Why AI Claims Processing is Revolutionizing the Insurance Industry

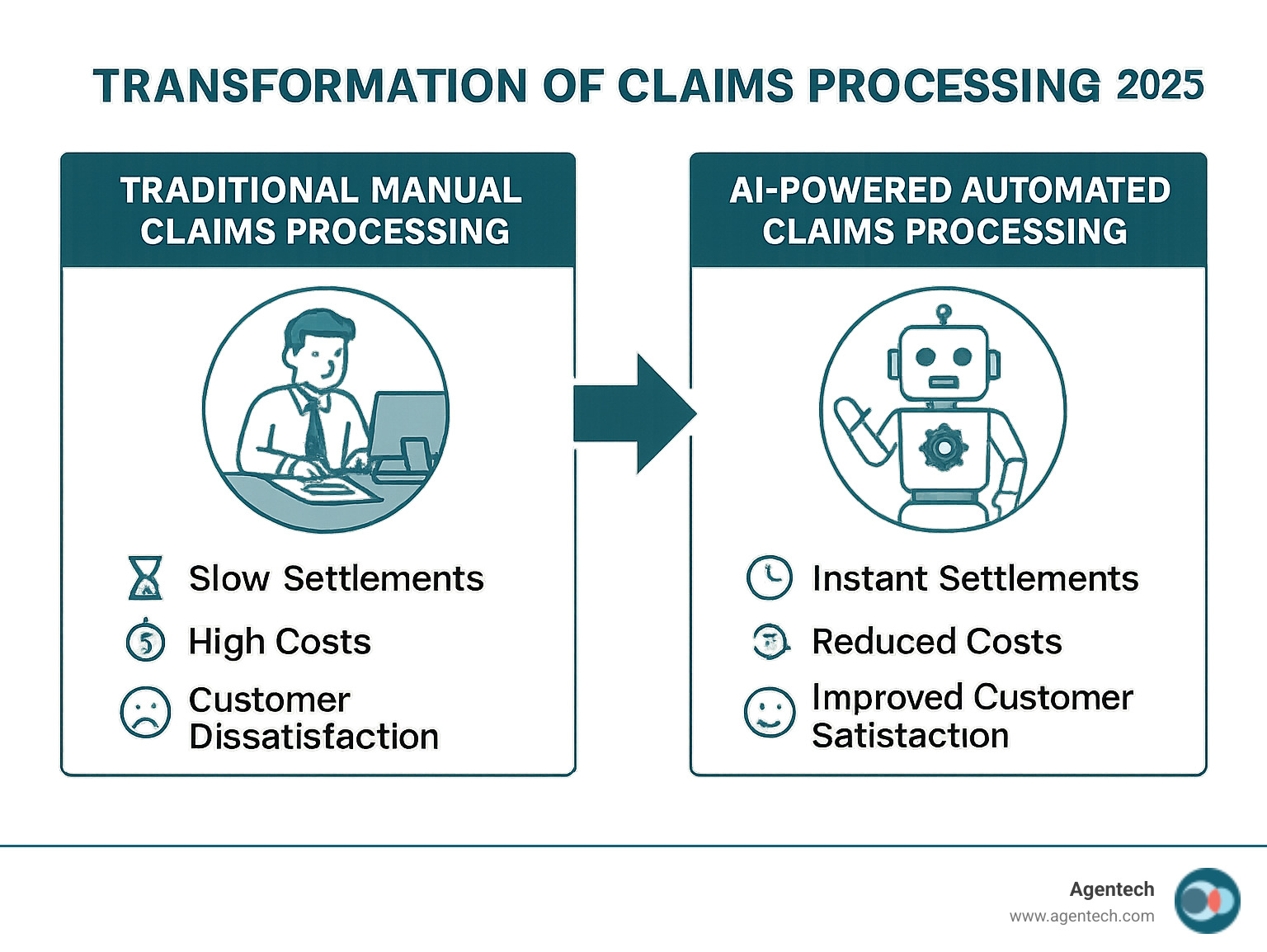

AI claims processing uses artificial intelligence to automate and improve insurance claims from submission to settlement. This technology transforms claims management by reducing manual work, improving accuracy, and accelerating settlements with intelligent automation.

