Why Digital Claims Processing Matters for Your Bottom Line and Your Customers

Digital claims processing transforms how P&C insurance carriers, TPAs, and Independent Adjusting firms handle claims by replacing manual, paper-based workflows with automated, technology-driven systems. Here's what you need to know:

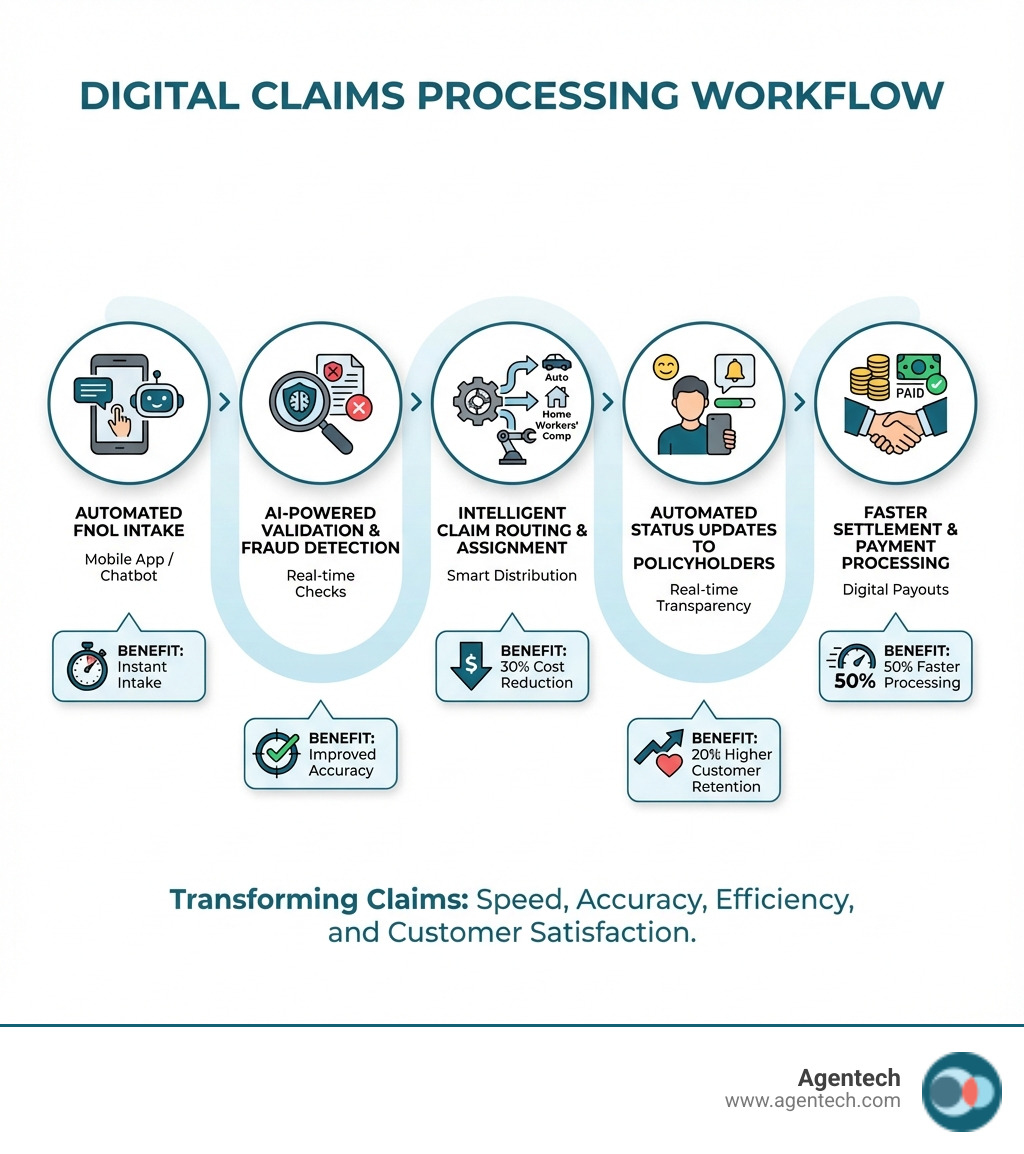

Core Components of Digital Claims Processing:

