Why Modern Claims Processing Solutions Matter for P&C Insurance

Claims processing solutions are software systems that automate and streamline the entire claims lifecycle for Property & Casualty insurance carriers, TPAs, and Independent Adjusting firms. Here's what they deliver:

Key Capabilities:

- Automated intake and assignment: Digital FNOL capture with rules-based routing to the right adjuster

- AI-powered document processing: Extract data from medical reports, repair estimates, and photos without manual entry

- Workflow automation: Guide adjusters through evaluation, reserves, payments, and closure with built-in compliance

- Real-time analytics: Identify fraud patterns, track cycle times, and benchmark performance across your portfolio

- Straight-through processing: Handle simple claims end-to-end without human intervention

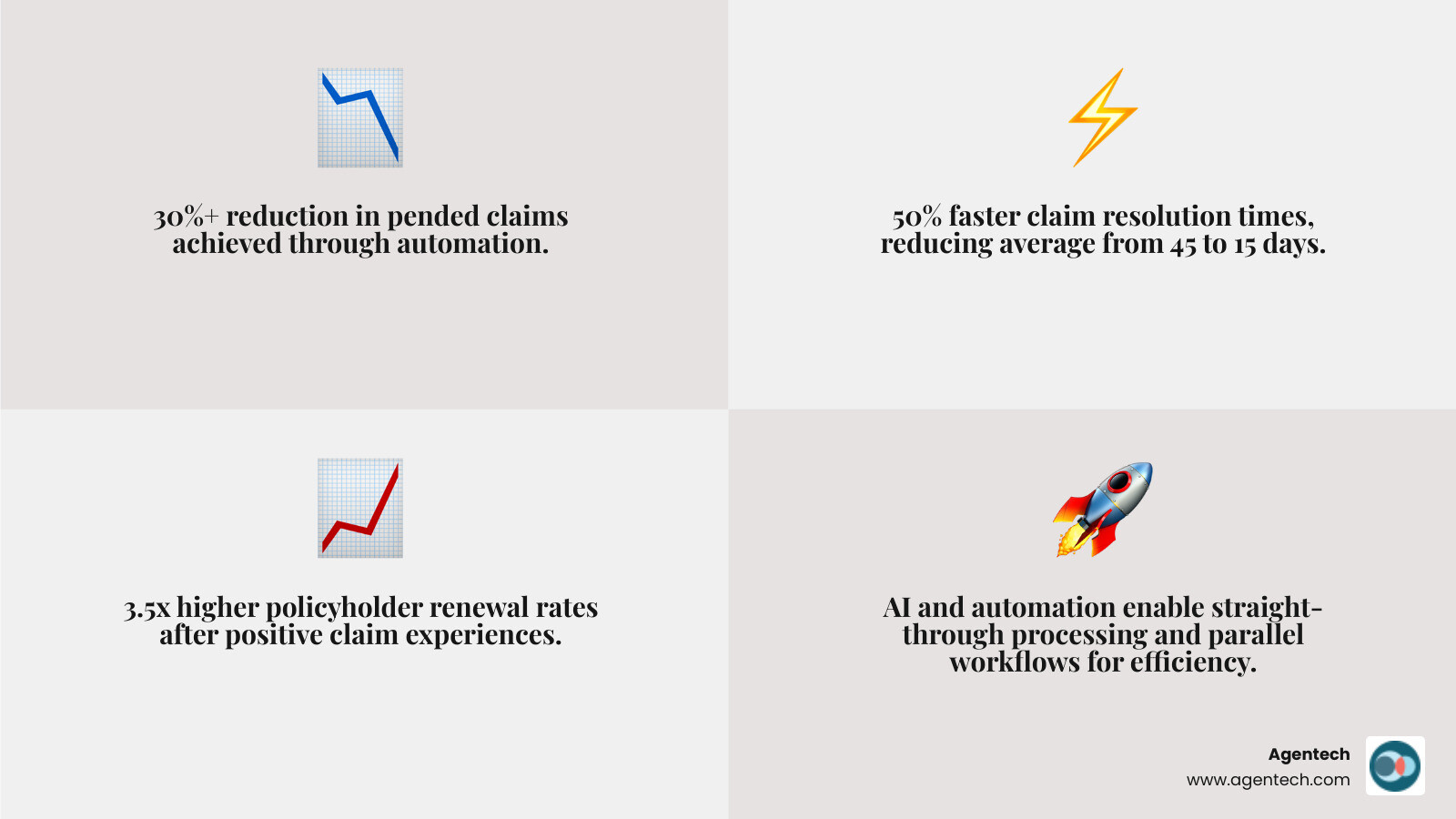

Bottom Line Results:

- 30%+ reduction in pended claims

- 50% faster claim resolution times

- 3.5x higher policyholder renewal rates after positive claims experiences

Claims are the moment of truth for P&C insurers. When a policyholder files a claim for a damaged roof, a car accident, or a workers' comp injury, your response defines their entire relationship with your brand.

But most claims teams still rely on manual processes. Adjusters spend hours on data entry instead of investigations. Paper forms get lost. Phone calls to check claim status eat up valuable time. Meanwhile, 50% of the insurance workforce will retire by 2036, leaving fewer hands to handle growing claim volumes.

The stakes are high. A positive claims experience makes policyholders 3.5 times more likely to renew. A negative one sends them straight to your competitors.

Modern claims processing solutions solve this problem. They automate repetitive tasks, extract data from documents instantly, and route claims to the right expert based on complexity and skill set. The result is faster settlements, lower costs, and happier customers.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for the P&C insurance industry. After scaling and exiting TokenEx in 2021, I've focused on changing claims processing solutions through AI that handles document analysis, fraud detection, and workflow automation at speeds impossible for manual teams.

What is a Claims Management System for P&C Insurance?

A claims management system for P&C insurance is more than just claims software. It is a comprehensive digital platform designed to manage and evaluate claims from policyholders, from the moment a claim is reported until its final closure. We build these systems to organize, track, and process P&C claims with unparalleled efficiency, significantly reducing manual work and boosting overall productivity for carriers, TPAs, and independent adjusting firms.

