Why Insurance Automation Matters for P&C Insurance

Insurance automation is the use of AI, machine learning, and robotic process automation to handle repetitive tasks in Property & Casualty insurance, including claims processing, underwriting, and fraud detection. It helps carriers, TPAs, and IA firms reduce manual data entry, accelerate claim settlements, and improve accuracy across residential property, auto, pet, and workers' compensation lines.

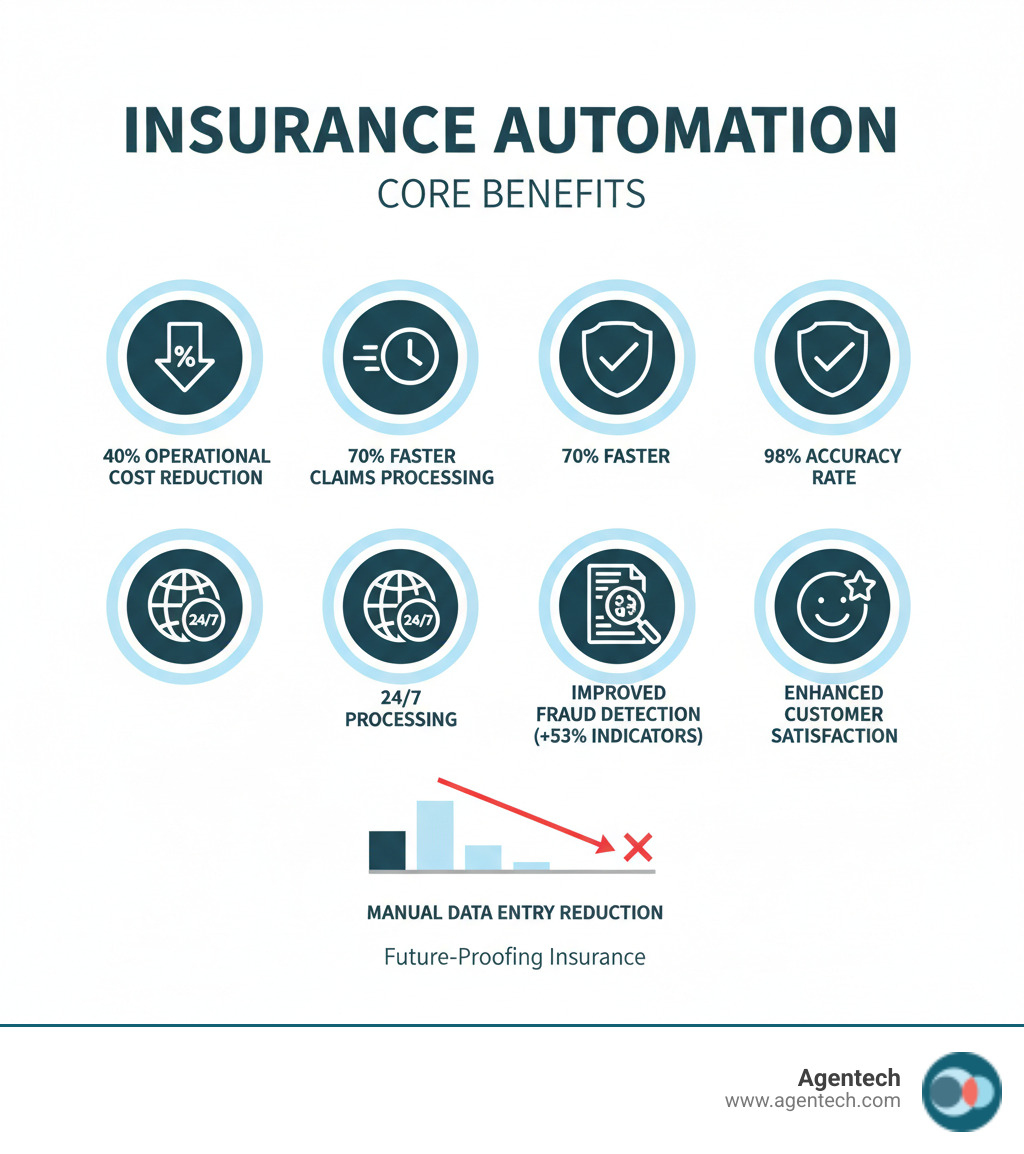

Key benefits of insurance automation for P&C insurance:

