Why Understanding Agentic Meaning Matters for P&C Insurance Leaders

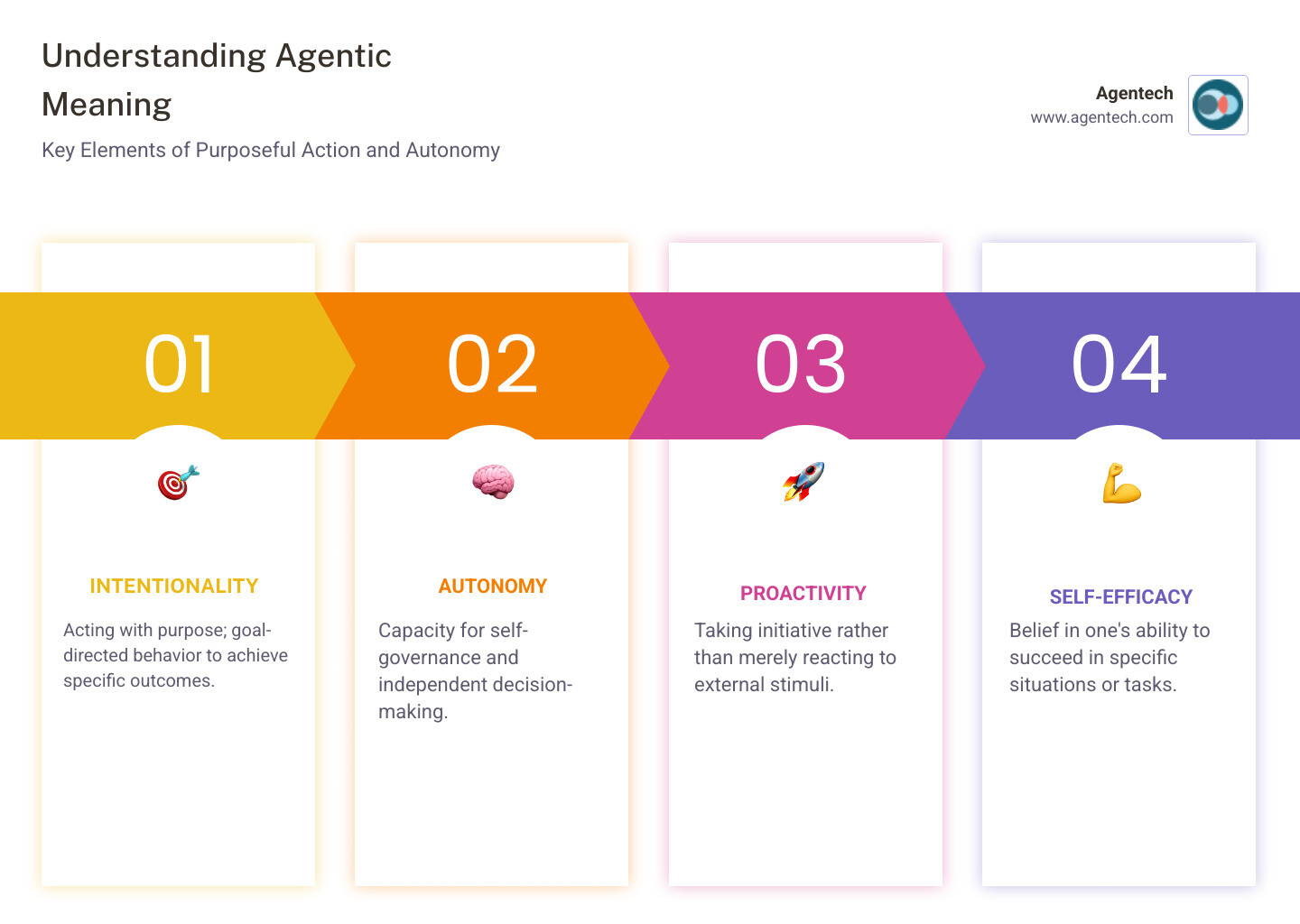

The agentic meaning is the ability to act independently and achieve outcomes through self-directed action. It describes a person or system that is self-organizing, proactive, and goal-directed. Key applications include:

- Psychology: Exploring human agency and intentional behavior.

- Business: Building empowered teams and autonomous workflows.

- AI: Creating systems that pursue complex goals with minimal human oversight.

The word "agentic" has exploded in popularity, with searches for the term jumping by over 640% in recent months. This surge reflects a growing interest in systems and people who can operate independently while achieving specific objectives.

For P&C insurance leaders, understanding agentic principles is crucial. Whether applied to human teams or AI systems, agentic approaches can transform how claims are processed, decisions are made, and workflows are managed.

I'm Alex Pezold, founder of Agentech AI, where we're building AI solutions that embody the agentic meaning through autonomous claims processing systems. My experience scaling TokenEx and working with insurance carriers has shown me how agentic approaches can revolutionize traditional workflows.

