Why Core Insurance Software is the Backbone of Modern P&C Operations

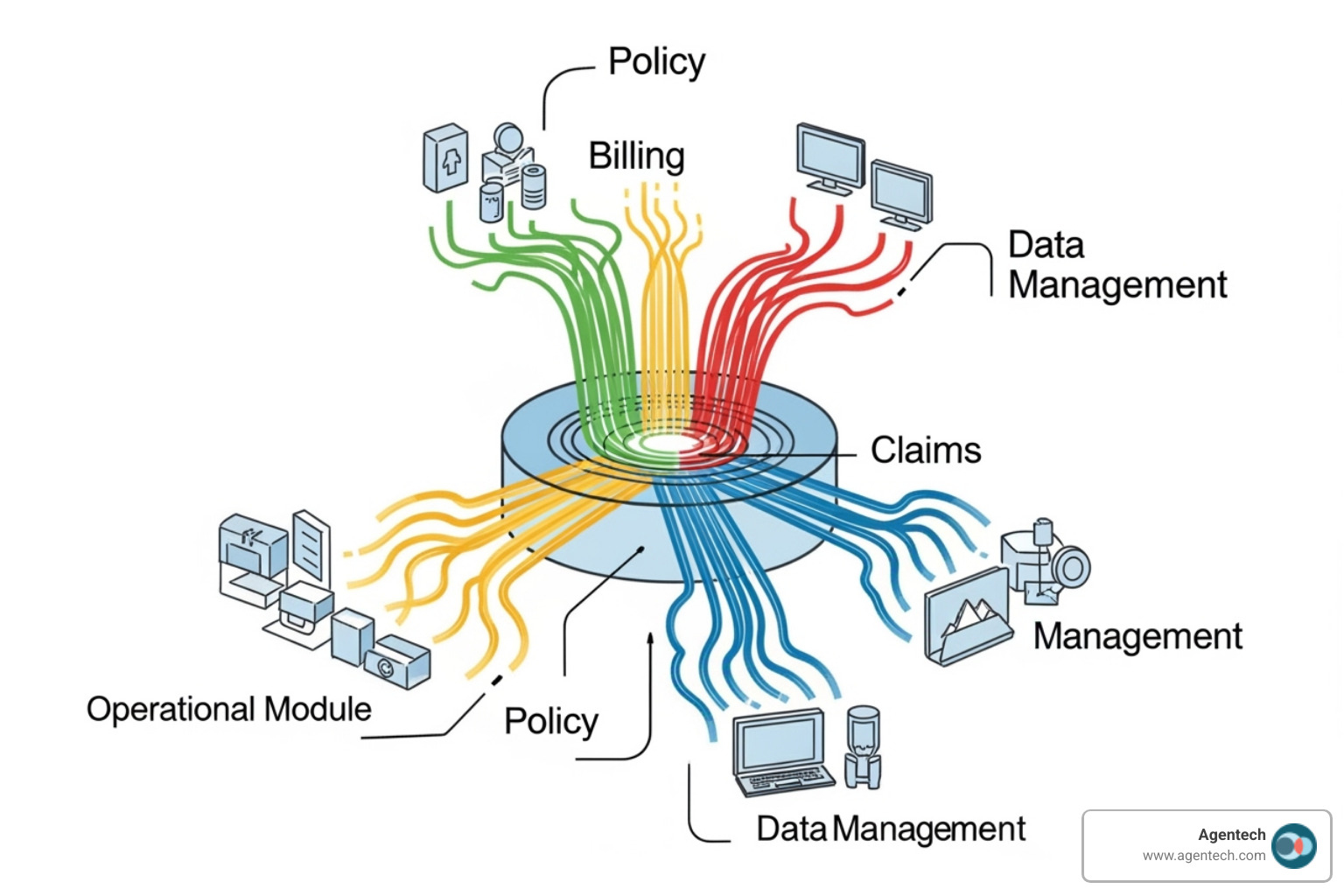

Core insurance software is the digital foundation managing the complete lifecycle for Property & Casualty carriers. These systems act as a single source of truth, handling everything from policy administration and billing to claims management and compliance for lines like residential property and workers' compensation.

A modern core system manages:

- Policy Administration: The full policy lifecycle from quotes to renewals.

- Billing & Premiums: Premium calculation, payment processing, and collections.

