Why Manual Insurance Workflows Are Costing Your Business Millions

Insurance workflow automation software is changing how Property & Casualty (P&C) carriers, TPAs, and adjusting firms handle claims, underwriting, and compliance. Here's a brief overview:

Top Solutions for P&C Insurance Automation:

| Solution Type | Best For | Key Benefit |

|---|---|---|

| AI Powered Claims Platforms | Claims processing automation | Significant reduction in administrative work |

| No Code Workflow Builders | Business led automation | Fast deployment without IT overhead |

| Enterprise Integration Tools | Large carriers with legacy systems | Seamless data flow across platforms |

| Document Processing Systems | High volume document handling | High accuracy in data extraction |

What to Look For:

- Integration with existing claims management software and policy admin systems

- AI capabilities for intelligent document processing

- Security features meeting GDPR, HIPAA, and SOC 2 standards

- Scalability to grow with your business

- A clear path to ROI within the first year

The numbers tell a sobering story. P&C insurance carriers lose billions annually to fraud, manual errors, and operational inefficiencies. One major insurer lost $100 million in annual revenue due to slow manual workflows and unsearchable documents. Elsewhere, claims processing times swelled to 48 hours per claim, with adjusters spending 70% of their time on administrative tasks.

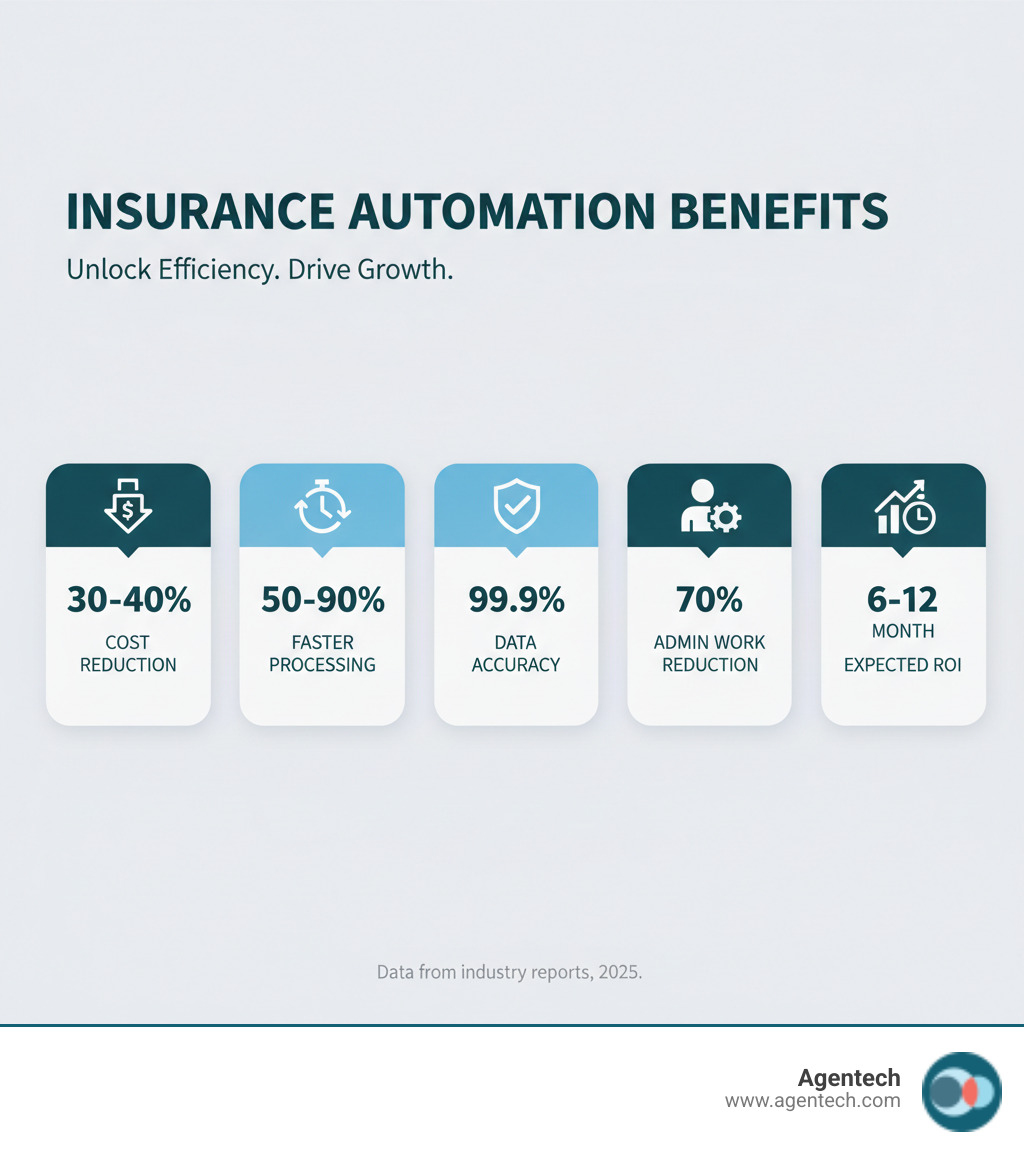

These are not isolated incidents. Across the P&C insurance industry, manual workflows create bottlenecks that hurt both the bottom line and customer satisfaction. The good news is that automation is no longer a luxury. Modern insurance workflow automation software can slash document processing time, reduce operational costs by 30-40%, and free up adjusters to focus on complex claims.

This shift is about giving your team better tools. When AI agents handle repetitive data entry and document classification, claims professionals can spend their time where it matters most: evaluating risk, detecting fraud, and building relationships.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance. After founding and scaling a successful tech company, I've focused on revolutionizing claims processing with insurance workflow automation software that delivers unprecedented speed and accuracy. In this guide, I'll explain how automation works and how to choose the right platform for your needs.

The High Cost of Manual Workflows and How Automation Helps

Behind the scenes at many P&C insurance operations, staff wade through mountains of paperwork, manually typing information from one system to another. It's exhausting, expensive, and unnecessary.