Key aspects of AI claims processing include automated data extraction from documents, photos, and forms; intelligent fraud detection using pattern recognition; real time claim triaging and priority assignment; predictive analytics for claim severity and cost estimation; natural language processing for customer communications; and computer vision for damage assessment from images.

The insurance industry faces mounting pressure from manual claims processing, which creates bottlenecks that frustrate customers. Research shows 31% of policyholders are dissatisfied with their claims experience, with 60% citing settlement speed as the main issue. Meanwhile, claims handlers spend about 30% of their time on work of low value.

Traditional methods cannot meet today's demands for speed. Customers expect claims settled in hours, not weeks, yet conventional systems based on rules only achieve 7% straight through processing.

This is where AI becomes a game changer. Leading insurers are already seeing dramatic results. One travel insurer achieved 57% automation while reducing processing time from weeks to minutes. Another saw claims processed twice as fast at a fraction of the cost.

I'm Alex Pezold. After years of building transformative technology, including my successful exit from TokenEx in 2021, I founded Agentech AI. We are revolutionizing ai claims processing by building an AI workforce that helps insurers process claims with best speed and accuracy.

Why Traditional Claims Processing Is Falling Behind

Traditional claims processing is struggling. Teams are often buried in paperwork and manual data entry, a scenario that is costly for insurers and frustrating for customers.

The numbers are stark: while 21% of customers want claims settled in hours, 43% wait over two weeks for a resolution. This gap between expectation and reality drives customers away.

Slow settlements are the industry's biggest pain point. Manual handling adds 7 to 10 days to each claim, with handlers spending 30% of their time on work of low value like data entry.

These delays create high operational costs. A manually reworked claim costs $25 on average. With claims leakage between 8% and 12%, insurers lose significant revenue to inefficiencies.

Manual errors make things worse. Up to 35% of data inaccuracies come from human input, and commercial health insurers see a 19.3% error rate. Each mistake causes rework and frustrates customers.

The customer experience suffers greatly. An industry report found 31% of policyholders were dissatisfied with their claims, with 60% blaming settlement speed. A good experience retains 62% of customers, while a bad one keeps only 19%.

Adjusters also feel the strain. Nearly half handle over 125 claims, leading to adjuster burnout. This high turnover results in lost knowledge and expensive recruitment.

Legacy systems were not designed for the digital age. Automation based on rules only processes 7% of claims straight through, leaving the rest in manual queues. Insurers who fail to modernize will lose customers, money, and talent. The good news is that a solution exists, and progressive insurers are already reaping the benefits.

How AI Transforms the Claims Landscape

Imagine your claims team with a digital assistant that processes information with superhuman speed and accuracy. That is the reality ai claims processing delivers. AI is a strategic advantage, enabling decisions driven by data and boosting productivity. It handles repetitive tasks that consume time, freeing your adjusters to focus on complex decisions and customer care.

The Core Technologies Driving Change

The power of ai claims processing comes from several key technologies working together.

Machine Learning (ML): Algorithms learn from historical data to forecast claim costs, assess fraud risk, and prioritize cases.

Natural Language Processing (NLP): This technology understands human language, allowing it to extract data from documents, emails, and customer chats.

Computer Vision: AI can analyze photos and videos to assess property or vehicle damage, often replacing the need for a site visit.

Generative AI: A newer technology, pioneered by companies like OpenAI, that can create content, summarize documents, and draft communications.

Predictive Analytics: Using the computing power from providers like NVIDIA, this technology forecasts outcomes like claim severity and fraud patterns.

Key Benefits of AI Claims Processing

Insurers using ai claims processing are seeing dramatic, measurable results.

Improved efficiency: AI automates administrative tasks, allowing some insurers to achieve 57% automation and reduce processing times from weeks to minutes.

Improved accuracy: AI systems can reach 96% accuracy in data extraction, a vast improvement over the 35% of inaccuracies from human error. This means 70% of documents are understood automatically.

Significant cost savings: Automation can reduce processing costs by 50% to 65%. By reducing claims leakage from the average 8% to 12% to a leading rate of 2% to 3%, AI saves millions.

Better fraud detection: AI spots subtle patterns humans miss, with some insurers reporting a 40% drop in fraudulent activities.

