Why Speed is the New Standard in Claims

Rapid claims settlement is the ability to process and pay insurance claims in hours or days instead of weeks or months. To achieve it, P&C insurance carriers, TPAs, and Independent Adjusting firms need to:

- Leverage AI and automation to eliminate manual data entry and document review

- Implement Straight Through Processing (STP) for instant adjudication of routine claims

- Break down silos between underwriting and claims teams through integrated claims management software

- Empower adjusters with virtual collaboration tools and AI assistance

- Ensure data quality and seamless integration with existing systems

The P&C insurance industry has reached a critical inflection point. Claims are the moment of truth for P&C insurers. When policyholders file a claim after a car accident, property damage, or workplace injury, they expect resolution fast. Not in 30 days. Not even in a week. Many now expect answers within 24 hours or less.

Research shows that policyholders are 3.5x more likely to renew after a positive claims experience. Yet many insurers still struggle with manual processes that slow everything down. The result? 30% of dissatisfied claimants switch carriers, and winning them back costs 7 to 9 times more than keeping them in the first place.

The stakes are even higher now. With 50% of the current P&C insurance workforce retiring by 2036, P&C carriers face a labor crisis that makes speed and automation not just competitive advantages but survival requirements. Claims managers know this reality well. You're being asked to do more with less while meeting rising customer expectations.

The good news is that technology has caught up with these demands. AI driven claims management software can now process documents in minutes, detect fraud automatically, and route claims to the right adjuster instantly. Some insurers are already settling more than 67% of claims straight through, reducing processing times from days to hours and cutting operating costs by up to 48%.

I'm Alex Pezold, and at Agentech AI, we're building the AI workforce for P&C insurance, starting with solutions that enable rapid claims settlement for P&C carriers, TPAs, and IA firms. Before founding Agentech, I scaled and exited TokenEx in one of Oklahoma's largest technology exits, and I've seen how the right technology can transform entire industries.

The Primary Benefits of Rapid Claims Settlement for Policyholders

For policyholders, the benefits of rapid claims settlement are profound and directly impact their well being during often stressful times. When we expedite the claims process, we're not just improving efficiency; we're providing essential support and peace of mind.

- Increased Satisfaction: The faster a claim is processed, the more satisfied policyholders become. This direct correlation between speed and satisfaction is a cornerstone of customer retention and loyalty. Policyholders who experience swift, hassle free settlements are more likely to view their insurer positively and recommend them to others.

- Reduced Stress: Filing a claim often follows an unfortunate event such as an auto accident or property damage. These situations are inherently stressful. Waiting for a claims decision or payout only prolongs that anxiety. Rapid settlement alleviates this burden, allowing policyholders to focus on recovery and rebuilding their lives.

- Financial Stability: Unexpected losses can create significant financial strain. A quick payout ensures policyholders have the funds they need to cover repairs, medical expenses, or temporary living arrangements without enduring prolonged financial hardship. This immediate financial relief is crucial, especially for those who might not have extensive savings.

- Customer Loyalty and Retention: Insurers recognized for rapid claims processing not only retain existing customers but also attract new clients through positive word of mouth referrals. A positive claims experience makes policyholders significantly more likely to renew their policies. As research from Bain & Company suggests, improving customer retention in Property and Casualty insurance is directly linked to positive interactions, especially during the claims process. This positive experience translates into sustained business and a stronger brand reputation.

Rapid claims settlement transforms a potential point of frustration into an opportunity to build trust and demonstrate genuine care for policyholders.

