Why AI Claims Solutions Matter for P&C Insurance

AI claims solutions are technology platforms using artificial intelligence to automate and improve the P&C insurance claims process. They manage tasks like document review, data extraction, fraud detection, and decision support, helping insurers process claims faster and more accurately.

Key capabilities include:

- Automated document processing: Extracts data from photos, PDFs, and repair estimates.

- Intelligent decision support: Flags fraud, identifies subrogation, and recommends next steps.

- Faster settlements: Processes simple claims in minutes, not weeks.

- Improved accuracy: Analyzes unstructured data like police reports and handwritten notes.

- Cost reduction: Cuts operational expenses through automation.

- Better customer experience: Reduces settlement times and improves satisfaction.

If you're a claims manager facing manual work, slow settlements, and rising loss adjustment expenses, you're not alone. The traditional P&C claims process is broken. 31% of policyholders who filed recent claims were dissatisfied, with 60% blaming slow settlement speed. Meanwhile, claims handlers spend about 30% of their time on low value work like data entry. This is frustrating, expensive, and unsustainable.

The solution is not more staff or longer hours, but technology built for the complexity of P&C insurance claims.

I'm Alex Pezold, founder of Agentech AI. We're building the AI workforce for P&C insurance by deploying AI claims solutions that transform how carriers, TPAs, and adjusting firms handle claims. After successfully scaling and exiting TokenEx in 2021, I've focused on applying cutting-edge AI to solve the most time consuming problems in P&C insurance operations.

