Why AI Adoption and SaaS Consolidation Matter for Claims Management

AI adoption and saas consolidation are reshaping how Property & Casualty insurance carriers manage their technology. For claims managers, the pressure to adopt AI often conflicts with the need to control a sprawling software portfolio.

Key Takeaways:

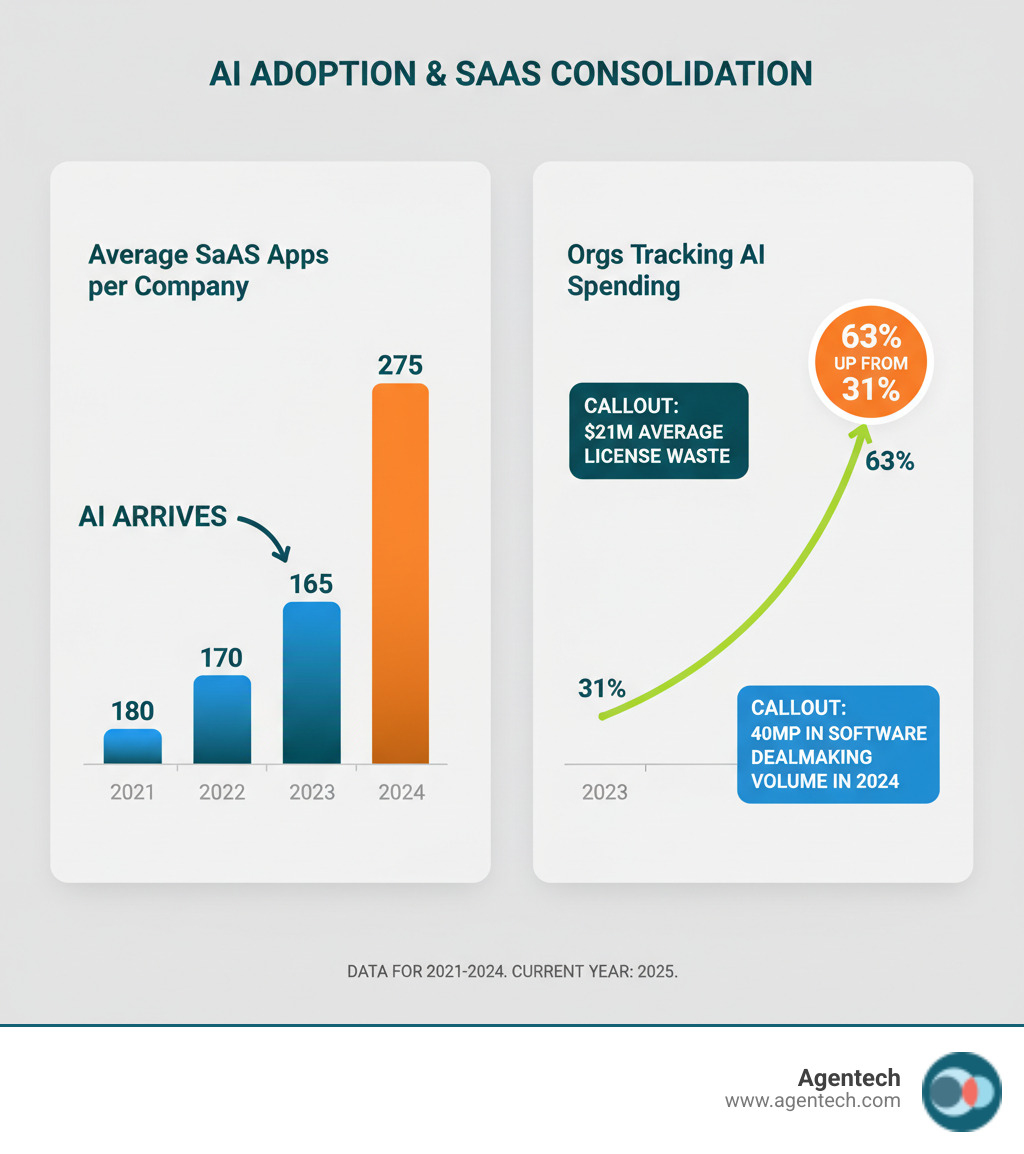

- The average company now uses 275 applications, reversing a previous downward trend.

- Organizations waste an average of $21M annually on unused software licenses.

- Companies successfully managing both trends see 20-30% cost reductions and 40-60% efficiency gains.