A Zapier study found that 88% of small and medium-sized businesses believe automation helps them compete with larger companies [1]. The playing field is leveling, and insurance workflow automation software is the great equalizer. Whether you're a regional carrier or a large TPA, automation provides access to the same efficiencies.

The benefits are tangible: improved accuracy reduces costly errors, lower operational costs boost your bottom line, and faster processing delights policyholders. Thoughtfully implemented P&C insurance back office automation can transform your operations from a cost center into a strategic advantage.

Challenges of Manual Insurance Workflows

The pain points of manual workflows appear in every important business metric.

- Slow Processing and Delays: A claim that should take hours can stretch into days. One provider found their manual workflows were so bogged down they couldn't find critical documents, with every incoming policy requiring multiple touchpoints and creating opportunities for error.

- Error Prone Data Entry: A simple typo in a policy number can cascade through claims and payment systems, creating hours of rework and frustrating a policyholder.

- Unsearchable Documents: When you can't find a specific endorsement or supporting document quickly, it's not just frustrating; it's a business risk, especially when regulators or customers need information.

- High Manual Intervention: Experienced claims adjusters and underwriters spend their days on low value work like copying and pasting information instead of evaluating complex liability or assessing risk.

- Inefficient Claims Processing: For a typical P&C carrier, a claim might take 48 hours to process before an adjuster even begins evaluation. That delay undermines the trust you work so hard to build.

How Automation Addresses These Challenges

Insurance workflow automation software eliminates these problems at their source.

- Streamlined Processes: Automation ingests, digitizes, and assembles all documents into searchable, compliant formats. Chaos becomes order, and manual effort drops dramatically.

- Reduced Administrative Work: When software handles data extraction and routing, your team is freed from repetitive tasks. One operation saw a 90% reduction in administrative work related to pre-processing claim documentation, allowing adjusters to focus on adjusting claims.

- Operational Budget Savings: That same operation slashed its operational budget by $6 million. These are typical results when you automate intelligently.

- Focus on High Value Tasks: When AI agents handle routine work, your people can focus on what they were hired for: claim approvals, fraud detection, and complex risk assessments. Job satisfaction improves, and so does the quality of decision making.

