Why AI Assistant Productivity Matters for P&C Insurance Claims

AI assistant productivity is changing how P&C insurance professionals handle their daily workload. Here's what you need to know:

Quick Overview: AI Assistants for Claims Productivity

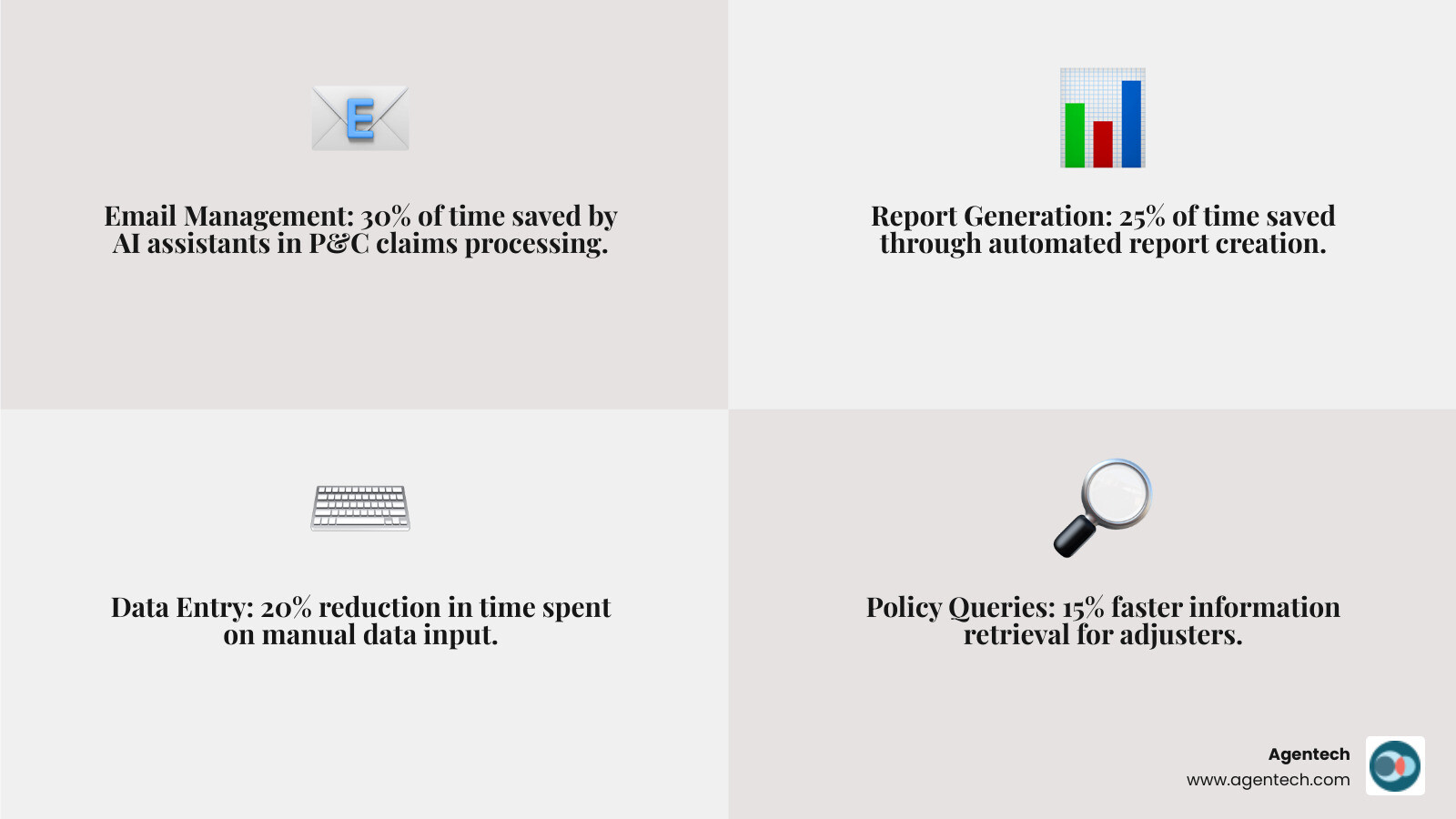

- Time Savings: AI assistants can save professionals 12+ hours per week by automating repetitive tasks

