Why Property & Casualty Insurance Needs Automation Now

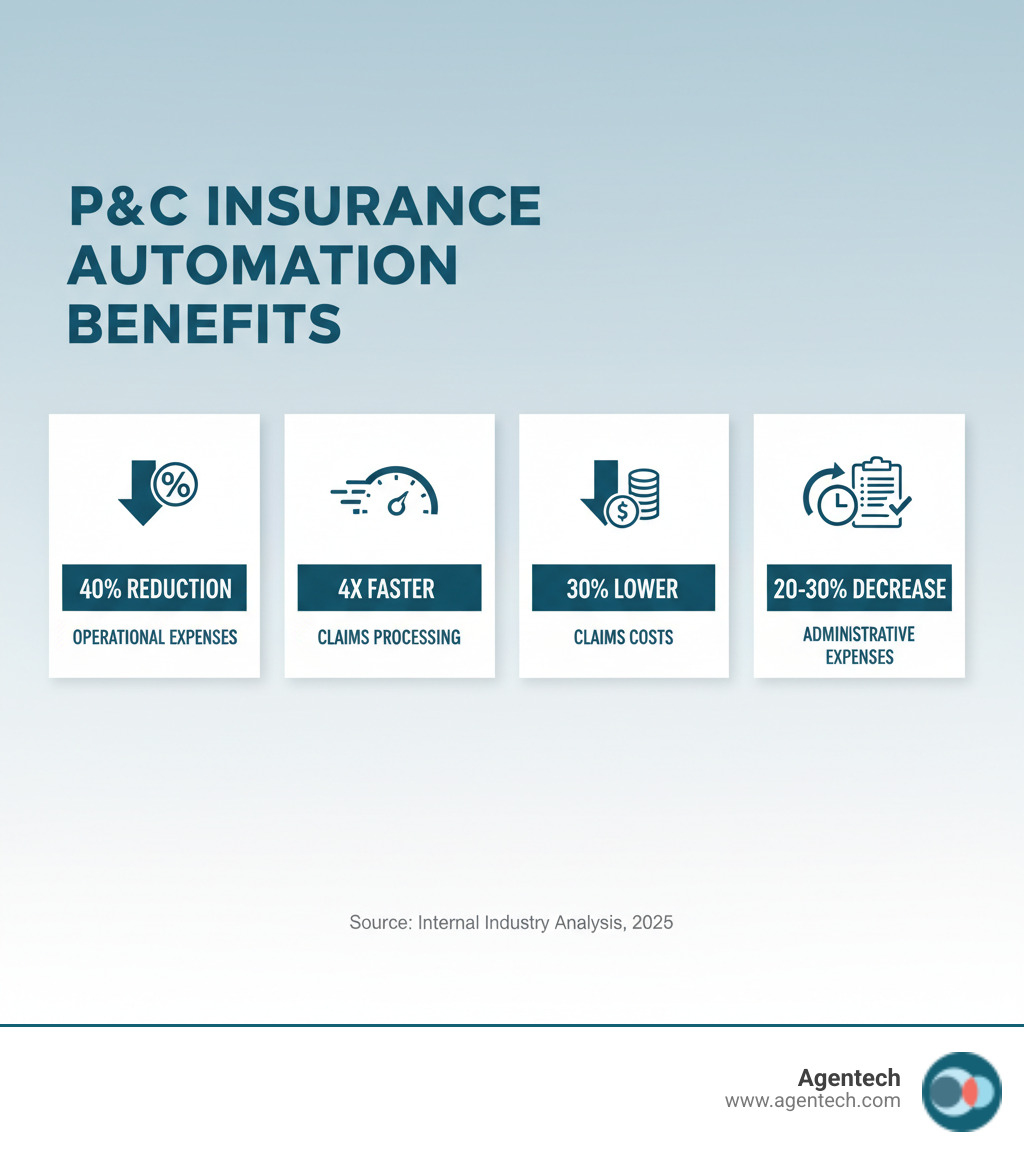

Automate insurance processes to transform how your P&C insurance operations handle claims, underwriting, and policy management. With automation, you can reduce operational costs by up to 40% over the next decade, process claims 4x faster with automated workflows, cut claims processing costs by 30% through intelligent automation, decrease cycle times by 50 to 70% in underwriting and onboarding, and reduce administrative expenses by 20 to 30% across key workflows.