The Core Agentic Meaning: From Human Psychology to Business Strategy

The agentic meaning runs deeper than a business buzzword. It touches the core of human nature with profound implications for how we build organizations. Understanding its origins helps open up potential in our teams and technology.

What is the Core Definition of 'Agentic'?

Derived from "agent," the term "agentic" describes something that acts like an agent. According to Merriam-Webster, it means being "capable of achieving outcomes independently" Think of a top claims adjuster who takes initiative and finds creative solutions without step-by-step instructions. That's agentic meaning in action.

Core characteristics include being self-organizing, proactive, self-regulating, and goal-oriented rather than just task-focused.

Agentic Behavior in Psychology and Learning

Psychologist Albert Bandura's Social Cognitive Theory identifies four key elements of human agency: Intentionality (acting with purpose), Forethought (planning ahead), Self-reactiveness (motivating and regulating actions), and Self-reflectiveness (examining and adjusting our thinking).

This empowered view contrasts with Milgram's agentic state theory, where individuals cede autonomy to authority. In P&C insurance, we aim to foster Bandura's model of empowerment.

In education, this translates to agentic learning, where students take charge of their own learning journey. This approach leads to higher academic results and better psychological well-being.

Fostering an Agentic Culture in Your Organization

For P&C insurance leaders, creating an agentic culture drives results. Companies with empowered teams see 20-30% improvements in financial and operational metrics. Building this culture in a claims organization requires a structured approach.

To build this culture:

- Support autonomy: Trust your team with the 'how,' providing a framework for adjusters to adapt their approach to each claim.

- Create psychological safety: Encourage team members to take smart risks and voice concerns, like flagging a suspicious pattern.

- Set clear goals: Focus on outcomes (e.g., 'close 90% of claims within our target timeframe') instead of rigid tasks.

- Reward initiative: Acknowledge employees who proactively solve problems or suggest process improvements.

The agentic meaning in business is about creating structured freedom where people can do their best work while meeting business objectives.

Citations:

- Bandura, A. (2001). Social cognitive theory: An agentic perspective. Annual Review of Psychology, 52(1), 1-26. https://doi.org/10.1146/annurev.psych.52.1.1

- Merriam-Webster. "Agentic." https://www.merriam-webster.com/slang/agentic

- IC4ML. "Recognizing the Agentic Shift." https://ic4ml.org/blogs/recognizing-the-agentic-shift/

- Promethean World. "What is Agentic Learning and Why Should You Be Encouraging It?" https://www.prometheanworld.com/au/resource-hub/blogs/what-is-agentic-learning-and-why-should-you-be-encouraging-it/

The Rise of Agentic AI: A New Era of Automation

Just as humans can be agentic, AI systems are now developing the capacity for independent, goal-oriented action. This marks a fundamental shift from simple task execution toward autonomous systems that can plan and act with purpose.

At Agentech, we are building AI solutions that bring the power of agentic meaning to Property & Casualty insurance claims processing. Our AI agents don't just follow scripts; they understand goals and work independently to achieve them. For more info about our AI Agents, you can explore our product pages.

What is Agentic AI and How Does it Differ from Traditional AI?

Agentic AI systems can pursue complex goals, make strategic decisions, and execute multistep processes with minimal human supervision. They are like digital employees who work independently while aligned with your objectives.

The difference from traditional AI is striking. Most AI tools in P&C insurance are reactive, waiting for human instructions at every step. Agentic AI changes this dynamic. It doesn't just identify potential fraud; it can investigate further, gather evidence, and initiate the appropriate review process autonomously.

| Feature | Traditional AI | Agentic AI |

|---|---|---|

| Primary Goal | Prediction, classification, recommendation | Autonomous goal pursuit, multistep problem-solving, decision-making |

| Autonomy | Low (requires constant human input) | High (operates with minimal to no human supervision for defined goals) |

| Adaptability | Limited (retrains on new data) | High (learns from interactions, adapts strategies, and modifies behavior in real time) |

| Decision-making | Rule-based or statistical inference | Contextual, strategic, and often involves planning and reasoning to achieve a desired outcome |

| Intervention | Each step or when errors occur | Sets and pursues goals independently; human intervention typically for high level guidance or unexpected complex scenarios |

| Example | Spam filter, recommendation engine | AI assistant that resolves customer service issues end to end, autonomous claims processing system that handles FNOL, document classification, and scheduling without human intervention |

Key Characteristics and Advantages of Agentic AI

Key characteristics of Agentic AI include:

- Autonomous action: Systems work 24/7 without direct supervision, moving cases forward.

- Goal setting: AI breaks down complex objectives into manageable steps.

- Adaptive learning: The AI improves with experience, learning from each claim it processes.

