Why Agentic AI Issue Resolution is Changing P&C Insurance Claims

Agentic ai issue resolution is revolutionizing how Property & Casualty (P&C) insurance carriers, TPAs, and Independent Adjusting firms handle claims. It uses autonomous AI systems to detect, analyze, and resolve issues without constant human oversight, shifting claims processing from reactive to proactive.

Key Benefits of Agentic AI Issue Resolution:

- Autonomous resolution of common customer service issues

- Proactive problem detection before claims become complex

- 24/7 monitoring and instant response capabilities

- Seamless integration with existing claims management software

- Human AI collaboration that augments rather than replaces adjusters

The traditional approach to claims processing often leaves adjusters overwhelmed by manual data entry, repetitive tasks, and growing backlogs. This reactive model means responding to issues only after they have impacted customer satisfaction and operational efficiency. Agentic AI changes this dynamic. Unlike rule based automation, agentic systems proactively monitor claims data, identify potential problems, and take corrective action before minor issues escalate.

This technology offers a path to dramatically improve efficiency, freeing up skilled adjusters to focus on complex, high-value work. Industry analysis predicts that agentic AI will soon autonomously resolve a majority of common customer service issues without human intervention, leading to significant operational improvements.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance carriers. Having successfully scaled and exited TokenEx, I've seen how technology can transform industries. I'm now focused on bringing that same impact to agentic ai issue resolution in claims processing.

What is Agentic AI and How Does It Differ from Traditional Automation?

Agentic AI represents a leap forward from traditional automation. While older automation follows predefined rules, Agentic AI acts as an intelligent collaborator with independent capabilities. It is a class of advanced AI systems that operate autonomously with memory, reasoning, and planning capabilities, working towards a goal without constant human oversight [10].

Instead of simply executing commands, Agentic AI sets goals, makes decisions, and adapts its behavior based on real-time inputs. This proactive nature enables true agentic ai issue resolution, where problems are addressed before they fully manifest.

Here is a quick comparison:

| Feature | Traditional Automation (Rule Based) | Agentic AI (Autonomous) |

|---|---|---|

| Operation | Reactive, executes predefined scripts | Proactive, plans and takes independent actions |

| Learning & Adaptation | Static, follows fixed rules | Dynamic, learns from experience, adapts behavior |

| Initiation | Requires human trigger or scheduled event | Initiates actions autonomously based on goals |

| Complexity Handling | Best for simple, repetitive tasks | Handles complex, ambiguous, multi step problems |

| Decision Making | Deterministic, rule based | Probabilistic, reasoning based, goal oriented |

| Goal Orientation | Task focused | Goal focused, with sub goal generation |

This shift from reactive tools to proactive systems is a game changer for P&C insurance claims. Learn more about the foundational concepts in our article on Agentic AI Definition.

From Generative AI to Agentic AI

Generative AI, known for creating content like text and images, typically waits for a human prompt and does not act on its own. Agentic AI improves these capabilities. It uses generative features to reason, plan, and execute actions autonomously to achieve a goal. It doesn't just create solutions; it implements them without constant human intervention.

This distinction is crucial. Many companies using Generative AI report no significant bottom line impact, a "gen AI paradox" that arises from focusing on simple tasks rather than automating complex business processes 6]. Agentic AI is positioned to deliver tangible value by moving beyond content generation to comprehensive task completion, as we've explored in [Changing Insurance Claims from Generative AI to Agentic AI.

The Role of an Agentic System as a Digital Coworker

Agentic AI serves as a digital coworker, not a replacement for human adjusters. At Agentech, we believe the future of claims is augmented. Our AI is designed to handle high volume, repetitive tasks like FNOL processing, document sorting, and routine communications.

This frees up human adjusters to focus on what they do best: applying expertise to complex cases, showing empathy to policyholders, and making strategic decisions. By embracing AI agents as digital coworkers, P&C insurance carriers can boost productivity, reduce operational costs, and improve job satisfaction. Adjusters become strategic problem-solvers, empowered by AI to deliver better outcomes. This model is explored in The Future of Work in P&C Insurance: Embracing AI Agents as Digital Co-Workers.

The Core Capabilities of Agentic AI Issue Resolution

The power of agentic ai issue resolution comes from a blend of technologies that enable AI to think, plan, and act within P&C claims processing. These systems go far beyond simple automation.