Property & Casualty insurance carriers, TPAs, and IA firms face mounting pressure from every direction. Customer expectations continue to rise while profit margins shrink. Manual claims processing takes an average of 25 days to settle, error rates can reach 20%, and claims leakage hits 11% of all settlements. These challenges drain resources and erode customer loyalty.

The Property & Casualty insurance industry stands at a critical crossroads. Rising operational costs, evolving customer demands, and fierce competition require a strategic response. Manual workflows simply cannot keep pace with modern demands for speed, accuracy, and transparency.

Automation offers the solution. By leveraging technologies like AI, RPA, and Intelligent Process Automation, P&C insurance organizations can streamline everything from First Notice of Loss intake to final settlement. The result? Faster claim resolutions, fewer errors, reduced costs, and happier customers.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance. After founding and successfully exiting TokenEx in 2021, I've focused on helping P&C carriers, TPAs, and IA firms automate insurance processes through cutting-edge AI solutions that transform claims operations and back-office workflows. This guide will show you how to achieve similar results in your organization.

The Compelling Case for Automation: Key Benefits for Carriers, TPAs, and IA Firms

The decision to automate insurance processes is about survival and growth in an industry where margins are tight and customer expectations keep climbing. For P&C carriers, TPAs, and IA firms, automation delivers tangible benefits that transform operations and customer service.

Increased Operational Efficiency and Productivity

When you automate insurance processes, hours spent on data entry, document verification, and routing routine inquiries disappear. Your adjusters and underwriters can finally focus on complex cases that need human judgment.

A McKinsey study on productivity estimates that automation can boost productivity and reduce operational expenses by up to 40% over the next decade. That's a changeal improvement.

Reduced cycle times follow naturally. When you digitize underwriting and onboarding processes, cycle times drop by 50 to 70 percent. Claims that once took weeks now take days. This speed doesn't just make your operations smoother; it makes them fundamentally more competitive.

Significant Cost Reduction and Resource Optimization

Automation proves its value by cutting the hidden costs of manual P&C insurance processes: labor hours, error corrections, and rework. When you automate insurance processes, those costs evaporate.

Claims processing cost savings can reach up to 30% through automation. Across all digitized processes, administrative expense reduction typically runs between 20 and 30 percent. At scale, automation can reduce operational costs by up to 30% within five years.

This is about resource optimization, freeing up capital and talent to focus on innovation and strategic growth rather than on repetitive tasks that machines handle better.

Improved Customer Experience Through Faster Service Delivery

Your policyholders want help fast when they need it most. A homeowner with a damaged roof or a family dealing with a car accident wants answers now, not next week.

Automation delivers that speed. Faster service delivery becomes possible when automated systems process claims four times faster than manual methods. Accuracy also matters. With fewer manual touchpoints, errors decrease dramatically, policy documents are correct, and claim settlements match what was promised.

As we explored in The Future of Insurance: How AI is Changing the Game, customer satisfaction directly impacts retention. Research shows that 74% of customers dissatisfied with how their claims were handled planned to change their provider. Improved satisfaction through automation is essential for keeping customers.

Improved Accuracy and Compliance

P&C insurance operates in a heavily regulated environment. Missing a compliance requirement can lead to penalties and reputation damage. Manual processes are vulnerable to human error, especially under time pressure.

When you automate insurance processes, you build compliance rules directly into your workflows. Every document is consistent, every required field gets completed, and every regulatory threshold triggers the right review. Fewer manual errors mean fewer compliance headaches.

Streamlined regulatory reporting becomes almost automatic. The system tracks everything, creates detailed audit trails, and generates reports with a click. Your compliance team can focus on strategic risk management instead of chasing down missing documentation.

Competitive Advantage for Small and Medium Sized P&C Insurance Businesses

Large P&C carriers have always had a resource advantage, but automation changes that equation.

For small and medium sized TPAs and IA firms, automation is the great equalizer. A study on SMB automation found that 88% of small and medium sized businesses believe automation helps them better compete with larger companies. When your team of ten people can process claims as fast as a department of a hundred people, size matters less.

You gain the agility to scale operations without proportionally increasing overhead and can offer service levels that match or exceed what the big players deliver. That is a path to sustainable growth in a challenging market.