- Claims Management: FNOL through settlement for auto, property, and other P&C claims.

- Data & Analytics: Real time insights and regulatory reporting.

- Integration: Connecting to third party systems via APIs for seamless workflows.

The challenge is significant, as over 70% of P&C insurers still use outdated legacy systems. These platforms create bottlenecks, slow down claim settlements, and frustrate both adjusters and policyholders. With 38% of P&C insurers admitting their core system is poorly integrated, the results are slow product launches and inefficient claims processing.

Modern, cloud native core insurance software with API first architectures enables faster implementations and seamless integrations. For claims managers, these systems reduce manual work and provide the foundation for AI powered automation.

I'm Alex Pezold, founder of Agentech AI. My experience has shown me how the right technology stack can revolutionize P&C operations for carriers, TPAs, and IA firms by integrating cutting edge automation with core insurance software.

The Anatomy of a Modern Core Insurance System

Think of core insurance software as the central nervous system of a P&C carrier, creating a single source of truth. When one part of the system updates, every other part knows instantly. This eliminates confusion about policy coverage, premium status, or claim progress, which is critical when managing residential property claims, workers' compensation cases, or auto policy renewals.

Modern core insurance software actively manages the complete P&C insurance lifecycle. Let's break down how its interconnected components work together.

Policy Administration and Underwriting

The policy lifecycle, from quote to cancellation, is handled seamlessly by a strong core insurance software platform. For P&C lines like residential property, auto, and workers' compensation, this means managing different coverage options and state-specific regulations. Modern systems generate quotes in real time and process endorsements through automated workflows, ensuring consistency and compliance.

Underwriters gain access to sophisticated analytics, allowing them to focus on complex risks while the system handles repetitive tasks. Renewals are also automated, as the software reviews policies, recalculates premiums, and generates documents, preventing chaos for carriers managing thousands of policies. You can explore more about how these systems fit into the broader technology landscape in our article on P&C insurance IT systems.

Billing and Premium Management

Your billing system must be accurate and flexible. Core insurance software automatically handles complex premium calculations and supports various payment plans and methods, from annual bank drafts to monthly credit card payments. The system also manages collections by tracking due dates, sending automated reminders, and initiating workflows when payments are late. For distribution partners, it ensures accurate and timely commission management, strengthening agent and broker relationships. All this data feeds into financial reports, giving leadership clear visibility into the company's financial health.

Claims Management for P&C Carriers

This is the moment of truth for any P&C carrier, TPA, or IA firm. The First Notice of Loss (FNOL) kicks off the claims process, and modern core insurance software allows claimants to report losses through multiple channels. The system captures details, assigns the claim, and starts the workflow automatically. Adjudication involves investigating the claim, verifying coverage, and assessing damages, with all information organized within the claims management software.

Accurate reserving is crucial for financial planning, and the system adjusts funds as more information becomes available. During settlement, the platform processes payments and generates all necessary documents. It also helps identify and track subrogation opportunities, which can significantly impact loss ratios. When your core system works with intelligent automation, adjusters can focus on helping people. Learn more in our article on AI powered claims management software.

Data, Analytics, and Compliance

Your core insurance software is a rich data repository. Real time analytics turn this data into actionable insights, presented through business intelligence dashboards. Claims managers can spot bottlenecks, and underwriters can identify trends. This data driven approach extends to regulatory reporting, where the system automates the creation of detailed filings required by state insurance departments. Modern platforms also prioritize data security with robust encryption and access controls, while complete audit trails ensure accountability and transparency across all operations.

Citations:

Agentech. "What is a P&C Insurance IT System?" agentech.com. https://www.agentech.com/resources/articles/insurance-it-systems

Agentech. "AI-Powered Claims Processing System." agentech.com. https://www.agentech.com/resources/articles/ai-claims-processing-system

