Why P&C Insurance Process Management is Critical for Modern Carriers

Insurance process management is a systematic approach to optimizing workflows across Property & Casualty insurance operations. Effective P&C insurance process management delivers:

- Reduced operational costs by up to 30% through workflow automation

- Faster claim processing with cycle times cut by 50 to 70%

- Improved accuracy with 75% fewer manual data entry errors

- Higher customer satisfaction through streamlined service

- Better regulatory compliance with standardized, auditable processes

The P&C insurance industry faces pressure to modernize. Legacy systems, manual data entry, and fragmented workflows create bottlenecks that frustrate customers and drain resources. Many carriers still rely on slow, paper processes, even though the average person files roughly three auto insurance claims by age 70.

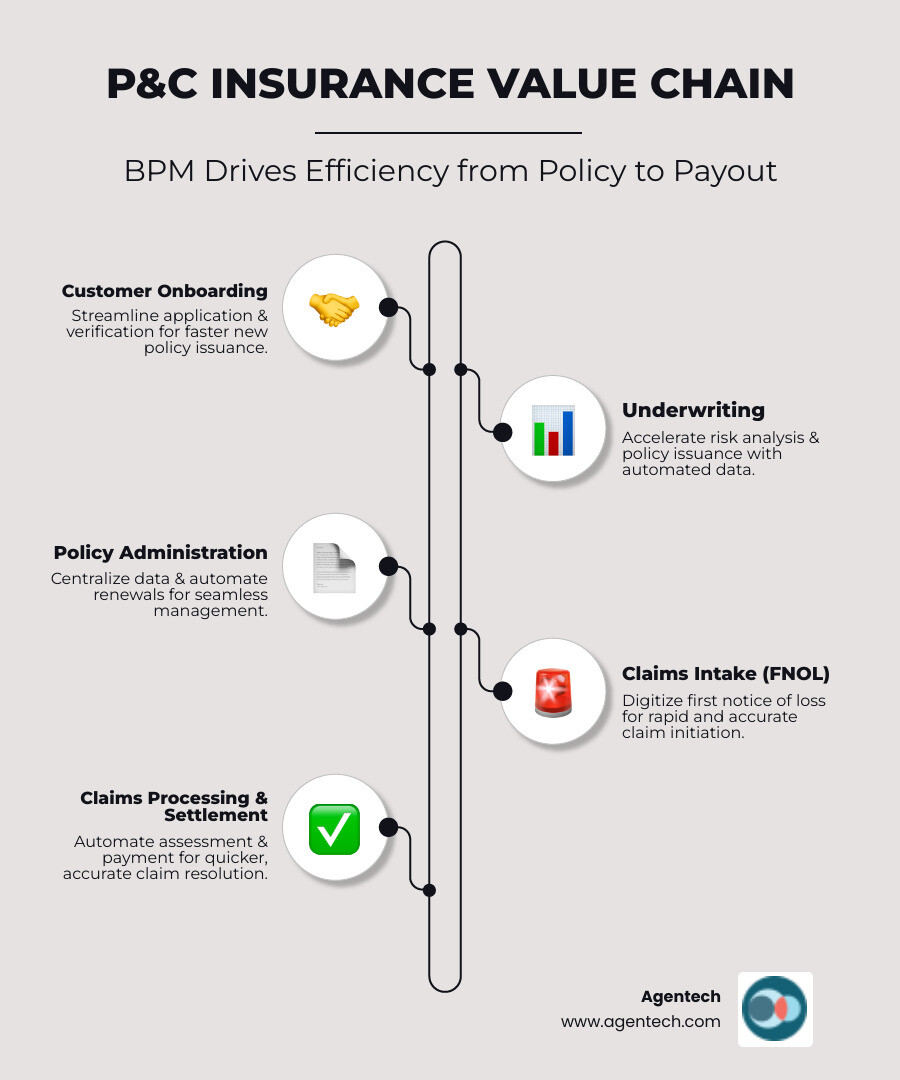

Business Process Management (BPM) offers a solution. By automating repetitive tasks, standardizing workflows, and integrating systems, BPM transforms how P&C carriers operate. Automation can boost productivity and reduce operational expenses by up to 40% over the next decade.

For claims managers, effective process management is essential for staying competitive as customer expectations rise and profit margins tighten.

As Alex Pezold, founder of Agentech AI, my experience has shown that effective P&C insurance process management requires both strategic vision and practical execution to deliver measurable results.

The Core Challenges in P&C Insurance and How BPM Provides the Solution

The Property & Casualty insurance world is filled with operational challenges. Whether handling property claims, auto accidents, or workers' compensation cases, the complexities can seem overwhelming.

Legacy systems are a primary issue. Many P&C carriers use outdated technology, creating information silos where claims and underwriting platforms cannot communicate. This leads to manual handoffs and errors. Adding to this is regulatory complexity, with each state having unique rules for claim timeframes and policy language. This patchwork of regulations makes inefficient claims handling a significant problem. Meanwhile, underwriting delays caused by manual processes mean lost business as competitors approve policies in minutes. For more on tackling these challenges, explore our guide on P&C Insurance Back Office Automation.