Citations:

(1) McKinsey & Company. "Insurance productivity 2030: Reimagining the insurer for the future." https://www.mckinsey.com/industries/financial-services/our-insights/insurance-productivity-2030-reimagining-the-insurer-for-the-future

(3) McKinsey & Company. "Time for insurance companies to face digital reality." https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/time%20for%20insurance%20companies%20to%20face%20digital%20reality/digital-disruption-in-insurance.ashx

(4) Agentech. "The Future of Insurance: How AI is Changing the Game." https://www.agentech.com/resources/articles/the-future-of-insurance-how-ai-is-changing-the-game

(5) Zapier. "The State of Business Automation 2021." https://zapier.com/blog/state-of-business-automation-2021/

Core P&C Insurance Processes to Automate

Not every P&C insurance process needs automation right away. Trying to automate everything at once is overwhelming and often fails. Instead, we recommend a focused approach. Start with the processes that are time-consuming, cause the most headaches, or are the most costly. These are the areas where automation delivers the biggest return.

For most P&C carriers, TPAs, and IA firms, five processes stand out as prime candidates to automate insurance processes: Claims Processing often delivers the most dramatic improvements. Underwriting and Policy Issuance comes next, where automation can reduce cycle times and improve consistency. Customer Onboarding, Document Management, and Compliance and Reporting are also key areas for initial focus.

We dig deeper into how we can optimize these functions in our article on P&C Insurance Back Office Automation.

The Specific Advantages of Automating Claims Processing

Claims processing is your moment of truth with policyholders. When someone files a claim for residential property damage, an auto accident, or a workers' compensation injury, they are often stressed. A smooth, fast claims experience can turn that anxiety into loyalty. A slow, error-prone process is how you lose customers.

First Notice of Loss (FNOL) intake is where it all begins. Manual FNOL is a pain point, with customers facing complicated forms and your team spending hours on data entry. Automation transforms this by letting policyholders submit claims through digital channels that capture data directly into your claims management software. AI and Intelligent Document Processing can extract and validate details from submitted claims, with AI innovations reducing processing duration by 50 to 90 percent. (2)

Once a claim is in the system, automated tasking and routing ensures it lands on the right desk. Instead of manual assignment, automation can route claims based on type, complexity, or adjuster expertise. This keeps your team working at peak efficiency. Our work with Odie Pet Insurance, implementing Agentech to Automate Claims Tasking, shows how powerful this can be.

Fraud detection is another area where automation shines. Fraud accounts for 10% of P&C claims in the United States, costing P&C insurers $80 billion annually. (4) AI can analyze patterns across thousands of claims, spotting red flags that humans might miss. It can flag suspicious claims for investigation, reducing leakage and protecting your bottom line.

The combination of these automated steps leads to faster resolution and settlement. Claims that used to take days of manual effort can be processed within hours. (2) This speed translates directly into cost savings, with claims processing costs reduced by up to 30%. (3)

Improved customer satisfaction naturally follows. When policyholders get quick, transparent, and accurate resolutions, they remember and renew their policies. We explore this connection further in our article on AI Claims Processing in P&C Insurance.

Streamlining Underwriting, Policy Issuance, and Renewals

Underwriting is the engine that powers your P&C insurance business. Traditional underwriting is often stuck in the past, with manual reviews that are slow and inconsistent.

Automation brings consistency and speed to this critical process. Risk assessment and data analysis become more sophisticated when you use a standardized risk assessment model. AI and machine learning take this even further, analyzing vast amounts of data to predict risk more accurately than traditional methods.

Automated document generation eliminates one of the most tedious parts of the underwriting process. Once an application is approved, your system can instantly generate policy documents and renewal notices with zero manual effort, typos, or delays.

The financial impact is substantial. By digitizing the underwriting and onboarding process, you can reduce administrative expenses by 20 to 30 percent. (3) That money can be reinvested in growing your business.

Optical Character Recognition technology deserves special mention. OCR can digitize handwritten applications and extract data from various forms, populating your systems automatically. This eliminates hours of manual data entry and reduces transcription errors for residential property, auto, or workers' compensation submissions.

Citations:

(1) McKinsey & Company. "Insurance productivity 2030: Reimagining the insurer for the future."

(2) Activepieces. "Automating Insurance IT Workflows: A Comprehensive Guide."

(3) McKinsey & Company. "Time for insurance companies to face digital reality."

(4) Insurance Support World. "Automated Claims Processing – Why is it important for the insurers?"

