Why Content Automation Matters for P&C Insurance Operations

Content automation examples in P&C insurance services are changing how Property & Casualty carriers, Third Party Administrators, and Independent Adjusting firms handle their daily workload. Here are the most impactful applications:

Top Content Automation Examples in P&C Insurance:

- Automated FNOL and Claims Intake: Extract data from emails and forms to create claim files instantly

- Intelligent Document Processing: Analyze medical reports and repair estimates with 95% accuracy

- Automated Policyholder Communications: Send personalized claim updates and renewal reminders

- Dynamic Underwriting Content: Generate risk summaries from aggregated property and loss data

- Compliance and Regulatory Reporting: Monitor changes and create audit trails automatically

- Lead Nurturing and Sales Content: Follow up with prospects within 5 minutes for 9x better conversion

- Fraud Detection Summaries: Flag suspicious patterns and generate investigation reports

- Agent and Broker Management: Calculate commissions and send license expiration alerts

- Proactive Renewal Content: Predict lapses and trigger personalized retention offers

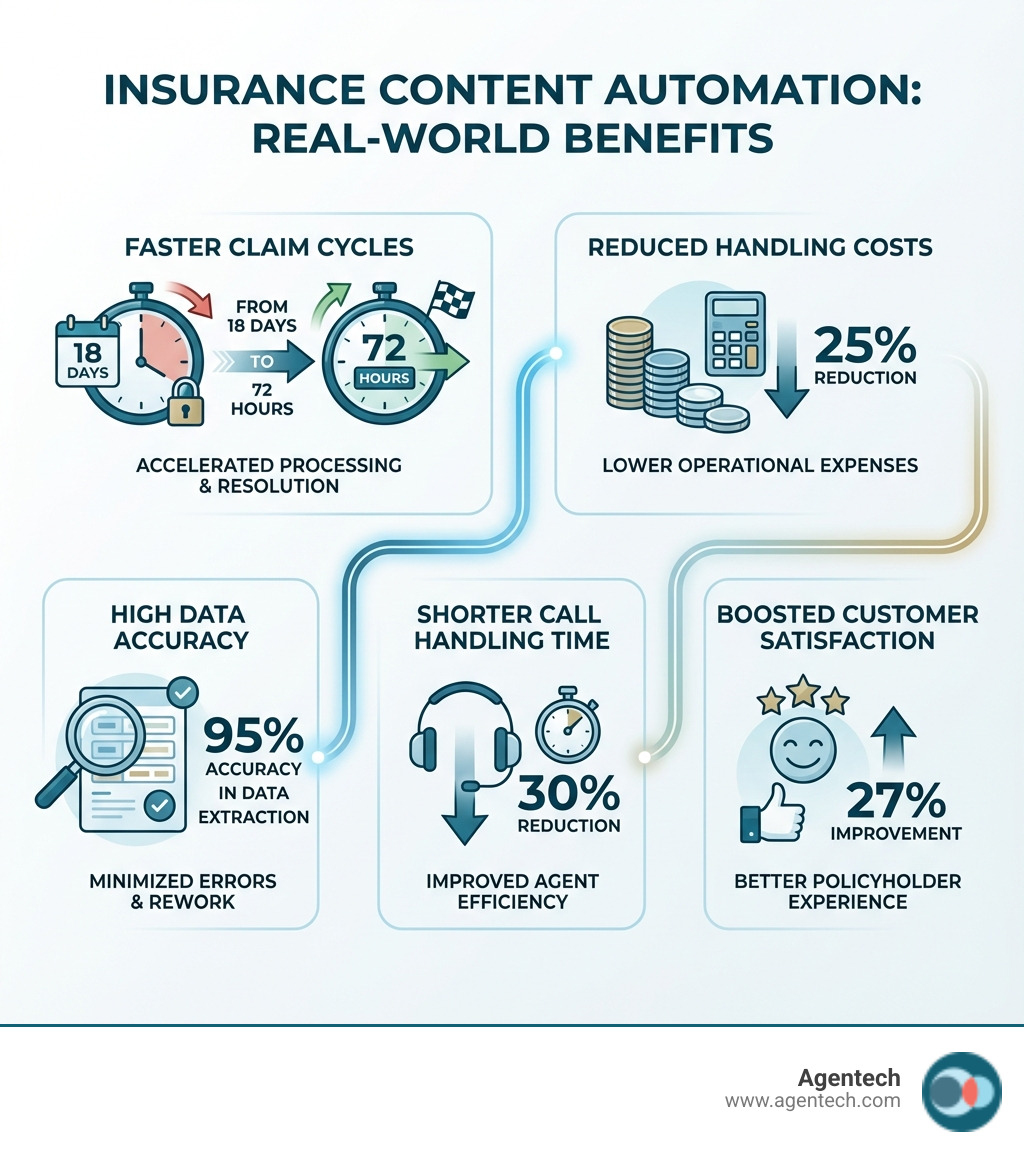

The research is clear. Only 44% of policyholders heard from their agent in the last 18 months. Meanwhile, claims cycles have shortened from 18 days to just 72 hours where automation is deployed. Manual data entry and fragmented communication increase the risk of errors and regulatory breaches, yet automation can reduce claims handling costs by 25%.

For busy claims managers in Property & Casualty insurance, this means less time wrestling with paperwork and more time resolving complex claims. Automation eliminates bottlenecks across underwriting, onboarding, policy servicing, and claims handling. It reduces delays, eliminates redundant information requests, and helps customers and agents get timely answers.

I'm Alex Pezold, and at Agentech AI, we are building the AI workforce for P&C insurance, starting with transformative content automation examples in P&C insurance services that deliver real results for pet insurance and beyond. My past experience has taught me that the right technology, implemented thoughtfully, can revolutionize an entire industry.

What is Content Automation in P&C Insurance?

Imagine a world where your Property & Casualty insurance operations flow as smoothly as a well oiled machine, without a single cog jamming. That is the promise of content automation in the context of P&C insurance services. Simply put, content automation in P&C insurance services involves using technology to streamline the creation, management, distribution, and processing of various forms of content throughout the P&C insurance lifecycle. This includes everything from initial policy applications and claims documents to customer communications and regulatory reports.

For Property & Casualty insurance carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) firms, this means less time spent on repetitive, manual tasks and more time focusing on what truly matters: serving policyholders and growing the business. Workflow automation, at its core, streamlines repetitive tasks and client communications, drastically reducing reliance on manual reminders and checklists. It creates consistency and improves client engagement by ensuring regular, timely contact without extra effort from your team.