- Cost reduction: Up to 40% decrease in operational costs

- Speed: 70% faster claims processing, with some claims settled in under 24 hours

- Accuracy: Over 98% accuracy compared to 80% human accuracy

- Scalability: Handle more claims without increasing headcount

- Fraud detection: 53% more fraud indicators identified through AI

The pressure to modernize is real. McKinsey estimates that by 2030, more than 90% of pricing and underwriting for many policies will be automated. Yet, manual claims processing remains a major bottleneck in many P&C operations, frustrating adjusters and delaying payments to policyholders.

For claims managers, the challenge is reducing administrative work without disrupting workflows. The answer is strategic automation that augments your team, not replaces it.

This is about practical tools that handle repetitive tasks so your adjusters can focus on what they do best: making sound decisions, communicating with empathy, and resolving complex cases that require human judgment.

I'm Alex Pezold, founder of Agentech AI. We're building the AI workforce for P&C insurance, starting with claims automation. After a career scaling technology companies, I've seen how the right tools can transform operations. I'm now focused on bringing that same impact to the insurance industry through AI-driven solutions.

The Dawn of a New Era: What is Insurance Automation and Why is it Essential?

A fundamental shift is underway in Property & Casualty insurance. For carriers, Third Party Administrators, and Independent Adjusting firms, the old ways of working are giving way to something faster and more efficient. Customer expectations for speed, shaped by on-demand services, now apply to filing an auto or property claim. The gap between these expectations and what traditional manual processes can deliver is widening.

Many P&C operations are still bogged down by paperwork and manual data entry. These bottlenecks frustrate adjusters, increase costs, and drive policyholders to faster competitors. Insurance automation tackles these operational challenges, freeing your team for work that requires human judgment and empathy. When a system can extract data in seconds or flag suspicious activity instantly, the entire operation transforms.

According to McKinsey research, more than 90% of pricing and underwriting tasks for individual and small business insurance policies will be fully automated by 2030. The firms that accept this shift now will gain a massive competitive advantage. This isn't about replacing your team; it's about giving them superpowers. For more on how this change is unfolding, see The Future of Insurance: How AI Is Changing the Game.

The Core Technologies Driving Automation

Let's get practical about what powers insurance automation in P&C operations. These technologies are changing how claims teams work.

| Technology | Function | Best Use Case in P&C Claims | Business Impact in P&C Claims |

|---|---|---|---|

| AI | Broad field of intelligent decision making | Comprehensive claim assessment, fraud detection | Improved decision accuracy, faster claim resolution, reduced fraud losses |

| ML | Pattern identification, predictions | Predictive modeling for risk assessment, fraud scoring | Improved underwriting precision, proactive fraud flagging, optimized pricing |

| RPA | Automating repetitive, rule based tasks | Data extraction from documents, system updates, FNOL intake | Significant reduction in manual effort, increased processing speed, fewer human errors |

| NLP | Understanding human language | Analyzing unstructured claim notes, customer service chatbots | Faster processing of text based data, improved customer communication, consistent information extraction |

| Agentic AI | Proactive, task oriented decision making | End to end claim processing, policy issuance, complex workflows | Autonomously completes multi step tasks, boosts adjuster productivity, scales operations without headcount |

Artificial Intelligence (AI) encompasses systems that make intelligent decisions, like assessing claim legitimacy or determining fault in an auto accident, completing tasks in seconds that would take an adjuster hours.

Machine Learning (ML) systems learn from data to spot patterns. By analyzing thousands of workers' compensation claims, they can predict which cases may become complex, leading to better risk assessment and reserving.

Robotic Process Automation (RPA) is a digital assistant for repetitive, rule-based tasks. It can pull data from a First Notice of Loss form, update your claims management software, and send confirmation emails, eliminating tedious manual work.