At its core, a robust claims management system serves as a centralized data hub, bringing together all relevant information related to a claim. This can include policy details, incident reports, photos, videos, medical records, repair estimates, and communication logs. Imagine all the puzzle pieces of a claim neatly arranged in one accessible place, rather than scattered across various folders and disparate systems. This centralization is crucial for maintaining data integrity and ensuring that every team member has access to the most current and accurate information.

Furthermore, a sophisticated workflow engine powers these systems. This engine is responsible for routing claims based on predefined categories and assignment rules. It acts like a smart traffic controller, directing each claim to the appropriate adjuster or department based on its characteristics and the expertise required. This ensures that claims are handled by the right person at the right time, preventing delays and improving the quality of service.

Core Functionalities of Claims Management Software

Let us dig into the specific functionalities that define modern P&C claims management software:

- Claim Intake and First Notice of Loss (FNOL): This is the critical first step where a claim is reported. Modern solutions offer digital channels for FNOL, such as online portals, mobile apps, or even automated chatbots. These systems often use wizard-based, dynamic, and response-driven questions to guide policyholders or agents through the intake process, capturing all necessary details efficiently. This capability integrates policy search and retrieval during claim intake, ensuring that the reported incident is immediately linked to an active policy.

- Policy Verification: Once a claim is initiated, the system automatically verifies the policy's validity and coverage relevant to the reported incident. This step is often integrated seamlessly with the intake process to confirm eligibility quickly.

- Rules-Based Assignment: After intake, the system intelligently assigns the claim to the most suitable adjuster. This is not a random process, but rather a sophisticated rules-based segmentation and assignment mechanism. Claims are routed instantly to the right expert at the right time based on a multi-factor dynamic system that considers skill set, licensing, geography, claim type, complexity, and even vendor involvement. This ensures that a complex property claim goes to a property specialist, while a simple auto claim might be assigned for straight through processing. For more details on how intelligent agents can automate these assignments, you can explore our resources on More info about AI Agents.

