Why Modern P&C Claims Adjusters Depend on the Right Software

Insurance claims adjuster software is the digital toolkit that helps Property & Casualty (P&C) insurance professionals manage, process, and settle claims efficiently. The main categories of tools adjusters use include:

- Claims Estimating Tools - To calculate repair and replacement costs for property and auto damage.

- Claims Management Platforms - To handle the entire claims lifecycle from First Notice of Loss (FNOL) to settlement.

- AI Automation Tools - To automate repetitive tasks like data entry, document review, and fraud detection.

- Document Management Systems - To organize and secure claims-related files and records.

- Communication and Collaboration Tools - To connect adjusters with all stakeholders.

The P&C insurance industry has evolved dramatically. What once required hours of manual work now happens in minutes through modern claims software. For P&C carriers, Third Party Administrators (TPAs), and Independent Adjusting (IA) firms, this technology is essential for managing residential property claims, auto physical damage, and workers' compensation cases. Without it, adjusters drown in administrative tasks. With it, they can focus on fair, accurate settlements and policyholder satisfaction.

Organizations using modern claims software report significant efficiency gains and reduced cycle times. But with dozens of options available, how do you choose the right tools for your team?

I'm Alex Pezold, founder of Agentech AI. We're building the AI workforce for insurance, helping insurers transform their operations with insurance claims adjuster software powered by agentic AI. Our technology handles the repetitive administrative tasks adjusters face daily.

This guide walks you through the essential software categories, key features, and how emerging AI is reshaping the claims profession. You'll find practical insights to make informed decisions.

What is Claims Adjuster Software and Why is it Essential?

Insurance claims adjuster software is the digital platform that powers modern P&C claims handling. It centralizes all the moving parts of a claim, from the first report to the final settlement. Instead of juggling paperwork, notes, and manual calculations, adjusters have everything they need in one system.

This technology marks a fundamental shift for P&C carriers, TPAs, and Independent Adjusting firms. It frees adjusters from tedious administrative work so they can focus on investigating claims, serving policyholders, and making fair decisions. Tasks like data entry, document filing, and deadline tracking are automated, saving hours of human time. For new adjusters, proficiency in claims software has become the single most important technical skill to master. It's how the work gets done.

The effects are widespread. Adjusters work faster, carriers reduce costs, and policyholders get quicker, smoother experiences. To understand the broader landscape, our guide on InsureTech Made Easy: Understanding Insurance Software Systems explains how all the pieces fit together.