- Automated data intake through mobile apps, web portals, and chatbots

- AI-powered validation that checks information in real time

- Straight-through processing for simple claims in residential property, auto, pet, and workers' compensation

- Real-time status tracking that keeps policyholders informed at every step

- Digital document management that eliminates paper files and manual routing

Key Benefits at a Glance:

- Speed: Cut processing time by up to 50%

- Cost: Reduce operational expenses by 30%

- Accuracy: Minimize human error through automated validation

- Customer Satisfaction: Boost retention rates by 20% with faster, transparent service

The claims experience is the ultimate moment of truth for policyholders. Research from PwC shows that 32% of customers will leave a company they love after just one bad experience. For P&C insurers, this means a poor claims experience doesn't just frustrate customers. It drives them straight to competitors.

About 70% of all customer churn in insurance stems from a bad claims experience. The stakes are high. Manual processes create delays, errors, and frustration. Digital claims processing solves these problems by streamlining workflows from first notice of loss through final settlement.

I'm Alex Pezold, and I've spent my career building and scaling technology businesses that solve real operational challenges. At Agentech AI, we're revolutionizing Digital claims processing for P&C insurance through AI solutions that augment your existing team, beginning with pet insurance and expanding across residential property, auto, and workers' compensation lines.

The Great Divide: Traditional vs. Digital Claims Processing

For decades, the insurance industry relied on methods that, while familiar, often felt like navigating a labyrinth blindfolded. Imagine stacks of paper, endless phone calls, and the frustrating game of "who has the file now?" This was the reality of traditional claims processing. But today, the landscape is shifting dramatically. We are moving from those slow, opaque, and frustrating methods to a world of fast, transparent, and convenient digital solutions. This section explores what digital claims processing truly means and how it stands apart from its antiquated predecessors.

The Pitfalls of Traditional, Paper-Based Claims

Let us paint a picture. A policyholder experiences a residential property loss, a fender bender, or a pet emergency. They call their P&C insurer, perhaps fill out a form, and then the waiting game begins. This is where the pitfalls of traditional methods become painfully clear. We often saw:

- Manual data entry: Adjusters painstakingly transcribe information from paper forms into various systems, a process ripe for error and incredibly time consuming.

- Endless phone tag: Customers and adjusters spend valuable time chasing updates, leading to frustration and delays.

- Lack of transparency: Policyholders are left in the dark, unsure of their claim's status, breeding anxiety and dissatisfaction.

- High potential for human error: Mistakes in data entry or misplacing physical documents can lead to costly rework and inaccurate settlements.

- Slow resolution times: The sheer volume of manual steps bogs down the entire process, stretching resolution times from days to weeks, or even months for complex cases.

- High administrative costs: The labor intensive nature of traditional processing, coupled with physical storage and paper handling, drives up operational expenses for P&C insurance carriers and TPAs.

Many claims processes are still done on paper or on old, unreliable systems, perpetuating these inefficiencies. This not only frustrates policyholders but also drains valuable resources from our teams.

The Power of a Modern, Digital Claims Processing Experience

Now, envision a different scenario. A policyholder reports a claim via a mobile app, uploads photos and videos of the damage, and receives instant confirmation. This is the power of a modern, digital claims processing experience. It is a change that benefits everyone involved.

- Automated data intake: Claims can be submitted anytime, anywhere, through user friendly online portals or mobile apps, with data automatically flowing into our systems. This eliminates manual entry and speeds up the initial stages significantly.

- Real time status updates: Policyholders receive proactive notifications via text or email at every step of their claim's journey. They are no longer left wondering.

- Self service portals and mobile apps: Customers can track their claims, upload additional documents, and communicate with adjusters at their convenience. In fact, 75% of customers want to track their claims through websites or apps, and 74% say quick claims handling is a top priority.

- AI powered validation: Our systems can instantly verify submitted data for accuracy and completeness, flagging any discrepancies for human review, thus minimizing errors.

- Faster, more accurate settlements: With streamlined workflows and intelligent automation, claims are processed more efficiently, leading to quicker and more precise payouts.