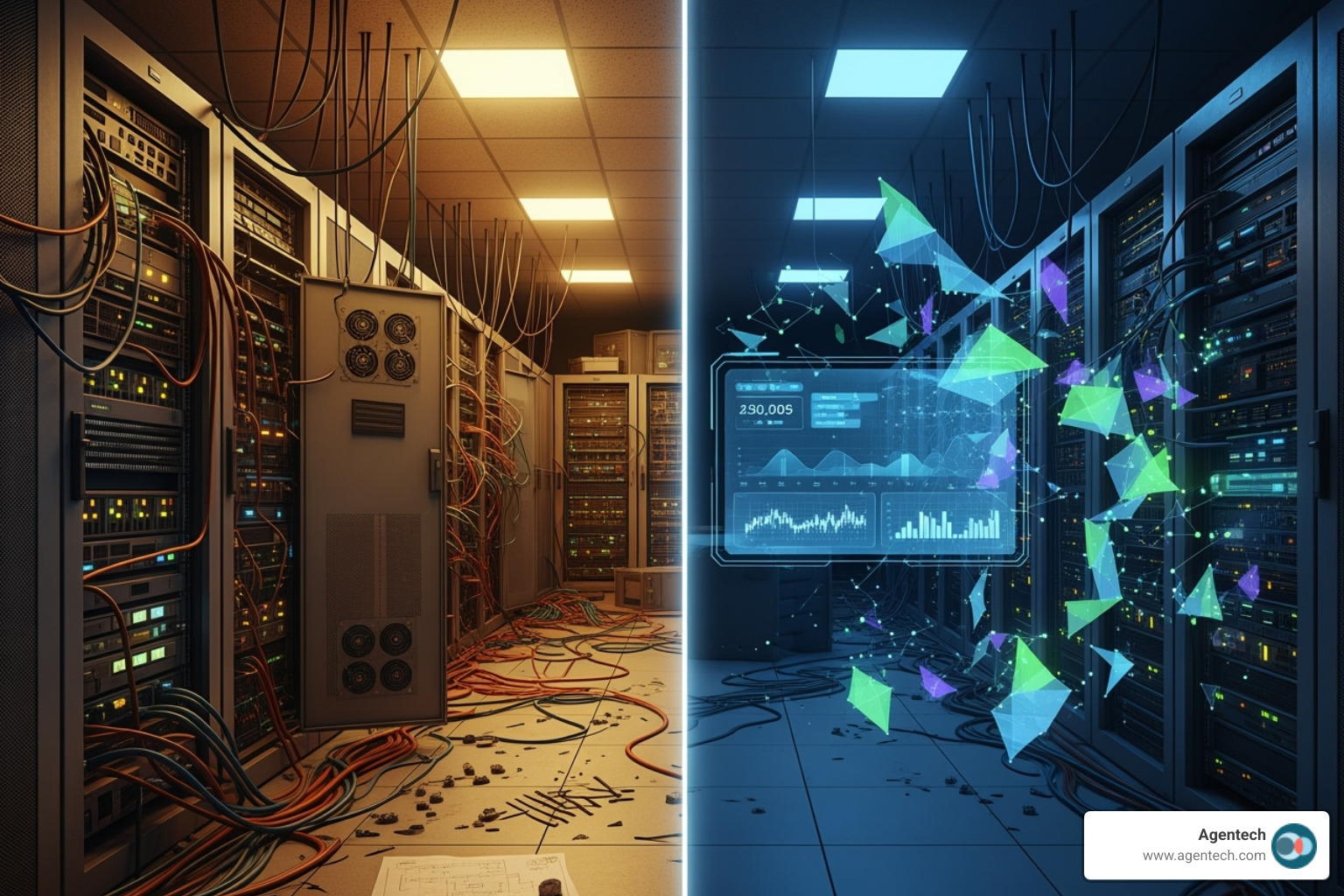

Legacy vs. Modern: Why Upgrading Your Core Insurance Software is Crucial

The P&C insurance industry is at a crossroads. Over 70% of P&C insurers operate on legacy systems, creating a widening gap between customer expectations and what these aging platforms can deliver. With 38% of P&C insurers believing their core system is outdated and poorly integrated, many know they are at a disadvantage. For claims professionals handling residential property, auto, or workers' compensation claims, this means frustrating delays and manual workarounds.