- Improved Customer Relationships: In P&C insurance, claims handling defines your brand. Fast, accurate, and transparent processing builds trust when it matters most.

Citations:

[1] State of Business Automation 2021

[2] P&C Insurance Back Office Automation

Core P&C Insurance Workflows Ripe for Automation

When considering automation for your P&C insurance operations, focus on the daily tasks that consume the most time and create the most frustration. Prime candidates include claims processing, policy underwriting, document management, and compliance checks.

These are areas where insurance workflow automation software delivers measurable results right away for carriers, TPAs, and Independent Adjusting Firms.

Streamlining Claims Processing from FNOL to Settlement

Claims processing is where automation truly excels. The journey begins with the First Notice of Loss (FNOL). Modern insurance workflow automation software automatically captures claim details from any channel—email, web form, or transcribed call—without manual data entry.

Supporting documents like police reports, repair estimates, and medical records are automatically digitized. Advanced optical character recognition and intelligent document processing extract key information with high accuracy, making it immediately available to adjusters. The system can then triage claims based on predefined rules, routing simple claims for straight-through processing and complex ones to specialized teams.

AI powered analytics can also spot patterns that indicate potential fraud by analyzing historical and real-time data. This proactive approach helps prevent losses. For a typical P&C insurance company, automated document processing can slash processing times from 48 hours to under 30 minutes per claim, with 99.9% accuracy. Explore more about this change in our article on AI Claims Processing for P&C Insurance.

Accelerating Policy Underwriting and Risk Assessment

Policy underwriting is traditionally a slow process of gathering documents and manually assessing data points. Automation platforms, combined with tools like Optical character recognition, transform this workflow. Information is gathered seamlessly from online applications, and the system automatically extracts data into a standardized risk assessment model.

This consistency leads to fairer, more accurate underwriting decisions and reduces unconscious bias. By automating document intake, underwriters escape tedious administrative work, leading to significant cost reductions and shorter cycle times. This frees them to focus on complex cases, and for brokers and policyholders, faster policy issuance creates a better experience.

Automating Document Management and Regulatory Compliance

Document management in P&C insurance can be overwhelming. Automation is essential for organizing the chaos. A centralized, searchable repository for all documents, organized with metadata and smart tagging, eliminates frantic searches for files.

Every action in an automated system creates an immutable audit trail, which is invaluable for regulatory inquiries. Robust security measures, including encryption and access controls, protect sensitive information. With hundreds of regulatory updates occurring daily, manual compliance is nearly impossible. Automation helps you stay ahead of requirements like GDPR, HIPAA, and GLBA, providing real-time monitoring and alerts that dramatically reduce the risk of costly violations.

Learn more about balancing innovation with these requirements in our article on AI in P&C Insurance: Balancing Innovation and Regulation.

Citations:

[1] AI Claims Processing for P&C Insurance

[2] Optical character recognition

[4] metadata

[5] AI in P&C Insurance: Balancing Innovation and Regulation

Key Features of Top Insurance Workflow Automation Software

When evaluating insurance workflow automation software, certain features are non-negotiable for P&C carriers, TPAs, and Independent Adjusting Firms. The best platforms deliver on six fronts: integration, scalability, security, AI capabilities, user experience, and customization.

Let's explore what matters most in the key areas.

Seamless Integration with Existing Insurance IT Systems

New technology often fails because it doesn't integrate with existing systems. Many P&C insurance companies depend on critical legacy systems that cannot be easily replaced. The right insurance workflow automation software must have robust API capabilities to act as a bridge between new tools and your core claims software or policy administration systems.

Effective integration prevents data silos, ensuring information flows freely and consistently. This harmonized data approach eliminates redundant data entry and gives everyone a complete, up-to-date picture. To understand how these pieces fit into your broader technology ecosystem, see our article on P&C Insurance IT Systems.

The Role of AI and Machine Learning in Modern insurance workflow automation software

AI and machine learning are what separate basic automation from intelligent automation. In modern insurance workflow automation software, AI can make decisions, learn from experience, and improve over time.