Natural Language Processing (NLP) allows computers to understand human language. It can analyze unstructured text from adjuster notes, policyholder emails, and medical documents to extract key facts, saving significant time.

Agentic AI is the next evolution. Unlike automation that follows rigid rules, agentic AI understands context and can complete entire workflows with minimal supervision, acting as a true digital coworker. Want to understand how this technology is reshaping the industry? Check out our Agentic AI Definition.

The Unseen Benefits of a Modern Approach

The obvious wins from insurance automation are lower costs and faster processing. But some of the most valuable benefits are less obvious.

- Data Accuracy: Automated systems achieve over 98% accuracy compared to 80% for manual entry. This means cleaner data, more reliable reporting, and fewer errors that frustrate policyholders.

- Scalability: When a catastrophe causes a surge in property claims, automation allows your existing team to handle the increased volume without being overwhelmed. You can scale your business without proportionally growing headcount.

- Employee Engagement: Automation boosts employee engagement. By removing tedious data entry, adjusters can focus on the rewarding parts of their job: solving complex cases and helping policyholders. This leads to higher job satisfaction and retention.

- System Integration: Modern automation platforms act as connective tissue between legacy systems. They pull data from one system and push it to another, breaking down data silos and ensuring everyone has the information they need.

The best technology is the kind you don't really notice. It just makes everything work better. Learn more about this philosophy in The Best AI Doesn't Feel Like AI. It's Invisible.

Citations:

- McKinsey & Company. (n.d.). Insurance productivity 2030: Reimagining the insurer for the future. Retrieved from https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Insurance%20productivity%202030%20Reimagining%20the%20insurer%20for%20the%20future/Insurance-productivity-2030.pdf

Automation in Action: Key Use Cases for P&C Insurance Automation

This section details practical use cases for insurance automation in P&C insurance, showing how it transforms core functions like residential property, auto, pet, and workers' compensation claims. These are the workflows your team touches every day, from initial report to final settlement.

Revolutionizing Claims Processing

Claims processing is where insurance automation delivers the most immediate impact for P&C carriers, TPAs, and IA firms. Getting it right means being fast and accurate.

- First Notice of Loss (FNOL) Intake: AI-powered forms and chatbots can automate the entire initial report. The system extracts information, validates policy details, and can even achieve straight-through processing for simple claims, freeing adjusters for complex evaluations.

- Automated Damage Assessment: For auto and residential property claims, computer vision AI can analyze photos of damage to estimate repair costs instantly. What once took days of back-and-forth can now happen in minutes.

- Payout Decisions: For straightforward claims, automation can drive payout decisions without human review. The system checks information against policy terms and triggers payment, with some insurers settling claims in real time.

The result is a dramatic reduction in claim cycle times, with research showing up to a 70% reduction in claims processing costs. This delivers the speed and service that builds policyholder loyalty.

Want to go deeper? Check out our articles on AI Claims Processing System and Transforming Insurance Claims: The Evolution from Generative AI to Agentic AI.

Streamlining Underwriting and Policy Management

Insurance automation also delivers powerful results in underwriting and policy management.

- Real-Time Risk Modeling: AI enables real-time risk modeling for P&C lines by continuously analyzing fresh data like weather patterns for property insurance or driving behavior for auto policies.

- Dynamic Pricing Adjustments: This real-time intelligence allows for dynamic pricing, offering personalized rates that more accurately reflect actual risk, making you more competitive and profitable.

- Automated Policy Renewals: Automated policy renewals handle a major administrative burden. With 40% of underwriting being administrative work, automation frees your team for complex cases that require human expertise.

For more on optimizing these processes, our article on Insurance Back Office Automation provides additional insights.

Enhancing Fraud Detection and Compliance

Insurance fraud is a massive problem, costing the U.S. $308.6 billion annually. AI algorithms change the game in fraud detection.

AI analyzes vast amounts of data to spot subtle fraud patterns that humans would miss. In auto or workers' compensation claims, AI can flag inconsistencies or unusual billing patterns, learning continuously to improve accuracy. This improved pattern recognition ensures your team investigates high-priority cases while legitimate claims are processed faster. Suspicious activity alerts go to the right people with the evidence they need to make informed decisions.