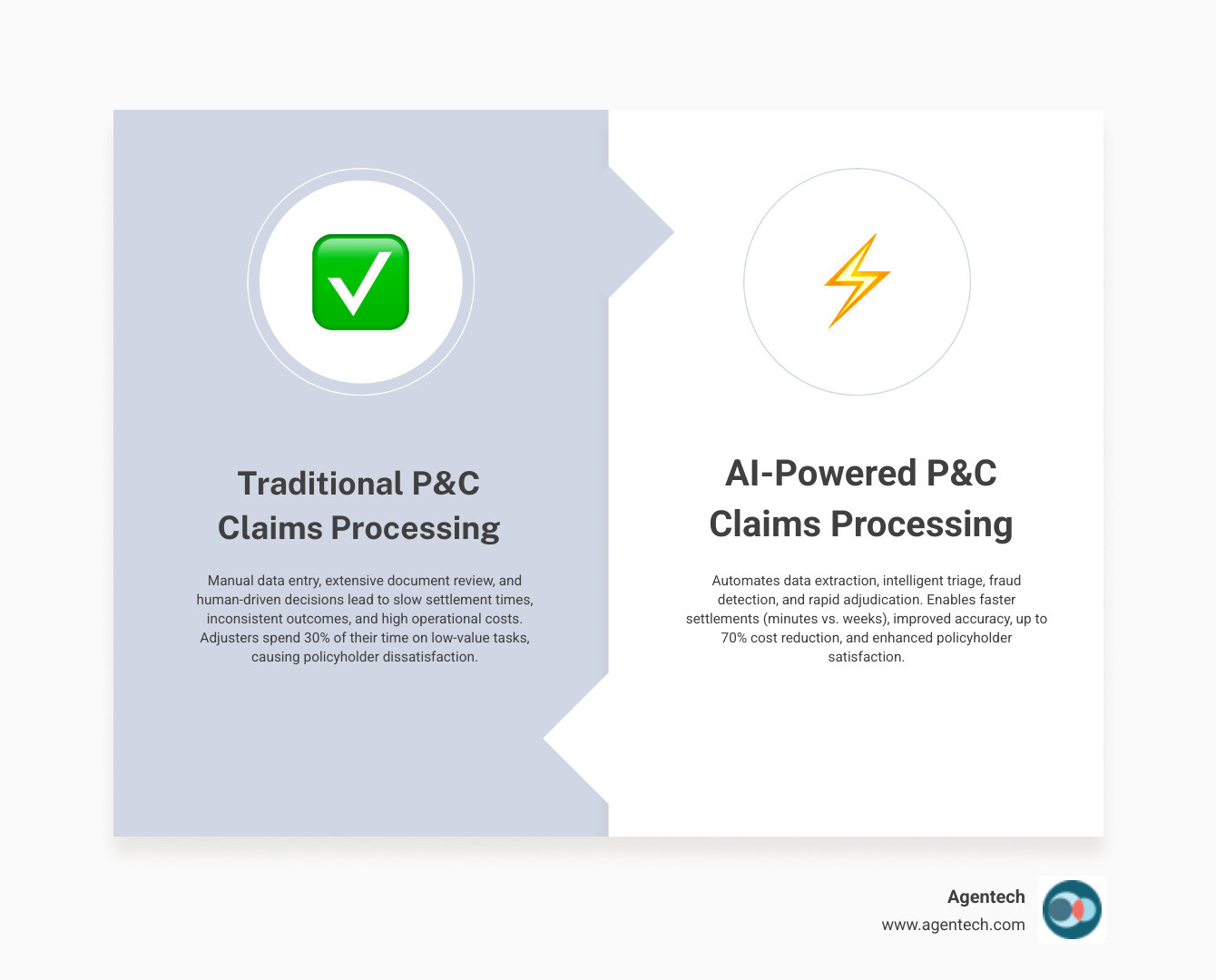

The Bottleneck: Why Traditional P&C Claims Processing Is Broken

When a policyholder has a burst pipe or a fender bender, it kicks off a complex process for P&C insurance carriers, TPAs, and IA firms. Traditional claims handling struggles with modern demands, creating a bottleneck that impacts costs and customer loyalty.

A primary challenge is the manual workload. Claims handlers spend 30% of their time on low value administrative tasks like reviewing documents and transcribing data. This is an inefficient use of human capital that could be spent on complex problem-solving.

Another issue is unstructured data. A typical P&C claim file contains a mix of police reports, handwritten notes, photos, and repair estimates. Traditional systems cannot process this diverse information, leading to inconsistent decisions and slow settlements. In fact, an industry report found that 31% of policyholders were dissatisfied with their claims experiences, with 60% blaming slow settlement speeds. A slow process increases policyholder churn and damages brand reputation.

High operational costs are a direct result. Manual data entry, rework, and delayed settlements increase loss adjustment expenses. The industry also faces a labor shortage, creating a cycle of overworked staff and unhappy customers. Addressing this "P&C insurance labor crisis" requires innovative solutions like AI.

The Limits of Rules Based Automation

Many P&C insurance organizations use rules based automation, but these systems have significant limitations. They operate on a simple "if X, then Y" logic, which works for predictable tasks but fails with the nuances of P&C claims.

The core problem is unstructured data. A police report from an auto accident, with its narrative descriptions and diagrams, doesn't fit into predefined fields. Rules based systems struggle to interpret context or adapt to variations in such documents. They may handle basic data entry but fail with the messy reality of a claim.

This means only a small fraction of claims can achieve straight-through processing. Most require human intervention to interpret and validate unstructured information. This isn't true automation; it just shifts the burden. We need a more intelligent approach to automate P&C insurance claims processing.

| Criteria | Rules Based Automation | AI Powered Automation |

|---|---|---|

| Data Handling | Primarily structured data | Structured and unstructured data (text, images, audio) |

| Adaptability | Low: requires manual updates for new rules/scenarios | High: learns from new data, adapts to variations |

| Accuracy | High for predefined rules, low for exceptions/unstructured data | High: improves over time with more data and context |

| Scalability | Limited by complexity of rules and manual exceptions | High: can process vast volumes of diverse data efficiently |

The High Cost of Inefficiency

The inefficiencies of traditional P&C claims processing hit the bottom line hard. When claims handlers spend 30% of their time on low value tasks, it directly increases loss adjustment expenses (LAE). These expenses negatively impact an insurer's combined ratio and profitability.

Beyond direct costs, inefficiency causes missed opportunities. A claims handler bogged down in paperwork might overlook a subrogation opportunity to recover costs from a third party. AI, however, can flag suspicious patterns, like photos in a weather damage claim that are similar to previous claims, a detail a human might miss.

Inefficiency also harms policyholder retention. Slow settlement speeds lead to frustrated policyholders who are more likely to switch insurers. This means losing a customer and incurring the high cost of acquiring a new one. Reducing administrative burden turns these costs into savings and stronger customer relationships.

How AI Claims Solutions Revolutionize P&C Operations

The good news is that we are implementing solutions. AI claims solutions are changing P&C operations by introducing intelligence and automation. These are practical applications of artificial intelligence, machine learning, generative AI, natural language processing (NLP), and computer vision that deliver measurable results today.

At its core, AI for P&C insurance claims empowers claims professionals with advanced tools. It helps streamline the claims process, moving beyond the rigidity of traditional automation. Our AI powered claims automation uses these technologies to quickly and accurately review claims documents in context. Instead of just scanning for keywords, our systems understand the meaning behind the information, generating summaries and recommendations. This transforms the claims process from a manual, reactive effort into a proactive, efficient workflow.

Intelligent Document Processing and Data Extraction

A major impact of AI claims solutions is intelligent document processing and data extraction. Our AI systems automate data intake from any source, turning unstructured data into actionable insights.