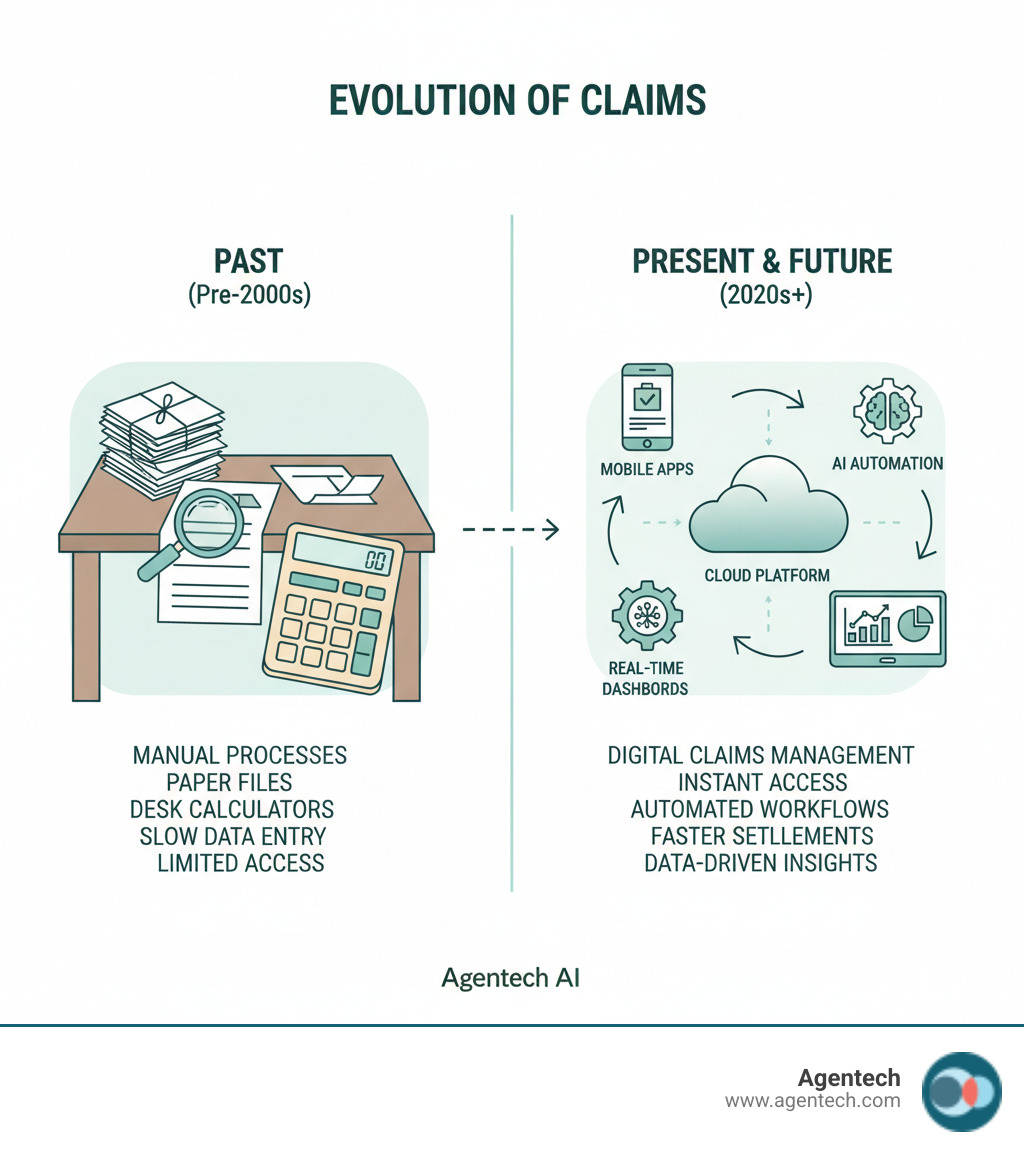

The Shift from Manual to Digital

In the pre-software era, an adjuster assessing a flooded basement would use physical price books, call multiple vendors, and manually calculate every line item. The process was slow, exhausting, and prone to error. Consistency was nearly impossible, as estimates depended on which catalog was used or which vendor was called.

Claims software changed everything. Adjusters gained access to massive databases with current pricing for materials and labor across different regions. They could digitally sketch damaged areas and generate detailed estimates in a fraction of the time. This shift dramatically improved not just speed, but also accuracy and consistency. Two adjusters handling similar claims now produce similar estimates because they work from the same data. This consistency builds trust and is why modern Insurance IT Systems are the backbone of P&C insurance today.

Core Benefits for Adjusters and Carriers

The impact of modern insurance claims adjuster software is concrete and measurable across P&C insurance operations.

- Speed and Efficiency: Carriers often see 30% efficiency gains immediately. Automating routine tasks allows adjusters to handle more claims, reducing settlement times from weeks to days.

- Accuracy and Consistency: Working with validated, industry-wide data instead of manual calculations reduces errors. Built-in checks flag inconsistencies, leading to more reliable outcomes.

- Policyholder Satisfaction: Today's customers expect fast, digital experiences. Claims software provides the transparency and speed that lead to higher satisfaction and loyalty.

- Cost Reduction: Less manual work, fewer errors, and faster settlements lower operational expenses. Better fraud detection also protects against significant losses. Fraud costs P&C insurers billions annually, according to the National Association of Insurance Commissioners, and software that spots suspicious patterns saves money.

- Compliance and Auditing: The software creates automatic audit trails, tracking every action and ensuring workflows follow regulatory and internal policies. This makes audits and regulatory inquiries manageable.

- Smarter Decision-Making: Analytics and reporting tools provide real data on claims portfolios. Managers can spot trends, identify bottlenecks, and make strategic decisions based on facts.

