Why Content Automation Insurance Services Matter for P&C Claims

Content automation insurance services are changing how Property & Casualty (P&C) insurance carriers, Third-Party Administrators (TPAs), and Independent Adjusting (IA) firms manage the high volume of documents in their daily operations.

Quick Answer: What are content automation insurance services?

These services use AI to automate document-heavy tasks across the P&C insurance lifecycle, delivering:

Automated document processing: Classify, extract, and validate data from claims forms, loss runs, and medical reports. Faster claims handling: Cut processing time from hours to minutes. Reduced manual work: Free adjusters from repetitive data entry to focus on high-value decisions. Improved accuracy: Minimize human error and premium leakage with AI validation. Better compliance: Create audit trails and enforce regulatory standards automatically.

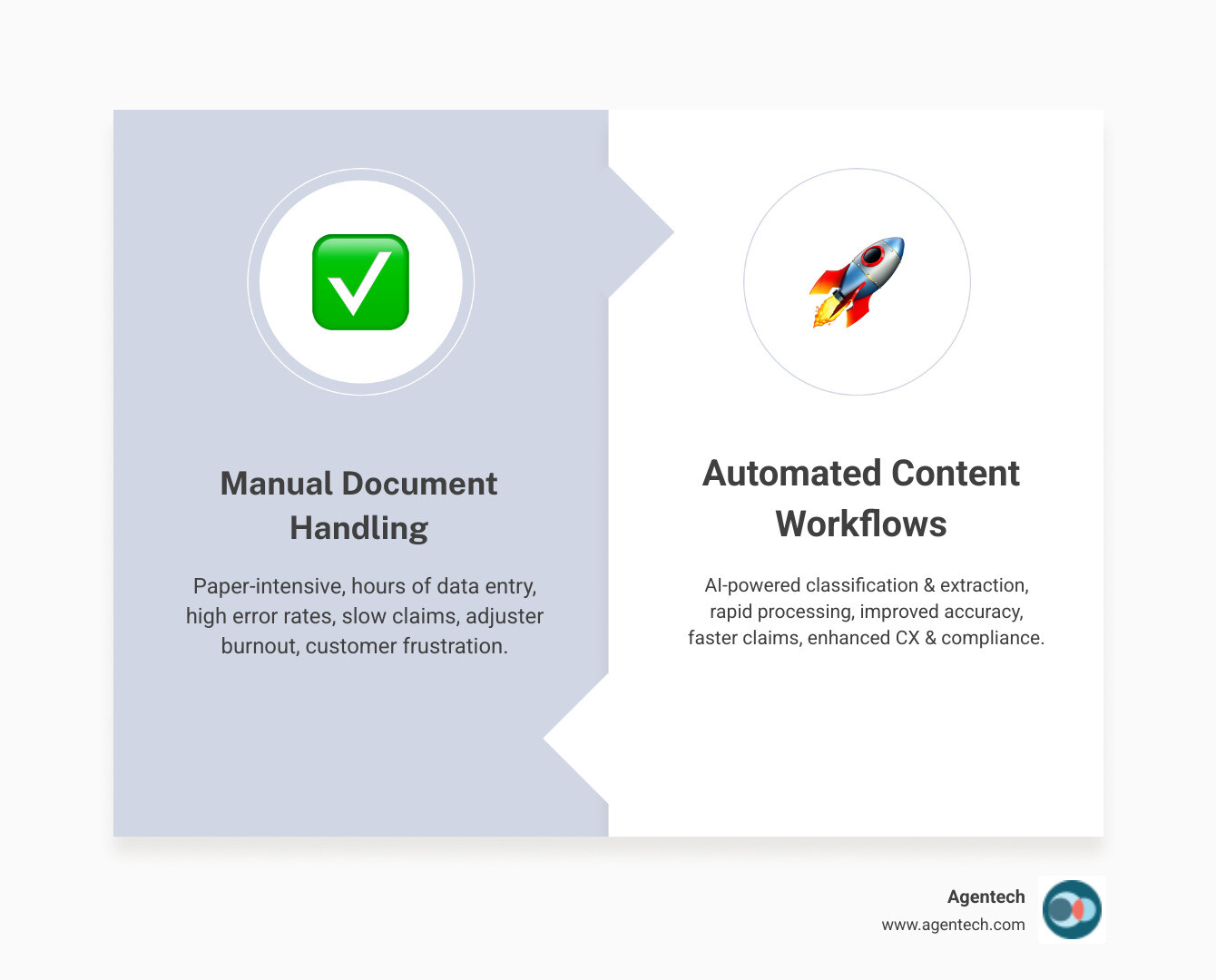

The Challenge

P&C insurance operations are burdened by manual paperwork, creating bottlenecks that slow settlements, frustrate customers, and burn out teams. Customers now expect a seamless digital experience, and 83% of P&C insurance CIOs cite customer experience as their primary driver for automation. Research shows automation can yield 30% improvements in claims processing times and a 42% improvement in operational productivity.

This guide explains how content automation works, the technologies behind it, and how to implement it in your claims operation.

I'm Alex Pezold, founder of Agentech AI. We're building the AI workforce for P&C insurance, starting with claims processing. My focus is on developing content automation insurance services that act as digital coworkers for adjusters, revolutionizing how P&C carriers handle document-intensive work.

The Core Benefits of Content Automation for P&C Insurance

Imagine a P&C insurance operation where documents flow seamlessly and teams focus on strategic tasks instead of data entry. This is the promise of content automation insurance services, which deliver advantages across your business.

Boosting Operational Efficiency and Reducing Costs

The most immediate gain from content automation insurance services is a major boost in operational efficiency and reduced costs. Slow, manual processes become fast, streamlined workflows.

For P&C carriers, TPAs, and IA firms, this means:

Faster processing times: AI systems classify, extract, and validate data from thousands of documents in a fraction of the time it takes humans, cutting down time for claims intake and underwriting. Reduced manual tasks: Teams are freed from manual data entry and document sorting, reallocating their time to complex problem-solving and customer interaction. Lower operational expenses: Less manual work directly lowers labor costs and reduces expensive errors. Scalability: Automated systems handle spikes in document volume, like after a major weather event, without needing overtime or temporary staff. Increased productivity: With AI handling routine tasks, adjusters focus on their core competencies. McKinsey reports a 42% enhancement in operational productivity for companies using these technologies.