- 63% of organizations now track AI spending, up from just 31% the previous year.

- AI is driving market consolidation, with software dealmaking jumping 40% in 2024.

The insurance industry faces a convergence paradox. AI promises to automate claims tasks, but it often adds another tool to an already bloated stack. This leads to redundant claims management software, security gaps, and frustrated adjusters.

However, AI adoption and saas consolidation are two sides of the same coin. Smart P&C carriers use the push toward AI as a catalyst to consolidate their claims software. They eliminate redundant tools and standardize on unified platforms, creating a foundation where AI delivers value instead of chaos.

The stakes are high. License waste alone averages $21M per organization. With IT managing just 16% of applications, shadow IT is common in claims departments. Meanwhile, 50% of SaaS companies are integrating AI capabilities, and carriers who fail to adapt risk falling behind.

I'm Alex Pezold, founder of Agentech AI. We're building the AI workforce for P&C insurance, and I've seen how these trends create both opportunity and complexity.

The Twin Engines of Change: Why AI and SaaS Consolidation Are Happening Now

In the P&C insurance industry, two powerful forces are converging: the urgent need to adopt AI and the equally pressing need to consolidate bloated software stacks. These are not separate trends; they are deeply interconnected, each amplifying the other.

Think of them as interlocking gears. AI adoption and SaaS consolidation are creating a fundamental shift in how P&C insurance carriers operate. The AI market is projected to hit $1.8 trillion by 2030, and 63% of organizations now track AI spending, up from 31% the previous year.

This AI revolution is happening amid "SaaS sprawl." The average company now uses 275 applications, leading to siloed data, security risks, and an average of $21 million in wasted spend per organization annually.

However, companies tackling both challenges see remarkable results, including 20-30% cost reductions and 40-60% efficiency gains. The market is responding, with software dealmaking jumping 40% in 2024, driven by AI.

Key Drivers for SaaS Consolidation in P&C Insurance

P&C carriers face unique pressures from software sprawl.

- Redundant claims software: Different teams often use separate applications for the same tasks, creating inefficiency.

- Strained budgets: With millions wasted on unused licenses, CFOs are demanding consolidation.

- Security implications: Each application is a potential vulnerability, making fragmented claims software a major risk.

- Adjuster frustration: Switching between tools kills productivity and creates a desire for a single source of truth.

- IT burden: Supporting a bloated claims software stack drains resources that could be used for innovation.

The Irresistible Pull of AI Adoption

Despite software sprawl, P&C carriers cannot ignore AI.

- Competitive pressure: Carriers using AI to process claims faster and more accurately will win market share.

- Improved decision making: AI turns claims data into actionable insights for better underwriting and more consistent decisions.

- Automation of repetitive tasks: AI frees up adjusters for complex, high-value work, addressing the industry's labor shortage. Learn more about Solving the Insurance Labor Crisis with AI-Driven Innovation.

- Predictive analytics: AI SaaS platforms can boost revenue and profit margins by identifying emerging claims trends.

- Generative AI capabilities: These tools create adaptive, goal-driven "systems of work" for tasks like personalized policyholder communication. Explore more about AI Claims Processing Insurance.

- Accessibility and scalability: AI SaaS makes enterprise-level capabilities available to firms of all sizes, with 50% of SaaS companies already integrating [AI](https://www.pwc.com/us/en/tech-effect/ai-analytics/ai-predictions.html).

The question is not whether to adopt AI or consolidate, but how to do both strategically.

Citations:

- Source 2: Why Adopt AI SaaS?. (n.d.). Retrieved from https://www.capicua.io/blog/why-adopt-ai-saas

- Source 3: AI adoption and SaaS Consolidation: The future of CX efficiency. (n.d.). Retrieved from https://ask-ai.zendesk.com/hc/en-us/articles/19154371720849-AI-adoption-and-SaaS-Consolidation-The-future-of-CX-efficiency

- Source 4: AI adoption to force wave of software consolidation — Dealspeak North America. (n.d.). Retrieved from https://mergermarket.ionanalytics.com/deal/mna/1512419

- Source 6: SaaS Consolidation in 2025: Benefits, Risks & How to Do It. (n.d.). Retrieved from https://zylo.com/blog/saas-consolidation

The Convergence Paradox: Navigating the Benefits and Risks

AI adoption and saas consolidation can pull in opposite directions. Consolidation aims for simplicity, while AI often adds complexity. For P&C insurance carriers, the challenge is finding the sweet spot where these forces strengthen each other.