The shift to digital is not just about efficiency. It is about satisfaction. J.D. Power’s 2024 study reports satisfaction with digital claims at an impressive 871 out of 1000 points, up 17 points from the previous year. This shows a clear preference for digital interactions.

| Feature | Traditional Claims Processing | Digital Claims Processing |

|---|---|---|

| Average Cycle Time | Weeks to Months | Days to Weeks |

| Cost Per Claim | High | Significantly Lower |

| Accuracy Rate | Prone to Human Error | High, AI Validated |

| Customer Satisfaction | Often Low | High |

This table vividly illustrates the stark contrast. Digital claims processing is not just an improvement; it is a revolution that delivers tangible benefits to P&C insurance carriers, TPAs, IA firms, and most importantly, our valued policyholders.

Key Drivers and Compelling Benefits of Going Digital

The move to digital is no longer a luxury. It is a strategic necessity for P&C insurance carriers, TPAs, and IA firms. The market demands it, customers expect it, and our bottom line thrives on it. We are seeing a confluence of factors that make this digital shift not just compelling, but absolutely essential for survival and growth.

Why P&C Insurers Can't Afford to Wait

The pressure to modernize our claims operations comes from multiple directions. Ignoring these drivers is akin to navigating without a compass in a rapidly changing ocean.

- Rising customer expectations: Today's policyholders, especially younger generations, are digital natives. They expect the same speed, transparency, and convenience from their P&C insurance provider as they do from any other online service. Waiting weeks for a claim resolution feels archaic. Research shows that 67% of consumers switch carriers due to unpleasant experiences, and 88% of customers are more likely to stay with insurers that offer fast, digital claims experiences. We must meet these heightened expectations or risk losing our customer base.

- Intense cost pressures and the need for operational efficiency: Manual claims processing wastes billions annually. Automating healthcare claims alone could save U.S. insurers over $11 billion each year, and we anticipate similar vast savings in the P&C sector. The demand for lean operations and optimal resource allocation means we must leverage technology to cut unnecessary costs.

- The competitive threat from agile technology driven entrants: Insurtechs and digital first competitors are setting new benchmarks for efficiency and customer experience. They are not burdened by legacy systems and can innovate at lightning speed. To compete, we must accept the same technological advancements.

- The high cost of inaction: The financial consequences of failing to adapt are staggering. According to a 2024 study by Accenture, poor claims experiences could put up to $170 billion of global insurance premiums at risk by 2027. Nearly every dissatisfied claimant is ready to switch providers. We simply cannot afford to lose that much business due to outdated processes.

The Win-Win: Advantages for Insurers and Policyholders

The beauty of digital claims processing is that it creates a win win situation. What is good for our P&C insurance carriers, TPAs, and IA firms is also profoundly beneficial for our policyholders.

Benefits for P&C insurers:

- Reduced operational costs: McKinsey research shows automation can cut claims processing time by up to 50% and operational costs by 30%. Faster settlements free up capital and reduce administrative overhead, while fewer errors minimize costly rework.

- Improved fraud detection: AI and machine learning are game changers here. An European insurance carrier significantly improved its fraud detection accuracy implementing an AI based fraud detection system, resulting in an 18 percent increase in fraud prevention as well as productivity gains in fraud investigation. This protects our bottom line and keeps premiums fair for honest policyholders.

- Improved adjuster productivity and morale: By automating monotonous, repetitive tasks, our adjusters are freed to focus on complex cases, customer interaction, and strategic decision making. This leads to higher job satisfaction and more efficient claims handling overall. We are actively Solving the Insurance Labor Crisis with AI-Driven Innovation, ensuring our human experts can do their best work.

Benefits for policyholders:

- Faster resolution: This is often the top priority for customers. Digital processes drastically cut down on the time it takes to get a claim settled.

- Greater convenience: Submitting claims and tracking progress from a smartphone or computer fits seamlessly into modern life. No more waiting on hold or mailing documents.

- Transparent process: Regular digital updates keep policyholders informed. Customers who receive regular digital updates are twice as likely to say their claims were resolved faster than expected. This transparency builds immense trust and reduces anxiety during what can be a stressful time.

- Builds trust and loyalty: When customers have a positive claims experience, they are far more likely to remain loyal. Insurers who excel in claims experience enjoy customer retention rates 20% higher than their peers.

The transition to digital claims processing is not merely an upgrade; it is a strategic investment in our future, promising a more efficient, secure, and customer centric P&C insurance operation.

