Why Modern Back Office Systems Matter for P&C Insurance Operations

Insurance back office software is the operational backbone for Property & Casualty (P&C) insurance carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) firms, powering policy administration, claims management, and accounting.

Core Functions of Insurance Back Office Software:

- Policy Management: Handle endorsements, renewals, and midterm adjustments (MTAs) across residential property, auto, pet, and workers' compensation lines.

- Claims Processing: Automate workflows from First Notice of Loss (FNOL) through settlement and reserve management.

- Financial Operations: Manage premium collections, carrier settlements, commission tracking, and month end close.

- Document Control: Centralize all policy and claims documentation with version tracking and secure storage.

- Integration Capabilities: Connect with CRM systems, carrier platforms, and other tools via an API driven architecture.

The challenge for most claims managers is clear. Manual data entry consumes hours, workflows break down between systems, and claim settlements drag on. Modern back office platforms solve these problems by creating a single source of truth for all policy and claims data. Research shows that leading P&C insurers implementing these systems achieve dramatic results, including significant cost reductions, near perfect straight through processing rates, and ROI exceeding 500% in some cases.

The difference between operational excellence and constant firefighting often comes down to the technology running behind the scenes.

I'm Alex Pezold, founder of Agentech AI, where we are building the AI workforce for P&C insurance. After founding and scaling a successful technology company, I have focused on changing P&C operations through insurance back office software powered by AI, starting with claims automation for carriers and TPAs. My experience in building scalable technology solutions now drives our mission to help P&C insurance organizations process claims with speed and accuracy.

Core Functionalities and Their Impact on Efficiency

Think of insurance back office software as the engine room of your P&C insurance operation. While front office teams interact with policyholders, the back office is where policies are administered, claims are processed, and finances are managed. For carriers, TPAs, and IA firms handling residential property, auto, pet, and workers' compensation lines, this is where operational excellence is won or lost.

The real magic comes from having a single source of truth for all your data. When information lives in one place and flows automatically, you eliminate the endless cycle of data reentry. Errors drop, and your team stops wasting time on redundant tasks to focus on work that matters.

The numbers tell a compelling story. Some P&C insurers have transformed their operations with modern back office technology, achieving a 60% cost reduction while pushing their straight through processing rate from 80% to 98%. These are not just impressive statistics; they represent fewer frustrated policyholders and a healthier bottom line.

Streamlining the Entire Policy Lifecycle

Policy administration for P&C lines like residential property, auto, pet, or workers' compensation involves a continuous cycle of endorsements, renewals, and midterm adjustments (MTAs). Each change requires careful attention, and that is where modern back office platforms shine.

Good insurance back office software automates the creation and management of policy documentation. Enter the data once, and the system handles the rest, eliminating rekeying and ensuring accuracy across systems. Renewals become almost effortless as the system monitors the cycle, sends alerts, and can even flag opportunities for cross selling or upselling.

MTAs and endorsements, which often create administrative bottlenecks, flow smoothly through automated workflows. Policy changes are reflected immediately and accurately, allowing your team to spend less time on paperwork and more time ensuring policyholders have the coverage they need.

Enhancing Claims Management from FNOL to Resolution

Claims management is where the rubber meets the road in P&C insurance. Your ability to process a claim quickly and accurately defines your relationship with a policyholder.

Insurance back office software and dedicated claims management software transform the claims journey from First Notice of Loss (FNOL) through final resolution. Modern systems use automated document review to instantly scan and analyze claim documents, speeding up initial triage and helping identify costly claims early. For a deeper look at how this works, check out our article on AI Claims Processing System.

Your adjusters get intuitive dashboards with instant access to each customer's complete claim history. They can manage reserves, track movements, and handle the settlement process without jumping between systems. This leads to faster decisions and better outcomes. The financial impact is real, with some carriers saving millions by optimizing providers and lowering claim duration through better claims management software.