Consider a P&C auto claim with photos, a police report, repair estimates, and medical bills. Our AI uses advanced computer vision and AI OCR (Optical Character Recognition) to ingest these documents. It understands the context, extracting line items from an estimate, key details from a police report, and codes from a medical bill. This reduces the time handlers spend on tedious tasks like creating the claim profile.

Advanced AI solutions can recognize hundreds of document types, using deep learning and large language models (LLMs) to accurately extract data, including handwriting. Some systems can process all types of medical documents with over 99% accuracy. This is critical for P&C claims, which often mix property damage, liability, and medical records, as seen in workers' compensation. Automating initial data capture creates a faster, more accurate claims journey.

Advanced Analytics for Fraud, Subrogation, and Complexity

Beyond data extraction, AI claims solutions provide advanced analytics to help P&C insurers with fraud, subrogation, and claim complexity. Traditional methods in these areas often fall short.

For fraud detection, identifying fraudulent claims historically relied on manual cross referencing, which is error prone. Our AI systems change this. AI can detect fraudulent content in documents and images, performing photo similarity scoring to flag reused photos. For example, one insurer used AI to flag photos in a weather damage claim that were similar to those in prior claims, uncovering potential fraud. Advanced AI uses predictive analytics to spot duplicate claims, document tampering, and inconsistencies in file metadata. This level of scrutiny significantly reduces fraudulent payments.

Subrogation is another area where AI makes a difference. Opportunities are often missed due to complexity and data volume. Our AI uncovers these by analyzing claims data, policy language, and legal precedents. One P&C insurer used generative AI to identify a subrogation opportunity that was previously overlooked. AI can also analyze defense panel performance to minimize litigation costs. Automating the identification of these issues with AI claims analytics software helps recover more funds and improve claim outcomes.

The Tangible Benefits for P&C Insurers and Policyholders

Adopting AI claims solutions delivers tangible benefits across the P&C insurance ecosystem, creating a win win for insurers and policyholders.

For P&C insurers, benefits include improved profitability and operational excellence. Faster claims resolution means less time on open files and reduced overhead. This speed doesn't sacrifice accuracy; AI often improves it by catching errors humans might miss.

For policyholders, the impact is a smoother, faster, and more transparent claims experience. This improves customer satisfaction, fostering loyalty and reducing churn. An efficient claims experience makes policyholders more likely to stay with their insurer and recommend them to others.

Key Benefits of AI Claims Solutions for P&C Insurers

Here are the specific advantages P&C insurers can expect from AI claims solutions:

- Reduced operational costs: Automating repetitive tasks with AI dramatically cuts manual intervention. Some users see a reduction of over 70% in operational costs through automation, leading to significant savings for P&C insurance carriers, TPAs, and IA firms.

- Lowered loss ratios: AI's ability to detect fraud and identify subrogation opportunities decreases overall claim payouts. Some AI claims management solutions have resulted in hundreds of millions in realized savings and a 5 to 10 point reduction in the combined ratio for clients.

- Increased adjuster productivity: With AI handling administrative tasks, adjusters can focus on complex cases requiring human judgment. This can lead to an improvement of over 20% in handling capacity, allowing adjusters to process more claims efficiently.

- Improved decision consistency: AI applies objective analysis to all claims, ensuring consistent and fair decisions. This reduces variability from human subjectivity and leads to more predictable outcomes.

- Scalability for surge events: During natural disasters, claim volumes can spike. AI solutions are inherently scalable, designed to accommodate sudden increases in claims while preserving accuracy. This ensures your claims operations remain responsive when disaster strikes. We believe AI for P&C insurance operations is a necessity for resilience.

Changing the Policyholder Experience

The policyholder's experience is the moment of truth. AI claims solutions are reshaping this experience from a source of frustration into one of reassurance.

The most significant change is faster settlement speed. We know 60% of dissatisfied policyholders cited settlement speed as their main issue. AI addresses this directly. For example, one large insurer transformed its manual process into an automated experience, reducing processing time from weeks to minutes and achieving 57% automation. Some AI solutions can achieve instant settlement on a majority of claims. Imagine the relief of a homeowner receiving rapid confirmation of their claim after a property event. This acceleration is a game changer for customer satisfaction.

Beyond speed, AI enables proactive communication and 24/7 service. Chatbots and virtual AI assistants can answer questions and provide status updates anytime. This reduces the burden on human agents and ensures policyholders feel supported. By designing for the future of the claims experience, we can offer personalized and compassionate support, even for complex workers' compensation cases. This level of customer service, driven by AI, reduces dissatisfaction and increases policyholder retention, making AI customer service for P&C insurance a vital component of modern claims.