- Claim Evaluation: This phase involves a thorough assessment of the claim. Modern systems leverage best practices in workplans to guide adjusters through the evaluation process, ensuring consistency and compliance. This includes reviewing evidence, obtaining additional documentation, and determining the extent of damage or loss.

- Reserve Management: Accurate reserving is vital for an insurer's financial health. Claims software provides robust financial management tools, allowing for granular reserves and advanced capabilities to track potential payouts throughout the claim's lifecycle.

- Payment Processing: Once the claim evaluation is complete and liability is determined, the system facilitates swift and accurate payment processing. This can involve issuing payments to claimants, vendors, or healthcare providers, all while maintaining a clear audit trail.

- Subrogation: For some claims, the insurer may have the right to recover payments from a third party responsible for the loss. Modern systems include subrogation tracking capabilities to manage these recovery efforts efficiently, helping to reduce overall loss ratios.

- Claim Closure: The final stage involves formally closing the claim. Dynamic business rules ensure that all appropriate steps are taken and all necessary documentation is complete before a claim is closed, ensuring compliance and preventing future issues.

The Power of Modern Claims Processing Solutions

Modern claims processing solutions are changing the P&C insurance landscape by opening up immense operational efficiency and delivering tangible results. We are seeing reduced cycle times, which means claims are resolved faster, leading to lower loss ratios and significantly improved adjuster productivity. Imagine a world where your claims team can focus on complex cases and customer interaction, rather than getting bogged down in administrative minutiae. This is the promise of advanced claims software.

Consider the statistics: policyholders are 3.5 times more likely to renew their policies after a positive claims experience. This highlights the direct link between efficient claims processing and customer retention. Moreover, with 50% of the current insurance workforce projected to retire by 2036, the need for solutions that can do more with fewer human resources is not just an advantage, it is a necessity. Modern systems bridge this gap by empowering existing staff and streamlining operations.

How AI and Automation Drive Efficiency

Artificial intelligence (AI) and automation are the twin engines driving the efficiency revolution in claims processing. We leverage these technologies to fundamentally change how claims are handled:

- Repetitive Task Automation: One of the biggest time sinks in traditional claims processing is the sheer volume of repetitive administrative tasks. Systems powered by AI can automate these mundane activities, such as data entry, document classification, and routine communication. This frees up adjusters to focus on high value tasks that require human judgment and empathy. For more on how we achieve this, read about Automating Insurance Claims Processing.

- Intelligent Data Extraction: Claims involve a mountain of documents: medical reports, police reports, repair estimates, photos, and more. AI, particularly intelligent character recognition (ICR) and natural language processing (NLP), can intelligently extract relevant data from these unstructured and semi-structured documents. The power of data parsing and image/video analysis is immense. Our AI for P&C insurance document management solutions are trained on vast datasets, enabling them to process millions of claim documents, ensuring accuracy and speed. Visit AI for Insurance Document Management to learn more.

- Straight-through Processing (STP): This is the holy grail of claims efficiency. STP allows simple, low-complexity claims to be processed and settled end-to-end without any human intervention. We have seen examples where almost 50% of digitally filed claims are handled straight through, with some achieving nearly 80% STP. This dramatically reduces cycle times and processing costs, while also improving relationships with agents, brokers, and policyholders.

- Machine Learning Models: Machine learning (ML) models are continuously learning from historical claims data. They can predict claim severity, identify potential fraud patterns, and even suggest optimal settlement amounts. This data driven approach improves decision-making and leads to more accurate outcomes. Find more about the application of Machine Learning in Claims Processing.

Key Benefits of Modern Claims Processing Solutions

Implementing modern claims processing solutions brings a cascade of benefits to P&C insurance operations:

- Improved Accuracy: By automating data extraction and processing, we significantly reduce the risk of human error. This leads to fewer errors and cleaner claims, which in turn reduces the number of pended claims and redetermination requests.

- Reduced Operational Costs: Automation streamlines workflows, minimizes manual effort, and accelerates cycle times. This directly translates to lower administrative expenses and more efficient resource utilization, ultimately reducing claims management costs.

