Why AI Administrative Automation is Changing P&C Insurance Claims

AI administrative automation uses artificial intelligence to handle repetitive administrative tasks, freeing your team for more complex work. For P&C insurance carriers, TPAs, and IA firms, this technology can automate data entry from FNOL forms, extract information from accident reports, route claims, generate reports, and process invoices.

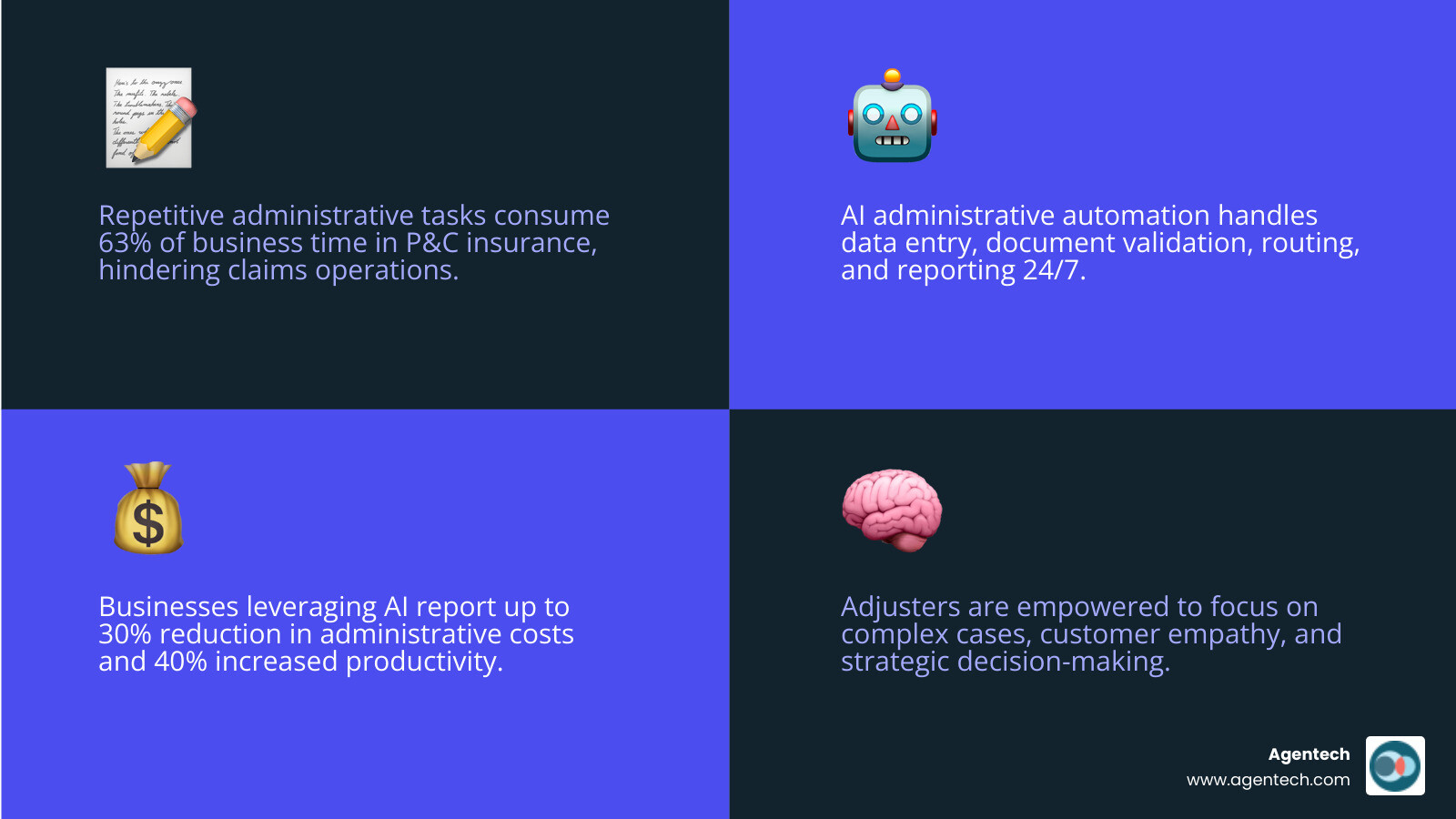

This is critical because a significant portion of business tasks are administrative. For busy claims managers in Property & Casualty insurance, this burden slows down operations. Your adjusters spend hours on data entry and document processing when they could be negotiating settlements or investigating complex claims.