Beyond fraud, automation strengthens compliance. Automated systems monitor regulatory changes and update workflows accordingly, reducing your risk of penalties and protecting your reputation.

Our article AI in Insurance: Balancing Innovation and Regulation explores how to steer this landscape responsibly.

Citations:

- McKinsey & Company. (n.d.). Insurance productivity 2030: Reimagining the insurer for the future. Retrieved from https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Insurance%20productivity%202030%20Reimagining%20the%20insurer%20for%20the%20future/Insurance-productivity-2030.pdf

- Conroy Simberg. (n.d.). Insurance Fraud Costs the U.S. $308 Billion Annually. Retrieved from https://www.conroysimberg.com/blog/insurance-fraud-costs-the-u-s-308-billion-annually/

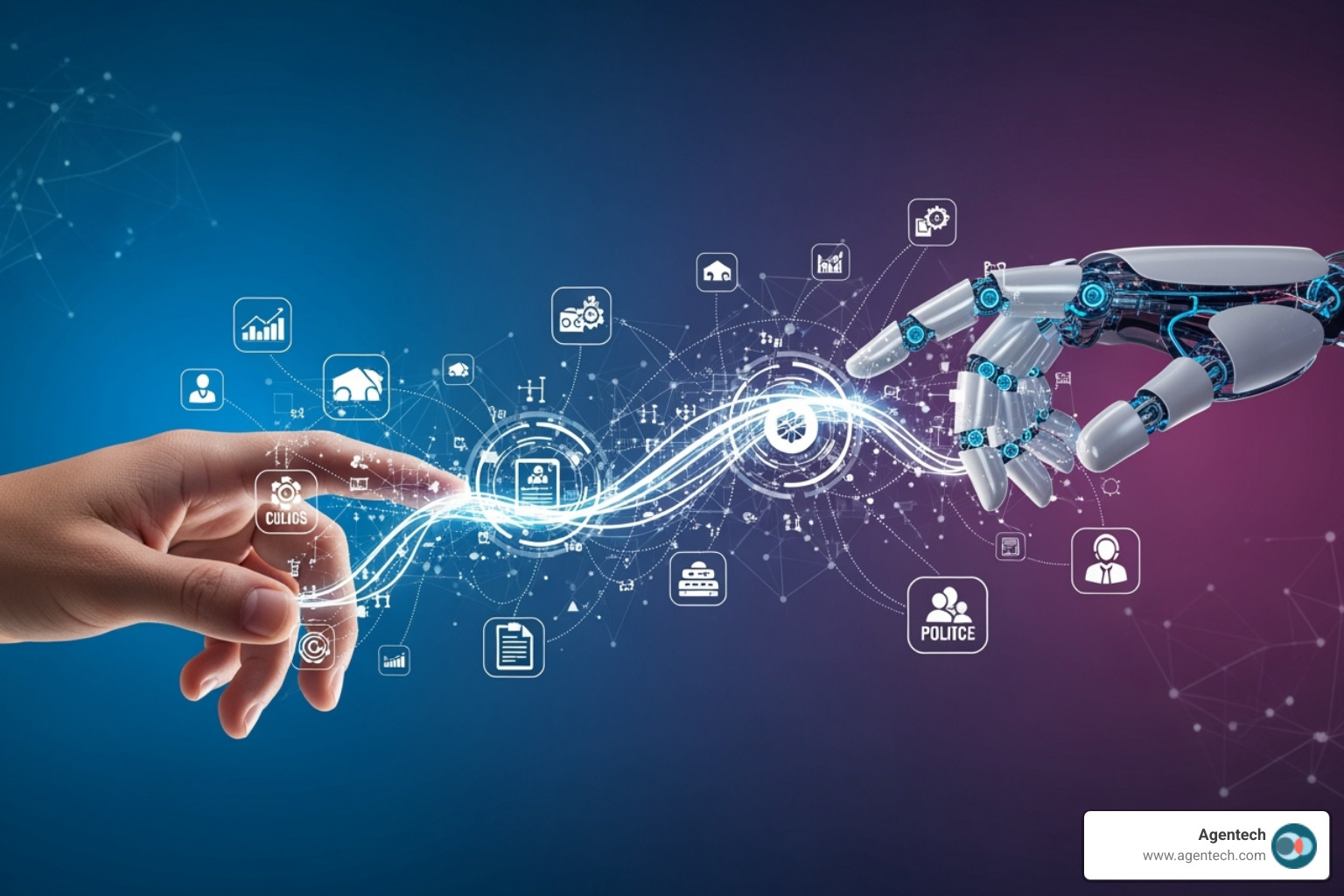

The Human + Machine Partnership: Automation's Impact on the P&C Insurance Workforce

When we talk about insurance automation, the first concern is often job loss. However, the goal is not replacement but augmentation. Technology handles the tedious work so your skilled professionals at P&C carriers, TPAs, and IA firms can focus on what they do best.

By removing endless data entry and document sorting, adjusters can dedicate their time to investigating complex claims, making nuanced decisions, and connecting with policyholders with empathy. Automation frees them to provide the human touch that matters most during a stressful event. With skilled adjusters harder to find and retain, automation is a solution that allows you to do more with your talented team. Our article Solving the Insurance Labor Crisis with AI-Driven Innovation digs into this partnership.

The Evolving Role of the Insurance Professional

The introduction of insurance automation is creating an exciting shift for P&C insurance professionals.

- From Data Entry to Data Analysis: The role is shifting from typing information to interpreting AI-generated insights to make smarter decisions. An adjuster can review a property claim where AI has already extracted data and flagged issues, applying their expertise to make the final call.

- Focus on Complex Claims and Relationships: Automation efficiently handles simple, routine claims. This frees your team to tackle challenging situations that require human expertise, such as multi-vehicle accidents or disputed liability cases.