- Faster Claim Resolution: Automated processes, intelligent routing, and STP capabilities drastically cut down the time it takes to settle a claim. Quicker resolutions mean happier policyholders and improved brand reputation.

- Scalability: Modern cloud based solutions are inherently scalable. They can easily handle fluctuations in claim volume, whether due to seasonal peaks or catastrophic events, without requiring massive upfront infrastructure investments.

- Data-Driven Decisions: With comprehensive data capture and advanced analytics, P&C insurers gain invaluable insights into their claims operations. This enables data driven decision-making, leading to better outcomes, reduced fraud, and optimized strategies. For a deeper dive into how AI transforms operations, see AI for P&C Insurance Operations.

Enhancing the Policyholder Experience

Beyond operational gains, modern claims processing solutions are pivotal in elevating the policyholder experience, which, as we know, directly impacts retention.

- Proactive Communication: Solutions enable automated, proactive communication with policyholders throughout the claims journey. This keeps them informed about the status of their claim, what to expect next, and any required actions, reducing anxiety and improving satisfaction.

- Digital Self-Service Portals: Providing policyholders with secure online portals allows them to submit claims, upload documents, track progress, and communicate with adjusters at their convenience. This empowers them and reduces the burden on customer service teams.

- Faster Payments: The efficiency gained through automation directly translates to quicker claim settlements and payments. There is nothing quite like a swift resolution to soothe the stress of an unfortunate event.

- Increased Transparency: Digital systems offer greater transparency, allowing policyholders to see the progression of their claim in real time. This builds trust and confidence in the insurer.

The impact of a positive claims experience cannot be overstated. Research from Bain & Company reveals that policyholders are 3.5 times more likely to renew their policy after a positive claims experience. This statistic underscores why investing in sophisticated Policyholders are more likely to renew after a positive claims experience is not just about cost savings, but about fostering long term customer loyalty.

Tailoring Solutions for P&C Insurance Needs

The beauty of advanced claims processing solutions lies in their adaptability. While the core principles of efficiency and automation remain constant, these solutions can be finely tuned to meet the specific needs of various P&C insurance segments, whether it is P&C carriers, third-party administrators (TPAs), or independent adjusting (IA) firms. Each of these entities has unique operational requirements and challenges that a custom system can address.

Property & Casualty (P&C) Insurance

Within the broad spectrum of P&C insurance, modern claims software offers specialized functionalities:

- Automated Damage Assessment: For auto and property claims, AI driven tools can analyze photos and videos of damage to provide initial assessments, estimate repair costs, and even identify potential fraud. This significantly speeds up the initial evaluation phase.

- Weather Peril Data Integration: P&C insurers, especially those dealing with property claims, need to understand the impact of severe weather. Solutions can integrate with external weather data providers to quantify the effects of weather perils, understand their scope, and anticipate catastrophe claims as they happen.

- Vendor Management: Managing a network of repair shops, contractors, and other service providers is crucial. Claims software helps manage these vendors, from assignment to invoicing, ensuring smooth coordination during claim resolution. This is especially important for moving fast during catastrophes while managing field adjusters and vendors.

- Structural Estimations: For property claims, precise structural and personal property estimations are critical. Automated workflows streamline this process, reducing manual effort and improving accuracy. Our Automated Click-to-Claim Software helps in this area, enabling rapid, accurate claims processing.

Niche and Specialty Lines within P&C

Beyond standard auto and home, claims processing solutions also cater to niche and specialty lines, each with its own set of complexities:

- Workers' Compensation: These claims often involve intricate medical reports, legal considerations, and long term care management. Solutions can automate the analysis of medical reports, track treatment plans, and manage legal documentation, ensuring compliance and efficient case management.

- Pet Insurance: A rapidly growing segment, pet insurance claims require efficient processing of veterinary bills and medical histories. Our solutions, such as those detailed on our Pet Insurance page, are designed to streamline these unique claims, ensuring fast and compassionate service for pet owners.