Unlike rigid, rule based systems, modern AI uses machine learning to understand context, handle exceptions, and improve over time. It can read a handwritten report, extract key details, and populate your claims management software, flagging inconsistencies for human review. The impact is significant, with organizations reporting up to a 30% reduction in administrative costs and 40% increases in productivity. This translates to faster claim cycle times and lower loss adjustment expenses.

I'm Alex Pezold, founder of Agentech AI. We are building an AI workforce for P&C insurance claims processing, leveraging ai administrative automation to transform how carriers, TPAs, and adjusting firms manage the paperwork that slows down every claim.

The illustration above shows how AI administrative automation transforms P&C insurance workflows: manual tasks like FNOL data entry, document processing, vendor assignment, and invoice management become automated processes that run 24/7, resulting in faster claim settlements, reduced LAE, improved accuracy, and adjusters focused on high value work like complex case analysis and customer service.

Understanding AI Automation vs. Traditional Methods

Traditional automation follows rigid if then rules. It is precise but inflexible, grinding to a halt when it encounters unexpected data, like an FNOL form with a new field. It requires everything to be perfectly aligned to function.

AI administrative automation is different. It learns and adapts to the messy reality of real world documents, such as handwritten reports and varied invoice formats. This is possible through a combination of core technologies. Machine learning allows AI to learn from past P&C insurance claims, natural language processing helps it understand human language, and predictive analytics uses historical data to forecast future events, like estimating repair costs or litigation risk. These capabilities allow AI to read an unstructured accident report, extract relevant details, and flag inconsistencies without human intervention. To understand how these technologies work together in practice, you can explore more info about how it works.

How AI Differs in an Administrative Context

The true advantage of AI is how it handles the exceptions that are common in claims administration. AI brings cognitive capabilities that mirror experienced adjusters. It understands context, not just keywords, grasping the relationships between events and likely damages in an accident report. This allows it to provide decision making support, such as flagging a claim with characteristics of fraud or suggesting an optimal repair vendor.

Most importantly, AI continuously improves by learning from every document it reads and every decision it supports. When it encounters something it cannot handle, it handles exceptions by routing the issue to a human adjuster with full context. This intelligent escalation ensures your team focuses only on cases that truly need their judgment.

Primary Administrative Tasks AI Can Automate

AI administrative automation can have an immediate impact on numerous repetitive tasks in claims administration.

- Data entry and validation: AI extracts and cross references data from FNOL forms, medical bills from injury claims, and policy documents, catching inconsistencies automatically.

- Document processing and classification: AI identifies, sorts, and routes incoming documents like accident reports and repair estimates to the correct adjuster and file.

- Email and communication management: AI can draft routine responses, summarize long email threads, and schedule follow up communications.

- Scheduling and calendar coordination: AI arranges inspections, appraisals, and interviews by finding convenient times and managing invitations and reminders.

- Report generation: AI automatically pulls data from multiple sources to create claim summaries, trend analyses, and compliance reports.

- Invoice processing: AI extracts invoice details, matches them to service records, verifies accuracy, and initiates payment workflows, flagging discrepancies for review.

Our virtual AI assistants are built to handle these tasks, allowing your adjusters to focus on high value work. You can learn more about them in Virtual AI Assistants for P&C Insurance: Meet Your New Best Friend.

Citations:

- Medium. (2024). "The Role of AI in Automating Administrative Tasks".

- Agentech. "How It Works".

- Agentech. "Virtual AI Assistants for P&C Insurance: Meet Your New Best Friend".

The Transformative Benefits of AI in Administrative Roles

Imagine your claims adjusters starting their day with routine data entry and document sorting already completed. Instead of drowning in paperwork, they can immediately focus on investigating complex claims and negotiating fair settlements. This is what ai administrative automation delivers to P&C insurance operations today.