Consider Agentic AI: autonomous agents that can understand context, take action, and learn from interactions. An AI system can handle your entire claims intake process, from reading the FNOL to routing it to the right adjuster. Intelligent data extraction, powered by Natural Language Processing (NLP), allows the software to comprehend the meaning in claims notes and policy documents.

Predictive analytics helps you forecast trends and spot risks, like potential fraud, before they become problems. At Agentech, our AI assistants handle repetitive administrative tasks, freeing your adjusters to focus on complex claims that need human judgment. We give your team superpowers. For a deeper look, read our insights on P&C Insurance Claims Machine Learning.

Essential Security and Data Privacy Features

In P&C insurance, you handle incredibly sensitive information. A data breach is catastrophic, with potential recovery costs running into the millions, not to mention severe regulatory fines from bodies governing HIPAA and GDPR.

Top-tier security is a must. Look for these essential features in any insurance workflow automation software:

- Data Encryption: Protects data both at rest (in storage) and in transit (while moving between systems).

- Role Based Access Controls (RBAC): Ensures users can only access the information and tools necessary for their jobs.

- Multi Factor Authentication (MFA): Adds a critical layer of security to prevent unauthorized access.

- Threat Detection and Monitoring: Actively monitors for suspicious activity and provides automated alerts to notify you of potential issues immediately.

- Detailed Audit Trails: Logs every action for compliance, investigations, and accountability.

- Compliance Certifications: Adherence to standards like GDPR, HIPAA, GLBA, and SOC 2 is non-negotiable.

These features are the foundation that allows you to adopt automation confidently. See how we balance efficiency with security in our Hybrid AI Solution for P&C Claims Automation.

Citations:

[2] Agentic AI

[4] P&C Insurance Claims Machine Learning

[5] Hybrid AI Solution for P&C Claims Automation

A Comparative Look at Insurance Workflow Automation Software Solutions

Finding the right insurance workflow automation software for your P&C insurance operation involves matching a solution to your specific needs. The market offers a range of options for carriers, TPAs, and Independent Adjusting Firms.

Understanding Different Types of insurance workflow automation software

Different solutions serve different purposes. Here’s a quick breakdown:

- No Code/Low Code Platforms: Allow business users to build simple workflows with visual interfaces, sometimes with the option to add custom code for more complex logic.

- Enterprise Grade Suites: Comprehensive solutions for large organizations, covering multiple business functions but often requiring significant IT involvement.

- API Led Integration Tools: Specialize in connecting disparate systems, which is crucial in P&C insurance where legacy P&C insurance systems are common.

- Specialized AI Solutions: Use advanced AI to handle cognitive tasks like intelligent document processing and fraud detection, often delivering the most dramatic results for data-heavy operations.

Choosing the Right Solution for Your Business Needs

Selecting software is about finding the best fit. Focus on these key evaluation criteria:

- Scalability: Can the software grow with your business? Cloud-based solutions often offer more flexibility to scale with demand.

- Cost: What is the total cost of ownership? Consider subscription fees, maintenance, and integration costs. Pay as you go models can be smart for growing firms.

- Integration: Does it connect seamlessly with your existing core claims software and policy admin systems? Robust API capabilities are essential.

- Industry Specificity: Is it built for P&C insurance workflows? Generic platforms don't understand the nuances of FNOL, claim approvals, or ACORD forms.

For instance, specialized platforms like Agentech focus on AI Powered Claims Automation with Digital Agents. Our AI agents handle repetitive administrative tasks in claims processing, which is ideal for carriers and TPAs looking to boost adjuster productivity without replacing human decision making.

Best Practices for Implementation and Adoption

Choosing the software is only half the battle. Successful implementation is key.

- Assess and Document: Thoroughly map your existing workflows to identify bottlenecks and opportunities for automation.

- Start with a Pilot: Begin with a small, high-impact project to test the solution and demonstrate early wins.

- Train Your Staff: Comprehensive training is essential. Emphasize how automation will augment their roles, not replace them.

- Use a Phased Rollout: Gradually expand automation across departments to allow your team to adapt without feeling overwhelmed.

- Measure and Optimize: Define key performance indicators (KPIs) beforehand and continuously track metrics like processing times, error rates, and cost savings to optimize performance.