The Upside: Achieving a Flywheel Effect for Efficiency

When done right, consolidation and AI create a flywheel effect: a consolidated platform provides clean data for AI, and AI makes the platform smarter. The results are significant:

- Cost Savings: Organizations see 20-30% reductions in SaaS licensing and maintenance costs by eliminating redundant claims management software.

- Efficiency Gains: Automation and reduced context-switching lead to 40-60% efficiency gains, allowing adjusters to focus on helping policyholders.

- Simplified Infrastructure: A streamlined stack means fewer systems for IT to manage, patch, and secure.

- Stronger Compliance: Centralized data makes it easier to manage and protect sensitive P&C insurance data, which is nearly impossible with hundreds of scattered applications.

The Downside: Potential Risks of AI Adoption and SaaS Consolidation

The process is not without risks that require careful planning.

- Data migration challenges: Moving years of claims data from legacy systems to a new platform is complex and requires meticulous planning to avoid data loss.

- User adoption problems: Adjusters may resist changing familiar workflows. Proper training and communication are essential to avoid a productivity dip.

- AI model maintenance: AI models need ongoing retraining and monitoring to remain effective, a significant and often overlooked task.

- Hidden costs of AI: New AI features have driven a 10% increase in average SaaS pricing, and AI-related spending is projected to jump 36% per organization.

- Integration headaches: Connecting AI with existing claims management software can be resource-intensive and technically challenging.

- Vendor lock-in: Consolidating to a single platform increases dependence on that vendor, potentially limiting future flexibility.

For a deeper look at this decision, see our article on Buy vs. Build: Navigating the SaaS AI Technology Decision. Acknowledging these risks is the first step to managing them effectively.

Citations:

- Source 2: Why Adopt AI SaaS?. (n.d.). Retrieved from https://www.capicua.io/blog/why-adopt-ai-saas

- Source 3: AI adoption and SaaS Consolidation: The future of CX efficiency. (n.d.). Retrieved from https://ask-ai.zendesk.com/hc/en-us/articles/19154371720849-AI-adoption-and-SaaS-Consolidation-The-future-of-CX-efficiency

- Source 4: AI adoption to force wave of software consolidation — Dealspeak North America. (n.d.). Retrieved from https://mergermarket.ionanalytics.com/deal/mna/1512419

- Source 5: AI Adoption & SaaS Consolidation | The Current Thing #6. (n.d.). Retrieved from https://p2x.xyz/blog/ai-adoption-saas-consolidation-current-thing-6

- Source 6: SaaS Consolidation in 2025: Benefits, Risks & How to Do It. (n.d.). Retrieved from https://zylo.com/blog/saas-consolidation

Securing the Merge: New Security Challenges from AI Adoption and SaaS Consolidation

AI adoption and saas consolidation create a perfect storm of security challenges for P&C insurance carriers. Consolidation aims to centralize data, but AI needs that data to flow between platforms. This tension strains traditional security measures designed for a simpler era.

As AI systems access vast amounts of sensitive claims data—from policyholder information to medical records—the potential for exposure grows exponentially. Key risks include:

- Data exposure: As data moves between claims management software and AI engines, the risk of accidental or malicious exposure increases.

- Compliance violations: The complex flow of data makes it harder to maintain compliance with privacy laws and insurance regulations.

- Shadow AI usage: Adjusters may use unapproved AI tools, uploading sensitive claims data to unsecured systems and creating governance gaps.

- Increased attack surface: A consolidated platform, if not properly secured, becomes a larger and more attractive target for cyberattacks.

Why Traditional Data Loss Prevention (DLP) Falls Short

Traditional DLP solutions are inadequate for this new landscape. Built for a pre-AI world, they focus on preventing unauthorized file movement, not understanding data content or context. They cannot distinguish between legitimate AI processing and a malicious attack, leading to a flood of false positives that overwhelm security teams. This "alert fatigue" is dangerous, as real threats can be missed.

How Data Security Posture Management (DSPM) Provides a Modern Solution

Data Security Posture Management (DSPM) is a modern approach designed for the challenges of AI adoption and saas consolidation in P&C insurance.

DSPM provides comprehensive visibility into how sensitive claims data flows between your consolidated software and AI systems. Unlike DLP, DSPM understands data in context, recognizing legitimate AI activity while flagging unauthorized access. This dramatically reduces false alerts.