- Performance Boost: Skilled workers see up to 40% improvement in performance when using AI tools

- Key Applications: Email drafting, report generation, policy queries, data extraction, and workflow automation

- Focus Shift: Reduce time on administrative tasks to focus on complex claim evaluations and customer service

- P&C Specific: Especially valuable for residential property, auto, pet, and workers' compensation claims processing

If you're a claims manager drowning in paperwork, you're not alone. The average P&C insurance professional spends roughly one month per year just managing their email inbox. Add to that the endless data entry, report writing, policy lookups, and documentation required for every claim, and it's no wonder many adjusters feel overwhelmed.

The good news? You don't have to work harder to get more done. AI assistants are here to handle the repetitive, time-consuming tasks that eat up your day, freeing you to focus on what really matters: evaluating complex claims, making informed decisions, and delivering excellent service to policyholders.

These tools aren't about replacing human judgment. They're about reclaiming your time so you can apply that judgment where it counts. Whether you work for a P&C carrier, a Third-Party Administrator, or an Independent Adjusting firm, AI assistants can help you process more claims faster without sacrificing quality.

I'm Alex Pezold, founder of Agentech AI, where we're building the AI workforce for P&C insurance with a focus on AI assistant productivity in claims processing. After founding and scaling TokenEx to a successful exit, I've dedicated my work to helping P&C insurance professionals work smarter through AI-driven solutions that improve adjuster productivity without replacing human decision-making.

What Are AI Assistants and How Do They Fundamentally Work?

At its heart, an AI assistant is an intelligent software program designed to lend a helping hand with various tasks. Think of it as a digital colleague that never sleeps, never complains, and is always ready to tackle routine work. For P&C insurance professionals, this means a significant shift in how we manage our day. These tools act as personalized support systems, taking on the mundane so we can focus on the meaningful.

The magic behind these assistants lies in advanced technologies:

- Machine Learning: This is how AI learns. By analyzing vast amounts of data, which in our case could be millions of claim documents, policy wordings, and adjuster notes, the AI identifies patterns and makes predictions or decisions without being explicitly programmed for every scenario. It’s how the assistant gets smarter the more it interacts with our claims data. You can learn more about machine learning to understand its foundational role.

- Natural Language Processing (NLP): NLP is what allows AI assistants to understand, interpret, and generate human language. When we ask a question about a policy or request a draft email, NLP enables the AI to comprehend our intent and respond in a way that feels natural and helpful. This technology is vital for seamless interaction and is continuously evolving, as explored in articles about natural language processing.

The benefits for P&C professionals are substantial and multifaceted:

- Significant Time Savings: Imagine cutting down hours spent on repetitive tasks. Statistics show that AI can save professionals a significant amount of time each week. Some of us are already experiencing even greater gains, with our AI productivity stack saving us over 20 hours per week. This isn't just about speed; it's about freeing up precious time for complex claim investigations and strategic decisions.

- Improved Work Quality: AI doesn't just work faster; it can also work better. By providing consistent, accurate support, AI can help improve highly skilled workers’ performance by an impressive 40% compared to those who don’t use it. This means fewer errors, more thorough analyses, and ultimately, better outcomes for our policyholders.

- Reduced Administrative Load: From drafting initial claim summaries to categorizing emails, AI assistants can shoulder a significant portion of the administrative burden. This directly translates to less burnout and more energy for our teams.

- Focus on Strategic Decision Making: When AI handles the grunt work, our adjusters and claims managers can dedicate their cognitive energy to what humans do best: critical thinking, empathizing with customers, and making nuanced judgments that AI cannot replicate. This shift allows for a much more rewarding and impactful role in the claims process.