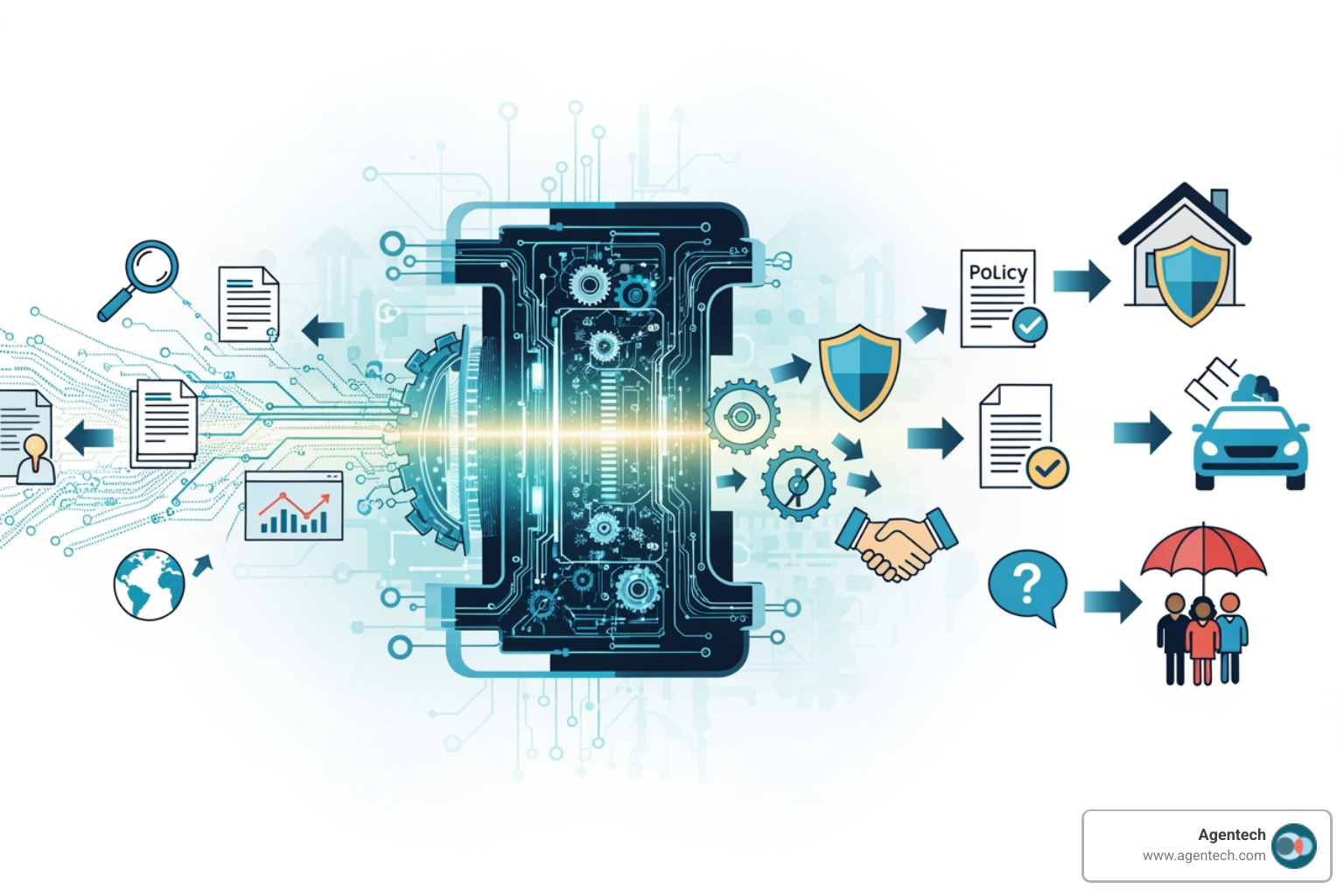

Leveraging Technology for Rapid Claims Settlement

The backbone of rapid claims settlement in today's P&C insurance landscape is cutting edge technology. We're witnessing a digital change driven by advancements in artificial intelligence (AI), automation, machine learning (ML), image recognition, and sophisticated data extraction techniques. These tools are not just improving existing processes; they're fundamentally reshaping how claims are handled, making them faster, more accurate, and more cost effective.

The Core Components of a Straight Through Processing (STP) System

Straight Through Processing (STP) is a transformative approach designed to streamline the entire claims process by minimizing human intervention from initial claim registration to final settlement. It's about ensuring data flows seamlessly through various stages of the claims lifecycle without getting bogged down by manual steps.