Mastering Financial Operations and Accounting

Behind every policy and claim sits a complex web of financial transactions. Premium collections, commission tracking, and carrier settlements must happen accurately and on time to avoid reconciliation nightmares.

Modern back office platforms handle these financial operations with specialized accounting designed for P&C insurance. Many systems feature a dynamic, dual entry ledger built around insurance transactions, ensuring accuracy and transparency. Automation extends to tasks like currency conversion and cash matching, reducing the finance team's workload. Month end close processes that once took days can now take hours.

When your accounting is built for the P&C insurance industry, your financial teams can work efficiently. You get faster closes, more accurate financial statements, and the confidence to make strategic decisions based on reliable data.

The Strategic Impact of Insurance Back Office Software

The P&C insurance world is changing fast. Insurance back office software is no longer just about keeping the lights on; it has become a strategic weapon for carriers, TPAs, and IA firms that want to stay ahead.

Digital change in P&C insurance means fundamentally rethinking operations. Organizations that adopt modern back office platforms can make decisions based on real data, not gut feelings. This shift from reactive to proactive operations changes everything, from how residential property policies are priced to how complex workers' compensation claims are handled.

The strategic value goes beyond processing policies or claims faster. It is about seeing patterns that were previously invisible, understanding true profitability, and identifying bottlenecks before they become problems. This level of insight empowers organizations to innovate faster, adapt to market shifts, and deliver an experience that builds policyholder loyalty.

How AI and Automation Drive Unprecedented ROI

Let us talk numbers, because the ROI story around AI and automation in insurance back office software is genuinely remarkable. We are not talking about marginal improvements, but figures that command attention.

Case studies show that streamlining operations with modern back office software can lead to a 60% cost reduction. Some mid sized P&C carriers have saved millions by lowering litigation rates and medical expenses. In some instances, clients have seen ROIs exceeding 500%. These results happen when you automate the repetitive tasks that bog down talented professionals.

Think about the hours your team spends on data entry and document processing. Our AI powered automation tools are designed to handle these kinds of administrative tasks. This means your adjusters can focus on complex cases that need human judgment and empathy. For a deeper look, check out our article on Insurance Back Office Automation.

The beauty of AI automation is that it learns and improves over time, catching errors and working around the clock. This is not about replacing your team; it is about giving them superpowers. Learn more about where this is all heading in The Future of Insurance: How AI is Changing the Game.

Improving Data Analytics for Smarter Business Insights

Data is everywhere in P&C insurance. The challenge is making sense of it all. Modern insurance back office software transforms this flood of information into actionable insights that drive smarter decisions.

A robust back office platform gives you a 360 degree view of your P&C insurance portfolios. You can see which residential property policies are most profitable or which auto claims tend to drag on the longest. This comprehensive visibility moves you beyond guesswork and into data driven strategy.

Advanced analytics built into these systems enable predictive analytics, helping you forecast trends. You can spot patterns that indicate fraud risk, identify growth opportunities, and benchmark your performance against industry standards. The right platform provides graphical business insights from existing management system data, targeting areas to boost employee productivity and focus on profitable relationships.

Leading agencies understand this. Many of the top agencies on the Business Insurance Top 100 List rely on modern technology to drive their success. They know that better data leads to better pricing, underwriting, and claims outcomes across all lines, from pet insurance to workers' comp.

Ensuring Seamless Integration and Data Flow

Every P&C insurance professional knows the frustration of information locked in another system. Data silos hurt efficiency and create errors. Modern insurance back office software solves this through seamless integration and smooth data flow.

API driven architecture is the key. This means your back office system can talk to other systems automatically. Your CRM, carrier platforms, and document management tools can all connect and share information without manual intervention. When a customer updates their address in one system, that change flows everywhere it needs to go instantly.

This connectivity is crucial for achieving Straight Through Processing (STP), where transactions flow from start to finish without human touch. Imagine a simple endorsement that updates automatically across policy, billing, and carrier systems. Breaking down data silos means your team spends less time hunting for information and more time using it. This level of integration transforms how quickly you can respond to market demands and serve your policyholders.