For a deeper dive into how AI can boost performance, particularly for skilled workers, consider the insights from this study on generative AI and worker productivity.

Key Applications for Boosting Professional Productivity

The beauty of AI assistant productivity lies in its versatility. These tools can be seamlessly integrated into various aspects of our daily work, changing how we approach everything from communication to complex claim investigations.

Streamlining Communication and Writing

Communication is the cornerstone of P&C insurance claims management, yet it often consumes an inordinate amount of time. AI assistants are reshaping this area:

- Email Drafting: Whether it is an initial acknowledgment to a policyholder or a detailed request for information, AI can generate first drafts in seconds. We simply describe what we need and the AI email assistant crafts a message, allowing us to refine it for tone, grammar, and specific claim details [Source 1].

- Email Summarization: Long email threads can slow down claim handling. AI can quickly condense lengthy exchanges into concise summaries so we grasp the key points without reading every word. This is invaluable when catching up on a claim history or preparing for a call.

- Tone and Style Adjustment: An AI assistant can help ensure our communications are always professional and empathetic. We can ask it to adjust the tone of a message to be more formal, more reassuring, or more direct, so our message lands as intended.

- Grammar and Clarity Support: AI writing assistance can catch grammar mistakes, suggest clearer sentence structures, and help us maintain a consistent brand voice and regulatory appropriate language.

- Automated Report Generation: Instead of manually compiling data, we can ask an AI assistant a question and it can generate instant, visual, and shareable reports from our claims data [Source 1]. This means less time wrestling with spreadsheets and more time analyzing insights.

- Data Visualization into Charts: AI can transform structured claims data into charts and graphs that highlight trends, cycle times, and leakage indicators, helping leaders make better operational decisions.

- First Draft Creation for Claims Documents: From initial claim reports to internal memos, AI can kickstart the writing process, providing a solid foundation that we can then review and customize. This significantly reduces the time spent staring at a blank page.

Accelerating Research and Information Synthesis

The volume of information in Property & Casualty insurance can be overwhelming. AI assistants act as our personal research analysts, making sense of vast data sets:

- AI-powered Search within Claims Management Software: Imagine instantly finding specific details across thousands of claim files and internal documents. AI search can scan our internal knowledge bases and provide relevant information quickly [Source 2, Source 3]. This means less time digging through archives and more time on actual claim resolution.

- Sourced Answers with Citations from Internal Knowledge Bases: A critical feature for P&C insurance is the ability to get answers that are not only fast but also verifiable. Some AI tools provide source-linked answers, referencing the original policy or document from which the information was drawn [Source 1]. This is crucial for maintaining accuracy and compliance.

- Analysis of Long Claim Documents: Policy wordings, loss reports, and expert assessments can be lengthy. AI can analyze these documents, highlight key clauses, identify relevant sections, and answer specific questions about their content.

- Summarizing Policy Wordings and Loss Reports: AI assistants can condense complex policy language and detailed loss reports into digestible summaries so adjusters quickly grasp essential information without reading every paragraph.

For a deeper understanding of how AI can transform the analysis of P&C claims data, we encourage you to explore More on AI for claims data analysis.

Optimizing Task and Project Management

Managing multiple claims at once requires impeccable organization. AI assistants bring new levels of efficiency to task and project management:

- Automated Workflows in Claims Management Software: Automation platforms can connect our various applications and automate routine tasks. For instance, we can set up an automation to create a new task in our claims management software every time a new email related to a specific claim is received [Source 2]. This eliminates manual data entry and ensures nothing falls through the cracks.

- Breaking Down Complex Claims into Actionable Tasks: A large residential property loss or workers' compensation claim can feel like an impossible mountain of work. AI can break it down into smaller, manageable sub-tasks, providing a clear roadmap for resolution [Source 3].

- Smart Scheduling of Inspections: AI scheduling assistants can optimize calendars by suggesting the best times for inspections, meetings, and focus work, taking into account existing commitments and priorities [Source 2, Source 3]. This is particularly helpful for field adjusters juggling site visits for auto and residential property claims.