The benefits are substantial. We see increased adjuster productivity as our always on AI assistants handle the mundane, freeing up human talent for complex problem solving. Accuracy improves because automated workflows reduce human error and enforce compliance standards consistently. Policyholder communication becomes much easier, with timely updates and personalized interactions. Manual data entry and fragmented communication are notorious for increasing the risk of errors and regulatory breaches. Our approach to content automation directly addresses these pain points by reducing delays, eliminating redundant information requests, and helping customers and agents get timely answers. By integrating and automating data flow across silos, we gain insights in real time for better decision making.

According to McKinsey, the P&C insurance sector is seeing disruptive changes that demand modernization and the adoption of new technologies like AI. This is not just about cutting costs. It is about creating an organization that is more agile, responsive, and centered on the policyholder. Automation eliminates bottlenecks across underwriting, onboarding, policy servicing, and claims handling, making it an indispensable tool for the modern Property & Casualty insurance enterprise.

9 Practical Content Automation Examples in Insurance Services

Now, let us look at some tangible content automation examples in P&C insurance services that are already making a significant impact in the Property & Casualty sector.

1. Automated First Notice of Loss (FNOL) and Claims Intake

One of the first and most critical content automation examples in P&C insurance services is automating the First Notice of Loss (FNOL) and claims intake process. When a policyholder experiences a loss, they need immediate assistance. Our systems can automatically capture and validate claim information from various sources, whether it is an email, a web form, or even a transcription from voice to text. We use Optical Character Recognition (OCR) to extract relevant data points from unstructured documents, such as accident reports or initial statements. This data is then used to automatically create a claim file, integrate with relevant systems to retrieve policy data, and start the necessary workflows for review, assessment, and approval.

This automation significantly reduces manual entry, which is often a bottleneck. Claims cycles can be shortened dramatically. For instance, some Property & Casualty companies have seen claims cycles reduced from 18 days to just 72 hours with automation. This rapid response improves efficiency and sets a positive tone for the policyholder's entire claims experience. In addition, AI applied to policyholder inquiries has led to a 25% drop in repeat queries, as automated systems provide quick, accurate responses. We believe that We Made AI Do the Most Tedious, Time Consuming Task in Claims Processing: Creating the Claim Profile, which frees up adjusters for more critical work.