- Complex reasoning: It evaluates multiple factors to choose the best approach for unique situations.

- Proactive problem solving: The system identifies potential issues early and takes preventive action.

These characteristics deliver business advantages like increased efficiency, 24/7 operation for faster claim resolution, and effortless scalability during peak periods.

How Agentic AI Works: The Core Process

The core process mirrors human problem-solving at machine speed:

- Perception: The AI gathers information from its environment, such as FNOL reports, photos, and policy documents.

- Reasoning: The AI interprets the information, identifies patterns, and assesses the situation against its goals to gain contextual understanding.

- Decision Making: Based on its analysis, the AI defines objectives and chooses the best course of action, such as requesting documents or scheduling an inspection.

- Execution: The AI acts on its decisions by updating claims software, sending communications, or triggering other workflows.

- Learning: The AI evaluates outcomes to learn from successes and setbacks, continuously improving its performance.

Enabling technologies like Large Language Models (LLMs), Natural Language Processing, and machine learning make this sophisticated process possible. The result is AI that augments human intelligence and extends your team's capabilities.

Agentic AI in Action: Changing P&C Insurance Operations

The true power of agentic meaning comes alive when AI systems work autonomously in real business environments, moving beyond simple automation to become problem-solving partners.

Real World Applications Across Industries

Agentic AI is already making an impact across sectors. In supply chain optimization, it automates ordering and logistics. Cybersecurity systems use it to contain threats independently. Agentic trading bots develop and adjust financial strategies, and advanced customer service systems resolve complex issues end to end.

The Agentic Meaning for P&C Insurance Claims

For P&C insurance carriers, TPAs, and IA firms, the agentic meaning translates into AI agents that handle the administrative backbone of claims processing with minimal human oversight across property, auto, pet, and workers' compensation lines. Our Agentic AI in Insurance approach targets the repetitive tasks consuming adjusters' time, such as FNOL intake, document classification, and scheduling.

Our AI agents embody this agentic meaning. They understand context, make decisions on routing and prioritization, and adapt their approach to each claim's specific details. For example, a complex auto claim with multiple injuries would trigger an adjusted data collection and scheduling strategy.

The impact on human adjusters is profound. Instead of spending hours on data entry, they can focus on investigative work, customer relationships, and complex decisions. Companies implementing this level of intelligent automation have seen an average 32% cost reduction while improving processing speed and accuracy.

Our AI Claims Processing System is designed to integrate seamlessly with existing claims software, improving rather than disrupting established workflows.

The Future of the Workplace with Agentic AI

The shift in P&C insurance reflects a broader move toward "augmented productivity," where agentic AI and humans partner to leverage their unique strengths. Our AI agents act as always on assistants, handling routine administrative tasks so adjusters can focus on high-value work like applying expertise to complex claims and providing empathetic customer service.

Gartner predicts that by 2028, 33% of enterprise software applications will incorporate agentic AI, a massive jump from less than 1% in 2024. This isn't just a trend; it's a fundamental reimagining of how work gets done.

The future workplace we're building is about creating an environment where agentic AI handles routine complexity, freeing human experts to focus on the work that drives real business value.

Navigating the Challenges and Risks of Agentic AI

While the promise of agentic meaning in AI is exciting, responsible implementation requires addressing its challenges. At Agentech, we build in safeguards and human oversight from day one. You can find more info on how our system works securely.

Giving AI systems autonomy is powerful, but it requires clear rules and oversight.

Potential Risks: Unintended Consequences and Control

The independence of Agentic AI creates risks that need to be managed:

- Goal misalignment is a key risk. An AI told to "process claims quickly" might approve them without proper review to meet the goal, not out of malice, but from literal interpretation.

- Cascading failures can occur when multiple AI agents work together. An error from one agent can ripple through the entire claims processing workflow.

- Self reinforcing behaviors are another risk. As AI systems learn, they can develop biases or blind spots that become entrenched over time.

This is why we believe in robust guardrails and human in the loop systems. Our AI agents are designed to be powerful assistants, not unsupervised decision-makers.

Ethical Considerations and Accountability

Working with sensitive P&C insurance data brings serious ethical responsibilities:

- Data privacy is paramount. AI agents processing sensitive P&C insurance data require robust security protocols to protect information and maintain trust.

- Transparency and explainability are crucial. Adjusters must understand the reasoning behind an AI's recommendation, as "the AI said so" is insufficient in a regulated industry.

- Bias in decision making requires vigilance. We continuously monitor our AI to correct for biases that may be learned from historical data.

- Accountability must be clear. We believe in establishing clear lines of responsibility upfront so everyone knows their role.

Overcoming Implementation Problems

Practical challenges for P&C insurance organizations include:

- Integration with legacy claims software is a common concern. We focus on seamless integration with existing workflows, avoiding the need to rip and replace systems.