The key components that make an STP system effective in P&C insurance claims include:

- Automated Data Entry: This is where the journey to speed begins. Instead of adjusters manually inputting information from various documents, STP systems use AI and optical character recognition (OCR) to automatically capture data from claims forms, police reports, medical documents, and other submitted evidence. This not only accelerates the initial intake but also drastically reduces human error.

- Real Time Monitoring: An STP system continuously tracks the status of a claim as it progresses. This real time visibility allows for immediate identification of bottlenecks or deviations from standard workflows. It ensures that claims are always moving forward, triggering automated actions or alerts when necessary.

- Integrated Claims Management Software: Seamless integration is paramount. STP systems connect various platforms and databases, linking policy information, customer data, and external resources. This eliminates data silos, ensuring that all relevant information is accessible and consistent across the entire claims ecosystem. Our claims management software integrates these components to provide a unified view.

- AI Driven Decisions: At the heart of STP lies AI driven decision making. Automated systems apply pre set rules, policy terms, and predictive analytics to evaluate claims and quickly determine payouts. This can include validating data by cross referencing it with stored records, assessing damage based on submitted evidence, and even flagging potential fraud for review. For routine, straightforward claims, AI can make swift decisions about payouts, often reducing processing times from days to mere hours.

By integrating these components, an STP system enables us to process thousands of claims simultaneously, significantly reducing turnaround times and ensuring that policyholders receive their settlements promptly. To dive deeper into how these systems are built, explore our insights on More info about AI Claims Processing Systems.

How AI and Automation Accelerate P&C Claims

AI and automation are not just buzzwords; they are the engines driving unprecedented speed and accuracy in P&C claims. We leverage these technologies to streamline every stage of the claims lifecycle.

- Automated Damage Assessment: Imagine a policyholder submitting photographs of vehicle damage or property loss through a mobile app. Image recognition technology, powered by AI, can analyze these images to assess the extent of damage, categorize it, and even generate preliminary repair estimates. This process significantly reduces the need for physical inspections in many cases, allowing for swift decisions about payouts and cutting processing times from days to hours.

- Fraud Detection: Machine learning algorithms are incredibly adept at analyzing vast datasets, recognizing patterns, and identifying anomalies that human adjusters might miss. By cross referencing current claim data with historical records and external data sources, AI can detect potential fraud or inconsistencies with high accuracy. This allows us to flag suspicious claims for human review while fast tracking legitimate ones. Our AI uses advanced checks to spot duplicate claims, document tampering, and inconsistencies, which is crucial for maintaining integrity in the claims process.

- Virtual Inspections: Virtual collaboration tools empower both adjusters and policyholders. For instance, a policyholder can use their smartphone camera to provide a live video feed of the damage to a remote adjuster. This allows us to perform initial assessments, guide policyholders on loss mitigation, and gather necessary information without an in person visit. This not only accelerates the process but also reduces travel time and costs.

- Natural Language Processing (NLP) for Document Analysis: Claims involve a mountain of paperwork, from policy documents to medical reports and repair invoices. NLP allows automated systems to understand, interpret, and extract critical information from both structured and unstructured text documents, even handwritten ones. Our AI agents can categorize over 50 different types of claims documents with over 98% accuracy and consistency, extracting key details like claimant name, policy number, claim amount, and cause for claim. This capability drastically cuts down on manual data entry and review time.

These technological advancements provide the intelligence needed to make quicker, more accurate decisions, shifting us from a reactive to a proactive claims approach. To learn more about how AI is revolutionizing the industry, see Transforming Insurance Claims with AI.

Breaking Down Silos and Empowering Your Team

One of the most persistent obstacles to rapid claims settlement has historically been the operational silos that often exist between different departments within a P&C insurance organization, particularly between underwriting and claims teams. These divisions, often characterized by unclear communication channels, differing objectives, and a lack of integrated technology, lead to breakdowns in communication, information gaps, and redundant efforts. These inefficiencies not only slow down the claims process but also negatively impact overall operational performance and policyholder satisfaction.