Implementing the Right Technology: From AI to AI Agents

Understanding how to implement AI claims solutions effectively is the next step. This means adopting 'insurance grade AI' and integrating it into your P&C claims operations. We see AI not as a replacement for adjusters, but as a powerful coworker.

The key to successful implementation is recognizing that AI is a tool designed for adjusters. It augments human capabilities, letting your team focus on nuanced, human centric work. This "human in the loop" approach keeps final decisions with your adjusters while AI handles data processing. It's a partnership that maximizes efficiency and expertise. When choosing a SaaS AI technology, it's crucial to select solutions built for the P&C insurance industry.

What is 'Insurance Grade AI'?

"Insurance grade AI" refers to AI models specifically trained and optimized for the complexities of the P&C insurance industry. This specialization makes them effective for P&C claims processing.

An experienced P&C claims adjuster learns from thousands of cases. Insurance grade AI can consider tens of millions of expired policies and closed claims, remembering and comparing every fact. These models are trained on vast, industry specific data, allowing them to understand the context and terminology of P&C insurance claims in a way general purpose AI cannot.

The result is high accuracy. This specialized training helps avoid "AI hallucinations," where generative AI produces erroneous information. It's vital to validate AI generated summaries and recommendations with robust logic to ensure quality and trust, catching potential hallucinations before they impact a claim. This precision is essential for P&C claims, where accuracy impacts financial outcomes and compliance. P&C insurance artificial intelligence is about deep, contextual understanding.

Choosing the Right AI Claims Solutions for Your Firm

When selecting AI claims solutions for your P&C firm, focus on agentic AI capabilities. Agentic AI can act autonomously to pursue objectives with minimal supervision. These "digital coworkers" can plan, adapt, and execute multi step tasks.

Our agentic models can reason over context and decide the best path for a claim. They are intelligent assistants that contribute meaningfully to the claims process. The future of work in P&C insurance involves embracing AI agents as digital coworkers, freeing human adjusters for high value activities.

Seamless integration is another key factor. New claims software should integrate with your existing core systems via API connectivity for smooth data flow. A minimal IT lift is crucial, and some solutions can be fully implemented in just a few months. Scalability is also paramount. Your chosen AI solution must grow with your business, handling increasing claim volumes without compromising performance. By considering these factors, you can choose AI claims solutions that augment your human expertise and drive value.

Frequently Asked Questions about AI in P&C Claims

We understand that adopting new technology can come with questions. Here are some of the most common inquiries we hear about AI claims solutions in P&C insurance:

How quickly can AI process a P&C insurance claim?

The speed varies by complexity, but for many P&C insurance claims, it is remarkably fast. Simple claims can be processed and settled in minutes. For example, some AI systems process claims in under 5 minutes on average. A large US-based travel insurance company achieved 57% automation, reducing processing time from weeks to minutes. Some clients experience instant settlement on a majority of claims. This acceleration in faster claims resolution tools means policyholders get resolutions much sooner, enhancing their experience.

Does AI replace claims adjusters?

No. Our philosophy is that AI should augment, not replace, claims adjusters. We believe in human centric AI that empowers human ingenuity. AI handles the repetitive, data intensive tasks, freeing adjusters to focus on what they do best: applying empathy, critical thinking, and complex problem solving to nuanced cases. Our virtual AI assistants take on administrative burdens, allowing adjusters to dedicate their expertise to the human side of claims. The goal is to make adjusters more productive and efficient.

What is the implementation process like?

Implementing AI claims solutions is smoother than many P&C insurers anticipate with modern SaaS claims software. Our approach focuses on minimal IT lift and seamless integration. Some platforms can be fully implemented in 8 to 12 weeks.

The process involves integrating the AI solution with your existing core insurance management systems, often through flexible APIs. This ensures smooth data flow without overhauling your current infrastructure. Data security and privacy are paramount, with robust measures to protect policyholder information. Our hybrid AI solution combines out of the box efficiency with custom QA precision for a streamlined implementation that gets you running quickly.

Conclusion: The Future of P&C Claims is Here

We've explored the bottlenecks of traditional P&C claims processing, from unstructured data and the limits of rules based automation to high costs and policyholder dissatisfaction.

The future of P&C claims is one of change. AI claims solutions are a necessity, offering a path to greater efficiency, accuracy, and customer satisfaction. By using advanced AI, we can automate tasks, detect fraud, find subrogation opportunities, and process claims at unimaginable speeds. The benefits are tangible: reduced operational costs, lower loss ratios, increased adjuster productivity, and a better policyholder experience.