Modern core insurance software offers a clear path forward, representing a fundamental shift in how P&C carriers, TPAs, and IA firms can operate. The resources available through Agentech notes on modernization can help guide your journey.

| Attribute | Legacy Core Systems | Modern Core Systems |

|---|---|---|

| Speed | Slow product launches, manual processes, delayed claims | Rapid product configuration, automated workflows, fast claims |

| Integration | Siloed, complex, expensive custom integrations | API first, seamless third party connections, ecosystem ready |

| Scalability | Limited, costly to expand, hardware-dependent | Cloud native, elastic scaling, on demand resources |

| Maintenance | High cost, specialized skills needed, infrequent updates | Continuous updates, automated, lower TCO, evergreen SaaS |

| Customer Experience | Inconsistent, manual touchpoints, limited self service | Omnichannel, personalized, self service portals, real time |

The High Cost of Legacy Systems

Many P&C insurance operations still run on monolithic, mainframe based systems that are difficult and expensive to maintain. This rigidity creates information silos, forcing adjusters to waste time on manual data entry across different screens. The biggest impacts are high maintenance costs that drain innovation budgets and a slow speed to market for new products. Launching a new residential property or workers' compensation offering can take so long that the market opportunity disappears.

The Strategic Advantage of Modern Platforms

Modern core insurance software is built on entirely different principles. A cloud native architecture provides infrastructure that scales automatically with demand, so you only pay for what you use. An API first design makes connecting to third party systems for fraud detection or telematics straightforward. This flexibility is often improved by a Microservices architecture, which breaks the system into smaller, independent services that can be updated individually.

Furthermore, low code configuration empowers business users, not just IT specialists, to design products and modify workflows, dramatically accelerating speed to market. The result is a superior omnichannel customer experience, where policyholders can interact seamlessly across mobile, web, and phone. Finally, continuous updates ensure your system stays evergreen with the latest features and security patches, eliminating disruptive upgrade projects. To dive deeper, check out our guide on Understanding modern P&C insurance software systems.

This modernization is the foundation for competing effectively in today's P&C market.

Citations:

- Agentech. "Modernizing Core Insurance Systems." agentech.com.

- Agentech. "Insuretech Made Easy: Understanding Insurance Software Systems." agentech.com.

Key Considerations for Choosing a Core System

Selecting the right core insurance software is one of the most critical decisions for your P&C carrier, TPA, or IA firm. The ideal system depends on your unique business vision, operational needs, and growth plans. It must handle your current P&C lines, such as residential property, auto, and workers' compensation, and scale with you as you expand.

Deployment and Architecture Models

Your deployment choice sets the stage for future operations. While on premise systems offer control, they come with significant IT overhead. SaaS platforms have become the standard for modern P&C carriers, offering automatic updates and eliminating server management headaches.

The underlying architecture is equally important. Cloud native platforms deliver superior performance and scalability. Many leading systems use a microservices architecture, breaking applications into smaller components for greater flexibility. This approach is detailed further in our article on Exploring microservices in P&C insurance. Some vendors also offer headless architecture, separating the front end interface from back end logic to enable custom user experiences. Finally, consider whether an all in one suite or a modular, best of breed approach better suits your needs.

Evaluating Scalability and Future-Proofing Your Core Insurance Software

Scalability ensures your core insurance software can grow with your business. Look for elastic scaling that automatically adjusts resources to match demand, which is crucial for handling unpredictable events like a surge in property claims after a storm. Future proofing means choosing a platform that evolves with the industry. Key features include tools for new product configuration that allow you to launch innovative P&C products without extensive coding.

An API marketplace and robust third party integrations turn your core system into a hub for specialized tools, from AI powered claims automation to telematics data for auto insurance. Low code tools are also vital, as they empower business users to configure workflows and rules, improving your speed to market and responsiveness.

Vendor Partnership and Support

Choosing a vendor is a long term partnership. Look for strong implementation support from a dedicated team that understands your business processes. Comprehensive training and documentation are essential for user adoption and long term success. An active customer community offers invaluable peer support and best practices for your P&C carrier, TPA, or IA firm.

Pay close attention to Service Level Agreements (SLAs) that guarantee uptime and issue resolution. Most importantly, evaluate the vendor's long term vision and product roadmap. A partner who invests in R&D and incorporates emerging technologies like AI will help ensure your core system remains a competitive advantage, not a legacy burden.

At Agentech, we recognize that a robust core platform is the ideal foundation for intelligent automation. The right core insurance software creates opportunities for innovation, while the wrong one constrains your options for years.

Citations:

- Agentech. "Microservices in Insurance." agentech.com.