- Upskilling and Continuous Learning: This evolution requires investing in your people. Training your team to work with AI tools empowers them to become strategic problem-solvers, making their roles more fulfilling and their careers more rewarding.

At Agentech, we believe in designing technology that supports adjusters. Learn more in AI Designed With Adjusters In Mind.

The Future of Work: Agentic AI and Digital Agents

Agentic AI represents the next chapter in the human-machine partnership. Unlike basic automation, it acts as a proactive partner, understanding context and completing entire workflows. Imagine a digital coworker handling a pet insurance claim from start to finish, only involving a human when something unusual requires their judgment.

These digital agents work autonomously around the clock, reviewing documents, verifying coverage, and even communicating with policyholders. Your human team supervises and steps in only when their expertise is truly needed. With analysts predicting that 33% of enterprise software will include agentic AI by 2028, this shift is happening now.

Your adjusters become supervisors and strategists, overseeing digital agents and focusing on high-value work like relationship building and complex negotiations. It's a better use of their skills and better for everyone involved.

To understand more about this shift, explore The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers and Agentic AI in Insurance: When Bots Become Your Best Agents.

The future of insurance automation isn't about choosing between humans and machines. It's about combining the best of both.

Navigating the Path to Automation: Strategy, Challenges, and Mitigation

Starting on the insurance automation journey requires a clear roadmap. This section provides a guide for P&C carriers, TPAs, and IA firms to implement automation successfully and avoid common pitfalls.

A Strategic Approach to Implementing Insurance Automation

We recommend a thoughtful, phased approach to implementing insurance automation:

- Start Small with a Pilot Project: Identify a low-risk, high-impact task, such as FNOL intake for auto claims. A successful pilot builds confidence and demonstrates tangible ROI.

- Build a Dedicated Team: Assemble a cross-functional team of IT specialists, process owners, and adjusters to guide implementation and ensure the technology meets real-world needs.

- Expand Efforts Based on ROI: Use the measured return on investment from your pilot to justify expanding automation to other areas with high efficiency gains.