The Technology Powering Modern Digital Claims Processing

The magic behind digital claims processing is not magic at all. It is the clever application of cutting edge technologies that work in concert to transform antiquated workflows into seamless, intelligent processes. Let us dig into the technological backbone enabling this revolution for P&C insurance.

AI and Automation: The Engine of Efficiency

At the heart of modern claims change are Artificial Intelligence and automation. These are not futuristic concepts; they are here now, driving tangible benefits for P&C insurance carriers, TPAs, and IA firms.

- Robotic Process Automation (RPA): This technology is a workhorse for repetitive tasks. RPA bots can mimic human actions to handle high volume, rule based processes like data entry, extracting information from structured documents, and initiating claim setups. This frees our human adjusters from mundane, monotonous work, allowing them to focus on tasks that truly require human judgment and empathy.

- Automated First Notice of Loss (FNOL): The FNOL is the initial reporting of a claim, and automation here is a game changer. Through chatbots and mobile apps, policyholders can quickly and easily submit their claim details, upload photos, and even provide geolocated information. A Japan based P&C insurer saw a 20% reduction in call center volume and 30% fewer follow up calls after implementing digital FNOL. Digital case tracking tools can reduce status request calls by more than 50%. This dramatically speeds up the crucial first step of the claims journey.

- Straight Through Processing (STP): For simple, low risk claims in areas like residential property, auto, pet, and workers' compensation, STP allows claims to be processed from FNOL to settlement with minimal or no human intervention. Our AI Claims Processing System can intelligently task and route claims, identifying those suitable for STP and ensuring swift resolution. This is where we see significant gains in speed and cost reduction.

Agentech AI’s solutions are specifically designed to augment your existing team. Our AI assistants boost adjuster productivity by handling the tedious, administrative tasks, enabling your human experts to focus on complex decision making and providing compassionate service.

Data Analytics and Machine Learning for Smarter Decisions

Beyond automation, the intelligent use of data is paramount. Data analytics and machine learning (ML) transform raw information into actionable insights, leading to smarter, more accurate, and fairer claim decisions.

- Predictive analytics: By analyzing historical data, our systems can predict the potential complexity and severity of a claim early in the process. This allows P&C insurers to allocate resources more effectively, proactively engage with policyholders, and anticipate potential challenges.

- Insurance Claims Machine Learning: ML algorithms are incredibly adept at sifting through vast amounts of data to identify patterns that indicate potential fraud. These are often subtle anomalies that a human might miss. For example, a European insurance carrier significantly improved its fraud detection accuracy implementing an AI based fraud detection system, resulting in an 18 percent increase in fraud prevention. Our Insurance Claims Machine Learning solutions are constantly learning and improving their ability to detect fraudulent activity, protecting our P&C insurance carriers from significant financial losses.

- The importance of analyzing claims data regularly: Continuous improvement is not a buzzword; it is a necessity. By analyzing claims data regularly and completely, we refine our understanding of consumer behavior, identify weaknesses in our processes, and continually improve for our customers. This data driven approach also significantly improves fraud detection capabilities and improves overall risk management.

These technologies are not just tools; they are integral partners in building a responsive, efficient, and resilient digital claims processing ecosystem for P&C insurance.

Your Roadmap to a Successful Digital Change

Starting on a digital change journey for claims processing can feel like a daunting task. It is not simply about plugging in new software. It is about rethinking processes, managing expectations, and ensuring that technology serves both our business goals and our customers' needs. We understand the complexities involved, and we are here to guide P&C insurance carriers, TPAs, and IA firms through this transition.

Overcoming Problems in Your Digital Claims Processing Transition

The path to digital claims is not without its bumps. However, with careful planning and the right partners, these challenges are entirely surmountable.

- Integrating new platforms with legacy P&C Insurance IT Systems: Many P&C insurers operate with established, often complex, legacy IT systems. Introducing new digital solutions must be done thoughtfully to ensure seamless integration. This can be a significant hurdle, requiring careful planning, API led integration, and often a phased migration approach. We understand the intricacies of P&C Insurance IT Systems and design our solutions for compatibility.