These benefits create a better experience for everyone involved in residential property, auto physical damage, and workers' compensation claims. The software doesn't just make the work faster; it makes it better.

Citations:

- AllLines Training. "What is Claims Estimating Software?"

- Agentech. "InsureTech Made Easy: Understanding Insurance Software Systems."

- Agentech. "Insurance IT Systems."

- National Association of Insurance Commissioners. "Insurance Fraud."

Key Features of Modern Claims Management Software

Modern insurance claims adjuster software is a digital command center that integrates the entire P&C claims process. The best platforms share core capabilities that simplify an adjuster's work.

Key features include claims intake and FNOL tools that let policyholders report incidents via mobile apps or online portals, often with photos. Automated workflows guide each claim through the correct steps, while document management keeps all files organized in one secure location. Built-in communication tools connect adjusters with policyholders and vendors, and analytics help managers track performance. With mobile capabilities, adjusters can work from the field, and integration APIs connect the claims platform to other essential systems like policy administration and billing.

For property and auto claims, you'll also need cost databases with regional pricing, estimating tools for damage assessment, and fraud detection to catch suspicious activity early.

Smart Claims Management and Workflow Automation

Workflow automation is where claims software delivers immense value. It handles routine decisions and repetitive tasks, freeing up adjusters.

When a new claim arrives, automated task assignment routes it to the right adjuster based on claim type, severity, and workload. The software tracks deadlines and sends real-time status alerts so nothing is missed. Every action is logged in an audit trail, creating a complete record for internal reference and compliance checks. The best platforms allow you to customize these rules to match your specific workflows, a key component of Insurance Back Office Automation.

Data, Analytics, and Fraud Detection

Every claim generates valuable data. Modern insurance claims adjuster software uses centralized dashboards to turn this data into actionable insights, showing team performance, bottlenecks, and claim trends.

Perhaps the most critical use of analytics is fraud detection. With fraudulent claims costing P&C insurers billions, catching suspicious patterns early is crucial. AI-powered tools analyze claims as they come in, flagging anomalies like duplicate submissions or unusual billing patterns.

Predictive analytics can also forecast claim severity and identify subrogation opportunities, allowing adjusters to manage complications proactively. These smart systems, a core part of AI Claims Processing Insurance, learn from historical data to make better predictions about future claims.

Understanding the Core Types of P&C Insurance Claims Adjuster Software

The world of insurance claims adjuster software is varied, with each tool solving specific challenges for P&C professionals. Think of it as a toolbox: some tools handle precision work, others manage the big picture, and the newest ones use AI to work alongside you.

Here are the three core categories:

- Claims Estimating Tools: These are precision instruments for calculating repair and replacement costs for property and auto physical damage claims. Adjusters use them daily to create detailed estimates.

- Comprehensive Claims Management Platforms: These are the command centers that manage the entire claims journey, from First Notice of Loss to settlement. P&C carriers, TPAs, and IA firms rely on them to handle auto, property, workers' compensation, and liability claims.

- AI and Automation Layers: This is the newest evolution. These tools don't replace your existing platforms but sit on top of them to automate tedious work like data entry, document indexing, and photo labeling. This is where Agentech focuses, building AI agents that act as digital coworkers.

| Function Category | Primary Use | Key Feature | Best For |

|---|---|---|---|

| Claims Estimating Tools | Calculating repair/replacement costs for property/auto | Extensive cost databases, sketching, mobile capture | Property damage, residential property, auto physical damage (APD) |

| Comprehensive Claims Management | End-to-end claims lifecycle management | Workflow automation, policy integration, communication | P&C carriers, TPAs, IA firms managing diverse claim types |

| AI and Automation Layers | Automating repetitive tasks, enhancing decisions | Digital AI agents, intelligent triage, predictive analytics | Boosting adjuster productivity and streamlining administrative work |

Claims Estimating Tools

Estimating software is how an adjuster can quickly and accurately determine repair costs. These systems are fundamental to residential property and auto physical damage claims.