- Automated Meeting Summaries: Meetings are necessary but time-consuming. AI meeting assistants can record, transcribe, and summarize our meetings, highlighting key discussion points, decisions made, and action items [Source 2, Source 3]. This keeps everyone aligned and ensures follow-ups are clear.

- Action Item Extraction and Assignment: Beyond summarizing, some AI tools can automatically extract action items from meeting transcripts and even suggest who should be responsible for them, streamlining post-meeting follow-up.

To learn more about how AI can automate and optimize back office tasks in P&C insurance, visit Learn about AI for back office tasks.

Revolutionizing AI Assistant Productivity in P&C Insurance Claims

The impact of AI assistant productivity is particularly profound in the specialized world of P&C insurance claims. By focusing on the unique pain points of adjusters, AI can deliver targeted solutions that dramatically improve efficiency and accuracy.

Automating FNOL and Claim Profile Creation

First Notice of Loss (FNOL) and the subsequent creation of a claim profile are critical, yet often manual and time-intensive, steps in claims processing. For P&C insurance across residential property, auto, pet, and workers' compensation claims, AI offers transformative capabilities:

- Automated Data Extraction from Intake Forms: Whether a policyholder submits information via a web form, email, or even a phone call (with voice-to-text AI), AI can automatically extract relevant data points. This includes policy numbers, claimant details, incident dates, loss descriptions, and more, significantly reducing manual data entry errors and speeding up the intake process.

- Instant Claim Profile Creation in Claims Management Software: Once the data is extracted, AI can instantly populate a new claim profile within our claims management software. This means that within moments of an FNOL, a comprehensive digital file is ready for an adjuster to review, complete with all initial details. This eliminates delays and allows adjusters to begin their work much faster.

We have seen how AI can tackle even the most tedious tasks. Find how we've revolutionized one of the most time-consuming parts of claims processing: Creating the claim profile with AI.

Maximizing Adjuster AI Assistant Productivity

Once a claim is initiated, AI continues to support adjusters, enhancing their productivity at every turn:

- Fast Policy Query Answers: Adjusters frequently need to consult complex policy documents to verify coverage, exclusions, and limits. AI assistants can provide instant answers to policy-related questions, searching across our entire knowledge base of policy wordings, endorsements, and guidelines.

- Source-Linked Responses from Your Knowledge Base: Critically, these AI-generated answers aren't just guesses. They are backed by direct links to the original source documents within our internal knowledge base [Source 1]. This ensures accuracy and allows adjusters to quickly verify information, which is paramount in the regulated P&C insurance industry.

- Quick Retrieval of Claim Documents: Imagine needing a specific document from a claim file that is months or even years old. With AI-powered search, adjusters can quickly retrieve any relevant document—be it an appraisal, medical report, or communication log—with a simple query.

- Drafting Customer Communications: From initial contact letters to settlement offers, AI can draft various customer communications, ensuring consistency, accuracy, and adherence to our brand voice. This frees adjusters to focus on the content and empathy of their message, rather than the drafting process itself.

These capabilities are designed to empower adjusters. Explore how AI is specifically custom to meet the needs of adjusters: AI designed for adjusters.

Best Practices for Implementing AI Assistants

Integrating AI assistants into P&C insurance workflows requires a thoughtful approach. It is not just about adopting new tools, it is about building a new way of working that maximizes AI assistant productivity while mitigating potential risks.

Building Your AI Stack for Peak Productivity

A successful AI integration starts with strategy, not just buying more technology. We need to be intentional about how we build our AI stack:

- Identifying Time-Consuming Tasks in P&C Claims: The first step is to pinpoint the tasks that consume the most time and mental energy for our adjusters and claims teams. These are typically repetitive activities that do not require unique human skills or complex judgment, such as data entry, initial email drafting, or routine policy lookups.

- Starting with One or Two Key Processes: Rather than overhauling everything at once, a phased approach works best. Choose one or two high-impact repetitive processes to automate with AI. This allows teams to adapt gradually and provides quick wins that build confidence in the technology.