By embracing content automation, we work smarter, making operations more agile and cost-effective. Learn more about changing your back office with P&C Insurance Back Office Automation.

Enhancing the Customer and Adjuster Experience

Policyholders expect fast, transparent service from their P&C insurer. Content automation insurance services improve both the customer and adjuster experience.

For policyholders, this means:

24/7 service: AI agents provide instant responses and process routine requests around the clock. Faster claims resolutions: By accelerating document processing, claims are resolved much quicker, which is crucial during stressful times. Personalized communication: Automated tools can tailor communications, making customers feel valued. Deloitte notes that digital platforms have set customer expectations for on-demand, personalized interactions.

Content automation also improves the daily work life of adjusters:

Reduced adjuster workload: AI agents offload repetitive tasks, freeing adjusters to focus on complex cases requiring human empathy and negotiation. Improved job satisfaction: When adjusters are empowered with efficient tools, they spend less time on paperwork and more time helping policyholders, increasing job satisfaction. Empowered decision making: AI provides adjusters with immediate access to accurate, summarized information, enabling faster, more informed decisions.

The result is a virtuous cycle: happy adjusters lead to happy customers. See how AI is redefining the adjuster's role in how AI transforms the claims experience.

Why content automation insurance services are a strategic advantage

Beyond efficiency, content automation insurance services offer a strategic advantage in the competitive P&C insurance industry through improved compliance and data management.

Strengthened compliance: Automated systems can be programmed to adhere strictly to regulatory guidelines for document handling and data privacy. Accurate audit trails: Every automated action is logged, creating an immutable audit trail for transparency and accountability. Adherence to regulations: Automation ensures operations remain compliant with evolving rules, minimizing the risk of penalties. Reduced E&O claims risk: Automation significantly reduces human error, a common cause of inaccuracies that can open agencies up to E&O claims. Consistent data capture: Automated data extraction ensures information is captured uniformly, eliminating discrepancies and ensuring data integrity for risk assessment.

Content automation transforms compliance from a burden into an integrated part of your operations. For more on balancing innovation with regulation, read our article on AI in P&C Insurance: Balancing Innovation and Regulation.