Their power comes from massive cost databases with material and labor pricing for hundreds of geographic regions. The software automatically applies the correct costs for a specific zip code. Sketching and measurement tools let adjusters create detailed diagrams and calculate square footage with precision on a tablet or phone. Mobile capabilities are a game-changer, allowing field adjusters to start a claim, capture photos, and generate a preliminary estimate on-site.

Comprehensive Claims Management Platforms

While estimating tools focus on one task, comprehensive claims management platforms orchestrate the entire lifecycle. These systems are the central nervous system for claims operations.

An FNOL module captures initial details and routes the claim to the right adjuster. Policy integration automatically verifies coverage and pulls policy terms. The platform's real power is in automated workflows that guide each claim through predefined steps, assign tasks, and trigger actions based on your rules. Payment processing modules handle disbursements securely, and stakeholder portals give policyholders and vendors transparent access to track claim status. This eliminates the chaos of managing claims across disconnected systems.

Our partnership with Snapsheet brings this vision to life, and you can read more about how we're revolutionizing claims processing with AI-driven digital agents.

AI and Automation Layers

This is where Agentech lives. AI and automation layers don't replace your existing claims software; they make it smarter and more efficient by handling the grunt work.

Imagine an adjuster gets a new claim with dozens of photos. Instead of spending 20 minutes manually labeling each one, AI-powered photo labeling does it in seconds. AI can also extract information from PDFs and reports, cutting data entry and document indexing time by 70% or more.

AI triage is especially powerful at FNOL. The system can analyze initial data to detect probable total losses or suggest the next best action, ensuring adjusters focus their expertise where it's needed most. We think of our AI as digital coworkers that handle repetitive tasks, freeing human adjusters to focus on complex investigations, policyholder relationships, and nuanced decisions.

Our specialized AI Agents are designed for P&C insurance workflows, integrating seamlessly with your existing systems. We use a hybrid approach, which you can learn about in our article on how Agentech combines out-of-the-box efficiency with custom QA precision.

The result is that adjusters can handle more claims with better accuracy and less stress. That's the promise of AI in modern insurance claims adjuster software.

Citations:

- Agentech. "Snapsheet and Agentech Partner to Revolutionize Claims Processing with AI-Driven Digital Agents."

- Agentech. "A Hybrid AI Solution for Claims Automation: How Agentech Combines Out-of-the-Box Efficiency with Custom QA Precision."

The Future of P&C Insurance Claims Adjuster Software: AI and Automation

The P&C insurance industry is at an exciting crossroads. Current insurance claims adjuster software is powerful, but challenges remain with data silos and integrating new platforms with legacy systems. The great news is that emerging technologies, especially artificial intelligence, are set to drive a fundamental shift in how claims are processed. For a broader look, read The Future of Insurance: How AI is Changing the Game.

The Rise of Agentic AI

You've likely heard of generative AI that creates content. Agentic AI is the next step: it doesn't just create, it acts. Agentic AI proactively handles tasks, makes decisions within set boundaries, and works alongside humans to get things done. It's the difference between an assistant who waits for instructions and a colleague who sees what needs doing and does it.

This is the vision behind Agentech. Our AI Agents are designed to function as true digital coworkers for claims adjusters. We are pioneering this with AI Agents that act as digital coworkers to handle tedious administrative work like labeling photos, summarizing assignments, and indexing documents. This frees human adjusters to focus on complex investigations, connecting with policyholders, and making judgment calls that require human insight. We are not replacing adjusters; we are making their jobs better and more meaningful. For a deeper dive, explore our Agentic AI Definition.

The Role of Machine Learning and Predictive Analytics

Machine learning (ML) and predictive analytics are already working behind the scenes in advanced insurance claims adjuster software. These technologies analyze historical claims data to spot patterns and make predictions that change how claims are approached.

- Predicting Claim Severity: ML models can analyze initial claim details to forecast how complex and costly a claim will likely be, helping managers prioritize resources.

- Identifying Subrogation Opportunities: The technology can flag claims where another party might be responsible for damages, helping P&C carriers recover costs.

- Predicting Attorney Involvement: By recognizing patterns in claim characteristics, analytics can identify which claims are likely to end up in litigation, allowing for proactive management.