(5) Based on industry benchmarks for automation speed improvements.

Your Toolkit for Automation: Technologies and Best Practices

When you're ready to automate insurance processes, understanding your technology options is essential. You don't need to be a tech expert to make smart choices. Here are the tools changing P&C insurance operations.

Robotic Process Automation (RPA) is a common starting point. Think of RPA as a digital workforce for tedious, repetitive tasks. These software bots can log into applications, enter data, and work with legacy systems that lack modern APIs. Because RPA interacts with the graphic user interface, it's compatible with older applications. (4) Your claims team can stop manually copying data between systems.

Intelligent Process Automation (IPA) combines RPA with AI capabilities. IPA handles complex, cognitive tasks that require judgment, interpreting unstructured data and learning over time. McKinsey Digital reports that IPA can address up to 70% of current tasks, resulting in cost savings of 20% to 35% and a 50% to 60% decrease in process time. (2) This allows for complete workflow change.

At the heart of this is Artificial Intelligence (AI). Machine learning algorithms learn from historical data to identify patterns and make predictions, which is crucial for fraud detection and risk assessment in P&C insurance. Natural language processing (NLP) enables computers to understand human language in claim documents or emails. For example, NLP can extract claim data from phone calls, the preferred filing method for 72% of consumers. (4) Predictive analytics uses your data to forecast trends and uncover risks.

The most exciting development is Agentic AI and autonomous agents. These are AI systems designed to act autonomously toward a goal, breaking down complex tasks and executing them. They augment human adjusters by handling administrative work, freeing your team for high-value tasks like complex decision-making and customer interactions. We define this in our Agentic AI Definition article. To see this in action, check out our guide on How Agentic AI is Changing P&C Insurance Operations.

Best Practices to Automate P&C Insurance Processes Successfully

A structured approach ensures success and maximizes your return on investment.

Begin with a workflow assessment to understand your current P&C insurance processes. Identify inefficiencies and bottlenecks, then prioritize high-volume, repetitive, and error-prone areas. Claims processing and policy renewals are great starting points for quick wins.

Select the right claims management software for your needs. You need a solution that is scalable, secure, and integrates with your existing P&C insurance IT systems. Look for user-friendly platforms with AI-driven insights and no-code customization. For guidance, refer to Insuretech Made Easy: Understanding P&C Insurance Software Systems.

Ensure data security and governance from day one. Implement encryption, access controls, and clear data governance policies. Use metadata and tagging to make documents searchable. A unified data strategy is essential, as data silos hinder 70% of automation initiatives. (4)

Implement a pilot project, scale gradually, and optimize continuously. Start small to test your solution and gather feedback. Once successful, scale to other departments. Continuously monitor Key Performance Indicators and adapt based on performance data.

Train your team, involve employees, and foster adoption. Automation is about people as much as technology. Provide comprehensive training and involve employees from the start, using a "human-in-the-loop" design. This builds confidence and ensures your team feels empowered. When your team sees automation as a tool that makes their jobs easier, you've won half the battle.

Citations:

(2) McKinsey Digital

(4) Insurance Support World

Frequently Asked Questions about Automating P&C Insurance Processes

We understand that implementing automation can bring questions. Here are common inquiries we receive from P&C carriers, TPAs, and IA firms looking to automate insurance processes.

How does automation impact the role of a P&C insurance adjuster?

Automation augments rather than replaces adjusters. The goal is not to remove the human element but to empower skilled adjusters to do their best work.

Adjusters spend hours on administrative tasks like data entry and chasing documents. This pulls them away from their core functions: investigating complex claims, making nuanced decisions, and supporting policyholders.

AI assistants handle these repetitive tasks, freeing up adjusters to focus on high-value activities. This leads to more time for thorough investigations, empathetic customer interactions, and thoughtful decision-making. The result is increased adjuster productivity and improved job satisfaction, as they can focus on solving problems, which reduces burnout.

We dig deeper into this topic in our article, Virtual AI Assistants for P&C Insurance: Meet Your New Best Friend.

What is the biggest challenge when implementing automation?

For many P&C insurance organizations, the biggest hurdle is integration with legacy IT systems. Most P&C insurers rely on aging technology, which is 18 years old on average according to McKinsey. These systems can be complex and resistant to change, making it hard to connect new automation tools.