Key Technologies Driving Content Automation Insurance Services

The power behind content automation insurance services comes from the sophisticated application of several cutting-edge technologies working together to process and generate content.

Foundational Technologies: AI, ML, and NLP

At the heart of content automation are several key technologies:

Artificial Intelligence (AI): The broad field of enabling machines to perform tasks requiring human intelligence, such as reasoning and learning to optimize document workflows. Machine Learning (ML): A subset of AI that allows systems to learn from data. An ML model trained on claims documents can recognize patterns, extract data, and flag potential fraud, improving with more data. Natural Language Processing (NLP): A branch of AI that enables computers to understand and interpret human language, crucial for processing unstructured text in emails, adjuster notes, and reports. Optical Character Recognition (OCR): Augmented by AI, modern OCR converts scanned documents and images into editable, searchable data, digitizing physical paperwork. Robotic Process Automation (RPA): Software robots that automate repetitive, rule-based tasks, often working with AI to move extracted data between systems.

These technologies handle both structured data (from standardized forms) and unstructured data (from emails or notes). Advances in ML and NLP allow AI solutions to accurately extract critical information from complex sources, turning it into actionable data. For a deeper dive, explore P&C Insurance Claims Machine Learning.

The Rise of Generative and Agentic AI

Two advanced forms of AI are reshaping content automation insurance services: Generative AI and Agentic AI.

Generative AI: Refers to AI models that can create new content. In P&C insurance, it's a game-changer for:

- Content creation: Drafting personalized customer communications or summarizing lengthy claims reports.

- Data summarization: Instantly providing concise summaries of complex documents, highlighting key points for an adjuster.

- Improved customer engagement: Deloitte highlights how GenAI is defining new standards in customer engagement, enabling personalized interactions.

Agentic AI: An evolution of Generative AI, these systems (or "AI agents") perform complex tasks autonomously. They can make decisions, plan actions, and learn from outcomes to achieve goals. For P&C insurance, Agentic AI means:

- Autonomous task execution: An AI agent can process a First Notice of Loss (FNOL) from start to finish without human intervention.

- Digital coworkers: These agents work alongside human adjusters, handling high-volume, repetitive tasks and providing "always on" support.

- Continuous learning: Agentic AI systems constantly refine their processes based on every interaction.

The shift from Generative AI (creating content) to Agentic AI (acting on content) is profound. To understand this progression, read about the evolution from Generative AI to Agentic AI and get a clear Agentic AI Definition.

Practical Use Cases Across the P&C Insurance Lifecycle

Content automation insurance services are practical tools that can be deployed across every stage of the P&C insurance lifecycle, offering tangible benefits from claims to policy management.

Revolutionizing P&C Claims Processing

Claims processing is the most document-intensive function in P&C insurance and where automation delivers its most impactful results.

First Notice of Loss (FNOL): AI agents ingest FNOL reports from any channel, classify the claim type, extract key details, and initiate the claims workflow automatically. Document classification: Automation tools instantly classify incoming documents like accident reports, medical bills, and photos, routing them correctly within the claims file. Data extraction: AI accurately extracts critical data points like policy numbers, claimant names, and repair costs, eliminating manual entry and its associated errors and delays. Claim profile creation: Extracted data is used to automatically populate a comprehensive profile in your claims management software, making information immediately accessible. Automated communication: The system can trigger communications to policyholders, such as an acknowledgment of receipt or a status update. Fraud detection: By analyzing data patterns, AI can flag suspicious activity for human investigation, helping to mitigate fraud.

The impact is significant. BCG projects 20-30% reductions in loss adjustment expenses with AI in claims. This leads to faster resolutions and more efficient operations. For more, explore AI Claims Processing for P&C Insurance.

Streamlining Underwriting and Policy Management

Beyond claims, content automation insurance services add immense value to underwriting and policy management.

Submission intake: AI agents ingest submission documents in various formats (ACORD forms, loss runs), classify them, and extract relevant data for underwriters. Data validation: Extracted data is automatically validated against internal and external sources to ensure accuracy, reducing manual review time. Risk assessment: With consolidated data, AI can assist underwriters by highlighting key risk factors and inconsistencies. McKinsey & Company notes how data and analytics are redefining underwriting excellence. Quote generation: Automated systems can rapidly generate quotes and proposals, accelerating the sales cycle. Policy issuance: Automation handles the generation and issuance of policy documents and certificates of insurance. Renewal processing: AI agents can analyze policyholder data to suggest renewal adjustments and automate the dispatch of notices.