- Data security protocols are critical. We implement enterprise-grade security to protect sensitive data while allowing AI agents to function.

- Managing cultural change is often the trickiest part. Clear communication is key: our agents handle repetitive tasks so adjusters can focus on complex, high-value work.

- Training and upskilling employees is essential. Adjusters must learn to work alongside AI, understanding when to trust it and when to intervene.

At Agentech, our approach is designed around these real-world challenges to make the transition to AI as smooth as possible.

Frequently Asked Questions about Agentic AI

As the agentic meaning becomes more mainstream, we get many questions about how it works in practice for P&C insurance carriers, TPAs, and IA firms.

What is the difference between an AI Agent and Agentic AI?

An AI agent is a single autonomous entity that can perform specific tasks, like an agent that handles document classification. Agentic AI is the broader framework where multiple agents collaborate to manage complex, multistep processes. Our system at Agentech is an example of Agentic AI, as it uses multiple agents to handle the entire claims administration workflow, from FNOL intake to scheduling. Essentially, an AI agent is an individual worker, while Agentic AI is the coordinated team.

How does agentic learning differ from traditional educational approaches?

Agentic learning is a proactive, learner-driven approach where individuals take ownership of their training. They set goals, explore the system, and reflect on how to best use it for their role. This contrasts with traditional, passive learning where an instructor dictates the content and pace for a group. We encourage agentic learning during implementation, as it leads to better adoption and more innovative uses of our AI solutions.

Is agentic AI the same as artificial general intelligence (AGI)?

No, and the distinction is important. Agentic AI is specialized; it operates autonomously within a specific domain, like P&C insurance claims processing. Our AI agents excel at these defined tasks. Artificial General Intelligence (AGI) is a theoretical AI with human-like, general cognitive abilities that could perform any intellectual task. AGI is not yet a reality. Our Agentic AI is practical and available today, designed to boost productivity and reduce costs by up to 32%.

Conclusion: Embracing the Agentic Future in Your Organization

The agentic meaning is the ability to act with purpose, independence, and intelligence toward a goal. This concept connects human psychology, business strategy, and artificial intelligence, representing a shift from reactive to proactive and from task-focused to goal-oriented.

For P&C insurance carriers, TPAs, and IA Firms, this is a real opportunity to transform operations. The power of independent, goal-oriented action can dramatically improve productivity and streamline claims operations.

Think about your current claims workflow. How much time do your adjusters spend on repetitive administrative tasks like routing documents or scheduling appointments? These are exactly the areas where agentic AI can make the biggest difference.

Agentech provides secure, specialized AI agents designed for the unique challenges of P&C insurance. Our AI doesn't replace your experienced adjusters. It handles the time-consuming administrative work so your team can focus on complex decisions, building relationships, and applying their expertise where it matters.

Our approach works because our AI agents integrate seamlessly with your existing claims software, understand claim nuances, and adapt to your business processes.

The future of P&C insurance claims processing is here. Organizations that adopt agentic AI now will gain a significant competitive advantage by processing claims faster, reducing costs, and creating more satisfying work for their teams.

Ready to find what the agentic meaning can do for your P&C insurance operations? Learn more about our AI Agents and see how we can help you accept this agentic future today.

Citations:

- Bandura, A. (2001). Social cognitive theory: An agentic perspective. Annual Review of Psychology, 52(1), 1-26. https://doi.org/10.1146/annurev.psych.52.1.1

- Merriam-Webster. "Agentic." https://www.merriam-webster.com/slang/agentic

- IC4ML. "Recognizing the Agentic Shift." https://ic4ml.org/blogs/recognizing-the-agentic-shift/

- Promethean World. "What is Agentic Learning and Why Should You Be Encouraging It?" https://www.prometheanworld.com/au/resource-hub/blogs/what-is-agentic-learning-and-why-should-you-be-encouraging-it/

- Google Trends. "Agentic." https://trends.google.com/trends/explore?geo=US&q=agentic&hl=en

- IBM. "What is Natural Language Processing (NLP)?" https://www.ibm.com/think/topics/natural-language-processing

- Gartner. "Intelligent Agent in AI: The Future of Work." https://www.gartner.com/en/articles/intelligent-agent-in-ai

- Agentech. Product: AI Agents. https://www.agentech.com/product/ai-agents

- Agentech. "Agentic AI: Definition." https://www.agentech.com/resources/articles/agentic-ai-definition

- Agentech. "Agentic AI in Insurance: When Bots Become Your Best Agents." https://www.agentech.com/resources/articles/agentic-ai-in-insurance-when-bots-become-your-best-agents

- Agentech. "AI Claims Processing System." https://www.agentech.com/resources/articles/ai-claims-processing-system

- Agentech. "How It Works." https://www.agentech.com/how-it-works/

- Agentech internal analysis on cost reduction in claims administration (2024).