Data silos are another significant obstacle. When information is isolated across systems, it's difficult for automation to access the data it needs. In fact, data silos hinder 70% of automation initiatives. Security concerns also weigh on decision-makers, as new technology must protect sensitive policyholder data.

We overcome these challenges with several strategies. API-first tools allow for flexible integration. Phased implementation lets us start small and build confidence. Flexible platforms that work with existing infrastructure make the transition smoother.

Our article on P&C insurance IT systems provides more context on navigating these complexities.

How do you measure the ROI of P&C insurance automation?

Measuring the Return on Investment of automation is crucial. The benefits are measurable in several ways.

Cost savings are often the most visible metric. This includes reduced operational costs, lower claims processing costs, and decreased administrative expenses. AI can reduce regulation-related costs by 20-30% and processing costs by 50-65%. These savings compound as you automate insurance processes.

Productivity gains are another part of the story. Track metrics like claims processed per adjuster and reduced policy issuance times. Automated systems can process claims and applications four times faster than manual methods, meaning your team can handle more volume without adding headcount.

Customer satisfaction scores and retention rates reflect the policyholder experience. Faster resolution and more accurate information lead to happier customers. Accenture found that 74% of customers dissatisfied with claims handling considered changing providers.

Error reduction is also valuable. Fewer manual errors lead to less rework, improved data accuracy, and reduced financial losses. This saves money and protects your reputation.

By tracking these metrics, we can demonstrate how automation delivers tangible benefits. The ROI typically becomes evident within the first year and continues to grow.

Citations:

(1) McKinsey & Company. "Insurance productivity 2030: Reimagining the insurer for the future."

(2) Insurance Support World. "Automated Claims Processing – Why is it important for the insurers?"

(3) McKinsey & Company. "Time for insurance companies to face digital reality."

(4) Zapier. "State of Business Automation 2021."

(5) Agentech. Various internal articles and case studies.

Conclusion: Paving the Way for a More Efficient Future

We have covered a lot of ground together, and if there is one thing I hope you take away, it is this: the journey to automate insurance processes is about much more than implementing new technology. It is about reimagining how we serve our policyholders, support our teams, and build a sustainable future in the competitive P&C insurance landscape.

Throughout this guide, we have explored how automation drives operational efficiency, delivers significant cost savings, and dramatically improves customer satisfaction. We have seen how it transforms the claims experience from a stressful ordeal into a smooth, transparent process that builds loyalty and trust. These are not just theoretical benefits. They are real outcomes that P&C carriers, TPAs, and IA firms are achieving today.

The reality is that automation has moved from a nice-to-have to a necessity for staying competitive in P&C insurance. Manual workflows simply cannot keep pace with rising customer expectations, tighter profit margins, and the operational pressures facing our industry. The carriers and firms that accept automation now will be the ones that thrive in the years ahead.

Looking forward, future trends like Agentic AI promise even greater levels of autonomy and intelligence in how we handle P&C claims, underwriting, and back office operations. But here is what excites me most: these technologies are designed to augment human expertise, not replace it. They handle the administrative burden so our adjusters, underwriters, and customer service teams can focus on what humans do best: making complex decisions, showing empathy, and delivering personalized service.

Empowering your team is at the heart of successful automation. When we free our people from repetitive tasks, we give them the space to use their judgment, experience, and compassion. That is where the real magic happens in P&C insurance.

At Agentech, we have built our solutions with this philosophy in mind. Our Agentic AI platform is specifically designed for P&C carriers, TPAs, and IA firms who want to automate insurance processes without losing the human touch. We focus on seamless integration with your existing systems, boosting adjuster productivity, and changing your operations in ways that make sense for your business. If you are curious about how AI is addressing the broader challenges our industry faces, I encourage you to read about solving the insurance labor crisis with AI-driven innovation.

The path forward is clear. The technology is proven. The results speak for themselves. Now it is about taking that first step.

Take the next step: Discover how Agentech can transform your operations.

Citations:

- McKinsey. "Insurance Productivity 2030: Reimagining the Insurer for the Future."

- McKinsey Digital. "Intelligent Process Automation: The Engine at the Core of the Next-Generation Operating Model."

- McKinsey. "Time for Insurance Companies to Face Digital Reality: Digital Disruption in Insurance."

- Luxoft. "Automated claims processing: A full guide for forward-thinking insurers."

- Multimodal. "AI-Powered Insurance Document Automation: A Definitive Guide."