- Building Consistent Usage Habits: Like any new tool, AI assistants require consistent usage to deliver full value. We encourage teams to build tiny habits around these tools, such as using them for one specific task daily or setting up a new automation weekly. This steady integration fosters familiarity and maximizes adoption.

- Integrating AI into Existing Claims Management Software: For AI to truly improve productivity, it must integrate smoothly with current claims management software and other core tools. Many enterprises struggle with integrating AI into their tech stacks, so solutions that act as an orchestration layer and connect disparate systems can be especially valuable [Source 2]. This ensures a unified experience and avoids creating new silos.

- Focusing on Augmenting Adjuster Skills: The goal of AI is not to replace skilled adjusters but to empower them. We should use AI for busywork, allowing adjusters to dedicate their brainwork to complex problem solving, customer empathy, and strategic decision making.

Mastering the Art of the Prompt

The quality of AI output is directly proportional to the quality of our input. Learning to speak to AI effectively is a skill that pays dividends:

- Providing Clear Context for Claim Queries: When asking an AI assistant a question about a claim, we must provide sufficient context. Instead of just asking, "What is the deductible?" we might ask, "For policyholder John Doe, claim #12345, what is the deductible for wind damage based on their homeowner's policy, and what section of the policy states this?"

- Being Specific with Requests: Vague prompts lead to vague answers. We need to be specific about what we want the AI to do, including the desired format, length, and key information to include. For example, "Draft an email to the policyholder explaining the next steps for their auto claim, using a reassuring tone and including a link to our online claim portal."

- Defining Constraints for Outputs: If we need a summary of a document, we can specify, "Summarize this loss report in 200 words, focusing on the cause of loss and estimated damages." These constraints guide the AI to deliver precise results.

- Iterating and Refining Prompts for Better Results: AI interaction is often an iterative process. If the first response is not quite right, we can provide corrective feedback such as, "Make it more concise" or "Include the policy number in the subject line." This helps the AI learn our preferences and improve its output over time.

Mitigating Risks and Avoiding Pitfalls

While the benefits of AI are clear, we must also be mindful of potential downsides and implement safeguards:

- Data Privacy and Security Protocols: In P&C insurance, handling sensitive policyholder data is paramount. Any AI solution we adopt must adhere to high standards of data privacy and security. We must ensure that AI models are not trained on proprietary data without explicit consent and that all information is protected with enterprise-grade security, as seen with solutions like Microsoft 365 Copilot [Source 5].

- Verifying AI-Generated Information: While AI is powerful, it is not infallible. We must always verify AI-generated information, especially for critical decisions related to claim payouts, legal compliance, or customer communications. Human oversight remains indispensable to ensure accuracy and prevent AI hallucinations in which the AI generates plausible but incorrect information [Source 2].

- The Importance of Human Oversight: AI assistants are tools to augment human capabilities, not replace human judgment [Source 1, Source 4]. For complex claim evaluations, sensitive customer interactions, and nuanced decision making, the human element is irreplaceable. We use AI to free up adjusters for these high-value tasks, not to remove them from the process.

- Avoiding Cognitive Decline: As we rely more on AI for routine tasks, there is a risk that our own cognitive abilities might atrophy if we do not consciously exercise our critical thinking skills [Source 7]. We should continue to engage in problem-solving and creative tasks to maintain mental acuity.

- Overcoming Integration Challenges: The struggle to integrate AI with existing tech stacks is real for many organizations [Source 2]. Choosing AI solutions that are designed for seamless integration or using orchestration tools is key to avoiding an AI tools graveyard of unused software.

The Future is Agentic: What's Next for AI in the Workplace?

The journey of AI in P&C insurance is rapidly evolving. We're moving beyond simple generative AI tools that create content, towards more sophisticated "agentic" systems. This shift promises to redefine AI assistant productivity even further, making our digital helpers more autonomous and proactive.