2. Intelligent Document Processing and Data Extraction

P&C insurance claims, especially in residential property, auto, pet, and workers' compensation, are filled with documents. This includes unstructured data in medical reports, police reports, repair estimates, and many other forms. Manually sifting through these documents consumes a lot of time and is prone to error. This is where Intelligent Document Processing (IDP) is a prime example of content automation in P&C insurance services.

IDP solutions, powered by AI and machine learning, automate document capture, recognition, and classification. They can analyze and extract relevant information from claims forms, policy documents, and correspondence, giving claims adjusters immediate access to the data they need without manual data entry or extensive searches. For example, our AI agents have been known to extract key fields from complex documents with over 95% accuracy. This not only speeds up the process but also reduces loss adjustment expenses by 20 to 30 percent. Imagine the time saved and the accuracy gained when reviewing a stack of medical bills for a workers' compensation claim or detailed repair estimates for a damaged vehicle. This capability is at the heart of AI Claims Processing Insurance.

3. Automated Policyholder Communications

Keeping policyholders informed is essential, especially during a claims process. However, manually sending personalized updates, claim status notifications, renewal reminders, and payment alerts for every policyholder is a massive task. Automated policyholder communications are a strong example of content automation in P&C insurance services that directly affects customer experience.

Our systems can generate personalized messages based on specific events or triggers in the policy or claims lifecycle. For instance, an automated email can be sent when a claim moves from "under review" to "approved," or a text message can remind a policyholder about an upcoming premium payment. This regular, timely contact, without extra effort from your team, creates consistency and improves policyholder engagement. The impact on customer satisfaction is clear. Call handling times have been reduced by 30 percent across multiple centers, and customer satisfaction scores have improved by 27 percent where conversational automation was deployed. This proactive and personalized communication ensures policyholders feel valued and informed, changing the claims experience as we discuss in Designing for the Future: How AI Transforms the Claims Experience.

4. Dynamic Underwriting and Risk Assessment Content

Underwriting is the backbone of P&C insurance and involves complex risk assessment. Dynamic underwriting and risk assessment content automation uses AI to aggregate large amounts of data from diverse sources, including property data, historical loss records, and external data like flood maps or crime statistics. Our systems can then automatically create comprehensive risk summaries and even propose policy terms.

This automation significantly speeds up the underwriting process, leading to faster proposal creation times. It ensures consistent and objective decision making and reduces human subjectivity. For complex policies, the processing time has decreased by almost 40 percent with automation. Imagine an AI agent pulling all necessary data for a commercial property risk assessment in seconds, flagging potential issues, and presenting a concise summary for the underwriter. This is how The Future of Insurance: How AI is Changing the Game is unfolding, arming underwriters with the data they need to be productive and efficient.

5. Automated Compliance and Regulatory Reporting

Compliance is not just a buzzword. It is a critical, complex, and constantly evolving challenge in Property & Casualty insurance. This makes automated compliance and regulatory reporting one of the most vital content automation examples in P&C insurance services. Manual data entry and fragmented communication notoriously increase the risk of errors and regulatory breaches.

Our AI systems can monitor regulatory changes in real time, analyze complex legal documents, and ensure compliance with applicable laws. This is particularly crucial for P&C insurance, where regulations can vary by state and line of business. Automation can generate audit trails, validate data against compliance rules, and create the required reports automatically. This significantly reduces the risk of penalties and improves data governance. The compliance cycle itself has been improved by 60 percent using robotic process automation. With AI, our systems can dynamically adapt to new rules, ensuring that regulatory oversight is not only reactive but also proactive, as explored in AI in Insurance: Balancing Innovation and Regulation.

6. Personalized Lead Nurturing and Sales Content

In the competitive world of P&C insurance, speed and personalization are essential to convert leads into loyal policyholders. Personalized lead nurturing and sales content automation ensures that potential customers receive timely and relevant information, which builds trust and engagement.

The statistics are compelling. You are nine times more likely to convert a web lead if you follow up within 5 minutes. Our automated systems can respond to new leads instantly, send personalized email campaigns, assign tasks to agents, and nurture prospects through their journey. This ensures that no lead is missed and that agents can focus on interactions of high value. Automation has led to a 75 percent increase in process efficiency for simple sales tasks, and conversion rates have lifted by 20 to 25 percent using personalization driven by AI. This means more effective sales efforts and a stronger pipeline.

7. Automated Fraud Detection Summaries

Fraud is a persistent threat in P&C insurance and costs the industry billions each year. Automated fraud detection summaries represent a powerful example of content automation in P&C insurance services that directly affects your bottom line. Our machine learning models can analyze large datasets to identify anomalies and suspicious patterns in claims data that might signal fraudulent activity.

