automate

Now that we have explored the benefits, let us dive into the specifics. The beauty of insurance automation tools is their ability to streamline many different parts of your P&C insurance operation, whether you handle residential property claims, auto policies, or workers' compensation cases.

Many core processes at P&C insurance carriers, TPAs, and IA Firms involve repetitive tasks that are prime candidates for automation. By strategically implementing the right tools, you can transform how your team works.

Understanding which high volume and repetitive workflows to automate first is crucial for delivering the biggest impact. We are going to walk through seven critical P&C insurance workflows where automation makes a real difference. Understanding these is essential for leveraging InsureTech Made Easy: Understanding Insurance Software Systems to their full potential. Let us explore where these tools can make the biggest difference.

1. Customer Onboarding and Policy Administration

The customer onboarding experience sets the tone for the entire relationship. A process involving endless paperwork and repetitive data entry creates strain for both policyholders and your team. This is where insurance automation tools truly shine.

Imagine a workflow where digital forms automatically populate your core systems and seamless system integration eliminates duplicate data entry. This is the reality of automation. Automated data extraction and validation can reduce manual keying mistakes by up to 85 percent, a massive improvement that keeps your operations ready for an audit.

When we implement Insurance Back Office Automation, we transform policy issuance from a bottleneck into a competitive advantage. New policyholders get coverage faster, and your team spends less time on repetitive tasks. By standardizing the intake process, we create a consistent, efficient experience for every customer.

2. Policy Underwriting and Risk Assessment

Underwriting is where P&C insurance carriers assess risk and determine pricing, but the process is often bogged down by manual document handling. Insurance automation tools transform this critical function.

Systems powered by AI can automatically ingest submission data, verify documents, and trigger follow ups for missing information. This lets your underwriting team focus on assessing risk instead of chasing paperwork. For dense documents like loss runs, optical character recognition (OCR) technology digitizes and extracts relevant data points quickly.

By implementing a standardized risk assessment model, automation ensures consistency and improves portfolio quality. This leads to a much faster time to quote, a huge competitive advantage. Some carriers have reported reducing underwriting submission setup times by 80%. With this efficiency, carriers have seen an average growth of 111% in annual premiums when leveraging AI.

Automation does not replace skilled underwriters. It handles the repetitive tasks, freeing your team to focus on the nuanced risk evaluation that requires human expertise.

3. Claims Processing with P&C Insurance Automation Tools

Claims processing is where insurance automation tools deliver some of the most significant results in P&C insurance. This is the moment that matters most to policyholders and where adjusters spend the bulk of their time.

The First Notice of Loss (FNOL) intake can be overwhelming. AI Agents can achieve 99% straight through FNOL processing, handling initial requests automatically and giving policyholders an immediate response. This speed dramatically reduces manual effort.

Once a claim is opened, claims packets arrive with reports, estimates, and photos. Automated document indexing solves this. AI can categorize over 50 different types of claims documents with 98% accuracy in document classification, organizing everything so adjusters can find what they need instantly. We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile, freeing adjusters to evaluate the claim itself.

Claims triage becomes effortless as automation routes claims to the right adjuster based on complexity and workload. Fraud detection powered by AI can also spot patterns that might slip past human review, protecting your organization.

Modern AI Claims Processing Insurance handles the administrative burden, allowing your adjusters to bring their expertise and empathy to the human side of claims. When integrated into claims management software, these tools create a system that is fast, accurate, and fair.

4. Document Management and Storage

P&C insurance creates a staggering amount of paperwork. Without proper management, this information becomes a liability. Insurance automation tools transform this chaos into an organized, accessible system.

Think of a centralized repository as a smart digital filing cabinet. Instead of manual sorting, automated file sorting takes over, using intelligent classification to place every policy form and claims photo exactly where it belongs.

The real magic happens when we Organize files with metadata and tagging. This creates searchable archives where finding a specific document takes seconds, not hours, cutting down the time your team spends hunting for information.

Secure cloud storage with SOC 2 compliance ensures sensitive policyholder data stays protected. Authorized team members can access what they need from anywhere, while unauthorized users stay locked out. Automation also identifies and eliminates duplicate documents, cleaning up your archives and preventing confusion.