- The Evolution of AI in P&C Insurance: What began with basic automation and data analysis is now progressing to systems that can understand context, make decisions, and execute multi-step processes autonomously within our claims management software.

- From Generative Tools to Agentic Systems: While generative AI is excellent for drafting emails or summarizing documents, agentic AI takes it a step further. It involves AI systems that can plan, execute, and monitor their own actions to achieve a goal, often interacting with multiple tools and systems along the way.

- Agentic AI Explained: An agentic AI system is designed to perform autonomous, multi-step tasks. Instead of simply responding to a single prompt, it can break down a complex goal into a series of sub-tasks, execute them, and even self-correct if it encounters an issue. For example, an agentic AI could receive an FNOL, extract all relevant data, create a new claim file, assign it to the appropriate adjuster based on workload and expertise, and then draft an initial communication to the policyholder—all without direct human intervention at each step. To dig deeper into this concept, explore What is Agentic AI?.

- Proactive Assistance in Claims Handling: Imagine an AI assistant that not only answers your questions but proactively flags potential issues in a claim, suggests optimal next steps based on historical data, or even initiates follow-up tasks. This "AI Agent Assist" can act as a real-time coach for human agents, providing insights and recommendations during live interactions [Source 6].

- The Rise of Digital Coworkers: Amazon's CEO has forecasted a future with billions of AI agents acting as coworkers, and we are already seeing this vision materialize in P&C insurance. Agentic AI systems are becoming invaluable digital colleagues, handling hundreds of routine tasks that once consumed hours of human time. Find more about Amazon CEO Forecasts Billions of AI Agents as Coworkers—and Agentic AI is Already Powering P&C Insurance Claims with Hundreds.

- Augmenting Human Roles, Not Replacing Them: Crucially, this evolution is about augmentation. Agentic AI handles the repetitive, rule-based, and data-intensive aspects of claims, freeing our human adjusters to focus on the complex, empathetic, and strategic elements that truly require human judgment. It means more time for policyholder relations, complex fraud investigations, and high-value decision making. This vision of collaborative work is changing the industry, as detailed in The future of work in P&C insurance.

Conclusion: Start Working Smarter Today

The era of AI assistant productivity is not a distant future, it is here, and it is reshaping how we work in P&C insurance claims. By embracing these intelligent tools, we can fundamentally transform our operations.

We have seen how AI assistants can help us reclaim valuable time by automating tasks like email drafting, report generation, and policy lookups. They boost our claims processing output by accelerating research, streamlining communication, and optimizing task management. Most importantly, they free skilled adjusters and claims professionals to focus on complex evaluations, nuanced customer service, and strategic decision making, the work that truly adds value and requires the human touch.

For P&C carriers, Third-Party Administrators, and Independent Adjusting firms, AI is not just a technological upgrade, it is a powerful partner that improves efficiency, improves accuracy, and ultimately leads to better outcomes for both our businesses and our policyholders.

At Agentech, we are at the forefront of this change, building AI-powered solutions specifically designed to transform Property & Casualty claims automation. Our ensemble of AI Agents is ready to become your digital coworkers, enabling your teams to work smarter, not harder.

Ready to see how our AI Agents can transform your claims operations? Discover our ensemble of AI Agents today.

Citations:

- AI Assistant product page.

- The best AI productivity tools blog post.

- The Best AI Tools to Slash Your Work Time (Hopefully) in Half blog post.

- AI assistants are transforming how teams operate blog post.

- Microsoft 365 Copilot product information page.

- AI Agent Assist: Your Next CX Revolution blog post.

- Is Generative AI Making Us Dumber? blog post.

- machine learning

- natural language processing

- insights from this study on generative AI and worker productivity

- More on AI for claims data analysis

- Learn about AI for back office tasks

- Creating the claim profile with AI

- AI designed for adjusters

- What is Agentic AI?

- Amazon CEO Forecasts Billions of AI Agents as Coworkers—and Agentic AI is Already Powering Insurance Claims with Hundreds

- The future of work in insurance