Identifying Process Bottlenecks in P&C Insurance

Process bottlenecks often stem from a few key areas. Manual data entry consumes adjusters' time as they input the same information into multiple systems, increasing the risk of errors. Fragmented workflows cause claims to bounce between departments like estimating, vendor management, and legal, with each handoff creating delays. Siloed departments operate with separate processes and incompatible data, preventing representatives from seeing a complete claim status.

This fragmentation directly harms customer satisfaction. Policyholders become frustrated when they have to repeat their story to different departments. Since the average person files roughly three auto insurance claims by the time they're 70, these negative experiences have long-term consequences.

How Business Process Management (BPM) Transforms Operations

Business Process Management (BPM) provides a clear path to operational efficiency. It maps out the most effective route for every process from beginning to end.

Process standardization ensures consistency, so every adjuster follows the same steps for similar claims, reducing errors and improving service quality. Workflow automation handles repetitive tasks, freeing your team to focus on complex negotiations and customer relationships. Instead of manual entry, automation populates all systems from a single input. Data integration breaks down silos, allowing systems to communicate seamlessly. This improved visibility helps managers spot bottlenecks early.

The agility from managed processes allows carriers to adapt quickly to market changes and new regulations. The P&C insurance BPM market is projected to reach $4.78 billion by 2026, showing that P&C insurance process management is now essential for survival and growth. Smart P&C carriers, TPAs, and IA firms are turning operational headaches into competitive advantages with BPM.

Key P&C Insurance Workflows Ripe for Automation and Their Benefits

Certain P&C insurance workflows are prime candidates for automation, particularly those involving high volumes of paperwork and repetitive tasks. These are the areas where P&C insurance process management delivers the biggest wins.

Workflows like claims processing, underwriting, customer onboarding, and policy administration directly impact customer experience and operational efficiency. Streamlining them through automation creates a smoother, faster experience that builds policyholder loyalty. Modern automation handles routine tasks, allowing your team to focus on complex decisions.

Automating Claims Processing for Speed and Accuracy

Claims processing is a critical customer touchpoint. Automation transforms this experience. First Notice of Loss (FNOL) can be handled through online portals or mobile apps, allowing customers to upload photos and start the process immediately. AI tools can then perform an initial damage assessment from these images, providing preliminary estimates. Document verification is accelerated as claims management software uses OCR to scan invoices and reports, flagging issues automatically.

Claim triage routes simple claims for processing without manual intervention while sending complex cases to specialists. Fraud detection powered by AI analyzes thousands of claims to spot suspicious patterns that humans might miss. The result is significant: automation can reduce claims processing costs by up to 30%. Learn more in our guide on AI Claims Processing for P&C Insurance.

Streamlining Underwriting and Customer Onboarding

Automation dramatically speeds up underwriting. Data gathering becomes seamless as systems pull information from external and internal sources, providing underwriters with comprehensive risk profiles instantly. Risk analysis powered by AI processes historical data to identify patterns and suggest appropriate premiums. Once a decision is made, policy issuance is automated, from generating documents to setting up billing. Renewals are also automated to prevent lapses.

Digital ID verification eliminates paperwork and simplifies onboarding for new customers. The impact is clear: digitizing underwriting reduces cycle times by 50 to 70 percent, helping convert prospects into satisfied policyholders.

Enhancing Customer Experience Through Efficient Workflows

Effective automation leads to faster service and transparency. Customers notice when a claim that once took weeks is resolved in days. Proactive communication, such as automated updates on claim status and renewals, keeps policyholders informed. Self-service portals empower customers to manage their policies and claims on their own time. Automation also reduces errors by eliminating manual data re-entry. These improvements lead to increased satisfaction and stronger customer relationships, a crucial competitive advantage.

Strategic Implementation of P&C Insurance Process Management

Implementing P&C insurance process management is a strategic initiative, not just a claims software purchase. It requires a thoughtful approach that integrates new solutions with existing systems without disrupting daily operations.

Most P&C carriers, TPAs, and IA firms have systems in place. The key is to integrate new process management solutions effectively, ensuring your team can adapt without being overwhelmed.

Building a Successful BPM Implementation Strategy

A successful strategy begins with understanding your current state. Key steps include:

- Workflow assessment: Map current processes to identify inefficiencies and opportunities for automation.

- Selecting claims management software: Choose a flexible solution that integrates with legacy systems and is easy to use.

- Pilot project: Test your new approach on a specific workflow, like FNOL, to work out kinks and prove the concept.

- Employee training: Go beyond simple instruction on which buttons to click to help staff understand how new tools make their jobs easier and more rewarding.

- Change management: Communicate the 'why' behind the changes and celebrate early wins to build momentum and acceptance.

- Continuous optimization: BPM is not a single fix. Use data to continuously refine and improve processes over time.

The Role of AI and Automation in Modern P&C Insurance Process Management

AI and automation are changing P&C insurance. AI assistants now work alongside adjusters, handling routine inquiries and collecting initial claim details. This frees up human experts for complex cases. Machine learning algorithms analyze claims data to flag potential fraud and predict case complexity. Robotic Process Automation (RPA) handles repetitive tasks like data entry and document processing with perfect accuracy.