AI Agents can reduce document classification times by over 90%. These systems work 24/7, ensuring your documents are always organized, secure, and ready when you need them.

5. Regulatory Compliance and Auditing

The P&C insurance industry operates within a complex web of regulations. Failure to comply can result in hefty fines and reputational damage. Insurance automation tools are your best friend in navigating this landscape.

Regulations like ISO 27001 security standards and GDPR or CCPA privacy requirements are extensive and evolving. Automated compliance checks can be built directly into your workflows, ensuring every step adheres to the latest rules. This reduces the risk of human error and ensures consistency.

One of the most valuable features is the creation of clear audit trails. These provide a timestamped record of all actions and decisions. When regulators or internal auditors call, you have comprehensive, organized records at your fingertips, keeping you audit ready at all times.

Robust automation platforms come with built in data security, including encryption and role based access controls. Our approach to AI in Insurance: Balancing Innovation and Regulation emphasizes integrating technology responsibly. Automation turns compliance from a reactive burden into a proactive advantage, allowing you to focus on serving customers with peace of mind.

6. Renewal Processing and Client Retention

Renewals are the heartbeat of a successful P&C insurance operation, yet the process often feels like a scramble at the last minute. Insurance automation tools can turn renewals into a proactive strategy that boosts client retention.

Automation brings intelligence to renewals through renewal analytics, helping identify policies at risk of lapsing and opportunities for expanding coverage. Automated notifications prompt timely outreach, while client segmentation allows for custom communication based on policy type or risk profile.

Proactive risk identification is where automation truly shines, flagging changes in a policyholder's situation that might affect their coverage needs. Addressing these changes proactively strengthens the relationship and ensures they have the right coverage.

Agencies leveraging renewal analytics typically cut their remarketing prep time by 50%. Even better, they often see a 4 point lift in retained premium. This approach aligns with The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers, where your team builds relationships while automation handles the mechanics.

7. Reporting and Analytics

In P&C insurance, data is everywhere, but it is useless without clear, actionable insights. Insurance automation tools transform mountains of data into intelligence that drives your business forward.

Imagine customized dashboards showing Key Performance Indicators (KPIs) like claims frequency, loss ratios, and underwriting profitability in real time. No more waiting days for reports. Instead, you get immediate insights into your P&C insurance operations.

When we Utilize predictive analytics, we can forecast future trends and anticipate emerging risks, allowing us to adjust strategies proactively. Claims leakage analysis becomes far more precise, helping pinpoint where you might be overpaying or missing subrogation opportunities.

Automation handles the heavy lifting of data collection and analysis. This frees your team to interpret insights, ask the right questions, and develop strategies that move the business forward. For P&C insurance carriers, TPAs, and IA Firms, this capability transforms operations, making you more agile and responsive.

How to Successfully Implement Automation Solutions

Bringing insurance automation tools into your P&C insurance operation is a thoughtful journey that requires planning and a commitment to change. A carefully planned implementation strategy ensures your investment delivers real, measurable results.

If you are Not Sure Where to Start with AI?, you are not alone. The key is taking the first step with confidence.

Key Considerations for Adopting P&C Insurance Automation Tools

Before you begin, consider what really matters for a smooth rollout.

- Start with a pilot project. Pick one workflow, like FNOL intake, to prove the value and build internal champions before expanding.

- Choose scalable solutions. Your technology should grow with your business, adapting to new lines of business and evolving customer expectations.

- Prioritize security and data privacy. Look for solutions with SOC 2 compliance, robust encryption, and clear data governance policies.

- Ensure seamless integration with core systems. Your automation solution must work harmoniously with your existing claims software and policy administration systems. A Hybrid AI Solution for Claims Automation is designed with this in mind.

- Accept the "human in the loop" philosophy. Automation is here to support your talented team, not replace them. The best systems keep humans involved in critical decisions and quality checks.

Overcoming Challenges and Mitigating Risks

Implementing new technology will have bumps. Anticipating these challenges is the secret to success.

- Data migration requires careful planning. Clean your data beforehand and consider migrating in phases.