By automating these processes, underwriters can focus on complex risk analysis and strategic decisions, leading to faster turnaround and a competitive edge. Learn how these systems fit your infrastructure in P&C Insurance Claims Software Systems.

A Strategic Guide to Implementing Content Automation

Starting on the implementation of content automation insurance services can seem daunting, but a clear strategy makes it a manageable and rewarding endeavor that transforms how your P&C organization operates.

Your Roadmap to Effective Implementation

A successful implementation requires careful planning. We recommend the following roadmap:

- Audit current workflows to find bottlenecks: Review your existing claims, underwriting, and policy management processes to identify manual, repetitive tasks and areas prone to error. This pinpoints the highest-impact areas for automation.

- Define clear goals and KPIs: Set specific, measurable goals, such as a 30% reduction in claims processing time or a 15% increase in adjuster productivity, to measure success and demonstrate ROI.

- Secure buy-in from all teams (IT, claims, underwriting): Involve key stakeholders from the outset. Their insights are invaluable for designing effective solutions, and their support is essential for smooth adoption.

- Start with a high-impact pilot project: Don't try to automate everything at once. Begin with a smaller project with a clear problem and high potential for success, such as automating FNOL data extraction.

- Measure results and iterate before scaling: Continuously monitor the pilot project against your KPIs. Gather feedback, make adjustments, and optimize workflows before considering a wider rollout.

If you are unsure where to begin, our guide Not Sure Where to Start with AI? offers practical advice.

How to choose the right content automation insurance services

Selecting the right content automation insurance services is a critical decision. A key choice is whether to opt for integrated platforms or standalone tools.

| Feature | Integrated Platforms | Standalone Tools |

|---|---|---|

| Seamless Integration | Designed to work together, minimizing integration headaches. | May require custom integrations, leading to complexity. |

| Scalability | Built for enterprise-wide deployment and growth. | Can be limited in scope, may struggle with high volume. |

| Single Source of Truth | Centralized data management, reducing data silos. | Risk of fragmented data across different systems. |

| Long-Term ROI | Higher initial investment, but greater efficiency and strategic value over time. | Lower upfront cost, but potential for higher management and integration costs. |

| Initial Setup | More complex initial setup, but streamlined long-term. | Faster initial setup for specific tasks. |

| Management | Centralized management and vendor relationship. | Multiple tools, multiple vendors, increased management overhead. |

When evaluating solutions, consider:

- Your specific needs: Are you focused on claims, underwriting, or both?

- Integration capabilities: How well does the solution integrate with your existing claims software and core platforms?

- Scalability: Can the solution grow with your business and handle increasing volumes?

- AI capabilities: Look for robust AI, ML, and NLP features. Does it include Generative and Agentic AI?

- Security and compliance: Ensure the solution meets stringent security standards and regulatory requirements.

- Vendor support: What implementation, training, and ongoing support does the vendor offer?

For more insights on technology decisions, see our article on Navigating the SaaS AI Technology Decision.

Navigating the Challenges of Insurance Content Automation

While content automation insurance services offer immense benefits, successful implementation requires awareness and planning for potential challenges.

Overcoming Implementation and Data Problems

Common issues can arise during the implementation of content automation:

High initial investment: The upfront cost for advanced AI solutions can be substantial.

- Mitigation: Focus on clear ROI calculations from pilot projects to justify the investment. Consider a phased implementation to demonstrate value early.

Handling unstructured data: Accurately extracting nuanced information from complex documents like adjuster notes or varied medical records can be difficult.

- Mitigation: Choose AI solutions with strong NLP capabilities designed for insurance data. Use a "human in the loop" strategy where AI flags uncertain data for human review, which also helps the AI learn.

Legacy system integration: Integrating modern automation tools with older platforms can be technically challenging.

- Mitigation: Prioritize solutions with flexible APIs and integration frameworks. Modernizing core P&C Insurance IT Systems may be a necessary parallel effort.