The benefits are transformative. Organizations using AI administrative automation report administrative costs dropping by up to 30% and productivity jumping by 40%. For P&C carriers, TPAs, and IA firms, this means faster claim settlements and lower loss adjustment expenses. More importantly, your skilled adjusters stop being data entry clerks and become the expert investigators and negotiators they were trained to be.

Boosting Efficiency and Productivity

Efficiency in a P&C claims operation means having your talented people focus on work that requires human judgment. Automating routine work like data entry and claim routing is the first step. AI operates 24/7 without breaks, processing claims as they arrive, not just during business hours. This around the clock operation dramatically reduces claim cycle times.

When AI handles the administrative burden, each adjuster can manage more claims without working longer hours. This increased capacity helps address the staffing challenges in the P&C insurance industry, allowing you to do more with your existing team. For more on this, see our article on Solving the P&C Insurance Labor Crisis with AI-Driven Innovation.

Achieving Cost Savings and Higher Accuracy

AI administrative automation delivers significant cost savings. By minimizing human error in data entry, AI eliminates the costly rework and delays that follow. AI systems perform tasks with near perfect accuracy, ensuring consistency and preventing mistakes.

This directly contributes to lowering Loss Adjustment Expense (LAE). When administrative tasks are automated, claims move through the system faster with fewer touches, reducing the cost per claim. Furthermore, AI improves compliance adherence by ensuring every process follows regulatory requirements, helping you avoid expensive penalties and legal issues.

These savings come from faster processing, fewer errors, and adjusters focused on high value work. Our AI solutions are designed with adjusters in mind to solve their real world challenges. Learn more about our approach at AI Designed with Adjusters in Mind.

Citations:

- Artefact & Odoxa (2025). The Future of Work with AI.*

Datamatics Global Services: Annual Report 2023-24.

A Practical Guide to AI Administrative Automation in Your Business

Implementing ai administrative automation requires a strategic approach. The most successful projects begin with a thorough workflow analysis to identify bottlenecks, repetitive tasks, and sources of error. These pain points are often hiding in plain sight, such as manual data entry from medical bills or scheduling back and forth via email.

Once you have identified these areas, focus on processes that are high volume, repetitive, and rule based. These are the sweet spots where AI delivers immediate value. We recommend starting small with a focused pilot project, such as automating FNOL data entry for auto claims. A successful pilot demonstrates quick wins and builds enthusiasm for broader adoption.

Identifying the Right Processes for AI Administrative Automation

For P&C insurance operations, several administrative processes are ideal for automation.

- First Notice of Loss (FNOL) intake: AI can automatically extract data from various sources (emails, web forms), verify it against policy records, and populate your claims management software in seconds.

- Claims data entry: Throughout the claim lifecycle, AI can read documents like appraisal reports and medical records, automatically updating the relevant fields for an adjuster to review.

- Policy information verification: AI instantly cross references claim details with policy data, flagging coverage questions for human review.

- Medical bill review: For injury claims, AI can review complex medical bills for accuracy, coding compliance, and duplicate charges.

- Vendor assignment: AI can intelligently assign the right adjuster or contractor based on claim type, location, severity, and workload.

These processes are just the beginning. Our AI Claims Processing System and solutions for P&C Insurance Back Office Automation are built to handle these tasks and more.

Effective AI Tools and Platforms for Administrative Tasks

The AI landscape offers several categories of tools relevant to P&C insurance administration.

- Intelligent Document Processing (IDP): These platforms use AI to extract and validate data from structured and unstructured documents, like FNOL forms and handwritten notes.

- AI powered scheduling tools: These tools go beyond finding open slots to analyze availability and suggest optimal times for inspections and interviews.

- Communication management platforms: AI can draft routine emails, summarize threads, and manage follow ups, ensuring consistent communication.

- No code automation platforms: These user friendly platforms allow your claims team to build and deploy AI workflows with drag and drop interfaces.

- Data analytics and reporting tools: AI powered analytics can identify trends, generate reports, and predict outcomes like claim severity or fraud probability.