Superior customer experience: Faster, more accurate processing improves satisfaction. As noted in The Future of Insurance: How AI is Changing the Game, 62% of customers stay after a good experience, compared to 19% after a bad one.

AI vs. Traditional Rule Based Automation

Processing powered by AI is a major leap from the traditional automation based on rules many insurers still use.

| Feature | Traditional Rule Based Automation | AI Powered Claims Processing |

|---|---|---|

| Flexibility | Rigid, follows predefined rules, struggles with exceptions. | Adaptive, learns and adjusts to new data and scenarios. |

| Data Handling | Primarily handles structured data; struggles with unstructured data. | Excels at processing both structured and unstructured data (text, images). |

| Decision Making | Deterministic, executes if/then statements; limited intelligence. | Intelligent, makes probabilistic decisions, identifies patterns, predicts outcomes. |

| Scalability | Can automate high volumes of simple, predictable tasks. | Handles high volumes, adapts to complexity, and learns over time. |

Traditional systems based on rules are rigid and struggle with the messy, unstructured data common in claims, leading to a low 7% straight through processing rate. AI excels where these systems fail, interpreting complex situations and learning from experience to achieve higher automation and accuracy.

Practical Applications of AI Claims Processing

AI enables a claims team to operate like a well oiled machine, with claims flowing seamlessly from report to settlement. AI claims processing delivers automation from end to end with remarkable impact in the real world. Some insurers have achieved 57% automation, cutting processing time from weeks to minutes. Let's explore how.

Automating the Entire Claims Lifecycle

Modern ai claims processing connects each stage of the claims journey.

First Notice of Loss (FNOL): AI agents can process over 99% of FNOL requests straight through, using intelligent chatbots to guide customers and provide immediate acknowledgment.

Intelligent Document Processing: AI uses Optical Character Recognition and NLP to convert documents like medical records and police reports into structured data, with 70% correctly interpreted without human review.

Automated Damage Assessment: Computer vision analyzes photos, videos, and drone footage to assess damage instantly and accurately.

Real Time Fraud Detection: AI systems continuously analyze data to flag suspicious claims for investigation while allowing legitimate ones to proceed quickly. Insurers report a 40% drop in fraudulent activities.

Claims Triage: AI algorithms assess and route incoming claims based on complexity and urgency, eliminating bottlenecks.

Automated Settlement: For simple claims, Robotic Process Automation handles payment workflows, enabling near instant payouts.

Our exploration in Changing Insurance Claims with Agentic AI reveals how these AI agents work alongside adjusters, boosting productivity without replacing human judgment and expertise.

AI's Impact Across Different Insurance Lines

The adaptability of ai claims processing allows it to meet the unique demands of each insurance sector.

Automotive Insurance: Computer vision provides instant damage assessments from photos, while telematics data improves accuracy and fraud detection.

Property Insurance: During catastrophic events, AI processes high claim volumes efficiently. Drone technology enables remote damage assessments, with some solutions processing 90% of claims after a hurricane in two weeks.

Commercial Insurance: AI assists by scanning legal documents, analyzing complex data, and summarizing contracts, freeing up legal professionals for strategic work.

Healthcare: With 62% of hospitals still using manual processes, AI is critical. It ensures clean claims from the start, reducing denials by up to 70% through intelligent medical coding and streamlined authorizations.

Specialty Lines: Even niche areas like pet insurance benefit. As shown in our Odie Pet Insurance case study, AI agents can automate indexing, FNOL, and triage.

The common thread is that AI amplifies human expertise, handling routine tasks so your team can focus on work that requires human insight and empathy.

A Strategic Guide to Adopting AI

Adopting ai claims processing is a strategic journey requiring a clear roadmap. It involves careful planning, change management, and a vision for future proofing your operations. A proven path to success exists, and we have guided many insurers along it.

Navigating Implementation Challenges

Preparing for potential roadblocks is key to a smooth transition.

Implementation Costs: View the initial investment strategically. Start with projects with high impact for quick wins and to spread costs.

Data Privacy and Security: This is paramount. A robust AI solution must include advanced encryption, strict access controls, and adherence to regulations like HIPAA, GDPR, and PCI DSS.