A Practical Guide to Choosing Your Solution

Selecting the right insurance back office software is a critical decision. Getting it right can transform your entire operation, while getting it wrong can cost time, money, and sanity. With a clear understanding of your needs and the right evaluation framework, you can make a choice that sets you up for long term success.

Defining Your Needs: Core vs. Specialized Insurance Back Office Software

Before comparing features, honestly assess what you need. A large P&C carrier handling residential property and auto insurance has different requirements than a TPA focused on workers' compensation claims. An IA firm processing pet insurance might need something else entirely.

Think about your daily operations. If you are drowning in policy endorsements, robust policy administration is a priority. If your claims team is struggling with FNOL processing, you will want claims management software that excels in automation. If you are a TPA needing to connect with multiple carrier systems, integration is your top priority.

Scalability also matters. Your software platform needs to flex with fluctuating policy volumes and evolving business needs. This is where the Buy vs. Build: Navigating the SaaS AI Technology Decision question often comes into play, particularly for highly specialized requirements.

Critical Selection Criteria

Once you understand your needs, you can evaluate potential solutions against criteria that matter. Here is what separates great insurance back office software from the merely adequate:

- System Scalability and Flexibility: You need a platform that handles current volume but can also accommodate growth. Look for modularity and customization options that let you adapt workflows to your unique processes.

- Security and Compliance: Your chosen solution must meet stringent standards like SOC 2 Type 2 and comply with regulations such as CCPA. Protecting sensitive policyholder data is non negotiable.

- Integration Capabilities: An open API architecture that connects seamlessly with your CRM, carrier platforms, and other tools is essential for breaking down data silos and enabling Straight Through Processing.

- Vendor Support and Training: A strong partnership with your software provider, including comprehensive training and support, makes the difference between a smooth rollout and a painful one.

- Total Cost of Ownership: Look beyond the sticker price. Consider implementation costs, maintenance, and subscription fees to get a clear picture of the total financial commitment.

- User Experience: An intuitive interface is crucial. The most powerful features mean nothing if your staff struggles with basic navigation.

The Future of Insurance Back Office Software: Agentic AI

The next evolution of insurance back office software is here, and it is powered by Agentic AI. This goes beyond simple automation to intelligent systems that act as a true claims professional co pilot, enhancing your team's capabilities.

Picture Digital Coworkers that understand natural language instructions and execute complex workflows across multiple systems. This language to action AI tackles one of the biggest challenges in P&C insurance, where much of the claims data is unstructured. For a deeper dive, check out our Agentic AI Definition.

These Virtual AI Assistants handle the repetitive administrative tasks that consume adjusters' time. They review documents, extract key information, and flag items that need human attention. This frees your experts to focus on critical thinking, empathy, and nuanced decision making. Explore more in Virtual AI Assistants for Insurance: Meet Your New Best Friend.

At Agentech, we are building these AI powered automation tools for P&C insurance operations. Our always on AI assistants integrate with existing systems, boosting adjuster productivity without replacing the human decision making essential to quality claims handling.

Frequently Asked Questions about Insurance Back Office Platforms

We often hear similar questions from P&C carriers, TPAs, and IA firms as they explore insurance back office software. Let us tackle some of the most common ones.