Our AI Agents for P&C Insurance integrate many of these capabilities. They are trained specifically on P&C insurance workflows to work alongside your adjusters as digital teammates, handling administrative tasks so your team can focus on what they do best.

Citations:

- World Economic Forum. (2025). "AI agents are revolutionizing administration for businesses".

- Medium. (2024). "The Role of AI in Automating Administrative Tasks".

Best Practices for Integrating AI into Your Workflows

Successfully integrating ai administrative automation is about people and processes, not just technology. The best implementations prioritize change management, maintain human oversight, set clear objectives, measure ROI, plan for scalability, and create continuous feedback loops.

Think of it as a partnership between humans and machines. Your adjusters bring empathy and experience, while our AI brings speed and consistency. When these strengths work together, the results are transformative.

Ensuring Data Security in AI Administrative Automation

Protecting sensitive policyholder data is a regulatory and ethical imperative in P&C insurance. A secure AI implementation is non negotiable.

- Data privacy: Adhere to rigorous data protection measures and comply with regulations like GDPR and CCPA.

- End to end encryption: Protect all data, both at rest and in transit, with robust encryption protocols to prevent unauthorized access.

- Access controls: Implement strict, role based access controls to ensure personnel and AI systems only access data necessary for their function.

- Compliance with regulations: Regularly audit your AI systems and data handling processes to ensure ongoing compliance with industry specific regulations like HIPAA.

- AI model bias: Mitigate bias by using diverse training data, regularly auditing models, and maintaining human oversight to correct unfair outcomes.

Prioritizing security builds trust with policyholders and protects the integrity of your operations.

Training Your Team and Fostering Adoption

The success of ai administrative automation depends on your team's adoption of the new tools. Our approach focuses on empowering your team, not replacing them.

Start with AI literacy, providing practical training on how the technology will benefit daily tasks. Focus on upskilling staff for more strategic work like complex case analysis and negotiation, which become more central as AI handles routine tasks. It is crucial to highlight benefits for employees, emphasizing how automation frees them from mundane work and reduces burnout.

Creating internal champions who are early adopters can help guide colleagues and overcome skepticism. Finally, overcome resistance to change with transparency. Involve employees in the process of designing new workflows so they feel like partners in the transition. This collaborative approach is key to building an Agentic AI workforce that works seamlessly with your team. Learn more at Agentic AI in P&C Insurance: When Bots Become Your Best Agents.

Citations:

- Artefact & Odoxa (2025). The Future of Work with AI.

- World Economic Forum. (2025). "AI agents are revolutionizing administration for businesses".

The Evolving Role of the Administrative Professional

The adoption of ai administrative automation is not about job replacement; it is about job evolution. AI excels at repetitive, rule based tasks, but it cannot replicate the invaluable human skills that make your team irreplaceable: communication, creative problem solving, and emotional intelligence.

As AI takes over mundane work, administrative roles in P&C insurance are shifting toward more strategic tasks. Your team can focus on process optimization, vendor relationship management, and resolving complex issues that require human intuition. This evolution also means a greater focus on complex problem solving, as AI can flag anomalies but requires a human to investigate the "why" and devise a solution.

Communication and emotional intelligence become even more critical. With AI handling routine data processing, your team has more time for meaningful interactions with policyholders during difficult times. This "human in the loop" approach, where AI handles the heavy lifting and humans provide oversight and judgment, ensures both efficiency and empathy. These "soft skills" are what truly set your team apart. To understand the full scope of this change, we invite you to read The Future of P&C Insurance: How AI is Changing the Game.

Future of Administrative Jobs and AI Collaboration

Looking ahead, AI will become a true digital coworker. We are moving toward hyperautomation, which combines AI with other technologies to create seamless, end to end automation of entire business processes. Imagine a claim moving from FNOL to initial assessment with AI handling the administrative workflow, freeing adjusters for investigation and negotiation.

Our AI agents are designed to integrate into your existing claims management software, learning from interactions to autonomously perform tasks. This creates a partnership where AI handles routine operations while your human team focuses on strategic insights. The shift from generative AI to agentic AI means these systems can not only generate content but also execute tasks and make decisions within defined parameters. This evolution is explored further in Transforming P&C Insurance Claims: The Evolution from Generative AI to Agentic AI.