Key benefits of DSPM include automated remediation to fix exposures, real-time monitoring to detect threats as they occur, and a forward-looking approach that adapts to your evolving technology stack. For P&C carriers balancing innovation with regulation, DSPM is a strategic necessity. Learn more in our article on AI in Insurance: Balancing Innovation and Regulation.

Citations:

- Source 1: AI adoption and SaaS consolidation: Navigating security challenges in 2025. (n.d.). Retrieved from https://www.polymerase.io/blog/ai-adoption-saas-consolidation-security-challenges-2025

A Practical Framework for a Unified Strategy

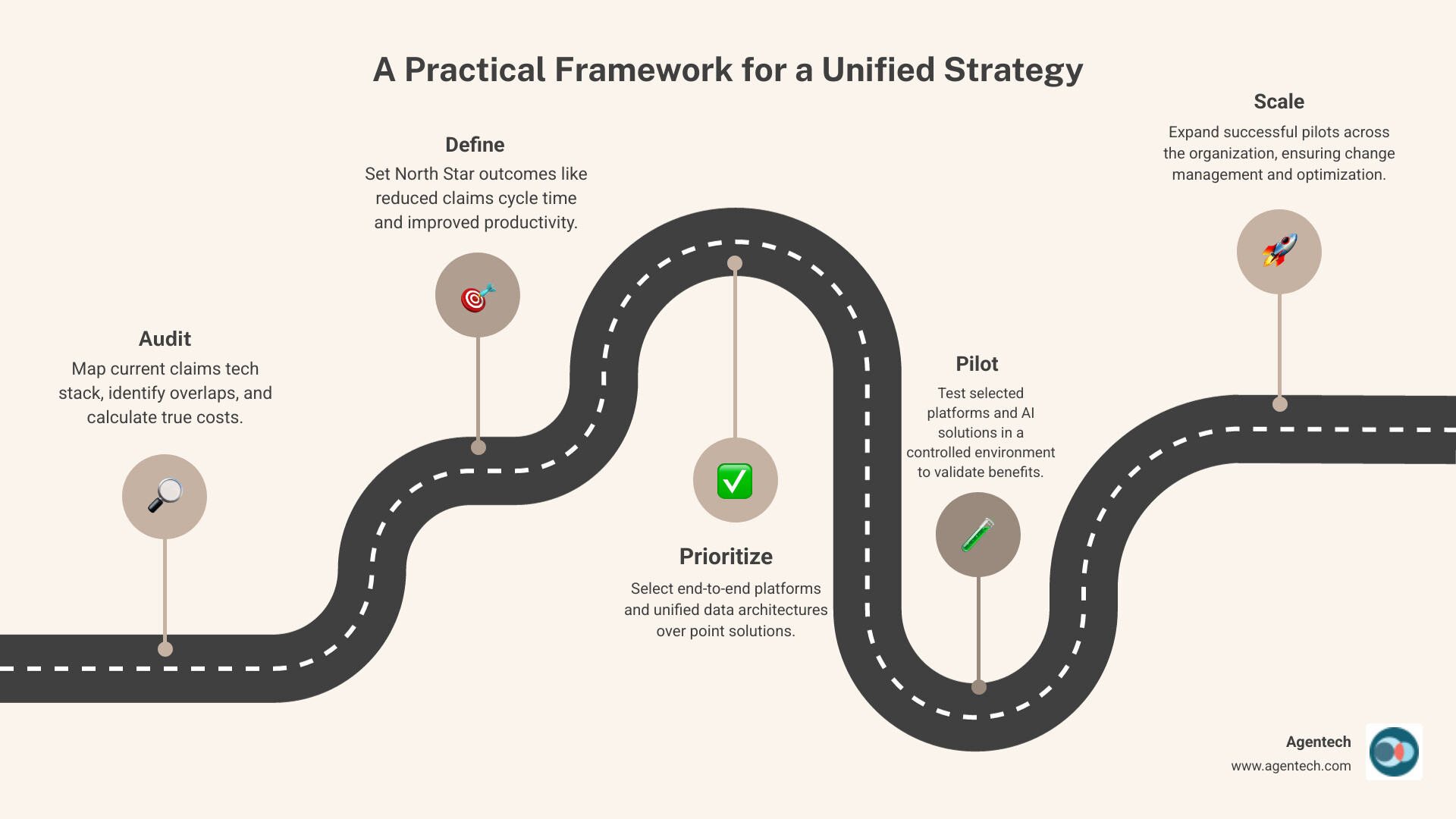

Juggling AI adoption and saas consolidation can feel overwhelming, but a structured approach can turn this challenge into a strategic advantage for P&C insurance carriers. This practical roadmap helps you make smart decisions about which claims software to keep, which to retire, and where AI can deliver real value.