When claims processing is delayed, the cost implications for P&C insurers can be significant. Beyond the direct financial impact of extended handling times and increased administrative work, delays can lead to:

- Higher Ultimate Claim Costs: Prolonged claims can escalate in cost due to various factors, including claims inflation, additional investigation expenses, or even litigation. Faster settlement frequently results in lower ultimate claim costs.

- Loss of Customer Loyalty and Retention: As we've discussed, policyholders expect speed. An inability to respond promptly can tarnish an insurer's reputation, driving dissatisfied clients to competitors. Losing a customer is far more expensive than retaining one.

- Operational Inefficiencies: Manual processes and delays tie up valuable resources. Adjusters spend time on administrative tasks rather than high value activities like customer interaction or complex claim assessment. This misallocation of resources increases operational costs.

- Increased Fraud Risk: Longer processing times can inadvertently create more opportunities for fraudulent activities, as complex or delayed cases may receive less scrutiny or become harder to verify over time.

- Reputational Damage: In today's interconnected world, negative claims experiences can quickly spread through social media and word of mouth, damaging an insurer's brand and making it harder to attract new business.

Addressing these silos and empowering our teams is not just about efficiency; it's about building a resilient, customer centric organization ready for the future. This is especially critical given the looming labor crisis in P&C insurance, where a significant portion of the workforce is set to retire. We must leverage technology to solve these challenges. For more on this, consider Solving the Insurance Labor Crisis with AI.

Using Automation to Bridge Departmental Gaps

Automation is the key to dismantling these operational silos and fostering seamless collaboration across underwriting and claims departments. Our approach focuses on creating an environment where information flows freely and efficiently, enabling faster and more accurate claims decisions.

- Centralized Data: Automation consolidates data from various sources into a single, accessible platform. This means underwriting information, policy details, and historical claims data are all available to the claims team in real time. This eliminates the need for manual data requests and ensures everyone is working with the most current and accurate information.

- Automated Communication: We implement automation tools such as chatbots and digital workspaces that facilitate instant and transparent communication between teams. For example, an underwriting system can automatically notify the claims team of policy changes, or a claims system can flag specific policy clauses for underwriting review. This proactive communication prevents misunderstandings and speeds up decision making.

- Workflow Transparency: Automation provides end to end visibility of the claims process. Both underwriting and claims teams can monitor the status of a claim, understand its progression, and identify any potential roadblocks. This transparency fosters accountability and allows for proactive intervention, rather than reactive problem solving.

- Shared Insights: AI plays a crucial role in analyzing cross departmental data to identify patterns, pinpoint inefficiencies, and suggest solutions for better collaboration. By leveraging advanced analytics, we can gain insights into how policy terms impact claims outcomes, or how certain underwriting decisions affect claims severity. These shared insights enable continuous improvement and a more harmonized approach to risk management and claims handling.

By minimizing the manual handling of claims and breaking down these barriers through STP, we can allocate our resources more effectively, allowing team members to focus on high value tasks such as customer interaction and complex risk assessment. This leads to improved overall claims settlement efficiency and a better experience for our policyholders.

The 'Always on Senior Adjuster': A New Model for Rapid Claims Settlement

The "Always on Senior Adjuster" concept, enabled by virtual collaboration tools, is revolutionizing how P&C claims teams operate, benefiting both junior adjusters and the company as a whole. This innovative model tackles the critical need for experienced guidance and rapid decision making, especially in the face of a shrinking experienced workforce.

- Virtual Collaboration Tools: These tools, such as live video feeds, digital whiteboards, and shared document platforms, enable real time connection between field adjusters and remote experts. For instance, a junior adjuster in the field can use a tablet to stream video of a damaged property to a seasoned senior adjuster in the office. This direct line of communication provides immediate, expert guidance.

- Mentoring Junior Adjusters: Less experienced adjusters can perform complex analyses on critical claim cost drivers with the remote support of a seasoned adjuster. This remote mentorship significantly reduces the number of errors and the need for multiple trips back to the claim site. It also provides a rich, collaborative learning experience, accelerating the development of junior staff. The senior adjuster essentially becomes an "always on" resource, guiding their junior counterparts through challenging assessments.