The administrative professionals who accept AI as a collaborative partner will find their roles more strategic and valuable than ever before.

Citations:

- Artefact & Odoxa (2025). The Future of Work with AI.

- World Economic Forum. (2025). "AI agents are revolutionizing administration for businesses".

Frequently Asked Questions about AI Administrative Automation

Here are answers to the questions we hear most often about implementing ai administrative automation in a P&C insurance operation.

Do I need technical skills to set up AI automations?

No. Modern AI platforms are built for business users, not developers. With no code platforms, you can build powerful automations using user friendly, drag and drop interfaces. Many systems also offer pre built templates for common P&C insurance tasks like FNOL intake or vendor assignment. Your knowledge of the claims process is far more important than any coding skill.

Can AI assistants adapt to specific business workflows and learn over time?

Yes. This is a key advantage of AI over traditional automation. Powered by machine learning models, AI assistants continuously learn from new data and user interactions. Through feedback loops, where your team can correct or refine the AI's work, the system becomes progressively more accurate and aligned with your specific business rules and terminology. It can even be fine tuned on your proprietary data for optimal performance.

Will AI take over administrative jobs in the P&C insurance industry?

No, AI will transform administrative jobs, not eliminate them. AI handles the repetitive tasks like data entry and document sorting, which frees your team for more meaningful work. This allows adjusters to focus on negotiation, complex case analysis, and customer empathy—work that requires human judgment and emotional intelligence.

Think of AI as a tool that augments human intelligence. The most effective P&C insurance operations will be those where humans and AI work as partners. The AI provides speed and consistency, while humans provide judgment and strategic thinking. This collaboration makes existing jobs more rewarding and your entire operation more effective.

Conclusion

The move to ai administrative automation is about reclaiming time, reducing costs, and empowering your P&C insurance team. We have seen how AI's cognitive capabilities and continuous learning offer a powerful alternative to traditional automation, handling the daily grind of data entry, document processing, and reporting.

The benefits are clear: up to 30% reduction in administrative costs, faster claim cycles, and improved accuracy. This allows your adjusters to focus on complex investigations and the empathetic interactions that policyholders need.

The path forward involves strategically identifying processes for automation, using the right tools, and fostering a culture of collaboration between your team and the technology. This is not about replacing people but about elevating their roles to be more strategic and impactful.

At Agentech, our AI agents are built for the P&C insurance industry. They integrate with your existing claims management software to provide always on assistance, amplifying your team's capabilities. The future of claims processing is a partnership where humans and AI work together to create operations that are faster, smarter, and more human.

Explore how Agentech can transform your claims administration

Citations:

- Artefact & Odoxa (2025). The Future of Work with AI.

- Datamatics Global Services: Annual Report 2023-24.

- FlowForma. (2025). "7 AI Automation Examples to Apply in Your Own Business".

- Jotform. (2025). "Top 10 AI tools for administrative tasks".

- Lindy.ai. (2025). "AI for Administrative Tasks: 8 Time-Saving Automations You Should Use".

- Medium. (2024). "The Role of AI in Automating Administrative Tasks".

- Medium. (2024). "AI for managing administrative tasks".

- Nova Mundi. (2025). Research on automation use cases.

- OpenAI Community. (2024). "How I built 'AdminGPT', an AI-powered administrative assistant using OpenAI's Assistant API".

- OpenStudio. (2024, 2 september). When AI Revolutionizes Administrative Management.

- TalentHR. (2025). "9 HR Tasks You Can Automate with AI".

- Tanka.ai. (2025). "AI Administrative Assistant: Efficient Office Support".

- Tupsakhare, P. (2025). Intelligent Automation: Integrating AI and RPA for Smarter Processes. International Journal on Science and Technology (IJSAT), Vol. 16, Issue 1, Jan–Mar 2025.

- Viridem. (2025). "AI and Intelligent Automation: A Strategic Lever for Changing Accounts Payable Automation".

- World Economic Forum. (2025). "AI agents are revolutionizing administration for businesses".