When a potential fraud case is flagged, our systems can automatically create detailed fraud summary reports for investigators, highlighting key red flags and relevant information. This significantly streamlines the investigation process and allows human experts to focus their time where it is most needed. The effectiveness is clear. Fraud probability detection has improved by up to 45 percent with automation. For instance, Allstate Corporation uses an automated claim processing system with fraud detection capabilities to handle data and make assessments. This intelligent application of AI helps protect your business and policyholders, a topic we examine in Insurance Claims Machine Learning.

8. Agent and Broker Onboarding and Management

Managing a network of agents and brokers, especially for Property & Casualty insurance, involves a significant amount of administrative work. Automated agent and broker onboarding and management content streamlines these operations in the back office and makes life easier for everyone.

Our systems can automate commission calculations based on predefined rules, track agent performance metrics, and create performance reports. They can also send automated alerts for approaching agent license expiration dates, which ensures compliance and prevents disruptions. Centralized messaging and collaboration tools support smooth communication. Paperless onboarding alone has lowered operating costs by 28 percent. This automation frees up administrative staff, allowing them to focus on supporting agents and brokers more effectively, improving productivity and strengthening partnerships. We explore this further in Insurance Back Office Automation.

9. Proactive Policy Renewal and Retention Content

Retaining existing policyholders is often more cost effective than acquiring new ones. Proactive policy renewal and retention content automation uses predictive analytics to identify policyholders at risk of lapse and then triggers personalized outreach.

Our systems can deploy lapse prediction capabilities, which have been shown to improve retention by 20 percent. Based on these predictions, personalized renewal offers or alternative policy suggestions can be automatically prepared and sent to policyholders. This ensures that your P&C insurance organization maintains regular, timely contact, even when policyholders are not actively buying coverage. For example, Liberty Mutual automates policy renewal and cancellation through various channels, allowing policyholders to review, renew, or change their policies easily. This approach helps build loyalty and ensures policyholders know you are thinking of them. We discuss how Virtual AI Assistants for Insurance: Meet Your New Best Friend can assist in these efforts.

The Technology Powering Insurance Content Automation

Behind these content automation examples in P&C insurance services are powerful technologies. Let us look at the key players.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is like having a digital workforce that mimics human interactions with software applications. It is particularly effective at handling repetitive tasks that are based on rules. In P&C insurance, RPA bots can automate data migration between separate systems, perform copy and paste functions across applications, and process large volumes of routine transactions. RPA is especially useful for linking legacy claims software that might not have modern APIs and can effectively extend their life.

RPA streamlines everyday business processes that often drain workers' time, energy, and morale. By deploying RPA bots across multiple systems, we can improve accuracy and efficiency and free up human resources for more strategic tasks. Case studies have shown up to a 200 percent increase in return on investment within the first year of RPA deployment in financial services. RPA bots can reduce claim workforce hours by an impressive 65 to 70 percent. This foundational technology is a stepping stone toward a more automated future, as we explain in The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers.

Artificial Intelligence (AI) and Machine Learning (ML)

While RPA handles tasks based on rules, Artificial Intelligence (AI) and Machine Learning (ML) bring cognitive capabilities to content automation. This is where the real change happens. AI and ML allow systems to learn from data, make predictions, and support complex decision making. Natural Language Processing (NLP), a subset of AI, allows machines to understand, interpret, and generate human language, which is crucial for processing unstructured content like policy documents or customer emails.

AI goes beyond simply following rules. It can analyze patterns, identify correlations, and adapt its behavior over time. For example, AI can be used for predictive analytics in underwriting, fraud identification, or personalized customer interactions. This intelligence leads to increased productivity for P&C insurance agents and contact center staff, averaging 14 to 34 percent, or even 42 percent with generative AI solutions. AI is not only about automation. It is about smarter automation that can solve complex problems and drive innovation, which is vital for Solving the Insurance Labor Crisis with AI Driven Innovation.

The Rise of Agentic AI

The latest development in this technological journey is Agentic AI. While RPA follows explicit rules and traditional AI performs cognitive tasks, Agentic AI introduces autonomous agents that can understand goals of a high level, plan their own actions, and coordinate with other AI agents and tools from third parties to achieve those goals. It is a significant improvement beyond earlier forms of automation.