- Reducing Errors and Improving First Time Resolution: With immediate expert oversight, junior adjusters are less likely to make mistakes, leading to more accurate initial assessments and estimates. This improves the likelihood of first time claim resolution, meaning the claim is settled correctly and efficiently on the first attempt, minimizing rework and delays.

- Improving Customer Experience: When adjusters are empowered with immediate expert support, they can provide more confident and accurate information to policyholders. This leads to faster claim settlement, which consistently results in higher customer satisfaction. Policyholders appreciate the efficiency and the clear communication, fostering trust and loyalty.

- Lowering Ultimate Claim Costs: By reducing errors, accelerating settlement, and minimizing repeat visits to claim sites, virtual collaboration helps lower ultimate claim costs. It also optimizes the use of senior adjusters' time, allowing them to oversee more claims virtually instead of spending hours traveling.

This model is a game changer, allowing us to maintain high quality service and achieve rapid claims settlement even as our workforce evolves.

A Practical Roadmap to Implementation

Implementing rapid claims settlement strategies requires a structured and thoughtful approach. It is not merely about adopting new technology, but about strategically integrating it into existing workflows to maximize impact. We follow a clear roadmap to ensure successful transition and tangible results for P&C carriers, TPAs, and IA firms.

- Assessing Current P&C Claims Workflows: Before any new technology is introduced, we thoroughly map out each step of your current claims process, from initial submission to final settlement. This involves identifying manual touchpoints, bottlenecks, data silos, and areas prone to errors. Understanding your existing "as is" state is crucial for designing an effective "to be" automated process.

- Setting Clear Objectives: What do you aim to achieve? Is it a 30% reduction in processing time, a 15% increase in customer satisfaction, or a specific reduction in operational costs? We work with you to define clear, measurable, achievable, relevant, and time bound (SMART) goals. These objectives will guide the entire implementation process and serve as benchmarks for success.

- Choosing Scalable Claims Management Software: The right technology is paramount. We help you select claims management software and AI solutions that are not only powerful and user friendly but also scalable and compatible with your existing systems. The chosen software must be able to grow with your business needs and integrate seamlessly without disrupting current operations. Our insights on Buy vs. Build AI Technology Decision can guide this critical choice.

- Data Integration and Management: The effectiveness of automated claims processing relies heavily on the quality and accuracy of the data being processed. We establish robust data validation processes and security protocols to safeguard sensitive information. This ensures smooth integration and preserves data integrity across all platforms, preventing inconsistencies and errors. Accurate and timely data plays a vital role in expediting claims processing and reducing costs, enabling us to detect fraud, make informed decisions, and streamline back office operations.

- System Testing and Iteration: Before a full rollout, we conduct thorough testing to identify and resolve any bugs or issues in the workflow. This involves pilot programs with a subset of claims or adjusters, gathering feedback, and making necessary adjustments. Continuous iteration ensures the system performs optimally and meets the defined objectives.

By following this roadmap, we ensure a smooth transition to an automated claims environment that delivers rapid claims settlement and significant operational improvements.

Overcoming Common Challenges in Claims Automation

While the benefits of claims automation are clear, implementing these advanced systems can present several challenges. We understand these problems and have strategies to overcome them, ensuring a successful transition to rapid claims settlement.

- Data Quality and Integrity: Automated systems are only as good as the data they process. Poor data quality, inconsistencies, or incomplete records can lead to inaccurate decisions and undermine the efficiency gains of automation.

- Solution: We implement rigorous data validation processes at the point of data capture, often using AI to cleanse and enrich data. Establishing clear data governance policies and continuous monitoring ensures data integrity.

- Legacy System Integration: Many P&C insurers operate with legacy systems that do not communicate well with modern automation tools. This can create data silos and significant inefficiencies, hindering a unified claims process.

- Solution: We use flexible APIs and middleware solutions to create seamless connections between legacy systems and new automation platforms. Our goal is to integrate without disrupting existing operations, ensuring that data flows freely across the entire ecosystem.