Step 1: Audit Your Current Claims Technology Stack

You cannot fix what you cannot see. Before making changes, gain complete visibility into every piece of claims software your team uses, including shadow IT. IT teams often manage only 16% of applications.

- Map all tools and identify functional overlaps.

- Calculate true costs, including subscriptions, maintenance, and lost productivity from context switching. The average organization wastes $21 million annually on unused licenses alone.

- Understand data flows to find bottlenecks and manual processes.

- Uncover shadow IT to close security and compliance gaps.

Step 2: Define Your North Star Outcomes

With a clear picture of your current state, define specific, measurable business objectives. Vague goals like "improve efficiency" are not enough. Focus on key outcomes for P&C insurance carriers:

- Reduce claims cycle time to improve policyholder satisfaction and lower operational costs.

- Increase adjuster productivity by automating repetitive tasks.

- Improve policyholder satisfaction (CSAT) through faster, more personalized service.

- Lower Loss Adjustment Expense (LAE) by optimizing workflows.

These concrete targets provide the ROI metrics needed to justify investments and keep your team focused.

Step 3: Prioritize Platforms, Not Point Solutions

Move away from a patchwork of disconnected tools toward integrated platforms.

- Evaluate end-to-end solutions that reduce the number of systems your adjusters need to touch.

- Seek a unified data architecture to provide the clean, consistent data that AI needs to be effective.

- Favor platforms with strong integration capabilities to connect with essential third-party systems.

- Retire redundant software to realize cost savings and efficiency gains.

Adopting AI-powered claims processing as part of your platform strategy can be transformative. Learn more in our article on AI Claims Processing Insurance.

Citations:

- Source 2: Why Adopt AI SaaS?. (n.d.). Retrieved from https://www.capicua.io/blog/why-adopt-ai-saas

- Source 3: AI adoption and SaaS Consolidation: The future of CX efficiency. (n.d.). Retrieved from https://ask-ai.zendesk.com/hc/en-us/articles/19154371720849-AI-adoption-and-SaaS-Consolidation-The-future-of-CX-efficiency

- Source 6: SaaS Consolidation in 2025: Benefits, Risks & How to Do It. (n.d.). Retrieved from https://zylo.com/blog/saas-consolidation

The Future of Claims Tech: A Consolidated, AI-Powered Ecosystem

The landscape of claims technology is being reshaped by AI adoption and saas consolidation. For P&C insurance carriers, this means moving toward an ecosystem where AI is embedded within a streamlined, consolidated software stack. This future is defined by a wave of M&A, the rise of AI-native platforms, and a shift from rigid workflows to dynamic, goal-driven "systems of work".

How AI Adoption Is Driving a Wave of SaaS Market Consolidation

AI's transformative power is accelerating consolidation in the SaaS market. Software dealmaking jumped 40% to $304.2 billion in 2024, signaling a robust M&A environment driven by AI. Key trends include:

- Big Tech Acquisitions: Companies like Microsoft and Oracle are buying SaaS firms to integrate AI into their cloud platforms.

- Private Equity Targets: PE firms are consolidating smaller SaaS companies, injecting capital, and enhancing them with AI.

- Impact on Valuations: AI's ability to automate tasks is disrupting traditional seat-based pricing models, making some firms attractive acquisition targets.

- AI-Native Startups: New companies built around AI are growing fast and becoming prime acquisition targets or IPO candidates (Source 4, Source 9).

For a deeper dive, explore our article on The Future of Insurance: How AI is Changing the Game.

Preparing Your Firm for the New AI-Driven Landscape

P&C insurance carriers must adapt to thrive in this new landscape.

- Rethink Success Metrics: Focus on retention, policyholder satisfaction, and sustainable revenue, not just user growth.

- Focus on Demonstrating ROI: SaaS buyers are focused on cost savings. Clearly demonstrate the quantifiable ROI of any AI or consolidation project.

- Prepare for Procurement Scrutiny: With rising AI spending, expect tougher questions from procurement teams.

- Emphasize Sustainable Value: Avoid "checkbox" AI features. Focus on solutions that solve real claims processing problems.