At Agentech, our systems use a combination of technologies. Multi agent collaboration allows specialized AI agents to handle different parts of complex problems. Reinforcement learning helps agents improve over time, while natural language processing lets them understand and generate human-like language. Causal reasoning helps them find the root causes of problems, not just the symptoms. See how our system works in practice.

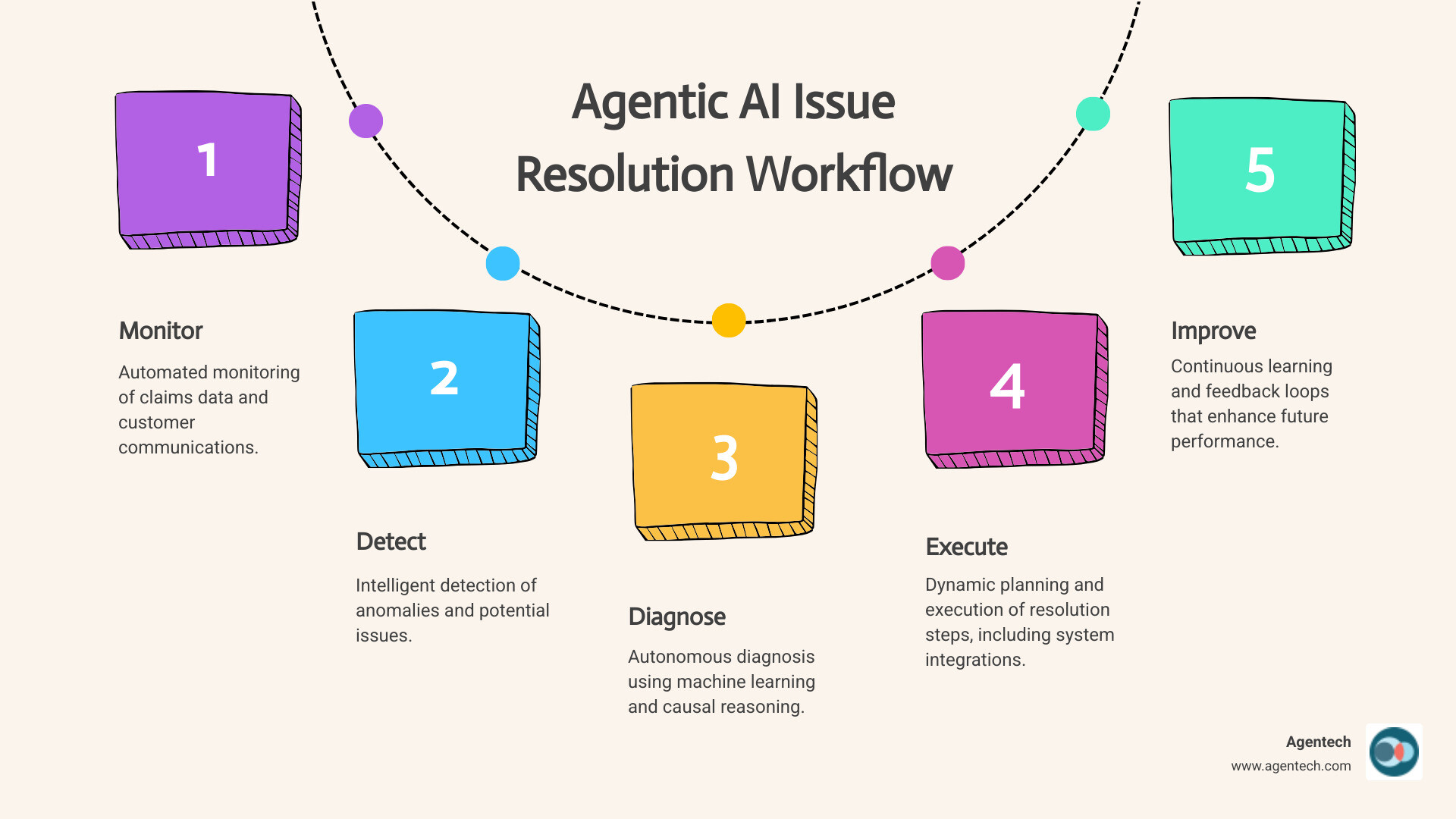

Autonomous Incident Detection and Diagnosis

Agentic AI systems continuously monitor claims data, policyholder interactions, and external factors for anomalies. Instead of waiting for a problem to be reported, the AI proactively identifies it.