This shift empowers your adjusters with intelligent digital coworkers, allowing them to focus on the complex, human centric aspects of their work. It's about choosing insurance grade AI that is purpose built for the P&C insurance industry, ensuring accuracy and contextual understanding.

At Agentech, we provide these transformative AI claims solutions. We believe in a future where P&C claims are handled with speed, precision, and empathy, driven by the collaboration of human expertise and advanced AI. The time to accept this future is now.

Explore how AI Agents can transform your claims operations

Citations:

- Accenture. (2022). Poor claims experiences could put up to $170B of global insurance premiums at risk by 2027, according to new Accenture research. https://newsroom.accenture.com/news/2022/poor-claims-experiences-could-put-up-to-170b-of-global-insurance-premiums-at-risk-by-2027-according-to-new-accenture-research

- Agentech. (n.d.). Solving the Insurance Labor Crisis with AI-Driven Innovation. https://www.agentech.com/resources/articles/solving-the-insurance-labor-crisis-with-ai-driven-innovation

- Agentech. (n.d.). Automating Insurance Claims Processing. https://www.agentech.com/resources/articles/automating-insurance-claims-processing

- Agentech. (n.d.). Reduce Administrative Burden. https://www.agentech.com/resources/articles/reduce-administrative-burden

- Agentech. (n.d.). AI-Powered Claims Automation. https://www.agentech.com/resources/articles/ai-powered-claims-automation

- Agentech. (n.d.). How is AI Changing the Insurance Claims Process. https://www.agentech.com/resources/articles/how-is-ai-transforming-the-insurance-claims-process

- Agentech. (n.d.). Insurance Document Processing Automation. https://www.agentech.com/resources/articles/insurance-document-processing-automation

- Agentech. (n.d.). We Made AI Do the Most Tedious, Time-Consuming Task in Claims Processing: Creating the Claim Profile. https://www.agentech.com/resources/articles/we-made-ai-do-the-most-tedious-time-consuming-task-in-claims-processing-creating-the-claim-profile

- Agentech. (n.d.). Insurance Claims Analytics Software. https://www.agentech.com/resources/articles/insurance-claims-analytics-software

- Agentech. (n.d.). Machine Learning in Claims Processing. https://www.agentech.com/resources/articles/machine-learning-in-claims-processing

- Agentech. (n.d.). Efficient Claims Handling. https://www.agentech.com/resources/articles/efficient-claims-handling

- Agentech. (n.d.). AI for Insurance Operations. https://www.agentech.com/resources/articles/ai-for-insurance-operations

- Agentech. (n.d.). Designing for the Future: How AI Transforms the Claims Experience. https://www.agentech.com/resources/articles/designing-for-the-future-how-ai-transform-the-claims-experience

- Agentech. (n.d.). AI Customer Service Insurance. https://www.agentech.com/resources/articles/ai-customer-service-insurance

- Agentech. (n.d.). AI Designed with Adjusters in Mind. https://www.agentech.com/resources/articles/ai-designed-with-adjusters-in-mind

- Agentech. (n.d.). Buy vs. Build: Navigating the SaaS AI Technology Decision. https://www.agentech.com/resources/articles/buy-vs-build-navigating-the-saas-ai-technology-decision

- Agentech. (n.d.). Insurance Artificial Intelligence. https://www.agentech.com/resources/articles/insurance-artificial-intelligence

- Agentech. (n.d.). The Future of Work in Insurance: Embracing AI Agents as Digital Coworkers. https://www.agentech.com/resources/articles/the-future-of-work-in-insurance-embracing-ai-agents-as-digital-coworkers

- Agentech. (n.d.). Agentic AI in Insurance: When Bots Become Your Best Agents. https://www.agentech.com/resources/articles/agentic-ai-in-insurance-when-bots-become-your-best-agents

- Agentech. (n.d.). Faster Claims Resolution Tools. https://www.agentech.com/resources/articles/faster-claims-resolution-tools

- Agentech. (n.d.). Virtual AI Assistants for Insurance: Meet Your New Best Friend. https://www.agentech.com/resources/articles/virtual-ai-assistants-for-insurance-meet-your-new-best-friend

- Agentech. (n.d.). A Hybrid AI Solution for Claims Automation: How Agentech Combines Out-of-the-Box Efficiency with Custom QA Precision. https://www.agentech.com/resources/articles/a-hybrid-ai-solution-for-claims-automation-how-agentech-combines-out-of-the-box-efficiency-with-custom-qa-precision

- Agentech. (n.d.). Explore how AI Agents can transform your claims operations. https://www.agentech.com/product/ai-agents/