Legacy System Integration: Many insurers have older systems. Success requires robust APIs and middleware for seamless data exchange. This seamless integration is a unique selling point for Agentech.

Skilled Personnel: You do not need an army of data scientists. Instead, focus on upskilling your existing team and fostering a culture of learning.

Organizational Resistance: Address concerns about job replacement with clear communication. Show employees how AI makes their work better, not obsolete, a balance explored in AI in Insurance: Balancing Innovation and Regulation.

The Future is a Partnership Between Humans and AI

A common misconception is that AI will replace jobs. The future is a partnership between humans and AI, not replacement. AI acts as a digital coworker, handling repetitive work so humans can focus on what they do best.

Augmenting Adjusters: Our "always on AI assistants" take over the 30% of an adjuster's time spent on administrative work of low value.

Empowering Human Expertise: With administrative burdens removed, adjusters can focus on complex analysis, customer interactions, and strategic problem solving.

Focusing on Complex Cases: Automation of routine claims allows human adjusters to apply their emotional intelligence and negotiation skills to sensitive cases.

This collaborative approach, detailed in AI Designed with Adjusters in Mind, is central to our solutions.

Essential Features of an AI Claims Processing Solution

When evaluating solutions, look for these essential features. A quality solution should offer seamless integration to connect effortlessly with your existing platforms; this is an Agentech specialty. It must have scalability to handle fluctuating claim volumes, from daily incidents to catastrophic events. Look for robust security, including ISO27001 certification, advanced encryption, and comprehensive data governance. Real time analytics, dashboards, and KPIs are needed to monitor performance and make decisions driven by data. The AI should also allow for custom workflows to adapt to your unique business needs. Finally, an interface that is user friendly is crucial for adoption by both adjusters and policyholders.

Frequently Asked Questions about AI in Claims

Here are answers to the most common questions insurance leaders ask about ai claims processing.

Will AI completely replace claims adjusters?

No, AI will not completely replace claims adjusters. The industry is moving toward a partnership between humans and AI. AI excels at tedious administrative tasks, which consume about 30% of an adjuster's time. This frees adjusters to focus on what humans do best: handling complex cases, applying nuanced judgment, and providing empathetic customer service. AI augments human capabilities, making adjusters more valuable, not obsolete.

How secure is my data with AI claims processing?

Security is critical when handling sensitive claims data. Reputable AI solutions are built with security as a foundation. Key measures include advanced encryption to protect data both in transit and at rest, and mandatory regulatory compliance with standards like HIPAA, GDPR, and PCI DSS. Data is also kept safe through secure hosting in cloud environments with strict access controls and clear data governance policies that define how data is collected, used, and stored.

At Agentech, we build our platform on these principles to earn and maintain your trust.

What is the expected ROI from implementing AI in claims?

The return on investment for ai claims processing is significant and multifaceted. You can expect major cost savings, as automation can reduce processing costs by 50% to 65%. Some carriers have saved over $7 million with just one component of our technology. Speed and efficiency also improve, with processing times dropping from weeks to minutes. Fraud reduction is another key benefit, as detection powered by AI can lower fraudulent activities by 40%. Finally, a better claims experience has a direct impact on customer retention, with 62% of customers staying after a good experience versus 19% after a bad one.

While the exact ROI varies, most insurers see positive returns within the first year.

Conclusion: The Inevitable Future of Insurance Claims

The future of ai claims processing is here. Traditional methods, with their manual bottlenecks and high costs, are being replaced by intelligent automation. The alternative is a world where claims are approved in hours, fraud is caught proactively, and adjusters are empowered to focus on work of high value.

The benefits are clear and proven: improved efficiency, significant cost savings, and a superior customer experience. Adopting AI is no longer just an operational upgrade; it is a competitive advantage that will define the industry's leaders.

The technology will only continue to advance, with more sophisticated models and deeper integrations. At Agentech, our mission is to lead this change. Our AI agents are designed to augment human judgment, not replace it. We handle the administrative burden so your team can focus on what matters most: your customers.

The question is not if AI will transform claims, but when you will accept it. The insurers who thrive tomorrow are those who adopt ai claims processing today.

Are you ready to lead the change?

Learn more about Agentic AI for claims processing and find how we can help you build a faster, smarter claims operation that is more focused on the customer.