- Data Security and Privacy: Automated claims processing systems handle large volumes of personal and sensitive information, including policyholder data and, in the case of workers' compensation, medical records. Data security is a top concern, especially with strict regulations like HIPAA.

- Solution: We prioritize robust security protocols, including encryption, access controls, and regular security audits. Our systems are designed to comply with all relevant regulatory requirements, such as HIPAA guidelines, to safeguard sensitive information and ensure policyholder privacy.

- Regulatory Compliance: The insurance industry is heavily regulated, and any automated system must adhere to a complex web of local, state, and federal laws.

- Solution: We ensure our solutions are built with compliance in mind, incorporating configurable rule engines that can adapt to changing regulations. Comprehensive audit trails ensure that all automated decisions are traceable and explainable, providing transparency for regulatory scrutiny.

By proactively addressing these challenges, we pave the way for a smooth and effective implementation of automated claims processing, open uping the full potential of rapid claims settlement.

Conclusion: The Future is Fast, Automated, and Human Centric

The future of claims processing in P&C insurance is undeniably fast, highly automated, and deeply human centric. We are moving beyond simple triage and settlement towards a holistic approach that accepts loss prevention and mitigation, turning challenges like inflation and natural catastrophes into opportunities for smarter, more agile action.

Future trends will further accelerate settlement times:

- Advanced AI and Machine Learning: We will see an increasing role for AI in more sophisticated data analysis and prediction. This includes agentic AI, which refers to advanced AI systems that can autonomously plan, adapt, and execute multi step tasks with minimal human supervision. These systems can break down complex claims goals into sub tasks and select optimal strategies, further enhancing decision making in policy checking, fraud detection, and claims adjudication.

- Proactive Loss Prevention and Mitigation: Leveraging data from sources like satellite imagery and IoT devices, P&C insurers will be able to proactively communicate with policyholders before, during, and after events. This includes ongoing monitoring of sites for pre and post repair change detection, which aids in fraud prevention and property protection valuation. This proactive stance ensures faster recovery and helps prevent claims inflation.

- Hyper Personalization and Customer Experience: The digital change in the insurance sector will continue, leading to more integrated and customer focused digital solutions. Policyholders will experience seamless, intuitive interactions, with the ability to file claims digitally and receive instant updates, further boosting satisfaction and loyalty.

- Improved Virtual Collaboration: The "Always on Senior Adjuster" model will become standard, with virtual collaboration tools empowering junior adjusters and optimizing resource allocation. This will reduce errors, improve training, and ensure that expertise is available exactly when and where it's needed, even during surge events.

- Continuous Improvement through Data: The vast amounts of data generated by automated processes will be leveraged for continuous improvement. AI will analyze this data to pinpoint inefficiencies, refine workflows, and optimize decisions, leading to a lower combined ratio and higher NPS scores for insurers.

The era of rapid claims settlement is not a distant dream; it's a present reality being built by companies like Agentech AI. We are empowering P&C carriers, TPAs, and IA firms to accept this future by integrating cutting edge AI into their claims management software. Our AI agents boost adjuster productivity without replacing human decision making, ensuring that the human touch remains at the heart of every claim while leveraging technology for unparalleled speed and efficiency.

We believe that the best AI doesn't feel like AI; it's invisible, seamlessly enhancing human capabilities. This competitive edge is not just about speed, but about building stronger relationships with policyholders and creating a more resilient, efficient, and profitable insurance ecosystem.

To find how our AI agents can transform your claims operations, we invite you to Explore our AI Agents for claims automation.

Citations:

- Bain & Company. (n.d.). How to Improve Customer Retention in Property and Casualty Insurance. Retrieved from https://www.bain.com/insights/how-to-improve-customer-retention-in-property-and-casualty-insurance-snap-chart/

- HHS.gov. (n.d.). HIPAA Privacy Rule. Retrieved from https://www.hhs.gov/hipaa/for-professionals/privacy/laws-regulations/index.html