- Be Prepared to Sell: Continuously communicate the benefits of new systems to stakeholders to ensure strong user adoption.

Frequently Asked Questions about AI Adoption and SaaS Consolidation

Why is SaaS consolidation so important for P&C insurance carriers?

SaaS consolidation is crucial for P&C carriers to lower costs by eliminating redundant claims software and unused licenses, which average $21 million in waste annually per organization. It also improves data security by reducing vulnerabilities and simplifies IT management. Most importantly, consolidation creates a streamlined foundation with clean, interconnected data, which is essential for any AI implementation to succeed.

How does AI adoption impact SaaS pricing models?

AI is disrupting traditional seat-based SaaS pricing. As AI automates tasks previously done by multiple users, the software's value shifts from the number of users to the overall efficiency and outcomes it delivers. This is leading to more consumption-based or value-based pricing models, where carriers pay for the results or processing capacity the AI provides, not just the number of human users.

What is the first step to consolidating our claims software stack?

The first and most critical step is a comprehensive audit of your claims technology. You must gain full visibility into every application your claims department uses, including shadow IT tools adopted by individual adjusters. This audit should identify who uses each tool, its true cost, and where functionality overlaps. Without this clear picture, you cannot make strategic decisions about which tools to consolidate or eliminate (Source 3, Source 6).

Conclusion: From Tool Sprawl to Strategic Advantage

The journey through ai adoption and saas consolidation is more than a technology refresh; it is a fundamental shift in claims management for P&C insurance carriers. We've seen how the boom in SaaS applications, combined with the rapid rise of AI, has led to an average of 275 applications per company and $21 million in annual waste from unused licenses.

The key takeaway is that ai adoption and saas consolidation are not competing priorities but complementary forces. Consolidation creates the unified data foundation that AI needs to deliver value. In turn, AI transforms a consolidated platform into an intelligent system that automates tasks and improves outcomes. Organizations that align these forces are achieving 20-30% cost reductions and 40-60% efficiency gains.

While the security challenges are real, modern solutions like Data Security Posture Management (DSPM) provide the necessary protection for sensitive P&C insurance data. By following a practical framework—Audit, Define, and Prioritize—carriers can turn an overwhelming challenge into manageable, strategic steps.

The market is already moving toward consolidation, with AI-driven software dealmaking jumping 40% in 2024. Carriers that proactively consolidate their claims software and thoughtfully integrate AI will gain a significant competitive advantage. Those who wait risk being left behind with fragmented, inefficient systems.

At Agentech, we understand the unique challenges facing P&C insurance carriers, TPAs, and IA Firms. Our AI-powered automation tools are designed to work within your consolidated claims environment, empowering your adjusters to focus on what matters most. The future of claims processing is consolidated, intelligent, and ready to transform how you serve your policyholders.

Transform your claims processing with AI-powered automation

Citations:

- AI adoption and SaaS consolidation: Navigating security challenges in 2025. (n.d.). Retrieved from https://www.polymerase.io/blog/ai-adoption-saas-consolidation-security-challenges-2025

- Why Adopt AI SaaS?. (n.d.). Retrieved from https://www.capicua.io/blog/why-adopt-ai-saas

- AI adoption and SaaS Consolidation: The future of CX efficiency. (n.d.). Retrieved from https://ask-ai.zendesk.com/hc/en-us/articles/19154371720849-AI-adoption-and-SaaS-Consolidation-The-future-of-CX-efficiency

- AI adoption to force wave of software consolidation — Dealspeak North America. (n.d.). Retrieved from https://mergermarket.ionanalytics.com/deal/mna/1512419

- AI Adoption & SaaS Consolidation | The Current Thing #6. (n.d.). Retrieved from https://p2x.xyz/blog/ai-adoption-saas-consolidation-current-thing-6

- SaaS Consolidation in 2025: Benefits, Risks & How to Do It. (n.d.). Retrieved from https://zylo.com/blog/saas-consolidation

- AI and Cloud Vendor Selection: Select Results from IDC's 3Q24 Cloud Pulse Survey. (n.d.). Retrieved from https://my.idc.com/getdoc.jsp?containerId=US51093024

- AI — State of Adoption 2024. (n.d.). Retrieved from https://sapinsider.org/research-reports/ai-state-of-adoption-2024

- State of the Cloud 2024. (n.d.). Retrieved from https://www.bvp.com/atlas/state-of-the-cloud-2024