Measuring ROI: Demonstrating return on investment can be difficult if benefits are intangible or KPIs are not well-defined.

- Mitigation: Establish clear, measurable KPIs from the start, tracking not just cost savings but also processing speed, accuracy rates, and customer satisfaction.

Mitigating Risks in Content Automation

Beyond technical issues, there are operational risks associated with AI that P&C insurers must mitigate.

AI hallucinations: Generative AI can sometimes produce plausible but factually incorrect outputs.

- Mitigation: Always implement a "human in the loop" for critical AI-generated content. A recent Air Canada liability case where the airline was held liable for its chatbot's misinformation shows why human oversight is critical.

Data security and privacy: Automation involves processing vast amounts of sensitive policyholder data.

- Mitigation: Choose solutions that adhere to the highest security standards, including robust encryption, access controls, and compliance with data privacy regulations.

Accountability: Determining who is accountable when an AI system makes a mistake can be complex.

- Mitigation: Establish clear governance frameworks that define roles for AI oversight. The "human in the loop" approach helps maintain human accountability.

Employee training and adoption: Without proper change management, employees may resist new AI tools.

- Mitigation: Position AI as a digital coworker, not a replacement. Invest in training that teaches employees how to leverage AI to focus on higher-value tasks. Our philosophy is about Embracing AI Agents as Digital Coworkers.

Conclusion

The P&C insurance industry is at a pivotal moment where the demand for digital experiences and operational efficiency makes content automation insurance services a strategic necessity.

The key benefits are clear: improved operational efficiency and significant cost reductions; a dramatically improved customer experience with faster, personalized service; empowered adjusters and underwriters focused on complex problem-solving; and strengthened compliance and reduced risk of errors.

The technologies driving this change, from AI and Machine Learning to Agentic AI, are ready to be deployed. While challenges exist, they are surmountable with a strategic approach that integrates technology with human expertise.

At Agentech, we believe the future of P&C insurance is a synergy between human and artificial intelligence. Our AI agents act as digital coworkers for claims teams, handling repetitive tasks to boost adjuster productivity, ensure accuracy, and delight policyholders with faster service.

Do not let your P&C operation get left behind. It is time to accept the power of content automation insurance services to transform your claims processing and secure a competitive edge.

Explore our AI Agents to see how you can transform your claims processing.

Citations:

- Gartner. (n.d.). CX and OpEx driving insurance digitalisation. IT Brief. Retrieved from https://itbrief.com.au/story/cx-and-opex-driving-insurance-digitalisation-gartner

- McKinsey & Company. (n.d.). IT modernization in insurance: Three paths to change. Retrieved from https://www.mckinsey.de/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/IT%20modernization%20in%20insurance%20Three%20paths%20to%20transformation/IT-modernization-in%20insurance-Three-paths-to-transformation.pdf?utm_source=chatgpt.com

- Deloitte. (2021). Digitalization in Insurance: Reshaping the industry with technology. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/cn/Documents/human-capital/deloitte-cn-hc-digitalization-in-insurance-210831.pdf?utm_source=chatgpt.com

- Investopedia. (n.d.). Errors and Omissions Insurance (E&O). Retrieved from https://www.investopedia.com/terms/e/errors-omissions-insurance.asp

- Deloitte. (n.d.). Changing customer experience in insurance with generative AI. Retrieved from https://www2.deloitte.com/us/en/pages/financial-services/articles/transforming-customer-experience-in-insurance-with-generative-ai.html?utm_source=chatgpt.com

- BCG. (2023). The Future of Insurance Claims. Retrieved from https://www.bcg.com/publications/2023/the-future-of-insurance-claims

- McKinsey & Company. (n.d.). How data and analytics are redefining excellence in P&C underwriting. Retrieved from https://www.mckinsey.com/industries/financial-services/our-insights/how-data-and-analytics-are-redefining-excellence-in-p-and-c-underwriting?utm_source=chatgpt.com

- CBC News. (2024). Air Canada must pay passenger misled by chatbot. Retrieved from https://www.cbc.ca/news/canada/british-columbia/air-canada-chatbot-lawsuit-1.7116416#:~:text=In%20an%20argument%20that%20appeared,responsible%20for%20its%20own%20actions.%22