This all leads to optimized workloads. Experienced adjusters can tackle the toughest cases while simpler claims move through faster channels. The beauty of ML is that it continuously learns, making the system smarter with every claim processed. This moves the industry from reactive to proactive claims handling. To learn more, read our article on Insurance Claims Machine Learning.

Frequently Asked Questions about Claims Adjuster Software

We talk with P&C carriers, TPAs, and IA firms every day about insurance claims adjuster software. These are the questions that come up most often.

How do you choose the right claims management software?

Picking the right software involves a clear process. Here are the key steps:

- Assess Your Needs: Start by understanding your team's biggest pain points. Is it manual data entry, document management, or something else? The best software solves real problems.

- Prioritize Integration: Your new system must connect with your existing platforms, like policy administration and billing. Look for robust APIs and pre-built connectors to avoid data silos.

- Plan for Scalability: Choose software that can grow with you and adapt to your unique processes. Customizable workflows are essential for long-term flexibility.

- Evaluate User Experience: If the software is clunky or confusing, your adjusters won't use it effectively. Always ask for a demo and consider a pilot program.

- Understand Total Cost: Look beyond the upfront price. Consider subscription fees, integration charges, and training costs to understand the total cost of ownership. Our guide on Buy vs. Build: Navigating the SaaS AI Technology Decision can help with this decision.

Can claims software handle different types of P&C insurance claims?

Yes, and this is a key strength of modern platforms. A good system adapts to various claim types, including:

- Residential property claims

- Auto claims (physical damage and liability)

- Workers' compensation claims

- Liability claims (general and professional)

The secret is customization. Top platforms let you configure workflows, forms, and compliance rules to match the specific needs of each business line. This allows one robust system to support your entire operation.

What is the typical implementation time for new claims management software?

The timeline varies, but modern cloud-based solutions are much faster to implement than legacy systems. A straightforward implementation can be operational in a few weeks.

Key factors influencing the timeline include integration complexity with legacy systems and the volume of data migration required. However, pre-built connectors can speed this up significantly. Training is also faster now, with many intuitive platforms allowing adjusters to become productive in just a few hours.

For a full deployment with custom configuration, a typical timeline is eight to twelve weeks after historical data is received. A good vendor will provide a detailed plan upfront to set clear expectations.

Conclusion: Empowering Adjusters for the Future

The evolution of insurance claims adjuster software has fundamentally changed how P&C insurance professionals work. We've moved from manual processes to sophisticated platforms that empower adjusters to do their best work.

Modern claims software delivers increased efficiency, improved accuracy, and better customer experiences. For P&C carriers, TPAs, and IA firms, this means lower costs, assured compliance, and smarter decision-making. The future is automated, and it's already here. Agentic AI is creating digital coworkers that handle tedious administrative tasks, freeing adjusters to focus on what humans do best: investigating complex claims, building relationships, and making nuanced decisions that require empathy and expertise.

The right insurance claims adjuster software is more than a tool; it's a strategic partner. It shapes your team's ability to serve policyholders effectively across residential property, auto, and workers' compensation claims.

At Agentech, our AI-powered solutions are designed to augment your human adjusters, not replace them. Our AI Agents integrate seamlessly into your workflows to boost productivity and allow your team to focus on high-value work.

Ready to see how AI can transform your claims operations? Visit us at https://www.agentech.com to learn more about how we're empowering adjusters for the future.

Citations:

- Agentech. "Snapsheet and Agentech Partner to Revolutionize Claims Processing with AI-Driven Digital Agents."

- Agentech. "InsureTech Made Easy: Understanding Insurance Software Systems."

- Agentech. "Insurance IT Systems."

- Agentech. "Insurance Back Office Automation."

- Agentech. "AI Claims Processing Insurance."

- Agentech. "A Hybrid AI Solution for Claims Automation: How Agentech Combines Out-of-the-Box Efficiency with Custom QA Precision."

- Agentech. "The Future of Insurance: How AI is Changing the Game."

- Agentech. "Agentic AI Definition."

- Agentech. "Insurance Claims Machine Learning."

- Agentech. "Buy vs. Build: Navigating the SaaS AI Technology Decision."