- Embed Automation into Company Culture: Promote continuous improvement and offer upskilling programs. Communicate the benefits of automation to foster a mindset where it is seen as an improver, not a threat.

- Choose the Right Technology Partner: Select a partner with deep industry expertise and proven solutions that integrate with your existing claims management software.

If you are wondering where to begin, our article Not Sure Where to Start with AI? offers practical advice.

Overcoming Common Challenges and Risks

While the benefits are compelling, implementation has its challenges. Proactively addressing these is key to success.

- Legacy IT Systems: Outdated systems can be a hurdle, but modern automation platforms are often designed to integrate with or work on top of existing infrastructure as an intelligent layer.

- Data Security and Privacy: This is paramount. Any automation solution must feature robust cybersecurity and comply with regulations like GDPR and CCPA.

- High Implementation Costs: While there are upfront costs, automation should be viewed as a strategic investment. The long-term ROI from operational savings often outweighs the initial expense.

- Cultural Resistance: Employee concerns can be overcome with open communication and training that demonstrates how automation assists with tedious work, freeing them for more engaging tasks.

When considering new technology, the "buy versus build" decision is critical. Our article Buy vs. Build: Navigating the SaaS AI Technology Decision can help.

Real World Success in P&C Insurance Automation

The power of insurance automation is proven. For example, Odie Pet Insurance and AmerAdjust successfully implemented Agentic AI to streamline claims tasking and empower their adjusters with digital coworkers, improving efficiency and service. You can read more about their success here: Odie Pet Insurance Implements Agentic AI to Automate Claims Tasking and AmerAdjust Leverages Agentic AI's Digital Claims Co-Workers.

Major players are also seeing substantial returns. UK insurer Aviva deployed over 80 AI models in its claims domain, cutting liability assessment time for complex cases by 23 days and improving claim routing accuracy by 30 percent. These examples underscore the tangible benefits that P&C firms can achieve through strategic automation.

Conclusion

Our exploration of insurance automation leads to one conclusion: this technology is no longer a possibility but a necessity. For Property & Casualty carriers, TPAs, and Independent Adjusting firms, the question is not whether to automate, but how quickly you can implement it strategically.

We have seen how AI, machine learning, and Agentic AI are changing P&C operations, from accelerating claims processing to enhancing fraud detection. The results are clear: significant cost reductions, faster processing, and near-perfect accuracy.

Beyond the metrics, insurance automation is about creating a partnership between human expertise and AI efficiency. It amplifies the strengths of your adjustersjudgment, empathy, and complex problem-solvingby removing the burden of repetitive administrative tasks.

This hybrid model is the future of P&C insurance operations. Adjusters become strategic advisors, empowered by AI tools to handle routine tasks while they focus on complex cases and building policyholder relationships. Insurance automation has become a strategic imperative for survival and growth. The firms that accept it will set new benchmarks for excellence, while those who delay risk falling behind.

At Agentech, we are building the AI workforce for insurance. Our agentic AI solutions are designed to augment your claims team, integrating with your existing claims management software to act as digital coworkers that empower your people. The change is happening now. Companies like Odie Pet Insurance and AmerAdjust are seeing real results, proving that automation delivers on its promise when implemented thoughtfully.

Your next step is simple. Explore how Agentic AI can transform your claims operations and find what a true human-machine partnership can achieve for your P&C insurance organization. The future of claims processing is here, and it is more efficient, more accurate, and more human than ever before.

Citations:

- McKinsey & Company. (n.d.). Insurance productivity 2030: Reimagining the insurer for the future. Retrieved from https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Insurance%20productivity%202030%20Reimagining%20the%20insurer%20for%20the%20future/Insurance-productivity-2030.pdf

- Conroy Simberg. (n.d.). Insurance Fraud Costs the U.S. $308 Billion Annually. Retrieved from https://www.conroysimberg.com/blog/insurance-fraud-costs-the-u-s-308.6-billion-annually/

- McKinsey & Company. (2024). The future of AI in the insurance industry.

- Pingili, R. (2024). The Basics of Robotic Process Automation in Insurance Claims. International Journal For Multidisciplinary Research.