- Cargo and Marine Claims: These claims involve complex logistics, international regulations, and often significant financial implications. Specialized modules within claims software can handle the unique aspects of cargo valuation, damage assessment during transit, and compliance with maritime law.

Key Considerations for Selecting Your Claims Management System

Choosing the right claims management system is a strategic decision that can significantly impact your P&C insurance business. It is not just about features, but about finding a partner that aligns with your long-term goals and operational realities. We understand this, and we believe that careful consideration of several critical factors will lead to the most successful implementation. From integration capabilities to vendor partnership, and total cost of ownership to user adoption, each element plays a vital role. For those weighing the options, our insights on Buy vs. Build: Navigating the SaaS AI Technology Decision can be particularly helpful.

Critical Factors for Selecting Claims Processing Solutions

When evaluating claims processing solutions, we urge our clients to consider the following:

| Factor | Description |

|---|---|

| Integration Capabilities | The system should seamlessly integrate with your existing core systems, such as policy administration, billing, and third party data sources. Look for robust APIs and a proven track record of successful integrations to avoid creating data silos. |

| Scalability and Performance | Choose a solution that can grow with your business. A cloud based architecture is often preferable for its ability to handle fluctuating claim volumes, especially during catastrophic events, without performance degradation. |

| User Experience (UX) and Adoption | An intuitive and user friendly interface is crucial for adjuster adoption and productivity. The system should be easy to learn and navigate, minimizing the need for extensive training and reducing resistance to change. |

| Vendor Partnership and Support | Look beyond the claims software to the team behind it. A true partner will offer strong support, a clear product roadmap, and a collaborative approach to help you achieve your long-term strategic goals. |

| Total Cost of Ownership (TCO) | Evaluate the complete cost, including licensing, implementation, training, maintenance, and potential future upgrades. A subscription based SaaS model can offer more predictable costs compared to a large upfront capital expenditure. |

| Security and Compliance | Given the sensitive nature of claims data, the solution must adhere to the highest security standards and comply with industry regulations like GDPR and CCPA. Verify the vendor's security certifications and data handling protocols. |

The Future of Claims Processing in P&C Insurance

The P&C insurance industry is at a crossroads, facing significant challenges and exciting opportunities. We believe the future of claims processing solutions is not just about incremental improvements, but about a profound change driven by technology and a strategic shift in mindset.

One of the most pressing challenges is the impending talent gap. The U.S. Bureau of Labor Statistics indicates that 50% of the current insurance workforce will retire by 2036. This looming crisis underscores the urgent need for solutions that can amplify the capabilities of existing staff and automate tasks that would otherwise require new hires. AI is the answer to solving the insurance labor crisis with AI, ensuring continuity and even growth in the face of workforce changes.

We are also witnessing a fundamental shift from reactive claims handling to proactive loss prevention. Historically, claims have been a reactive cost center. However, modern systems are enabling insurers to evolve from mere triage and settlement towards active loss prevention and mitigation. By analyzing vast amounts of data, insurers can identify emerging risks, provide proactive advice to policyholders, and even intervene before a small incident escalates into a major claim. This transforms claims from a necessary expense into a strategic value driver.

The next wave of automation is hyper automation, characterized by the integration of various advanced technologies. This includes sophisticated Agentic AI Frameworks, which are not just about automating individual tasks, but creating intelligent digital agents that can perform complex workflows, make decisions, and even learn from interactions, much like a human coworker. These agents can handle everything from initial claim profiling to complex data correlation, freeing human adjusters to focus on empathy and intricate problem-solving.

Finally, the future will be defined by connected ecosystems and robust Insurtech partnerships. No single solution can do it all. The industry is moving towards platforms that seamlessly integrate with a wide array of specialized Insurtech solutions and complementary applications. This allows P&C insurers to rapidly deploy new capabilities, improve existing functionalities, and foster innovation through collaborative intelligence. This interconnected approach ensures that claims processing solutions remain agile, adaptive, and capable of meeting the changing demands of the market and policyholders.