For example, an agentic system might notice a pattern of slightly higher costs from a specific auto repair shop and start an investigation weeks before a human might. Using anomaly detection, our agents spot early warning signs and correlate information from multiple sources. This intelligent triaging of claims ensures urgent issues get immediate attention. The impact is significant; by 2029, Gartner predicts that agentic AI will autonomously resolve 80% of common customer service issues without human intervention.

Intelligent Planning and Resolution Execution

Once an issue is diagnosed, our AI agents create a custom action plan. This dynamic workflow generation means the system doesn't follow rigid steps. If a claim is missing a police report, the agent can draft a request to the policyholder, schedule a follow-up, and update the claim status.

This seamless system integration occurs via API calls to your existing claims management software. The AI can send communications, adjust reserves, or request documentation. We've successfully automated even the most tedious task in claims processing: creating the claim profile.

Continuous Feedback and Improvement for Agentic AI Issue Resolution

Agentic AI systems never stop improving. After each resolution, our AI agents analyze the outcome to determine if the solution was effective and efficient. This continuous learning from outcomes allows the system to adapt to your specific business needs, claims processes, and policyholder preferences.

The performance analytics generated highlight systemic weaknesses and suggest improvements. This refinement creates a virtuous cycle: the AI gets smarter, processes become more efficient, and adjusters can focus on work requiring human expertise. Our systems are designed with adjusters in mind to ensure every improvement benefits your team.

A Practical Guide to Implementing Agentic AI in P&C Claims

Implementing agentic ai issue resolution doesn't have to be an intimidating project. At Agentech, we recommend a phased approach that delivers value quickly while building team confidence.

Start with manageable proof-of-concept projects that provide clear wins without disrupting your entire operation. The biggest challenge is often human, not technical. Your adjusters need to see how this technology makes their jobs better. With a thoughtful approach, agentic AI becomes a reliable digital coworker.

Step 1: Identify High Impact, Low Risk Use Cases

Begin your agentic ai issue resolution journey by targeting tasks that are time consuming but don't require complex human judgment.

Good starting points include FNOL intake, claim profile creation, document indexing, and coverage verification. These are predictable, high-volume tasks that AI excels at. Automating initial communications, like acknowledgments and information requests, also frees up adjusters for conversations where empathy and expertise are critical. Starting here provides immediate results and proves the technology's value. If you're not sure where to start with AI, our team can help identify ideal entry points.

Step 2: Ensure Seamless Integration with Claims Management Software

A common pitfall is creating AI solutions that don't connect with your existing systems. Our approach is built on an API first architecture, allowing our agentic AI to plug into your current claims management software. Data synchronization happens in real-time, so the AI always has current information.

We understand the challenges of legacy system compatibility. Our solutions are designed for interoperability, enhancing rather than replacing your existing infrastructure. The goal is a seamless integration that feels like a natural extension of the tools your adjusters already use. Learn more about this in our article on Insurance IT Systems.

Step 3: Establish Governance and Human Oversight

Agentic AI operates autonomously, but not without oversight. Your adjusters remain in control of major decisions. We help establish clear decision boundaries so everyone knows what the AI handles independently and what requires human approval.

A human in the loop philosophy is key. Every AI action is logged in audit trails for traceability, which is crucial for compliance and building trust. Data privacy is non-negotiable; our systems automatically handle sensitive information according to regulations like SOC 2 and GDPR. Proper governance ensures secure adoption that protects your business and policyholders, a topic we cover in AI in Insurance: Balancing Innovation and Regulation.

Real World Applications in Property & Casualty Insurance

In the real world, agentic ai issue resolution is becoming essential for P&C insurance carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) Firms to stay competitive. Organizations that adopt this technology are seeing dramatic improvements in operational efficiency and cost reduction.

The paradigm is shifting from reactive problem solving to a proactive model where AI agents identify and resolve issues before they escalate.

Streamlining Auto and Residential Property Claims

Auto and residential property claims are ideal for agentic ai issue resolution due to their high volume of repetitive tasks.