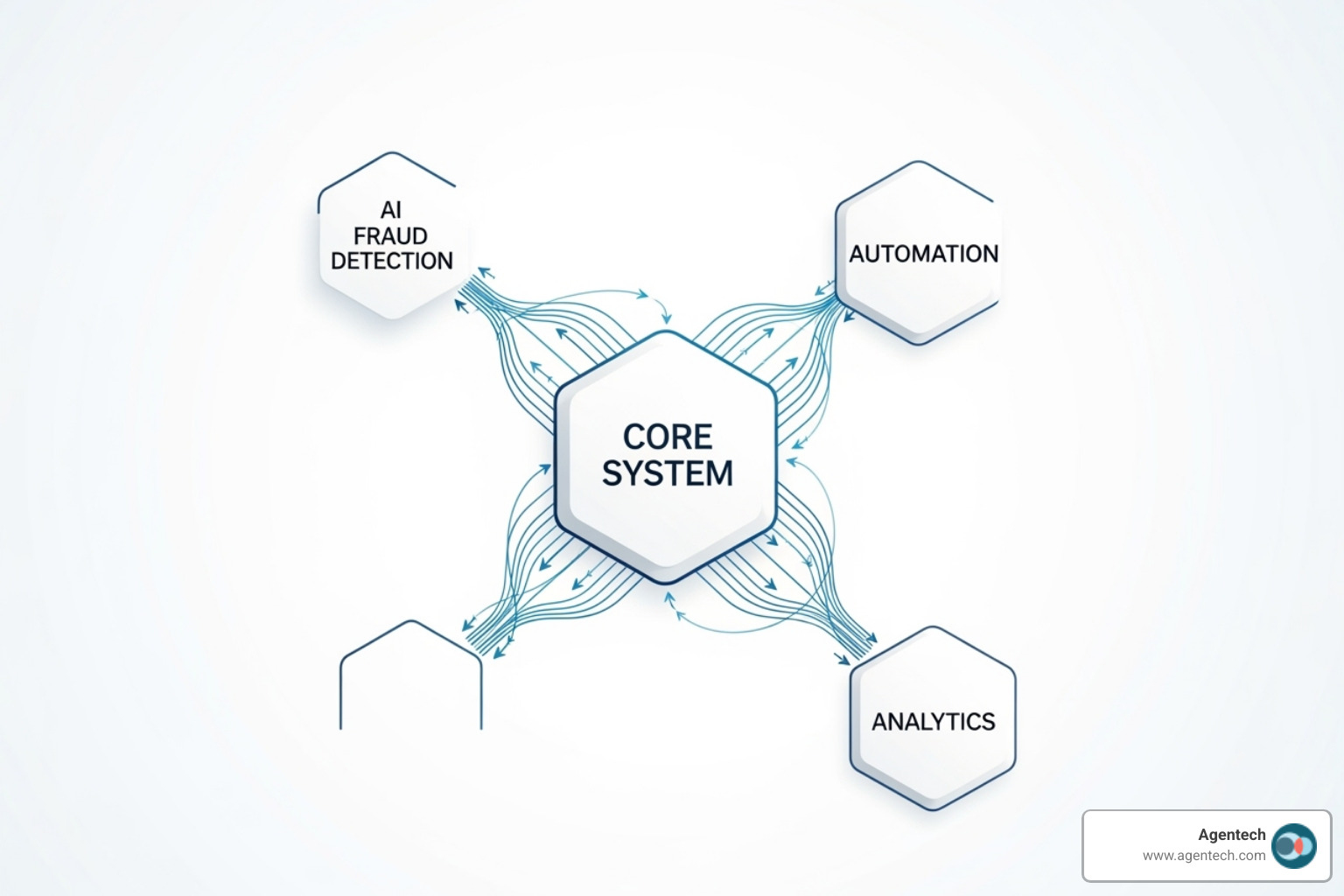

The Symbiotic Relationship: How AI Complements Core Insurance Software

Core insurance software and artificial intelligence are powerful partners. Your core system is the reliable foundation that manages workflows and maintains data integrity for P&C insurance operations. AI is the intelligence layer that makes this foundation smarter, faster, and more insightful, turning static data into actionable intelligence.

This partnership allows P&C carriers, TPAs, and IA firms to gain unprecedented efficiency and accuracy. While your core insurance software handles essential tasks for residential property, auto, or workers' compensation claims, AI analyzes patterns and predicts outcomes. To understand the bigger picture, see The future of P&C insurance with AI.