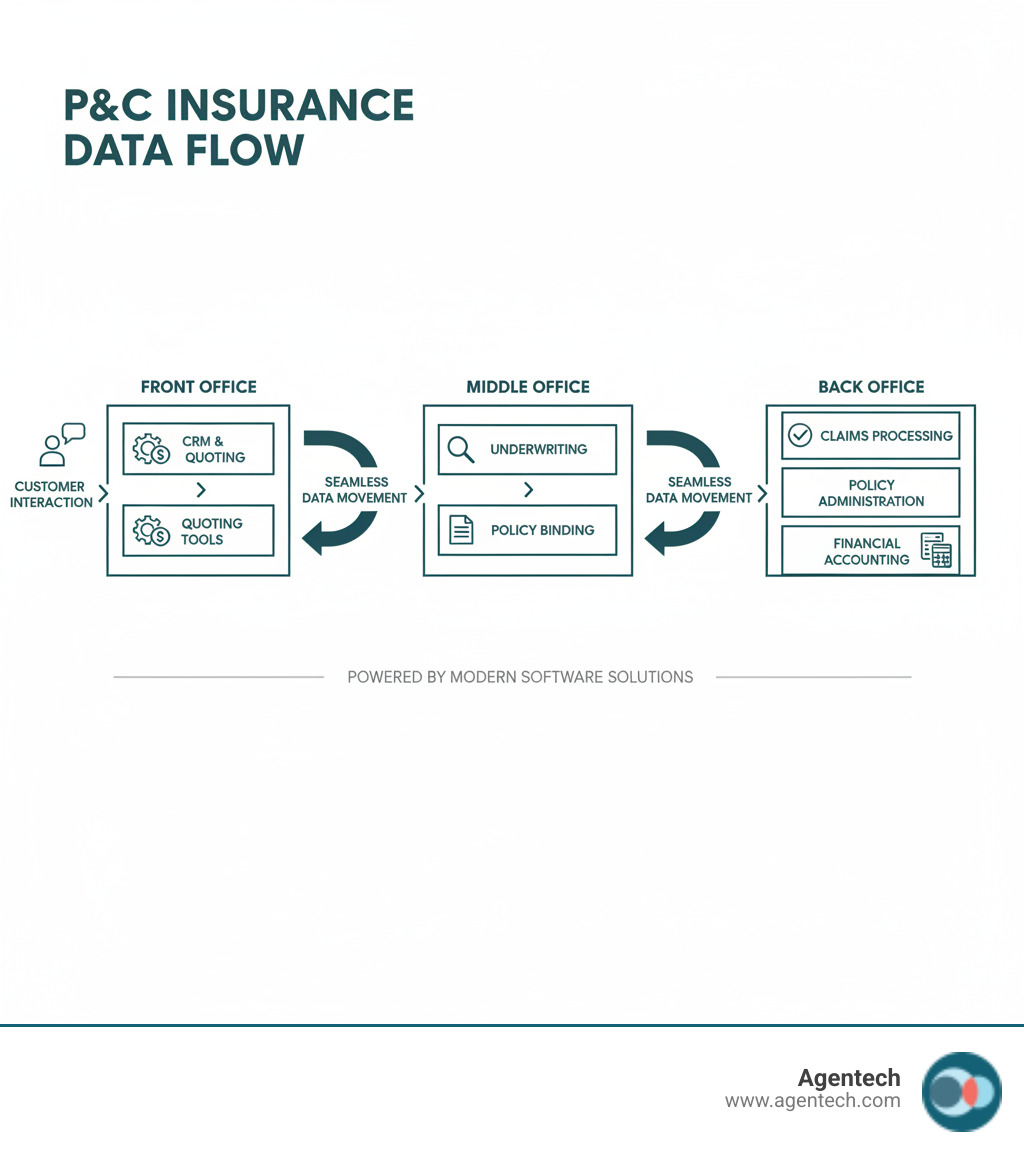

What is the difference between front office and back office software in P&C insurance?

Understanding the distinction is key to optimizing your operations. Think of your P&C insurance organization as a machine with different parts working in harmony.

Front office software focuses on customer facing activities like CRM for managing client relationships, quoting tools for new business, and client portals. Its primary goal is to improve the customer experience and drive sales.

Back office software, as we have explored, handles the internal operational processes. This includes policy administration for residential property, auto, pet, and workers' compensation lines, claims management from FNOL to settlement, billing, and accounting. Its goal is efficiency, accuracy, and compliance.

Middle office functions often bridge the gap, including post bind policy administration and processing endorsements. It is the connective tissue that ensures a smooth transition from promise to delivery. When all three work together, you deliver exceptional experiences for your policyholders.