- Ensuring robust data security and regulatory compliance: P&C insurance companies handle highly sensitive personal and financial data. As we move more processes online, data security and privacy become paramount. We must implement stringent encryption, role based access controls, and ensure compliance with evolving data protection regulations. The risk of cyber threats and data breaches is real, and proactive measures are non negotiable.

- Managing organizational change and securing employee buy in: The human element is crucial. Employees may be resistant to new technologies, fearing job displacement or struggling with new workflows. Effective change management strategies, including comprehensive training, clear communication about the benefits, and leadership support, are essential to secure buy in from our teams. It is not about replacing people; it is about empowering them.

- The strategic choice of Buy vs. Build: Navigating the SaaS AI Technology Decision: P&C insurers often face a critical decision: should we build our own digital claims solution in house, or should we buy a specialized SaaS (Software as a Service) offering? Building requires significant upfront investment, specialized talent, and ongoing maintenance. Buying a proven SaaS solution, like ours, can offer faster implementation, lower total cost of ownership, and access to cutting edge technology without the development burden. Our insights on Buy vs. Build: Navigating the SaaS AI Technology Decision can help you make an informed choice.

Building a Customer-Centric Journey

At the core of any successful digital claims processing strategy must be the customer. After all, the claims experience is the primary driver of customer loyalty and retention.

- Designing a seamless and intuitive user experience (UX) for all digital touchpoints: Whether it is a mobile app for FNOL, a web portal for tracking, or a chatbot for queries, every digital interaction must be easy to use, clear, and efficient. A frustrating digital experience is just as damaging as a slow manual one.

- Balancing automation with an accessible human touch for complex or sensitive claims: While automation drives efficiency, we must never lose sight of the human element. For complex claims, or situations requiring empathy and nuanced understanding, a human adjuster remains indispensable. The goal is to automate the mundane, freeing our adjusters to provide exceptional service where it matters most.

- Using digital communication to build trust and improve customer loyalty: Proactive, clear, and personalized digital communication keeps policyholders informed and feeling valued. Regular updates, transparent explanations, and easy access to information build trust during a stressful time, turning a potentially negative experience into an opportunity to strengthen the customer relationship. Our focus on Designing for the Future: How AI Transforms the Claims Experience ensures that every digital interaction contributes positively to the customer journey.

By addressing these challenges head on and prioritizing a customer centric approach, P&C insurance carriers, TPAs, and IA firms can successfully steer the transition to robust digital claims processing.

The Future of Claims: What's Next for Digital Innovation?

The world of digital claims processing is not static. It is a dynamic, evolving landscape, constantly reshaped by new technological advancements and changing customer expectations. For P&C insurance carriers, TPAs, and IA firms, staying ahead means not just adopting current digital solutions but also understanding the emerging trends that will define the claims experience of tomorrow.

One of the most exciting developments is the rise of hyper automation and Agentic AI. This is where AI moves beyond simply automating tasks to autonomously resolving more complex claim scenarios. Imagine an AI system that can not only process an FNOL but also, based on its intelligent assessment, initiate necessary repairs, communicate with all parties, and even approve payments, all with minimal human oversight. Our work in Agentic AI in P&C Insurance: When Bots Become Your Best Agents is at the forefront of this change, creating digital coworkers that are both efficient and smart.

The impact of IoT (Internet of Things), telematics, and drone data is also set to revolutionize claims. Connected devices, from smart home sensors to vehicle telematics, can provide real time data about incidents. This allows for proactive claims prevention and incredibly accurate, real time damage assessment. For instance, telematics data from a connected car can provide precise information about an accident, speeding up liability assessment and repair estimates. Drones can quickly survey large areas of residential property damage after a storm, providing vital information faster and safer than human adjusters. The mobility sector alone is expected to drive an eightfold premium growth in the next five years, largely due to the rise of ACES (autonomous, connected, electric, and shared) vehicles, which will fundamentally alter the nature of auto claims.

Emerging Trends to Watch:

- Agentic AI for autonomous task resolution: These intelligent agents will take on more decision making authority, handling a broader range of claims with increased autonomy, freeing up human adjusters for truly complex or sensitive cases.

- IoT for real time incident data: Sensors and connected devices will provide instant, verifiable data about incidents, enabling faster FNOL, more accurate damage assessment, and even proactive interventions to prevent claims.