Supercharging Claims Processing with AI

Claims processing is where AI's impact is most revolutionary. Your core insurance software manages the workflow, but AI automates the repetitive tasks that consume adjuster time. AI can scan documents, extract key information, and categorize claims, giving adjusters hours back to focus on complex decision making and customer service.

At Agentech, our AI assistants work alongside adjusters, providing real time insights to help close claims faster and more accurately. AI powered fraud detection also spots complex patterns that simple rules miss, using a human in the loop approach where experienced adjusters make the final call. Explore these capabilities in our insights on AI powered claims processing and our AI SaaS solutions guide.

The Future is Agentic: Evolving Your Core Insurance Software

The evolution of core insurance software is tied to AI advancements. We are moving beyond basic automation to agentic AI, which are systems that understand goals, create plans, and learn from experience. For P&C insurance, this enables a shift from reactive to proactive claims management. Imagine AI identifying a workers' compensation claim at risk of litigation and alerting the adjuster with preventative strategies.

This level of hyper automation and personalization is becoming a key competitive advantage. To understand what agentic AI means for your operations, read our Agentic AI definition. For its impact on claims, see our article on transforming insurance claims from generative to agentic AI. The future belongs to carriers who accept the synergy between robust core systems and intelligent AI.

Citations:

- Agentech. "The Future of Insurance: How AI is Changing the Game." agentech.com.

- Agentech. "AI-Powered Claims Processing System." agentech.com.

- Agentech. "Artificial Intelligence SaaS Explained: Your Ultimate Guide." agentech.com.

- Agentech. "Agentic AI Definition." agentech.com.

- Agentech. "Changing Insurance Claims: The Evolution from Generative AI to Agentic AI." agentech.com.

Conclusion: Building a Future-Ready P&C Operation

Your core insurance software is the strategic foundation that determines whether your P&C operation can thrive. Every claim processed and every product launched flows through this central system. Modern core insurance software, built on cloud native and API first architectures, delivers the agility needed to respond to market shifts in weeks, not months. These platforms scale effortlessly as your business grows, whether you're expanding your residential property portfolio or entering the pet insurance market.

However, core insurance software is most powerful when paired with intelligent AI solutions. At Agentech, we focus on this partnership. While your core system manages workflows, our AI powered automation tools handle the repetitive administrative work in claims processing. Our always on AI assistants integrate with your existing infrastructure, boosting adjuster productivity for residential property, auto, and workers' compensation cases.

This approach empowers your adjusters, it does not replace them. We give your team superpowers to focus on complex decisions and customer relationships while AI handles routine tasks. The result is faster settlements, happier policyholders, and more engaged adjusters.

Looking ahead, the evolution to agentic AI promises even more transformative capabilities, like proactive claims management and real time personalized underwriting. This future requires the right foundation.

Investing in modern core insurance software is about positioning your P&C operation for sustainable growth and operational excellence. The carriers, TPAs, and IA firms that accept this change now will lead the industry tomorrow.

Ready to see how AI can transform your claims processing? Learn how Agentech can enhance your core system and help you build a truly future ready P&C operation.

Citations:

- Agentech. "Insurance IT Systems." agentech.com/resources/articles/insurance-it-systems.

- Agentech. "AI Claims Processing System." agentech.com/resources/articles/ai-claims-processing-system.

- Agentech. "Modernizing Core Insurance Systems." agentech.com/resources/articles/modernizing-core-insurance-systems.

- Agentech. "Insuretech Made Easy: Understanding Insurance Software Systems." agentech.com/resources/articles/insuretech-made-easy-understanding-insurance-software-systems.

- Agentech. "Microservices in Insurance." agentech.com/resources/articles/microservices-in-insurance.

- Agentech. "The Future of Insurance: How AI is Changing the Game." agentech.com/resources/articles/the-future-of-insurance-how-ai-is-changing-the-game.

- Agentech. "Artificial Intelligence SaaS Explained: Your Ultimate Guide." agentech.com/resources/articles/artificial-intelligence-saas-explained-your-ultimate-guide.

- Agentech. "Agentic AI Definition." agentech.com/resources/articles/agentic-ai-definition.

- Agentech. "Changing Insurance Claims: The Evolution from Generative AI to Agentic AI." agentech.com/resources/articles/transforming-insurance-claims-the-evolution-from-generative-ai-to-agentic-ai.

- Agentech. "Learn how Agentech can improve your core system." agentech.com.