Automated damage assessment becomes more sophisticated as AI analyzes photos to categorize damage and suggest repair costs. Parts procurement and repair scheduling are transformed from manual coordination into a seamless process, where agentic systems communicate directly with vendors and repair shops. Subrogation identification becomes proactive, as AI agents analyze claim details to spot recovery opportunities immediately. Fraud detection also improves, with AI identifying suspicious patterns that might otherwise be missed. The result is faster cycle times and more satisfied policyholders, as our AI Claims Processing System demonstrates.

Enhancing Pet Insurance and Workers' Compensation for Agentic AI Issue Resolution

The benefits of agentic ai issue resolution are also clear in specialized lines like pet insurance and workers' compensation, which involve complex documentation and strict compliance.

Medical record analysis is a game-changer. AI can efficiently extract relevant information from veterinary bills or workplace injury documentation, verifying diagnoses and ensuring consistency. Treatment plan verification and billing code accuracy are improved as AI cross-references treatments against guidelines and fee schedules, flagging discrepancies. Fraud detection becomes more sophisticated through pattern recognition, and compliance checks for workers' compensation are automated and reliable.

Our work with Odie Pet Insurance shows what is possible when you implement Agentic to automate claims tasking. They achieved greater efficiency and accuracy, freeing their team to focus on customer service.

Frequently Asked Questions about Agentic AI in Claims

When considering agentic ai issue resolution for P&C insurance, it's natural to have questions. Here are answers to the most common ones we hear from carriers, TPAs, and IA firms.

How does agentic AI work alongside human adjusters?

Think of agentic AI as a digital teammate, not a replacement. It handles high volume, routine work like data entry, document sorting, and initial communications. This frees your human adjusters to focus on high value tasks: complex decision making, negotiations, and providing empathy to policyholders.

The AI acts as an always on assistant, handling routine tasks with precision. Your adjusters become strategic problem-solvers, empowered by AI to deliver better outcomes. This collaboration boosts productivity and job satisfaction.

Is it safe to allow AI to take action on claims files?

Yes, when implemented with proper governance and safeguards. We establish clear boundaries for what the AI can do autonomously. For example, our systems can automate data extraction and routine communications but require human approval for critical decisions like settlement amounts.

We use a "human in the loop" model where adjusters have ultimate control. All AI actions are logged in audit trails for traceability. System access is restricted, and real-time monitoring allows adjusters to pause or override AI actions, ensuring compliance and peace of mind.

What are the main challenges when adopting agentic AI?

The biggest challenge is often managing the human side of change. Staff may have initial skepticism about job security and learning new systems. Other challenges include integration complexity with legacy claims management software and ensuring data quality and privacy.

We recommend a phased implementation approach, starting with a small pilot project. This allows your team to see the benefits firsthand, builds confidence, and makes integration more manageable. Effective change management and training are crucial to help your team understand how AI improves their roles, ensuring a smooth transition.

Citations:

[6] Batra, G., et al. (2024). Seizing the agentic AI advantage. McKinsey & Company. Retrieved from https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/seizing-the-agentic-ai-advantage

[10] Melchior, S., & Morf, P. (n.d.). Agentic AI: the risks & rewards of adaptive AI. Zühlke. Retrieved from https://www.zuehlke.com/en/insights/agentic-ai-the-risks-and-rewards-of-adaptive-ai

Conclusion: The Future of Claims is Augmented, Not Replaced

The era of agentic ai issue resolution is here, changing how P&C insurance claims are handled. This technology moves beyond traditional automation, offering AI that thinks ahead, solves problems proactively, and continuously learns.

Instead of being buried in administrative tasks, your adjusters can focus on what they do best: building relationships, making complex judgments, and applying their expertise. Agentic AI doesn't replace the human touch; it amplifies it.

This augmented approach gives you a competitive advantage. You can process claims faster, reduce operational costs, and deliver a better customer experience. Improved efficiency means greater accuracy, consistency, and the ability to handle growing claim volumes without burning out your team.

At Agentech, we build AI agents specifically for the challenges of P&C insurance claims. We understand that seamless integration and thoughtful implementation are key. The future we're building is one where technology empowers people, adjusters feel valued, and policyholders receive faster, more accurate service.

Ready to see how this change could work for your organization? Explore our AI Agents and transform your claims processing.