Conclusion

We have explored how modern claims processing solutions are revolutionizing the P&C insurance industry. From automating mundane tasks and intelligently extracting data to enabling straight-through processing and enhancing policyholder experiences, these solutions are no longer a luxury but a strategic imperative. They empower P&C carriers, TPAs, and Independent Adjusting firms to move beyond the paperwork, changing claims from a reactive cost center into a proactive value driver.

The benefits are clear: improved accuracy, reduced operational costs, faster claim resolutions, and significantly improved policyholder satisfaction, leading to higher retention rates. As the insurance workforce evolves, AI and automation are stepping in to ensure continuity and efficiency, allowing human adjusters to focus on the human element of claims.

The future of claims processing is automated, intelligent, and deeply integrated. We at Agentech are proud to be at the forefront of this change, providing cutting-edge AI assistants that seamlessly integrate into existing workflows, boosting adjuster productivity without replacing human decision-making. We are building the next generation of claims solutions, making them smarter, faster, and more customer centric.

We invite you to find how our AI Agents can transform your claims operations, helping you achieve unparalleled efficiency and deliver exceptional service. Visit our product page to learn more about how we can help your organization thrive in this new era: Discover how AI Agents can transform your claims operations

Citations:

- Bain & Company. (n.d.). How to Improve Customer Retention in Property and Casualty Insurance. Retrieved from https://www.bain.com/insights/how-to-improve-customer-retention-in-property-and-casualty-insurance-snap-chart/

- Agentech. (n.d.). Reducing Fraud While Maintaining a Superb Claims Experience. Retrieved from https://www.agentech.com/resources/articles/reducing-fraud-while-maintaining-a-superb-claims-experience

- U.S. Chamber of Commerce. (n.d.). The America Works Report: Industry Perspectives. Retrieved from https://www.uschamber.com/workforce/education/the-america-works-report-industry-perspectives

- Agentech. (n.d.). Automating Insurance Claims Processing. Retrieved from https://www.agentech.com/resources/articles/automating-insurance-claims-processing

- Agentech. (n.d.). AI for Insurance Document Management. Retrieved from https://www.agentech.com/resources/articles/ai-for-insurance-document-management

- Agentech. (n.d.). Machine Learning in Claims Processing. Retrieved from https://www.agentech.com/resources/articles/machine-learning-in-claims-processing

- Agentech. (n.d.). AI for Insurance Operations. Retrieved from https://www.agentech.com/resources/articles/ai-for-insurance-operations

- Agentech. (n.d.). Automated Click-to-Claim Software. Retrieved from https://www.agentech.com/resources/articles/automated-click-to-claim-software

- Agentech. (n.d.). Pet Insurance. Retrieved from https://www.agentech.com/product/integrations/pet-insurance

- Agentech. (n.d.). Buy vs. Build: Navigating the SaaS AI Technology Decision. Retrieved from https://www.agentech.com/resources/articles/buy-vs-build-navigating-the-saas-ai-technology-decision

- Agentech. (n.d.). How It Works. Retrieved from https://www.agentech.com/how-it-works/

- Agentech. (n.d.). Insurance Claims Analytics Software. Retrieved from https://www.agentech.com/resources/articles/insurance-claims-analytics-software

- Agentech. (n.d.). Security. Retrieved from https://www.agentech.com/how-it-works/security

- Agentech. (n.d.). AI in Insurance: Balancing Innovation and Regulation. Retrieved from https://www.agentech.com/resources/articles/ai-in-insurance-balancing-innovation-and-regulation

- Agentech. (n.d.). Solving the insurance labor crisis with AI. Retrieved from https://www.agentech.com/resources/articles/solving-the-insurance-labor-crisis-with-ai-driven-innovation

- Agentech. (n.d.). Agentic AI Frameworks. Retrieved from https://www.agentech.com/resources/articles/agentic-ai-frameworks

- Agentech. (n.d.). More info about AI Agents. Retrieved from https://www.agentech.com/product/ai-agents

- Agentech. (n.d.). Find how AI Agents can transform your claims operations. Retrieved from https://www.agentech.com/product/