- Proactive claims prevention through advanced analytics: Leveraging vast datasets and predictive models, P&C insurers will move beyond reactive claims handling to actively identify and mitigate risks before they lead to a claim. For example, using weather data to alert residential property policyholders about impending risks.

The evolution of claims resolution will continue to see trends that we’ve seen grow and will continue to be of importance. We are not just adapting to the future; we are actively shaping it, ensuring that digital claims processing remains at the forefront of P&C insurance innovation.

Conclusion: Accept the Digital Edge

The message is clear. For P&C insurance carriers, TPAs, and IA firms, embracing digital claims processing is no longer a choice but a strategic imperative to remain competitive and relevant in an increasingly digital world. The benefits are too compelling to ignore: improved efficiency, significant cost savings, and a superior customer experience that fosters loyalty and retention.

We have explored how digital solutions transform every stage of the claims journey, from automated FNOL to AI powered fraud detection, all while prioritizing transparency and speed for the policyholder. We have also addressed the challenges inherent in this transition, emphasizing the importance of thoughtful integration, robust security, and a customer centric approach that balances automation with the invaluable human touch.

At Agentech AI, we are committed to providing cutting edge AI powered solutions specifically designed for the P&C insurance industry. Our technology is built to augment your existing team, automating tedious tasks so your adjusters can focus on what matters most: providing exceptional service and expertly handling complex claims. We believe in empowering your people, not replacing them.

Ready to revolutionize your claims operations and secure your digital edge? Find how our AI Agents can empower your team and delight your customers.

Citations:

- PwC. (n.d.). Experience is everything: Here’s how to get it right. Retrieved from https://www.pwc.com/us/en/services/consulting/library/consumer-intelligence-series/future-of-customer-experience.html

- J.D. Power. (2024). 2024 U.S. Claims Digital Experience Study. Retrieved from https://www.jdpower.com/business/press-releases/2024-us-claims-digital-experience-study

- Accenture. (2022). Poor Claims Experiences Could Put Up to $170B of Global Insurance Premiums at Risk by 2027, According to New Accenture Research. Retrieved from https://newsroom.accenture.com/news/2022/poor-claims-experiences-could-put-up-to-170b-of-global-insurance-premiums-at-risk-by-2027-according-to-new-accenture-research

- McKinsey & Company. (n.d.). Automation at scale: The benefits for payers. Retrieved from https://www.mckinsey.com/~/media/McKinsey/Industries/Healthcare%20Systems%20and%20Services/Our%20Insights/Automation%20at%20scale%20The%20benefits%20for%20payers/Automation-at-scale-The-benefits-for-payers.pdf

- EY. (n.d.). Claims in a digital era. Retrieved from https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/insurance/insurance-pdfs/EY-claims-in-a-digital-era.pdf

- Wenalyze. (n.d.). The evolution of claims resolution in the insurance sector. Retrieved from https://www.wenalyze.com/the-evolution-of-claims-resolution-in-the-insurance-sector/

- Agentech. (n.d.). Solving the Insurance Labor Crisis with AI-Driven Innovation. Retrieved from https://www.agentech.com/resources/articles/solving-the-insurance-labor-crisis-with-ai-driven-innovation

- Agentech. (n.d.). AI Claims Processing System. Retrieved from https://www.agentech.com/resources/articles/ai-claims-processing-system

- Agentech. (n.d.). Insurance Claims Machine Learning. Retrieved from https://www.agentech.com/resources/articles/insurance-claims-machine-learning

- Agentech. (n.d.). P&C Insurance IT Systems. Retrieved from https://www.agentech.com/resources/articles/insurance-it-systems

- Agentech. (n.d.). Buy vs. Build: Navigating the SaaS AI Technology Decision. Retrieved from https://www.agentech.com/resources/articles/buy-vs-build-navigating-the-saas-ai-technology-decision

- Agentech. (n.d.). Designing for the Future: How AI Transforms the Claims Experience. Retrieved from https://www.agentech.com/resources/articles/designing-for-the-future-how-ai-transform-the-claims-experience

- Agentech. (n.d.). Agentic AI in P&C Insurance: When Bots Become Your Best Agents. Retrieved from https://www.agentech.com/resources/articles/agentic-ai-in-insurance-when-bots-become-your-best-agents