Agentic AI systems can handle the complexity of the underwriting process by interpreting documents, integrating with core Property & Casualty claims management software, and applying underwriting rules dynamically. They can adapt to policy types, read unstructured data like medical reports, and flag and escalate cases when human judgment is truly needed. Unlike earlier systems, Agentic AI can make autonomous decisions and work across systems in real time. This transformative technology represents a new era for P&C insurance operations, where bots become truly intelligent digital coworkers. We explore this concept in Agentic AI in Insurance: When Bots Become Your Best Agents and provide a friendly guide in Rise of the Machines: A Friendly Guide to Agentic AI.

Frequently Asked Questions about Content Automation

How does automation affect the role of an insurance adjuster?

Automation does not replace the critical role of the P&C insurance adjuster. It improves it. By handling the repetitive administrative work, such as data entry, document processing, and initial claims triage, automation frees up adjusters to focus on more complex, tasks of high value. This means more time for thorough investigation, skilled negotiation, and empathetic communication with policyholders during difficult times. Automation empowers adjusters to apply their human expertise where it truly counts, rather than getting buried in paperwork. Our AI Designed With Adjusters In Mind solutions aim to make adjusters more efficient and effective, not redundant.

What are the biggest challenges when implementing automation?

Implementing content automation in P&C insurance services comes with its own challenges. One major hurdle is integrating new automation solutions with existing legacy claims management software. Many P&C insurance systems are decades old, and ensuring smooth data flow and compatibility can be complex. Data quality and security are also essential concerns. Poor data can lead to faulty automation, and protecting sensitive policyholder information is mandatory. Managing change within the organization is another key aspect. Employees may be hesitant or resistant to new technologies and will need clear communication, training, and a focus on how automation makes their jobs better, not obsolete. Choosing the right solution that provides a clear and measurable return on investment is also important. We often guide our clients through the decision of whether to Buy vs. Build: Navigating the SaaS AI Technology Decision.

Can small IA firms or TPAs benefit from content automation?

Yes. While large Property & Casualty carriers often have the resources to invest heavily in automation, small Independent Adjusting (IA) firms and Third Party Administrators (TPAs) can also see significant benefits. Scalable Software as a Service (SaaS) solutions mean there is no need for large IT teams in house or massive upfront investments. These firms can start by automating specific pain points or tasks with high volume and low complexity, and then scale up as needed. Many solutions offer models where you pay as you go, which makes automation accessible and affordable. For smaller entities, automation provides a crucial competitive edge, allowing them to operate with the efficiency and accuracy of larger organizations. If you are Not Sure Where to Start with AI?, we recommend identifying the manual processes that consume the most time and tackling those first.

Conclusion: Your Next Step in Claims Automation

The landscape of P&C insurance is evolving rapidly, and content automation examples in P&C insurance services are no longer a luxury but a strategic necessity. From optimizing FNOL and claims intake to personalizing policyholder communications and ensuring regulatory compliance, automation offers a clear path to higher efficiency, better accuracy, and better adjuster and policyholder experiences. It is about working smarter, not harder, and reshaping your operations for the digital age.

At Agentech AI, we specialize in providing advanced automation tools powered by AI specifically designed for the Property & Casualty insurance industry. Our specialized AI Agents are built to handle repetitive claims tasks and act as digital coworkers that integrate into your team, boosting productivity without ever replacing the essential human touch. The future of P&C insurance is automated, and we are here to help you lead the way.

Citations

- Accenture. "Why AI in P&C claims and underwriting is a game changer." 2021.

- Bain and Company. "Customer Behavior and Loyalty in Insurance: Global Edition." 2020.

- Coalition Against Insurance Fraud. "The Impact of Insurance Fraud." 2022.

- Deloitte. "2024 Insurance Outlook: Shifting from resilient to reinvented." 2023.

- Deloitte. "Automation with intelligence: RPA and AI in financial services." 2019.

- EY. "Global Insurance Outlook: P&C." 2023.

- EY. "Next wave underwriting in P&C insurance." 2022.

- Gartner. "Market Guide for Intelligent Automation Platforms." 2023.

- KPMG. "The future of claims in the P&C insurance market." 2022.

- Liberty Mutual. "Annual Report." 2022.

- McKinsey and Company. "Claims 2030: The future of claims in personal lines." 2020.

- McKinsey and Company. "Insurance 2030: The impact of AI on the future of insurance." 2018.

- McKinsey and Company. "Transforming claims management with advanced analytics." 2021.

- NAIC. "Innovation and Technology in P&C Insurance Markets." 2021.

- PwC. "Top issues: Insurance." 2023.

- Salesforce. "State of the Connected Customer." 2023.