Predictive analytics helps you forecast claim volumes and identify emerging risks. Our Agentic AI approach takes this further, with AI agents that understand context, learn from interactions, and act as true digital teammates. Automation enabled by AI can slash time spent on documentation up to 80%. Dive deeper into this technology in our article on Agentic AI in P&C Insurance: When Bots Become Your Best Agents.

Measuring Success and ROI for Your BPM Initiatives

Tracking the right metrics is crucial for proving ROI. Key Performance Indicators (KPIs) include:

- Cycle time reduction: The most visible win, as claims processing time drops from days to hours.

- Cost savings: Reduced administrative costs, less rework, and higher customer retention.

- Error rate reduction: Fewer mistakes mean fewer complaints and regulatory issues.

- Customer Satisfaction Scores (CSAT): Direct feedback on how process improvements benefit policyholders.

- Employee productivity: Measures how much more value your team delivers when freed from administrative tasks.

Studies show automation can reduce operational costs by up to 30% within five years. Establish baselines before you start, then track progress to demonstrate the value of your BPM investment.

Navigating Risks and Ensuring Compliance with BPM

Implementing advanced P&C insurance process management solutions can seem daunting, especially with concerns about sensitive data, budgets, and disrupting established processes. However, a BPM strategy that is executed well not only boosts efficiency but also strengthens compliance and security.

Mitigating Risks in BPM Implementation

Common implementation risks for P&C carriers include integration challenges with legacy systems, which can stretch budgets and timelines. Data security is another major concern when automating processes that handle sensitive policyholder information. Beyond the initial investment costs for claims software and training, there's also the risk of system failures during deployment.

Perhaps the biggest challenge is managing change. Experienced adjusters and underwriters may resist new automation. The key to success is to acknowledge these risks upfront. Plan for them with pilot projects, comprehensive training, and technology partners who understand the unique challenges of P&C insurance operations.

How BPM Bolsters Regulatory Compliance and Risk Management

BPM makes your operations more compliant and secure. Standardized procedures enforced by claims management software ensure every claim meets specific state regulatory requirements. Audit trails become a major asset, with every action and decision automatically recorded with a time stamp. This makes responding to regulatory requests simple and accurate.

Data governance is improved as information flows through secure, controlled channels with validation built in, reducing human error. Fraud detection becomes proactive, as systems powered by AI spot suspicious patterns that might otherwise go unnoticed. Consistent reporting provides real-time visibility into potential compliance issues, allowing you to address them before they become major problems.

Adherence to state regulations becomes a built-in feature of your operations. McKinsey estimates that automation can boost productivity and reduce operational expenses by up to 40% over the next decade, making robust P&C insurance process management essential for staying competitive and compliant.

Frequently Asked Questions about P&C Insurance Process Management

We often connect with P&C carriers, TPAs, and IA firms exploring ways to modernize their operations. Here are answers to the most common questions we hear.

How does technology benefit P&C insurance process management?

Technology acts as a turbo engine for your operations. Digital tools and cloud automation enable faster strategies for going to market, improve underwriting accuracy with superior data analysis, and create complete automation in claims processing. This reduces turnaround time from days to hours, creating a customer experience that builds loyalty and sets you apart.

What is the first step to automating a P&C insurance process?

The first step is a thorough workflow assessment. Before buying any claims software, you must map your current processes to identify inefficiencies, bottlenecks, and the repetitive manual tasks that are perfect candidates for automation. This assessment becomes your roadmap, showing you where to focus your efforts for maximum impact.

How does effective P&C insurance process management improve the adjuster's role?

It transforms the adjuster's role by automating tedious administrative tasks like data entry, document sorting, and routine paperwork. Our claims management software and AI tools handle these burdens, freeing adjusters to focus on activities of high value: complex claim evaluation, customer interactions, and critical decision-making. This improves productivity, reduces burnout, and increases job satisfaction, as adjusters can use their expertise to help customers in their time of need.

Conclusion: The Future of P&C Insurance is Efficient and Automated

The Property & Casualty insurance industry is at a crossroads. Continuing with legacy systems is a choice to fall behind. For P&C carriers, TPAs, and IA firms, mastering insurance process management is now critical for business.

The results are clear: automation can slash operational costs by up to 30% and reduce claims processing time by 50 to 70%. These aren't just statistics; they represent a better way to serve policyholders and support your teams.

By implementing Business Process Management powered by AI, we solve industry challenges that have existed for a long time. Claims processing becomes faster, underwriting becomes smarter, and customer onboarding becomes seamless. Your adjusters are empowered to focus on what they do best: applying their expertise to complex problems.

The future belongs to organizations that accept operational excellence. At Agentech, we understand this change is about people and processes, not just technology. Our AI-powered automation solutions integrate with your existing systems to augment human decisions, not replace it.

The companies that thrive will be those that act now, recognizing that P&C insurance process management is a strategic advantage. They will be the organizations that customers recommend and employees are proud to work for.

Ready to see what automation powered by AI can do for your claims operations? Our team is here to help you open up the efficiency that will define the future of P&C insurance. Find how AI powered automation can transform your claims operations.