For guidance on whether to build a custom solution or buy claims software, read our article on Buy vs. Build: Navigating the SaaS AI Technology Decision.

Citations:

[1] legacy P&C insurance systems

[2] AI Powered Claims Automation with Digital Agents

[3] Buy vs. Build: Navigating the SaaS AI Technology Decision

Frequently Asked Questions about Insurance Automation

We talk to P&C carriers, TPAs, and Independent Adjusting Firms every day about insurance workflow automation software. Here are answers to the most common questions.

How does automation improve customer experience in P&C insurance?

Insurance workflow automation software transforms the customer experience from one of waiting and wondering to one of speed and transparency. When claims processing is faster, policyholders get settlements sooner. Real-time status updates and self-service portals allow customers to file claims and check progress on their own schedule.

As industry analysts note, providing on-demand experiences is imperative. Automation makes this possible by enabling faster, more personalized communication without requiring your team to work around the clock. The result is happier policyholders who are more likely to renew and refer others.

What is the impact of automation on operational costs and efficiency?

This is where automation truly shines for P&C insurance operations. By automating repetitive tasks like data entry and document routing, you free up your staff to focus on complex work that requires human judgment. Automated processes are also more accurate, slashing the costs associated with fixing manual errors.

Industry reports suggest that automation can significantly cut operating costs, with AI powered solutions delivering the deepest savings. Most firms see a return on their investment in automation claims software within the first year. This efficiency allows your operation to handle more volume without proportionally increasing costs, creating room to grow and compete.

How can small to medium sized P&C insurance firms benefit from workflow automation?

Automation is no longer just for large enterprises. In fact, a Zapier study found that 88% of small and medium-sized businesses believe automation helps them compete with larger companies [1]. The playing field is more level than ever.

For smaller P&C carriers, TPAs, and adjusting firms with leaner teams, automation is especially valuable. It allows you to handle more claims and policies without hiring additional staff, reducing administrative overhead. Insurance workflow automation software also provides the scalability to grow your business without breaking your budget. The consistency and quality that automation brings helps build the trust and loyalty essential for long-term growth.

At Agentech, our AI powered automation is designed with this in mind, boosting productivity without requiring massive IT resources or replacing the human expertise that makes your firm special.

Citations:

[1] Zapier. "State of Business Automation 2021." https://zapier.com/blog/state-of-business-automation-2021/

[2] Agentech. "Insurance Back Office Automation." https://www.agentech.com/resources/articles/insurance-back-office-automation

Conclusion

The P&C insurance industry is at a turning point. Manual workflows are giving way to intelligent automation that helps us work smarter, faster, and more accurately.

Throughout this guide, we've seen how insurance workflow automation software solves real problems. It cuts costs, streamlines claims processing and underwriting, and leverages AI to handle complex tasks—all while keeping data secure and operations compliant.

The results speak for themselves: operational costs drop, claims that took days now process in minutes, and adjusters are freed from paperwork to focus on high-value work. Small and medium sized firms can compete more effectively, and customer satisfaction rises.

Most importantly, automation is not about replacing your people; it is about empowering them. When AI agents handle routine work, your team can focus on the complex claims, nuanced risk assessments, and customer relationships that build loyalty.

The trends are clear: AI will become more sophisticated, and customer expectations will continue to rise. The firms that thrive will be those that accept these changes now.

The question is not whether to automate, but how quickly your organization will adapt. Every day you wait is a day your competitors move ahead.

At Agentech, we built our platform for P&C insurance carriers, TPAs, and Independent Adjusting Firms. Our AI agents integrate seamlessly with your existing systems, working 24/7 to handle repetitive tasks while your adjusters focus on what matters. We do not replace human decision making; we improve it.

Ready to transform your claims processing? Find out how Agentic AI in P&C Insurance: When Bots Become Your Best Agents is reshaping the industry. Learn more about our solutions.

The future of P&C insurance is automated, intelligent, and human centered. Will you lead the change or follow it?

Citations:

[1] Agentic AI in P&C Insurance: When Bots Become Your Best Agents