How does back office software support regulatory compliance?

Regulatory compliance is a constant challenge in P&C insurance. Your insurance back office software is a powerful ally in meeting these requirements.

First, it provides centralized data, making audits significantly easier. All policy records, claims documents, and financial transactions are securely stored and readily accessible, ensuring transparency and accountability. Automated reporting features can generate the necessary documentation for regulators, reducing manual effort and the risk of human error.

Many advanced systems are built with compliance in mind, offering support for emerging accounting standards like IFRS 17. Furthermore, features for secure document retention and version control ensure you always have an accurate, compliant record of every interaction. This proactive approach helps you avoid costly penalties and maintain your reputation.

What is the typical ROI for implementing a new back office system?

The Return on Investment from a new insurance back office software system can be substantial. It is about improving efficiency, reducing risk, and empowering your teams.

Let us look at some compelling examples. One mid sized P&C carrier saved an impressive $4.2 million by optimizing providers and lowering claim duration through AI powered claims management software. The same carrier realized $16 million in savings by lowering litigation rates and medical expenses, and an additional $4.9 million by segmenting claims by severity. Another client achieved a remarkable 33% savings in Medicare Secondary Payer compliance costs.

Beyond direct cost savings, our AI powered automation tools boost adjuster productivity, freeing them from mundane administrative tasks to focus on complex cases and empathetic customer interactions. This leads to better adjuster satisfaction, reduced turnover, and improved claim outcomes.

We have seen overall ROIs that can exceed 500%, with full implementation in as little as 8 to 12 weeks and requiring minimal IT lift. These figures demonstrate that the investment in modern insurance back office software, particularly those leveraging AI, pays for itself in operational efficiency, cost reduction, and improved customer retention.

Conclusion

The journey through insurance back office software reveals that these systems are the strategic engines that power modern P&C insurance operations. For carriers, TPAs, and IA firms working across residential property, auto, pet, and workers' compensation lines, the right back office platform makes the difference between thriving and merely surviving.

We have explored how these solutions streamline the policy lifecycle, improve claims management, and master complex financial operations. We have seen the numbers: millions saved, costs cut by more than half, and ROIs exceeding 500%. These benefits represent real people spending less time on tedious data entry and more time serving policyholders.

The shift toward AI driven automation is where things get truly exciting. The back office is changing from a cost center into an innovation hub. Insurance back office software powered by Agentic AI is empowering claims professionals to achieve speed and accuracy, not by replacing human judgment, but by amplifying it.

This change is happening right now. The carriers and TPAs that accept these advancements are already seeing the benefits: faster claim settlements, happier policyholders, and healthier bottom lines.

At Agentech, we are proud to be building the AI workforce for P&C insurance. Our seamless integration and always on AI assistants are designed for P&C operations, boosting adjuster productivity while keeping human decision making at the center of every claim. We invite you to explore how these innovations can benefit your operations. Learn how AI can transform your back office operations.

The future of P&C insurance is not about choosing between human expertise and technology. It is about bringing them together. That future is here, and it starts with the right back office foundation.

Citations

- McKinsey & Company. Claims 2030: The future of claims. https://www.mckinsey.com/industries/financial-services/our-insights/claims-2030-the-future-of-claims

- Deloitte Insights. Insurance claims transformation. https://www2.deloitte.com/us/en/insights/industry/financial-services/insurance-claims-transformation.html

- Business Insurance. Top 100 U.S. Brokers. https://www.businessinsurance.com/biresources/bi-top-100-u-s-brokers/

- IFRS Foundation. IFRS 17 Insurance Contracts. https://www.ifrs.org/issued-standards/list-of-standards/ifrs-17-insurance-contracts/

- AICPA. What is SOC 2? https://www.aicpa.org/resources/article/what-is-soc-2

- ACORD. Standards. https://www.acord.org/standards

- NAIC. Property and Casualty Insurance. https://content.naic.org/industrypropertycasualty.htm