- Employee resistance is natural. Combat this with transparent communication and comprehensive training, showing your team how automation will make their jobs more meaningful.

- Integration complexity can be a surprise. Work closely with a vendor who understands your tech stack and provides clear APIs.

- Cost justification requires tracking metrics from the start. Document your baseline costs and processing times to demonstrate a clear ROI.

- Choosing the right vendor is your most important decision. Find a partner with deep P&C insurance expertise. The Best AI Doesn't Feel Like AI. It's Invisible. because it integrates naturally into your daily workflows.

Frequently Asked Questions about P&C Insurance Automation

Change can feel daunting, especially when it involves new technology. Let us address some of the most common concerns about P&C insurance automation.

Will AI replace P&C insurance adjusters and agents?

No, AI will not replace P&C insurance adjusters and agents. Think of AI as your incredibly capable assistant, not your replacement. AI excels at handling repetitive administrative work like data entry and document sorting. This frees you to focus on high value tasks where your expertise shines: advising clients, solving complex cases, and making nuanced decisions that require empathy and critical thinking. As we explore in Agentic AI in Insurance: When Bots Become Your Best Agents, AI is your digital coworker. Human judgment remains critical.

What is an example of AI in P&C insurance claims?

Imagine a policyholder files a claim after a car accident. The moment the First Notice of Loss (FNOL) arrives, an AI powered system begins automated intake, classifying the claim and extracting critical details. If the policyholder uploads photos, AI can perform an initial damage assessment. As documents like police reports and estimates flow in, AI handles classification for the claims packet with remarkable accuracy. This end to end automation is what we mean by an AI Claims Processing System. It gives the adjuster a massive head start.

How does automation help with regulatory compliance?

Automation makes navigating P&C insurance regulations significantly more manageable. It creates clear audit trails, where every action in a workflow is logged and timestamped. This provides an indisputable record for auditors. Insurance automation tools also perform automated compliance checks at every stage, ensuring adherence to the latest regulations and reducing the risk of costly human error. This standardization is vital for regulatory reporting and data privacy laws, as we explore in AI in Insurance: Balancing Innovation and Regulation.

The Future is Automated: Transform Your P&C Operations Today

The P&C insurance industry is at an exciting turning point. The shift toward automation is happening now, and the organizations that accept insurance automation tools today will lead tomorrow's market.

What does this future look like? It is a world where your team works alongside intelligent digital assistants that handle tedious tasks, as described in Agentic AI in Insurance: When Bots Become Your Best Agents. This is the promise of The Future of Insurance: How AI is Changing the Game.

For P&C carriers, TPAs, and IA Firms, this means faster underwriting, more accurate risk assessment, and dramatically reduced operational costs. The beauty of modern insurance automation tools is that they do not require you to rip out your existing systems. Agentech solutions integrate seamlessly into your current workflows, acting as invisible helpers that boost productivity.

This is not about replacing your talented adjusters and agents. It is about giving them superpowers. It is about freeing them from the administrative burden that has weighed down the industry for too long. The results speak for themselves: happier employees, more satisfied policyholders, and a healthier bottom line.

The future is not waiting. The question is not whether to automate, but how quickly you can start. We invite you to take that first step with us and see the results for yourself.

Transform your P&C operations today and step confidently into the automated future.

Get started with AI Agents!

Citations:

- Solving the Insurance Labor Crisis with AI-Driven Innovation

- AI Designed With Adjusters In Mind

- InsureTech Made Easy: Understanding Insurance Software Systems

- Insurance Back Office Automation

- We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile

- AI Claims Processing Insurance

- Organize files with metadata

- AI in Insurance: Balancing Innovation and Regulation

- The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers

- Utilize predictive analytics

- Not Sure Where to Start with AI?

- A Hybrid AI Solution for Claims Automation: How Agentech Combines Out-of-the-Box Efficiency with Custom QA Precision

- The Best AI Doesn't Feel Like AI. It's Invisible.

- Agentic AI in Insurance: When Bots Become Your Best Agents

- AI Claims Processing System

- The Future of Insurance: How AI is Changing the Game

- The AI Agent Platform Built Only for Insurance

- AI Agents